In today’s fast-evolving tech landscape, DocuSign, Inc. and monday.com Ltd. stand out as leaders in software application solutions. Both companies operate in overlapping markets focused on digital workflow and productivity, yet they pursue distinct innovation strategies—DocuSign excels in digital agreements, while monday.com offers versatile work operating systems. This article will guide you through a detailed comparison to identify which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between DocuSign and monday.com by providing an overview of these two companies and their main differences.

DocuSign Overview

DocuSign, Inc. is a leading provider of electronic signature software and digital agreement solutions. Founded in 2003 and based in San Francisco, it serves enterprise, commercial, and small businesses globally. The company’s offerings include AI-driven contract lifecycle management, remote online notarization, and industry-specific cloud products, positioning it strongly in the digital transaction management market with a market cap of approximately 11.4B USD.

monday.com Overview

monday.com Ltd., incorporated in 2012 and headquartered in Tel Aviv, develops cloud-based visual work operating systems designed to create customizable software applications and work management tools. The company serves a broad range of clients, including organizations, educational institutions, and government units. With a market cap near 6.5B USD, monday.com focuses on collaborative project management, CRM, and marketing solutions across multiple regions worldwide.

Key similarities and differences

Both DocuSign and monday.com operate in the software application industry and offer cloud-based solutions that enhance business workflows. DocuSign specializes in digital agreements and e-signatures with AI-powered contract management, while monday.com provides a modular work OS aimed at project and team management. Their business models emphasize SaaS delivery but target different core functions—contract automation versus work management—with DocuSign having a larger employee base and market capitalization.

Income Statement Comparison

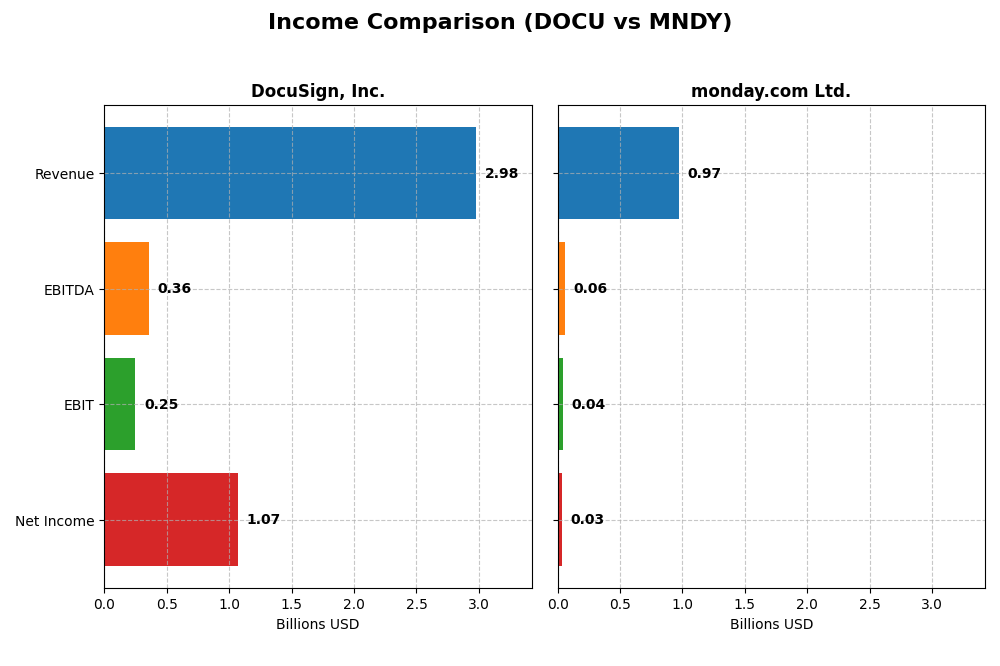

The table below compares key income statement metrics for DocuSign, Inc. and monday.com Ltd. based on their most recent fiscal year results, providing a snapshot of their financial performance.

| Metric | DocuSign, Inc. | monday.com Ltd. |

|---|---|---|

| Market Cap | 11.36B | 6.53B |

| Revenue | 2.98B | 972M |

| EBITDA | 357M | 58M |

| EBIT | 249M | 40M |

| Net Income | 1.07B | 32M |

| EPS | 5.23 | 0.65 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

DocuSign, Inc.

DocuSign’s revenue nearly doubled from 2021 to 2025, reaching $3B in 2025, with net income turning strongly positive at $1.07B after several years of losses. Gross margin remained robust at 79.1%, and net margin improved significantly to 35.9%. The latest fiscal year showed sustained revenue growth of 7.8% and a sharp net margin expansion, signaling a notable turnaround.

monday.com Ltd.

monday.com’s revenue grew more than fivefold from 2020 to 2024, hitting $972M, while net income moved from a loss to a modest profit of $32M in 2024. The company maintained a high gross margin of 89.3%, though net margin remained low at 3.3%. Recent results reflect strong top-line growth of 33.2% and improving profitability, yet margins are still comparatively thin.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement trends, with substantial revenue growth and improved profitability over their respective periods. DocuSign exhibits higher absolute net income and stronger net margins, indicating more mature profitability. monday.com shows impressive growth rates but maintains lower net margins. The choice depends on preference for scale and margin strength versus rapid expansion.

Financial Ratios Comparison

This table presents the most recent financial ratios for DocuSign, Inc. and monday.com Ltd., providing a side-by-side comparison for key performance indicators as of fiscal year 2025 and 2024 respectively.

| Ratios | DocuSign, Inc. (2025) | monday.com Ltd. (2024) |

|---|---|---|

| ROE | 53.3% | 3.14% |

| ROIC | 9.1% | -1.73% |

| P/E | 18.5 | 363 |

| P/B | 9.87 | 11.4 |

| Current Ratio | 0.81 | 2.66 |

| Quick Ratio | 0.81 | 2.66 |

| D/E | 0.062 | 0.103 |

| Debt-to-Assets | 3.1% | 6.3% |

| Interest Coverage | 129 | 0 |

| Asset Turnover | 0.74 | 0.58 |

| Fixed Asset Turnover | 7.28 | 7.13 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

DocuSign, Inc.

DocuSign presents a slightly favorable ratio profile with strong net margin at 35.87% and impressive return on equity of 53.32%, indicating efficient profitability. Concerns include a low current ratio of 0.81 and an unfavorable price-to-book ratio near 9.87, which may suggest liquidity and valuation issues. The company does not pay dividends, likely focusing on growth and reinvestment rather than shareholder distributions.

monday.com Ltd.

monday.com shows a neutral ratio stance with strengths in liquidity, evidenced by a current ratio of 2.66 and solid interest coverage. However, profitability ratios such as net margin (3.33%) and return on equity (3.14%) are weak, alongside a high price-to-earnings ratio of 362.98, indicating overvaluation risks. The company also pays no dividends, probably prioritizing reinvestment and expansion strategies over payouts.

Which one has the best ratios?

While both companies have 42.86% favorable ratios, DocuSign’s higher profitability and return on equity provide a more compelling financial strength despite some liquidity concerns. monday.com, conversely, benefits from stronger liquidity but struggles with profitability and valuation metrics. Overall, DocuSign’s ratios appear slightly better balanced for operational efficiency and investor returns.

Strategic Positioning

This section compares the strategic positioning of DocuSign, Inc. and monday.com Ltd., including Market position, Key segments, and Exposure to technological disruption:

DocuSign, Inc.

- Leading in e-signature software with global reach; faces competitive pressure in digital agreement solutions.

- Key revenue driver is subscription services focused on e-signatures and contract lifecycle management.

- Incorporates AI in contract analysis and automation; offers industry-specific cloud solutions mitigating disruption.

monday.com Ltd.

- Provides cloud-based Work OS with modular applications; competes in work management software internationally.

- Focuses on visual work OS supporting marketing, CRM, project management, and software development.

- Cloud-based platform enabling customizable workflows; adapts to various industries with modular blocks.

DocuSign, Inc. vs monday.com Ltd. Positioning

DocuSign is highly concentrated on e-signature and contract management with strong subscription revenue, while monday.com offers a diversified modular work OS platform. DocuSign integrates AI-driven features, whereas monday.com emphasizes flexible workflow customization.

Which has the best competitive advantage?

DocuSign shows a slightly favorable moat with increasing profitability, indicating improving competitive advantage. monday.com has a slightly unfavorable moat, destroying value despite growing profitability, suggesting weaker competitive positioning.

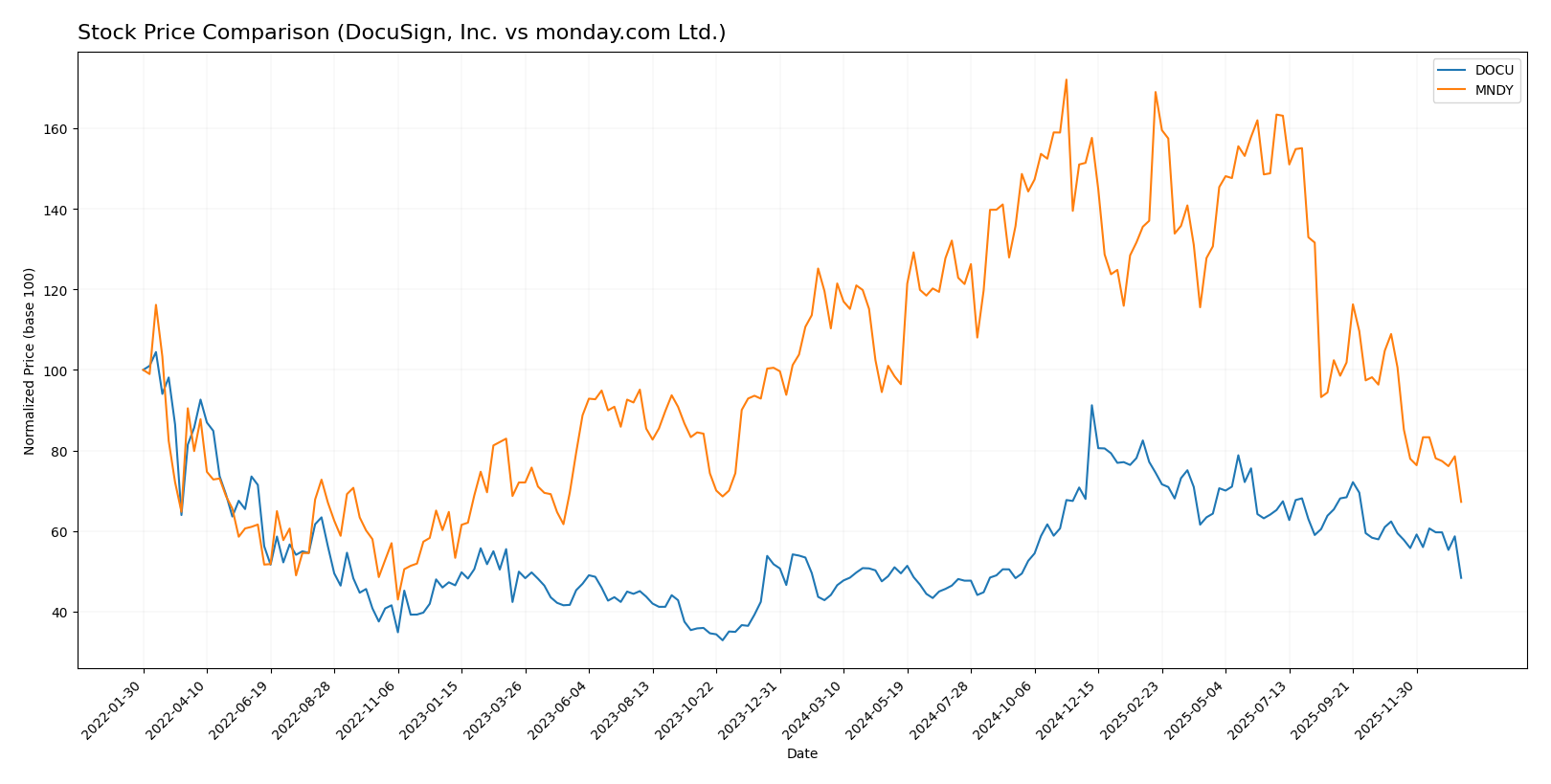

Stock Comparison

The stock price chart highlights divergent trajectories for DocuSign, Inc. and monday.com Ltd. over the past 12 months, reflecting contrasting market dynamics and investor sentiment.

Trend Analysis

DocuSign, Inc. (DOCU) exhibited a bullish trend with a 9.63% price increase over the last year, though the upward momentum decelerated. The stock fluctuated between a low of 50.84 and a high of 106.99, with moderate volatility (std deviation 12.98).

monday.com Ltd. (MNDY) showed a bearish trend, losing 39.06% over the same period. Its price moved from 324.31 at the peak to a low of 126.7, with higher volatility (std deviation 47.32) and decelerating price decline.

Comparatively, DocuSign delivered stronger market performance than monday.com, maintaining a positive annual return despite a recent downturn, whereas monday.com sustained substantial losses throughout the year.

Target Prices

The current analyst consensus presents moderately optimistic target prices for DocuSign, Inc. and monday.com Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| DocuSign, Inc. | 88 | 70 | 76.86 |

| monday.com Ltd. | 330 | 194 | 264.42 |

Analysts expect DocuSign’s stock to appreciate significantly from its current price of $56.71, while monday.com’s consensus target price of $264.42 suggests a strong upside compared to its present $126.70 share price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for DocuSign, Inc. and monday.com Ltd.:

Rating Comparison

DocuSign, Inc. Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: 5, indicating very favorable value.

- ROE Score: 4, marked as favorable for profitability.

- ROA Score: 4, favorable for asset utilization.

- Debt To Equity Score: 3, moderate financial risk.

- Overall Score: 3, moderate overall financial standing.

monday.com Ltd. Rating

- Rating: B-, also regarded as very favorable.

- Discounted Cash Flow Score: 4, rated favorable.

- ROE Score: 3, considered moderate in efficiency.

- ROA Score: 3, moderate asset utilization.

- Debt To Equity Score: 3, similarly moderate financial risk.

- Overall Score: 3, also moderate overall financial standing.

Which one is the best rated?

Based on the available data, DocuSign holds a higher rating of B+ compared to monday.com’s B-. DocuSign shows stronger scores in discounted cash flow, ROE, and ROA, suggesting better profitability and valuation metrics, while both have similar debt and overall scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

DocuSign Scores

- Altman Z-Score: 4.43, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

monday.com Scores

- Altman Z-Score: 6.33, indicating a safe zone, very low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

Which company has the best scores?

Both DocuSign and monday.com have Altman Z-Scores in the safe zone, with monday.com scoring higher, suggesting a stronger financial stability. Both companies have an identical Piotroski Score of 5, indicating average financial strength.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to DocuSign, Inc. and monday.com Ltd. by recognized grading firms:

DocuSign, Inc. Grades

The following table shows recent grades from reputable financial institutions for DocuSign, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Hold | 2025-12-05 |

| Baird | Maintain | Neutral | 2025-12-05 |

DocuSign’s grades predominantly reflect a neutral stance, with most analysts maintaining hold or sector perform ratings, indicating moderate expectations.

monday.com Ltd. Grades

Below are the latest grades from established grading companies for monday.com Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-01-15 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-23 |

| Tigress Financial | Maintain | Buy | 2025-12-11 |

| Baird | Maintain | Outperform | 2025-11-11 |

| Wells Fargo | Maintain | Overweight | 2025-11-11 |

| DA Davidson | Maintain | Buy | 2025-11-11 |

| Morgan Stanley | Maintain | Overweight | 2025-11-11 |

| Piper Sandler | Maintain | Overweight | 2025-11-11 |

monday.com Ltd. consistently holds strong buy and overweight ratings, highlighting bullish analyst sentiment and expectations of positive performance.

Which company has the best grades?

monday.com Ltd. has received notably stronger grades with a majority of buy and overweight recommendations, in contrast to DocuSign’s predominantly neutral and hold ratings. This divergence suggests monday.com is viewed more favorably by analysts, potentially implying higher growth or performance expectations for investors.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses of DocuSign, Inc. and monday.com Ltd. based on their latest financial and strategic evaluations.

| Criterion | DocuSign, Inc. (DOCU) | monday.com Ltd. (MNDY) |

|---|---|---|

| Diversification | Strong focus on subscription services (2.9B in 2025), limited product diversification but stable revenue base | Limited diversification, mainly project management platform |

| Profitability | High net margin (35.87%) and ROE (53.32%), neutral ROIC (9.09%) | Low net margin (3.33%) and ROE (3.14%), negative ROIC (-1.73%) |

| Innovation | Moderate innovation with growing ROIC trend, slightly favorable moat | Innovation improving with growing ROIC but still value destroying, slightly unfavorable moat |

| Global presence | Established global footprint with high subscription revenue | Growing presence but smaller scale and revenue compared to DOCU |

| Market Share | Significant market share in e-signature and digital agreements | Smaller market share in collaboration tools, high P/E ratio indicates growth expectations |

Key takeaways: DocuSign shows stronger profitability and a more stable business model with a slightly favorable moat, while monday.com is still in a growth phase with improving but currently unfavorable profitability metrics. Investors should weigh DocuSign’s stability against monday.com’s growth potential and higher risk.

Risk Analysis

Below is a comparative table of key risks for DocuSign, Inc. (DOCU) and monday.com Ltd. (MNDY) based on the most recent available data:

| Metric | DocuSign, Inc. (DOCU) | monday.com Ltd. (MNDY) |

|---|---|---|

| Market Risk | Moderate beta (0.994), price fell ~5% recently | Higher beta (1.255), price dropped ~4.6% recently |

| Debt Level | Low debt-to-equity (0.06), favorable interest coverage | Low debt-to-equity (0.1), favorable interest coverage (infinite) |

| Regulatory Risk | US and international compliance; FedRAMP authorization for government sector | International operations with exposure to multiple regulatory environments |

| Operational Risk | Large employee base (6.8K), moderate asset turnover (0.74) | Smaller workforce (2.5K), slightly lower asset turnover (0.58) |

| Environmental Risk | Standard for tech sector; no specific concerns reported | Similar tech sector profile; no significant environmental risk noted |

| Geopolitical Risk | US-based, lower geopolitical risk | Based in Israel, exposed to Middle East geopolitical tensions |

DocuSign shows lower market volatility and very strong financial stability with low debt and high interest coverage, mitigating financial risks. monday.com faces higher market risk due to greater beta and geopolitical exposure given its Israeli base. Both companies have moderate operational risks, but regulatory complexities can increase for monday.com given its broader international footprint. The most impactful risks are market volatility for monday.com and liquidity constraints for DocuSign, given its current ratio below 1. Investors should weigh these risks carefully in portfolio decisions.

Which Stock to Choose?

DocuSign, Inc. (DOCU) shows a favorable income evolution with a 7.78% revenue growth in 2025 and strong profitability evidenced by a 35.87% net margin and a 53.32% ROE. Its debt levels are low, with a debt-to-equity ratio of 0.06, and its overall rating is very favorable (B+).

monday.com Ltd. (MNDY) exhibits robust revenue growth of 33.21% in 2024 but maintains modest profitability, with a 3.33% net margin and 3.14% ROE. Debt is manageable with a debt-to-equity ratio of 0.1, and the company holds a very favorable overall rating (B-).

Investors seeking growth potential might find DOCU’s higher profitability and improving returns attractive, while those prioritizing liquidity and operational stability could view MNDY’s solid current ratios and moderate financial risk as favorable. The ratings and income statements suggest differing risk profiles and strategic fits depending on investor objectives.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of DocuSign, Inc. and monday.com Ltd. to enhance your investment decisions: