Intuit Inc. and DocuSign, Inc. are two prominent players in the software application industry, each driving innovation in financial management and digital agreement solutions, respectively. While Intuit focuses on comprehensive financial tools for businesses and consumers, DocuSign specializes in streamlining agreements with electronic signatures and AI-powered contract management. This comparison explores their market positions and innovation strategies to help you identify the most promising investment opportunity. Let’s find out which company stands out for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Intuit Inc. and DocuSign, Inc. by providing an overview of these two companies and their main differences.

Intuit Inc. Overview

Intuit Inc. focuses on providing financial management and compliance products for consumers, small businesses, self-employed individuals, and accounting professionals. Operating across multiple segments such as Small Business & Self-Employed, Consumer, Credit Karma, and ProConnect, Intuit offers solutions like QuickBooks, TurboTax, and personal finance platforms. Headquartered in Mountain View, California, it commands a strong market position in the software application industry.

DocuSign, Inc. Overview

DocuSign, Inc. specializes in electronic signature software and digital agreement management solutions for businesses globally. Its offerings include e-signature, contract lifecycle management, AI-driven insights, and industry-specific cloud solutions, catering to enterprises, commercial, and small businesses. Based in San Francisco, California, DocuSign operates primarily in the software application sector, focusing on streamlining agreement processes digitally.

Key similarities and differences

Both companies operate within the software application industry, offering cloud-based solutions to enhance business processes. Intuit emphasizes financial and tax management tools, while DocuSign centers on digital agreements and e-signatures. Intuit serves a broader market with diverse financial products, whereas DocuSign specializes in workflow automation and contract management. Each company targets businesses but with distinct core services and market approaches.

Income Statement Comparison

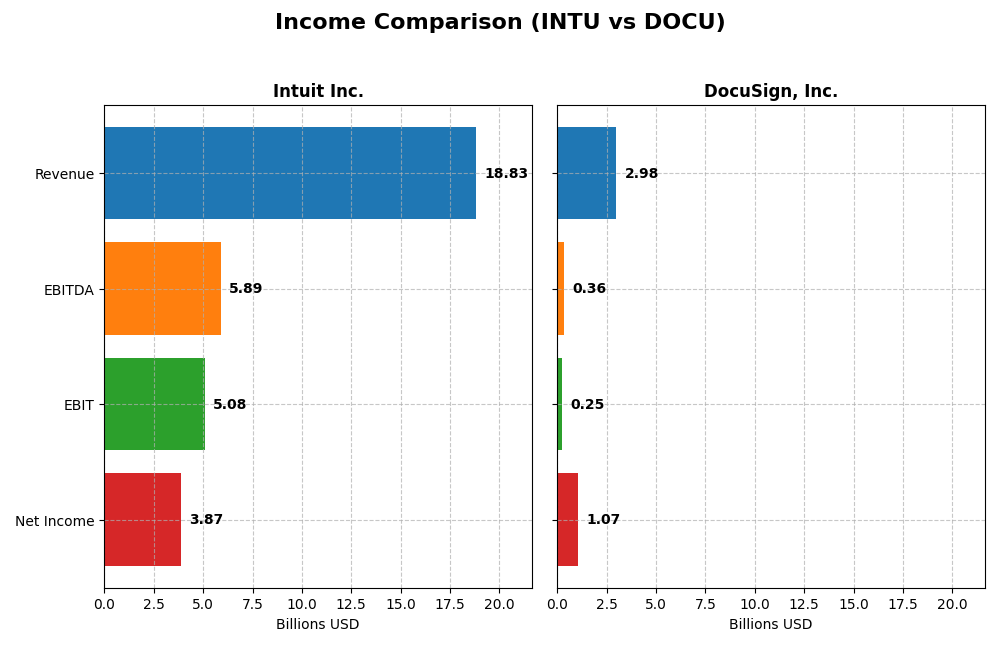

This table provides a side-by-side comparison of the most recent annual income statement metrics for Intuit Inc. and DocuSign, Inc., highlighting key financial performance indicators for fiscal year 2025.

| Metric | Intuit Inc. (INTU) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Market Cap | 151B | 11.4B |

| Revenue | 18.8B | 3.0B |

| EBITDA | 5.9B | 357M |

| EBIT | 5.1B | 249M |

| Net Income | 3.9B | 1.1B |

| EPS | 13.82 | 5.23 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Intuit Inc.

From 2021 to 2025, Intuit Inc. showed consistent revenue growth, nearly doubling from $9.63B to $18.83B, with net income rising from $2.06B to $3.87B. Margins remained strong, with a gross margin of 80.76% and net margin around 20.55%. The 2025 fiscal year saw revenue growth accelerate to 15.63%, alongside a 33.99% EBIT increase, indicating improving profitability.

DocuSign, Inc.

DocuSign’s revenue more than doubled from $1.45B in 2021 to $2.98B in 2025, while net income turned positive, reaching $1.07B in 2025 from a loss in 2021. The gross margin stayed favorable at 79.12%, but EBIT margin was modest at 8.38%. In 2025, revenue growth slowed to 7.78%, yet net margin surged significantly by 1239.29%, reflecting rapid operational improvements.

Which one has the stronger fundamentals?

Both companies display favorable income statement trends, with Intuit exhibiting higher and more stable margins alongside steady growth. DocuSign shows exceptional net income and margin improvements but from a lower base and with more volatility. Intuit’s overall margin consistency contrasts with DocuSign’s rapid but less stable profitability gains, highlighting different risk and growth profiles.

Financial Ratios Comparison

This table compares the most recent key financial ratios of Intuit Inc. and DocuSign, Inc. for fiscal year 2025, providing insight into their profitability, liquidity, leverage, and operational efficiency.

| Ratios | Intuit Inc. (INTU) | DocuSign, Inc. (DOCU) |

|---|---|---|

| ROE | 19.6% | 53.3% |

| ROIC | 14.8% | 9.1% |

| P/E | 56.8 | 18.5 |

| P/B | 11.2 | 9.9 |

| Current Ratio | 1.36 | 0.81 |

| Quick Ratio | 1.36 | 0.81 |

| D/E (Debt-to-Equity) | 0.34 | 0.06 |

| Debt-to-Assets | 18.0% | 3.1% |

| Interest Coverage | 19.9 | 129.0 |

| Asset Turnover | 0.51 | 0.74 |

| Fixed Asset Turnover | 12.5 | 7.3 |

| Payout Ratio | 30.7% | 0% |

| Dividend Yield | 0.54% | 0% |

Interpretation of the Ratios

Intuit Inc.

Intuit shows strong profitability with favorable net margin (20.55%) and return on equity (19.63%), supported by solid return on invested capital (14.78%). Its leverage ratios are healthy, with a debt-to-equity of 0.34 and good interest coverage. However, valuation multiples like P/E (56.82) and P/B (11.15) appear high. Intuit pays dividends, but the yield is low at 0.54%, indicating modest shareholder returns.

DocuSign, Inc.

DocuSign demonstrates very strong profitability with a high net margin (35.87%) and exceptional return on equity (53.32%), although return on invested capital is more moderate at 9.09%. The company maintains low leverage with debt-to-equity at 0.06 and excellent interest coverage. Its liquidity ratios are weak, with a current ratio of 0.81. DocuSign does not pay dividends, consistent with a possible reinvestment or growth strategy.

Which one has the best ratios?

Intuit presents a favorable overall ratio profile with balanced profitability, leverage, and liquidity, despite high valuation multiples and a low dividend yield. DocuSign exhibits superior profitability and minimal leverage but weaker liquidity and no dividend payout. Intuit’s ratios are globally more favorable, while DocuSign’s are slightly favorable due to some liquidity concerns.

Strategic Positioning

This section compares the strategic positioning of Intuit and DocuSign, including market position, key segments, and exposure to technological disruption:

Intuit Inc.

- Leading market position with strong competitive pressure in financial management software.

- Diverse segments: Small Business, Consumer, Credit Karma, and Professional Tax driving revenue growth.

- Moderate exposure with established cloud-based financial products and payment solutions.

DocuSign, Inc.

- Smaller market cap with competitive pressure in e-signature and agreement cloud solutions.

- Concentrated on electronic signature, contract lifecycle management, and AI-driven agreement automation.

- High technological disruption focus via AI, digital workflows, and remote online notarization.

Intuit Inc. vs DocuSign, Inc. Positioning

Intuit adopts a diversified approach across multiple financial management segments, balancing consumer and business products. DocuSign concentrates on digital agreement solutions with advanced AI capabilities, reflecting a focused but innovative market strategy.

Which has the best competitive advantage?

Intuit shows a slightly favorable moat with value creation but declining profitability, while DocuSign also has a slightly favorable moat with growing profitability but currently sheds value, indicating evolving competitive positions.

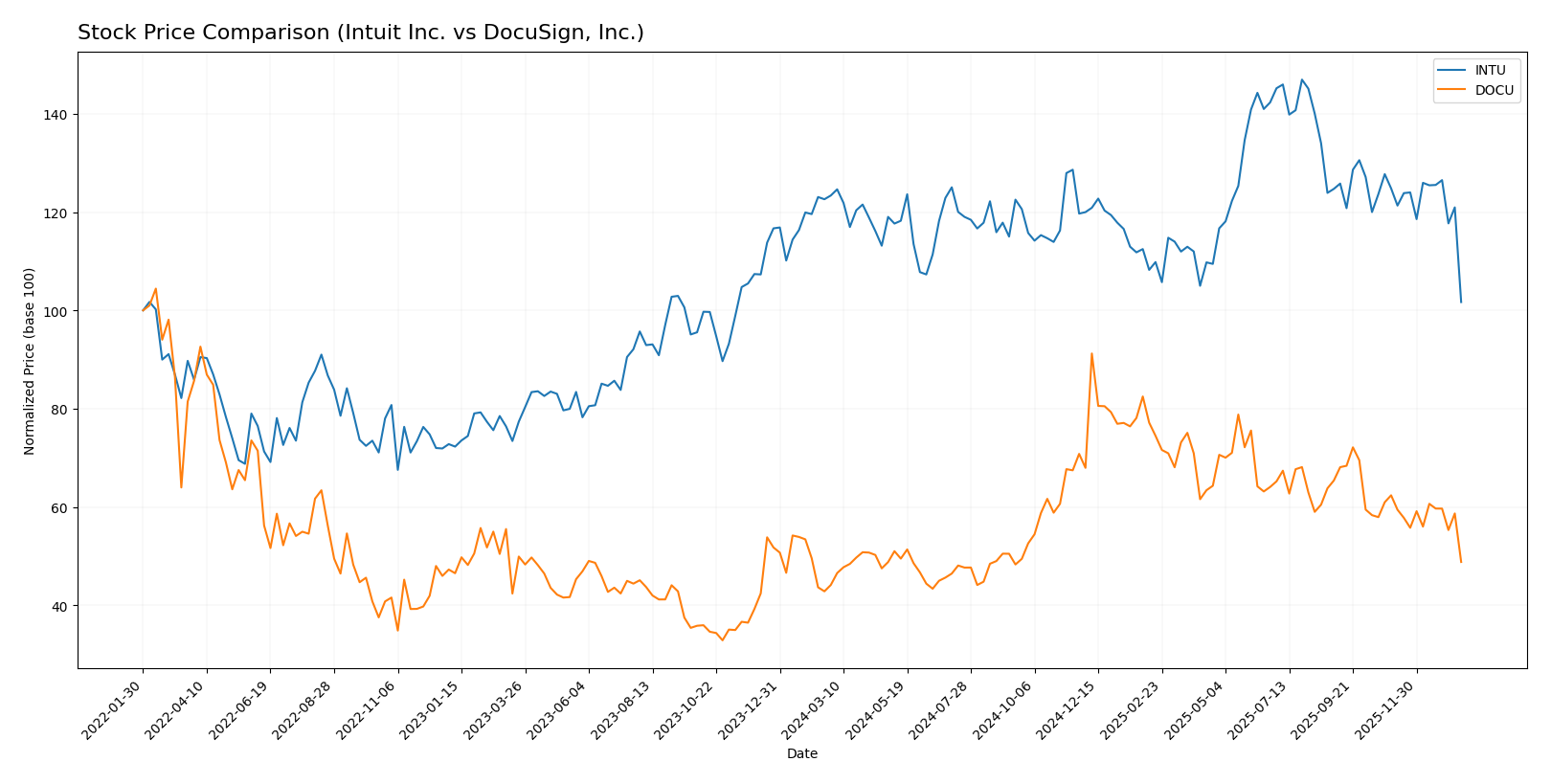

Stock Comparison

This stock price chart highlights significant divergent movements over the past 12 months, with Intuit Inc. exhibiting a sustained bearish trend and DocuSign, Inc. showing an overall bullish trajectory despite recent weakness.

Trend Analysis

Intuit Inc.’s stock declined by 17.58% over the past year, signaling a bearish trend with decelerating downward momentum. The price ranged from a low of 543.83 to a high of 785.95, with notable volatility (std deviation 51.54).

DocuSign, Inc. posted a 10.62% increase over the same period, reflecting a bullish trend with deceleration. Prices fluctuated between 50.84 and 106.99, accompanied by lower volatility (std deviation 12.97).

Comparing both stocks, DocuSign delivered the highest market performance over the year, contrasting with Intuit’s considerable decline despite higher volatility and volume activity.

Target Prices

The current analyst consensus reveals promising upside potential for both Intuit Inc. and DocuSign, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Intuit Inc. | 880 | 700 | 798.4 |

| DocuSign, Inc. | 88 | 70 | 76.86 |

Analysts expect Intuit’s stock to significantly exceed its current price of $542, indicating strong growth prospects. DocuSign’s consensus target similarly suggests a notable upside from its current $57 price, pointing to positive market sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Intuit Inc. and DocuSign, Inc.:

Rating Comparison

Intuit Inc. Rating

- Rating: B, considered Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable outlook on future cash flows.

- ROE Score: 4, showing efficient profit generation from equity.

- ROA Score: 5, demonstrating very effective asset utilization.

- Debt To Equity Score: 2, reflecting moderate financial risk.

- Overall Score: 3, a moderate overall financial standing.

DocuSign, Inc. Rating

- Rating: B+, also classified as Very Favorable.

- Discounted Cash Flow Score: 5, a Very Favorable score reflecting strong cash flow prospects.

- ROE Score: 4, equally favorable in generating shareholder returns.

- ROA Score: 4, favorable asset use but slightly below Intuit’s score.

- Debt To Equity Score: 3, indicating moderate but somewhat higher leverage than Intuit.

- Overall Score: 3, also moderate in overall financial health.

Which one is the best rated?

DocuSign holds a slightly higher rating (B+) compared to Intuit’s B, supported by a superior discounted cash flow score. However, Intuit leads in asset utilization with a higher ROA. Both companies share a moderate overall score of 3.

Scores Comparison

Here is a comparison of the financial health scores for Intuit Inc. and DocuSign, Inc.:

INTU Scores

- Altman Z-Score: 9.35, indicating a safe zone rating.

- Piotroski Score: 9, classified as very strong financial health.

DOCU Scores

- Altman Z-Score: 4.43, indicating a safe zone rating.

- Piotroski Score: 5, rated as average financial health.

Which company has the best scores?

Based on the provided data, Intuit Inc. has higher scores in both the Altman Z-Score and Piotroski Score, indicating stronger financial stability and health compared to DocuSign, Inc.

Grades Comparison

Here is a comparison of the recent grades issued by reputable financial institutions for Intuit Inc. and DocuSign, Inc.:

Intuit Inc. Grades

The following table summarizes the latest grades from major grading companies for Intuit Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Downgrade | Equal Weight | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| BMO Capital | Maintain | Outperform | 2025-11-18 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-18 |

| RBC Capital | Maintain | Outperform | 2025-09-02 |

| RBC Capital | Maintain | Outperform | 2025-08-22 |

| UBS | Maintain | Neutral | 2025-08-22 |

| Morgan Stanley | Maintain | Overweight | 2025-08-22 |

| Barclays | Maintain | Overweight | 2025-08-22 |

Intuit’s grades predominantly show a strong “Outperform” and “Overweight” trend, with a recent minor downgrade to “Equal Weight” by Wells Fargo.

DocuSign, Inc. Grades

The following table shows recent grades from recognized grading companies for DocuSign, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Hold | 2025-12-05 |

| Baird | Maintain | Neutral | 2025-12-05 |

DocuSign’s grades predominantly indicate a “Neutral” or “Hold” stance, with consistent maintenance across all grading companies.

Which company has the best grades?

Intuit Inc. has received generally stronger grades than DocuSign, with multiple “Outperform” and “Overweight” ratings compared to DocuSign’s predominantly “Neutral” and “Hold” grades. This suggests that investors might view Intuit as having greater growth potential and relative strength in analyst sentiment.

Strengths and Weaknesses

Below is a comparative table highlighting the key strengths and weaknesses of Intuit Inc. and DocuSign, Inc. based on their latest financial and operational data.

| Criterion | Intuit Inc. (INTU) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Diversification | Highly diversified with Consumer, Credit Karma, Global Business, and Professional Tax segments generating multi-B revenues | Primarily dependent on Subscription and Circulation revenue with minor Professional Services segment |

| Profitability | Strong profitability with 20.55% net margin and 19.63% ROE, but declining ROIC trend | Higher net margin at 35.87% and impressive 53.32% ROE, with growing ROIC trend but still shedding value overall |

| Innovation | Established market leader with consistent value creation, but ROIC declining | Rapidly growing profitability indicating improving innovation and competitive positioning |

| Global presence | Significant global business solutions presence | Mainly focused on digital signature and related services, expanding internationally but less diversified |

| Market Share | Large market share in financial and tax software | Growing market share in document management and e-signature, but competitive pressures remain |

Intuit demonstrates robust profitability and broad diversification, although its profitability is slightly declining. DocuSign shows strong growth potential and improving profitability but lacks the diversification and consistent value creation of Intuit. Investors should weigh Intuit’s stable value creation against DocuSign’s growth trajectory.

Risk Analysis

Below is a comparison of key risks for Intuit Inc. and DocuSign, Inc. based on the most recent data from 2025.

| Metric | Intuit Inc. | DocuSign, Inc. |

|---|---|---|

| Market Risk | Beta 1.25 indicates moderate volatility; price range $532.65-$813.7 | Beta 0.99 indicates lower volatility; price range $56.99-$99.3 |

| Debt level | Moderate leverage, Debt/Equity 0.34, Debt to Assets 18% (favorable) | Low leverage, Debt/Equity 0.06, Debt to Assets 3.1% (favorable) |

| Regulatory Risk | Moderate, operates in multiple jurisdictions with financial compliance requirements | Moderate, faces regulatory scrutiny in electronic signature and data privacy laws |

| Operational Risk | Low, diversified segments with strong operational metrics and stable employee base | Medium, reliance on SaaS platform with 6,800+ employees and competitive market |

| Environmental Risk | Low, technology sector with limited direct environmental impact | Low, primarily software services with minimal environmental footprint |

| Geopolitical Risk | Moderate, international exposure but mainly US and Canada | Moderate, global presence but US-centric headquarters |

The most impactful risks for both companies remain market volatility and regulatory changes, particularly in data privacy and compliance. Intuit’s moderate debt level and diverse product lines reduce operational risk, while DocuSign’s lower leverage but higher operational reliance on cloud infrastructure suggest caution. Both companies show financial resilience but require monitoring of sector-specific regulatory shifts.

Which Stock to Choose?

Intuit Inc. (INTU) shows strong income evolution with a 15.63% revenue growth in 2025 and favorable profitability ratios, including a 20.55% net margin and 19.63% ROE. Its debt levels remain moderate with a net debt to EBITDA of 0.64 and a solid rating of B, indicating overall financial health.

DocuSign, Inc. (DOCU) exhibits moderate income growth at 7.78% in 2025, with a higher net margin of 35.87% and an impressive 53.32% ROE. Despite a lower current ratio of 0.81, it maintains low debt levels with a net debt to EBITDA of 0.06 and a slightly stronger B+ rating reflecting stable financial footing.

For investors focused on stability and proven value creation, Intuit’s consistent income growth and favorable financial ratios might appear more appealing. Conversely, those with a tolerance for risk seeking rapid profitability improvement and high returns could find DocuSign’s accelerating ROIC and growth trajectory more compelling.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Intuit Inc. and DocuSign, Inc. to enhance your investment decisions: