Home > Comparison > Technology > FICO vs DOCU

The strategic rivalry between Fair Isaac Corporation and DocuSign, Inc. shapes the evolution of the technology sector’s software application industry. Fair Isaac operates as a data-driven analytics and decision management provider, while DocuSign focuses on high-margin digital agreement and workflow automation solutions. This analysis pits a mature analytics powerhouse against an innovative transaction enabler to identify which trajectory offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

Fair Isaac Corporation and DocuSign, Inc. stand as pivotal players in the software application industry, shaping digital decision-making and agreement processes.

Fair Isaac Corporation: Pioneer in Analytic Decision Software

Fair Isaac Corporation dominates the analytic software landscape by delivering data-driven decision management and scoring products. Its core revenue stems from two segments: Scores, offering credit and risk scoring solutions, and Software, delivering configurable decision management tools. In 2026, the company strategically focuses on expanding its FICO Platform to support advanced analytics and decision use cases worldwide.

DocuSign, Inc.: Leader in Digital Agreement Technology

DocuSign, Inc. leads the electronic signature market by providing a comprehensive suite of digital agreement solutions. Its revenue engine revolves around e-signature services, contract lifecycle management (CLM), and AI-powered agreement insights. The company’s 2026 strategy emphasizes AI-driven contract automation and sector-specific cloud offerings, targeting real estate, mortgage, and government compliance workflows.

Strategic Collision: Similarities & Divergences

Both companies operate within software applications but diverge sharply in focus: Fair Isaac champions decision automation with modular, analytic platforms, while DocuSign pioneers digital agreements and workflow automation. Their primary battlefront lies in embedding AI to enhance enterprise decision and contract processes. Investors encounter distinct profiles—Fair Isaac’s stable, data-centric moat contrasts with DocuSign’s rapid innovation in cloud-native, legally sensitive workflows.

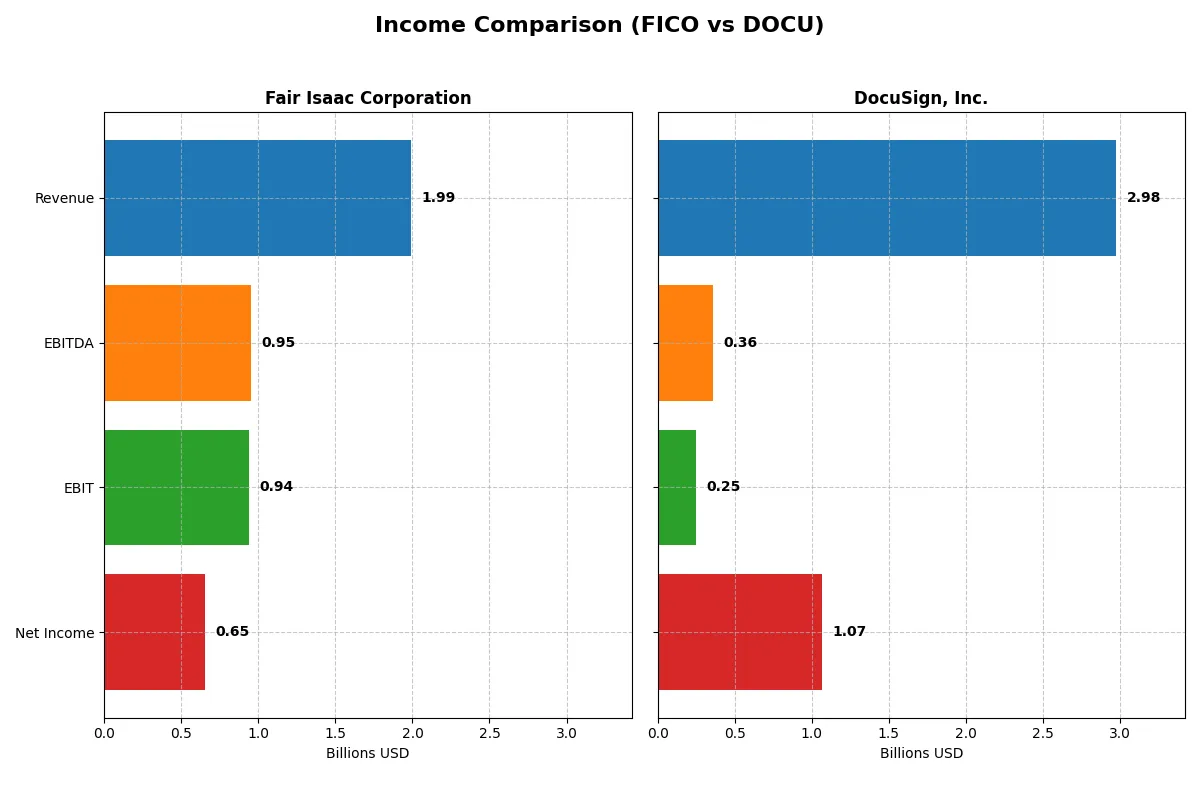

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Fair Isaac Corporation (FICO) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Revenue | 1.99B | 2.98B |

| Cost of Revenue | 354M | 622M |

| Operating Expenses | 712M | 2.16B |

| Gross Profit | 1.64B | 2.36B |

| EBITDA | 951M | 357M |

| EBIT | 936M | 249M |

| Interest Expense | 134M | 2M |

| Net Income | 652M | 1.07B |

| EPS | 26.9 | 5.23 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison uncovers which company runs its business more efficiently and delivers stronger profit growth.

Fair Isaac Corporation Analysis

Fair Isaac’s revenue grew steadily from $1.3B in 2021 to nearly $2B in 2025, marking a 51% increase. Net income surged 66% over the same period, reaching $652M in 2025. Gross margin remains robust at 82%, and net margin at 33%, signaling strong cost control and operational leverage. The 2025 results show accelerating efficiency, with EBIT margin climbing to 47%.

DocuSign, Inc. Analysis

DocuSign expanded revenue from $1.45B in 2021 to $3B in 2025, doubling its top line. Net income swung from a loss in early years to a $1.07B profit in 2025. Gross margin holds firm at 79%, but EBIT margin is only 8%, reflecting heavy operating expenses. However, recent years show explosive net margin and EPS growth, indicating improved profitability momentum.

Margin Strength vs. Growth Explosion

Fair Isaac delivers superior margin quality and consistent profit growth, with a high EBIT margin and steady net income rise. DocuSign impresses with rapid revenue and net income expansion, yet its low EBIT margin reveals ongoing operational cost pressures. For investors prioritizing margin resilience and sustainable earnings, Fair Isaac’s profile appears more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of these companies:

| Ratios | Fair Isaac Corporation (FICO) | DocuSign, Inc. (DOCU) |

|---|---|---|

| ROE | -37.3% | 53.3% |

| ROIC | 52.96% | 9.09% |

| P/E | 55.6x | 18.5x |

| P/B | -20.8x | 9.87x |

| Current Ratio | 0.83 | 0.81 |

| Quick Ratio | 0.83 | 0.81 |

| D/E (Debt-to-Equity) | -1.76 | 0.06 |

| Debt-to-Assets | 164.6% | 3.10% |

| Interest Coverage | 6.92x | 129x |

| Asset Turnover | 1.07 | 0.74 |

| Fixed Asset Turnover | 21.2 | 7.28 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and highlighting operational performance.

Fair Isaac Corporation

Fair Isaac posts a strong net margin at 32.75% and an exceptional ROIC of 52.96%, signaling operational efficiency. However, its negative ROE at -37.34% and stretched P/E of 55.64 suggest valuation concerns. The company pays no dividend, opting instead to reinvest heavily in R&D, aiming for long-term growth despite a weak current ratio at 0.83.

DocuSign, Inc.

DocuSign delivers a robust net margin of 35.87% and a favorable ROE of 53.32%, reflecting solid profitability. Its P/E of 18.51 is more reasonable, indicating moderate valuation. With no dividend payout, DocuSign prioritizes reinvestment in innovation and growth. The current ratio at 0.81 flags liquidity risk but is offset by strong interest coverage and low debt-to-assets at 3.1%.

Premium Valuation vs. Operational Safety

Fair Isaac exhibits superior operational returns but suffers from valuation stretch and liquidity issues. DocuSign balances profitability with a more moderate valuation and lower financial risk. Investors seeking growth with operational efficiency may lean toward Fair Isaac, while those favoring steadier financial health might prefer DocuSign’s profile.

Which one offers the Superior Shareholder Reward?

I compare Fair Isaac Corporation (FICO) and DocuSign, Inc. (DOCU) based on their shareholder reward strategies. Neither pays dividends, so total return depends on buybacks and reinvestment. FICO boasts robust free cash flow (31.8/share in 2025) and consistently zero dividend payout, signaling full reinvestment or buybacks. DOCU also pays no dividends but has a smaller free cash flow per share (4.5/share in 2025) and less operating margin (8.4% vs. FICO’s 47%). FICO’s buyback intensity is implicit in strong cash flow and operating cash flow coverage, supporting a sustainable repurchase program. DOCU’s lower margins and volatile profitability raise concerns about buyback sustainability. I conclude FICO offers a superior total return profile in 2026 due to its stronger free cash flow, higher operational efficiency, and more sustainable capital allocation.

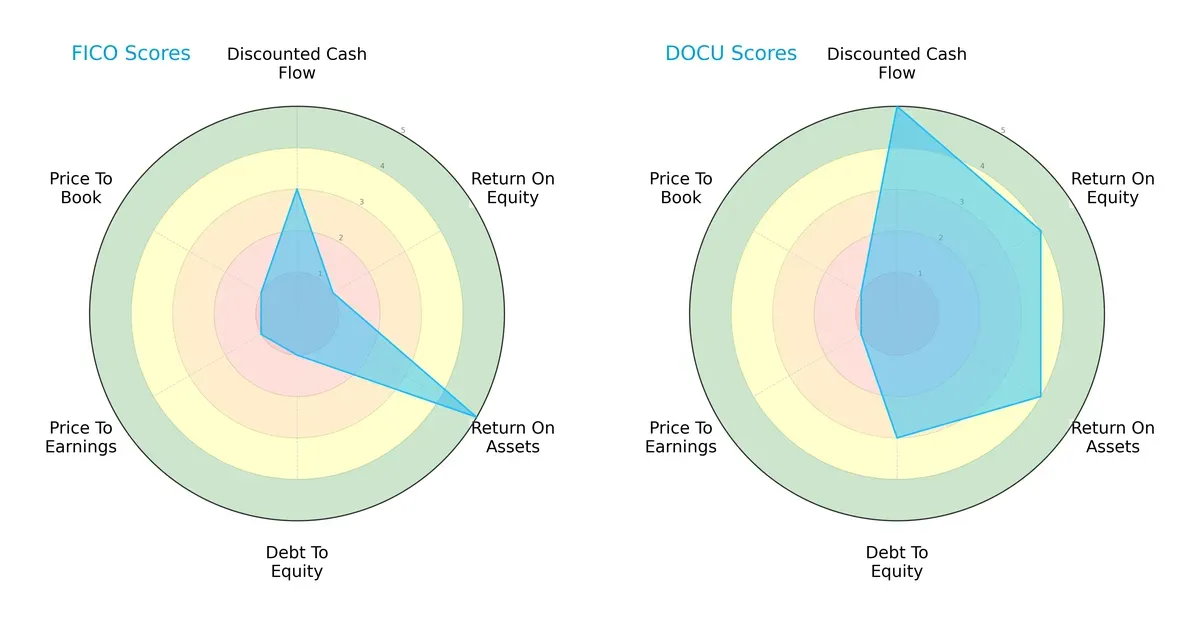

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their financial strengths and vulnerabilities:

DocuSign, Inc. (DOCU) presents a more balanced profile with strong DCF (5), ROE (4), and ROA (4) scores, signaling efficient capital use and growth potential. Fair Isaac Corporation (FICO) relies heavily on asset efficiency (ROA 5) but suffers from weak equity returns (ROE 1) and high leverage risk (Debt/Equity 1). DOCU’s moderate debt profile contrasts sharply with FICO’s financial fragility. Both show poor valuation scores (P/E and P/B at 1), suggesting market skepticism.

—

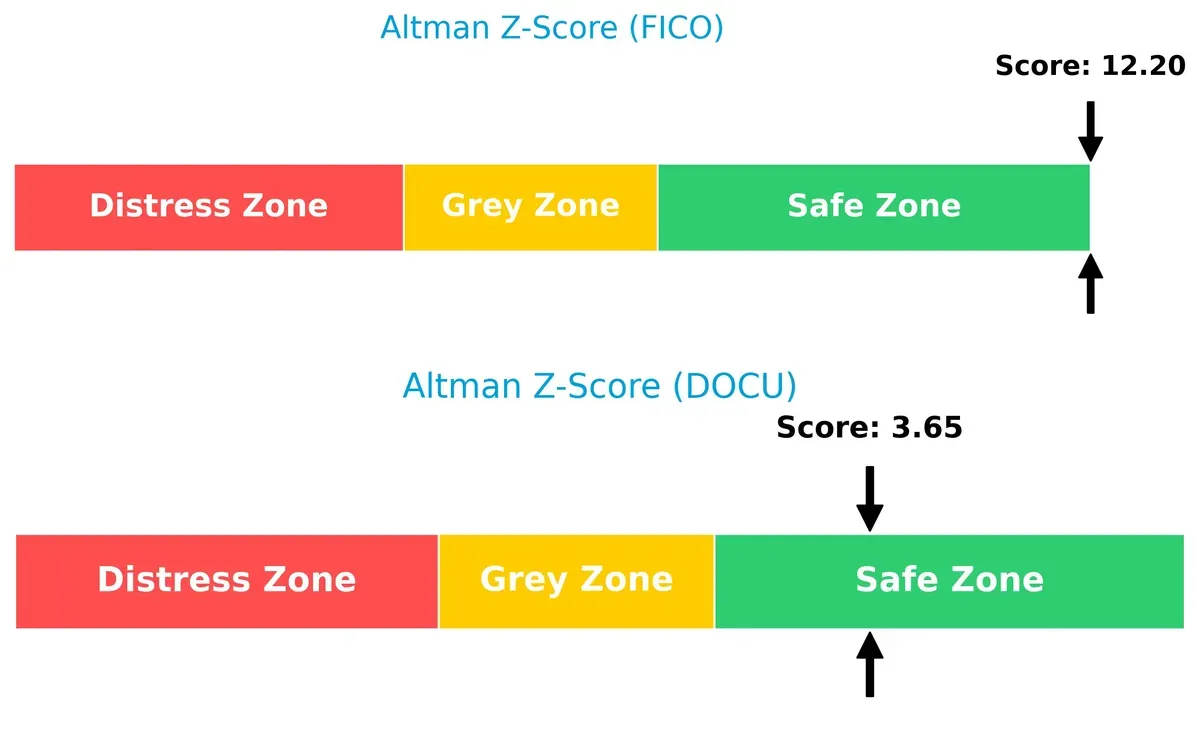

Bankruptcy Risk: Solvency Showdown

FICO’s Altman Z-Score (12.20) far exceeds DOCU’s (3.65), indicating a stronger solvency buffer in the current economic cycle:

Both firms reside in the safe zone, but FICO’s extremely high score reflects exceptional financial stability. DOCU’s moderate safe-zone score suggests reasonable solvency but with narrower margins, warranting cautious monitoring.

—

Financial Health: Quality of Operations

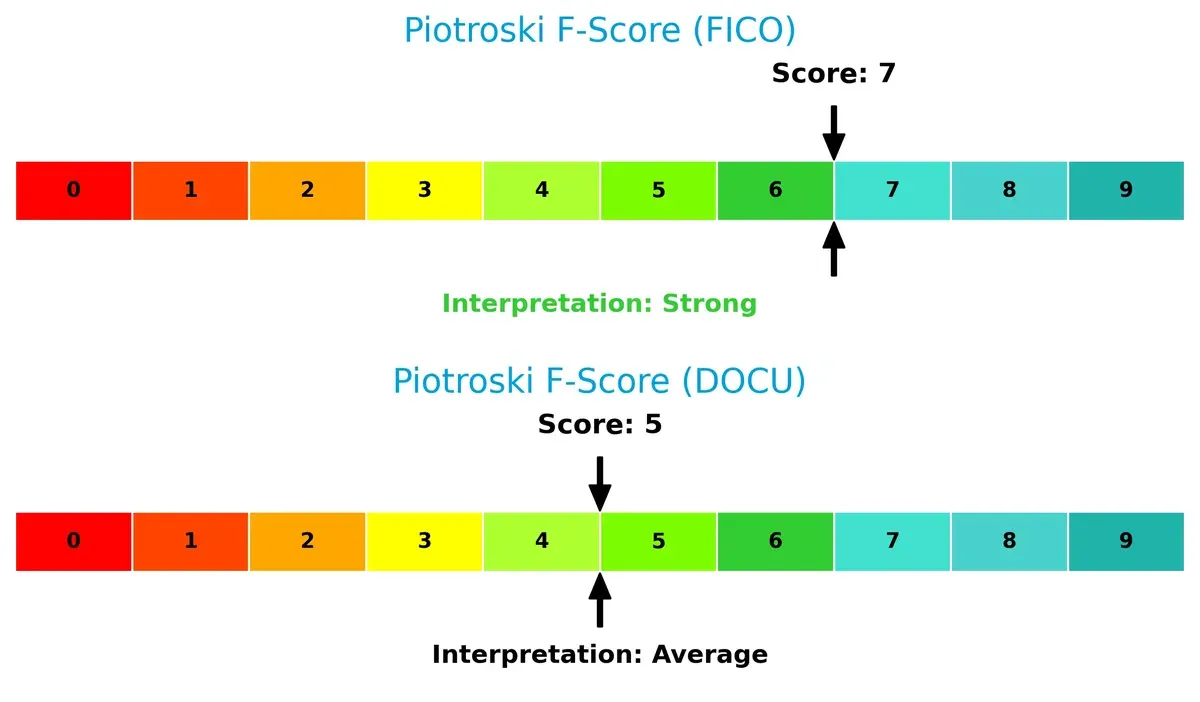

FICO’s Piotroski F-Score (7) outperforms DOCU’s (5), signaling stronger internal financial health and operational quality:

FICO demonstrates robust profitability, leverage, and liquidity metrics. DOCU’s average score raises red flags around internal efficiencies and financial controls. Investors should weigh DOCU’s operational risks against its growth prospects carefully.

How are the two companies positioned?

This section dissects the operational DNA of FICO and DOCU by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which business model offers the most resilient, sustainable competitive advantage today.

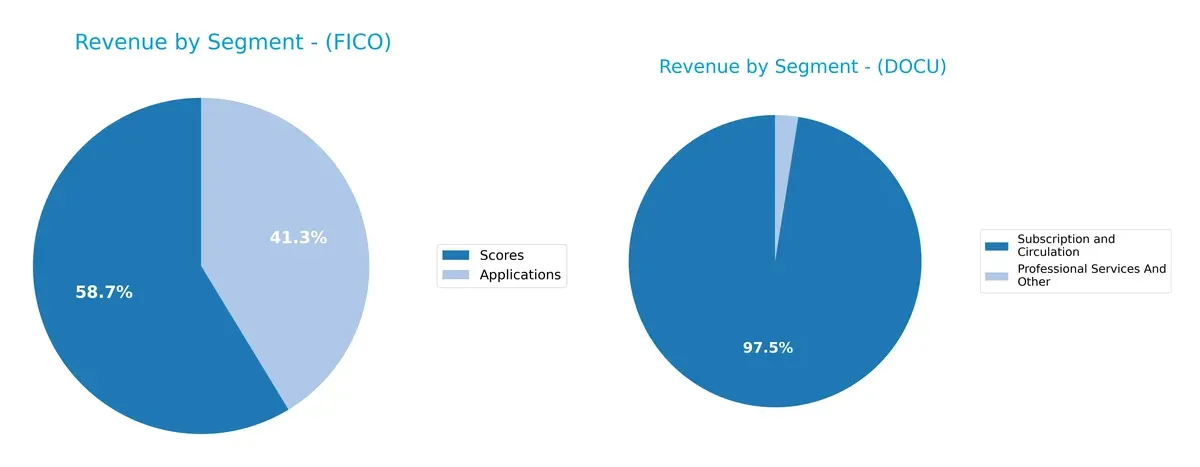

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Fair Isaac Corporation and DocuSign diversify their income streams and where their primary sector bets lie:

Fair Isaac Corporation anchors revenue in two segments: Scores at $1.17B and Applications at $822M in 2025. This mix reveals a balanced model with meaningful diversification. DocuSign, however, pivots heavily on Subscription and Circulation at $2.9B, dwarfing its $75M Professional Services. DocuSign’s reliance on subscription revenue signals ecosystem lock-in but raises concentration risk, while Fair Isaac’s broader base cushions sector downturns.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Fair Isaac Corporation (FICO) and DocuSign, Inc. (DOCU):

FICO Strengths

- High net margin at 32.75%

- Strong ROIC at 52.96% indicating efficient capital use

- Favorable interest coverage at 7.01

- Diverse product revenue from Applications and Scores

- Solid Americas and EMEA geographic revenues

DOCU Strengths

- Higher net margin at 35.87%

- Strong ROE at 53.32% reflecting profitable equity use

- Excellent interest coverage at 160.96

- Large subscription revenue base

- Significant US and growing Non-US presence

FICO Weaknesses

- Negative ROE at -37.34% signals poor equity returns

- High debt to assets at 164.6% indicates financial leverage risk

- Low current ratio at 0.83 reflects liquidity concerns

- Unfavorable P/E at 55.64 suggests overvaluation

- No dividend yield

- Limited product diversification focused on Scores

DOCU Weaknesses

- Moderate ROIC at 9.09% limits capital efficiency

- Unfavorable PB ratio at 9.87 questions valuation

- Low current ratio at 0.81 implies liquidity risk

- No dividend yield

- Revenue heavily concentrated in US market

Both companies show slightly favorable overall financial health but face liquidity constraints and lack dividend payouts. FICO’s strong capital efficiency contrasts with DOCU’s superior profitability and equity returns, reflecting different strategic focuses.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from the relentless erosion of competition:

Fair Isaac Corporation (FICO): Analytics Powerhouse with Intangible Asset Moat

FICO’s moat stems from proprietary analytics and scoring algorithms. It boasts a very favorable ROIC 44% above WACC and margin stability. Expansion into decision management software deepens its moat in 2026.

DocuSign, Inc. (DOCU): Network Effects with Emerging Profitability

DocuSign’s competitive edge lies in strong network effects within digital agreements. Its ROIC barely exceeds WACC, signaling a slight moat. However, rapid revenue growth and AI-driven contract tools offer upside disruption potential.

Intangible Assets vs. Network Effects: The Moat Depth Contest

FICO’s deeply entrenched intangible assets create a wider, more durable moat than DocuSign’s still-maturing network effects. FICO’s proven value creation better equips it to defend and extend market share.

Which stock offers better returns?

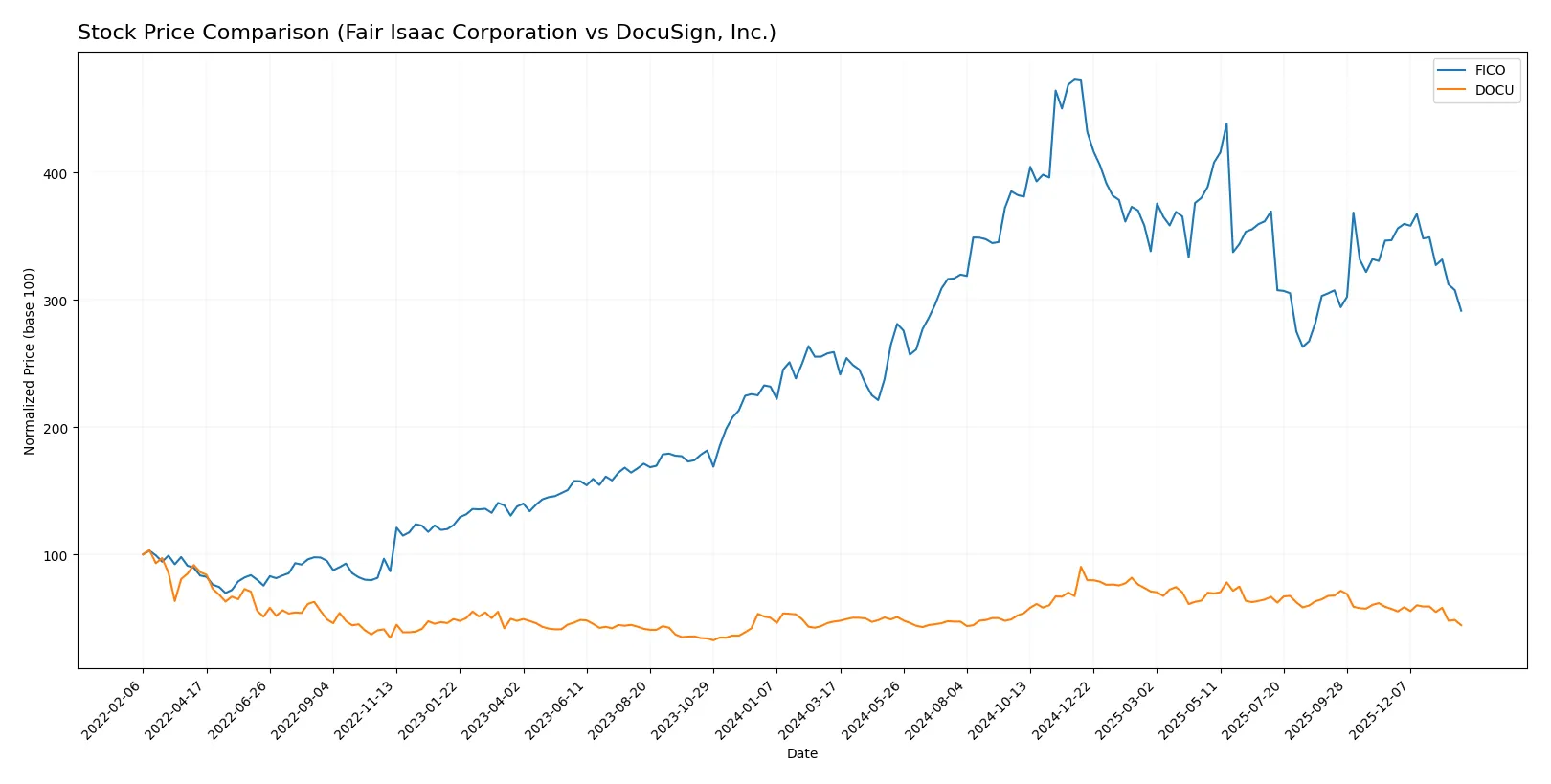

Over the past year, Fair Isaac Corporation’s stock gained 12.51%, showing a bullish but decelerating trend, while DocuSign, Inc. declined 6.13%, reflecting a bearish momentum.

Trend Comparison

Fair Isaac Corporation’s stock rose 12.51% over 12 months, exhibiting a bullish trend with decelerating momentum. Its price ranged between 1,110.85 and 2,375.03, signaling notable volatility.

DocuSign, Inc. showed a 6.13% decline over the same period, confirming a bearish trend with deceleration. Price fluctuated between 50.84 and 106.99, with lower volatility than FICO.

Fair Isaac Corporation outperformed DocuSign, delivering stronger returns and a sustained bullish trend despite recent short-term weakness.

Target Prices

Analysts present a clear target consensus for both Fair Isaac Corporation and DocuSign, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Fair Isaac Corporation | 1,640 | 2,400 | 2,115 |

| DocuSign, Inc. | 70 | 88 | 76.86 |

The target consensus for Fair Isaac exceeds its current price of 1,463, indicating upside potential. DocuSign’s consensus, at 76.86, also suggests room for growth from the current 52.54.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the recent institutional grades for Fair Isaac Corporation and DocuSign, Inc.:

Fair Isaac Corporation Grades

The following table summarizes key analyst grades for Fair Isaac Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-29 |

| Jefferies | Maintain | Buy | 2026-01-16 |

| Wells Fargo | Maintain | Overweight | 2026-01-14 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-11-06 |

| BMO Capital | Maintain | Outperform | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-10-14 |

| Barclays | Maintain | Overweight | 2025-10-02 |

| Needham | Maintain | Buy | 2025-10-02 |

DocuSign, Inc. Grades

The following table summarizes key analyst grades for DocuSign, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Hold | 2025-12-05 |

| Wedbush | Maintain | Neutral | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

Which company has the best grades?

Fair Isaac Corporation consistently receives Buy and Outperform ratings, indicating stronger institutional confidence. DocuSign’s grades cluster around Neutral and Hold, reflecting more cautious views. Investors may interpret this as Fair Isaac having a more favorable analyst outlook.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Fair Isaac Corporation

- Operates in analytics and decision management with strong legacy but faces disruption from AI-driven competitors.

DocuSign, Inc.

- Leads in e-signature software but contends with intensifying competition from integrated workflow platforms.

2. Capital Structure & Debt

Fair Isaac Corporation

- High debt-to-assets ratio (165%) signals financial leverage risk.

DocuSign, Inc.

- Maintains low debt (3% debt-to-assets), implying conservative financial management.

3. Stock Volatility

Fair Isaac Corporation

- Beta of 1.29 shows above-market volatility, increasing investment risk.

DocuSign, Inc.

- Beta near 1.0 indicates volatility aligned with market averages, offering steadier risk.

4. Regulatory & Legal

Fair Isaac Corporation

- Faces regulatory scrutiny on data privacy due to handling sensitive credit data globally.

DocuSign, Inc.

- Compliance demands rise with expanding AI features and cross-border e-signature laws.

5. Supply Chain & Operations

Fair Isaac Corporation

- Software delivery depends on cloud infrastructure; risks from outages and cybersecurity threats persist.

DocuSign, Inc.

- Relies on cloud ecosystems; operational risks stem from platform integration and uptime reliability.

6. ESG & Climate Transition

Fair Isaac Corporation

- Limited ESG disclosures; pressure to improve sustainability in data centers and product lifecycle.

DocuSign, Inc.

- Increasing focus on ESG, especially in reducing carbon footprint of cloud operations and governance.

7. Geopolitical Exposure

Fair Isaac Corporation

- Significant international presence exposes it to geopolitical tensions affecting data flows.

DocuSign, Inc.

- Global customer base faces risks from trade restrictions and data localization laws.

Which company shows a better risk-adjusted profile?

Fair Isaac’s most pressing risk is excessive leverage, which threatens financial stability despite strong operational returns. DocuSign’s primary risk lies in fierce market competition and evolving regulatory compliance. I observe DocuSign’s lower debt levels and stable beta provide a better risk-adjusted profile. Its Altman Z-score remains safe, but a middling Piotroski score signals room for operational improvement. Fair Isaac’s high debt-to-assets ratio and unfavorable ROE score heighten concern, despite excellent asset turnover. Overall, DocuSign offers a more balanced risk-return dynamic in 2026.

Final Verdict: Which stock to choose?

Fair Isaac Corporation (FICO) excels as a value creator with a durable moat fueled by exceptional capital efficiency. Its superpower lies in generating high returns on invested capital well above its cost of capital. The point of vigilance is its stretched liquidity position, which could challenge short-term resilience. FICO suits an Aggressive Growth portfolio aiming for long-term value creation.

DocuSign, Inc. (DOCU) commands a strategic moat through strong recurring revenue and robust equity returns. It exhibits a safer financial profile with low debt and remarkable interest coverage, offering stability amid volatility. DOCU fits well within a GARP (Growth at a Reasonable Price) portfolio, balancing growth prospects with a more conservative risk stance.

If you prioritize durable competitive advantages and superior capital returns, FICO is the compelling choice due to its proven value creation and strong income growth. However, if you seek a blend of growth with better financial stability and lower leverage, DOCU offers better stability despite a less pronounced moat. Each presents a distinct analytical scenario suited to different investor risk tolerances and strategic goals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Fair Isaac Corporation and DocuSign, Inc. to enhance your investment decisions: