In the dynamic energy sector, Diamondback Energy, Inc. (FANG) and Expand Energy Corporation (EXE) stand out as prominent players in oil and gas exploration and production. Both companies focus on unconventional onshore reserves within key U.S. basins, yet they differ in scale and strategic positioning. This comparison highlights their market overlap and innovation approaches to help you identify the most compelling investment opportunity in 2026. Let’s explore which company deserves a place in your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Diamondback Energy and Expand Energy by providing an overview of these two companies and their main differences.

Diamondback Energy Overview

Diamondback Energy, Inc. is an independent oil and natural gas company focused on acquiring, developing, exploring, and exploiting unconventional onshore reserves primarily in the Permian Basin of West Texas and New Mexico. The company operates extensive midstream infrastructure and holds significant acreage and producing wells, positioning itself as a major player in the Oil & Gas Exploration & Production industry. Founded in 2007, it is headquartered in Midland, Texas.

Expand Energy Overview

Expand Energy Corporation engages in the acquisition, exploration, and development of oil, natural gas, and natural gas liquids from underground reservoirs across the U.S. It holds interests mainly in natural gas plays in the Marcellus Shale and Haynesville/Bossier Shales. Formerly Chesapeake Energy, it rebranded in 2024 and is based in Oklahoma City, Oklahoma. Founded in 1989, Expand Energy operates a large portfolio of onshore unconventional natural gas assets.

Key similarities and differences

Both companies operate in the Oil & Gas Exploration & Production sector with a focus on onshore unconventional resources in the U.S., but Diamondback centers on oil-rich Permian Basin assets while Expand Energy emphasizes natural gas plays in the Appalachian and Gulf Coast regions. Diamondback also integrates midstream infrastructure into its operations, whereas Expand Energy primarily focuses on upstream production. Their geographic focus and asset types represent the key distinctions in their business models.

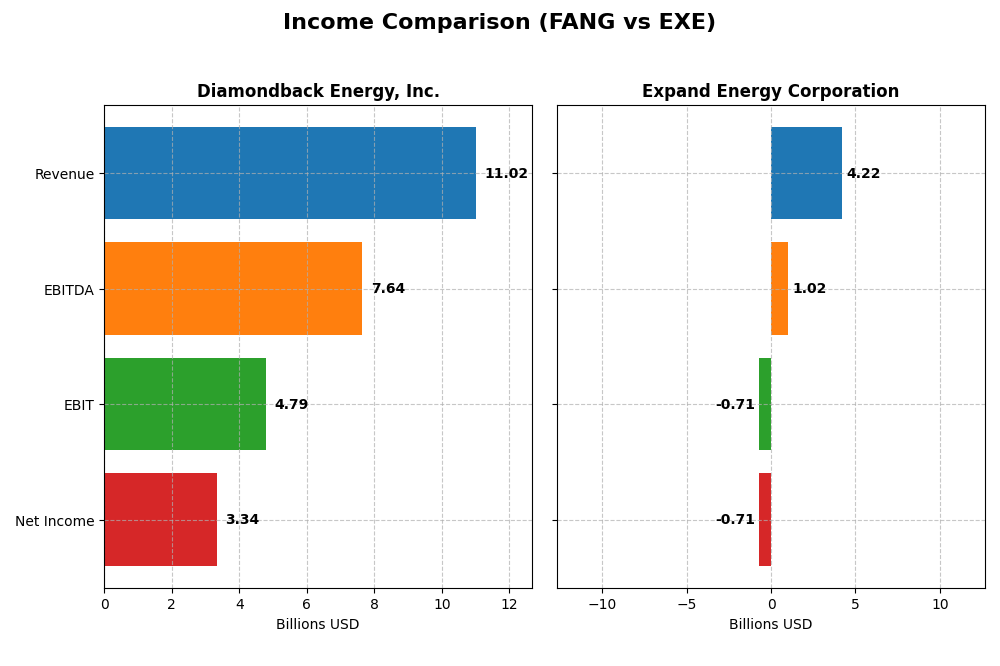

Income Statement Comparison

The table below presents a direct comparison of key income statement metrics for Diamondback Energy, Inc. (FANG) and Expand Energy Corporation (EXE) for the fiscal year 2024.

| Metric | Diamondback Energy, Inc. (FANG) | Expand Energy Corporation (EXE) |

|---|---|---|

| Market Cap | 42.9B | 24.2B |

| Revenue | 11.0B | 4.2B |

| EBITDA | 7.6B | 1.0B |

| EBIT | 4.8B | -711M |

| Net Income | 3.3B | -714M |

| EPS | 15.53 | -4.55 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Diamondback Energy, Inc.

Diamondback Energy showed strong revenue growth from 2020 to 2024, with a 32.19% increase in the last year alone. Net income also grew significantly over the period, despite a recent decline in net margin and EPS. Gross and EBIT margins remained favorable, indicating solid operational efficiency. The 2024 results reflect continued revenue expansion but a slight compression in profitability margins.

Expand Energy Corporation

Expand Energy’s revenue declined sharply by 45.71% in 2024 after peaking in 2022. Net income remained negative in the latest year, reflecting unfavorable EBIT and net margins. While gross margin stayed favorable, overall profitability deteriorated markedly. The recent year’s steep revenue and profit contraction marks a challenging phase following prior growth periods.

Which one has the stronger fundamentals?

Diamondback Energy exhibits stronger fundamentals with consistent revenue growth, positive net income, and favorable gross and EBIT margins. In contrast, Expand Energy faces significant revenue decline and negative profitability metrics recently, despite earlier gains. Overall, Diamondback’s financial performance appears more stable and resilient based on the income statement data.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Diamondback Energy, Inc. (FANG) and Expand Energy Corporation (EXE) based on their most recent fiscal year data from 2024.

| Ratios | Diamondback Energy, Inc. (FANG) | Expand Energy Corporation (EXE) |

|---|---|---|

| ROE | 8.85% | -4.06% |

| ROIC | 5.75% | -2.70% |

| P/E | 10.48 | -21.89 |

| P/B | 0.93 | 0.89 |

| Current Ratio | 0.44 | 0.64 |

| Quick Ratio | 0.41 | 0.64 |

| D/E | 0.33 | 0.33 |

| Debt-to-Assets | 18.47% | 20.88% |

| Interest Coverage | 15.11 | -6.53 |

| Asset Turnover | 0.16 | 0.15 |

| Fixed Asset Turnover | 0.17 | 0.17 |

| Payout ratio | 47.27% | -54.34% |

| Dividend yield | 4.51% | 2.48% |

Interpretation of the Ratios

Diamondback Energy, Inc.

Diamondback Energy displays a favorable net margin of 30.28% and a solid dividend yield of 4.51%, supported by a strong payout capacity. However, concerns arise with a below-average return on equity of 8.85% and weak liquidity ratios, including a current ratio of 0.44. The company maintains a moderate debt level and good interest coverage, but asset turnover remains low, suggesting operational efficiency challenges.

Expand Energy Corporation

Expand Energy faces unfavorable profitability ratios with negative net margin (-16.92%), return on equity (-4.06%), and return on invested capital (-2.7%). Liquidity ratios remain weak, with a current ratio of 0.64, and the company shows negative interest coverage, indicating financial stress. Despite these issues, it provides a 2.48% dividend yield, although its earnings do not fully cover dividend payments, implying risk in sustainability.

Which one has the best ratios?

Diamondback Energy exhibits a more favorable ratio profile overall, with stronger profitability, dividend yield, and financial health metrics. Expand Energy’s ratios point to operational and financial weaknesses, including losses and poor coverage ratios. Diamondback’s balance of favorable and unfavorable ratios suggests a more stable financial position compared to Expand Energy’s predominantly unfavorable metrics.

Strategic Positioning

This section compares the strategic positioning of Diamondback Energy, Inc. and Expand Energy Corporation, including market position, key segments, and exposure to technological disruption:

Diamondback Energy, Inc.

- Leading independent oil and gas producer in Permian Basin with significant acreage and reserves.

- Core business driven by upstream oil and gas production; also owns midstream infrastructure assets.

- Limited exposure to technological disruption mentioned; operates primarily in conventional and unconventional reservoirs.

Expand Energy Corporation

- Independent exploration and production focused on Marcellus and Haynesville/Bossier Shales natural gas plays.

- Revenue mainly from natural gas sales, gathering, transportation, and oil sales with diversified operations.

- No explicit technological disruption exposure stated; focused on natural gas resource plays and related services.

Diamondback Energy, Inc. vs Expand Energy Corporation Positioning

Diamondback’s strategy is concentrated on oil and gas production in the Permian Basin with integrated midstream operations, providing a focused but vertically linked model. Expand Energy exhibits a more diversified natural gas and oil portfolio across multiple shale basins, emphasizing gathering and processing services alongside production.

Which has the best competitive advantage?

Based on MOAT evaluation, Diamondback holds a slightly favorable position with growing profitability, while Expand Energy shows a slightly unfavorable moat status despite improving ROIC trends, indicating Diamondback currently has a modestly stronger competitive advantage.

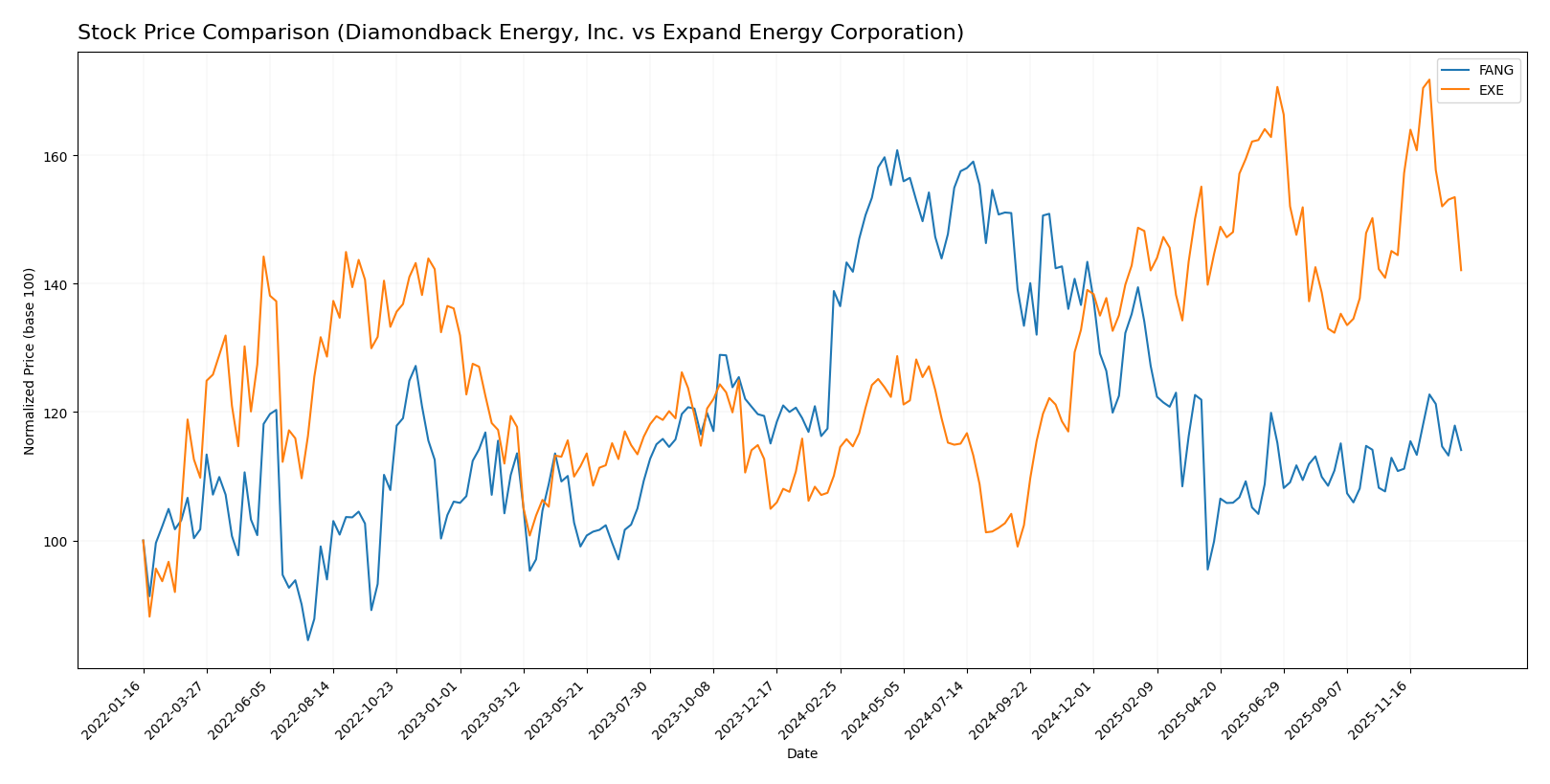

Stock Comparison

The stock price movements over the past 12 months reveal contrasting dynamics, with Diamondback Energy, Inc. (FANG) experiencing a notable decline, while Expand Energy Corporation (EXE) shows significant gains, reflecting divergent investor sentiment and trading volumes.

Trend Analysis

Diamondback Energy, Inc. (FANG) shows a bearish trend over the past year with a -17.84% price change and accelerating decline, hitting a high of 207.76 and a low of 123.37, amid high volatility (std dev 23.76). Recent months indicate slight recovery with a 1.06% increase.

Expand Energy Corporation (EXE) exhibits a bullish trend with a 29.09% price increase over the year, though the upward momentum is decelerating. The stock ranged between 70.84 and 122.86, with moderate volatility (std dev 12.95). Recently, the trend slightly reversed with a -2.06% change.

Comparing both stocks, EXE outperformed FANG over the past 12 months, delivering robust positive returns, while FANG’s performance was negative despite a minor recent rebound.

Target Prices

Analysts provide clear target price expectations for both Diamondback Energy, Inc. and Expand Energy Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Diamondback Energy, Inc. | 219 | 162 | 185.36 |

| Expand Energy Corporation | 150 | 125 | 140.63 |

The consensus target prices for Diamondback Energy and Expand Energy indicate potential upside from current prices of $147.41 and $101.63 respectively, reflecting moderately bullish analyst sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Diamondback Energy, Inc. and Expand Energy Corporation:

Rating Comparison

Diamondback Energy, Inc. Rating

- Rating: A- with a very favorable status

- Discounted Cash Flow Score: 5, very favorable

- Return on Equity Score: 4, favorable

- Return on Assets Score: 4, favorable

- Debt To Equity Score: 2, moderate

- Overall Score: 4, favorable

Expand Energy Corporation Rating

- Rating: B with a very favorable status

- Discounted Cash Flow Score: 4, favorable

- Return on Equity Score: 3, moderate

- Return on Assets Score: 4, favorable

- Debt To Equity Score: 2, moderate

- Overall Score: 3, moderate

Which one is the best rated?

Diamondback Energy, Inc. has higher overall and discounted cash flow scores compared to Expand Energy Corporation. Its return on equity score is also superior, indicating a better rating based strictly on the provided data.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Diamondback Energy, Inc. (FANG) and Expand Energy Corporation (EXE):

FANG Scores

- Altman Z-Score: 1.33, in distress zone indicating high bankruptcy risk.

- Piotroski Score: 5, rated average for financial strength.

EXE Scores

- Altman Z-Score: 2.43, in grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 6, rated average for financial strength.

Which company has the best scores?

Based on the provided data, EXE shows a better Altman Z-Score, placing it in the grey zone versus FANG’s distress zone. Both have average Piotroski Scores, with EXE slightly higher at 6 compared to FANG’s 5.

Grades Comparison

Here is a comparison of recent reliable grades for Diamondback Energy, Inc. and Expand Energy Corporation:

Diamondback Energy, Inc. Grades

The following table summarizes recent grades from established grading companies for Diamondback Energy, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2024-10-18 |

| Susquehanna | Maintain | Positive | 2024-10-18 |

| Keybanc | Maintain | Overweight | 2024-10-16 |

| Truist Securities | Maintain | Buy | 2024-10-16 |

| Piper Sandler | Maintain | Overweight | 2024-10-15 |

| Scotiabank | Maintain | Sector Outperform | 2024-10-10 |

| BMO Capital | Upgrade | Outperform | 2024-10-04 |

| Benchmark | Maintain | Buy | 2024-10-03 |

| Barclays | Upgrade | Overweight | 2024-10-02 |

| Wells Fargo | Maintain | Overweight | 2024-10-01 |

Overall, Diamondback Energy, Inc. shows consistently positive grades with several upgrades and multiple Overweight and Buy ratings.

Expand Energy Corporation Grades

The following table summarizes recent grades from established grading companies for Expand Energy Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-08 |

| Bernstein | Maintain | Outperform | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-19 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

| UBS | Maintain | Buy | 2025-12-12 |

| Piper Sandler | Maintain | Overweight | 2025-11-18 |

| Morgan Stanley | Maintain | Overweight | 2025-10-30 |

| UBS | Maintain | Buy | 2025-10-30 |

| Morgan Stanley | Maintain | Overweight | 2025-10-14 |

Expand Energy Corporation shows a strong consensus of Buy and Outperform ratings with no downgrades, reflecting a stable positive outlook.

Which company has the best grades?

Both companies have predominantly positive grades with Buy and Overweight recommendations. Diamondback Energy, Inc. has a larger number of grading companies involved and some upgrades, while Expand Energy Corporation displays consistent Buy and Outperform ratings from recent dates. For investors, these grades indicate favorable analyst sentiment toward both companies, but Diamondback’s broader analyst coverage could imply greater market attention.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Diamondback Energy, Inc. (FANG) and Expand Energy Corporation (EXE) based on their recent financial and operational data.

| Criterion | Diamondback Energy, Inc. (FANG) | Expand Energy Corporation (EXE) |

|---|---|---|

| Diversification | Moderate: Primarily upstream services with some midstream revenue (~$8.3B upstream in 2023, minor midstream). | High: Diverse segments including natural gas liquids, gathering, transportation, oil sales (~$2.9B oil and gas in 2024). |

| Profitability | Favorable net margin (30.28%), positive ROIC (5.75%), but low ROE (8.85%). | Unfavorable net margin (-16.92%), negative ROIC (-2.7%) and ROE (-4.06%). |

| Innovation | Slightly favorable moat status with growing ROIC trend, indicating improving operational efficiency. | Slightly unfavorable moat status but ROIC trend is improving, indicating potential for future profitability. |

| Global presence | Primarily US-focused with upstream and midstream operations, limited global diversification. | Significant natural gas and oil operations with broader service segments, suggesting wider operational scope. |

| Market Share | Strong in upstream services with stable revenue (~$8.3B in 2023). | Large revenue base in oil and gas (~$2.9B in 2024) but profitability challenges affect competitive standing. |

Key takeaways: Diamondback Energy exhibits better profitability and financial health with a focused upstream business, while Expand Energy shows greater diversification but struggles with negative profitability and value destruction despite improving trends. Investors should weigh risk tolerance against growth potential.

Risk Analysis

Below is a comparative table of key risk factors for Diamondback Energy, Inc. (FANG) and Expand Energy Corporation (EXE) for 2026:

| Metric | Diamondback Energy, Inc. (FANG) | Expand Energy Corporation (EXE) |

|---|---|---|

| Market Risk | Moderate (Beta 0.577, stable oil prices) | Moderate (Beta 0.449, natural gas price volatility) |

| Debt level | Low (Debt/Equity 0.33, favorable) | Low (Debt/Equity 0.33, favorable) |

| Regulatory Risk | Elevated (Permian Basin environmental regulations tightening) | Elevated (Marcellus and Haynesville shale regulations increasing) |

| Operational Risk | Moderate (Extensive midstream assets, operational complexity) | Moderate (Large number of wells, operational scale) |

| Environmental Risk | Medium (Water system management and emissions scrutiny) | Medium (Methane emissions focus in natural gas operations) |

| Geopolitical Risk | Low (Primarily US operations) | Low (Primarily US operations) |

In synthesis, regulatory and environmental risks are the most impactful and likely for both companies due to increasing climate policies targeting fossil fuel producers. Diamondback’s stable debt profile and diversified midstream assets mitigate market and operational risks better than Expand Energy, which faces negative profitability and lower interest coverage, raising financial caution. Investors should closely monitor regulatory developments and operational efficiency.

Which Stock to Choose?

Diamondback Energy, Inc. (FANG) shows a favorable income evolution with strong revenue growth of 32.19% in 2024 and an overall positive income statement evaluation. Its financial ratios are mostly favorable, including a solid net margin of 30.28% and a healthy dividend yield of 4.51%. The company carries moderate debt with a net debt to EBITDA of 1.61 and a robust interest coverage ratio of 16.46. Its rating is very favorable at A-, supported by good profitability, though some liquidity ratios are less favorable.

Expand Energy Corporation (EXE) experiences unfavorable income trends, with a 45.71% revenue decline in 2024 and an overall unfavorable income statement evaluation. Financial ratios reveal weaknesses such as a negative net margin of -16.92% and poor interest coverage at -5.78, despite favorable debt metrics. Its rating is very favorable at B but with moderate overall scores, reflecting operational challenges and lower profitability compared to FANG.

For investors focused on growth, FANG’s favorable income growth, mostly positive financial ratios, and strong rating might appear more attractive. Conversely, more risk-tolerant investors or those seeking potential turnaround opportunities may find EXE’s improving profitability trend and bullish longer-term price movement of interest, despite its current challenges and less favorable financial health.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Diamondback Energy, Inc. and Expand Energy Corporation to enhance your investment decisions: