DexCom, Inc. (DXCM) and STERIS plc (STE) are two influential players in the medical devices industry, each shaping healthcare through innovation. DexCom specializes in continuous glucose monitoring systems for diabetes management, while STERIS provides infection prevention and sterilization solutions worldwide. Their shared focus on advancing medical technology and overlapping healthcare markets makes this comparison timely. Join me as we explore which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between DexCom and STERIS by providing an overview of these two companies and their main differences.

DexCom Overview

DexCom, Inc. specializes in designing, developing, and commercializing continuous glucose monitoring (CGM) systems primarily for diabetes management. With a market cap of 26.4B USD, the company offers products like DexCom G6 and G7, targeting both patients and healthcare providers in the US and internationally. Headquartered in San Diego, DexCom focuses on innovation in medical devices to improve glucose monitoring accuracy and usability.

STERIS Overview

STERIS plc delivers infection prevention and procedural products and services globally, operating through four segments including Healthcare and Life Sciences. With a market cap of 25.3B USD, STERIS serves hospitals, healthcare providers, and pharmaceutical manufacturers with sterilization equipment, cleaning chemistries, and surgical instruments. Founded in 1985 and based in Dublin, Ireland, it emphasizes comprehensive infection control and equipment maintenance solutions.

Key similarities and differences

Both DexCom and STERIS operate in the medical devices industry and serve healthcare markets, yet their business focuses differ significantly. DexCom centers on glucose monitoring technology for diabetes care, while STERIS offers a broader range of infection prevention products and sterilization services. DexCom’s product lineup is patient-focused, whereas STERIS provides more procedural and capital equipment solutions to healthcare facilities and manufacturers.

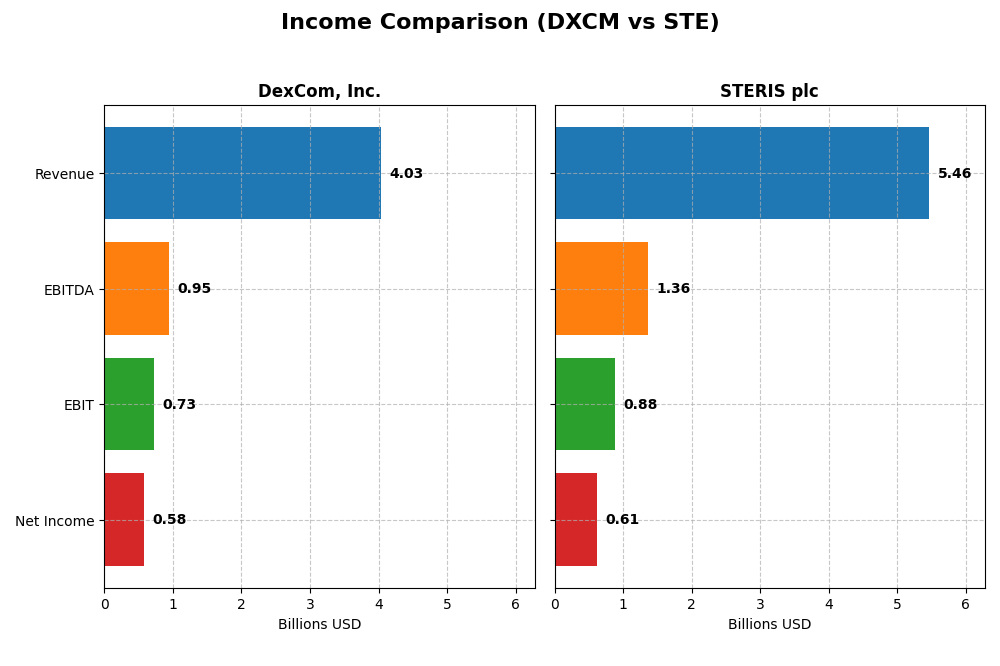

Income Statement Comparison

This table presents the most recent fiscal year income statement figures for DexCom, Inc. and STERIS plc, offering a clear side-by-side financial snapshot.

| Metric | DexCom, Inc. (DXCM) | STERIS plc (STE) |

|---|---|---|

| Market Cap | 26.4B | 25.3B |

| Revenue | 4.03B | 5.46B |

| EBITDA | 946M | 1.36B |

| EBIT | 728M | 882M |

| Net Income | 587.7M | 614.6M |

| EPS | 1.46 | 6.24 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

DexCom, Inc.

DexCom’s revenue and net income have shown consistent growth from 2020 to 2024, with revenue increasing by 109.3% overall and net income rising 16.7%. Gross and EBIT margins remain strong at 60.5% and 18.1%, respectively, although net margin declined by 4.4% last year. In 2024, revenue growth slowed slightly to 11.3%, while EBIT decreased marginally, reflecting rising operating expenses.

STERIS plc

STERIS reported steady revenue growth of 75.7% over the period 2021-2025, with net income increasing 54.7%. Gross margin improved to 44.0%, and EBIT margin stood at 16.2%, both favorable. The 2025 fiscal year showed moderate revenue growth of 6.2%, with net margin up significantly by 53%, supported by improved operational efficiencies despite operating expenses rising faster than revenue.

Which one has the stronger fundamentals?

Both companies display favorable income statement fundamentals with strong revenue and net income growth. DexCom excels with higher gross and net margins and robust revenue growth, though its EBIT and net margin slightly declined last year. STERIS shows solid margin improvements and substantial net margin growth recently, yet with more moderate revenue gains. Overall, both exhibit strengths, but DexCom’s higher margins and scale suggest comparatively stronger fundamentals.

Financial Ratios Comparison

The table below presents key financial ratios for DexCom, Inc. and STERIS plc based on the most recent fiscal year data available, facilitating a straightforward comparison of their financial health and performance.

| Ratios | DexCom, Inc. (DXCM) 2024 | STERIS plc (STE) 2025 |

|---|---|---|

| ROE | 27.4% | 9.3% |

| ROIC | 10.2% | 7.2% |

| P/E | 54.6 | 36.3 |

| P/B | 15.0 | 3.38 |

| Current Ratio | 1.47 | 1.96 |

| Quick Ratio | 1.28 | 1.39 |

| D/E (Debt-to-Equity) | 1.23 | 0.33 |

| Debt-to-Assets | 39.9% | 21.7% |

| Interest Coverage | 31.6 | 10.0 |

| Asset Turnover | 0.62 | 0.54 |

| Fixed Asset Turnover | 2.88 | 2.58 |

| Payout ratio | 0% | 35.8% |

| Dividend yield | 0% | 0.98% |

Interpretation of the Ratios

DexCom, Inc.

DexCom shows a mix of strong and weak ratios, with favorable net margin at 14.29% and a robust return on equity of 27.4%. However, it exhibits concerns with a high PE ratio of 54.61 and a debt-to-equity ratio of 1.23, signaling potential leverage risks. The company does not pay dividends, likely focusing on reinvestment and growth rather than shareholder payouts.

STERIS plc

STERIS displays generally favorable liquidity and leverage ratios, including a current ratio of 1.96 and a low debt-to-equity ratio of 0.33. While its net margin at 11.26% is solid, the return on equity is weak at 9.31%. STERIS pays dividends with a 0.98% yield but faces risks due to an unfavorable payout indicated by its PE and PB ratios, suggesting cautious dividend sustainability.

Which one has the best ratios?

STERIS holds a slight edge with a higher proportion of favorable ratios, particularly in liquidity and leverage metrics, and a balanced dividend policy despite some valuation concerns. DexCom’s higher profitability contrasts with its elevated valuation and leverage, resulting in a neutral overall ratio assessment. Thus, STERIS is marginally more favorable from a ratios perspective.

Strategic Positioning

This section compares the strategic positioning of DexCom, Inc. and STERIS plc, including Market position, Key segments, and Exposure to technological disruption:

DexCom, Inc.

- Focused on continuous glucose monitoring systems, competing in medical devices with high beta.

- Specializes in diabetes management devices and digital health integration, targeting healthcare.

- Engages in collaboration for next-gen glucose monitoring technology, facing evolving med-tech risks.

STERIS plc

- Broad medical devices provider with diversified segments and moderate competitive pressure in healthcare.

- Operates in Healthcare, Applied Sterilization, Life Sciences, and Dental segments with product and services.

- Provides capital equipment and sterilization services, exposed to technological advances in medical sterilization.

DexCom, Inc. vs STERIS plc Positioning

DexCom concentrates on diabetes-focused medical devices with innovation partnerships, while STERIS presents a diversified portfolio across multiple healthcare segments. DexCom’s niche focus contrasts with STERIS’s broad product and service mix, each shaping distinct competitive dynamics.

Which has the best competitive advantage?

Both companies are currently shedding value with slightly unfavorable MOAT evaluations. DexCom shows declining profitability, whereas STERIS’s profitability is improving, indicating differing potential in sustaining competitive advantage.

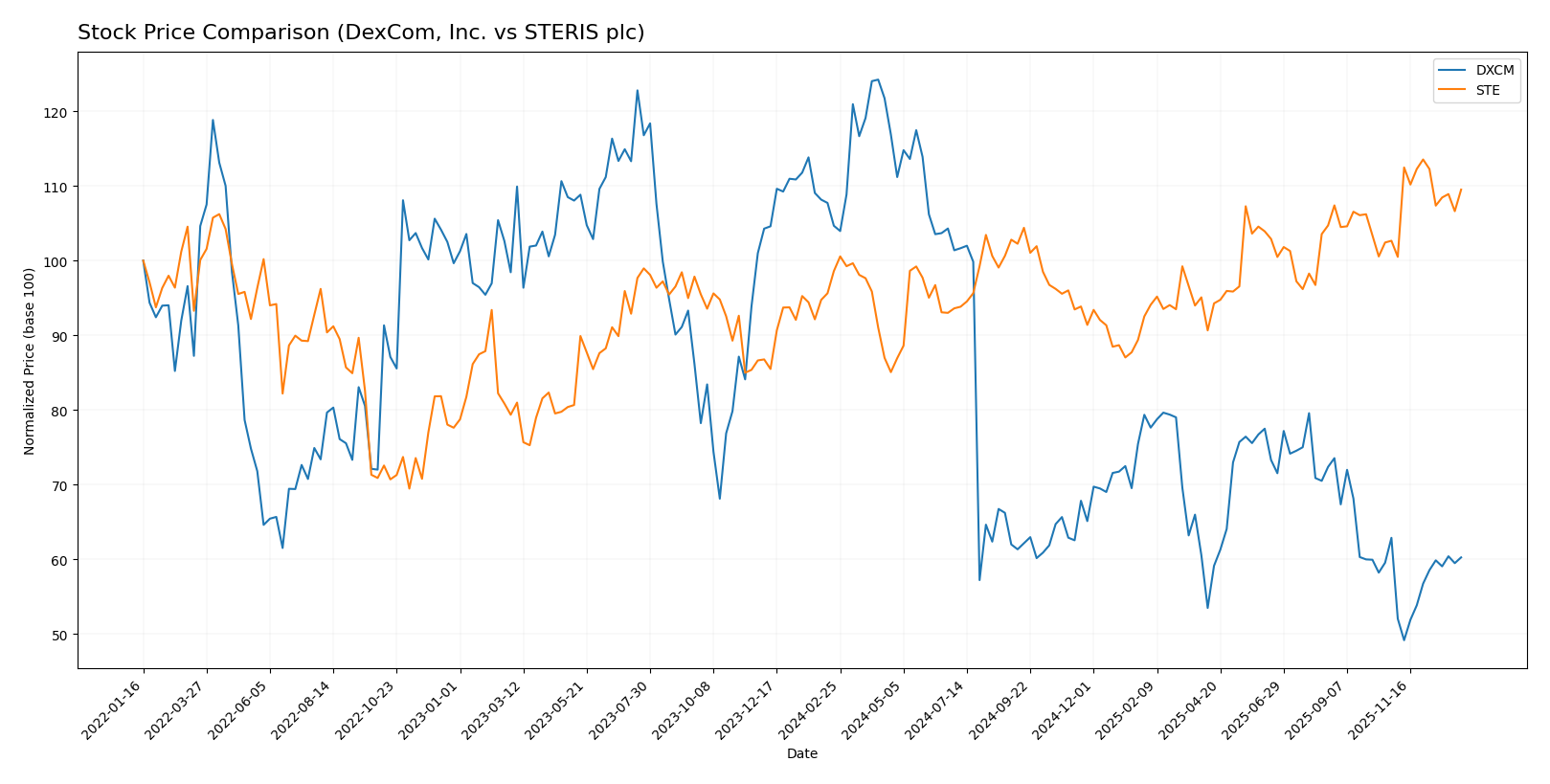

Stock Comparison

The stock price movements over the past 12 months reveal contrasting trends for DexCom, Inc. and STERIS plc, highlighting significant declines and gains respectively, alongside dynamic shifts in trading volumes and buyer dominance.

Trend Analysis

DexCom, Inc. (DXCM) experienced a bearish trend over the past year with a -42.42% price change, accompanied by acceleration and high volatility (std deviation 22.59). The stock ranged from a high of 138.93 to a low of 55.0. Recent months show a further slight decline of -4.17%.

STERIS plc (STE) demonstrated a bullish trend with an 11.07% price increase over the past 12 months, showing accelerating gains and moderate volatility (std deviation 14.87). The stock fluctuated between 199.51 and 266.28. Recently, it posted a 6.67% gain.

Comparing both, STERIS plc delivered the highest market performance with consistent upward momentum, whereas DexCom, Inc. faced significant downside pressure throughout the period.

Target Prices

Analysts present a clear consensus on target prices for DexCom, Inc. and STERIS plc, indicating potential upside from current market levels.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| DexCom, Inc. | 99 | 75 | 85.36 |

| STERIS plc | 265 | 245 | 256.67 |

For DexCom, the consensus target price of 85.36 suggests a significant upside compared to the current price of 67.4 USD. STERIS’s target consensus of 256.67 is close to its current price of 256.82 USD, indicating a balanced outlook among analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for DexCom, Inc. and STERIS plc:

Rating Comparison

DexCom, Inc. Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, favorable valuation view.

- ROE Score: 5, very favorable efficiency in equity use.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 3, moderate overall financial standing.

STERIS plc Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, favorable valuation view.

- ROE Score: 3, moderate efficiency in equity use.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

DexCom holds a higher rating at B+ with stronger ROE and ROA scores, indicating superior profitability and asset use, but carries greater financial risk with a lower debt-to-equity score compared to STERIS. Both share the same overall moderate score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for DexCom and STERIS:

DXCM Scores

- Altman Z-Score: 4.70, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 8, reflecting very strong financial health.

STE Scores

- Altman Z-Score: 5.91, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 8, reflecting very strong financial health.

Which company has the best scores?

Both DexCom and STERIS show strong financial health with identical Piotroski Scores of 8, indicating very strong fundamentals. STERIS has a higher Altman Z-Score of 5.91 compared to DexCom’s 4.70, suggesting marginally lower bankruptcy risk.

Grades Comparison

Here is a comparison of the recent grades assigned to DexCom, Inc. and STERIS plc by recognized grading companies:

DexCom, Inc. Grades

The table below details recent grades given to DexCom, Inc. by leading financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Mizuho | Maintain | Outperform | 2025-12-17 |

| Citigroup | Maintain | Buy | 2025-12-11 |

| Morgan Stanley | Upgrade | Overweight | 2025-12-02 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-10 |

| Argus Research | Maintain | Buy | 2025-11-07 |

| UBS | Maintain | Buy | 2025-11-03 |

| Barclays | Maintain | Equal Weight | 2025-11-03 |

| Truist Securities | Maintain | Buy | 2025-11-03 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

DexCom’s grades predominantly reflect a positive outlook, with consistent Buy and Outperform ratings from multiple reputed firms.

STERIS plc Grades

Below is a summary of recent grades awarded to STERIS plc by established grading entities.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-08-08 |

| Keybanc | Maintain | Overweight | 2025-07-22 |

| Morgan Stanley | Upgrade | Overweight | 2025-07-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-05-19 |

| JMP Securities | Maintain | Market Outperform | 2025-05-16 |

| Stephens & Co. | Maintain | Overweight | 2025-05-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-05-12 |

| JMP Securities | Maintain | Market Outperform | 2025-04-10 |

| Needham | Maintain | Hold | 2025-04-07 |

| JMP Securities | Maintain | Market Outperform | 2025-02-06 |

STERIS plc has maintained mostly positive grades, with several Overweight and Market Outperform ratings, balanced by a few Hold and Equal Weight grades.

Which company has the best grades?

DexCom, Inc. generally holds more consistent Buy and Outperform ratings from a broader range of firms, while STERIS plc’s grades show a mix of Overweight and Market Outperform with some Hold ratings. This difference may influence investor perception of stability and growth potential.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses of DexCom, Inc. (DXCM) and STERIS plc (STE) based on the most recent financial and operational data.

| Criterion | DexCom, Inc. (DXCM) | STERIS plc (STE) |

|---|---|---|

| Diversification | Limited product focus on diabetes devices | Well-diversified with balanced product & service revenues (~$2.87B products / $2.59B services in 2025) |

| Profitability | Favorable net margin (14.29%) and ROE (27.4%) | Moderate net margin (11.26%) but lower ROE (9.31%) |

| Innovation | High valuation multiples indicate market confidence in innovation (PE 54.61) | Moderate innovation perception; PE 36.35 reflects growth but more modest expectations |

| Global presence | Strong global reach in diabetes monitoring | Broad global footprint in healthcare and sterilization solutions |

| Market Share | Niche leader in continuous glucose monitoring | Leading player in infection prevention and surgical equipment markets |

Key takeaways: DexCom excels in profitability and innovation within a niche market but shows signs of declining capital efficiency. STERIS benefits from diversification and improving profitability, though its returns on equity remain modest. Both companies have slight moats with risks warranting cautious investment consideration.

Risk Analysis

Below is a comparative table summarizing key risk factors for DexCom, Inc. (DXCM) and STERIS plc (STE) based on the most recent data available:

| Metric | DexCom, Inc. (DXCM) | STERIS plc (STE) |

|---|---|---|

| Market Risk | High beta (1.48) indicates higher volatility relative to market | Moderate beta (1.03), more stable market movements |

| Debt level | Higher debt-to-equity ratio (1.23), moderate leverage risk | Lower debt-to-equity ratio (0.33), low leverage risk |

| Regulatory Risk | Moderate, due to FDA and international medical device regulations | Moderate, with global healthcare product regulations |

| Operational Risk | Product innovation dependency; supply chain disruptions possible | Diverse product segments mitigate operational risks |

| Environmental Risk | Moderate, medical device manufacturing impact | Moderate, sterilization chemicals and waste management |

| Geopolitical Risk | Primarily US-focused, limited exposure | Exposure to EU regulations and global markets |

DexCom faces higher market volatility and financial leverage risks, with a beta of 1.48 and debt-to-equity above 1.2. STERIS shows stronger balance sheet stability and lower leverage, reducing financial risk. Both companies operate in heavily regulated healthcare sectors, with regulatory and operational risks inherent to medical device and sterilization markets. Geopolitical risks are more pronounced for STERIS given its European base and global footprint. Overall, DexCom’s leverage and market sensitivity are the most impactful risks to monitor.

Which Stock to Choose?

DexCom, Inc. (DXCM) shows a favorable income evolution with 11.34% revenue growth in 2024 and strong profitability ratios, including a 27.4% ROE, but faces challenges with high valuation multiples and a slightly unfavorable debt profile. Its global income statement rating is favorable, though its MOAT is slightly unfavorable due to declining ROIC versus WACC.

STERIS plc (STE) presents a stable income growth profile with a 6.24% revenue increase in 2025 and mixed profitability ratios, including a modest 9.3% ROE. STE has a healthier debt situation and a slightly favorable global ratios evaluation, but its MOAT is also slightly unfavorable despite a growing ROIC trend.

For investors prioritizing growth and robust profitability, DXCM’s strong income growth and higher returns might appear attractive, whereas those seeking financial stability with a more conservative debt profile could find STE’s fundamentals slightly favorable. Both companies show slightly unfavorable MOATs, suggesting caution regarding value creation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of DexCom, Inc. and STERIS plc to enhance your investment decisions: