In the rapidly evolving medical devices sector, DexCom, Inc. (DXCM) and Insulet Corporation (PODD) stand out as leaders in diabetes care innovation. Both companies develop cutting-edge technologies—continuous glucose monitoring for DexCom and insulin delivery systems for Insulet—targeting overlapping markets with strong growth potential. This article will analyze their strengths and risks to help you decide which stock might be the smarter addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between DexCom and Insulet by providing an overview of these two companies and their main differences.

DexCom Overview

DexCom, Inc. specializes in the design, development, and commercialization of continuous glucose monitoring (CGM) systems for diabetes management. The company markets its products directly to healthcare professionals and offers advanced CGM technologies like Dexcom G6 and G7. Founded in 1999 and headquartered in San Diego, California, DexCom holds a leading position in medical devices related to glucose monitoring with a workforce of 10,200 employees.

Insulet Overview

Insulet Corporation develops and sells insulin delivery systems primarily targeting insulin-dependent diabetes patients. Its flagship product, the Omnipod System, is a tubeless, wearable insulin pump complemented by a wireless personal diabetes manager. Incorporated in 2000 and based in Acton, Massachusetts, Insulet distributes its products globally through distributors, pharmacies, and direct sales, employing around 3,900 people.

Key similarities and differences

Both DexCom and Insulet operate in the healthcare sector focusing on diabetes care devices, but their business models differ. DexCom centers on continuous glucose monitoring technology marketed mainly to medical professionals, while Insulet emphasizes insulin delivery systems sold through varied distribution channels. DexCom is larger by market capitalization and workforce size, reflecting its broader product integration and direct healthcare provider engagement.

Income Statement Comparison

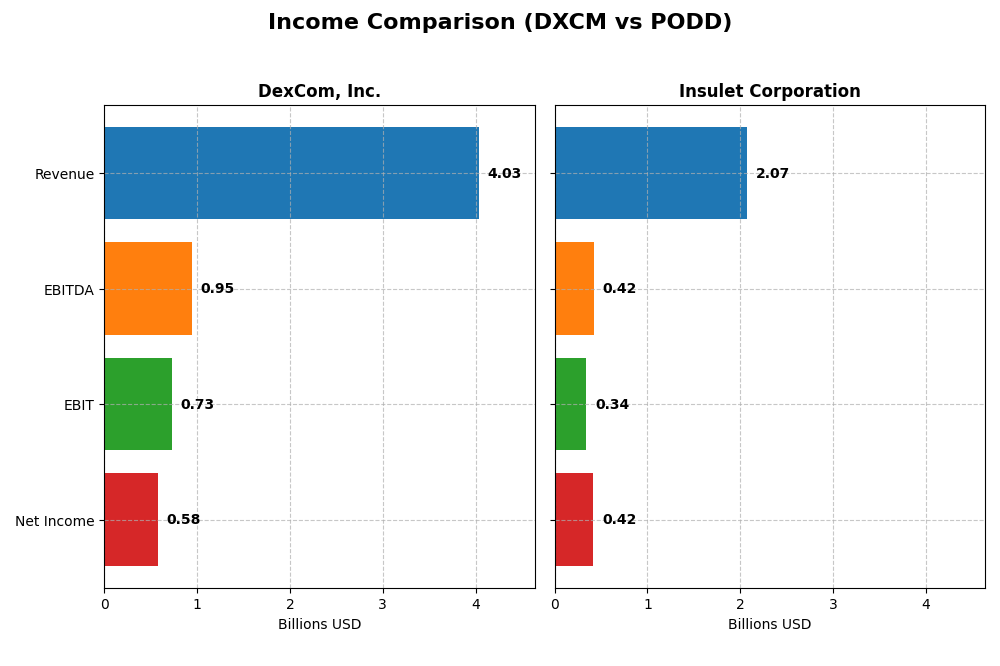

The following table compares key income statement metrics for DexCom, Inc. and Insulet Corporation for the fiscal year 2024, providing a clear view of their financial performance.

| Metric | DexCom, Inc. (DXCM) | Insulet Corporation (PODD) |

|---|---|---|

| Market Cap | 26.4B | 20.3B |

| Revenue | 4.03B | 2.07B |

| EBITDA | 946M | 424M |

| EBIT | 728M | 343M |

| Net Income | 587.7M | 418.3M |

| EPS | 1.46 | 5.97 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

DexCom, Inc.

DexCom has shown a strong upward trend in revenue, growing from $1.93B in 2020 to $4.03B in 2024, with net income rising from $494M to $588M. Margins remain generally favorable, with a gross margin above 60% and a net margin near 14%. However, in 2024, EBIT slightly declined by 0.37%, and net margin contracted by 4.43%, signaling some margin pressure despite revenue growth.

Insulet Corporation

Insulet experienced robust revenue growth from $904M in 2020 to $2.07B in 2024, with net income surging from $6.8M to $418M. Margins improved markedly, with gross margin reaching nearly 70% and net margin above 20%. The latest year showed strong momentum, with EBIT and net margin growth accelerating by 36.7% and 66.1%, respectively, reflecting enhanced profitability alongside revenue expansion.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement trends, but Insulet’s exceptional net income growth of 6051% over the period and consistent margin expansion stand out compared to DexCom’s steadier but slower net income increase of 17%. DexCom maintains solid margins but faced slight EBIT and net margin declines recently, whereas Insulet’s metrics all improved distinctly.

Financial Ratios Comparison

Below is a comparison of key financial ratios for DexCom, Inc. (DXCM) and Insulet Corporation (PODD) based on their most recent fiscal year data for 2024.

| Ratios | DexCom, Inc. (DXCM) | Insulet Corporation (PODD) |

|---|---|---|

| ROE | 27.4% | 34.5% |

| ROIC | 10.2% | 16.3% |

| P/E | 54.6 | 43.7 |

| P/B | 15.0 | 15.1 |

| Current Ratio | 1.47 | 3.54 |

| Quick Ratio | 1.28 | 2.73 |

| D/E (Debt-to-Equity) | 1.23 | 1.17 |

| Debt-to-Assets | 39.9% | 46.1% |

| Interest Coverage | 31.6 | 7.23 |

| Asset Turnover | 0.62 | 0.67 |

| Fixed Asset Turnover | 2.88 | 2.73 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

DexCom, Inc.

DexCom presents a balanced financial profile with strong profitability ratios including a 27.4% ROE and 14.29% net margin, indicating robust earnings generation. However, valuation metrics like a high PE of 54.61 and PB of 14.97 are unfavorable, suggesting the stock may be pricey. The company does not pay dividends, likely focusing on reinvestment and growth.

Insulet Corporation

Insulet shows favorable profitability with a 34.52% ROE and 20.19% net margin, outperforming DexCom in returns. Yet, valuation ratios remain elevated with a PE of 43.74 and PB of 15.1, and liquidity metrics such as a current ratio of 3.54 are marked unfavorable. Insulet pays no dividend, reflecting a growth or reinvestment strategy.

Which one has the best ratios?

Both companies share an equal proportion of favorable and unfavorable ratios, leading to a neutral overall assessment. Insulet excels in profitability metrics but faces concerns in liquidity, while DexCom’s valuation appears stretched despite solid returns. Neither company pays dividends, emphasizing growth over income for shareholders.

Strategic Positioning

This section compares the strategic positioning of DexCom, Inc. and Insulet Corporation, focusing on market position, key segments, and exposure to technological disruption:

DexCom, Inc.

- Leading CGM systems provider with strong direct sales to healthcare professionals amid competitive medical device market.

- Specializes in continuous glucose monitoring systems including G6 and G7 products, driving diabetes management innovation.

- Developing next-gen glucose monitoring with partnerships, facing ongoing innovation demands in digital health integration.

Insulet Corporation

- Focused on insulin delivery with Omnipod system sold via distributors and pharmacies in multiple regions.

- Concentrates on tubeless insulin pumps as core business, with significant international revenue growth.

- Relies on wireless, wearable insulin technology, adapting to advancements in diabetes device usability.

DexCom, Inc. vs Insulet Corporation Positioning

DexCom pursues a diversified approach with integrated CGM systems and developer APIs, while Insulet concentrates on insulin delivery devices and international expansion. DexCom’s direct healthcare engagement contrasts with Insulet’s distributor-based model, showing different market reach and innovation focuses.

Which has the best competitive advantage?

Insulet demonstrates a very favorable moat with growing ROIC and durable competitive advantage, while DexCom shows a slightly unfavorable moat with declining profitability and value creation challenges.

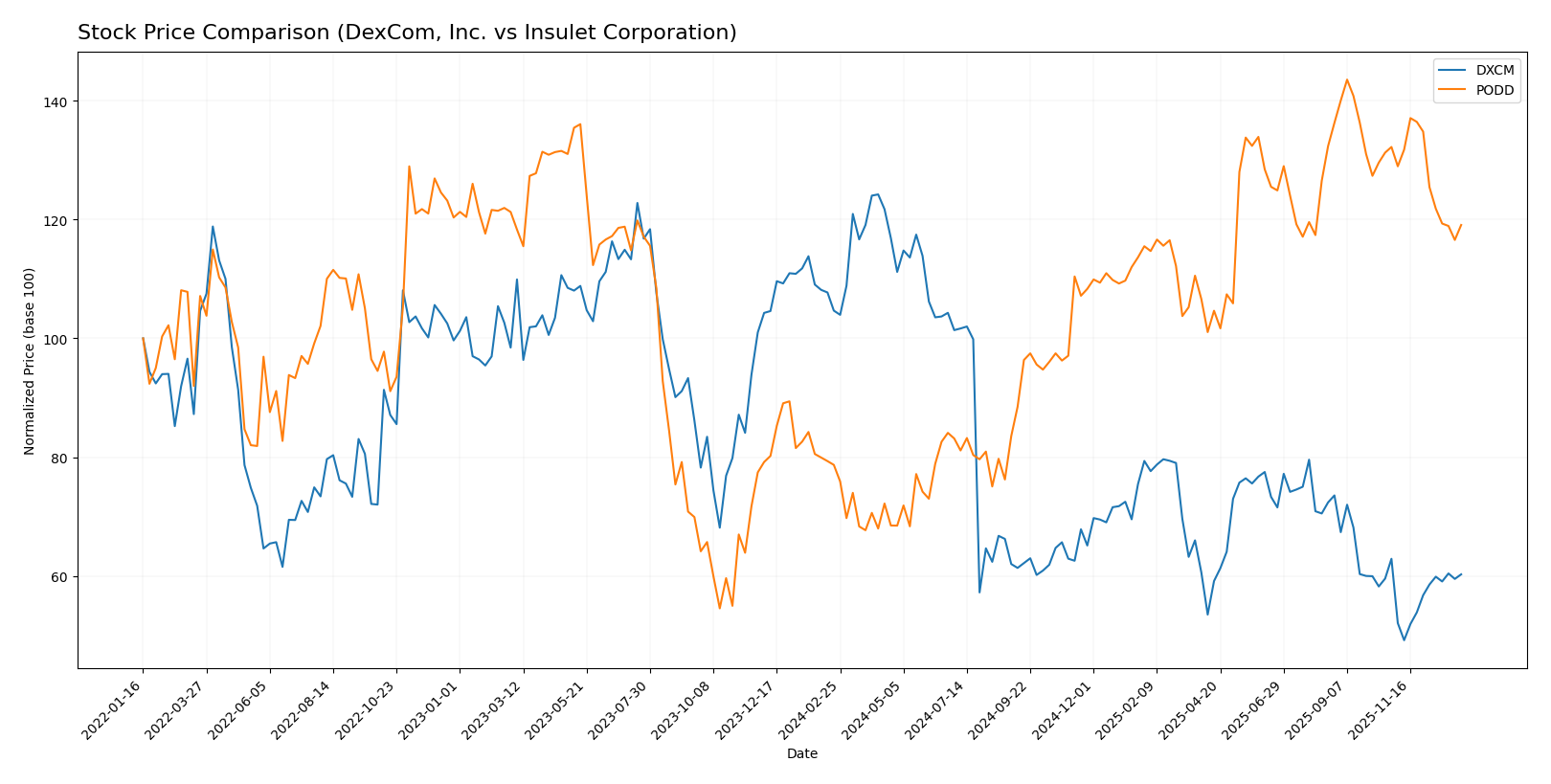

Stock Comparison

The past year revealed contrasting stock movements for DexCom, Inc. and Insulet Corporation, with DexCom experiencing a significant bearish acceleration while Insulet showed a strong bullish trend but with recent deceleration and volatility shifts.

Trend Analysis

DexCom, Inc. (DXCM) exhibited a bearish trend over the past 12 months with a price decline of 42.42%, marked by accelerating downward momentum and a high volatility level indicated by a 22.59 standard deviation. The stock ranged between 138.93 and 55.0 in price.

Insulet Corporation (PODD) showed a bullish trend over the same period, gaining 51.32% with decelerating upward momentum but higher volatility at 54.06 standard deviation. The price fluctuated between 348.43 and 164.31.

Comparing both, Insulet Corporation delivered the highest market performance with its 51.32% gain, whereas DexCom faced a steep 42.42% decline, reflecting divergent investor sentiment and trading dynamics.

Target Prices

Analysts present a cautiously optimistic consensus for DexCom, Inc. and Insulet Corporation based on current target prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| DexCom, Inc. | 99 | 75 | 85.36 |

| Insulet Corporation | 450 | 301 | 381.6 |

The target consensus for DexCom, Inc. at 85.36 USD is significantly above its current price of 67.4 USD, indicating potential upside. Similarly, Insulet Corporation’s consensus target of 381.6 USD exceeds its current 289.04 USD price, reflecting positive analyst expectations for both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for DexCom, Inc. and Insulet Corporation:

Rating Comparison

DXCM Rating

- Rating: B+, indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 4, favorable outlook on valuation.

- ROE Score: 5, very favorable efficiency in generating profit.

- ROA Score: 5, very favorable asset utilization effectiveness.

- Debt To Equity Score: 1, very unfavorable financial risk level.

PODD Rating

- Rating: B-, also considered very favorable by analysts.

- Discounted Cash Flow Score: 1, very unfavorable valuation score.

- ROE Score: 4, favorable profitability from shareholders’ equity.

- ROA Score: 4, favorable use of assets to generate earnings.

- Debt To Equity Score: 3, moderate financial risk with debt usage.

| Overall Score: 3, moderate comprehensive financial standing. | Overall Score: 2, moderate but lower than DXCM’s overall score. |

Which one is the best rated?

Based strictly on the provided data, DexCom holds a higher overall score (3 vs. 2) and stronger scores in discounted cash flow, ROE, and ROA. Insulet has a better debt-to-equity score but lags in other key metrics, making DexCom better rated overall.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for DexCom and Insulet:

DexCom Scores

- Altman Z-Score: 4.70, indicating a safe zone from bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

Insulet Scores

- Altman Z-Score: 9.99, indicating a safe zone from bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Which company has the best scores?

Insulet has a higher Altman Z-Score of 9.99 compared to DexCom’s 4.70, indicating lower bankruptcy risk; DexCom has a slightly stronger Piotroski Score of 8 versus 7.

Grades Comparison

The grade data from reputable firms for DexCom, Inc. and Insulet Corporation are as follows:

DexCom, Inc. Grades

This table summarizes recent grades and actions from credible grading companies for DexCom, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Mizuho | Maintain | Outperform | 2025-12-17 |

| Citigroup | Maintain | Buy | 2025-12-11 |

| Morgan Stanley | Upgrade | Overweight | 2025-12-02 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-10 |

| Argus Research | Maintain | Buy | 2025-11-07 |

| UBS | Maintain | Buy | 2025-11-03 |

| Barclays | Maintain | Equal Weight | 2025-11-03 |

| Truist Securities | Maintain | Buy | 2025-11-03 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

Overall, DexCom shows consistent favorable grades, predominantly “Buy” and “Outperform,” with one recent upgrade by Morgan Stanley.

Insulet Corporation Grades

This table presents recent credible grades and actions for Insulet Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Truist Securities | Maintain | Buy | 2025-12-18 |

| Canaccord Genuity | Maintain | Buy | 2025-12-17 |

| Canaccord Genuity | Maintain | Buy | 2025-11-24 |

| Truist Securities | Maintain | Buy | 2025-11-21 |

| BTIG | Maintain | Buy | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| UBS | Upgrade | Buy | 2025-11-19 |

| BTIG | Maintain | Buy | 2025-11-13 |

| UBS | Maintain | Neutral | 2025-11-07 |

Insulet Corporation has predominantly “Buy” and “Outperform” grades with an upgrade from UBS, indicating positive analyst sentiment.

Which company has the best grades?

Both DexCom and Insulet Corporation hold strong “Buy” and “Outperform” consensus grades. DexCom has a slightly higher count of “Outperform” ratings and an upgrade to “Overweight,” potentially signaling stronger analyst confidence that may influence investor interest.

Strengths and Weaknesses

Here is a comparative overview of key strengths and weaknesses for DexCom, Inc. (DXCM) and Insulet Corporation (PODD) based on the most recent financial and strategic data.

| Criterion | DexCom, Inc. (DXCM) | Insulet Corporation (PODD) |

|---|---|---|

| Diversification | Limited product range focused on glucose monitoring | Moderate diversification with drug delivery and international Omnipod segments |

| Profitability | Moderate profitability; net margin 14.29%, ROIC 10.2% but declining | Strong profitability; net margin 20.19%, ROIC 16.27% with growing trend |

| Innovation | Established leader in continuous glucose monitoring | Innovative in insulin delivery systems with strong growth |

| Global presence | Strong in North America, limited international exposure | Significant international growth, especially in Omnipod sales |

| Market Share | Leading market share in diabetes monitoring | Growing market share in insulin pumps globally |

DexCom shows moderate profitability but faces challenges with declining ROIC, indicating potential risks in sustaining value creation. Insulet stands out with strong profitability, expanding global presence, and a durable competitive advantage. Investors should weigh DexCom’s focused innovation against Insulet’s broader diversification and growth trajectory.

Risk Analysis

Below is a comparative table highlighting key risks for DexCom, Inc. (DXCM) and Insulet Corporation (PODD) as of 2026:

| Metric | DexCom, Inc. (DXCM) | Insulet Corporation (PODD) |

|---|---|---|

| Market Risk | Beta 1.48, sensitive to market swings | Beta 1.40, moderately volatile |

| Debt level | Debt-to-Equity 1.23 (unfavorable), debt/assets 39.9% (neutral) | Debt-to-Equity 1.17 (unfavorable), debt/assets 46.1% (neutral) |

| Regulatory Risk | High, medical device approvals and compliance critical | High, insulin delivery systems under strict FDA oversight |

| Operational Risk | Moderate, reliant on continuous innovation (G7 CGM launch) | Moderate, supply chain and distributor dependence |

| Environmental Risk | Low, limited direct environmental impact | Low, limited direct environmental impact |

| Geopolitical Risk | Moderate, global sales exposure | Moderate, international sales in multiple regions |

The most impactful risks are regulatory and market risks for both companies, given their exposure to stringent healthcare regulations and market volatility. DexCom’s higher beta and debt levels increase market risk sensitivity, while Insulet’s elevated debt-to-assets ratio warrants attention. Both firms remain financially stable with scores indicating low bankruptcy risk.

Which Stock to Choose?

DexCom, Inc. (DXCM) shows favorable income growth with a 109% revenue increase over five years, strong profitability metrics including a 14.3% net margin, and solid returns on equity (27.4%). However, it carries moderate debt (net debt to EBITDA 2.1) and faces mixed financial ratios, leading to a neutral global ratios evaluation. Its economic moat is slightly unfavorable due to declining ROIC below WACC, despite a very favorable B+ rating.

Insulet Corporation (PODD) demonstrates robust income growth, with revenue up 129% and exceptional net income growth of over 6,000% across five years. It has higher profitability with a 20.2% net margin and stronger returns on equity (34.5%). While debt levels are moderate (net debt to EBITDA 1.1), financial ratios are also neutral overall. PODD’s economic moat is very favorable, with ROIC well above WACC and increasing, supported by a slightly lower B- rating.

For investors, PODD’s very favorable moat and superior income growth might appeal to those prioritizing growth and competitive advantage. Conversely, DXCM’s stable profitability and higher rating could be more suitable for investors focused on quality and financial strength, despite its slightly unfavorable moat. Both stocks present balanced financial ratios, suggesting careful consideration aligned with risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of DexCom, Inc. and Insulet Corporation to enhance your investment decisions: