In the dynamic energy sector, Expand Energy Corporation (EXE) and Devon Energy Corporation (DVN) stand out as prominent players focused on oil and natural gas exploration and production. Both companies share a strong presence in the U.S. market, particularly in unconventional gas assets, and pursue innovative development strategies. This article will help you navigate their strengths and risks to identify which company may offer the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Expand Energy Corporation and Devon Energy Corporation by providing an overview of these two companies and their main differences.

Expand Energy Corporation Overview

Expand Energy Corporation operates as an independent exploration and production company focused on acquiring, exploring, and developing properties to produce oil, natural gas, and natural gas liquids in the US. It holds significant interests in natural gas resource plays, including the Marcellus and Haynesville/Bossier Shales, managing approximately 5,000 natural gas wells. Founded in 1989 and based in Oklahoma City, it was formerly known as Chesapeake Energy until rebranding in October 2024.

Devon Energy Corporation Overview

Devon Energy Corporation is an independent energy company engaged primarily in exploration, development, and production of oil, natural gas, and natural gas liquids across the United States. It operates around 5,134 gross wells and was incorporated in 1971. Devon Energy is headquartered in Oklahoma City and is recognized as a longstanding player in the energy sector with a focus on upstream oil and gas activities.

Key similarities and differences

Both companies operate in the Oil & Gas Exploration & Production industry in the US, focusing on oil, natural gas, and natural gas liquids extraction with substantial well counts near 5,000. Expand Energy emphasizes unconventional natural gas assets in major shale plays, while Devon maintains a broader upstream portfolio. Expand Energy is smaller by market cap and workforce, reflecting differing scales and strategic focuses despite overlapping geographic headquarters.

Income Statement Comparison

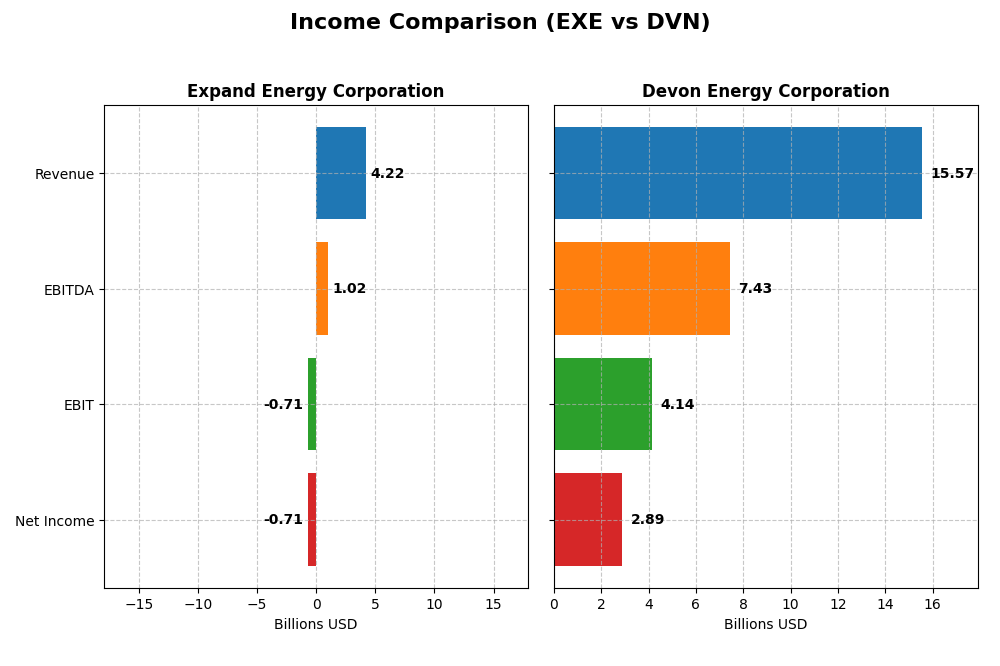

The table below presents the key income statement metrics for Expand Energy Corporation and Devon Energy Corporation for the fiscal year 2024, offering a side-by-side view of their financial performance.

| Metric | Expand Energy Corporation (EXE) | Devon Energy Corporation (DVN) |

|---|---|---|

| Market Cap | 24.2B | 22.9B |

| Revenue | 4.22B | 15.57B |

| EBITDA | 1.02B | 7.43B |

| EBIT | -711M | 4.14B |

| Net Income | -714M | 2.89B |

| EPS | -4.55 | 4.57 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Expand Energy Corporation

Expand Energy Corporation’s revenue declined from $11.4B in 2022 to $4.2B in 2024, with net income swinging from a $4.9B profit in 2022 to a $714M loss in 2024. Gross margins remained modestly favorable at 27%, but EBIT and net margins turned deeply negative in 2024. The latest year showed significant revenue and profit contraction, with worsening margins and earnings per share.

Devon Energy Corporation

Devon Energy Corporation’s revenue grew overall from $4.4B in 2020 to $15.6B in 2024, despite a slight dip in 2024. Net income rose substantially, reaching $2.9B in 2024. Margins remained generally robust, with a gross margin around 27% and positive EBIT and net margins near 26.6% and 18.6%, respectively. The recent year saw slight margin compression, though profitability stayed strong.

Which one has the stronger fundamentals?

Devon Energy demonstrates stronger fundamentals with consistent revenue growth, positive and stable margins, and improving net income over the period. Expand Energy, while showing some net income growth overall, experienced a sharp recent reversal with declining revenue and negative margins. Devon’s favorable margin structure and sustained profitability contrast with Expand Energy’s unfavorable income statement trends.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Expand Energy Corporation (EXE) and Devon Energy Corporation (DVN) for the fiscal year 2024.

| Ratios | Expand Energy Corporation (EXE) | Devon Energy Corporation (DVN) |

|---|---|---|

| ROE | -4.06% | 19.94% |

| ROIC | -2.70% | 10.80% |

| P/E | -21.89 | 7.05 |

| P/B | 0.89 | 1.41 |

| Current Ratio | 0.64 | 1.04 |

| Quick Ratio | 0.64 | 0.95 |

| D/E (Debt to Equity) | 0.33 | 0.63 |

| Debt-to-Assets | 20.88% | 30.18% |

| Interest Coverage | -6.53 | 9.40 |

| Asset Turnover | 0.15 | 0.51 |

| Fixed Asset Turnover | 0.17 | 0.61 |

| Payout Ratio | -54.34% | 32.41% |

| Dividend Yield | 2.48% | 4.60% |

Interpretation of the Ratios

Expand Energy Corporation

Expand Energy exhibits several weak financial ratios in 2024, including negative net margin (-16.92%) and return on equity (-4.06%), signaling profitability challenges. Its low current ratio (0.64) and negative interest coverage raise liquidity concerns. However, favorable valuation multiples like a price-to-earnings of -21.89 and a dividend yield of 2.48% show some investor appeal. The company pays dividends, but risks include potentially unsustainable distributions given its negative returns and free cash flow.

Devon Energy Corporation

Devon Energy displays strong profitability with a net margin of 18.57%, ROE of 19.94%, and a solid return on invested capital at 10.8%. Liquidity ratios are neutral, with a current ratio of 1.04 and quick ratio near 0.95. Interest coverage at 10.32 is favorable, indicating good debt servicing. The company pays a 4.6% dividend yield supported by healthy earnings, though some asset turnover metrics are neutral or unfavorable. Overall, its dividend and shareholder returns appear well-covered and sustainable.

Which one has the best ratios?

Devon Energy holds the advantage with predominantly favorable ratios, especially in profitability and coverage metrics, while Expand Energy struggles with multiple unfavorable indicators. Devon’s balanced liquidity and strong dividend yield further strengthen its profile. Expand’s weaker profitability and liquidity ratios, despite some valuation appeal, result in a less favorable overall assessment.

Strategic Positioning

This section compares the strategic positioning of Expand Energy Corporation (EXE) and Devon Energy Corporation (DVN) focusing on market position, key segments, and exposure to technological disruption:

Expand Energy Corporation

- Independent US exploration company with 5,000 wells, facing typical sector competitive pressures.

- Key segments include natural gas sales, liquids, and gathering operations, with diversified product streams.

- No explicit data on technological disruption exposure provided in the input.

Devon Energy Corporation

- Independent US energy company operating about 5,134 wells, competing in similar exploration and production markets.

- Primarily focused on natural gas liquids product sales, with regional segmentation including US and Canada.

- No explicit data on technological disruption exposure provided in the input.

Expand Energy Corporation vs Devon Energy Corporation Positioning

EXE shows a diversified product approach with multiple revenue streams, while DVN emphasizes natural gas liquids with geographic segmentation. EXE’s portfolio is concentrated in shale plays; DVN’s operational footprint spans US and Canada. Both face sector competition without detailed disruption insights.

Which has the best competitive advantage?

Based on MOAT evaluations, DVN exhibits a very favorable competitive advantage with value creation and growing ROIC, whereas EXE shows slightly unfavorable positioning, shedding value despite improving profitability trends.

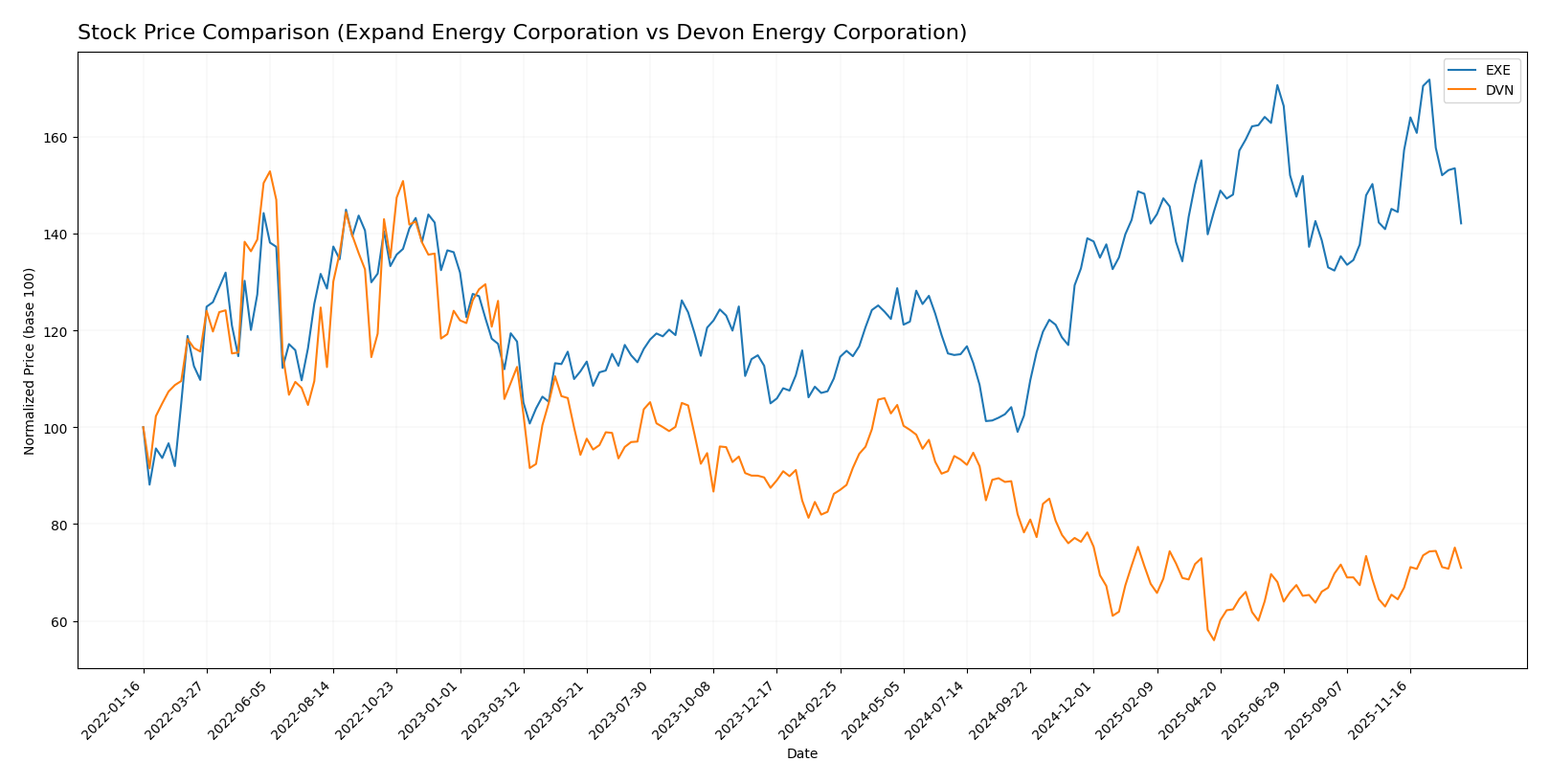

Stock Comparison

The stock prices of Expand Energy Corporation (EXE) and Devon Energy Corporation (DVN) have exhibited contrasting movements over the past 12 months, with EXE showing a significant bullish trend while DVN experienced a bearish trajectory, both with varying recent momentum and trading volumes.

Trend Analysis

Expand Energy Corporation’s stock recorded a bullish trend over the past year, gaining 29.09% but with deceleration in momentum. The price ranged from a low of 70.84 to a high of 122.86, with volatility measured by a 12.95 standard deviation.

Devon Energy Corporation’s stock showed a bearish trend over the same period, declining by 17.72% while accelerating its downward movement. Prices fluctuated between 28.23 and 53.42, with a lower volatility of 6.4 standard deviation.

Comparing both stocks, Expand Energy Corporation delivered the highest market performance with a 29.09% increase, contrasting with Devon Energy Corporation’s 17.72% decline over the past 12 months.

Target Prices

There is a clear target price consensus from reliable analysts for both Expand Energy Corporation and Devon Energy Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Expand Energy Corporation | 150 | 125 | 140.63 |

| Devon Energy Corporation | 48 | 40 | 43.5 |

Analysts expect Expand Energy’s stock to rise significantly above the current price of $101.63, indicating strong upside potential. Devon Energy’s consensus target price also suggests moderate growth from its current $35.76.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Expand Energy Corporation (EXE) and Devon Energy Corporation (DVN):

Rating Comparison

EXE Rating

- Rating: B, considered Very Favorable overall by analysts.

- Discounted Cash Flow Score: 4, marked as Favorable, suggesting good valuation.

- ROE Score: 3, Moderate, indicating average efficiency in generating profit.

- ROA Score: 4, Favorable, reflecting effective use of assets.

- Debt To Equity Score: 2, Moderate, moderate financial risk level.

- Overall Score: 3, Moderate, a balanced overall financial standing.

DVN Rating

- Rating: A-, also rated Very Favorable, indicating stronger analyst support.

- Discounted Cash Flow Score: 4, Favorable, similar valuation strength.

- ROE Score: 5, Very Favorable, showing excellent profit generation efficiency.

- ROA Score: 5, Very Favorable, superior asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk.

- Overall Score: 4, Favorable, better overall financial health assessment.

Which one is the best rated?

Devon Energy Corporation (DVN) holds a higher rating (A-) and generally stronger scores in ROE, ROA, and overall financial health compared to Expand Energy Corporation (EXE). However, DVN’s higher financial risk due to debt should be noted.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Expand Energy Corporation and Devon Energy Corporation:

EXE Scores

- Altman Z-Score: 2.43, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 6, reflecting average financial strength.

DVN Scores

- Altman Z-Score: 2.29, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 5, reflecting average financial strength.

Which company has the best scores?

Both EXE and DVN fall into the grey zone for Altman Z-Score, signaling moderate bankruptcy risk. EXE has a slightly higher Piotroski Score of 6 compared to DVN’s 5, indicating marginally stronger financial health.

Grades Comparison

The comparison of recent grades from major grading companies for Expand Energy Corporation and Devon Energy Corporation is as follows:

Expand Energy Corporation Grades

This table shows the latest grades assigned by reputable financial institutions to Expand Energy Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-08 |

| Bernstein | Maintain | Outperform | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-19 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

| UBS | Maintain | Buy | 2025-12-12 |

| Piper Sandler | Maintain | Overweight | 2025-11-18 |

| Morgan Stanley | Maintain | Overweight | 2025-10-30 |

| UBS | Maintain | Buy | 2025-10-30 |

| Morgan Stanley | Maintain | Overweight | 2025-10-14 |

Overall, Expand Energy Corporation’s grades consistently indicate a positive outlook, with most ratings clustered around Buy and Outperform.

Devon Energy Corporation Grades

Below is a summary of recent grades from established grading companies for Devon Energy Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2026-01-05 |

| Roth Capital | Maintain | Buy | 2025-12-31 |

| Citigroup | Maintain | Buy | 2025-12-17 |

| UBS | Upgrade | Buy | 2025-12-12 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

| Morgan Stanley | Maintain | Overweight | 2025-12-11 |

| JP Morgan | Upgrade | Overweight | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-11-18 |

| Susquehanna | Maintain | Positive | 2025-11-12 |

| Susquehanna | Maintain | Positive | 2025-10-20 |

Devon Energy Corporation shows a similarly positive trend with multiple upgrades and a mix of Buy, Outperform, and Overweight ratings.

Which company has the best grades?

Both Expand Energy Corporation and Devon Energy Corporation have received predominantly positive grades. Devon Energy has a higher volume of Buy and Overweight ratings including recent upgrades, which may indicate stronger analyst confidence. This could impact investors by suggesting Devon might be viewed as having a slightly more favorable outlook among analysts.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Expand Energy Corporation (EXE) and Devon Energy Corporation (DVN) based on the most recent data available:

| Criterion | Expand Energy Corporation (EXE) | Devon Energy Corporation (DVN) |

|---|---|---|

| Diversification | Moderate diversification with strong Natural Gas and related services sales; Oil sales are relatively small (69M USD in 2024) | Focused primarily on NGL products with significant sales (11.2B USD in 2024) but less diversified segment data available |

| Profitability | Unfavorable profitability: negative net margin (-16.92%), ROIC negative (-2.7%) | Favorable profitability: positive net margin (18.57%), strong ROIC (10.8%) |

| Innovation | Limited data on innovation; ROIC trend growing but still value destructive | Demonstrates durable competitive advantage with very favorable ROIC trend growth |

| Global presence | Significant operations in natural gas gathering, transportation, and processing | Primarily US and Canada segments, strong domestic presence |

| Market Share | Large revenue in natural gas sector but struggling with profitability and efficiency | Strong market position with better profitability and efficient capital use |

Key takeaways: Devon Energy shows a clear competitive advantage with strong profitability, efficient capital use, and favorable financial ratios, making it a more stable investment. Expand Energy, while growing its ROIC, currently struggles with profitability and liquidity, signaling higher risk for investors.

Risk Analysis

Below is a comparative table highlighting key risks for Expand Energy Corporation (EXE) and Devon Energy Corporation (DVN) as of 2024:

| Metric | Expand Energy Corporation (EXE) | Devon Energy Corporation (DVN) |

|---|---|---|

| Market Risk | Moderate (Beta 0.45, lower volatility) | Moderate-High (Beta 0.66, higher volatility) |

| Debt level | Low (Debt-to-Equity 0.33, favorable) | Moderate (Debt-to-Equity 0.63, neutral) |

| Regulatory Risk | Moderate (Energy sector regulatory exposure) | Moderate (Energy sector regulatory exposure) |

| Operational Risk | High (Negative net margin -16.92%, weak asset turnover) | Moderate (Positive net margin 18.57%, better efficiency) |

| Environmental Risk | Elevated (Oil & gas operations, shale gas focus) | Elevated (Similar operations, slightly larger scale) |

| Geopolitical Risk | Moderate (US-focused operations, stable) | Moderate (US-focused operations, stable) |

In summary, the most impactful risks for both companies stem from operational challenges and environmental factors inherent to oil and gas production. EXE shows weaker profitability and efficiency metrics, increasing operational risk. DVN carries a higher debt load but demonstrates stronger financial performance. Both face regulatory and environmental pressures typical of their sector, with geopolitical risk low due to US-centric operations. Investors should weigh EXE’s financial fragility against DVN’s leverage exposure when managing risk.

Which Stock to Choose?

Expand Energy Corporation (EXE) experienced a declining income trend with unfavorable profitability and financial ratios in 2024, including negative net margin (-16.92%) and ROE (-4.06%). Despite low debt levels and a favorable rating (B), the company shows signs of value destruction with a slightly unfavorable moat.

Devon Energy Corporation (DVN) reported favorable income evolution marked by positive net margin (18.57%) and strong profitability ratios, including ROE at 19.94%. Its financial ratios mostly favor stability, though debt metrics are neutral to unfavorable. The company holds a very favorable rating (A-) and a very favorable moat indicating value creation.

Investors focused on growth might find EXE’s improving ROIC trend intriguing despite its current challenges, while those prioritizing financial stability and proven profitability may lean towards DVN, which exhibits a durable competitive advantage and stronger income metrics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Expand Energy Corporation and Devon Energy Corporation to enhance your investment decisions: