Home > Comparison > Industrials > DAL vs UAL

The strategic rivalry between Delta Air Lines, Inc. and United Airlines Holdings, Inc. shapes the competitive dynamics of the global airline industry. Delta operates a hub-centered, network-intensive model with a strong international presence, while United leverages a broad geographic footprint with diversified service offerings. This analysis contrasts their operational strengths and capital allocation strategies to identify which airline presents a superior risk-adjusted profile for inclusion in a diversified industrials portfolio.

Table of contents

Companies Overview

Delta Air Lines and United Airlines dominate the global passenger and cargo air transportation market.

Delta Air Lines, Inc.: Global Network Powerhouse

Delta Air Lines centers on scheduled passenger and cargo air transportation across domestic and international routes. Its revenue engine relies on a broad network of hubs in key U.S. cities and international gateways, complemented by aircraft maintenance, engineering services, and vacation packages. In 2026, Delta’s strategic focus remains on expanding its digital sales channels and optimizing operational efficiency across its 1,200-aircraft fleet.

United Airlines Holdings, Inc.: Extensive Global Reach

United Airlines operates a vast air transportation network spanning North America, Asia, Europe, and beyond. It generates revenue from passenger and cargo services via its mainline and regional fleets, supplemented by catering, ground handling, and maintenance services. The company emphasizes enhancing service integration and expanding ancillary revenue streams while maintaining operational resilience in a highly competitive sector.

Strategic Collision: Similarities & Divergences

Both airlines prioritize broad international reach and diversified revenue streams but differ in business philosophy. Delta leans on hub optimization and digital sales, while United integrates ancillary services like catering and ground handling. Their primary battleground is passenger loyalty and network connectivity. Investors face distinct profiles: Delta’s scale and tech focus contrast with United’s service integration and operational breadth.

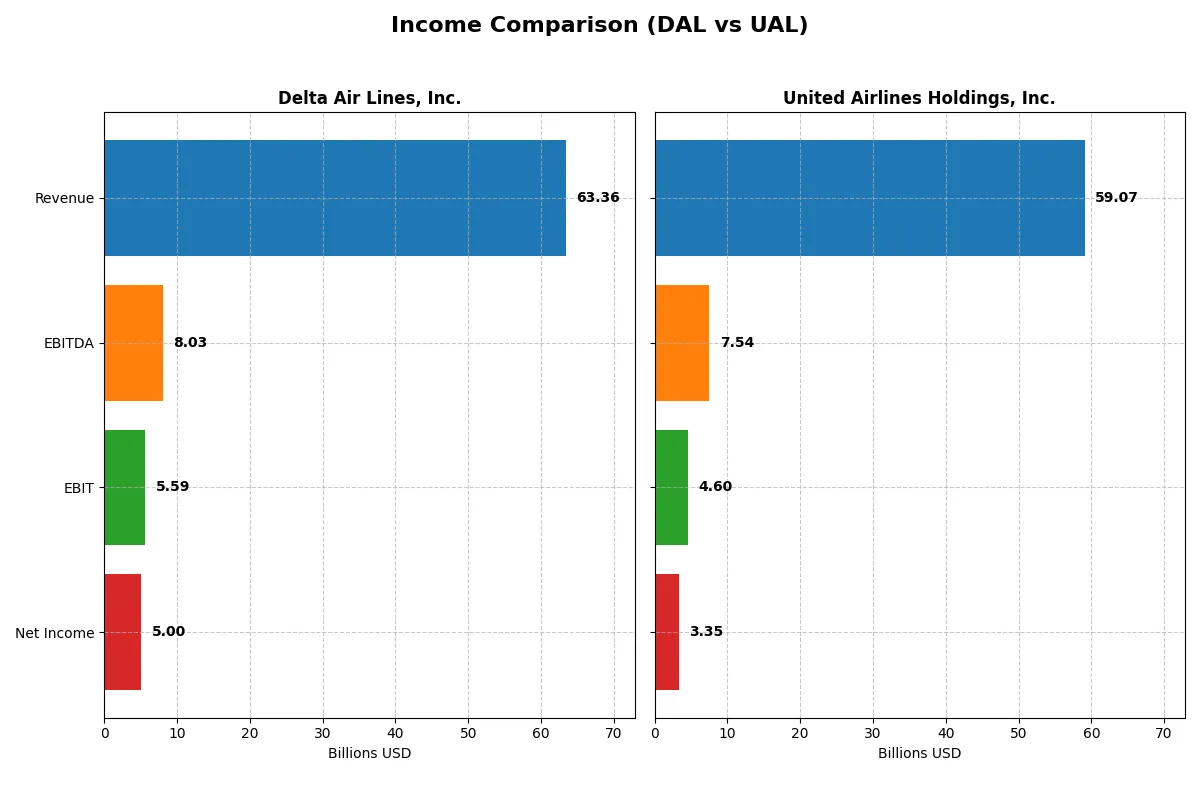

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Delta Air Lines, Inc. (DAL) | United Airlines Holdings, Inc. (UAL) |

|---|---|---|

| Revenue | 63.4B | 59.1B |

| Cost of Revenue | 48.9B | 21.2B |

| Operating Expenses | 8.7B | 33.2B |

| Gross Profit | 14.5B | 37.9B |

| EBITDA | 8.0B | 7.5B |

| EBIT | 5.6B | 4.6B |

| Interest Expense | 0.7B | 1.2B |

| Net Income | 5.0B | 3.4B |

| EPS | 7.72 | 10.21 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates a more efficient and profitable corporate engine in the current economic cycle.

Delta Air Lines, Inc. Analysis

Delta’s revenue grew steadily from $30B in 2021 to $63B in 2025, nearly doubling over five years. Net income surged from $280M to $5B, reflecting strong bottom-line momentum. Gross margin declined slightly to 22.8%, yet net margin expanded to 7.9%, indicating Delta’s improving cost control and operational leverage in 2025.

United Airlines Holdings, Inc. Analysis

United’s revenue climbed from $24.6B in 2021 to $59B in 2025, showing solid growth. Net income rose from a loss of $2B to a profit of $3.35B. United boasts a robust gross margin of 64.1% but a thinner net margin of 5.7%, signaling higher operating expenses that weighed on its bottom-line efficiency despite improving EPS.

Margin Strength vs. Bottom-Line Growth

Delta delivers superior net margin expansion and a stronger absolute net income gain, doubling United’s profitability in 2025. United excels in gross margin, benefiting from lower direct costs, yet struggles with higher operating expenses. Investors seeking consistent profit growth may favor Delta’s improving efficiency, while those valuing gross margin dominance might focus on United’s operational scale.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Delta Air Lines, Inc. (DAL) | United Airlines Holdings, Inc. (UAL) |

|---|---|---|

| ROE | 24.1% | 21.9% |

| ROIC | 8.3% | 6.6% |

| P/E | 9.0 | 10.9 |

| P/B | 2.17 | 2.39 |

| Current Ratio | 0.40 | 0.65 |

| Quick Ratio | 0.34 | 0.59 |

| D/E | 1.02 | 2.39 |

| Debt-to-Assets | 26.0% | 47.7% |

| Interest Coverage | 8.57 | 3.86 |

| Asset Turnover | 0.78 | 0.77 |

| Fixed Asset Turnover | 1.38 | 1.14 |

| Payout Ratio | 8.8% | 0% |

| Dividend Yield | 0.98% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence critical for investment insight.

Delta Air Lines, Inc.

Delta posts a favorable 24.12% ROE, signaling strong profitability, with a neutral net margin at 7.9%. Its P/E of 8.99 suggests the stock trades at a reasonable valuation. While dividends yield just 0.98%, the company balances shareholder returns with steady capital deployment. However, a low current ratio of 0.4 signals liquidity risk.

United Airlines Holdings, Inc.

United reports a solid 21.94% ROE but a slightly weaker 5.68% net margin. Its P/E ratio of 10.91 indicates a modestly higher valuation than Delta. United pays no dividends, focusing instead on reinvestment to support growth. The current ratio at 0.65 improves liquidity relative to Delta, though debt levels remain elevated.

Balanced Profitability vs. Liquidity Concerns

Delta offers a stronger profitability profile at a lower valuation but suffers from liquidity constraints. United shows a more conservative liquidity stance but with higher leverage and no dividends. Investors prioritizing stable returns may lean toward Delta; those focused on operational resilience might prefer United’s profile.

Which one offers the Superior Shareholder Reward?

Delta Air Lines, Inc. (DAL) offers a modest 0.98% dividend yield with a low 8.8% payout ratio, indicating strong free cash flow coverage (46%). It supplements dividends with steady buybacks, enhancing total returns sustainably. United Airlines Holdings, Inc. (UAL) pays no dividend but aggressively reinvests in growth and has a higher free cash flow per share ($7.8 vs. DAL’s $5.9). UAL’s buyback program is also active, but its leverage is higher and dividend absence leaves income-focused investors wanting. I judge DAL’s balanced dividend and buyback model as more sustainable and attractive for total shareholder return in 2026.

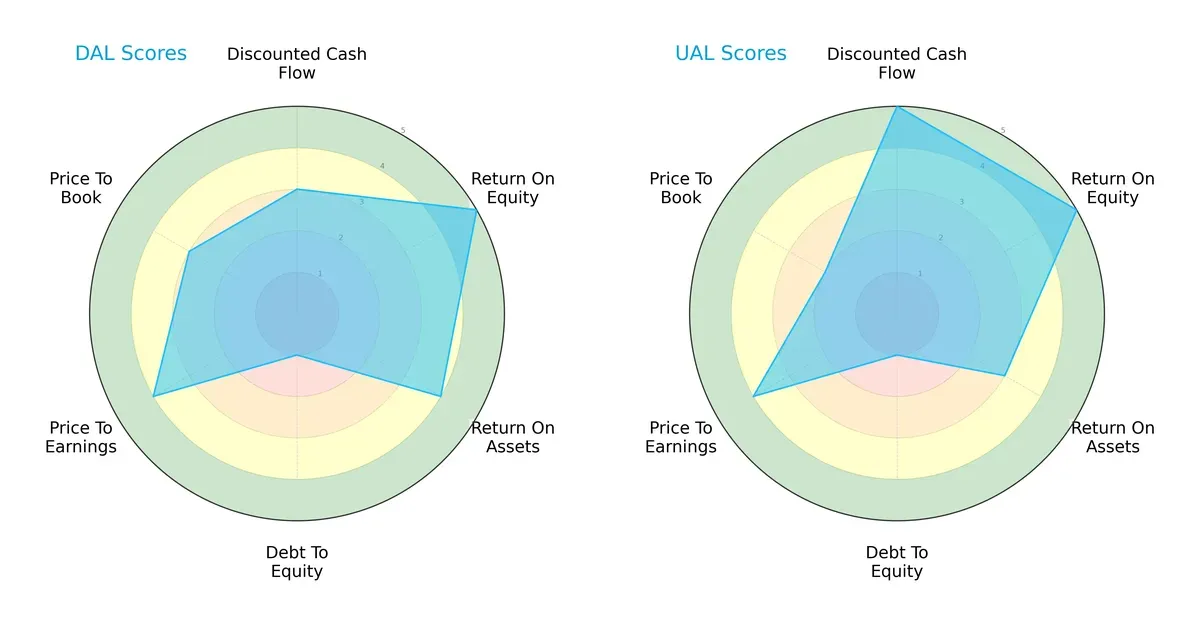

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Delta Air Lines and United Airlines, highlighting their core financial strengths and vulnerabilities:

Delta Air Lines presents a balanced profile with solid ROE (5) and ROA (4), but struggles with debt (1). United Airlines leverages a strong DCF score (5) and robust ROE (5) yet shows weaker asset efficiency (ROA 3) and pricier book valuation (P/B 2). Delta’s moderate DCF (3) contrasts with United’s edge in cash flow projections, but both share high financial leverage risk.

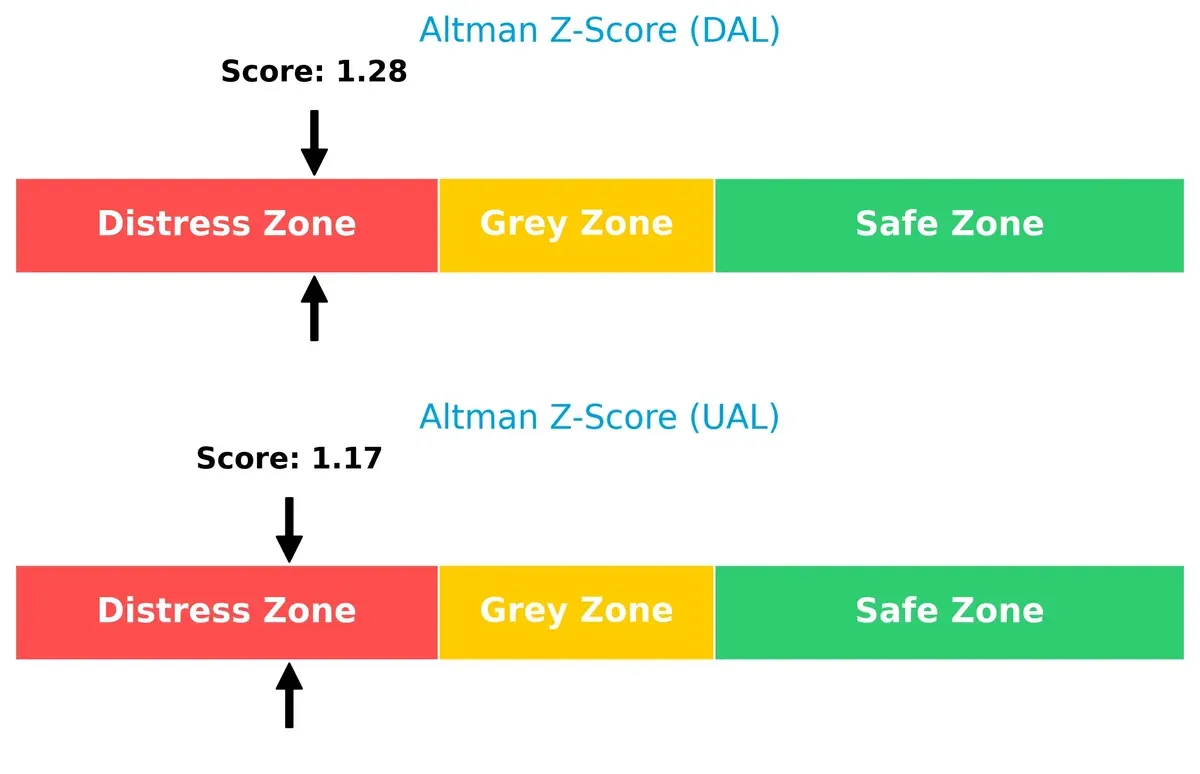

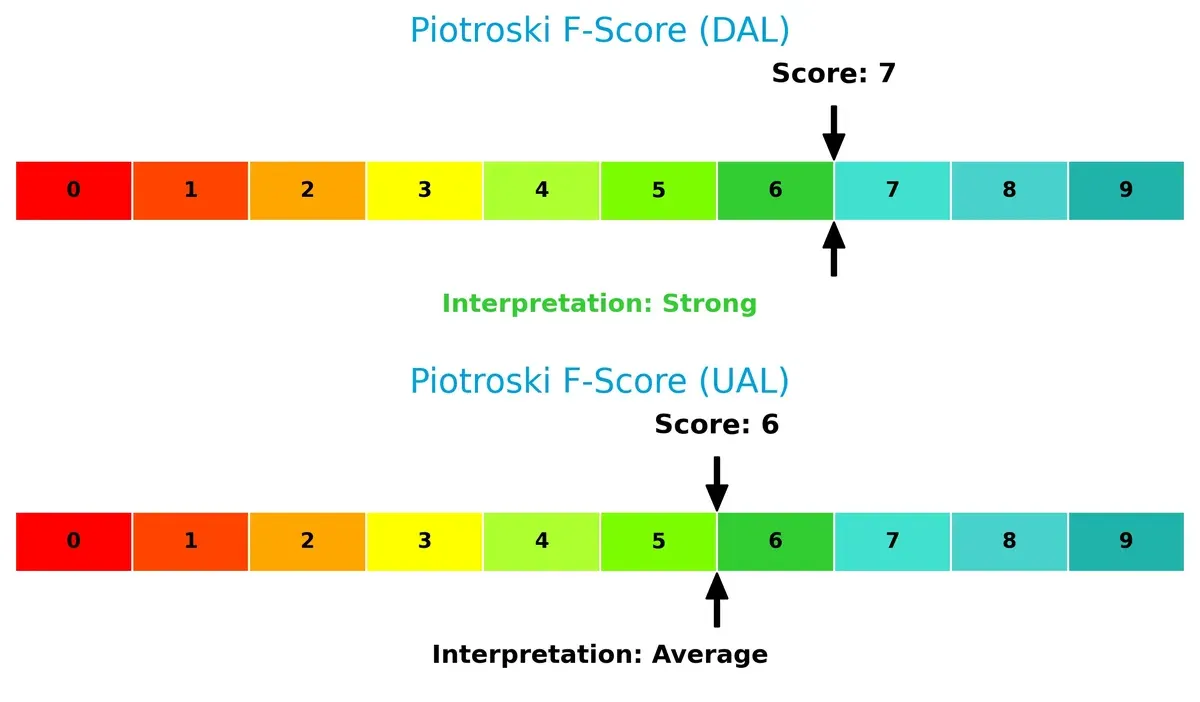

Bankruptcy Risk: Solvency Showdown

Both airlines fall into the distress zone with Altman Z-Scores below 1.8, signaling elevated bankruptcy risk in this volatile industry cycle:

Delta’s Z-Score (1.28) slightly outperforms United’s (1.17), but both indicate fragile solvency. Historically, airline capital structures under stress demand cautious capital allocation and liquidity monitoring.

Financial Health: Quality of Operations

Delta’s Piotroski F-Score (7) signals strong operational quality, outperforming United’s average score (6), suggesting Delta manages profitability and financial efficiency more effectively:

Delta’s superior score reflects better internal controls and earnings quality, while United’s lower score raises mild red flags on operational consistency. Investors should weigh these differences amid cyclical sector challenges.

How are the two companies positioned?

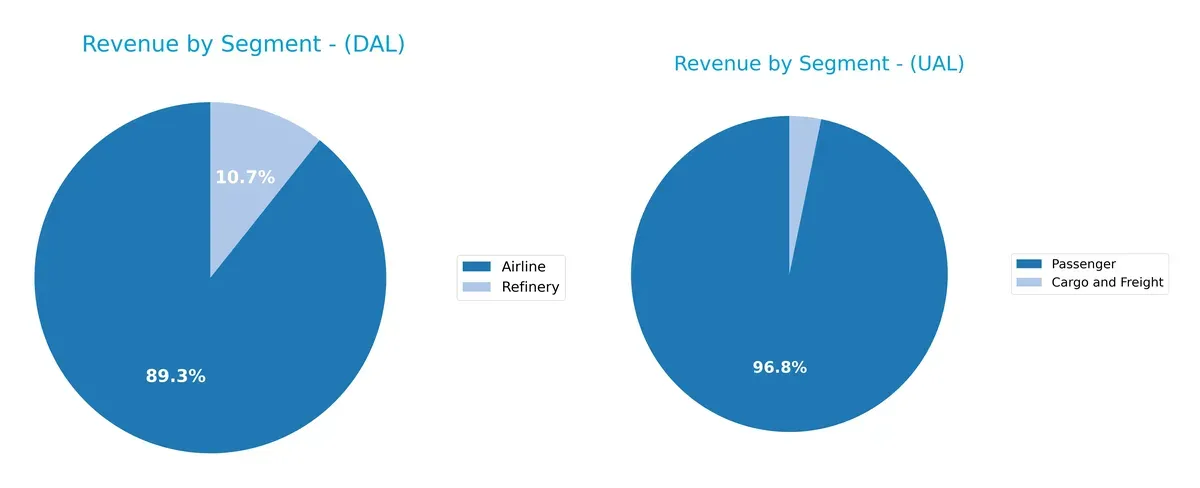

This section dissects the operational DNA of Delta and United by comparing their revenue distribution by segment alongside their internal strengths and weaknesses. The final objective confronts their economic moats to identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Delta Air Lines and United Airlines diversify their income streams and where their primary sector bets lie:

Delta Air Lines anchors its revenue in the Airline segment with $58.3B in 2025, complemented by a $6.96B Refinery business, showing moderate diversification. United Airlines relies more heavily on its Passenger segment, generating $53.4B, with a smaller $1.78B Cargo and Freight segment. Delta’s refinery stake offers a hedge against fuel cost volatility, while United’s focus increases exposure to passenger travel cycles, raising concentration risk amid economic shifts.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Delta Air Lines, Inc. and United Airlines Holdings, Inc.:

Delta Air Lines Strengths

- Diversified revenue with significant refinery segment complementing airline operations

- Favorable ROE of 24.12% outpaces UAL

- Lower debt-to-assets ratio at 25.97% signals stronger balance sheet control

United Airlines Strengths

- Strong passenger revenue base with over 53B in 2025

- Favorable WACC at 6.13% indicates efficient capital costs

- Higher PE suggests market confidence relative to DAL

Delta Air Lines Weaknesses

- Low current and quick ratios (0.4 and 0.34) raise liquidity concerns

- Debt-to-equity slightly above 1.0 implies heavier leverage

- Dividend yield under 1% may disappoint income investors

United Airlines Weaknesses

- Elevated debt-to-equity ratio at 2.39 signals higher financial risk

- Lower interest coverage ratio of 3.77 limits debt service flexibility

- Zero dividend yield reduces shareholder return appeal

Delta’s strengths lie in diversified revenue streams and conservative leverage, but liquidity is a clear risk. United shows strong revenue and capital cost advantages but carries heavier debt and weaker coverage ratios. These factors shape each airline’s strategic capacity to weather market cycles and invest for growth.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive pressure in capital-intensive industries like airlines:

Delta Air Lines, Inc.: Hub Network and Operational Efficiency Moat

Delta’s primary moat stems from its extensive hub network and operational scale, driving stable margins and rising profitability. Its slight ROIC growth signals potential moat strengthening through international expansion in 2026.

United Airlines Holdings, Inc.: Global Reach and Fleet Optimization Moat

United’s competitive edge lies in its global route diversity and fleet optimization, contrasting Delta’s concentrated hubs. Despite shedding value relative to WACC, growing ROIC suggests United’s operational improvements may deepen its moat in 2026.

Hub Dominance vs. Global Reach: The Competitive Moat Faceoff

Both airlines show slightly favorable moats with rising ROIC trends but remain value shedders relative to WACC. Delta’s entrenched hub network offers a wider moat, better equipping it to defend market share amid intensifying competition.

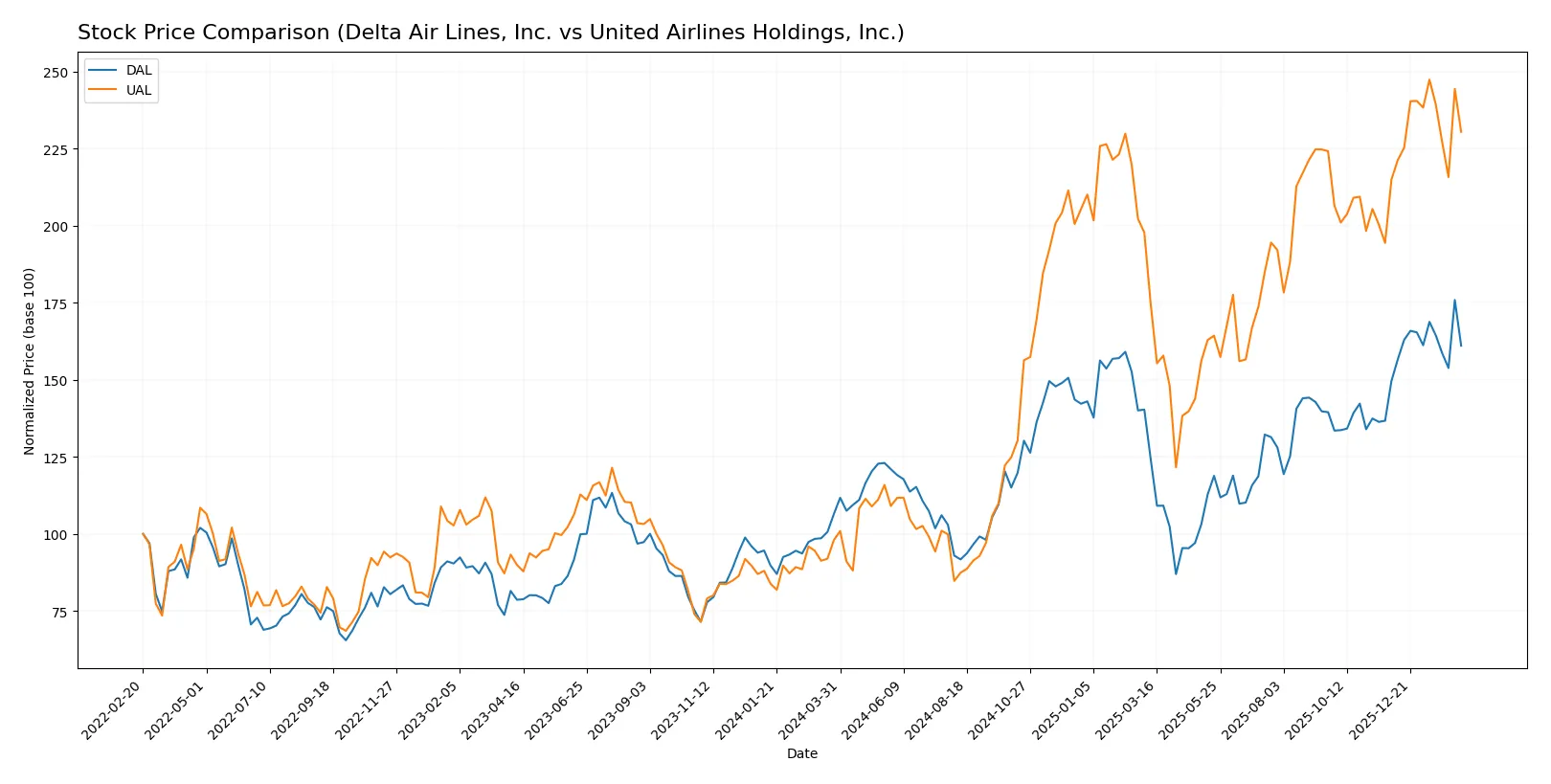

Which stock offers better returns?

The past year showed strong gains for both stocks, with notable price surges and dynamic trading volumes shaping their market narratives.

Trend Comparison

Delta Air Lines, Inc. (DAL) posted a 51.35% price increase over 12 months, marking a bullish trend with accelerating momentum and a moderate 9.14 volatility level. Its recent 7.64% gain confirms continued upward movement.

United Airlines Holdings, Inc. (UAL) surged 135.18% in the same period, also bullish but with decelerating gains and higher volatility at 23.58. Recent growth slowed slightly to 7.19%, maintaining positive momentum.

UAL outperformed DAL substantially, delivering the highest market return over the year despite a deceleration in trend acceleration, reflecting stronger investor enthusiasm and price appreciation.

Target Prices

Analysts project strong upside potential for both Delta Air Lines and United Airlines based on consensus targets.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Delta Air Lines, Inc. | 70 | 88 | 80.54 |

| United Airlines Holdings, Inc. | 110 | 150 | 136.5 |

The consensus target for Delta exceeds its current price of $69, signaling moderate upside. United’s target consensus of $136.5 is significantly above its $109 price, indicating strong analyst confidence in further gains.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

This section presents the latest institutional grades for Delta Air Lines, Inc. and United Airlines Holdings, Inc.:

Delta Air Lines, Inc. Grades

The table below summarizes recent grades from major financial institutions for Delta Air Lines:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-14 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Susquehanna | Maintain | Positive | 2026-01-09 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| B of A Securities | Maintain | Buy | 2026-01-06 |

| Goldman Sachs | Maintain | Buy | 2026-01-06 |

| B of A Securities | Maintain | Buy | 2025-10-15 |

| UBS | Maintain | Buy | 2025-10-10 |

| Deutsche Bank | Maintain | Buy | 2025-10-10 |

| Bernstein | Maintain | Outperform | 2025-10-10 |

United Airlines Holdings, Inc. Grades

Below are the most recent institutional grades for United Airlines Holdings:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-01-22 |

| Argus Research | Maintain | Buy | 2026-01-22 |

| UBS | Maintain | Buy | 2026-01-22 |

| Goldman Sachs | Maintain | Buy | 2026-01-13 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Susquehanna | Maintain | Positive | 2026-01-09 |

| Citigroup | Maintain | Buy | 2026-01-07 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| UBS | Maintain | Buy | 2026-01-06 |

| B of A Securities | Maintain | Buy | 2026-01-06 |

Which company has the best grades?

Both Delta Air Lines and United Airlines consistently receive strong Buy ratings from top-tier institutions. Delta shows a slight edge with an Outperform rating from Bernstein, which could indicate marginally higher confidence. Investors may interpret these grades as broadly positive for both stocks, reflecting solid institutional support.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Delta Air Lines, Inc.

- Strong hub network and diversified international presence provide competitive advantage.

United Airlines Holdings, Inc.

- Broad global reach but slightly less diversified hubs may limit market power.

2. Capital Structure & Debt

Delta Air Lines, Inc.

- Debt-to-equity ratio of 1.02 is concerning, signaling leverage risk despite moderate debt-to-assets.

United Airlines Holdings, Inc.

- Higher debt-to-equity at 2.39 poses greater financial risk and pressure on interest coverage.

3. Stock Volatility

Delta Air Lines, Inc.

- Beta of 1.338 indicates higher volatility relative to the market, increasing risk in downturns.

United Airlines Holdings, Inc.

- Beta of 1.263 suggests slightly lower volatility but still above market average.

4. Regulatory & Legal

Delta Air Lines, Inc.

- Subject to complex international regulations; refinery operations add regulatory complexity.

United Airlines Holdings, Inc.

- Faces intense regulatory scrutiny globally; legal issues could arise from diverse operations.

5. Supply Chain & Operations

Delta Air Lines, Inc.

- Large fleet of 1,200 aircraft requires robust maintenance; operational efficiency is key.

United Airlines Holdings, Inc.

- Diverse fleet and services increase operational complexity and supply chain vulnerability.

6. ESG & Climate Transition

Delta Air Lines, Inc.

- Refinery segment presents higher carbon risk; must accelerate climate transition efforts.

United Airlines Holdings, Inc.

- Heavy reliance on fossil fuels challenges ESG goals; transition risk remains significant.

7. Geopolitical Exposure

Delta Air Lines, Inc.

- Exposure to European and Asian hubs adds geopolitical uncertainty but diversifies risk.

United Airlines Holdings, Inc.

- Extensive global network increases vulnerability to geopolitical tensions and trade disruptions.

Which company shows a better risk-adjusted profile?

Delta’s most impactful risk lies in its high leverage and low liquidity ratios, signaling potential financial strain in adverse conditions. United faces even greater debt risk with weaker interest coverage. Despite Delta’s higher stock volatility, its more favorable debt-to-assets and stronger operational hubs offer a marginally better risk-adjusted profile. Notably, Delta’s Altman Z-score signals distress but is slightly better than United’s, underscoring its relatively stronger position amid sector challenges.

Final Verdict: Which stock to choose?

Delta Air Lines, Inc. (DAL) excels as a cash-generating powerhouse with improving profitability and robust return on equity. Its key point of vigilance remains a weak liquidity position, signaling caution for short-term obligations. DAL fits well in an aggressive growth portfolio focused on operational efficiency and financial discipline.

United Airlines Holdings, Inc. (UAL) leverages its strategic moat in revenue growth and expanding gross margins, supported by a stronger current ratio and more conservative capital allocation. Compared to DAL, UAL offers a relatively safer financial profile, making it suitable for GARP investors seeking steady growth with moderate risk.

If you prioritize aggressive operational efficiency and high return on equity, Delta Air Lines outshines due to its superior profitability improvements. However, if you seek growth combined with better liquidity and a steadier capital structure, United Airlines offers better stability despite a premium valuation. Both present compelling but distinct analytical scenarios for different investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Delta Air Lines, Inc. and United Airlines Holdings, Inc. to enhance your investment decisions: