In today’s fast-evolving tech landscape, choosing the right software stock requires insight into innovation and market positioning. Dayforce Inc (DAY) specializes in human capital management solutions, serving enterprises with integrated payroll and HR platforms. SoundHound AI, Inc. (SOUN) focuses on voice AI technology, creating conversational platforms for diverse industries. This article compares their business models and growth potential to identify the more compelling investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Dayforce Inc and SoundHound AI, Inc. by providing an overview of these two companies and their main differences.

Dayforce Inc Overview

Dayforce Inc operates as a human capital management (HCM) software company, offering a cloud platform that integrates human resources, payroll, benefits, workforce management, and talent management. Serving clients in the US, Canada, and internationally, it targets both large enterprises and small businesses through direct sales and third-party channels. The company is headquartered in Minneapolis with a workforce of 9,600 employees.

SoundHound AI, Inc. Overview

SoundHound AI, Inc. develops an independent voice AI platform designed to enable businesses to create conversational voice assistants. Its Houndify platform includes tools such as automatic speech recognition and natural language understanding to enhance customer interactions across industries. Based in Santa Clara, California, SoundHound employs 842 people and focuses on delivering voice AI technology solutions.

Key similarities and differences

Both Dayforce and SoundHound operate in the technology sector within the software application industry, focusing on cloud-based solutions. Dayforce specializes in human capital management software, while SoundHound emphasizes voice AI platforms and conversational technologies. The companies differ significantly in scale, with Dayforce having a market cap of 11.1B and a larger workforce, whereas SoundHound is smaller at 4.7B market cap and fewer employees.

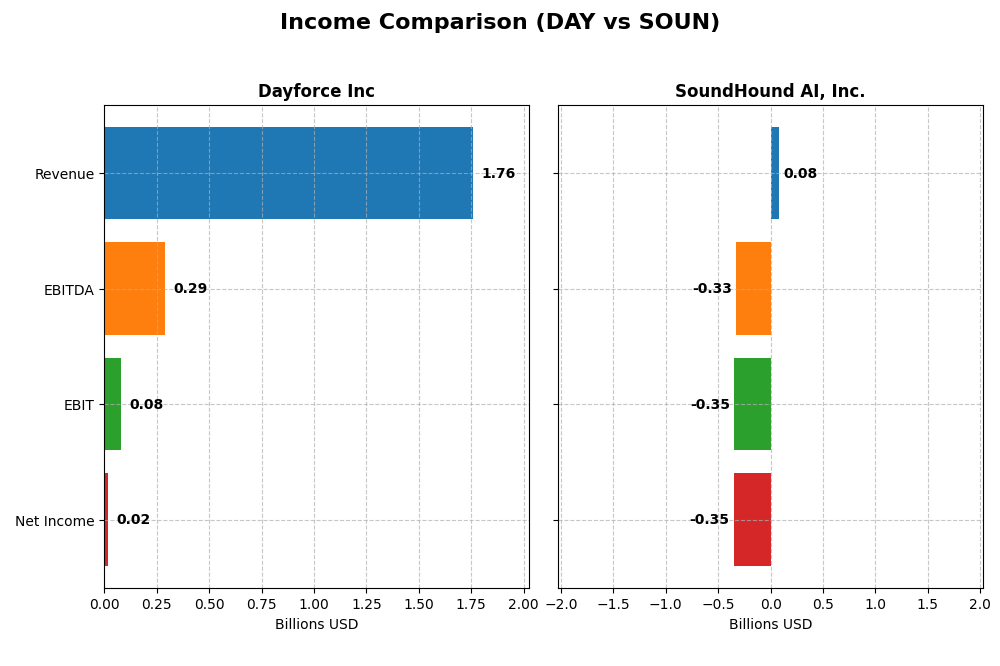

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Dayforce Inc and SoundHound AI, Inc. for the fiscal year 2024.

| Metric | Dayforce Inc | SoundHound AI, Inc. |

|---|---|---|

| Market Cap | 11.1B | 4.7B |

| Revenue | 1.76B | 85M |

| EBITDA | 288M | -329M |

| EBIT | 78.2M | -348M |

| Net Income | 18.1M | -351M |

| EPS | 0.11 | -1.04 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Dayforce Inc

Dayforce Inc exhibited strong revenue growth from 2020 to 2024, nearly doubling its top line to $1.76B in 2024. Net income also improved significantly over the period, turning positive after several years of losses, reaching $18.1M in 2024. Margins showed resilience with a favorable gross margin of 46.14%, while EBIT and net margins remained neutral. The latest year saw revenue and gross profit grow by over 16% and 25% respectively, although EBIT and net income margins contracted, signaling increased operating expenses.

SoundHound AI, Inc.

SoundHound AI’s revenue surged substantially by more than 550% over 2020-2024, reaching $84.7M in 2024. Despite this growth, the company continued to report net losses, with a net income of -$351M in 2024 and highly negative EBIT margins at -410.61%. Gross margin was favorable at 48.86%, but high operating expenses and interest costs pressured profitability. The latest year showed strong revenue and gross profit growth but a sharp decline in EBIT and net margins, reflecting heavy investment and cost base expansion.

Which one has the stronger fundamentals?

Dayforce presents stronger fundamentals with consistent revenue and net income growth, positive margins, and a favorable overall income statement evaluation. In contrast, SoundHound shows impressive top-line expansion but sustained losses and unfavorable margins, leading to an overall unfavorable income statement view. While SoundHound invests heavily for growth, Dayforce’s more balanced profitability and margin stability indicate a firmer income statement foundation.

Financial Ratios Comparison

The table below compares key financial ratios for Dayforce Inc and SoundHound AI, Inc. based on their most recent fiscal year data from 2024.

| Ratios | Dayforce Inc (DAY) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| ROE | 0.71% | -191.99% |

| ROIC | 1.31% | -68.13% |

| P/E | 633.3 | -19.15 |

| P/B | 4.50 | 36.76 |

| Current Ratio | 1.13 | 3.77 |

| Quick Ratio | 1.13 | 3.77 |

| D/E (Debt to Equity) | 0.48 | 0.02 |

| Debt-to-Assets | 13.52% | 0.79% |

| Interest Coverage | 2.56 | -28.05 |

| Asset Turnover | 0.19 | 0.15 |

| Fixed Asset Turnover | 7.46 | 14.28 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Dayforce Inc

Dayforce Inc shows several unfavorable ratios, including low net margin (1.03%), ROE (0.71%), and ROIC (1.31%), signaling weak profitability. The company’s P/E ratio is very high at 633.29, which may raise valuation concerns. Favorable points include a solid quick ratio (1.13) and manageable debt levels. Dayforce does not pay dividends, indicating a reinvestment strategy or focus on growth.

SoundHound AI, Inc.

SoundHound AI exhibits predominantly unfavorable ratios, with a deeply negative net margin (-414.06%) and ROE (-191.99%), reflecting significant losses and poor profitability. Its WACC is elevated at 17.71%, increasing capital costs. However, it benefits from a strong quick ratio (3.77) and low debt ratios. SoundHound does not pay dividends, likely due to its early growth phase and emphasis on R&D.

Which one has the best ratios?

Both companies face considerable challenges with predominantly unfavorable profitability and valuation metrics. SoundHound’s losses and high capital costs appear more severe, despite better liquidity and lower leverage. Dayforce shows some stability with lower debt and a slightly better margin profile. Overall, neither company presents a clearly favorable ratio profile as of 2024 fiscal data.

Strategic Positioning

This section compares the strategic positioning of Dayforce Inc and SoundHound AI, Inc., including market position, key segments, and exposure to technological disruption:

Dayforce Inc

- Established HCM software leader with 11B market cap; faces moderate competitive pressure.

- Focuses on cloud HCM solutions for HR, payroll, benefits, and workforce management; drives revenue mainly from recurring cloud services.

- Operating in mature software sector with cloud-based HCM; moderate risk of disruption from evolving AI and automation technologies.

SoundHound AI, Inc.

- Smaller voice AI platform with 4.7B market cap; higher beta indicates greater market volatility.

- Develops voice AI platforms and tools for conversational assistants; revenue from hosted services and licensing.

- Positioned in emerging voice AI technology with innovation focus; potentially higher disruption risk from fast-evolving AI landscape.

Dayforce Inc vs SoundHound AI, Inc. Positioning

Dayforce has a diversified HCM software offering with a large established market presence and stable recurring revenue streams, while SoundHound is more concentrated in voice AI technology with a smaller scale and higher market volatility. Both face value destruction but show improving profitability trends.

Which has the best competitive advantage?

Both companies currently shed value with ROIC below WACC but show growing ROIC trends. Their competitive advantages are slightly unfavorable, reflecting challenges in generating consistent economic profits despite improving profitability.

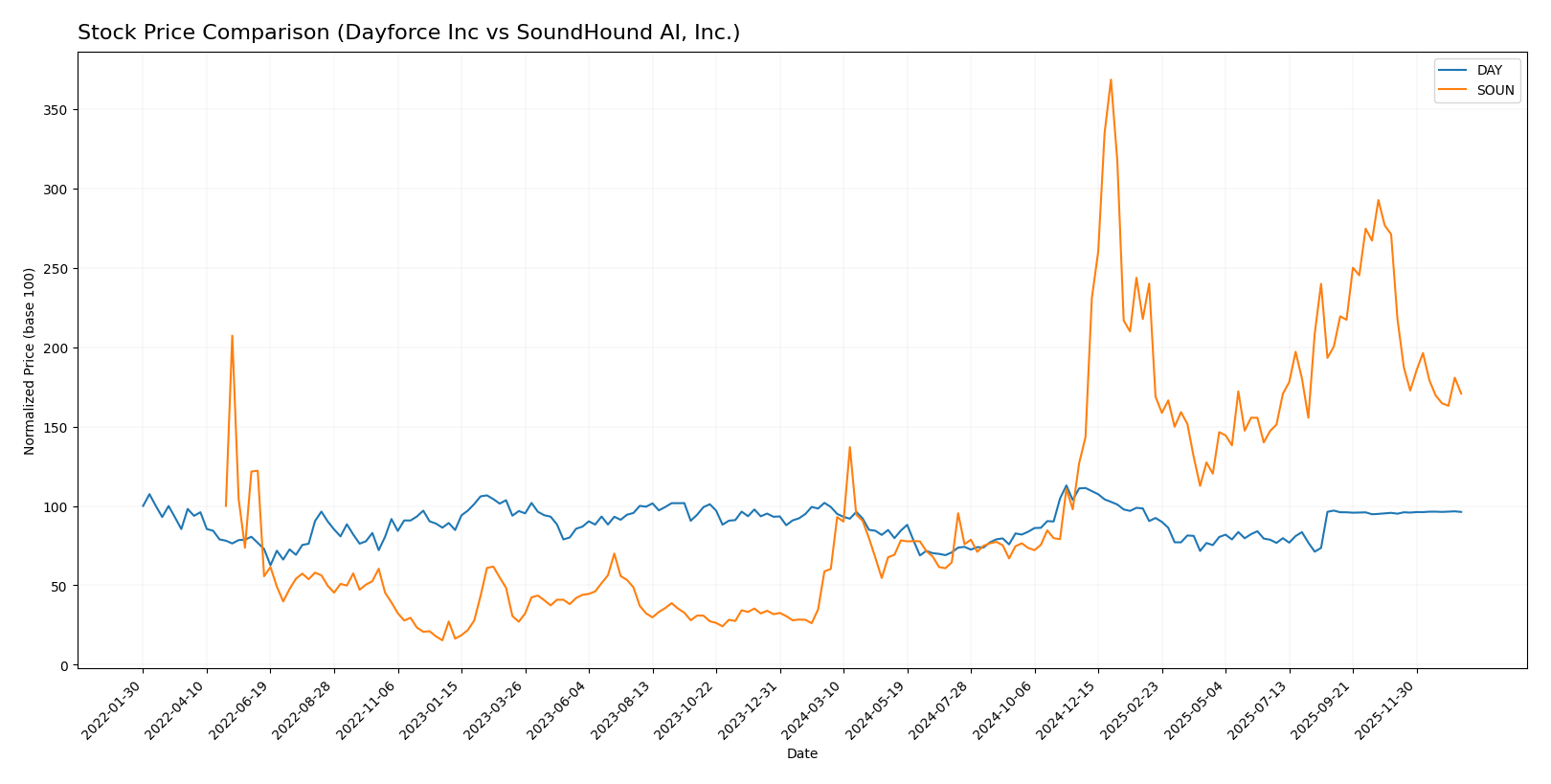

Stock Comparison

The stock price movements over the past year reveal contrasting dynamics between Dayforce Inc and SoundHound AI, Inc., with significant price growth for SoundHound and a mild decline for Dayforce, alongside shifting trading volumes.

Trend Analysis

Dayforce Inc’s stock experienced a bearish trend over the past 12 months, declining by 3.16% with decelerating downward momentum and a high volatility of 7.84. The price ranged between 49.46 and 81.14, with a slight recent uptick of 0.61%.

SoundHound AI, Inc. showed a strong bullish trend over the same period, gaining 183.16% despite deceleration. Volatility was moderate at 4.66, with prices fluctuating from 3.55 to 23.95. However, the recent period reflects a sharp 37.0% decline and a negative slope.

Comparing both stocks, SoundHound AI significantly outperformed Dayforce Inc in market performance over the past year, though recent trends indicate contrasting short-term momentum.

Target Prices

The consensus target prices from analysts show a clear projection for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Dayforce Inc | 70 | 70 | 70 |

| SoundHound AI, Inc. | 15 | 11 | 13.33 |

Analysts expect Dayforce Inc’s stock to hold steady around its current price of $69.16, while SoundHound AI’s target consensus at $13.33 suggests moderate upside from the current $11.10 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Dayforce Inc and SoundHound AI, Inc.:

Rating Comparison

Dayforce Inc Rating

- Rating: C-, considered very favorable overall.

- Discounted Cash Flow Score: 2, moderate status.

- ROE Score: 1, very unfavorable status.

- ROA Score: 1, very unfavorable status.

- Debt To Equity Score: 2, moderate status.

- Overall Score: 1, very unfavorable status.

SoundHound AI, Inc. Rating

- Rating: C-, considered very favorable overall.

- Discounted Cash Flow Score: 1, very unfavorable status.

- ROE Score: 1, very unfavorable status.

- ROA Score: 1, very unfavorable status.

- Debt To Equity Score: 4, favorable status.

- Overall Score: 1, very unfavorable status.

Which one is the best rated?

Both companies share the same overall rating of C- with very unfavorable overall scores. Dayforce shows a moderate score on discounted cash flow and debt to equity, while SoundHound scores favorably only on debt to equity but less on discounted cash flow.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for each company:

Dayforce Inc Scores

- Altman Z-Score: 1.24, indicating financial distress risk.

- Piotroski Score: 5, representing average financial strength.

SoundHound AI, Inc. Scores

- Altman Z-Score: 6.62, indicating strong financial safety.

- Piotroski Score: 3, indicating very weak financial health.

Which company has the best scores?

SoundHound AI has a much higher Altman Z-Score, placing it in the safe zone, while Dayforce is in distress. However, Dayforce has a better Piotroski Score, reflecting stronger financial strength than SoundHound AI.

Grades Comparison

Here is the grades comparison for Dayforce Inc and SoundHound AI, Inc.:

Dayforce Inc Grades

The following table shows recent analyst grades for Dayforce Inc from recognized grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Hold | 2025-10-30 |

| Stifel | Downgrade | Hold | 2025-09-19 |

| Citigroup | Downgrade | Neutral | 2025-09-17 |

| Wells Fargo | Upgrade | Equal Weight | 2025-08-22 |

| BMO Capital | Downgrade | Market Perform | 2025-08-22 |

| Keybanc | Downgrade | Sector Weight | 2025-08-22 |

| Needham | Downgrade | Hold | 2025-08-22 |

| Barclays | Maintain | Equal Weight | 2025-08-22 |

| Deutsche Bank | Maintain | Hold | 2025-08-22 |

| Jefferies | Maintain | Hold | 2025-08-21 |

Overall, Dayforce Inc’s grades have shown a tendency toward downgrades and hold ratings, indicating a cautious outlook by analysts.

SoundHound AI, Inc. Grades

Below are the latest analyst grades for SoundHound AI, Inc. from credible grading entities.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

SoundHound AI, Inc. maintains predominantly buy and outperform ratings, reflecting a generally positive analyst sentiment.

Which company has the best grades?

SoundHound AI, Inc. has received generally stronger grades than Dayforce Inc, with more buy and outperform recommendations. This suggests a more favorable analyst outlook, which may influence investor confidence and portfolio decisions accordingly.

Strengths and Weaknesses

The following table compares key strengths and weaknesses of Dayforce Inc and SoundHound AI, Inc based on their recent financial and operational data.

| Criterion | Dayforce Inc (DAY) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Diversification | Strong focus on cloud recurring services with $1.52B recurring revenue, moderate professional services | Smaller scale with $83M total revenue, more reliance on hosted services and licensing |

| Profitability | Slightly unfavorable: low net margin (1.03%), ROIC 1.31% below WACC of 8.69% | Unfavorable: negative margins, ROIC -68%, WACC 17.71%, significant value destruction |

| Innovation | Moderate innovation in cloud payroll and workforce management services | High innovation in AI voice recognition but profitability remains challenging |

| Global presence | Established client base with recurring cloud services, expanding profitability trend | Smaller footprint, growing hosted services revenue but limited scale |

| Market Share | Significant market share in cloud workforce management with $1.5B+ in recurring revenue | Niche player in AI voice tech with growing but modest revenue |

Key takeaways: Both companies are currently value destroyers with ROIC below their cost of capital. Dayforce shows improving profitability and a stronger recurring revenue base, making it a more stable choice. SoundHound is highly innovative but faces greater financial challenges and scale limitations. Investors should weigh innovation potential against profitability risks.

Risk Analysis

Below is a comparative table outlining key risks for Dayforce Inc and SoundHound AI, Inc. based on the most recent 2024 data:

| Metric | Dayforce Inc | SoundHound AI, Inc. |

|---|---|---|

| Market Risk | Beta 1.18 (moderate) | Beta 2.88 (high volatility) |

| Debt Level | Debt-to-Equity 0.48 (moderate) | Debt-to-Equity 0.02 (low) |

| Regulatory Risk | Moderate (software sector) | Moderate (AI and voice tech sector) |

| Operational Risk | Large workforce (9,600 employees) | Smaller workforce (842 employees) |

| Environmental Risk | Low (software focus) | Low (software focus) |

| Geopolitical Risk | Moderate (US based) | Moderate (US based) |

The most significant risks are market volatility for SoundHound AI, with a very high beta of 2.88 indicating greater price swings, and Dayforce’s moderate debt level combined with an unfavorable profitability profile. SoundHound’s financial losses and weak profitability metrics heighten operational risk, while Dayforce’s Altman Z-Score signals distress risk despite its larger size. Investors should weigh SoundHound’s high market risk and financial instability against Dayforce’s moderate leverage and profitability challenges.

Which Stock to Choose?

Dayforce Inc has shown favorable income growth overall, with a 109% revenue increase and 553% net income growth over five years. However, its profitability ratios remain mostly unfavorable, with low ROE at 0.71% and modest net margin of 1.03%. Debt levels are manageable, and the rating is very favorable despite some weak financial ratio scores.

SoundHound AI, Inc. exhibits strong revenue growth of 551% over the period but suffers from significant net income declines and negative profitability ratios, including a -192% ROE and -414% net margin. Its debt is low, supported by a favorable debt-to-equity score, yet the overall rating is very favorable mainly due to potential upside despite current financial weaknesses.

Investors seeking growth may find SoundHound AI’s accelerating revenue appealing despite its negative profitability and higher risk profile. Conversely, more risk-averse investors focused on stable income and balance sheet strength might favor Dayforce Inc, which shows improving profitability trends and a better overall income statement evaluation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Dayforce Inc and SoundHound AI, Inc. to enhance your investment decisions: