In the dynamic world of software applications, Dayforce Inc. and Pegasystems Inc. stand out as key players driving innovation in human capital management and enterprise software. Both companies share a focus on cloud-based solutions and serve overlapping markets, making their strategies and growth potential highly comparable. This article will explore their strengths and risks to help you decide which company deserves a spot in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Dayforce Inc and Pegasystems Inc. by providing an overview of these two companies and their main differences.

Dayforce Inc Overview

Dayforce Inc operates as a human capital management (HCM) software company, offering a cloud HCM platform that includes human resources, payroll, benefits, workforce, and talent management. It also provides solutions for small businesses and payroll services through Bureau solutions. Headquartered in Minneapolis, Minnesota, Dayforce serves clients in the US, Canada, and internationally, focusing on delivering comprehensive HCM software solutions.

Pegasystems Inc. Overview

Pegasystems Inc. develops enterprise software applications primarily focused on customer engagement and digital process automation. Its offerings include the Pega Platform, Pega Infinity, and various customer service and sales automation tools. Headquartered in Cambridge, Massachusetts, Pegasystems serves diverse industries globally, including financial services, healthcare, and government, through direct sales and partnerships with technology providers.

Key similarities and differences

Both Dayforce and Pegasystems operate in the software application industry within the technology sector, focusing on cloud-based platforms. Dayforce specializes in human capital management solutions, while Pegasystems targets customer engagement and process automation. Dayforce has a larger workforce of 9,600 employees compared to Pegasystems’ 5,443. The companies differ in geographic focus and product scope, but both emphasize scalable enterprise software solutions.

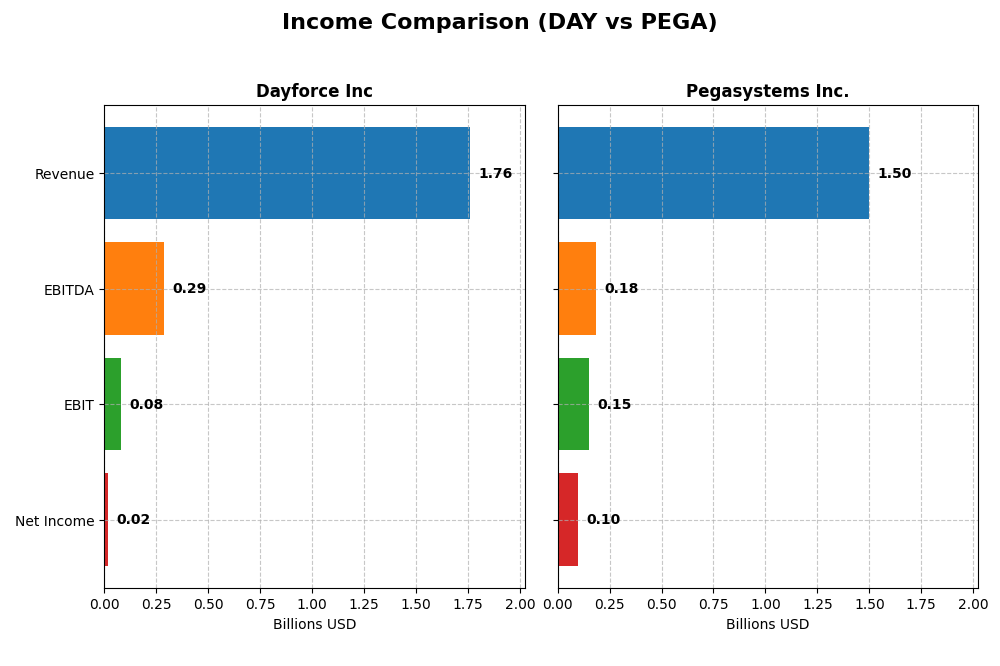

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent fiscal year income statement metrics for Dayforce Inc and Pegasystems Inc., providing key financial figures for investor analysis.

| Metric | Dayforce Inc | Pegasystems Inc. |

|---|---|---|

| Market Cap | 11.1B | 8.9B |

| Revenue | 1.76B | 1.50B |

| EBITDA | 288M | 185M |

| EBIT | 78.2M | 149.5M |

| Net Income | 18.1M | 99.2M |

| EPS | 0.11 | 0.58 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Dayforce Inc

Dayforce Inc exhibited strong revenue growth from 2020 to 2024, doubling its top line to $1.76B with a favorable gross margin of 46.14%. Net income surged over the period, though the most recent year saw a net income decline to $18M, reflecting a sharp contraction in EBIT and net margin. Operating expenses grew alongside revenue, pressuring profitability despite solid top-line expansion.

Pegasystems Inc.

Pegasystems showed consistent revenue growth, reaching $1.50B in 2024 with a favorable gross margin near 74%. Net income improved significantly, hitting $99M in the latest year with a favorable net margin of 6.63%. The company experienced modest revenue growth last year but strong expansions in EBIT and net margin, supported by controlled operating expenses compared to revenue increases.

Which one has the stronger fundamentals?

Pegasystems demonstrates stronger fundamentals with higher and more stable margins, including a notably superior net margin and EBIT margin. Its consistent profitability growth and operating expense management contrast with Dayforce’s significant recent margin compression and net income decline despite rapid revenue gains. Both companies show overall favorable income trends, but Pegasystems’ income statement reflects more balanced growth and efficiency.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Dayforce Inc and Pegasystems Inc., based on their most recent fiscal year data (2024).

| Ratios | Dayforce Inc (DAY) | Pegasystems Inc. (PEGA) |

|---|---|---|

| ROE | 0.71% | 16.94% |

| ROIC | 1.31% | 7.40% |

| P/E | 633.3 | 80.1 |

| P/B | 4.50 | 13.57 |

| Current Ratio | 1.13 | 1.23 |

| Quick Ratio | 1.13 | 1.23 |

| D/E (Debt-to-Equity) | 0.48 | 0.94 |

| Debt-to-Assets | 13.5% | 31.1% |

| Interest Coverage | 2.56 | 18.12 |

| Asset Turnover | 0.19 | 0.85 |

| Fixed Asset Turnover | 7.46 | 14.36 |

| Payout Ratio | 0% | 10.3% |

| Dividend Yield | 0% | 0.13% |

Interpretation of the Ratios

Dayforce Inc

Dayforce Inc displays mostly unfavorable financial ratios, including a low net margin of 1.03%, weak return on equity at 0.71%, and a high price-to-earnings ratio of 633.29, indicating valuation concerns. Favorable aspects include a solid quick ratio of 1.13 and manageable debt levels. The company does not pay dividends, reflecting a reinvestment strategy or growth phase with no shareholder returns via dividends.

Pegasystems Inc.

Pegasystems Inc. shows a stronger ratio profile with a favorable return on equity of 16.94% and a robust interest coverage of 21.87, although its price-to-book ratio at 13.57 and low dividend yield of 0.13% raise some caution. The company pays a modest dividend, but the yield remains low, suggesting limited income returns. Overall, ratios reflect moderate strength with some valuation concerns.

Which one has the best ratios?

Between the two, Pegasystems Inc. exhibits a more balanced ratio set with fewer unfavorable metrics and a slightly favorable overall opinion. Dayforce Inc. faces significant challenges in profitability and valuation ratios, resulting in an unfavorable global assessment. Pegasystems’ better returns and coverage ratios suggest relatively stronger financial health.

Strategic Positioning

This section compares the strategic positioning of Dayforce Inc and Pegasystems Inc., including Market position, Key segments, and disruption:

Dayforce Inc

- Positioned in human capital management software with strong market presence in US, Canada, international, facing moderate competitive pressure.

- Key segments include Cloud Dayforce and Powerpay recurring services plus professional services driving growth.

- Exposure to technological disruption centered on cloud HCM platform innovation and payroll solutions.

Pegasystems Inc.

- Operates in enterprise software with broad geographic reach including Americas, Europe, Asia-Pacific, under competitive pressure.

- Key segments cover Pega Cloud, subscription licenses, maintenance, consulting, and customer engagement software.

- Exposure includes digital process automation, customer engagement platforms, and cloud software development infrastructure.

Dayforce Inc vs Pegasystems Inc. Positioning

Dayforce focuses on a concentrated HCM cloud platform and payroll services, benefiting from recurring revenues but narrower scope. Pegasystems has a more diversified software portfolio across industries and geographies, leveraging broad application development and customer engagement solutions.

Which has the best competitive advantage?

Both companies are shedding value with ROIC below WACC yet show growing profitability trends. Neither currently holds a strong economic moat, indicating similar moderate challenges in sustaining competitive advantages.

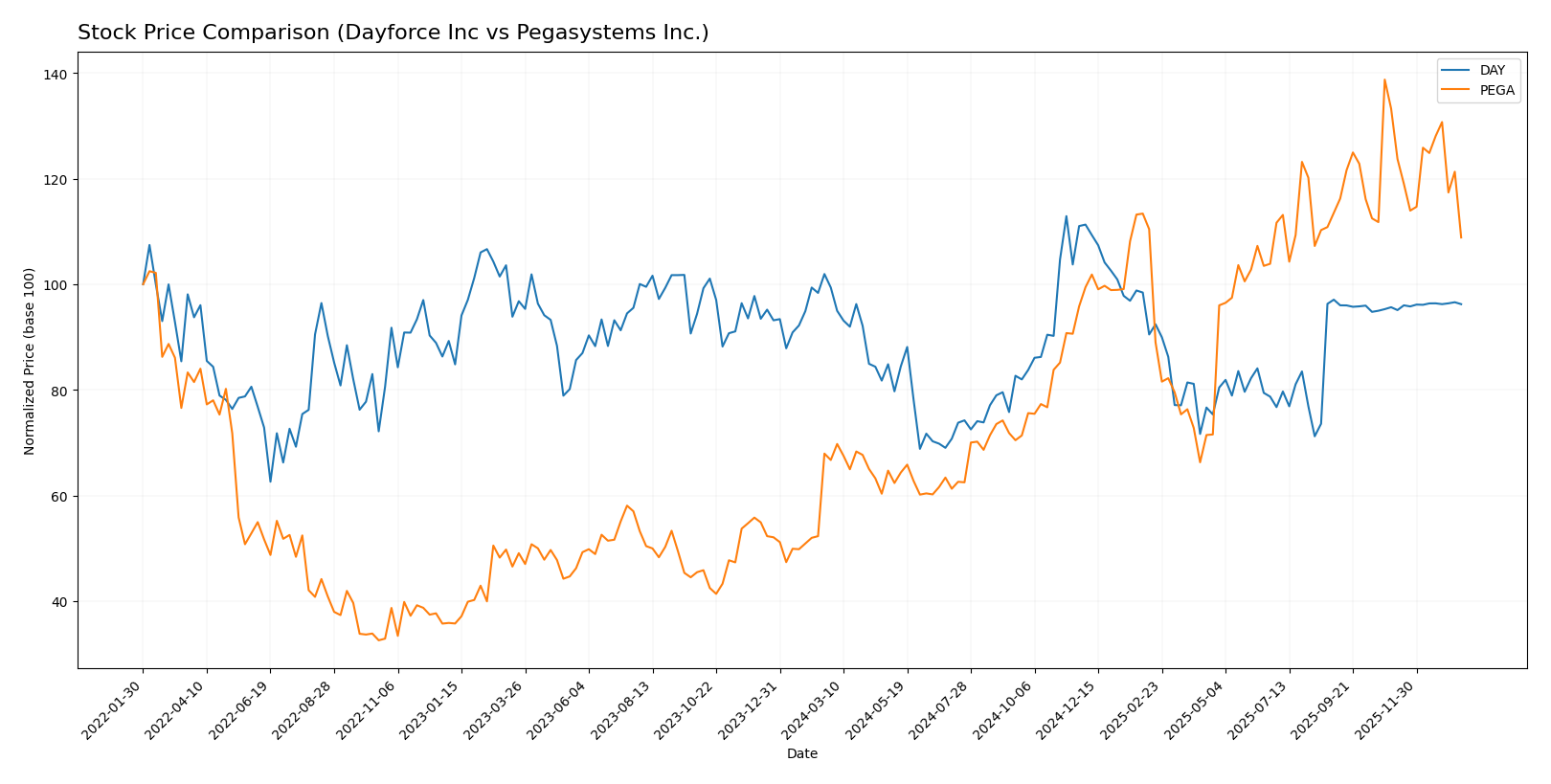

Stock Comparison

The stock price movements over the past 12 months reveal contrasting trends, with Dayforce Inc experiencing a mild bearish shift and Pegasystems Inc showing a strong bullish performance despite recent deceleration.

Trend Analysis

Dayforce Inc’s stock price decreased by 3.16% over the past year, indicating a bearish trend with deceleration. The price ranged between 49.46 and 81.14, with moderate volatility at a 7.84 standard deviation.

Pegasystems Inc’s stock price rose sharply by 63.18% during the same period, confirming a bullish trend despite deceleration. The stock showed higher volatility, with a 10.77 standard deviation and prices fluctuating between 28.73 and 66.27.

Comparing both, Pegasystems Inc delivered the highest market performance with a significant positive price change, while Dayforce Inc faced a mild decline over the last 12 months.

Target Prices

The current analyst consensus reflects a positive outlook for both Dayforce Inc and Pegasystems Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Dayforce Inc | 70 | 70 | 70 |

| Pegasystems Inc. | 80 | 67 | 74 |

Analysts expect Dayforce’s stock to hold steady around its current price of $69.16, while Pegasystems shows potential upside from $51.99 to a consensus target near $74.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Dayforce Inc and Pegasystems Inc.:

Rating Comparison

Dayforce Inc Rating

- Rating: C- rating classified as Very Favorable

- Discounted Cash Flow Score: 2, considered Moderate

- ROE Score: 1, classified as Very Unfavorable

- ROA Score: 1, classified as Very Unfavorable

- Debt To Equity Score: 2, considered Moderate

- Overall Score: 1, classified as Very Unfavorable

Pegasystems Inc Rating

- Rating: B+ rating classified as Very Favorable

- Discounted Cash Flow Score: 3, considered Moderate

- ROE Score: 5, classified as Very Favorable

- ROA Score: 5, classified as Very Favorable

- Debt To Equity Score: 3, considered Moderate

- Overall Score: 3, classified as Moderate

Which one is the best rated?

Based strictly on the provided data, Pegasystems Inc holds a superior rating with a B+ and higher overall, ROE, and ROA scores compared to Dayforce Inc’s C- rating and lower financial scores.

Scores Comparison

This table compares the Altman Z-Score and Piotroski Score for Dayforce Inc and Pegasystems Inc to provide a snapshot of their financial health:

Dayforce Inc Scores

- Altman Z-Score: 1.24, in distress zone indicating high risk

- Piotroski Score: 5, average financial strength

Pegasystems Inc Scores

- Altman Z-Score: 10.31, in safe zone indicating low risk

- Piotroski Score: 8, very strong financial strength

Which company has the best scores?

Pegasystems Inc has the best financial scores, with a safe zone Altman Z-Score and a very strong Piotroski Score, while Dayforce Inc shows financial distress and average strength.

Grades Comparison

Here is a comparison of the recent grades assigned by reputable grading companies for Dayforce Inc and Pegasystems Inc.:

Dayforce Inc Grades

The following table presents recent grades for Dayforce Inc from established grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Hold | 2025-10-30 |

| Stifel | Downgrade | Hold | 2025-09-19 |

| Citigroup | Downgrade | Neutral | 2025-09-17 |

| Wells Fargo | Upgrade | Equal Weight | 2025-08-22 |

| BMO Capital | Downgrade | Market Perform | 2025-08-22 |

| Keybanc | Downgrade | Sector Weight | 2025-08-22 |

| Needham | Downgrade | Hold | 2025-08-22 |

| Barclays | Maintain | Equal Weight | 2025-08-22 |

| Deutsche Bank | Maintain | Hold | 2025-08-22 |

| Jefferies | Maintain | Hold | 2025-08-21 |

Dayforce’s grades show a predominance of hold and neutral ratings with several recent downgrades, indicating a cautious outlook among analysts.

Pegasystems Inc. Grades

The table below lists recent grades for Pegasystems Inc. from recognized grading institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-10-23 |

| RBC Capital | Maintain | Outperform | 2025-10-23 |

| Barclays | Maintain | Equal Weight | 2025-10-23 |

| Rosenblatt | Maintain | Buy | 2025-10-23 |

| DA Davidson | Upgrade | Buy | 2025-10-22 |

| Rosenblatt | Maintain | Buy | 2025-10-15 |

| Rosenblatt | Maintain | Buy | 2025-07-24 |

| DA Davidson | Maintain | Neutral | 2025-07-24 |

| Wedbush | Maintain | Outperform | 2025-07-24 |

Pegasystems benefits from a strong consensus with a majority of buy and outperform ratings, reflecting a more optimistic analyst sentiment.

Which company has the best grades?

Pegasystems Inc. holds the better grades overall, with a larger number of buy and outperform ratings compared to Dayforce Inc.’s hold and neutral consensus. This suggests Pegasystems may attract more investor confidence, potentially impacting demand and valuation positively.

Strengths and Weaknesses

The table below compares the key strengths and weaknesses of Dayforce Inc and Pegasystems Inc based on their latest financial and operational data.

| Criterion | Dayforce Inc (DAY) | Pegasystems Inc. (PEGA) |

|---|---|---|

| Diversification | Focused on cloud-based HR and payroll services, limited product range | Broader software portfolio including cloud, consulting, and subscription licenses |

| Profitability | Low net margin (1.03%), low ROE (0.71%), unfavorable profitability ratios | Moderate net margin (6.63%), strong ROE (16.94%), slightly favorable profitability ratios |

| Innovation | Improving ROIC trend but still value destructive; limited product innovation | Growing ROIC with favorable innovation indicators in cloud and subscription services |

| Global presence | Moderate, mainly North America focused | Stronger global footprint with diversified revenue streams |

| Market Share | Smaller recurring revenue base (~$1.52B in 2024) | Larger and growing revenues in cloud and subscriptions (~$1.58B in 2024) |

Dayforce shows potential with a growing ROIC but struggles with profitability and diversification. Pegasystems, while also slightly value destructive, maintains stronger profitability, broader diversification, and a more robust global presence, making it a comparatively more attractive option for investors seeking growth and stability.

Risk Analysis

The table below summarizes key risks for Dayforce Inc and Pegasystems Inc based on the most recent 2024 data.

| Metric | Dayforce Inc (DAY) | Pegasystems Inc. (PEGA) |

|---|---|---|

| Market Risk | Beta 1.18, volatile tech sector exposure | Beta 1.08, moderately volatile market exposure |

| Debt level | Moderate debt/equity 0.48, interest coverage low at 1.93 | Higher debt/equity 0.94, but strong interest coverage 21.87 |

| Regulatory Risk | US and international compliance challenges | Broad global footprint increases regulatory complexity |

| Operational Risk | Integration risks post-name change and platform updates | Diverse product suite with some complexity risks |

| Environmental Risk | Low direct exposure, software industry | Low direct exposure, software industry |

| Geopolitical Risk | Moderate, US-based with some international sales | Higher exposure due to global presence |

Dayforce faces the most impactful risks from its low profitability and financial distress signals, including a low Altman Z-score (1.24, distress zone) and weak returns on equity and assets. Pegasystems, with a strong Altman Z-score (10.3, safe zone) and robust profitability, shows lower financial risk but faces moderate market and regulatory risks due to its broader international footprint. Investors should weigh Dayforce’s financial vulnerabilities against Pegasystems’ relatively stable profile when managing portfolio risk.

Which Stock to Choose?

Dayforce Inc (DAY) shows a favorable income statement with strong revenue and net income growth over 2020–2024, yet its financial ratios are mostly unfavorable, reflecting weak profitability and moderate debt levels. The company carries a slightly unfavorable moat rating due to value destruction despite rising profitability.

Pegasystems Inc. (PEGA) presents a favorable income statement with steady revenue and profitability growth, supported by mostly neutral to favorable financial ratios and strong returns on equity and assets. Its moat rating is also slightly unfavorable, indicating value destruction but improving profitability.

For investors, PEGA may appear more favorable for those seeking financial strength and growth stability, while DAY could be interpreted as more suitable for those accepting higher risks amid improving profitability trends. Both companies demonstrate value challenges but also signs of recovery in profitability metrics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Dayforce Inc and Pegasystems Inc. to enhance your investment decisions: