In the dynamic software application industry, Dayforce Inc and PagerDuty, Inc. stand out as innovative players shaping enterprise operations. Dayforce focuses on human capital management with comprehensive cloud solutions, while PagerDuty leads in digital operations management using advanced machine learning. Both companies serve global markets and emphasize technology-driven growth. In this article, I will analyze their strengths and risks to help you identify which stock deserves a place in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Dayforce Inc and PagerDuty, Inc. by providing an overview of these two companies and their main differences.

Dayforce Inc Overview

Dayforce Inc operates as a human capital management (HCM) software company serving clients in the US, Canada, and internationally. Its flagship cloud platform integrates HR, payroll, benefits, workforce management, and talent management functionalities. The company targets both large enterprises and small businesses through its Powerpay solution. Headquartered in Minneapolis, Dayforce has a market cap of 11.1B USD and employs approximately 9,600 people.

PagerDuty, Inc. Overview

PagerDuty, Inc. provides a digital operations management platform that uses machine learning to analyze data signals from software systems and devices. It serves diverse industries including technology, telecommunications, and financial services. Founded in 2009 and based in San Francisco, PagerDuty has a market cap of about 1B USD and around 1,242 employees. The company focuses on improving operational efficiency and predictive issue resolution.

Key similarities and differences

Both Dayforce and PagerDuty operate in the software application industry within the technology sector and trade on the NYSE. They offer cloud-based platforms but target distinct markets: Dayforce centers on human capital management, while PagerDuty focuses on digital operations management. Dayforce is significantly larger in market capitalization and workforce size, reflecting its broader HR service offerings compared to PagerDuty’s specialized operational focus.

Income Statement Comparison

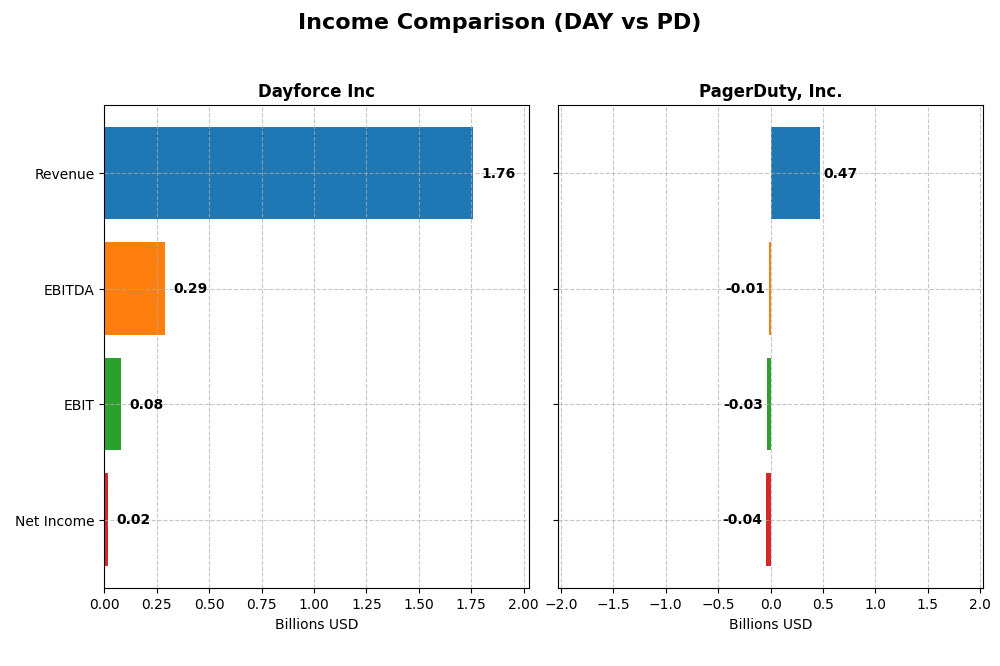

Below is a side-by-side comparison of the most recent full fiscal year income statements for Dayforce Inc and PagerDuty, Inc., highlighting key financial metrics.

| Metric | Dayforce Inc (DAY) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Cap | 11.1B | 1.0B |

| Revenue | 1.76B | 467M |

| EBITDA | 288M | -12M |

| EBIT | 78.2M | -32.5M |

| Net Income | 18.1M | -42.7M |

| EPS | 0.11 | -0.59 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Dayforce Inc

Dayforce Inc showed strong overall revenue growth of 109% from 2020 to 2024, reaching $1.76B in 2024. Net income also grew substantially over the period, although it dropped sharply in 2024 to $18M from $55M in 2023. Gross margins remained favorable at 46.14%, but EBIT and net margins contracted in the latest year, indicating margin pressure despite revenue expansion.

PagerDuty, Inc.

PagerDuty’s revenue increased steadily by 119% from 2021 to 2025, hitting $467M in 2025. Despite this growth, the company remained unprofitable with a net loss of $42.7M in 2025, though net margin improved compared to prior years. Gross margin was strong at 82.96%, but negative EBIT and net margins reflect ongoing operational challenges. Margins and profitability showed signs of improvement in the latest fiscal year.

Which one has the stronger fundamentals?

Both companies exhibit favorable revenue growth and strong gross margins, but Dayforce demonstrates positive net income growth over the longer term, albeit with recent margin compression. PagerDuty shows consistent revenue gains and margin improvement but remains unprofitable overall. Dayforce’s positive net income contrasts with PagerDuty’s losses, suggesting relatively stronger fundamentals in profitability despite some recent setbacks.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Dayforce Inc and PagerDuty, Inc., offering key metrics to understand their operational and financial health as of their latest fiscal years.

| Ratios | Dayforce Inc (2024) | PagerDuty, Inc. (2025) |

|---|---|---|

| ROE | 0.71% | -32.92% |

| ROIC | 1.31% | -9.66% |

| P/E | 633.29 | -39.87 |

| P/B | 4.50 | 13.12 |

| Current Ratio | 1.13 | 1.87 |

| Quick Ratio | 1.13 | 1.87 |

| D/E (Debt to Equity) | 0.48 | 3.57 |

| Debt-to-Assets | 13.52% | 50.00% |

| Interest Coverage | 2.56 | -6.46 |

| Asset Turnover | 0.19 | 0.50 |

| Fixed Asset Turnover | 7.46 | 16.61 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Dayforce Inc

Dayforce Inc shows mostly unfavorable profitability ratios, including a low net margin of 1.03% and ROE of 0.71%, indicating weak earnings efficiency. Debt metrics are favorable, with a debt-to-equity ratio of 0.48 and low debt-to-assets at 13.52%. The company does not pay dividends, likely reinvesting earnings to support growth and operations, with no dividend yield recorded.

PagerDuty, Inc.

PagerDuty presents significant profitability challenges, with a negative net margin of -9.14% and a deeply negative ROE of -32.92%. Liquidity ratios are strong, including a current ratio of 1.87, but leverage is high, as debt-to-equity stands at 3.57 and debt-to-assets at 50%. PagerDuty also pays no dividends, reflecting its reinvestment focus amid losses and growth initiatives.

Which one has the best ratios?

Both companies exhibit unfavorable overall ratio assessments, with Dayforce slightly better in debt management and PagerDuty stronger in liquidity. Profitability remains poor for both, but PagerDuty’s higher leverage and negative interest coverage add risk. Considering all factors, neither currently stands out with clearly superior financial ratios.

Strategic Positioning

This section compares the strategic positioning of Dayforce Inc and PagerDuty, Inc., focusing on market position, key segments, and exposure to technological disruption:

Dayforce Inc

- Large market cap of 11B USD with significant competitive pressure in HCM software

- Focuses on human capital management software with cloud HCM platform and payroll solutions

- Moderate exposure to technological disruption with cloud-based HR and payroll services

PagerDuty, Inc.

- Smaller market cap of 1B USD, competing in digital operations management software

- Operates a digital operations management platform using machine learning across industries

- High exposure to disruption via AI-driven data correlation and predictive analytics

Dayforce Inc vs PagerDuty, Inc. Positioning

Dayforce has a diversified focus on HCM and payroll with stable recurring revenues, while PagerDuty concentrates on digital operations management leveraging advanced machine learning. Dayforce’s broad segments contrast with PagerDuty’s industry-spanning platform approach.

Which has the best competitive advantage?

Both companies have a slightly unfavorable MOAT status, shedding value but showing growing profitability. Dayforce’s larger scale contrasts with PagerDuty’s innovative platform, resulting in comparable challenges sustaining a durable competitive advantage.

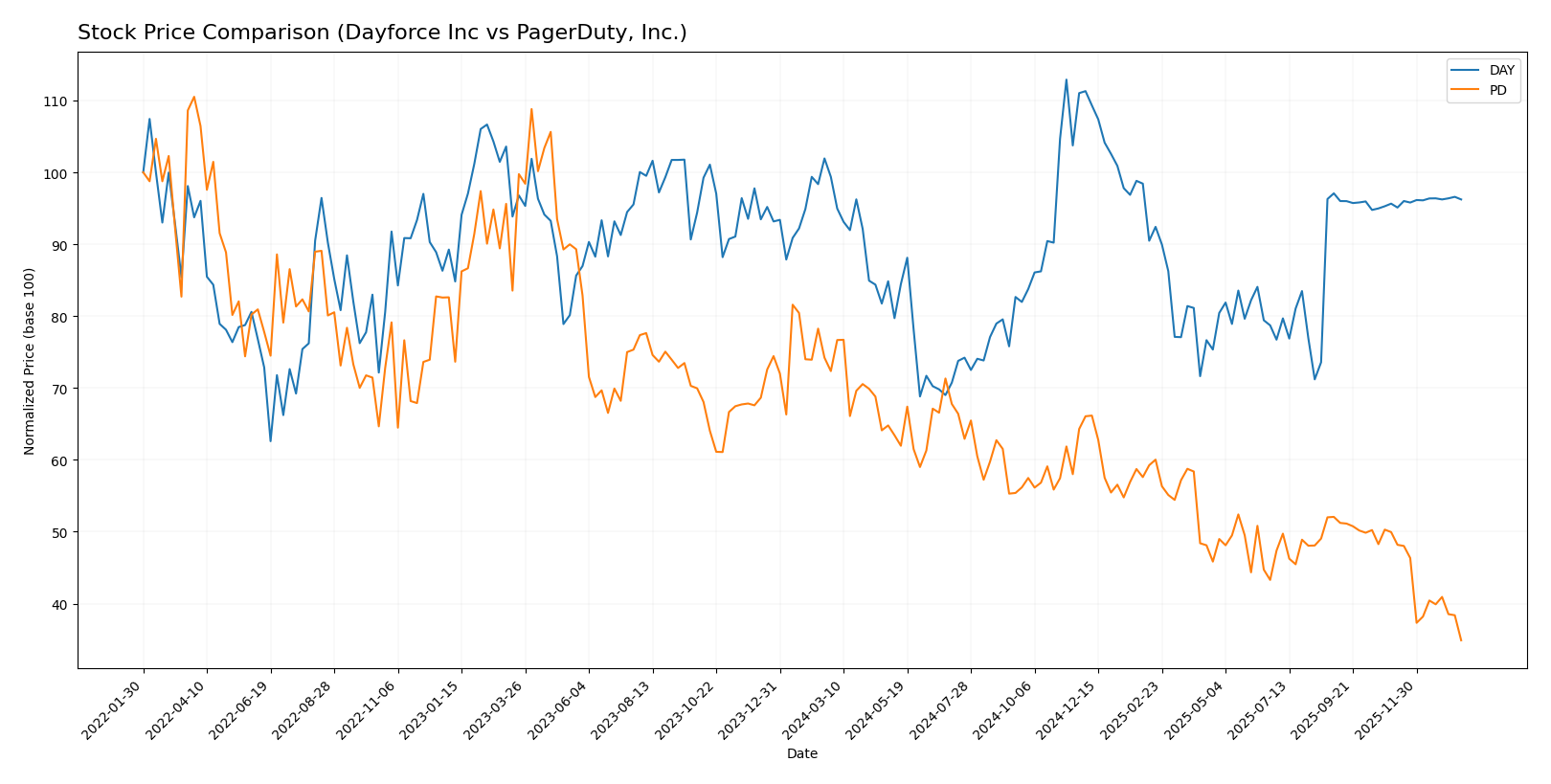

Stock Comparison

The stock price movements of Dayforce Inc (DAY) and PagerDuty, Inc. (PD) over the past 12 months reveal contrasting bearish trends with varying degrees of deceleration and volume dynamics.

Trend Analysis

Dayforce Inc’s stock showed a bearish trend with a -3.16% decline over the past year, marked by deceleration and high volatility (7.84 std deviation), peaking at 81.14 and bottoming at 49.46.

PagerDuty, Inc. experienced a sharper bearish trend, declining -51.76% in the same period with deceleration and moderate volatility (2.92 std deviation), reaching a high of 24.66 and a low of 11.22.

Comparing both, Dayforce Inc delivered a significantly higher market performance than PagerDuty, Inc., which suffered a steep drop exceeding half its value over the year.

Target Prices

The consensus target prices from recognized analysts indicate a mixed outlook for these technology firms.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Dayforce Inc | 70 | 70 | 70 |

| PagerDuty, Inc. | 19 | 15 | 16.2 |

Analysts expect Dayforce’s stock price to remain stable around $70, very close to its current $69.16. PagerDuty’s consensus target of $16.2 suggests a potential upside from its current $11.22 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Dayforce Inc and PagerDuty, Inc.:

Rating Comparison

Dayforce Inc Rating

- Rating: C- with a status of Very Favorable.

- Discounted Cash Flow Score: 2, Moderate.

- ROE Score: 1, Very Unfavorable.

- ROA Score: 1, Very Unfavorable.

- Debt To Equity Score: 2, Moderate.

- Overall Score: 1, Very Unfavorable.

PagerDuty, Inc. Rating

- Rating: A- with a status of Very Favorable.

- Discounted Cash Flow Score: 5, Very Favorable.

- ROE Score: 5, Very Favorable.

- ROA Score: 5, Very Favorable.

- Debt To Equity Score: 1, Very Unfavorable.

- Overall Score: 4, Favorable.

Which one is the best rated?

PagerDuty, Inc. has a higher rating (A-) and better scores in Discounted Cash Flow, ROE, ROA, and Overall Score compared to Dayforce Inc, which shows lower scores and a C- rating.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Dayforce Inc and PagerDuty, Inc.:

Dayforce Inc Scores

- Altman Z-Score: 1.24, indicating financial distress risk in the distress zone.

- Piotroski Score: 5, reflecting average financial strength.

PagerDuty, Inc. Scores

- Altman Z-Score: 1.26, indicating financial distress risk in the distress zone.

- Piotroski Score: 7, reflecting strong financial strength.

Which company has the best scores?

PagerDuty shows a slightly higher Altman Z-Score but remains in distress, while its Piotroski Score indicates stronger financial health than Dayforce, whose scores suggest higher financial risk and average strength.

Grades Comparison

The following is a detailed comparison of the recent grades assigned to Dayforce Inc and PagerDuty, Inc.:

Dayforce Inc Grades

This table shows the recent grades and rating actions from various reliable grading companies for Dayforce Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Hold | 2025-10-30 |

| Stifel | Downgrade | Hold | 2025-09-19 |

| Citigroup | Downgrade | Neutral | 2025-09-17 |

| Wells Fargo | Upgrade | Equal Weight | 2025-08-22 |

| BMO Capital | Downgrade | Market Perform | 2025-08-22 |

| Keybanc | Downgrade | Sector Weight | 2025-08-22 |

| Needham | Downgrade | Hold | 2025-08-22 |

| Barclays | Maintain | Equal Weight | 2025-08-22 |

| Deutsche Bank | Maintain | Hold | 2025-08-22 |

| Jefferies | Maintain | Hold | 2025-08-21 |

The overall trend for Dayforce Inc shows mostly downgraded or maintained grades, with a consensus rating of “Hold,” reflecting a cautious stance by analysts.

PagerDuty, Inc. Grades

This table presents the recent grades and rating actions from recognized grading companies for PagerDuty, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-07 |

| RBC Capital | Downgrade | Sector Perform | 2026-01-05 |

| TD Cowen | Maintain | Buy | 2025-11-26 |

| Craig-Hallum | Downgrade | Hold | 2025-11-26 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-26 |

| RBC Capital | Maintain | Outperform | 2025-11-26 |

| Truist Securities | Maintain | Buy | 2025-11-19 |

| Baird | Maintain | Neutral | 2025-09-04 |

| RBC Capital | Maintain | Outperform | 2025-09-04 |

| Canaccord Genuity | Maintain | Buy | 2025-09-04 |

PagerDuty, Inc. maintains a more positive rating trend, with several Buy and Outperform grades, although a few downgrades have occurred; the consensus remains “Hold.”

Which company has the best grades?

PagerDuty, Inc. has generally received stronger grades with multiple Buy and Outperform ratings compared to Dayforce Inc’s predominantly Hold and Neutral grades. This difference may influence investors’ perception of relative growth potential and risk.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Dayforce Inc and PagerDuty, Inc. based on the most recent financial and operational data.

| Criterion | Dayforce Inc | PagerDuty, Inc. |

|---|---|---|

| Diversification | Moderate: Mainly cloud HR/payroll services; limited product range but steady recurring revenue (1.5B USD in 2024) | Limited: Focused on digital operations management, less diversified product portfolio |

| Profitability | Low profitability: Net margin 1.03%, ROIC 1.31%, shedding value but improving ROIC trend | Negative profitability: Net margin -9.14%, ROIC -9.66%, also shedding value but slight ROIC growth |

| Innovation | Moderate: Growing ROIC suggests improving operational efficiency | Moderate: Slightly unfavorable moat but growing ROIC indicates some innovation impact |

| Global presence | Strong: Cloud services with recurring revenues indicate scale and market penetration | Growing: Expanding presence in digital operations but higher debt levels limit financial flexibility |

| Market Share | Stable in HR/payroll cloud segment with 1.5B USD recurring revenue | Niche positioning in incident response and digital ops, smaller market share compared to broader SaaS peers |

Key takeaways: Both companies are currently shedding value but show improving profitability trends, indicating potential operational improvements. Dayforce benefits from a more diversified recurring revenue base and stronger market presence, while PagerDuty faces higher financial risk despite innovation momentum. Caution and continuous monitoring are advised before investing.

Risk Analysis

The table below summarizes key risks for Dayforce Inc and PagerDuty, Inc. based on their latest financial and operational data from 2025-2026.

| Metric | Dayforce Inc (DAY) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Risk | Beta 1.18, moderate volatility | Beta 0.63, lower volatility |

| Debt level | Debt/Equity 0.48, moderate | Debt/Equity 3.57, high leverage |

| Regulatory Risk | Moderate, US & international HCM compliance | Moderate, multi-industry software regulations |

| Operational Risk | Large workforce (9,600); complexity in cloud HCM platform | Smaller workforce (1,242); focus on digital ops platform |

| Environmental Risk | Low, primarily software-based | Low, primarily software-based |

| Geopolitical Risk | Moderate, global operations | Moderate, global operations |

In synthesis, the most impactful risks are financial leverage and operational complexity. PagerDuty’s high debt-to-equity ratio (3.57) and negative interest coverage highlight significant financial risk. Dayforce’s moderate debt and larger scale pose operational risks but better leverage. Both companies face typical market and regulatory risks inherent to global software firms. Caution is advised due to Dayforce’s weak profitability and PagerDuty’s financial distress signals despite a strong operational score.

Which Stock to Choose?

Dayforce Inc (DAY) has shown favorable income growth with a 16.27% revenue increase in 2024 and a positive long-term income trend. However, its financial ratios are mostly unfavorable, including a low return on equity of 0.71% and a high price-to-earnings ratio of 633.29. The company maintains moderate debt levels with a net debt to EBITDA of 2.27 and holds a very favorable rating of C-.

PagerDuty, Inc. (PD) exhibits strong income statement improvements with 8.54% revenue growth in 2025 and 85.7% of income metrics favorable. Financial ratios reveal challenges, including a negative net margin of -9.14% and high debt levels indicated by a debt-to-equity ratio of 3.57. Its overall rating stands at A-, signaling a very favorable assessment despite these weaknesses.

Considering ratings and income evaluations, PagerDuty’s stronger rating and favorable income statement growth might appeal to growth-oriented investors, while Dayforce’s more moderate debt and stable income improvements could seem preferable for those prioritizing financial stability. Both firms display unfavorable financial ratios and value destruction signs, suggesting cautious interpretation aligned with individual risk tolerance.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Dayforce Inc and PagerDuty, Inc. to enhance your investment decisions: