In the dynamic world of technology, selecting the right software company to invest in requires careful analysis. Dayforce Inc and Domo, Inc. both operate within the software application industry, yet they target distinct niches—human capital management versus business intelligence platforms. Their innovative cloud solutions and overlapping market presence make them compelling contenders. This article will guide you through a detailed comparison to uncover which company presents the most attractive investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Dayforce Inc and Domo, Inc. by providing an overview of these two companies and their main differences.

Dayforce Inc Overview

Dayforce Inc operates as a human capital management (HCM) software company providing cloud-based solutions for human resources, payroll, benefits, workforce, and talent management. Serving markets in the US, Canada, and internationally, it offers platforms such as Dayforce and Powerpay, targeting both large enterprises and small businesses. The company has a market cap of 11.1B USD and employs around 9,600 people.

Domo, Inc. Overview

Domo, Inc. offers a cloud-based business intelligence platform that connects employees across an organization to real-time data and insights. Its platform enables business management from smartphones, targeting clients in the US, Japan, and other international markets. Domo has a market cap of 257M USD and employs approximately 888 people, focusing primarily on data-driven decision-making software.

Key similarities and differences

Both Dayforce and Domo operate in the technology sector within the software application industry, offering cloud-based platforms that enhance business operations. However, Dayforce focuses on HCM solutions including payroll and workforce management, while Domo specializes in business intelligence and data visualization. Dayforce is significantly larger in market capitalization and workforce size, reflecting a broader product scope and market presence.

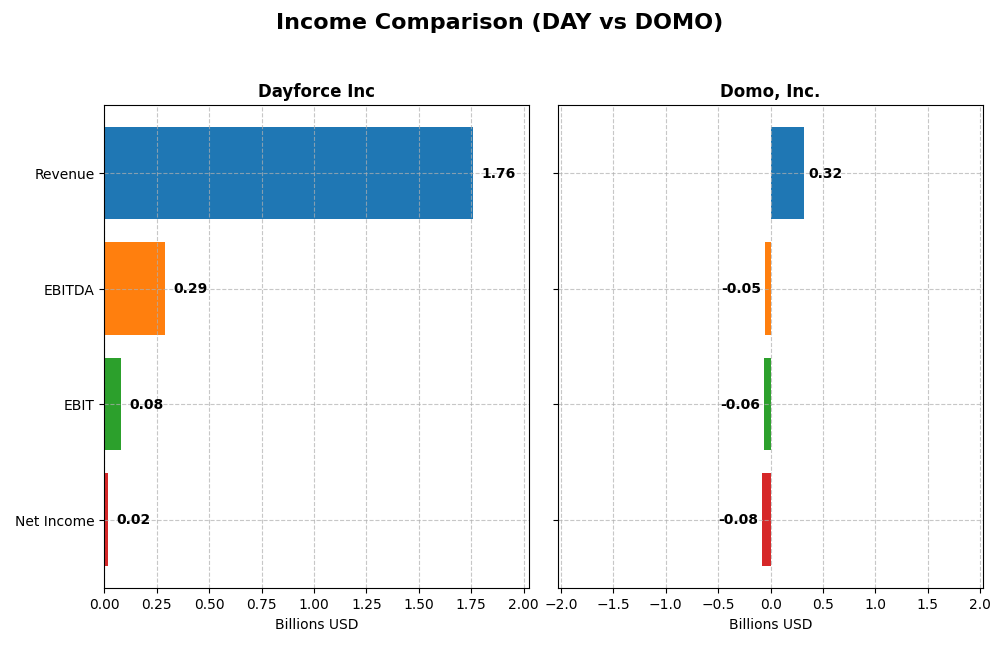

Income Statement Comparison

This table compares the key income statement metrics for Dayforce Inc and Domo, Inc. for their most recent fiscal years, providing a snapshot of their financial performance.

| Metric | Dayforce Inc (2024) | Domo, Inc. (2025) |

|---|---|---|

| Market Cap | 11.1B | 257M |

| Revenue | 1.76B | 317M |

| EBITDA | 288M | -50M |

| EBIT | 78M | -59M |

| Net Income | 18M | -82M |

| EPS | 0.11 | -2.13 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Dayforce Inc

Dayforce Inc demonstrated strong revenue growth from 2020 to 2024, doubling its revenue to 1.76B in 2024. Net income improved significantly over the period, despite a sharp decline in 2024 to 18M. Margins showed mixed trends, with gross margin favorable at 46.14%, but EBIT and net margins declined recently, reflecting margin pressure despite revenue gains.

Domo, Inc.

Domo, Inc. showed moderate revenue growth of 51% over 2021-2025, reaching 317M in 2025, but net income remained negative and marginally worse at -82M in 2025. While gross margin remained favorable at 74.45%, EBIT and net margins were persistently unfavorable. Recent year results showed a slight revenue decline and deteriorating profitability with negative margins.

Which one has the stronger fundamentals?

Dayforce Inc exhibits stronger fundamentals with favorable overall income statement metrics, including significant revenue and net income growth and a solid gross margin. In contrast, Domo shows unfavorable profitability metrics and persistent net losses despite decent gross margins. Dayforce’s mixed margin performance contrasts with Domo’s sustained negative earnings, indicating relatively better financial health.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Dayforce Inc and Domo, Inc., reflecting their fiscal year 2024 and 2025 performances respectively.

| Ratios | Dayforce Inc (2024) | Domo, Inc. (2025) |

|---|---|---|

| ROE | 0.71% | 46.23% |

| ROIC | 1.31% | 194.73% |

| P/E | 633.3 | -3.98 |

| P/B | 4.50 | -1.84 |

| Current Ratio | 1.13 | 0.56 |

| Quick Ratio | 1.13 | 0.56 |

| D/E | 0.48 | -0.76 |

| Debt-to-Assets | 13.5% | 63.2% |

| Interest Coverage | 2.56 | -2.99 |

| Asset Turnover | 0.19 | 1.48 |

| Fixed Asset Turnover | 7.46 | 8.17 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Dayforce Inc

Dayforce shows several unfavorable profitability ratios, including net margin at 1.03% and return on equity at 0.71%, indicating weak earnings relative to equity. Valuation ratios like PE at 633.29 and PB at 4.5 also appear stretched, with interest coverage at 1.93 suggesting potential difficulties in meeting interest expenses. The company does not pay dividends, likely reflecting reinvestment priorities and a cautious approach to capital allocation.

Domo, Inc.

Domo exhibits mixed ratios with a strong return on equity of 46.23% and return on invested capital at 194.73%, highlighting efficient capital use despite a negative net margin of -25.84%. However, liquidity ratios are weak, with current and quick ratios at 0.56, raising short-term solvency concerns. Domo also does not pay dividends, possibly due to ongoing growth investments and negative earnings.

Which one has the best ratios?

Domo presents a more favorable profile in profitability and asset turnover compared to Dayforce, which struggles with low returns and high valuation multiples. However, Domo’s liquidity and debt-to-assets ratios are concerning. Overall, Domo’s mix of favorable and unfavorable ratios yields a neutral stance, while Dayforce’s predominantly unfavorable ratios suggest greater financial challenges.

Strategic Positioning

This section compares the strategic positioning of Dayforce Inc and Domo, Inc., focusing on market position, key segments, and exposure to technological disruption:

Dayforce Inc

- Large market cap of 11B with moderate competitive pressure in HCM software.

- Key segments include cloud HCM platform, payroll, benefits, and workforce management.

- Moderate exposure to disruption due to cloud solutions in established HCM and payroll markets.

Domo, Inc.

- Smaller market cap of 257M, facing higher competitive pressure in business intelligence software.

- Focuses on cloud-based business intelligence with real-time data and mobile management.

- Higher exposure to disruption given reliance on evolving cloud BI technology and real-time data innovation.

Dayforce Inc vs Domo, Inc. Positioning

Dayforce has a diversified HCM portfolio with strong recurring revenues, while Domo concentrates on cloud BI subscriptions. Dayforce’s broader service range contrasts with Domo’s specialized focus, reflecting different market approaches and scale advantages.

Which has the best competitive advantage?

Domo shows a very favorable MOAT with high ROIC above WACC and growing profitability, indicating a durable competitive advantage. Dayforce has a slightly unfavorable MOAT, shedding value despite improving ROIC trends.

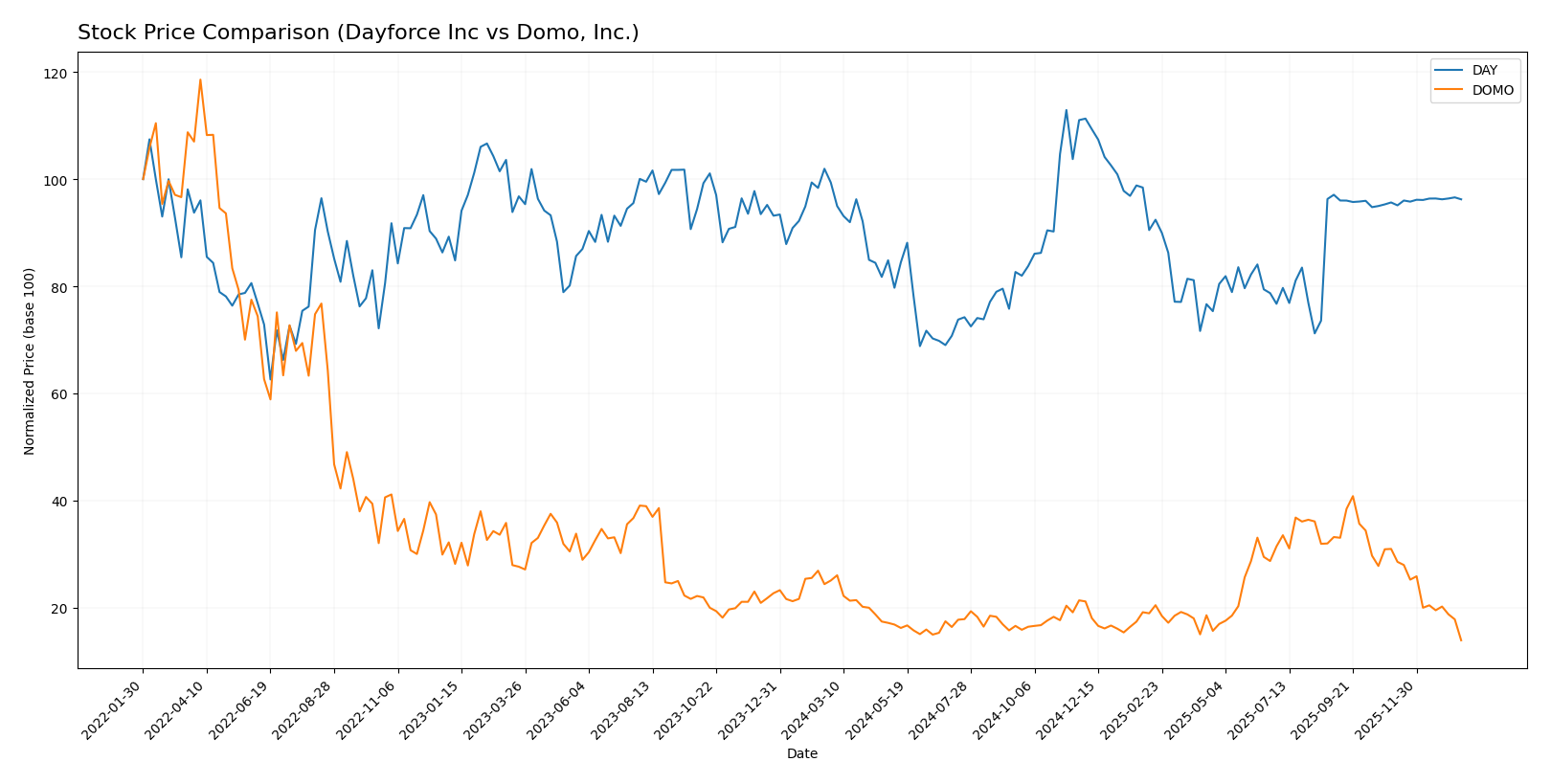

Stock Comparison

The stock price movements of Dayforce Inc and Domo, Inc. over the past 12 months reveal distinct bearish trends with varying degrees of decline and recent trading dynamics that highlight shifts in buyer dominance and market sentiment.

Trend Analysis

Dayforce Inc’s stock declined by 3.16% over the past year, marking a bearish trend with deceleration in its downward momentum. The price ranged between 49.46 and 81.14, with recent slight positive movement of 0.61%.

Domo, Inc.’s stock showed a more pronounced bearish trend with a 44.54% decrease over the same period and decelerating losses. The price fluctuated between 6.15 and 18.06, with recent sharp negative change of -55.11%.

Comparing the two, Dayforce Inc delivered the highest market performance with a moderate 3.16% decline, while Domo, Inc experienced a significantly larger drop, reflecting weaker market sentiment.

Target Prices

The current analyst consensus presents clear target prices for Dayforce Inc and Domo, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Dayforce Inc | 70 | 70 | 70 |

| Domo, Inc. | 13 | 10 | 11.5 |

Analysts expect Dayforce’s stock to hold steady around its current price of $69.16, while Domo’s consensus target of $11.5 suggests significant upside from its current $6.15 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and scores for Dayforce Inc and Domo, Inc.:

Rating Comparison

Dayforce Inc Rating

- Rating: C- with a “Very Favorable” status.

- Discounted Cash Flow Score: 2, indicating a moderate valuation.

- ROE Score: 1, reflecting very unfavorable profitability from equity.

- ROA Score: 1, showing very unfavorable asset utilization.

- Debt To Equity Score: 2, showing moderate financial risk.

- Overall Score: 1, rated as very unfavorable overall.

Domo, Inc. Rating

- Rating: C with a “Very Favorable” status.

- Discounted Cash Flow Score: 1, indicating a very unfavorable valuation.

- ROE Score: 5, reflecting very favorable profitability from equity.

- ROA Score: 1, showing very unfavorable asset utilization.

- Debt To Equity Score: 1, indicating very unfavorable financial stability.

- Overall Score: 2, rated as moderate overall.

Which one is the best rated?

Based strictly on the provided data, Domo, Inc. holds a higher overall and ROE score, indicating stronger profitability and a moderate overall rating compared to Dayforce Inc’s lower overall and ROE scores. However, Dayforce shows better discounted cash flow and debt-to-equity scores.

Scores Comparison

Here is a comparison of the financial health scores for Dayforce Inc and Domo, Inc.:

Dayforce Inc Scores

- Altman Z-Score: 1.24, indicating distress zone risk

- Piotroski Score: 5, reflecting average financial strength

Domo, Inc. Scores

- Altman Z-Score: -10.10, indicating distress zone risk with higher bankruptcy probability

- Piotroski Score: 3, reflecting very weak financial strength

Which company has the best scores?

Dayforce shows a higher Piotroski Score (5 vs. 3) indicating relatively stronger financial health, while both companies are in the Altman Z-Score distress zone. Dayforce’s scores suggest a less severe financial risk compared to Domo.

Grades Comparison

Here is a detailed comparison of the latest reliable grades assigned to Dayforce Inc and Domo, Inc.:

Dayforce Inc Grades

The table below summarizes recent analyst grades for Dayforce Inc from established grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Hold | 2025-10-30 |

| Stifel | Downgrade | Hold | 2025-09-19 |

| Citigroup | Downgrade | Neutral | 2025-09-17 |

| Wells Fargo | Upgrade | Equal Weight | 2025-08-22 |

| BMO Capital | Downgrade | Market Perform | 2025-08-22 |

| Keybanc | Downgrade | Sector Weight | 2025-08-22 |

| Needham | Downgrade | Hold | 2025-08-22 |

| Barclays | Maintain | Equal Weight | 2025-08-22 |

| Deutsche Bank | Maintain | Hold | 2025-08-22 |

| Jefferies | Maintain | Hold | 2025-08-21 |

The overall trend for Dayforce Inc shows multiple downgrades with a consensus rating of Hold, reflecting cautious investor sentiment.

Domo, Inc. Grades

Below is the table of recent grades from reputable grading companies for Domo, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Neutral | 2025-12-05 |

| TD Cowen | Maintain | Buy | 2025-12-05 |

| Lake Street | Maintain | Hold | 2025-12-05 |

| DA Davidson | Maintain | Neutral | 2025-12-01 |

| JMP Securities | Maintain | Market Outperform | 2025-09-10 |

| DA Davidson | Maintain | Neutral | 2025-08-28 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-08-28 |

| TD Cowen | Upgrade | Buy | 2025-08-26 |

| JMP Securities | Maintain | Market Outperform | 2025-06-25 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-06-25 |

Domo, Inc. has generally maintained or upgraded ratings, with a consensus Buy rating signaling more positive analyst outlooks.

Which company has the best grades?

Domo, Inc. has received stronger and more consistent buy-oriented grades compared to Dayforce Inc’s predominantly Hold and Neutral ratings. This difference may influence investors seeking growth opportunities versus more cautious holdings.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses for Dayforce Inc (DAY) and Domo, Inc. (DOMO) based on the most recent financial and operational data.

| Criterion | Dayforce Inc (DAY) | Domo, Inc. (DOMO) |

|---|---|---|

| Diversification | Strong recurring revenue mix: $1.52B total in 2024 with Cloud Dayforce and Powerpay services | Subscription-driven revenue of $286M in 2025, less diversified with significant reliance on subscription services |

| Profitability | Low profitability: net margin 1.03%, ROIC 1.31%, shedding value (ROIC < WACC) | Mixed profitability: Negative net margin (-25.84%) but high ROE (46.23%) and ROIC (194.73%), creating value |

| Innovation | Moderate innovation with stable recurring services growth | High innovation indicated by very favorable moat and rapidly growing ROIC |

| Global presence | Established with consistent revenue growth in cloud services | Smaller scale, focused on subscription, with rapid growth but weaker liquidity ratios |

| Market Share | Larger market share in workforce management with $1.35B cloud recurring services | Growing market share in data analytics platform but smaller revenue base (~$286M subscription) |

Key takeaways: Dayforce Inc benefits from a diversified, stable revenue base but struggles with low profitability and value creation. Domo, Inc. shows strong growth and innovation with a durable competitive advantage, though profitability and liquidity indicators reveal risks. Investors should weigh stable cash flows against innovation-driven growth and risk exposure.

Risk Analysis

Below is a comparative table summarizing key risks for Dayforce Inc and Domo, Inc. based on the latest available data for 2025-2026.

| Metric | Dayforce Inc (DAY) | Domo, Inc. (DOMO) |

|---|---|---|

| Market Risk | Beta 1.18, moderate volatility | Beta 1.65, higher volatility |

| Debt level | Debt-to-Equity 0.48, favorable | High debt-to-assets 63.23%, unfavorable |

| Regulatory Risk | Moderate, operates in US/Canada | Moderate, international presence |

| Operational Risk | Large scale, 9600 employees | Smaller scale, 888 employees |

| Environmental Risk | Moderate, tech sector standard | Moderate, tech sector standard |

| Geopolitical Risk | US-based, stable environment | US-based with international exposure |

Dayforce shows moderate market risk with manageable debt and operational scale but suffers from weak profitability and potential financial distress (Altman Z-score 1.24, distress zone). Domo faces higher market volatility, significant leverage concerns, and very weak financial health (Altman Z-score -10.1), increasing its bankruptcy risk. Market risk and financial leverage are the most impactful for both companies.

Which Stock to Choose?

Dayforce Inc (DAY) shows a favorable income evolution with 16.3% revenue growth in 2024 and a generally positive long-term trend. However, its financial ratios are mostly unfavorable, with weaknesses in profitability and valuation metrics. The company carries moderate debt but benefits from a solid quick ratio and low debt-to-assets. Its overall rating is very favorable, though some key scores indicate caution.

Domo, Inc. (DOMO) presents an unfavorable income evolution recently, with slight revenue decline and negative margins, despite a strong gross margin. Financial ratios are mixed, with half favorable and half unfavorable, including a very high ROIC but weak liquidity and high debt-to-assets. The company’s rating is also very favorable but with moderate overall scores reflecting financial instability.

Which stock might appear more favorable depends on the investor’s profile. Risk-tolerant or growth-oriented investors could see potential in Domo’s strong ROIC and value creation, despite short-term weaknesses. Conversely, more risk-averse investors seeking consistent income growth and balance sheet stability might lean towards Dayforce, given its improving income statement and stronger liquidity ratios.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Dayforce Inc and Domo, Inc. to enhance your investment decisions: