Home > Comparison > Healthcare > UHS vs DVA

The strategic rivalry between Universal Health Services, Inc. and DaVita Inc. shapes the healthcare sector’s evolution. Universal Health Services operates a broad network of acute care and behavioral health facilities, reflecting a capital-intensive hospital services model. In contrast, DaVita focuses on outpatient kidney dialysis services, emphasizing specialized, high-volume care delivery. This analysis will evaluate which operational trajectory offers superior risk-adjusted returns, guiding investors toward the optimal portfolio allocation in healthcare.

Table of contents

Companies Overview

Universal Health Services and DaVita Inc. stand as key players in the U.S. healthcare services landscape, each commanding distinct niches.

Universal Health Services, Inc.: Leading Acute and Behavioral Care Provider

Universal Health Services dominates as a provider of acute care hospitals and behavioral health facilities, generating revenue through comprehensive inpatient and outpatient services. Its 2022 focus emphasized expanding and optimizing a network of 363 inpatient and 40 outpatient facilities across multiple regions, reinforcing its broad healthcare footprint and integrated management services.

DaVita Inc.: Premier Kidney Dialysis Specialist

DaVita Inc. specializes in kidney dialysis and related clinical laboratory services, operating a sprawling network of 2,815 U.S. outpatient centers and 339 international sites. In 2021, it concentrated on enhancing integrated care for chronic kidney failure patients and expanding both home-based and inpatient dialysis solutions, aligning clinical research with patient-centric kidney care management.

Strategic Collision: Similarities & Divergences

Both companies compete in the healthcare facilities sector but adopt divergent models. Universal Health Services pursues a broad acute and behavioral service approach, while DaVita focuses on a specialized, chronic kidney care ecosystem. Their primary battleground lies in outpatient service delivery scale and clinical integration. Investors face distinct profiles: Universal Health Services offers diversification across care types, DaVita presents a niche but deeply integrated care platform.

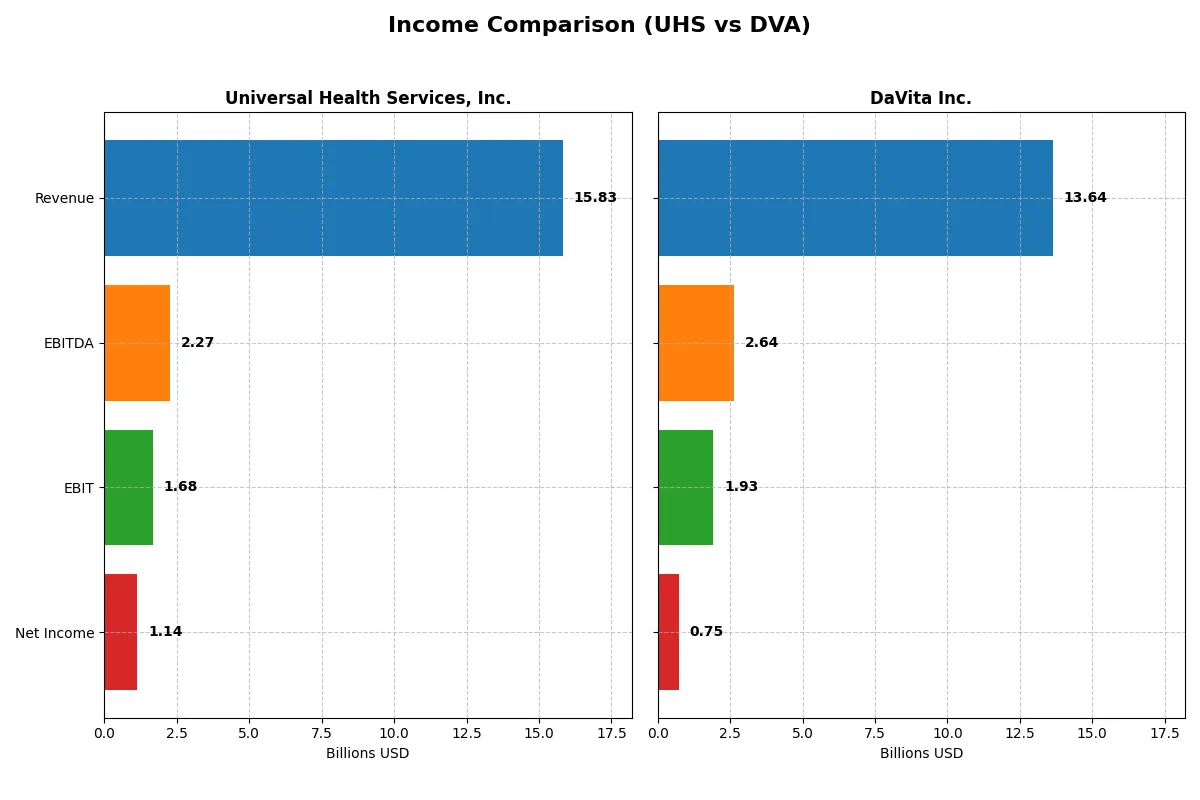

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Universal Health Services, Inc. (UHS) | DaVita Inc. (DVA) |

|---|---|---|

| Revenue | 15.8B | 13.6B |

| Cost of Revenue | 1.59B | 10.0B |

| Operating Expenses | 12.6B | 1.67B |

| Gross Profit | 14.2B | 3.68B |

| EBITDA | 2.27B | 2.64B |

| EBIT | 1.68B | 1.93B |

| Interest Expense | 188M | 550M |

| Net Income | 1.14B | 747M |

| EPS | 17.16 | 10.06 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

The following income statement comparison uncovers which company operates with superior financial efficiency and profitability consistency.

Universal Health Services, Inc. Analysis

UHS shows a robust revenue climb from 11.6B in 2020 to 15.8B in 2024, with net income rising from 940M to 1.14B. Its gross margin remains exceptionally high near 90%, supporting strong operational leverage. The 2024 surge in EBIT and net margin highlights accelerating profitability and efficient cost control.

DaVita Inc. Analysis

DVA’s revenue rose from 11.6B in 2021 to 13.6B in 2025, though net income declined from 978M to 722M. Gross margin around 27% contrasts sharply with UHS’s, signaling lower cost efficiency. The past year saw a dip in profitability metrics, including net margin contraction and EPS decline, indicating operational headwinds.

Margin Dominance vs. Revenue Growth

UHS clearly outperforms DVA in margin strength and profit growth, reflecting superior cost management and scalable operations. While DVA expands revenue, its shrinking net income and margins caution on profitability sustainability. For investors prioritizing earnings quality and margin resilience, UHS presents a more compelling financial profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Universal Health Services, Inc. (UHS) | DaVita Inc. (DVA) |

|---|---|---|

| ROE | 17.13% | -111.90% |

| ROIC | 10.55% | 9.88% |

| P/E | 10.46 | 13.43 |

| P/B | 1.79 | -15.02 |

| Current Ratio | 1.27 | 1.29 |

| Quick Ratio | 1.17 | 1.24 |

| D/E | 0.74 | -23.12 |

| Debt-to-Assets | 34.25% | 86.10% |

| Interest Coverage | 8.97 | 3.47 |

| Asset Turnover | 1.09 | 0.76 |

| Fixed Asset Turnover | 2.26 | 2.55 |

| Payout ratio | 4.67% | 0% |

| Dividend yield | 0.45% | 0% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, unveiling hidden risks and operational excellence that raw numbers alone cannot expose.

Universal Health Services, Inc.

UHS demonstrates strong profitability with a favorable 17.13% ROE and a solid 10.55% ROIC, surpassing its 8.03% WACC. The stock trades at a reasonable 10.46 P/E and a neutral 1.79 P/B, indicating fair valuation. Dividend yield is low at 0.45%, reflecting a reinvestment focus on operational efficiency and stable cash flow generation.

DaVita Inc.

DVA shows a neutral 9.88% ROIC but suffers from a highly unfavorable -111.9% ROE, signaling significant shareholder equity challenges. Valuation appears stretched with a 13.43 P/E despite weak profitability. The company pays no dividend, likely prioritizing debt management given its elevated 86.1% debt-to-assets ratio and cautious cash conversion.

Valuation Discipline vs. Financial Strain

UHS offers a better balance of operational efficiency and valuation discipline, with robust returns above cost of capital. DVA’s negative ROE and heavy leverage increase risk despite some attractive multiples. Investors seeking measured growth and stability may lean toward UHS, while DVA fits those tolerating higher financial strain.

Which one offers the Superior Shareholder Reward?

I compare Universal Health Services (UHS) and DaVita Inc. (DVA) on dividends, buybacks, and reinvestment strategies. UHS pays a modest 0.45% dividend yield with a low 4.7% payout ratio, supported by strong free cash flow of 16.9/share. Its buyback activity remains steady, enhancing shareholder value sustainably. DVA, in contrast, pays no dividends, focusing on reinvestment with a robust free cash flow of 15.2/share and heavy debt load (86% debt-to-assets). DVA’s high leverage risks distribution sustainability despite solid cash flow. I find UHS’s balanced dividend and buyback blend offers more reliable total returns in 2026.

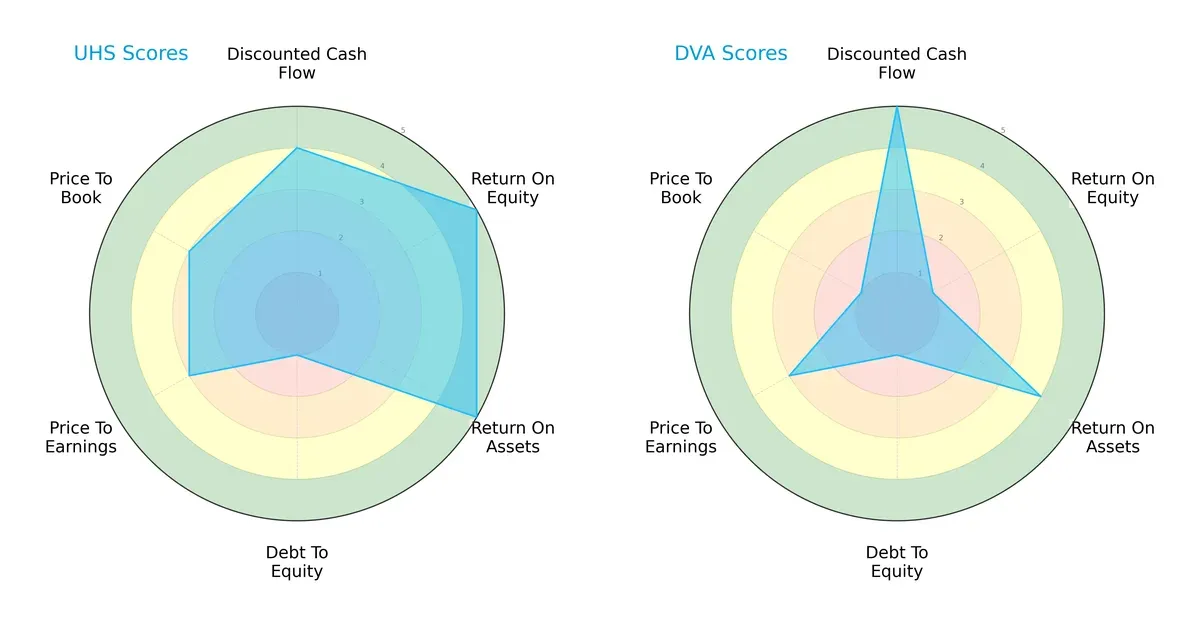

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Universal Health Services and DaVita Inc., highlighting their core financial strengths and vulnerabilities:

Universal Health Services (UHS) shows a balanced profile with very favorable ROE and ROA scores (5 each) and a solid DCF score (4). However, its debt-to-equity score is very unfavorable (1), signaling high leverage risk. DaVita (DVA) excels in DCF (5) but suffers from a very unfavorable ROE (1) and price-to-book score (1), indicating valuation concerns. UHS relies on operational efficiency, while DVA depends on cash flow strength amid financial strain.

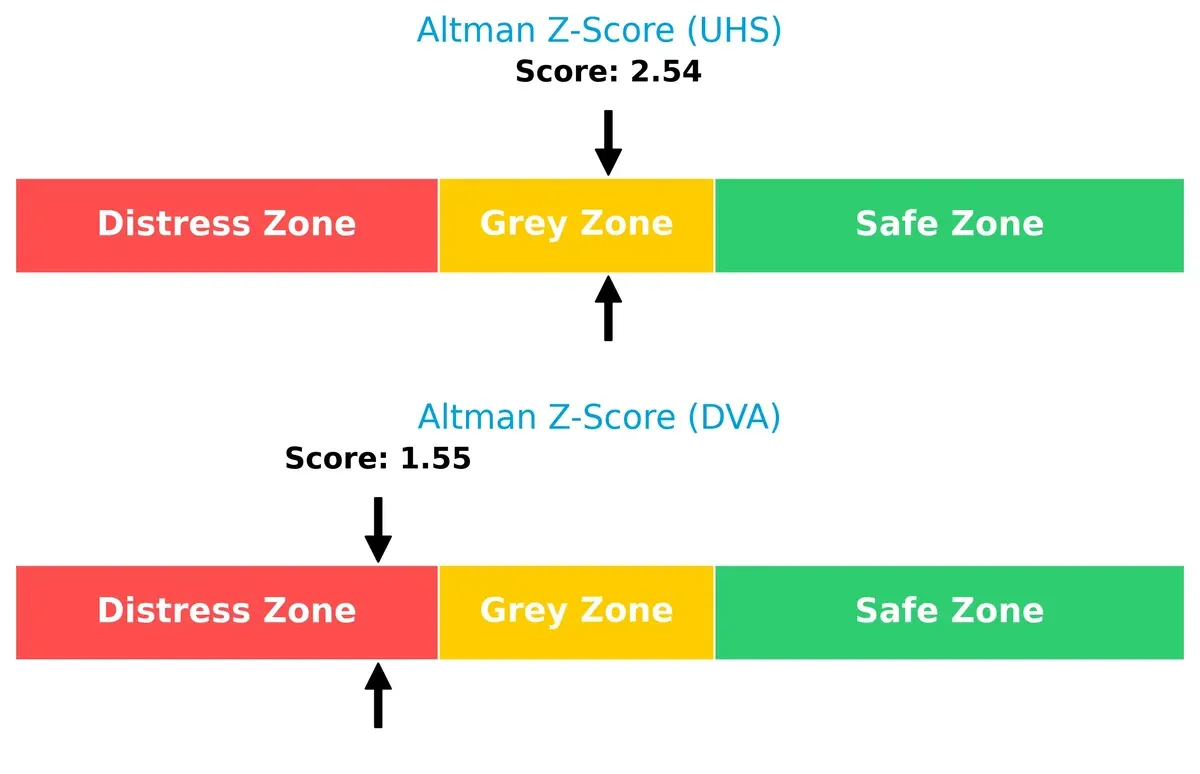

Bankruptcy Risk: Solvency Showdown

UHS’s Altman Z-Score of 2.54 places it in the grey zone, suggesting moderate bankruptcy risk, while DVA’s 1.55 signals distress and higher insolvency probability in this credit cycle:

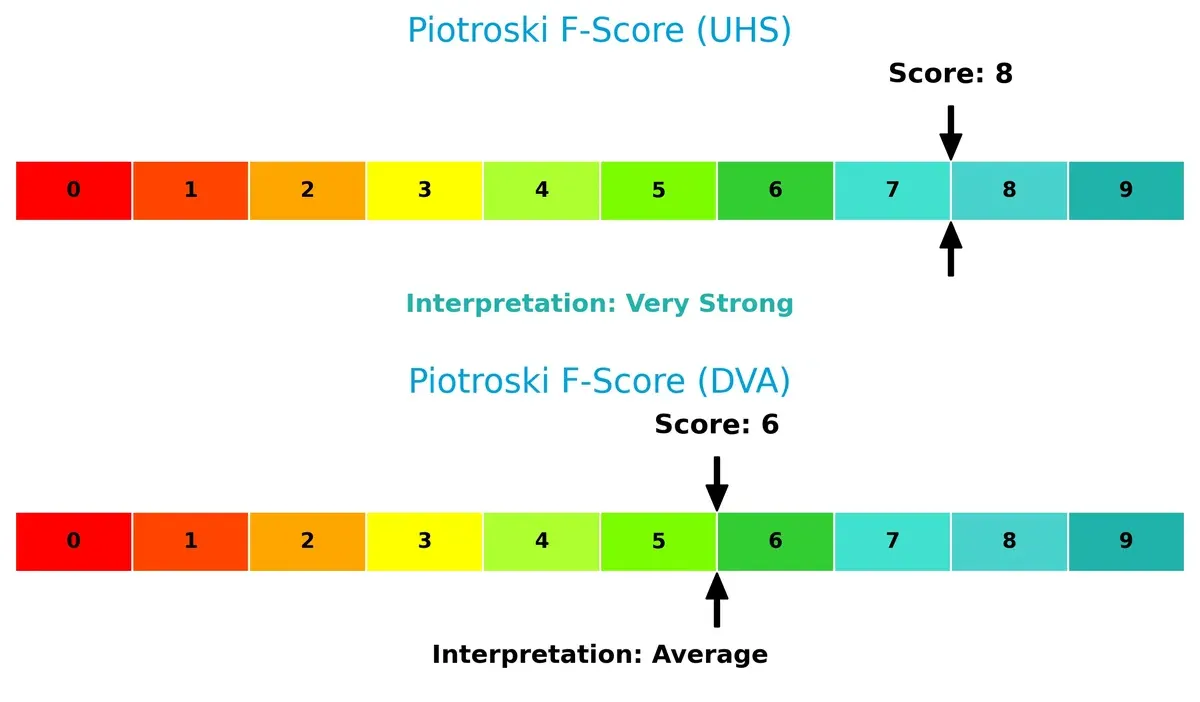

Financial Health: Quality of Operations

UHS’s Piotroski F-Score of 8 reflects very strong financial health and operational quality. DVA’s score of 6, though decent, flags some internal financial weaknesses compared to UHS:

How are the two companies positioned?

This section dissects UHS and DVA’s operational DNA by comparing revenue distribution and internal dynamics, including strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable advantage today.

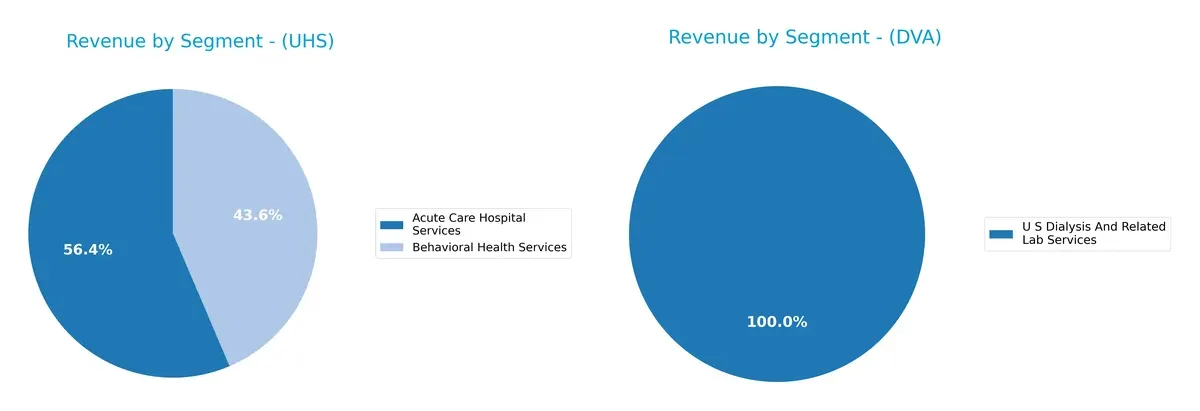

Revenue Segmentation: The Strategic Mix

This comparison dissects how Universal Health Services, Inc. and DaVita Inc. diversify their income streams and reveals their primary sector bets:

Universal Health Services anchors its revenue in two major segments: Acute Care Hospital Services at $8.9B and Behavioral Health Services at $6.9B, showing a balanced diversification. DaVita, by contrast, pivots almost entirely on U.S. Dialysis and Related Lab Services at $11.3B, with minimal contribution from other segments. UHS’s mix reduces concentration risk, while DaVita’s dominance exposes it to sector-specific vulnerabilities but strengthens its niche leadership.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Universal Health Services, Inc. (UHS) and DaVita Inc. (DVA):

UHS Strengths

- Solid profitability with ROE 17.13% and ROIC 10.55%

- Favorable valuation metrics including PE 10.46

- Good liquidity ratios: current 1.27 and quick 1.17

- Strong asset turnover at 1.09 indicating efficient use of assets

- Diversified revenue streams from Acute Care and Behavioral Health Services

- Slightly favorable global financial ratios at 42.86% positive

DVA Strengths

- Favorable WACC at 5.08% suggesting lower capital costs

- Positive PE 13.43 and PB -15.02 valuations

- Healthy quick ratio 1.24 and favorable debt-to-equity ratio -23.12

- Stable revenue from U.S. Dialysis and Related Lab Services

- Presence of other segments contributing to diversification

- Slightly favorable global financial ratios despite some challenges

UHS Weaknesses

- Moderate net margin at 7.22% rated neutral

- Dividend yield low at 0.45%, considered unfavorable

- Moderate debt-to-assets at 34.25% with neutral risk

- Fixed asset turnover neutral at 2.26

- Half of ratios neutral, indicating room for improvement

DVA Weaknesses

- Negative ROE at -111.9% reflecting poor profitability

- High debt-to-assets at 86.1% flagged as unfavorable risk

- Interest coverage low at 3.51, posing debt servicing concerns

- Dividend yield zero, unfavorable for income investors

- Asset turnover 0.76 neutral but below UHS

- Higher ratio of unfavorable metrics at 21.43%

UHS shows strength in profitability, asset efficiency, and diversified service lines, supporting a balanced financial profile. DVA benefits from lower capital costs and solid liquidity but faces significant profitability and leverage challenges. These contrasts imply different strategic priorities for risk management and growth focus.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the critical shield safeguarding long-term profits from relentless competitive pressure and market erosion:

Universal Health Services, Inc. (UHS): Diversified Healthcare Infrastructure Moat

UHS leverages scale and operational integration across acute and behavioral health services, reflected in a strong 2.5% ROIC-WACC spread and rising ROIC. Expansion into behavioral health deepens its moat in 2026.

DaVita Inc. (DVA): Specialized Kidney Care Network Moat

DVA’s competitive edge stems from its specialized dialysis network and integrated care, showing a wider 4.8% ROIC-WACC gap. However, recent margin contractions signal challenges in sustaining growth beyond core markets.

Verdict: Integrated Care Scale vs. Specialized Network Dominance

DaVita commands a wider moat via higher ROIC excess returns but faces margin pressures. UHS’s diversified platform offers stable margin expansion and broader market reach. I find UHS better positioned to defend market share long term.

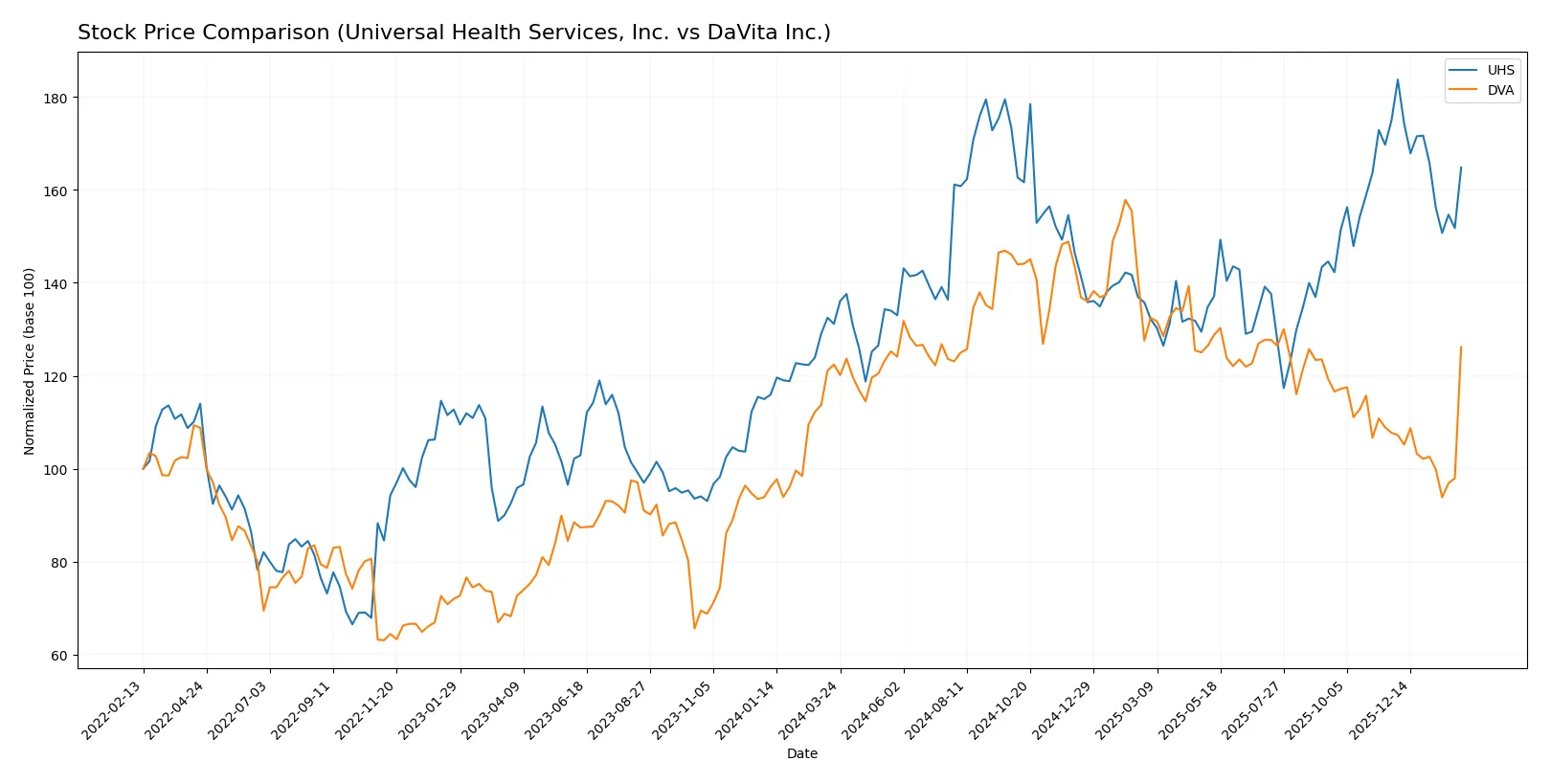

Which stock offers better returns?

The past year reveals contrasting price dynamics between Universal Health Services and DaVita Inc., with UHS showing a strong overall rise but recent weakness, while DVA exhibits modest gains and recent strength.

Trend Comparison

Universal Health Services’ stock rose 25.68% over 12 months, marking a bullish trend with decelerating momentum. It reached a high of 243.63 and a low of 155.6, showing significant volatility with a 21.3 standard deviation.

DaVita’s stock gained 3.06% over the same period, also bullish but with accelerating momentum. It recorded highs at 176.2 and lows at 104.74, exhibiting moderate volatility with a 14.88 standard deviation.

UHS delivered the highest annual market performance, despite recent declines, while DVA posted smaller but accelerating gains, reflecting distinct trading patterns and investor sentiment.

Target Prices

Analysts present a clear consensus on target prices for Universal Health Services, Inc. and DaVita Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Universal Health Services, Inc. | 203 | 274 | 241.4 |

| DaVita Inc. | 158 | 190 | 168.67 |

The target consensus for UHS suggests upside potential above the current price of $218.56, reflecting confidence in its healthcare facilities. DaVita’s consensus target also exceeds its current price of $140.83, indicating expected recovery despite recent price weakness.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of recent institutional grades for Universal Health Services, Inc. and DaVita Inc.:

Universal Health Services, Inc. Grades

This table lists recent grades assigned by reputable financial institutions to Universal Health Services, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-22 |

| Wells Fargo | Downgrade | Equal Weight | 2026-01-07 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Guggenheim | Maintain | Buy | 2025-12-02 |

| Wells Fargo | Maintain | Overweight | 2025-11-13 |

| RBC Capital | Maintain | Sector Perform | 2025-10-30 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-29 |

| Guggenheim | Maintain | Buy | 2025-10-29 |

| UBS | Maintain | Buy | 2025-10-29 |

| Barclays | Maintain | Overweight | 2025-10-28 |

DaVita Inc. Grades

This table shows recent institutional grades assigned to DaVita Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-02-04 |

| Barclays | Maintain | Equal Weight | 2026-02-03 |

| TD Cowen | Maintain | Hold | 2025-11-03 |

| Barclays | Maintain | Equal Weight | 2025-10-30 |

| Barclays | Maintain | Equal Weight | 2025-10-09 |

| B of A Securities | Maintain | Underperform | 2025-09-10 |

| Barclays | Maintain | Equal Weight | 2025-08-07 |

| Truist Securities | Maintain | Hold | 2025-05-19 |

| Barclays | Maintain | Equal Weight | 2025-02-18 |

| Barclays | Maintain | Equal Weight | 2024-10-31 |

Which company has the best grades?

Universal Health Services, Inc. consistently receives strong Buy and Overweight ratings, indicating robust institutional confidence. DaVita Inc. mostly garners Hold and Equal Weight grades, with some Underperform ratings, reflecting more cautious outlooks. Investors may perceive UHS as favored by analysts, potentially impacting market sentiment and portfolio positioning.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Universal Health Services, Inc. (UHS)

- Operates extensive acute care and behavioral health facilities across 39 states and internationally, facing intense competition in multiple care segments.

DaVita Inc. (DVA)

- Focuses on kidney dialysis services with a niche market but competes globally, including in 10 countries, facing specialized competitors.

2. Capital Structure & Debt

Universal Health Services, Inc. (UHS)

- Moderate leverage with debt-to-assets at 34.25%, interest coverage strong at 8.96x; debt-to-equity score very unfavorable indicating potential financial risk.

DaVita Inc. (DVA)

- High leverage with debt-to-assets at 86.1%, interest coverage weaker at 3.51x; debt-to-equity score very unfavorable, signaling significant balance sheet risk.

3. Stock Volatility

Universal Health Services, Inc. (UHS)

- Beta of 1.269 suggests higher volatility than market average, with a price range between $152.33 and $246.33.

DaVita Inc. (DVA)

- Beta of 1.011 indicates near-market volatility, but recent 5.6% price drop signals increased short-term risk.

4. Regulatory & Legal

Universal Health Services, Inc. (UHS)

- Subject to broad healthcare regulations across multiple states and countries, with exposure to compliance risks in behavioral health and acute care.

DaVita Inc. (DVA)

- Faces strict regulations specific to dialysis and kidney care, with potential legal risk from treatment protocols and reimbursement policies.

5. Supply Chain & Operations

Universal Health Services, Inc. (UHS)

- Manages diverse supply chains for 363 inpatient and 40 outpatient facilities, increasing operational complexity and vulnerability to disruptions.

DaVita Inc. (DVA)

- Operates large outpatient dialysis network requiring specialized equipment and supplies, making it sensitive to supply chain bottlenecks.

6. ESG & Climate Transition

Universal Health Services, Inc. (UHS)

- Growing pressure to improve ESG practices in healthcare delivery and energy use across multiple sites.

DaVita Inc. (DVA)

- Faces increasing scrutiny on sustainability in medical waste management and energy consumption in dialysis operations.

7. Geopolitical Exposure

Universal Health Services, Inc. (UHS)

- Exposure limited but includes UK and Puerto Rico operations, subject to varying healthcare policies and geopolitical risks.

DaVita Inc. (DVA)

- International operations in 10 countries expose it to geopolitical instability and currency fluctuations.

Which company shows a better risk-adjusted profile?

UHS’s most impactful risk is its moderate leverage combined with an unfavorable debt-to-equity ratio, though it benefits from strong operational scale and stable cash flows. DVA’s dominant risk is its high leverage and distress-zone Altman Z-Score, raising bankruptcy concerns. UHS shows a better risk-adjusted profile, supported by a very strong Piotroski Score of 8 versus DVA’s average 6. The recent 5.6% price drop in DVA highlights market apprehension about its financial health.

Final Verdict: Which stock to choose?

Universal Health Services (UHS) stands out for its robust capital efficiency and consistent value creation, evidenced by a growing ROIC well above its WACC. Its superpower lies in operational resilience and strong profitability metrics. However, investors should monitor its moderate leverage as a point of vigilance. UHS fits portfolios aiming for steady, aggressive growth underpinned by operational discipline.

DaVita (DVA) leverages a strategic moat rooted in its specialized healthcare services and recurring revenue streams. It offers a more volatile but potentially rewarding profile, with a favorable cost of capital and solid free cash flow yield. Compared to UHS, DVA carries higher financial risk but could suit portfolios focused on GARP—growth at a reasonable price—with an appetite for cyclical healthcare exposure.

If you prioritize operational efficiency and durable profitability, UHS is the compelling choice due to its superior capital allocation and stable income growth. However, if you seek growth tempered by strategic niche advantages and are willing to accept higher leverage, DVA offers better upside potential. Both demand careful risk management but serve distinct investor avatars balancing growth and stability differently.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Universal Health Services, Inc. and DaVita Inc. to enhance your investment decisions: