Home > Comparison > Healthcare > SOLV vs DVA

The strategic rivalry between Solventum Corporation and DaVita Inc. shapes the future of healthcare services. Solventum operates as a diversified medical solutions provider spanning Medsurg, dental, and health IT segments. In contrast, DaVita focuses on kidney dialysis and integrated care services. This analysis examines their contrasting operational models and growth vectors to identify which company presents a superior risk-adjusted opportunity for a diversified portfolio.

Table of contents

Companies Overview

Solventum Corporation and DaVita Inc. both hold significant roles within the healthcare sector, shaping patient care and medical solutions.

Solventum Corporation: Diverse Healthcare Solutions Provider

Solventum Corporation operates across four segments, focusing on medical supplies and healthcare technologies. Its revenue stems from advanced wound care, dental products, health IT software, and filtration technologies. In 2026, Solventum emphasizes innovation in integrated healthcare solutions to address critical patient needs and improve operational efficiency.

DaVita Inc.: Kidney Care Specialist

DaVita Inc. dominates the kidney dialysis market by operating a vast network of outpatient centers and providing comprehensive kidney care services. It generates income through dialysis treatments, lab services, clinical research, and integrated care management. The company’s strategic focus remains on enhancing patient outcomes and expanding care delivery across multiple care settings.

Strategic Collision: Similarities & Divergences

While both companies serve healthcare needs, Solventum pursues a diversified product portfolio, unlike DaVita’s focused specialty in renal care. They compete indirectly in medical infrastructure and patient service innovation. Solventum’s broad technology approach contrasts with DaVita’s patient-centric service model, defining distinct investment profiles shaped by diversification versus specialization.

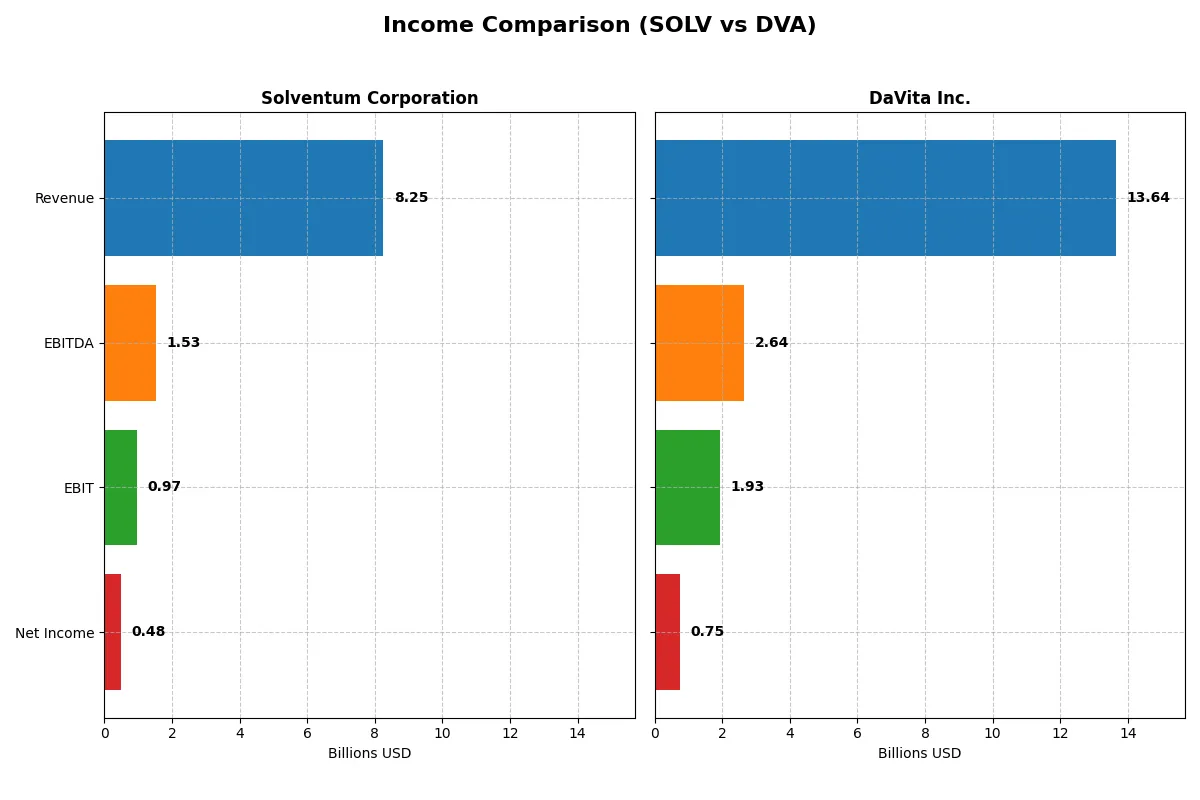

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Solventum Corporation (SOLV) | DaVita Inc. (DVA) |

|---|---|---|

| Revenue | 8.25B | 13.64B |

| Cost of Revenue | 3.66B | 9.96B |

| Operating Expenses | 3.56B | 1.67B |

| Gross Profit | 4.59B | 3.68B |

| EBITDA | 1.53B | 2.64B |

| EBIT | 972M | 1.93B |

| Interest Expense | 367M | 550M |

| Net Income | 479M | 747M |

| EPS | 2.77 | 10.06 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and sustainable corporate engine through revenue and profit dynamics.

Solventum Corporation Analysis

Solventum’s revenue edged up slightly to $8.25B in 2024, but net income plunged 64.6% to $479M, reflecting margin pressure. Gross margin remains healthy at 55.7%, yet EBIT and net margins deteriorated sharply, signaling faltering operational efficiency and a troubling earnings momentum heading into 2025.

DaVita Inc. Analysis

DaVita expanded revenue by 6.5% to $13.64B in 2025 but saw net income fall 25.1% to $722M. Despite a lower gross margin of 27%, DaVita sustains a stronger EBIT margin of 14.1%. Operating expenses grew proportionally with revenue, indicating controlled cost management amid margin compression.

Margin Resilience vs. Revenue Growth

Solventum boasts superior gross margins but suffers from steep earnings declines and margin erosion. DaVita, with a solid EBIT margin and better revenue growth, demonstrates more stable profitability. Investors seeking steadier operational control may find DaVita’s profile more attractive, while Solventum’s sharp margin declines pose significant caution.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Solventum Corporation (SOLV) | DaVita Inc. (DVA) |

|---|---|---|

| ROE | 16.19% (2024) | -111.90% (2025) |

| ROIC | 6.85% (2024) | 9.88% (2025) |

| P/E | 23.89 (2024) | 13.43 (2025) |

| P/B | 3.87 (2024) | -15.02 (2025) |

| Current Ratio | 1.20 (2024) | 1.29 (2025) |

| Quick Ratio | 0.84 (2024) | 1.24 (2025) |

| D/E | 2.71 (2024) | -23.12 (2025) |

| Debt-to-Assets | 55.41% (2024) | 86.10% (2025) |

| Interest Coverage | 2.82 (2024) | 3.47 (2025) |

| Asset Turnover | 0.57 (2024) | 0.76 (2025) |

| Fixed Asset Turnover | 5.09 (2024) | 2.55 (2025) |

| Payout ratio | 0% (2024) | 0% (2025) |

| Dividend yield | 0% (2024) | 0% (2025) |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, unveiling hidden risks and operational strengths that shape investor decisions.

Solventum Corporation

Solventum delivers a solid 16.2% ROE and moderate 5.8% net margin, reflecting decent profitability. The stock trades at a neutral P/E of 23.9 but shows an unfavorable PB of 3.87, suggesting valuation tension. It pays no dividend, instead reinvesting heavily in R&D with a 9.4% revenue allocation, fueling growth.

DaVita Inc.

DaVita posts a negative ROE at -111.9%, signaling severe equity erosion despite a similar 5.5% net margin to Solventum. Its valuation looks attractive with a favorable P/E of 13.4 and strong PB ratio. DaVita also forgoes dividends, focusing on operational improvement and maintaining a solid quick ratio of 1.24.

Valuation Discipline vs. Profitability Stability

DaVita offers cheaper valuation metrics but suffers from a stark negative ROE, raising risk concerns. Solventum balances profitability with a reasonable P/E but faces pressure on book value multiples. Investors seeking stability may prefer Solventum’s profile, while those prioritizing valuation might consider DaVita’s riskier stance.

Which one offers the Superior Shareholder Reward?

Solventum Corporation (SOLV) and DaVita Inc. (DVA) both forego dividends, focusing on reinvestment and buybacks. SOLV boasts stronger free cash flow per share (4.6 vs. 15.2 for DVA) and higher operating margins but carries heavy leverage (debt-to-equity ~2.7). DVA shows robust free cash flow yield and aggressive buybacks, despite fragile equity and sky-high leverage ratios. I see SOLV’s prudent capital allocation as more sustainable long-term. DVA’s financial risk and equity erosion temper its appeal. For 2026, I prefer SOLV’s balance of growth and capital discipline as the superior total shareholder return choice.

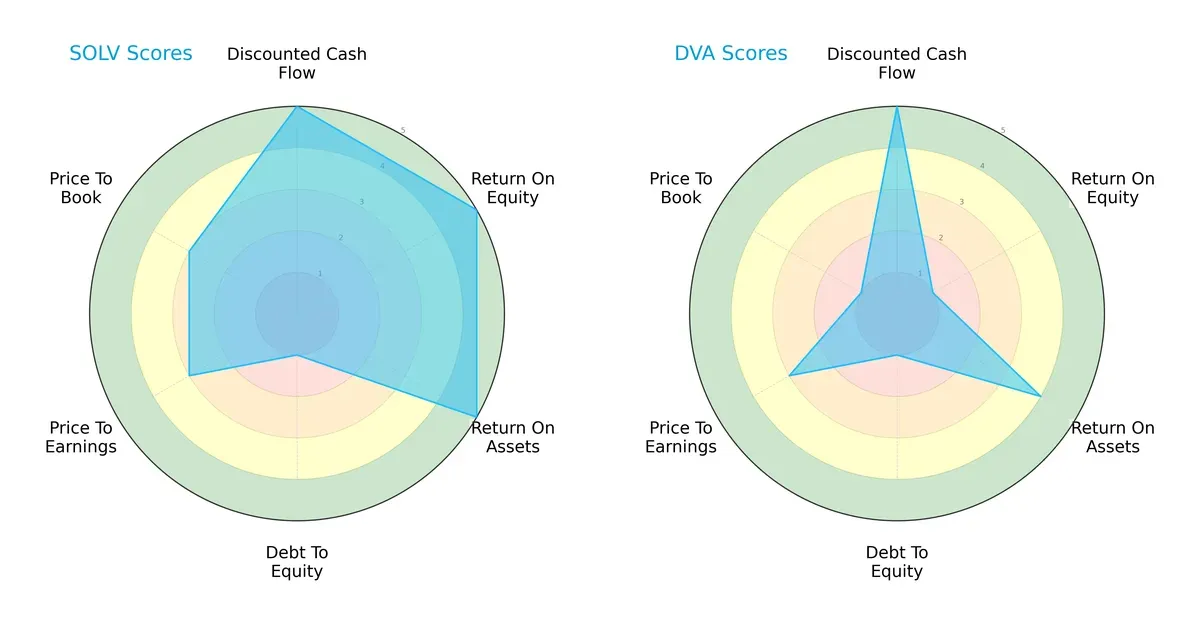

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Solventum Corporation and DaVita Inc., highlighting their financial strengths and vulnerabilities:

Solventum shows a balanced profile with very favorable DCF, ROE, and ROA scores, but carries significant financial risk with a poor debt-to-equity score. DaVita matches Solventum’s DCF strength but lags sharply in ROE and price-to-book valuation, indicating reliance on asset efficiency rather than profitability. Solventum’s moderate valuation metrics contrast with DaVita’s undervaluation signals, but Solventum’s leverage risk demands caution.

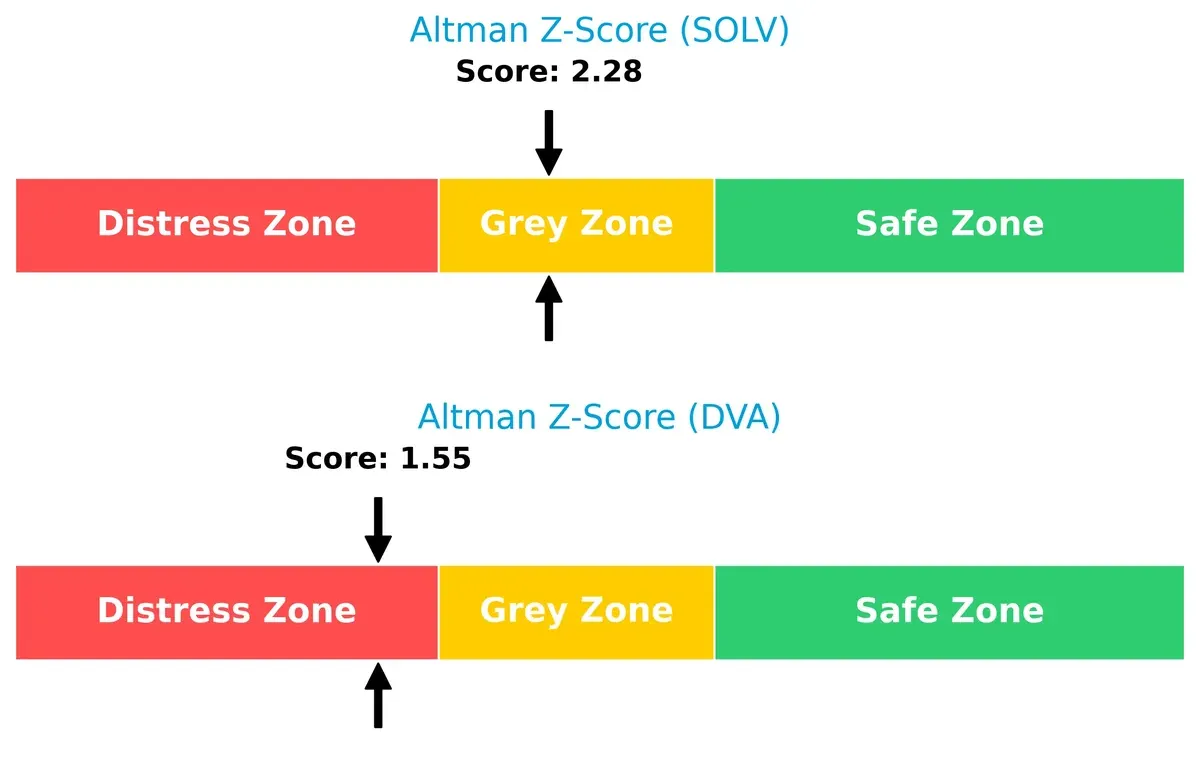

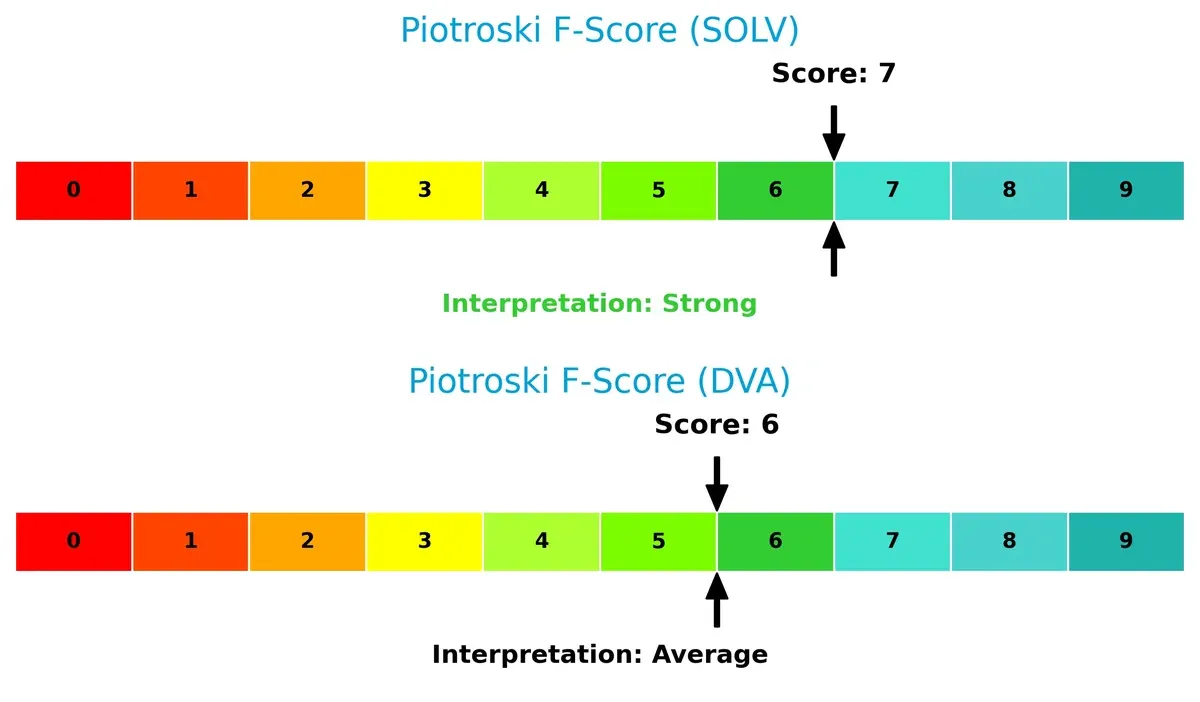

Bankruptcy Risk: Solvency Showdown

Solventum’s Altman Z-Score places it in the grey zone, suggesting moderate bankruptcy risk. DaVita’s distress zone score signals elevated insolvency risk in this cycle:

Financial Health: Quality of Operations

Solventum’s Piotroski F-Score of 7 indicates strong financial health, outperforming DaVita’s average score of 6. DaVita’s lower score hints at emerging red flags in operational efficiency and financial quality:

How are the two companies positioned?

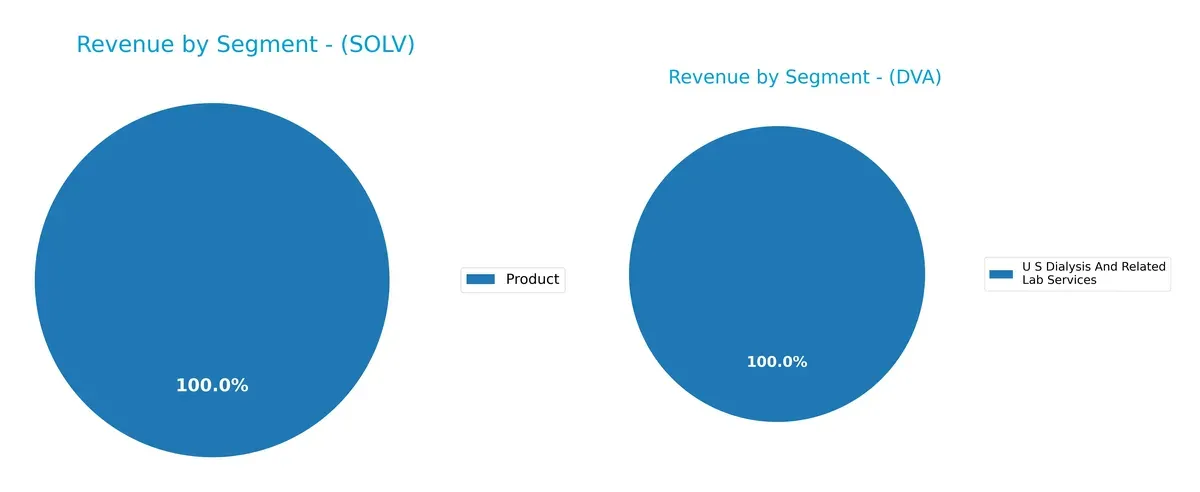

This section dissects the operational DNA of Solventum and DaVita by comparing their revenue distribution by segment alongside their internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Solventum Corporation and DaVita Inc. diversify their income streams and where their primary sector bets lie:

Solventum relies entirely on a single product segment generating $6.3B in revenue, showing no diversification. DaVita pivots primarily on U S Dialysis and Related Lab Services, with $11.3B, but supplements with $1.3B from other segments. DaVita’s mix reduces concentration risk and signals ecosystem lock-in, while Solventum’s singular focus heightens vulnerability to market shifts. This contrast reveals strategic bets: DaVita balances specialization with breadth; Solventum anchors on niche dominance.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Solventum Corporation and DaVita Inc.:

Solventum Corporation Strengths

- Favorable ROE of 16.19%

- WACC lower than ROIC at 5.22%

- Strong fixed asset turnover at 5.09

- Balanced US and Non-US revenue of 4.75B and 3.51B

DaVita Inc. Strengths

- Favorable PE at 13.43

- Favorable PB despite negative value

- Strong quick ratio at 1.24

- Neutral ROIC at 9.88% above WACC at 5.08%

Solventum Corporation Weaknesses

- High debt to equity at 2.71

- Debt to assets at 55.41%

- Unfavorable PB at 3.87

- No dividend yield

- Neutral current and quick ratios under 1

DaVita Inc. Weaknesses

- Negative ROE at -111.9%

- High debt to assets at 86.1%

- No dividend yield

- Debt to equity negative, complicating leverage assessment

Both companies show strengths in capital efficiency and valuation metrics but face leverage and dividend yield challenges. Solventum balances geographic revenue well, while DaVita’s valuation ratios appear more favorable despite profitability concerns. These factors shape their strategic financial priorities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true defense long-term profits have against relentless competition erosion:

Solventum Corporation: Diversified Solutions with Margin Stability

Solventum’s competitive edge lies in its diversified product portfolio and intangible assets. It shows stable margins but struggles to grow ROIC above WACC. New healthcare IT and filtration markets could test its moat in 2026.

DaVita Inc.: Specialized Renal Care with Scale Advantages

DaVita’s moat hinges on scale and integrated care services in dialysis, creating high switching costs unlike Solventum’s broader approach. It consistently grows ROIC well above WACC, signaling a widening moat and potential expansion into home-based dialysis.

Specialized Care Scale vs. Diversified Product Portfolio

DaVita’s deeper moat benefits from strong scale economies and integrated services, while Solventum’s stable but shallow moat faces margin pressures. DaVita is better equipped to defend and grow its market share in 2026.

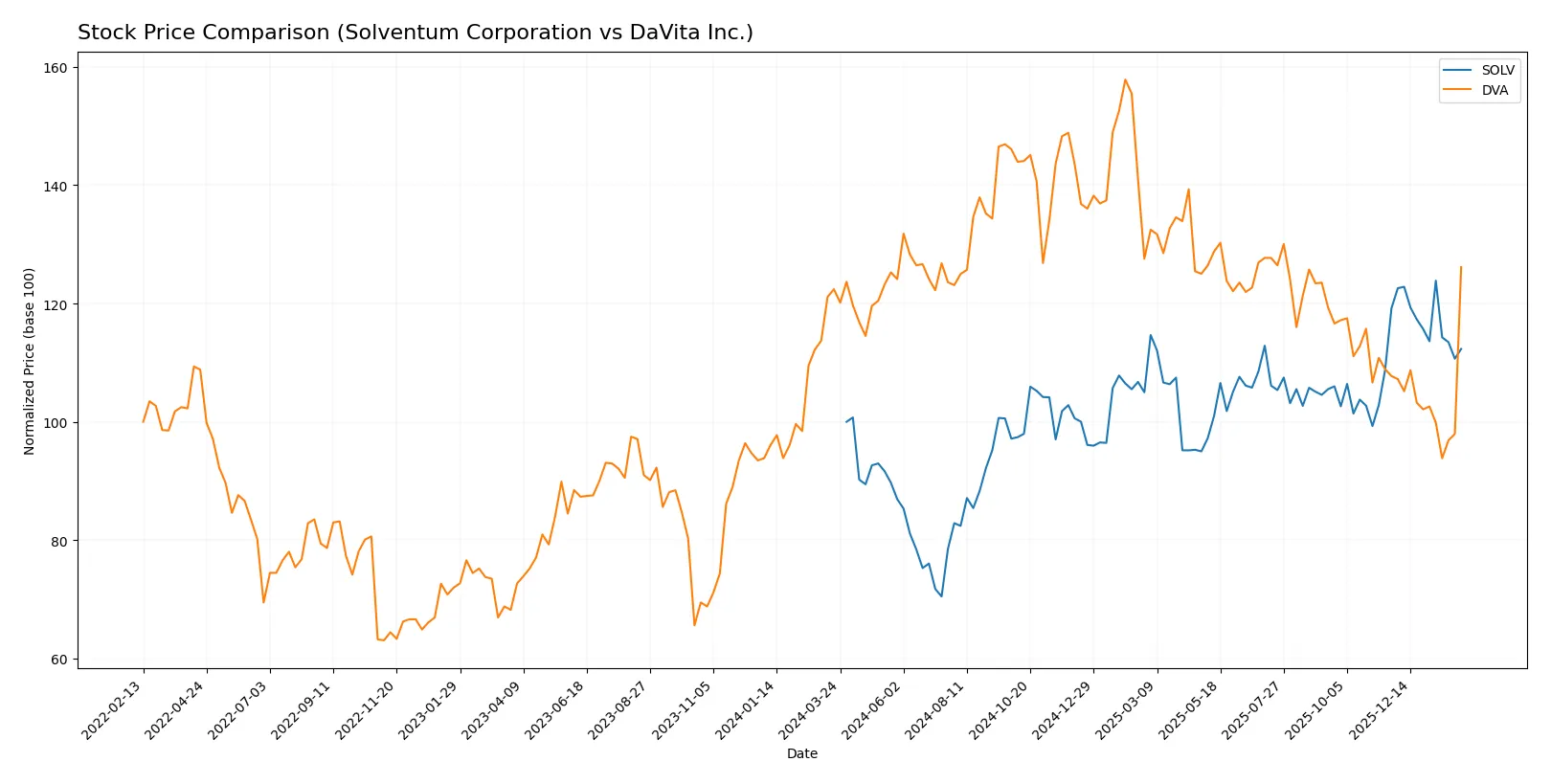

Which stock offers better returns?

Over the past 12 months, Solventum Corporation and DaVita Inc. showed notable price movements with divergent recent trends, reflecting shifting investor sentiment and trading dynamics.

Trend Comparison

Solventum Corporation’s stock rose 12.32% over the past year, marking a bullish trend with decelerating momentum and a price range between 49.0 and 86.14. However, recent months reveal a weakening trend with a 5.77% decline.

DaVita Inc. gained 3.06% over the same period, maintaining a bullish trend with accelerating momentum. It traded between 104.74 and 176.2, and recently surged 17.11%, despite slight negative slope indications.

DaVita’s recent price acceleration contrasts with Solventum’s recent decline. Overall, Solventum delivered stronger annual returns, but DaVita showed higher recent growth momentum.

Target Prices

Analysts maintain a bullish consensus on both Solventum Corporation and DaVita Inc., reflecting confidence in their healthcare sector prospects.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Solventum Corporation | 77 | 105 | 95.8 |

| DaVita Inc. | 158 | 190 | 168.67 |

Solventum’s consensus target of 95.8 exceeds its current 78.12 price, implying upside potential. DaVita’s 168.67 target also surpasses its 140.83 price, signaling expected appreciation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Solventum Corporation Grades

This table summarizes recent grades assigned to Solventum Corporation by leading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Upgrade | Overweight | 2026-01-26 |

| Mizuho | Upgrade | Outperform | 2026-01-20 |

| Stifel | Maintain | Buy | 2026-01-07 |

| BTIG | Upgrade | Buy | 2025-12-02 |

| UBS | Maintain | Neutral | 2025-11-10 |

| Piper Sandler | Maintain | Overweight | 2025-11-07 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-15 |

| Piper Sandler | Maintain | Overweight | 2025-08-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-08 |

| Morgan Stanley | Upgrade | Overweight | 2025-07-15 |

DaVita Inc. Grades

This table summarizes recent grades assigned to DaVita Inc. by leading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-02-04 |

| Barclays | Maintain | Equal Weight | 2026-02-03 |

| TD Cowen | Maintain | Hold | 2025-11-03 |

| Barclays | Maintain | Equal Weight | 2025-10-30 |

| Barclays | Maintain | Equal Weight | 2025-10-09 |

| B of A Securities | Maintain | Underperform | 2025-09-10 |

| Barclays | Maintain | Equal Weight | 2025-08-07 |

| Truist Securities | Maintain | Hold | 2025-05-19 |

| Barclays | Maintain | Equal Weight | 2025-02-18 |

| Barclays | Maintain | Equal Weight | 2024-10-31 |

Which company has the best grades?

Solventum Corporation consistently receives higher grades, including multiple upgrades to Overweight and Outperform. DaVita’s ratings cluster around Hold and Equal Weight, with one Underperform. Investors may view Solventum’s stronger consensus as a signal of confidence from analysts.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Solventum Corporation

- Operates diversified healthcare solutions, facing intense innovation pressure and sector competition.

DaVita Inc.

- Focused on kidney dialysis, DaVita faces competitive pressures from integrated care and specialty providers.

2. Capital Structure & Debt

Solventum Corporation

- High debt-to-equity ratio (2.71) and debt-to-assets (55.4%) pose leverage risks.

DaVita Inc.

- Although debt-to-assets is high (86.1%), negative debt-to-equity reflects complex capital structure, indicating potential financial risk.

3. Stock Volatility

Solventum Corporation

- Low beta (0.51) implies stock is less volatile than the market, offering relative stability.

DaVita Inc.

- Beta near 1.01 suggests market-level volatility, exposing investors to broader market swings.

4. Regulatory & Legal

Solventum Corporation

- Healthcare regulations impact multiple product lines, requiring constant compliance vigilance.

DaVita Inc.

- Subject to stringent kidney care regulations and reimbursement policies, regulatory shifts can materially affect earnings.

5. Supply Chain & Operations

Solventum Corporation

- Complex operations across four segments heighten supply chain vulnerabilities.

DaVita Inc.

- Extensive outpatient and inpatient services require resilient logistics; disruptions could affect patient care continuity.

6. ESG & Climate Transition

Solventum Corporation

- ESG initiatives needed across product manufacturing and filtration technologies amid increasing climate scrutiny.

DaVita Inc.

- Faces pressure to improve energy efficiency and waste management in dialysis centers to meet ESG standards.

7. Geopolitical Exposure

Solventum Corporation

- Primarily US-based with limited international exposure, reducing geopolitical risk.

DaVita Inc.

- Operates in 10 foreign countries, increasing exposure to geopolitical instability and currency fluctuations.

Which company shows a better risk-adjusted profile?

Solventum’s highest risk stems from its elevated leverage, while DaVita’s critical risk lies in regulatory and geopolitical complexities. Despite leverage concerns, Solventum offers lower stock volatility and a stronger overall financial rating. DaVita’s distress-level Altman Z-score and negative equity metrics raise caution. Thus, Solventum presents a better risk-adjusted profile amid 2026 uncertainties.

Final Verdict: Which stock to choose?

Solventum Corporation’s superpower lies in its strong operational efficiency and robust asset utilization. It maintains favorable returns on equity and capital, suggesting effective capital allocation and profitability. However, its elevated leverage demands vigilance, as high debt levels could amplify risks in volatile markets. It suits portfolios aiming for aggressive growth with a tolerance for financial risk.

DaVita Inc. commands a strategic moat through its capacity to create value with a growing ROIC well above its cost of capital. Its solid recurring cash flow and improving operational metrics offer a safety cushion relative to Solventum. This profile fits growth-at-a-reasonable-price investors seeking a blend of growth potential and somewhat better financial stability.

If you prioritize aggressive growth and operational efficiency, Solventum stands out for its capital returns despite leverage concerns. However, if you seek a company with a more sustainable competitive advantage and a safer balance sheet, DaVita offers better stability and value creation with a growing moat. Both present analytical scenarios tailored to different risk appetites and investment horizons.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Solventum Corporation and DaVita Inc. to enhance your investment decisions: