In today’s fast-evolving tech landscape, Datadog, Inc. and Zscaler, Inc. stand out as leaders in cloud-based software solutions. While Datadog excels in monitoring and analytics for IT infrastructure and applications, Zscaler focuses on cloud security and safe access management. Both companies address critical enterprise needs within overlapping markets, making their comparison essential. Join me as we analyze which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Datadog and Zscaler by providing an overview of these two companies and their main differences.

Datadog Overview

Datadog, Inc. offers a cloud-based monitoring and analytics platform designed for developers, IT operations teams, and business users. Its SaaS platform integrates infrastructure monitoring, application performance, log management, and security monitoring to deliver real-time observability. Founded in 2010 and based in New York City, Datadog serves a global customer base with a comprehensive suite of tools supporting cloud environments and incident management.

Zscaler Overview

Zscaler, Inc. is a cloud security company providing secure access solutions for users, servers, and IoT devices to SaaS applications and internal resources. Its platform includes tools for internet access, private access, digital experience monitoring, and workload segmentation to ensure compliance and reduce security risks. Headquartered in San Jose, California, Zscaler serves diverse industries worldwide with a focus on cloud security and digital experience.

Key similarities and differences

Both Datadog and Zscaler operate in the technology sector with cloud-centric platforms, focusing on software solutions that enhance operational efficiency and security. Datadog emphasizes monitoring and observability across technology stacks, while Zscaler concentrates on cloud security and secure access. Their business models rely on SaaS delivery, targeting enterprises requiring scalable, real-time insights and protection for cloud infrastructures.

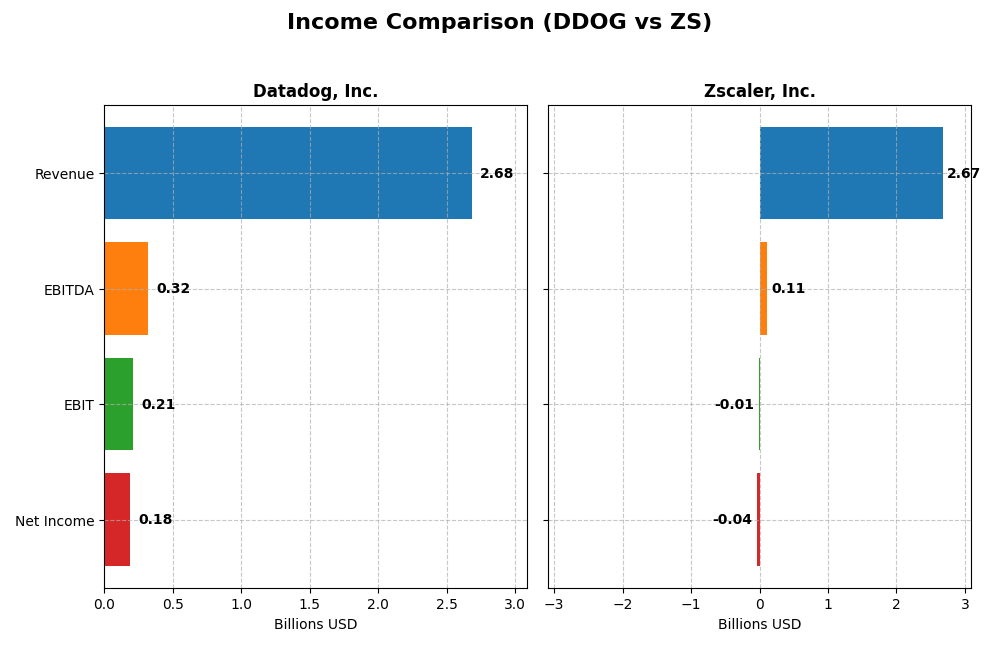

Income Statement Comparison

The table below presents the latest fiscal year income statement metrics for Datadog, Inc. and Zscaler, Inc., highlighting key financial indicators for comparison.

| Metric | Datadog, Inc. (DDOG) | Zscaler, Inc. (ZS) |

|---|---|---|

| Market Cap | 46.9B | 34.4B |

| Revenue | 2.68B | 2.16B |

| EBITDA | 318M | 65M |

| EBIT | 211M | -16M |

| Net Income | 184M | -58M |

| EPS | 0.55 | -0.39 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Datadog, Inc.

Datadog’s revenue increased markedly from 603M in 2020 to 2.68B in 2024, reflecting a 345% growth over five years. Net income swung from a loss of 25M in 2020 to a positive 184M in 2024, with net margin rising to 6.85%. The latest year showed strong improvements in margins and profitability, supported by a 26% revenue growth and a 264% earnings per share increase.

Zscaler, Inc.

Zscaler’s revenue grew from 673M in 2021 to 2.67B in 2025, achieving a 297% increase over the period. Despite this, net income remained negative, though losses narrowed from -262M in 2021 to -41M in 2025, reflecting a net margin of -1.55%. The most recent year saw solid revenue growth of 23% and improved net margin, yet profitability remains elusive with EBIT margin still negative.

Which one has the stronger fundamentals?

Datadog exhibits stronger fundamentals with consistently positive and improving net margins and profitability, alongside robust revenue and EPS growth. Zscaler shows favorable revenue expansion but struggles with persistent net losses and negative EBIT margins. While both companies demonstrate growth, Datadog’s income statement reflects a more sustainable earnings trajectory and margin stability.

Financial Ratios Comparison

The table below compares key financial ratios for Datadog, Inc. and Zscaler, Inc. based on their most recent fiscal year data, providing a snapshot of profitability, liquidity, valuation, and leverage metrics.

| Ratios | Datadog, Inc. (2024) | Zscaler, Inc. (2025) |

|---|---|---|

| ROE | 6.77% | -2.31% |

| ROIC | 1.07% | -3.18% |

| P/E | 261.4 | -1063.0 |

| P/B | 17.70 | 24.51 |

| Current Ratio | 2.64 | 2.01 |

| Quick Ratio | 2.64 | 2.01 |

| D/E (Debt-to-Equity) | 0.68 | 1.00 |

| Debt-to-Assets | 31.8% | 28.0% |

| Interest Coverage | 7.68 | -13.49 |

| Asset Turnover | 0.46 | 0.42 |

| Fixed Asset Turnover | 6.72 | 4.22 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Datadog, Inc.

Datadog displays a mixed ratio profile with favorable liquidity and interest coverage but struggles with profitability metrics like ROE and ROIC, both marked unfavorable. The valuation ratios such as P/E and P/B appear stretched, signaling caution. The company does not pay dividends, likely reflecting a reinvestment strategy consistent with its high R&D expense and growth focus.

Zscaler, Inc.

Zscaler’s ratios indicate challenges, with negative profitability ratios including net margin, ROE, and ROIC. Liquidity and debt metrics are relatively strong, supported by a favorable current ratio and manageable debt-to-assets. Zscaler also does not pay dividends, consistent with its negative earnings and emphasis on reinvestment and innovation in cloud security.

Which one has the best ratios?

Both companies show slightly unfavorable global ratio evaluations, with Zscaler having a higher proportion of unfavorable ratios. Datadog has stronger liquidity and interest coverage but weaker profitability and valuation metrics. Neither pays dividends, reflecting their growth and reinvestment priorities. The choice depends on weighing liquidity strength against profitability challenges.

Strategic Positioning

This section compares the strategic positioning of Datadog, Inc. and Zscaler, Inc. in terms of Market position, Key segments, and Exposure to technological disruption:

Datadog, Inc.

- Leading in application software monitoring with notable competitive pressure from cloud analytics firms.

- Serves developers, IT operations, and business users with a SaaS platform integrating monitoring and security tools.

- Faces disruption risks from evolving cloud monitoring technologies and security integration demands.

Zscaler, Inc.

- Focused on cloud security infrastructure with competitive pressure from cybersecurity and cloud access providers.

- Provides cloud security solutions including secure access, digital experience, and workload segmentation across industries.

- Exposed to rapid changes in cloud security threats and continuous innovation in cybersecurity platforms.

Datadog, Inc. vs Zscaler, Inc. Positioning

Datadog offers a diversified SaaS platform across monitoring and security, while Zscaler concentrates on cloud security infrastructure solutions. Datadog’s broad platform supports multiple user roles, whereas Zscaler targets specialized secure access and compliance needs. Both face distinct technological disruption challenges aligned with their focus.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOAT evaluations with negative ROIC compared to WACC but improving profitability trends. Neither currently demonstrates a strong sustainable competitive advantage based on value creation metrics.

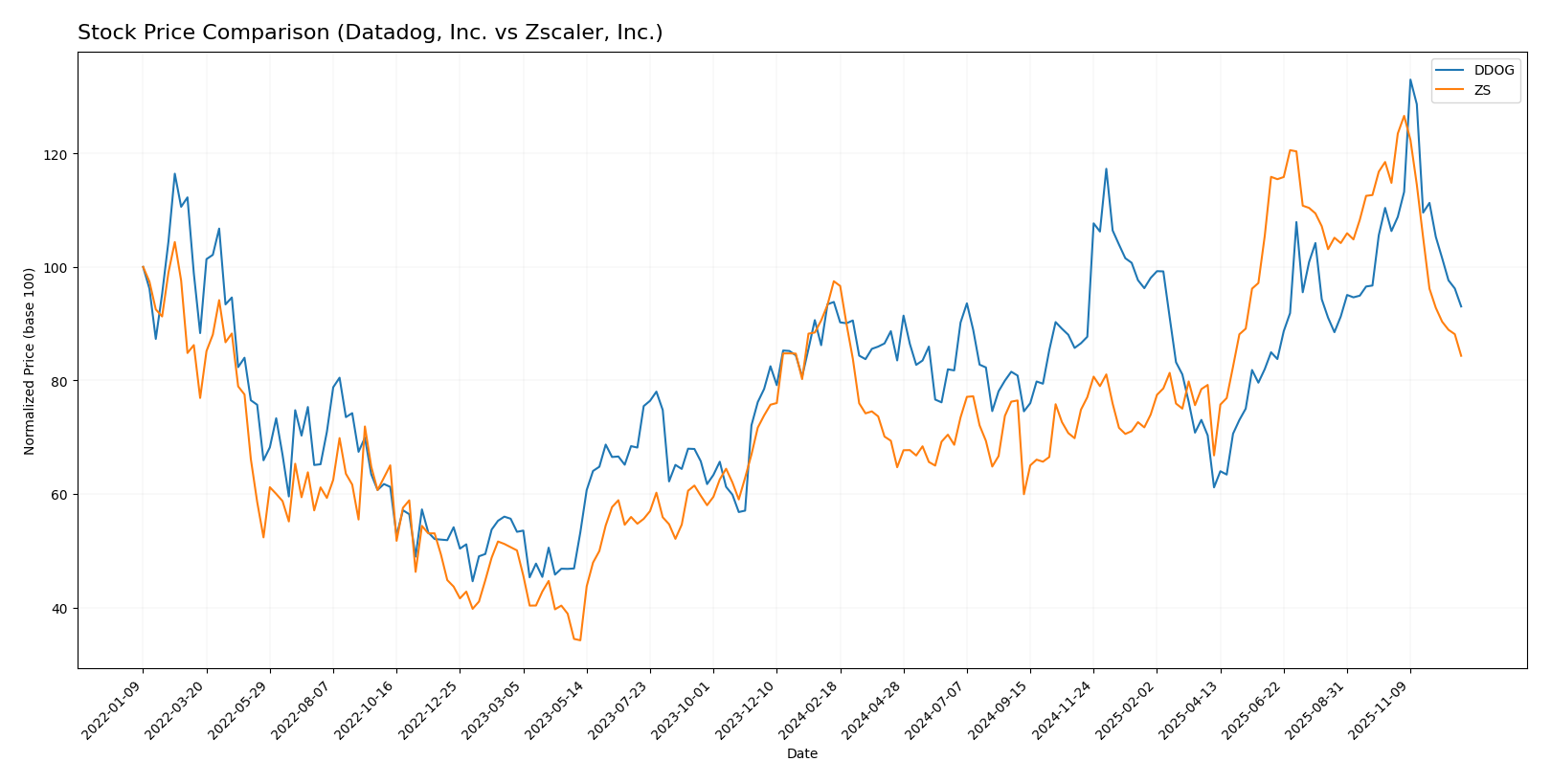

Stock Comparison

The past year showed significant bearish trends for both Datadog, Inc. and Zscaler, Inc., with marked price declines and decelerating momentum, reflecting shifting market sentiment and distinct trading volume patterns.

Trend Analysis

Datadog, Inc. (DDOG) experienced a slight bearish trend with a -0.85% price change over the past 12 months, accompanied by deceleration and a relatively moderate volatility of 18.61. The stock ranged between 87.93 and 191.24 during this period.

Zscaler, Inc. (ZS) displayed a stronger bearish trend with a -13.48% price drop in the same timeframe, also decelerating but with higher volatility at 47.29. The stock’s price fluctuated between 156.78 and 331.14, indicating wider swings.

Comparing the two, DDOG showed more resilience with a smaller price decrease, while ZS delivered the weakest market performance over the last year, marked by larger declines and volatility.

Target Prices

Analyst consensus presents an optimistic outlook for both Datadog, Inc. and Zscaler, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Datadog, Inc. | 215 | 105 | 180.87 |

| Zscaler, Inc. | 360 | 264 | 319.6 |

Target prices suggest substantial upside potential for both stocks compared to current prices: Datadog is trading near 134 USD, while Zscaler is around 221 USD, indicating room for growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Datadog, Inc. and Zscaler, Inc.:

Rating Comparison

Datadog, Inc. Rating

- Rating: C+, evaluated as Very Favorable

- Discounted Cash Flow Score: 4, Favorable

- ROE Score: 2, Moderate

- ROA Score: 3, Moderate

- Debt To Equity Score: 2, Moderate

- Overall Score: 2, Moderate

Zscaler, Inc. Rating

- Rating: C-, evaluated as Very Favorable

- Discounted Cash Flow Score: 4, Favorable

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 1, Very Unfavorable

Which one is the best rated?

Based strictly on the provided data, Datadog, Inc. holds higher scores in overall rating, ROE, ROA, and debt-to-equity metrics compared to Zscaler, Inc., which has lower scores except for an equal discounted cash flow score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Datadog and Zscaler:

DDOG Scores

- Altman Z-Score: 12.36, in safe zone indicating low bankruptcy risk.

- Piotroski Score: 6, average financial strength rating.

ZS Scores

- Altman Z-Score: 5.24, in safe zone showing low bankruptcy risk.

- Piotroski Score: 3, very weak financial strength rating.

Which company has the best scores?

Datadog has a higher Altman Z-Score and a better Piotroski Score than Zscaler. Both are in the safe zone for bankruptcy risk, but Datadog shows stronger overall financial health based on these metrics.

Grades Comparison

I present here the recent grades assigned by established grading companies for the two companies:

Datadog, Inc. Grades

The following table summarizes the current grades given to Datadog, Inc. by reputable financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-11-12 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-07 |

| Rosenblatt | Maintain | Buy | 2025-11-07 |

| RBC Capital | Maintain | Outperform | 2025-11-07 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Wells Fargo | Maintain | Overweight | 2025-11-07 |

| UBS | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-07 |

| Goldman Sachs | Maintain | Buy | 2025-11-07 |

| Truist Securities | Maintain | Hold | 2025-11-07 |

Datadog’s grades show a consistent pattern of positive ratings, predominantly Buy and Outperform, with only one Hold and one Equal Weight rating.

Zscaler, Inc. Grades

Below is a table displaying recent grades for Zscaler, Inc. from well-known grading entities.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Upgrade | Outperform | 2025-12-16 |

| Bernstein | Downgrade | Market Perform | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-12-01 |

| UBS | Maintain | Buy | 2025-11-26 |

| Bernstein | Maintain | Outperform | 2025-11-26 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-26 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Stifel | Maintain | Buy | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Mizuho | Maintain | Neutral | 2025-11-26 |

Zscaler’s recent grades reveal some volatility, with an upgrade to Outperform and a downgrade to Market Perform, but a majority of Buy and Outperform ratings remain.

Which company has the best grades?

Datadog maintains predominantly stable Buy and Outperform ratings with fewer fluctuations, while Zscaler shows mixed signals with recent upgrades and downgrades. Investors may interpret Datadog’s steadier grades as reflecting more consistent analyst confidence.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Datadog, Inc. (DDOG) and Zscaler, Inc. (ZS) based on the latest financial and operational data.

| Criterion | Datadog, Inc. (DDOG) | Zscaler, Inc. (ZS) |

|---|---|---|

| Diversification | Moderate product range, focused on cloud monitoring services | Relatively concentrated on cloud security solutions, with $2.67B revenue in 2025 |

| Profitability | Slightly favorable net margin (6.85%), but overall profitability is unfavorable due to ROIC (1.07%) below WACC | Negative net margin (-1.55%) and ROIC (-3.18%), indicating ongoing losses |

| Innovation | Strong innovation reflected in growing ROIC trend (+224.5%) despite current value destruction | Innovation visible via growing ROIC trend (+76.1%), but still destroying value |

| Global presence | Established global cloud monitoring footprint | Growing global cloud security presence |

| Market Share | Significant in cloud monitoring market but faces stiff competition | Niche leader in cloud security with expanding market share |

Key takeaway: Both companies are currently shedding value with ROIC below WACC, yet both show improving profitability trends. Datadog has a stronger net margin and liquidity position, while Zscaler is investing heavily in growth with a sizable revenue base but remains unprofitable. Caution is advised, with attention to their evolving profitability and market positioning.

Risk Analysis

Below is a comparative table of key risks for Datadog, Inc. (DDOG) and Zscaler, Inc. (ZS) based on the most recent data available as of 2026:

| Metric | Datadog, Inc. (DDOG) | Zscaler, Inc. (ZS) |

|---|---|---|

| Market Risk | Beta 1.23, moderate volatility | Beta 1.07, moderate volatility |

| Debt level | Debt-to-Equity 0.68, neutral risk | Debt-to-Equity 1.0, higher financial leverage |

| Regulatory Risk | Moderate, tech sector compliance | Moderate, cloud security regulations |

| Operational Risk | SaaS platform complexity, moderate | Cloud security reliance, moderate |

| Environmental Risk | Low, software sector | Low, software sector |

| Geopolitical Risk | Moderate, US-based with global presence | Moderate, US-based with global presence |

The most likely and impactful risks are market volatility and operational challenges due to the fast-evolving cloud and cybersecurity sectors. Zscaler’s higher debt level and weaker profitability metrics increase financial risk compared to Datadog, which maintains a safer liquidity position. Both companies face regulatory scrutiny inherent to technology and security industries but have low environmental risk profiles. Investors should monitor debt management and market conditions closely.

Which Stock to Choose?

Datadog, Inc. shows a favorable income evolution with strong revenue and net income growth over 2020-2024, supported by a high gross margin of 80.76%. Despite a slightly unfavorable global ratios evaluation and moderate profitability, its debt levels remain neutral, and the company holds a very favorable C+ rating.

Zscaler, Inc. also presents favorable income growth but with a lower gross margin of 76.87% and negative net margin in 2025. Its financial ratios are slightly less favorable, showing higher debt risk and weaker profitability metrics, reflected in a very favorable C- rating but with more unfavorable individual scores.

For investors, Datadog might appear more suitable for those prioritizing growth and improving profitability, while Zscaler could be considered by those focusing on potentially undervalued stocks despite higher risk. Both companies exhibit slightly unfavorable moats, indicating value destruction but improving returns.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Datadog, Inc. and Zscaler, Inc. to enhance your investment decisions: