In the dynamic world of software applications, Datadog, Inc. and SoundHound AI, Inc. stand out for their innovative approaches to technology solutions. Datadog excels in cloud monitoring and analytics, while SoundHound AI leads in voice artificial intelligence platforms. Both companies operate in fast-growing tech sectors with overlapping customer bases, making their comparison essential. Join me as we explore which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Datadog and SoundHound by providing an overview of these two companies and their main differences.

Datadog Overview

Datadog, Inc. offers a SaaS monitoring and analytics platform designed for developers, IT operations, and business users worldwide. The platform integrates infrastructure monitoring, application performance, log management, and security monitoring to deliver real-time visibility into customers’ technology stacks. Founded in 2010 and headquartered in New York City, Datadog serves a broad market with a comprehensive observability solution.

SoundHound Overview

SoundHound AI, Inc. specializes in voice artificial intelligence platforms that enable conversational experiences for businesses across various industries. Its flagship Houndify platform provides tools such as speech recognition, natural language understanding, and embedded voice solutions. The company, founded in 2022 and based in Santa Clara, California, focuses on advancing voice AI technology to enhance customer interactions.

Key similarities and differences

Both companies operate in the technology sector within the software application industry and trade on NASDAQ. Datadog focuses on IT infrastructure and application observability with a large employee base of 6,500, while SoundHound concentrates on voice AI with 842 employees. Market capitalization differs significantly, with Datadog at $41.7B and SoundHound at $4.7B, reflecting their scale and maturity variations.

Income Statement Comparison

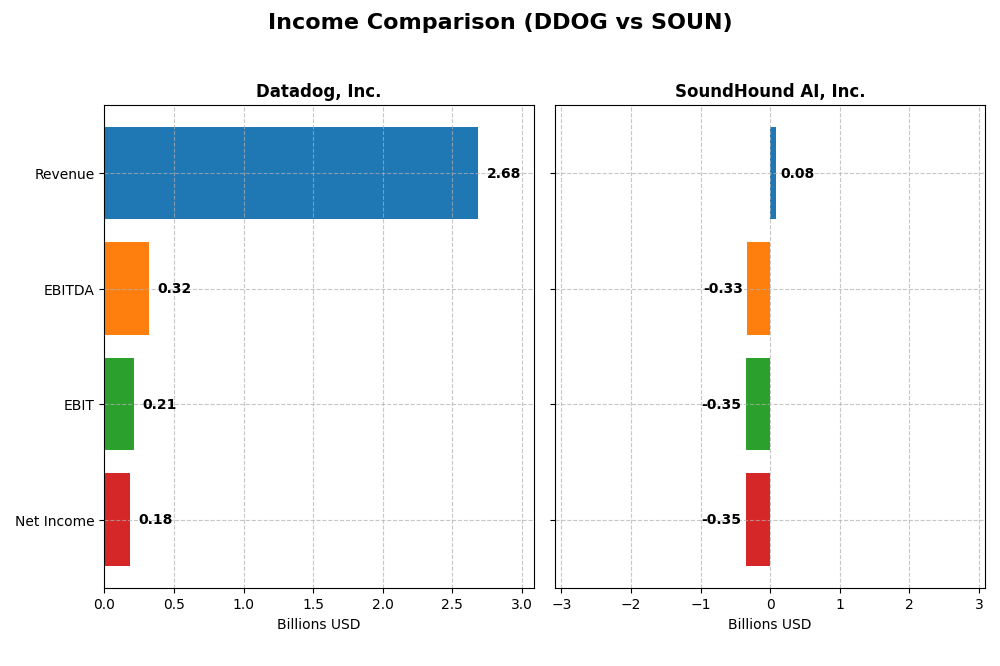

The table below presents a side-by-side comparison of key income statement metrics for Datadog, Inc. and SoundHound AI, Inc. for the fiscal year 2024.

| Metric | Datadog, Inc. (DDOG) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Cap | 41.7B | 4.7B |

| Revenue | 2.68B | 85M |

| EBITDA | 318M | -329M |

| EBIT | 211M | -348M |

| Net Income | 184M | -351M |

| EPS | 0.55 | -1.04 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Datadog, Inc.

Datadog’s revenue and net income have shown strong upward trends from 2020 to 2024, with revenue growing 344.81% and net income improving by 848.55%. Gross margins remained robust above 80%, while net margins expanded significantly, reaching 6.85% in 2024. The latest year showed accelerated growth, with net income and EPS surging, reflecting improved profitability and operational efficiency.

SoundHound AI, Inc.

SoundHound experienced rapid revenue growth of 550.63% over the period, reaching $85M in 2024, but continued to report net losses, with net income margins deeply negative at -414.06%. Gross margins remained moderate near 49%, but high operating expenses and interest costs weighed heavily. In 2024, revenue growth was favorable, yet net losses widened, indicating ongoing challenges in reaching profitability.

Which one has the stronger fundamentals?

Datadog presents stronger fundamentals with consistent revenue and profitability improvements, favorable margins, and positive cash flow indicators. SoundHound, while growing revenues rapidly, struggles with significant net losses, unfavorable EBIT and net margins, and costly financing. Datadog’s income statement reflects a more mature and profitable business model compared to SoundHound’s early-stage financial profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Datadog, Inc. (DDOG) and SoundHound AI, Inc. (SOUN) based on their latest fiscal year data for 2024.

| Ratios | Datadog, Inc. (DDOG) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| ROE | 6.77% | -191.99% |

| ROIC | 1.07% | -68.13% |

| P/E | 261.42 | -19.15 |

| P/B | 17.70 | 36.76 |

| Current Ratio | 2.64 | 3.77 |

| Quick Ratio | 2.64 | 3.77 |

| D/E (Debt-to-Equity) | 0.68 | 0.02 |

| Debt-to-Assets | 31.84% | 0.79% |

| Interest Coverage | 7.68 | -28.05 |

| Asset Turnover | 0.46 | 0.15 |

| Fixed Asset Turnover | 6.72 | 14.28 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Datadog, Inc.

Datadog shows a mixed ratio profile with a slightly unfavorable overall rating. Its current and quick ratios are favorable at 2.64, indicating good liquidity, but profitability ratios like ROE (6.77%) and ROIC (1.07%) are unfavorable. The high P/E of 261.42 and P/B of 17.7 suggest overvaluation risks. Datadog does not pay dividends, likely reinvesting earnings to support growth and innovation.

SoundHound AI, Inc.

SoundHound’s ratios reflect significant challenges, with an unfavorable overall rating. Negative net margin (-414.06%) and ROE (-191.99%) indicate heavy losses. While it has a strong quick ratio (3.77) and low debt ratios, interest coverage is deeply negative (-28.58). The company does not pay dividends, consistent with its negative earnings and focus on R&D and expansion.

Which one has the best ratios?

Datadog exhibits a more balanced financial condition with some favorable liquidity and asset turnover metrics, despite valuation concerns and moderate profitability. SoundHound faces more severe profitability and operational difficulties, reflected in its largely unfavorable ratios and negative earnings. Thus, Datadog’s ratios appear comparatively stronger based on the provided data.

Strategic Positioning

This section compares the strategic positioning of Datadog and SoundHound AI, including market position, key segments, and exposure to technological disruption:

Datadog, Inc.

- Leading cloud monitoring SaaS provider with strong competitive pressure in software applications.

- Offers integrated monitoring and analytics platform serving developers and IT operations globally.

- Positioned in cloud monitoring with incremental innovation, moderate exposure to tech disruption.

SoundHound AI, Inc.

- Smaller market cap company focused on voice AI technology facing high volatility.

- Provides voice AI platform with hosted services, licensing, and professional services.

- Operates in AI voice recognition, a rapidly evolving field with significant disruption risk.

Datadog vs SoundHound AI Positioning

Datadog presents a diversified cloud monitoring platform targeting broad IT and business users, benefiting from scale but facing competitive pressure. SoundHound AI concentrates on voice AI solutions with narrower focus but higher technological disruption exposure and smaller scale.

Which has the best competitive advantage?

Both companies are currently shedding value but show improving profitability. Datadog’s larger scale and integrated platform suggest a more stable moat compared to SoundHound AI’s niche and volatile market position.

Stock Comparison

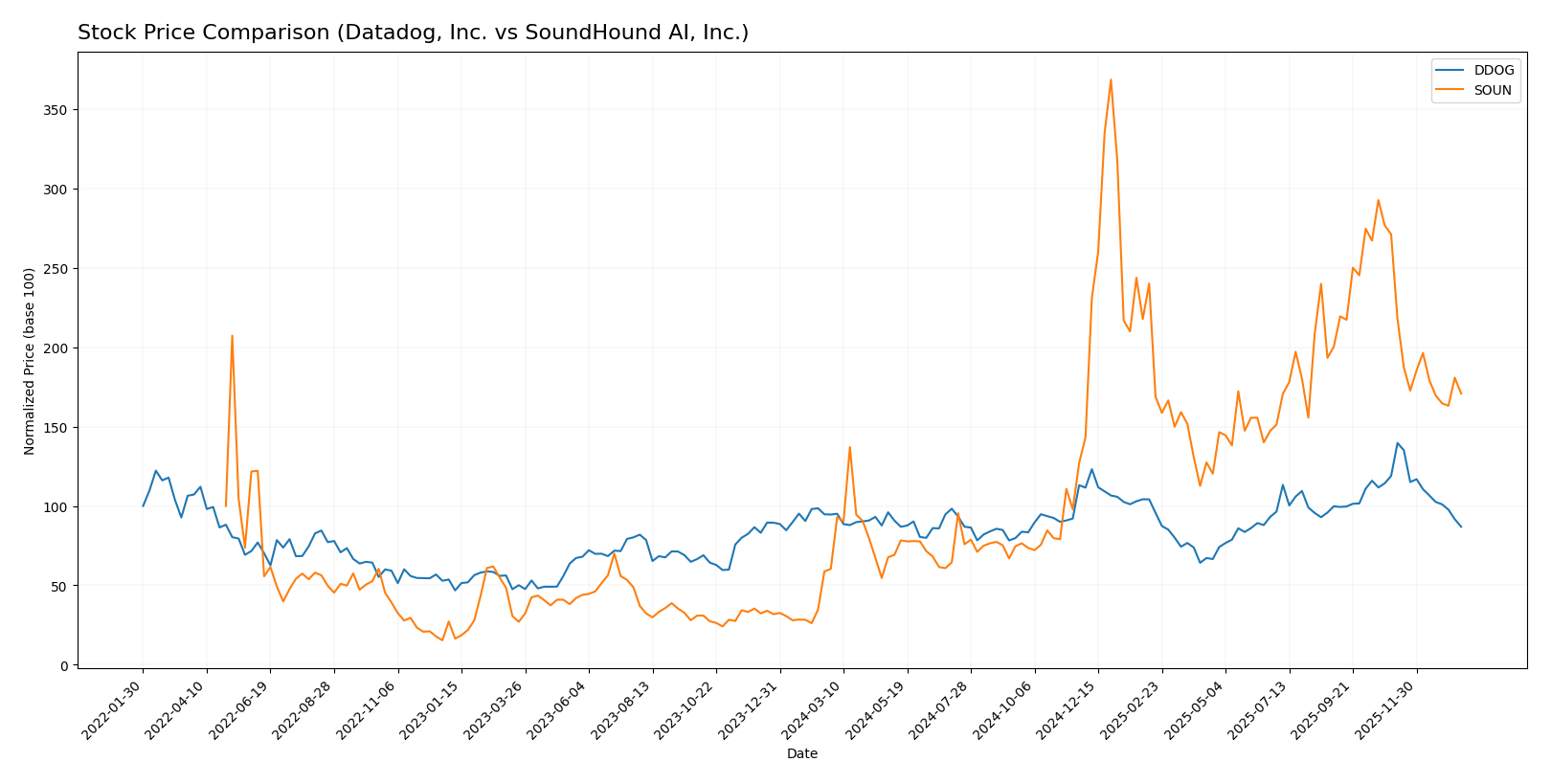

The stock price movements of Datadog, Inc. and SoundHound AI, Inc. over the past year reveal contrasting trends, with Datadog experiencing a bearish trajectory while SoundHound AI shows a strong bullish momentum despite recent declines.

Trend Analysis

Datadog, Inc. (DDOG) displayed a bearish trend with an overall price decline of 8.1% over the past 12 months, accompanied by decelerating momentum and a high volatility level (std deviation 18.63). The stock reached a high of 191.24 and a low of 87.93.

SoundHound AI, Inc. (SOUN) recorded a bullish trend with a substantial 183.16% price increase over the same period, though momentum slowed down. Volatility was lower (std deviation 4.66), and the stock fluctuated between 3.55 and 23.95.

Comparing both stocks, SoundHound AI delivered significantly higher market performance than Datadog over the past year, despite both showing strong seller dominance in recent trading periods.

Target Prices

Analysts present a clear target price consensus for both Datadog, Inc. and SoundHound AI, Inc., reflecting varied but optimistic outlooks.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Datadog, Inc. | 215 | 105 | 177.67 |

| SoundHound AI, Inc. | 15 | 11 | 13.33 |

For Datadog, the consensus target price at 177.67 significantly exceeds the current price of 119.02, indicating positive analyst expectations. SoundHound AI’s consensus target of 13.33 is moderately above its current price of 11.1, suggesting cautious optimism among analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Datadog, Inc. and SoundHound AI, Inc.:

Rating Comparison

Datadog, Inc. Rating

- Rating: C+, assessed as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation.

- ROE Score: 2, a Moderate level of profitability efficiency.

- ROA Score: 3, showing Moderate asset utilization.

- Debt To Equity Score: 2, Moderate financial risk.

- Overall Score: 2, Moderate overall financial standing.

SoundHound AI, Inc. Rating

- Rating: C-, also considered Very Favorable.

- Discounted Cash Flow Score: 1, rated Very Unfavorable.

- ROE Score: 1, considered Very Unfavorable.

- ROA Score: 1, rated Very Unfavorable in asset use.

- Debt To Equity Score: 4, Favorable with low financial risk.

- Overall Score: 1, Very Unfavorable overall rating.

Which one is the best rated?

Datadog holds a higher overall score and stronger ratings in key profitability and valuation metrics compared to SoundHound, which scores lower except for a favorable debt-to-equity ratio. Based purely on these scores, Datadog is better rated.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Datadog and SoundHound AI:

Datadog Scores

- Altman Z-Score: 11.37, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 6, categorized as average financial strength.

SoundHound AI Scores

- Altman Z-Score: 6.62, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 3, categorized as very weak financial strength.

Which company has the best scores?

Datadog shows a stronger Altman Z-Score and a better Piotroski Score compared to SoundHound AI, indicating comparatively higher financial stability and strength based on the provided data.

Grades Comparison

The following presents the recent grades from established grading companies for Datadog, Inc. and SoundHound AI, Inc.:

Datadog, Inc. Grades

This table summarizes recent ratings and grade changes for Datadog, Inc. by recognized financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Hold | 2026-01-07 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-07 |

Datadog’s grades predominantly show a positive consensus with multiple buy and overweight ratings, reflecting confidence from several major firms.

SoundHound AI, Inc. Grades

This table shows recent ratings and grade changes for SoundHound AI, Inc. by recognized financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

SoundHound AI’s grades show a generally positive outlook with multiple buy and outperform ratings, though some neutral stances persist.

Which company has the best grades?

Datadog, Inc. has received more consistent and numerous buy and overweight ratings from major firms, indicating stronger market confidence compared to SoundHound AI, Inc., whose grades include more neutral ratings. This may imply a relatively higher conviction from analysts towards Datadog’s stock potential.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Datadog, Inc. (DDOG) and SoundHound AI, Inc. (SOUN) based on the most recent financial and operational data.

| Criterion | Datadog, Inc. (DDOG) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Diversification | Moderate; primarily focused on cloud monitoring and analytics services | Moderate; revenue spread across hosted services, licensing, and professional services |

| Profitability | Neutral net margin (6.85%), but overall slightly unfavorable due to low ROIC (1.07%) and high valuation multiples | Negative profitability with very unfavorable margins (-414%) and ROIC (-68.13%) |

| Innovation | Strong innovation with growing ROIC trend, but currently shedding value | Growing ROIC trend indicating improving innovation, but still destroying value |

| Global presence | Established presence in cloud monitoring with decent asset turnover | Smaller scale with limited global footprint, but improving service revenue base |

| Market Share | Well-recognized in cloud infrastructure monitoring | Emerging player in AI voice and conversational platforms |

Key takeaways: Both companies are currently shedding value with ROIC below their cost of capital, yet they show improving profitability trends. Datadog offers more stability and established market presence, while SoundHound is still in an early growth phase with higher risks but potential upside from innovation.

Risk Analysis

Below is a comparative overview of key risks for Datadog, Inc. (DDOG) and SoundHound AI, Inc. (SOUN) as of 2024.

| Metric | Datadog, Inc. (DDOG) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Risk | Moderate (beta 1.26) | High (beta 2.88) |

| Debt level | Moderate (D/E 0.68) | Low (D/E 0.02) |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Moderate | High (early-stage AI tech) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Low | Low |

The most likely and impactful risks are market volatility and operational challenges. SoundHound faces higher market risk due to its elevated beta (2.88) and operational risk linked to nascent AI technology and weaker profitability metrics. Datadog’s moderate leverage and stable financial footing mitigate some risks but valuation multiples remain high, warranting caution.

Which Stock to Choose?

Datadog, Inc. (DDOG) shows a strong income evolution with 26.12% revenue growth in 2024 and favorable profitability metrics, including a 6.85% net margin. Its financial ratios are mixed, with a slightly unfavorable global evaluation and moderate debt levels, supported by a C+ rating indicating moderate overall strength.

SoundHound AI, Inc. (SOUN) has experienced significant revenue growth of 84.62% in 2024 but suffers from unfavorable profitability, including a -414.06% net margin. Its financial ratios are largely unfavorable despite low debt, reflected in a C- rating and a generally unfavorable global assessment.

For investors, Datadog’s favorable income statement and moderate rating might appeal to those prioritizing steady growth and moderate risk, while SoundHound’s high revenue growth but weak profitability and ratios could be of interest to risk-tolerant investors seeking potential turnaround opportunities. Both companies show growing ROIC but are currently shedding value.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Datadog, Inc. and SoundHound AI, Inc. to enhance your investment decisions: