In the fast-evolving software application industry, Datadog, Inc. and PagerDuty, Inc. stand out as leaders in digital operations management and cloud monitoring solutions. Both companies serve overlapping markets with innovative platforms that enhance IT performance and incident response. This comparison will dissect their strengths and growth potential to help you decide which stock might best complement your investment portfolio in 2026. Let’s explore which company offers the most compelling opportunity for investors today.

Table of contents

Companies Overview

I will begin the comparison between Datadog, Inc. and PagerDuty, Inc. by providing an overview of these two companies and their main differences.

Datadog Overview

Datadog, Inc. offers a cloud-based monitoring and analytics platform aimed at developers, IT operations teams, and business users worldwide. Its SaaS integrates infrastructure monitoring, application performance, log management, and security to deliver real-time observability. Founded in 2010 and based in New York City, Datadog serves a global market with a comprehensive suite of tools including network and user experience monitoring.

PagerDuty Overview

PagerDuty, Inc. operates a digital operations management platform that uses machine learning to analyze data signals from software systems and devices. Founded in 2009 and headquartered in San Francisco, PagerDuty serves diverse industries such as technology, telecommunications, retail, and financial services. Its platform focuses on predicting and resolving operational issues, supporting customers primarily in the US, Japan, and internationally.

Key similarities and differences

Both companies operate in the software application industry, providing platforms that enhance operational efficiency through real-time data analysis and monitoring. Datadog’s offering is broader, emphasizing cloud infrastructure and security monitoring, while PagerDuty specializes in digital operations management with machine learning-driven incident response. Datadog has a significantly larger market cap and workforce, reflecting its wider market reach and product scope compared to PagerDuty’s more focused niche.

Income Statement Comparison

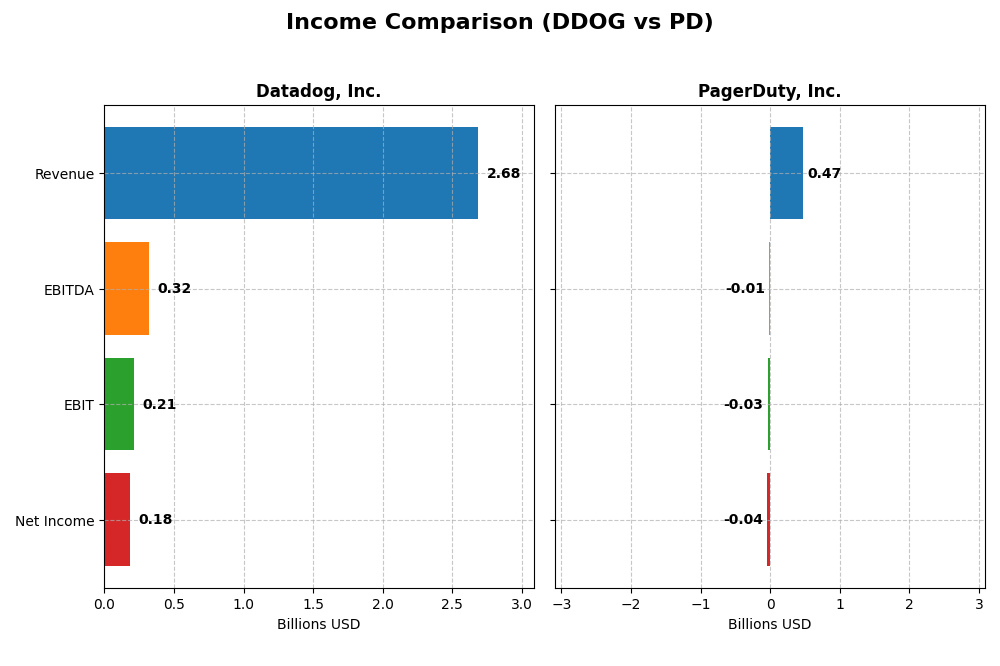

This table provides a side-by-side comparison of the most recent fiscal year income statement metrics for Datadog, Inc. and PagerDuty, Inc.

| Metric | Datadog, Inc. (DDOG) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Cap | 41.7B | 1.0B |

| Revenue | 2.68B | 467.5M |

| EBITDA | 318M | -11.9M |

| EBIT | 211M | -32.5M |

| Net Income | 184M | -42.7M |

| EPS | 0.55 | -0.59 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Datadog, Inc.

Datadog shows a strong upward trajectory in revenue and net income from 2020 to 2024, with revenue growing from $603M to $2.68B and net income improving from a loss of $25M to a profit of $184M. Margins have generally improved, with a gross margin at 80.76% and a net margin of 6.85% in 2024. The latest year saw a robust 26% revenue growth and nearly tripled net margin.

PagerDuty, Inc.

PagerDuty’s revenue increased steadily from $214M in 2021 to $467M in 2025, yet it remains unprofitable with net losses narrowing from $69M to $43M over the same period. Despite a favorable gross margin near 83%, the company’s EBIT and net margins remain negative at -6.95% and -9.14%, respectively. The 2025 fiscal year showed modest revenue growth of 8.5% and improved earnings metrics compared to prior years.

Which one has the stronger fundamentals?

Datadog exhibits stronger fundamentals with significant growth in revenue and profitability, positive and improving margins, and a favorable income statement evaluation. PagerDuty, although growing revenue, continues to face losses and negative margins, reflecting higher risk. Both show favorable revenue growth, but Datadog’s superior net income performance and margin stability give it the edge in fundamentals.

Financial Ratios Comparison

The following table compares the most recent available financial ratios for Datadog, Inc. and PagerDuty, Inc. as of fiscal year 2024 and January 2025 respectively.

| Ratios | Datadog, Inc. (2024) | PagerDuty, Inc. (2025) |

|---|---|---|

| ROE | 6.77% | -32.92% |

| ROIC | 1.07% | -9.66% |

| P/E | 261.4 | -39.87 |

| P/B | 17.70 | 13.12 |

| Current Ratio | 2.64 | 1.87 |

| Quick Ratio | 2.64 | 1.87 |

| D/E (Debt-to-Equity) | 0.68 | 3.57 |

| Debt-to-Assets | 31.8% | 50.0% |

| Interest Coverage | 7.68 | -6.46 |

| Asset Turnover | 0.46 | 0.50 |

| Fixed Asset Turnover | 6.72 | 16.61 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Datadog, Inc.

Datadog shows a mixed ratio profile with favorable liquidity (current and quick ratios at 2.64) and strong interest coverage (29.85), but faces challenges with profitability (ROE 6.77%, ROIC 1.07%) and valuation metrics (P/E 261.42, P/B 17.7) which are unfavorable. The company does not pay dividends, likely reflecting reinvestment in growth and R&D priorities.

PagerDuty, Inc.

PagerDuty’s ratios indicate weaker profitability (net margin -9.14%, ROE -32.92%), high leverage (debt-to-equity 3.57) and poor interest coverage (-3.51), despite a favorable WACC of 5.85%. Current and quick ratios are reasonable at 1.87. The firm also does not pay dividends, consistent with its negative earnings and focus on reinvestment and innovation.

Which one has the best ratios?

Datadog’s ratio profile is slightly unfavorable overall but benefits from stronger liquidity and interest coverage compared to PagerDuty, which displays more pronounced financial weaknesses and higher leverage. Datadog’s valuation appears stretched, while PagerDuty’s profitability and capital structure pose greater risks, resulting in a less favorable ratios assessment.

Strategic Positioning

This section compares the strategic positioning of Datadog and PagerDuty, focusing on Market position, Key segments, and exposure to technological disruption:

Datadog, Inc.

- Leading SaaS platform in monitoring and analytics with significant market cap and competitive pressure.

- Focuses on cloud infrastructure monitoring, application performance, log management, and security monitoring.

- Positioned in cloud and observability software with integration and automation, facing ongoing cloud tech disruptions.

PagerDuty, Inc.

- Digital operations management platform serving various industries with smaller market cap and moderate pressure.

- Offers machine learning-based digital operations management across multiple sectors including telecom, retail, and finance.

- Uses advanced machine learning for predictive operations, exposed to disruption in software-enabled system monitoring.

Datadog vs PagerDuty Positioning

Datadog has a diversified portfolio within cloud infrastructure and security monitoring, offering broad observability solutions, while PagerDuty concentrates on digital operations management with strong machine learning application. Datadog’s scale provides broader industry coverage; PagerDuty’s niche focus targets multiple specific sectors.

Which has the best competitive advantage?

Both companies are slightly unfavorable in MOAT evaluation, shedding value despite growing profitability. Datadog’s larger scale and diversified solutions suggest a more robust competitive position compared to PagerDuty’s smaller, sector-focused approach.

Stock Comparison

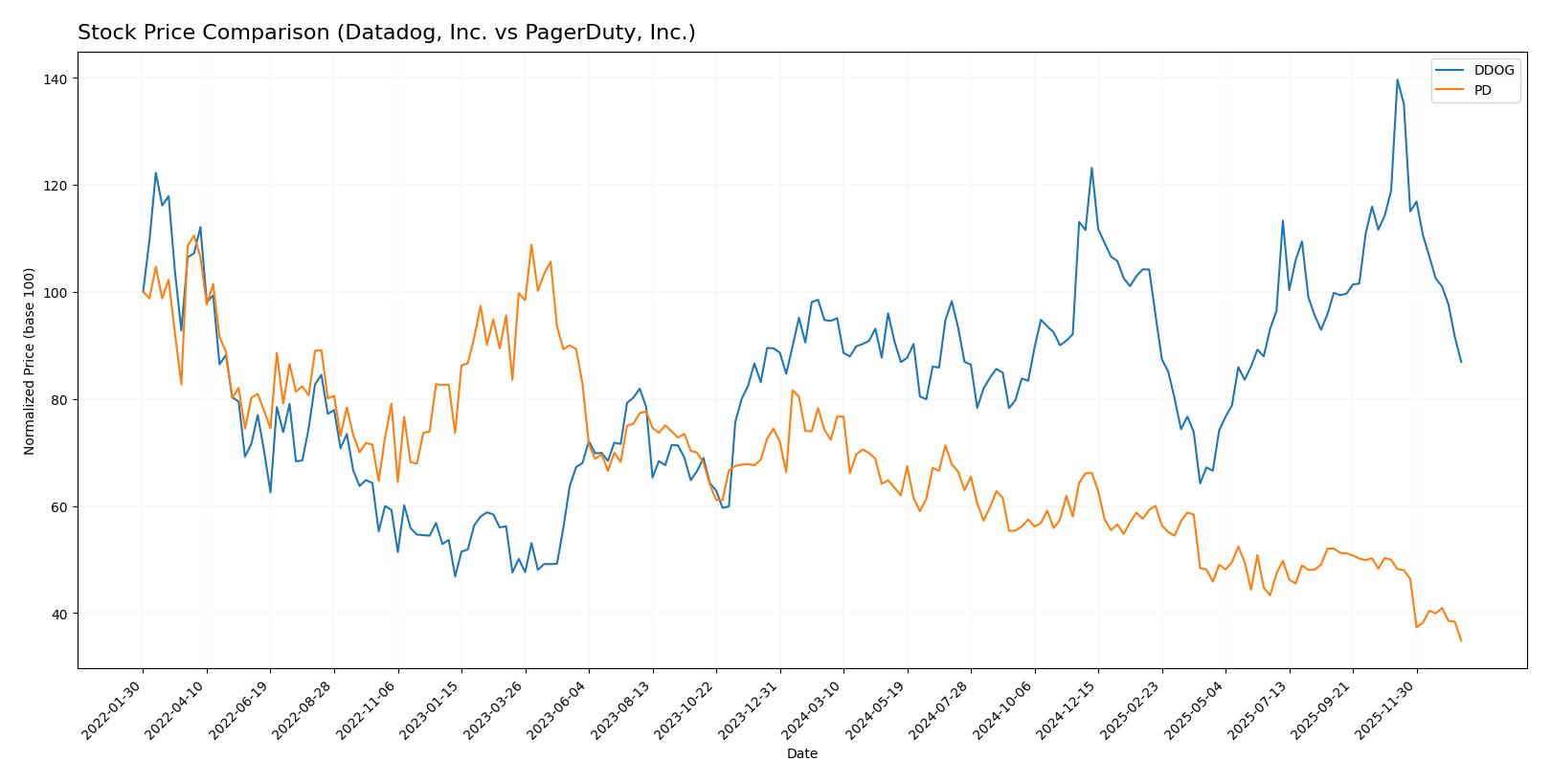

The stock price movements of Datadog, Inc. (DDOG) and PagerDuty, Inc. (PD) over the past 12 months reveal bearish trends with notable deceleration, differing volatility profiles, and pronounced recent declines in both stocks.

Trend Analysis

Datadog, Inc. (DDOG) experienced an 8.1% price decline over the past year, indicating a bearish trend with deceleration. The stock showed high volatility, with prices ranging from 87.93 to 191.24 and a standard deviation of 18.63.

PagerDuty, Inc. (PD) recorded a sharper 51.76% price drop over the same period, also bearish with deceleration. It exhibited lower volatility, fluctuating between 11.22 and 24.66, with a standard deviation of 2.92.

Comparing both, Datadog delivered the highest market performance despite its decline, as PagerDuty faced a substantially larger percentage decrease in stock price over the past year.

Target Prices

Analysts present a clear target price consensus for Datadog, Inc. and PagerDuty, Inc., reflecting varied upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Datadog, Inc. | 215 | 105 | 177.67 |

| PagerDuty, Inc. | 19 | 15 | 16.2 |

The consensus target prices for Datadog and PagerDuty suggest potential upside from their current prices of $119.02 and $11.22, respectively, indicating positive analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Datadog, Inc. and PagerDuty, Inc.:

Rating Comparison

Datadog Rating

- Rating: C+, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable DCF valuation.

- ROE Score: 2, reflecting moderate efficiency in generating profit from equity.

- ROA Score: 3, moderate effectiveness in utilizing assets.

- Debt To Equity Score: 2, moderate financial risk from debt levels.

- Overall Score: 2, reflecting a moderate overall financial standing.

PagerDuty Rating

- Rating: A-, considered very favorable by analysts.

- Discounted Cash Flow Score: 5, showing very favorable DCF valuation.

- ROE Score: 5, indicating very favorable efficiency in profit generation.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable due to higher debt risk.

- Overall Score: 4, indicating a favorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, PagerDuty holds higher ratings and scores than Datadog in most categories, including overall, DCF, ROE, and ROA scores. Datadog has a better debt-to-equity score, but PagerDuty is overall better rated by analysts.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Datadog, Inc. and PagerDuty, Inc.:

Datadog Scores

- Altman Z-Score: 11.37, indicating a safe zone and low bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

PagerDuty Scores

- Altman Z-Score: 1.26, indicating a distress zone and high bankruptcy risk.

- Piotroski Score: 7, classified as strong financial strength.

Which company has the best scores?

Datadog shows a significantly higher Altman Z-Score, placing it well within the safe zone, while PagerDuty is in the distress zone. PagerDuty has a slightly stronger Piotroski Score, but overall, Datadog’s scores indicate better financial stability based on the provided data.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Datadog, Inc. and PagerDuty, Inc.:

Datadog, Inc. Grades

This table presents recent grades from reputable financial institutions covering Datadog, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Hold | 2026-01-07 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-07 |

Overall, Datadog’s grades trend toward positive ratings with multiple “Buy,” “Overweight,” and “Outperform” designations, reflecting optimism from major financial analysts.

PagerDuty, Inc. Grades

This table presents recent grades from reputable financial institutions covering PagerDuty, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-07 |

| RBC Capital | Downgrade | Sector Perform | 2026-01-05 |

| TD Cowen | Maintain | Buy | 2025-11-26 |

| Craig-Hallum | Downgrade | Hold | 2025-11-26 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-26 |

| RBC Capital | Maintain | Outperform | 2025-11-26 |

| Truist Securities | Maintain | Buy | 2025-11-19 |

| Baird | Maintain | Neutral | 2025-09-04 |

| RBC Capital | Maintain | Outperform | 2025-09-04 |

| Canaccord Genuity | Maintain | Buy | 2025-09-04 |

PagerDuty’s grades show a mixed pattern with some downgrades alongside maintained “Buy” and “Outperform” ratings, suggesting a more cautious analyst outlook.

Which company has the best grades?

Datadog holds stronger and more consistent grades, predominantly “Buy” and “Overweight,” whereas PagerDuty has a more mixed profile with downgrades and “Hold” ratings. This disparity may influence investors seeking steadier analyst confidence.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Datadog, Inc. (DDOG) and PagerDuty, Inc. (PD) based on the most recent financial and operational data.

| Criterion | Datadog, Inc. (DDOG) | PagerDuty, Inc. (PD) |

|---|---|---|

| Diversification | Moderate product and service range; focused on cloud monitoring and analytics | Limited product range; mainly incident response software |

| Profitability | Slightly profitable with 6.85% net margin; ROIC 1.07% but below cost of capital | Unprofitable with -9.14% net margin; negative ROIC at -9.66% |

| Innovation | High innovation with growing ROIC trend and strong fixed asset turnover | Innovation visible in fixed asset turnover but overall profitability weak |

| Global presence | Strong global cloud presence and solid liquidity ratios | Smaller global footprint; higher debt levels restrict expansion |

| Market Share | Significant player in cloud monitoring with favorable liquidity and coverage | Niche market incident management provider with financial challenges |

Key takeaways: Both companies are currently shedding value as their ROIC remains below WACC. Datadog shows improving profitability and stronger financial health, while PagerDuty faces more pronounced profitability and leverage issues. Investors should weigh Datadog’s growth potential against PagerDuty’s financial risks.

Risk Analysis

Below is a comparative risk assessment table for Datadog, Inc. (DDOG) and PagerDuty, Inc. (PD) based on the most recent financial and market data.

| Metric | Datadog, Inc. (DDOG) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Risk | Beta 1.26 – Moderate volatility, higher sensitivity to market swings | Beta 0.63 – Lower volatility, more stable price movements |

| Debt level | Debt-to-Equity 0.68 (neutral), Debt-to-Assets 31.8% (neutral) | Debt-to-Equity 3.57 (unfavorable), Debt-to-Assets 50% (high leverage) |

| Regulatory Risk | Moderate, US-based software with standard compliance requirements | Moderate, US-based but with international exposure, possible evolving regulations impact |

| Operational Risk | Medium, with 6,500 employees and complex SaaS platform operations | Medium, smaller workforce (1,242) but dependent on ML and real-time data operations |

| Environmental Risk | Low, technology sector with minimal direct environmental impact | Low, similar sector and minimal environmental footprint |

| Geopolitical Risk | Moderate, exposure in North America and international markets | Moderate, US and Japan markets, susceptible to trade tensions |

The most impactful and likely risks differ significantly. PagerDuty’s high debt levels and negative interest coverage pose serious financial risks, compounded by an Altman Z-Score in the distress zone, suggesting bankruptcy risk. Datadog shows better financial stability with a safe zone Altman score, but its high valuation multiples and moderate market volatility may affect downside risk during market downturns.

Which Stock to Choose?

Datadog, Inc. (DDOG) shows a strong income evolution with 26.12% revenue growth in 2024 and a favorable net margin of 6.85%. Despite moderate profitability ratios and a neutral debt level, it carries a slightly unfavorable rating and is considered a slight value destroyer with improving ROIC.

PagerDuty, Inc. (PD) has a positive income growth trend but posts a negative net margin of -9.14% and weak profitability ratios. Its debt levels and interest coverage are unfavorable, though it holds a very favorable rating overall and is also seen as a slight value destroyer with slowly improving profitability.

For investors prioritizing growth and income stability, DDOG’s improving profitability and stronger income statement might appear more appealing. Conversely, risk-tolerant investors focusing on potential turnaround opportunities could find PD’s favorable rating and gradual ROIC improvement noteworthy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Datadog, Inc. and PagerDuty, Inc. to enhance your investment decisions: