In today’s fast-evolving tech landscape, Datadog, Inc. and monday.com Ltd. stand out as innovative leaders in software applications. Both companies operate in the cloud-based software sector, offering tools that enhance business productivity and operational insight. Their shared focus on scalable, user-friendly platforms makes them compelling candidates for comparison. In this article, I will help you decide which company presents the most attractive opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Datadog and monday.com by providing an overview of these two companies and their main differences.

Datadog Overview

Datadog, Inc. provides a cloud-based monitoring and analytics platform aimed at developers, IT operations teams, and business users. Its SaaS platform integrates infrastructure monitoring, application performance, log management, and security monitoring, delivering real-time observability across technology stacks. Founded in 2010 and headquartered in New York City, Datadog serves clients globally and employs around 6,500 people.

monday.com Overview

monday.com Ltd. develops cloud-based software applications including its Work OS, a visual work operating system composed of modular building blocks for work management. The company serves organizations worldwide across various sectors with solutions in marketing, CRM, project management, and software development. Founded in 2012 and based in Tel Aviv, monday.com employs about 2,500 full-time staff and focuses on flexible, customizable software tools.

Key similarities and differences

Both companies operate in the software application sector, offering cloud-based platforms designed to improve business productivity and operations. Datadog focuses on real-time monitoring and analytics for IT infrastructure, while monday.com provides a visual, modular work management system aimed at broader organizational workflows. Despite similar betas near 1.25, Datadog’s market cap at $41.7B is significantly larger than monday.com’s $6.5B, reflecting differing scale and market presence.

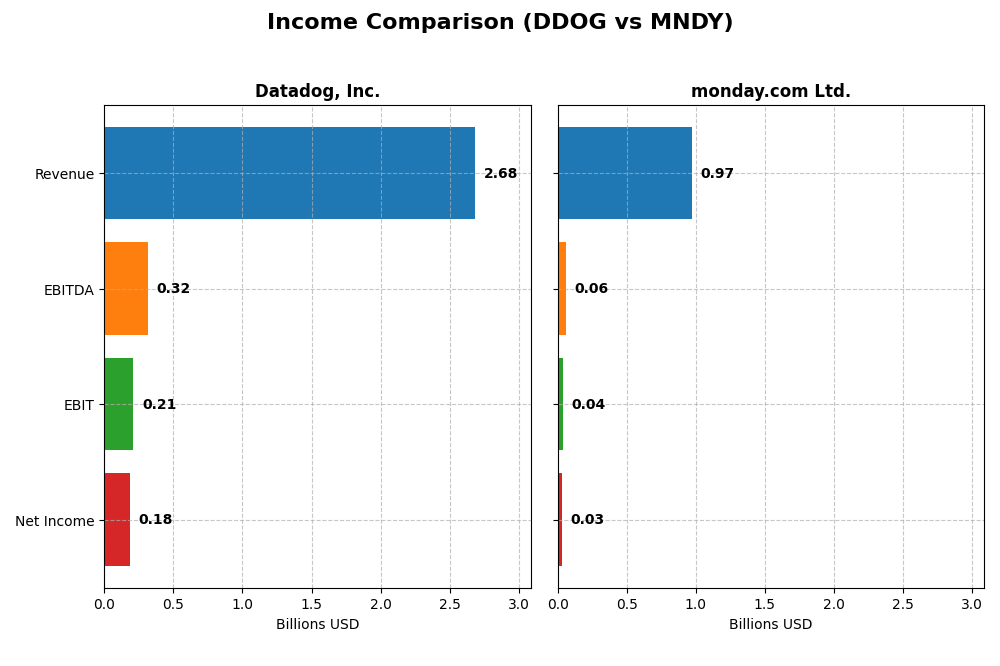

Income Statement Comparison

This table compares the key income statement metrics for Datadog, Inc. and monday.com Ltd. for their most recent fiscal year, 2024.

| Metric | Datadog, Inc. (DDOG) | monday.com Ltd. (MNDY) |

|---|---|---|

| Market Cap | 41.7B | 6.5B |

| Revenue | 2.68B | 972M |

| EBITDA | 318M | 58M |

| EBIT | 211M | 40M |

| Net Income | 184M | 32M |

| EPS | 0.55 | 0.65 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Datadog, Inc.

Datadog exhibited robust revenue growth from 603M in 2020 to 2.68B in 2024, with net income turning positive and rising to 184M in 2024. Margins improved notably, with gross margin around 80.8% and net margin reaching 6.85%. The latest year showed strong growth momentum, with revenue and net income surging over 26% and 279% respectively, highlighting improved profitability.

monday.com Ltd.

monday.com’s revenue advanced from 161M in 2020 to 972M in 2024, while net income recovered from heavy losses to a positive 32M in 2024. Its gross margin is higher at 89.3%, though net margin remains modest at 3.33%. The most recent year recorded a strong rebound with 33% revenue growth and a substantial net margin improvement, reflecting operational leverage despite ongoing challenges.

Which one has the stronger fundamentals?

Datadog demonstrates stronger fundamentals with higher absolute revenue and net income, coupled with more significant net margin expansion and consistent profitability gains. monday.com shows impressive revenue growth and a higher gross margin, but lower net margin and smaller net income base. Both companies present favorable income statements, yet Datadog’s margin stability and scale offer a more robust financial profile.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Datadog, Inc. (DDOG) and monday.com Ltd. (MNDY) based on their most recent fiscal year 2024 data.

| Ratios | Datadog, Inc. (DDOG) | monday.com Ltd. (MNDY) |

|---|---|---|

| ROE | 6.77% | 3.14% |

| ROIC | 1.07% | -1.73% |

| P/E | 261.4 | 363.0 |

| P/B | 17.7 | 11.4 |

| Current Ratio | 2.64 | 2.66 |

| Quick Ratio | 2.64 | 2.66 |

| D/E (Debt-to-Equity) | 0.68 | 0.10 |

| Debt-to-Assets | 31.8% | 6.3% |

| Interest Coverage | 7.68 | 0 |

| Asset Turnover | 0.46 | 0.58 |

| Fixed Asset Turnover | 6.72 | 7.13 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Datadog, Inc.

Datadog’s ratios show a mixed picture with a slightly unfavorable overall evaluation. The company has favorable liquidity ratios, such as a current ratio of 2.64 and strong interest coverage at 29.85, indicating solid short-term financial health. However, profitability ratios like ROE (6.77%) and ROIC (1.07%) are unfavorable, and valuation multiples such as a PE of 261.42 and PB of 17.7 are high. Datadog does not pay dividends, reflecting a reinvestment strategy focused on growth and innovation.

monday.com Ltd.

monday.com presents a neutral overall ratio evaluation, with favorable liquidity and leverage metrics, including a current ratio of 2.66 and a low debt-to-equity of 0.1. Profitability remains weak, with a net margin of 3.33% and negative ROIC at -1.73%. High valuation multiples persist, signaled by a PE of 362.98. The absence of dividends aligns with monday.com’s growth phase and investment in R&D and expansion efforts.

Which one has the best ratios?

monday.com holds a slightly better standing with a neutral global ratios opinion, bolstered by stronger leverage and interest coverage ratios. Datadog’s slightly unfavorable rating stems from higher valuation multiples and weaker profitability. Both companies lack dividend payments, emphasizing growth over income, but monday.com’s balance of favorable and neutral ratios places it ahead in this comparison.

Strategic Positioning

This section compares the strategic positioning of Datadog and monday.com, including market position, key segments, and exposure to disruption:

Datadog

- Strong presence in cloud monitoring with global competition pressure in SaaS infrastructure tools.

- Key drivers include infrastructure monitoring, application and security analytics, collaboration tools.

- Faces technological disruption from emerging cloud and security innovations but maintains integrative platform.

monday.com

- Focused on cloud-based Work OS and modular software for work management internationally.

- Business segments include marketing, CRM, project management, and software development solutions.

- Exposed to rapid shifts in work management software and evolving customer needs in multiple sectors.

Datadog vs monday.com Positioning

Datadog pursues a diversified approach across infrastructure monitoring and security, leveraging broad platform integration. monday.com concentrates on modular work operating systems tailored to diverse business functions, emphasizing flexibility but narrower core offerings.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOAT evaluations, shedding value despite growing ROIC trends, indicating improving profitability but ongoing challenges in sustaining competitive advantages. Neither currently demonstrates a strong economic moat based on ROIC versus WACC metrics.

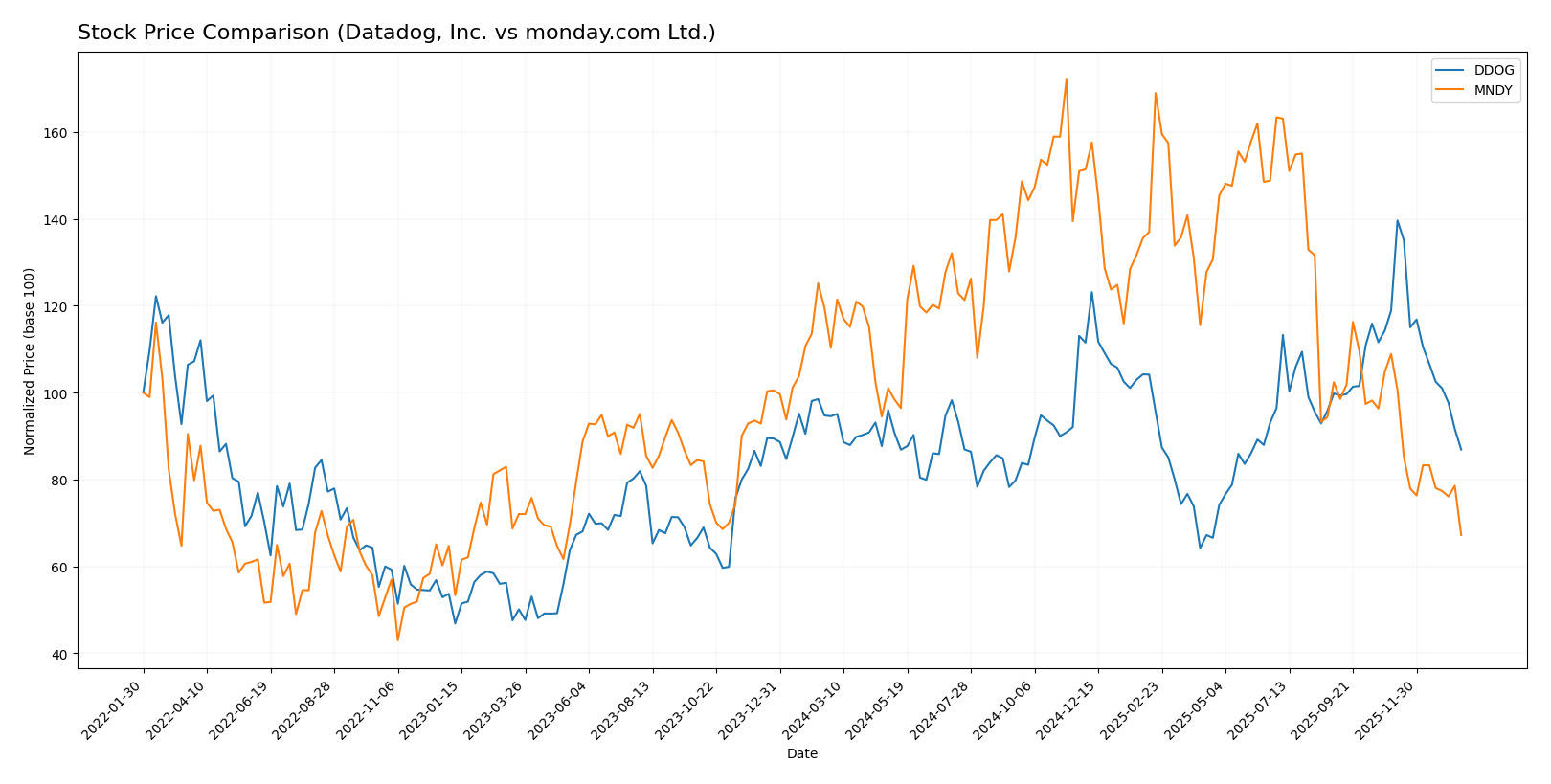

Stock Comparison

The stock price movements of Datadog, Inc. (DDOG) and monday.com Ltd. (MNDY) over the past year reveal notable bearish trends with significant declines and decelerating momentum, reflecting increased selling pressure and market volatility.

Trend Analysis

Datadog, Inc. (DDOG) experienced an 8.1% price decrease over the past 12 months, indicating a bearish trend with decelerating negative momentum. The stock showed a high volatility level, with prices ranging from 87.93 to 191.24.

monday.com Ltd. (MNDY) showed a more pronounced bearish trend with a 39.06% decline in stock price over the same period, accompanied by deceleration and higher volatility, fluctuating between 126.7 and 324.31.

Comparing both stocks, MNDY delivered the lowest market performance with a larger price drop than DDOG, confirming a stronger bearish trend for monday.com Ltd. over the past year.

Target Prices

Here is the current target price consensus from verified analysts for Datadog, Inc. and monday.com Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Datadog, Inc. | 215 | 105 | 177.67 |

| monday.com Ltd. | 330 | 194 | 264.42 |

Analysts expect significant upside potential for both stocks, with consensus targets well above current prices of $119.02 for Datadog and $126.70 for monday.com. This suggests positive growth outlooks in their respective software sectors.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Datadog, Inc. and monday.com Ltd.:

Rating Comparison

Datadog, Inc. Rating

- Rating: C+, classified as Very Favorable

- Discounted Cash Flow Score: 4, indicating favorable DCF

- ROE Score: 2, showing moderate efficiency in equity use

- ROA Score: 3, reflecting moderate asset utilization

- Debt To Equity Score: 2, moderate financial risk

- Overall Score: 2, moderate overall financial standing

monday.com Ltd. Rating

- Rating: B-, classified as Very Favorable

- Discounted Cash Flow Score: 4, indicating favorable DCF

- ROE Score: 3, showing moderate efficiency in equity use

- ROA Score: 3, reflecting moderate asset utilization

- Debt To Equity Score: 3, moderate financial risk

- Overall Score: 3, moderate overall financial standing

Which one is the best rated?

monday.com Ltd. holds a higher rating of B- compared to Datadog’s C+, with stronger scores in ROE, debt to equity, and overall score. Both share the same favorable discounted cash flow and moderate ROA scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Datadog, Inc. and monday.com Ltd.:

DDOG Scores

- Altman Z-Score: 11.37, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

MNDY Scores

- Altman Z-Score: 6.33, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, classified as average financial strength.

Which company has the best scores?

Datadog has a higher Altman Z-Score and Piotroski Score than monday.com, indicating stronger financial stability and slightly better financial strength based on these metrics.

Grades Comparison

The following section compares the recent grades assigned to Datadog, Inc. and monday.com Ltd. by verified grading companies:

Datadog, Inc. Grades

This table summarizes recent grade changes and actions by recognized financial institutions for Datadog, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Hold | 2026-01-07 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-07 |

Overall, Datadog, Inc. has predominantly maintained or upgraded to positive ratings, with multiple “Buy” and “Overweight” grades, indicating generally favorable analyst sentiment.

monday.com Ltd. Grades

This table details recent grades and actions from credible grading entities for monday.com Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-01-15 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-23 |

| Tigress Financial | Maintain | Buy | 2025-12-11 |

| Baird | Maintain | Outperform | 2025-11-11 |

| Wells Fargo | Maintain | Overweight | 2025-11-11 |

| DA Davidson | Maintain | Buy | 2025-11-11 |

| Morgan Stanley | Maintain | Overweight | 2025-11-11 |

| Piper Sandler | Maintain | Overweight | 2025-11-11 |

monday.com Ltd. consistently receives strong buy-side ratings with numerous “Buy,” “Overweight,” and “Outperform” grades, reflecting steady positive analyst confidence.

Which company has the best grades?

Both companies enjoy predominantly positive analyst grades with a consensus “Buy” rating; however, Datadog shows a recent upgrade trend, while monday.com maintains steady strong buy and outperform ratings, influencing investor perception of growth potential and risk.

Strengths and Weaknesses

Below is a comparison of the key strengths and weaknesses of Datadog, Inc. (DDOG) and monday.com Ltd. (MNDY) based on their recent financial performance and competitive positioning.

| Criterion | Datadog, Inc. (DDOG) | monday.com Ltd. (MNDY) |

|---|---|---|

| Diversification | Moderate product range, mostly cloud monitoring and analytics | Focused on work operating systems, less diversified |

| Profitability | Net margin 6.85% (neutral), ROIC 1.07% (unfavorable), growing profitability but still shedding value | Net margin 3.33% (unfavorable), ROIC -1.73% (unfavorable), improving but low profitability |

| Innovation | High innovation in cloud-native monitoring, strong fixed asset turnover (7x) | Innovative in workflow software, good fixed asset turnover (7.13x) |

| Global presence | Strong global cloud infrastructure presence | Growing global SaaS footprint but smaller scale |

| Market Share | Leading in cloud monitoring and analytics segment | Niche player in work OS with growing market share |

Key takeaways: Both companies are currently shedding value as ROIC remains below WACC, despite improvements in profitability. Datadog shows stronger margins and a more established global presence, while monday.com benefits from a lighter debt load and strong operational efficiency. Caution is advised due to high valuations and mixed profitability metrics.

Risk Analysis

Below is a comparative table highlighting key risk metrics for Datadog, Inc. (DDOG) and monday.com Ltd. (MNDY) based on the most recent data from 2024.

| Metric | Datadog, Inc. (DDOG) | monday.com Ltd. (MNDY) |

|---|---|---|

| Market Risk | Beta 1.263 (moderate) | Beta 1.255 (moderate) |

| Debt Level | Debt/Equity 0.68 (neutral) | Debt/Equity 0.10 (favorable) |

| Regulatory Risk | US-based, moderate | Israel-based, moderate |

| Operational Risk | Large scale with 6,500 employees, SaaS complexity | Smaller scale, 2,508 employees, SaaS complexity |

| Environmental Risk | Moderate, technology sector standard | Moderate, technology sector standard |

| Geopolitical Risk | Low (US-based) | Moderate to High (Israel-based) |

The most impactful and likely risks are market volatility for both companies, given their beta around 1.26, indicating sensitivity to market swings. monday.com’s geopolitical risk is elevated due to its Israel location, potentially affecting operations and investor sentiment. Datadog carries moderate debt with stable interest coverage, while monday.com’s low debt limits financial risk. Investors should weigh geopolitical exposure against growth prospects.

Which Stock to Choose?

Datadog, Inc. (DDOG) exhibits strong income growth with a 344.81% revenue increase over five years and a favorable 92.86% positive income statement evaluation. Despite slightly unfavorable financial ratios and a moderate overall rating of C+, it shows improving profitability and manageable debt levels.

monday.com Ltd. (MNDY) shows even higher revenue growth at 503.26% over five years and a solid 85.71% favorable income statement evaluation. Its financial ratios are neutral with a B- rating, reflecting lower debt and better coverage, though profitability metrics remain modest compared to DDOG.

Investors seeking growth potential might find MNDY appealing given its robust revenue expansion and stable financial ratios, while those valuing improving profitability amid moderate financial challenges could see DDOG as fitting. The choice could depend on one’s tolerance for financial ratio variability and preference for income growth versus profitability trends.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Datadog, Inc. and monday.com Ltd. to enhance your investment decisions: