Home > Comparison > Technology > DDOG vs FICO

The strategic rivalry between Datadog, Inc. and Fair Isaac Corporation shapes the evolution of the technology sector’s software application landscape. Datadog operates a cloud-based monitoring and analytics platform focused on real-time observability, while Fair Isaac delivers advanced analytic and decision management software with a strong emphasis on scoring solutions. This analysis pits Datadog’s growth-centric SaaS model against Fair Isaac’s established, diversified software offerings to identify the superior risk-adjusted investment opportunity.

Table of contents

Companies Overview

Datadog and Fair Isaac Corporation both hold influential roles in the software application industry, shaping enterprise decision-making and cloud monitoring.

Datadog, Inc.: Cloud Monitoring Powerhouse

Datadog dominates the cloud monitoring and analytics market. It generates revenue by offering a SaaS platform that integrates infrastructure, application, and security monitoring for real-time observability. In 2026, its strategic focus sharpens on expanding developer-focused observability and enhancing cloud security capabilities to meet growing enterprise demands.

Fair Isaac Corporation: Analytics and Decision Automation Leader

Fair Isaac Corporation excels in analytic software and decision management solutions. It earns revenue through its Scores and Software segments, providing scoring analytics and configurable decisioning software worldwide. The firm’s 2026 strategy emphasizes advancing modular platforms and broadening professional services to automate complex business decision processes.

Strategic Collision: Similarities & Divergences

Both companies deliver software-driven intelligence but with distinct philosophies: Datadog prioritizes a unified SaaS observability platform, while Fair Isaac focuses on customizable analytic decisioning solutions. They compete primarily in enterprise software but target different operational layers—Datadog on monitoring infrastructure; Fair Isaac on decision automation. This divergence creates unique investment profiles shaped by their contrasting growth trajectories and market niches.

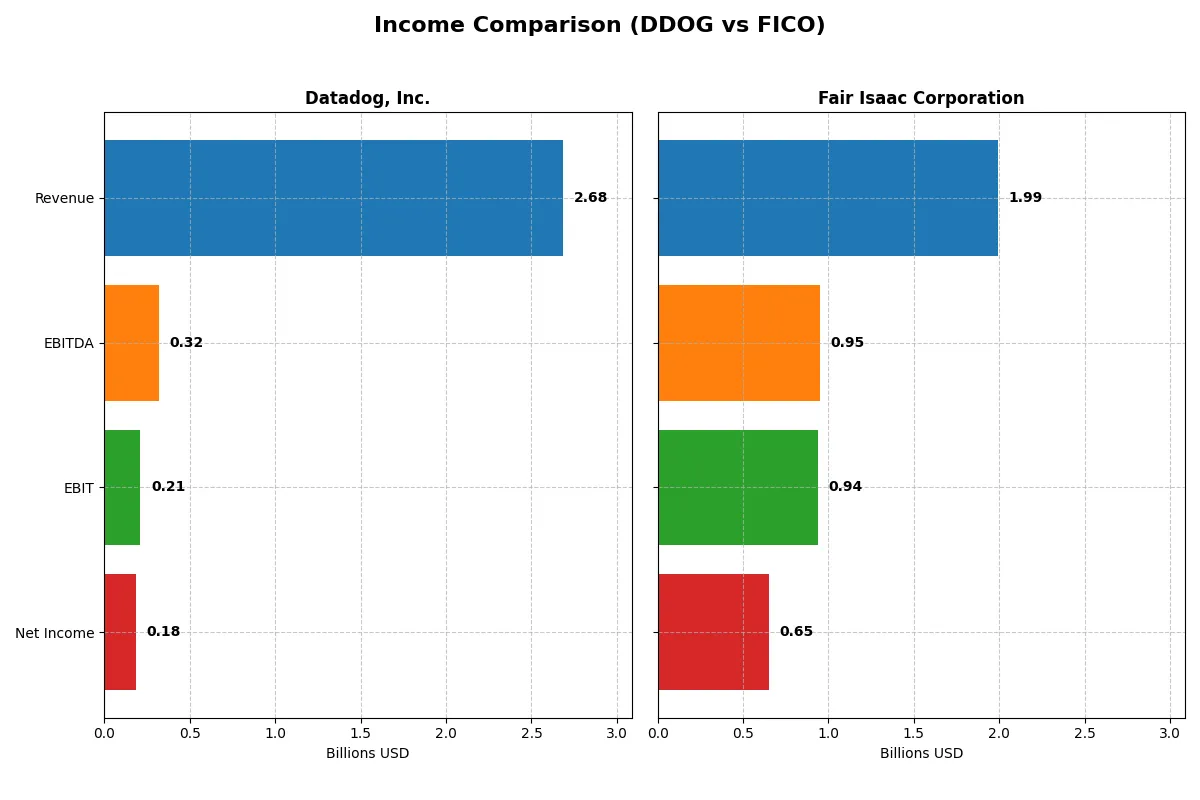

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Datadog, Inc. (DDOG) | Fair Isaac Corporation (FICO) |

|---|---|---|

| Revenue | 2.68B | 1.99B |

| Cost of Revenue | 516M | 354M |

| Operating Expenses | 2.11B | 712M |

| Gross Profit | 2.17B | 1.64B |

| EBITDA | 318M | 951M |

| EBIT | 211M | 936M |

| Interest Expense | 7M | 134M |

| Net Income | 184M | 652M |

| EPS | 0.55 | 26.9 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison uncovers the true operational efficiency behind each company’s financial performance and growth trajectory.

Datadog, Inc. Analysis

Datadog’s revenue soared from 603M in 2020 to 2.68B in 2024, reflecting a robust growth trend. Net income swung from a loss of 25M in 2020 to a positive 184M in 2024, signaling improving profitability. The company sustains a strong gross margin above 80%, while net margin climbed to a favorable 6.85% in 2024, highlighting rising operational leverage and efficiency.

Fair Isaac Corporation Analysis

Fair Isaac grew revenue steadily from 1.32B in 2021 to 1.99B in 2025. Its net income expanded from 392M to 652M over the same period, maintaining a commanding net margin of 32.75%. The gross margin remained solid above 82%, with an EBIT margin near 47%, demonstrating exceptional cost control and profitability momentum in the latest fiscal year.

Margin Power vs. Revenue Scale

Fair Isaac commands superior profitability with a net margin nearly five times that of Datadog, underpinned by stable revenue growth. Datadog impresses with rapid top-line expansion and margin improvement but lags behind in absolute profitability. For investors, Fair Isaac’s high-margin profile offers steady income, while Datadog’s growth story appeals to those prioritizing scale and margin expansion potential.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Datadog, Inc. (DDOG) | Fair Isaac Corporation (FICO) |

|---|---|---|

| ROE | 6.77% | -37.34% |

| ROIC | 1.07% | 52.96% |

| P/E | 261.4x | 55.6x |

| P/B | 17.7x | -20.8x |

| Current Ratio | 2.64 | 0.83 |

| Quick Ratio | 2.64 | 0.83 |

| D/E | 0.68 | -1.76 |

| Debt-to-Assets | 31.8% | 164.6% |

| Interest Coverage | 7.68x | 6.92x |

| Asset Turnover | 0.46 | 1.07 |

| Fixed Asset Turnover | 6.72 | 21.20 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and highlighting operational strengths critical for investment decisions.

Datadog, Inc.

Datadog’s profitability shows a modest 6.77% ROE, signaling limited shareholder returns. Its valuation is stretched, with a P/E of 261.42 and P/S around 18, reflecting high growth expectations. The company reinvests heavily in R&D, evident from a 43% R&D-to-revenue ratio, foregoing dividends to fuel innovation and expansion.

Fair Isaac Corporation

Fair Isaac delivers strong profitability with a 32.75% net margin and a robust 52.96% ROIC, indicating operational efficiency. Its P/E stands at 55.64, expensive but less stretched than Datadog. The firm pays no dividends, instead investing roughly 9.5% of revenue in R&D to sustain competitive advantage and growth.

Premium Valuation vs. Operational Safety

Datadog’s valuation appears highly stretched with weak returns, while Fair Isaac balances strong profitability against a still-premium price. Investors seeking operational safety and efficiency may prefer Fair Isaac’s profile; those betting on growth might consider Datadog’s reinvestment strategy despite higher risk.

Which one offers the Superior Shareholder Reward?

I observe Datadog (DDOG) and Fair Isaac Corporation (FICO) both do not pay dividends, focusing instead on reinvestment and buybacks. Datadog’s zero dividend yield and payout ratio reflect its growth reinvestment, with modest buyback intensity. FICO, also dividend-free, aggressively repurchases shares, supporting its 31.8% net margin and strong free cash flow of $31.8/share in 2025. Datadog’s buybacks lag behind, with a lower free cash flow per share of $2.5 in 2024. FICO’s high operating margin and sustained buybacks signal a superior, more sustainable total shareholder return. I conclude FICO offers a more attractive shareholder reward in 2026.

Comparative Score Analysis: The Strategic Profile

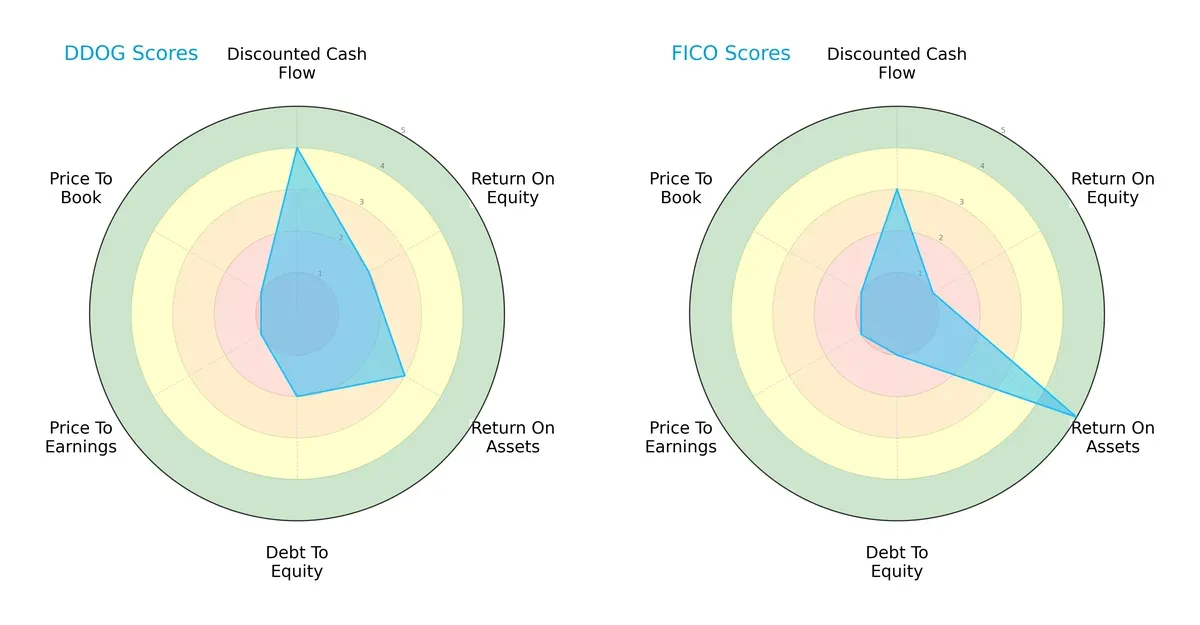

The radar chart reveals the fundamental DNA and trade-offs of Datadog, Inc. and Fair Isaac Corporation, highlighting their financial strengths and valuation challenges:

Datadog shows a stronger discounted cash flow score (4 vs. 3) and better return on equity (2 vs. 1), indicating more efficient capital use. Fair Isaac excels in return on assets (5 vs. 3), signaling superior asset utilization. Both have weak debt-to-equity and valuation scores, but Datadog’s profile is more balanced, while Fair Isaac relies heavily on asset efficiency.

Bankruptcy Risk: Solvency Showdown

Datadog’s Altman Z-Score of 12.46 slightly edges out Fair Isaac’s 12.20, both firmly in the safe zone. This signals robust solvency and low bankruptcy risk for both firms in the current economic cycle:

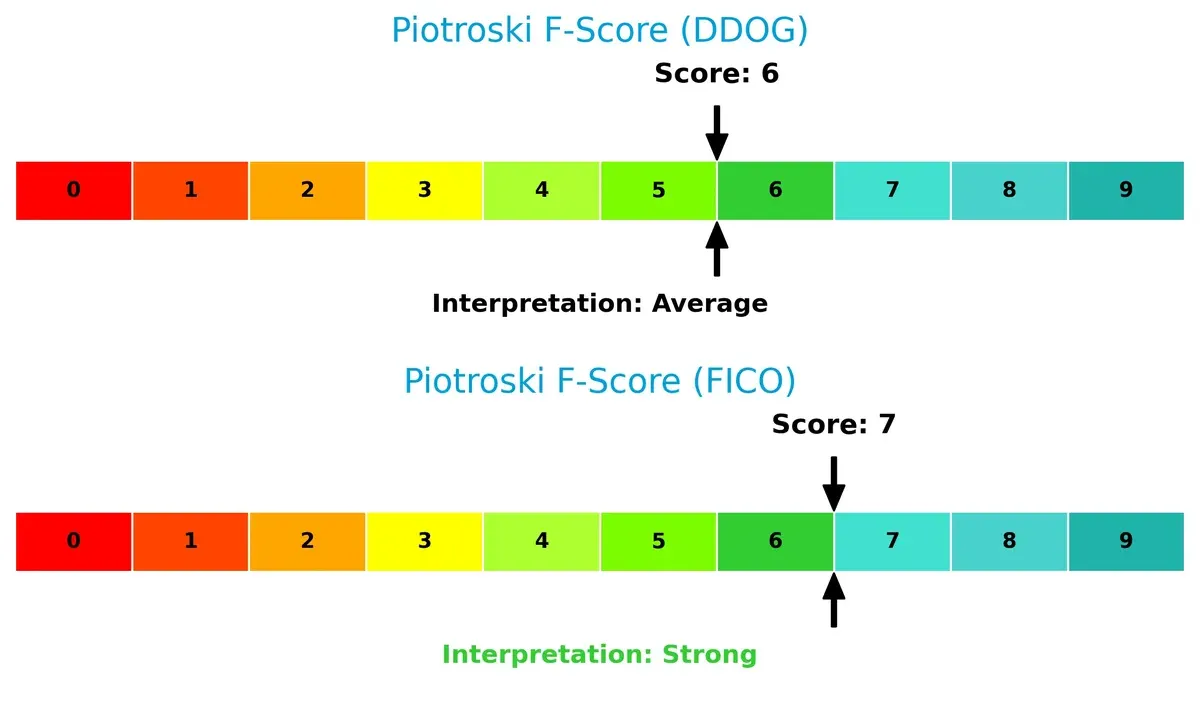

Financial Health: Quality of Operations

Fair Isaac’s Piotroski F-Score of 7 surpasses Datadog’s 6, indicating stronger internal financial health. Datadog’s average score suggests some operational red flags compared to Fair Isaac’s more consistent metrics:

How are the two companies positioned?

This section dissects the operational DNA of Datadog and Fair Isaac by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and determine which model offers the most resilient, sustainable competitive advantage today.

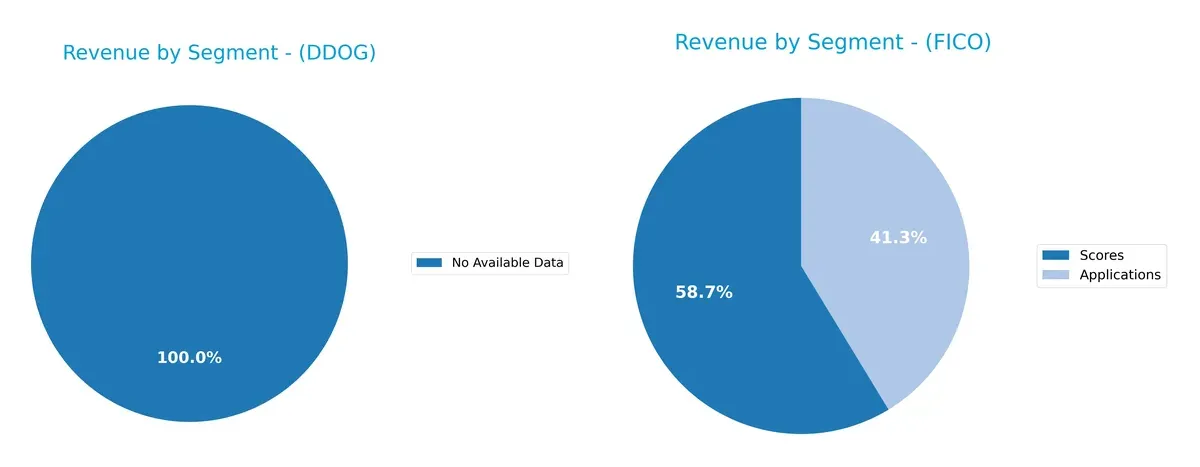

Revenue Segmentation: The Strategic Mix

This comparison dissects how Datadog, Inc. and Fair Isaac Corporation diversify their income streams and where their primary sector bets lie:

Datadog lacks segment data, so I cannot evaluate its revenue diversification. Fair Isaac leans on two main streams: Scores ($1.17B) and Applications ($822M) in 2025. Scores anchor its revenue, showing a semi-diversified approach. This mix reduces concentration risk compared to a single-segment dependency but still hinges on credit scoring dominance, reflecting strategic focus on financial analytics and decision sciences.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Datadog and Fair Isaac Corporation:

Datadog Strengths

- Strong liquidity with current and quick ratios at 2.64

- Favorable interest coverage at 29.85

- Growing international and North American revenues

Fair Isaac Corporation Strengths

- High net margin of 32.75%

- Strong ROIC at 52.96%

- Favorable debt to equity ratio

- High asset and fixed asset turnover

Datadog Weaknesses

- Unfavorable ROE and ROIC below WACC

- High valuation multiples (PE 261.42, PB 17.7)

- Low asset turnover

- No dividend yield

Fair Isaac Corporation Weaknesses

- Negative ROE at -37.34%

- Unfavorable current ratio at 0.83

- High debt to assets at 164.6%

- Negative PB value

- No dividend yield

Datadog shows solid liquidity but struggles with profitability and valuation metrics. Fair Isaac excels in profitability and asset efficiency but faces balance sheet risks and weak returns on equity. These contrasts highlight different strategic and financial challenges for each company.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from the relentless erosion of competition and market forces. Here’s how two tech firms stack up:

Datadog, Inc.: Emerging Switching Costs with Growing Profitability

Datadog banks on switching costs through its integrated cloud monitoring platform. Despite a slightly unfavorable ROIC vs. WACC, its soaring revenue and net income growth suggest a deepening moat as it expands internationally in 2026.

Fair Isaac Corporation: Durable Intangible Assets Cement Market Leadership

FICO’s moat stems from its proprietary analytics and scoring software, reflected in a very favorable ROIC exceeding WACC by 43%. Its solid margin expansion and steady growth forecast continued dominance and global market disruption.

Moat Strength Showdown: Switching Costs vs. Intangible Assets

FICO’s wider and more durable moat outperforms Datadog’s emerging switching costs. FICO’s superior capital efficiency and margin stability better position it to defend market share amid intensifying competition.

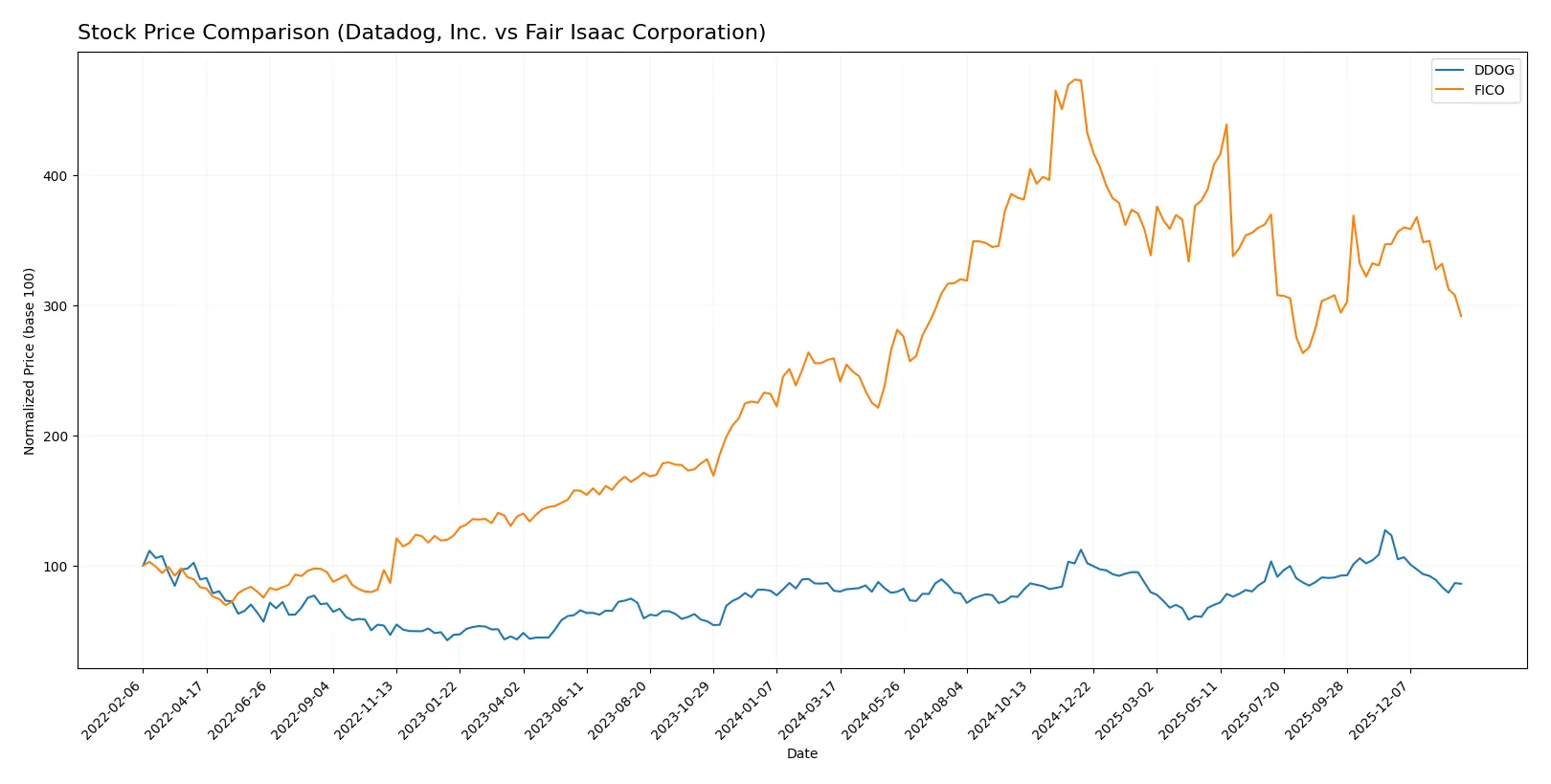

Which stock offers better returns?

Over the past year, both Datadog and Fair Isaac showed notable price gains, with recent declines marking a shift in trading dynamics and underlying momentum.

Trend Comparison

Datadog, Inc. stock rose 6.6% over the past 12 months, signaling a bullish but decelerating trend with a high volatility of 18.63 and a price range from 87.93 to 191.24.

Fair Isaac Corporation’s stock increased 12.51% in the same period, also bullish with deceleration, but experienced extreme volatility at 285.65, ranging between 1110.85 and 2375.03.

Fair Isaac delivered stronger market performance than Datadog, with a higher overall price increase despite both showing recent downward momentum.

Target Prices

Analysts present a positive outlook with solid upside potential for both Datadog, Inc. and Fair Isaac Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Datadog, Inc. | 105 | 215 | 175.84 |

| Fair Isaac Corporation | 1640 | 2400 | 2115 |

Datadog’s consensus target at 176 implies a 36% premium above its $129 current price, signaling bullish sentiment. Fair Isaac’s $2115 target suggests nearly 45% upside from its $1463 stock price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Datadog, Inc. Grades

The following table summarizes recent analyst grades for Datadog, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2026-01-30 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-27 |

| Stifel | Upgrade | Buy | 2026-01-22 |

| Mizuho | Maintain | Outperform | 2026-01-21 |

| TD Cowen | Maintain | Buy | 2026-01-21 |

| Citigroup | Maintain | Buy | 2026-01-16 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Hold | 2026-01-07 |

Fair Isaac Corporation Grades

Here are the latest analyst grades assigned to Fair Isaac Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-29 |

| Jefferies | Maintain | Buy | 2026-01-16 |

| Wells Fargo | Maintain | Overweight | 2026-01-14 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-11-06 |

| BMO Capital | Maintain | Outperform | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-10-14 |

| Barclays | Maintain | Overweight | 2025-10-02 |

| Needham | Maintain | Buy | 2025-10-02 |

Which company has the best grades?

Datadog, Inc. holds a strong consensus of buy and outperform ratings with recent upgrades. Fair Isaac Corporation also has predominantly buy and outperform grades but includes some neutral ratings. Datadog’s more frequent upgrades may suggest stronger near-term analyst confidence, potentially influencing investor sentiment.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Datadog, Inc. and Fair Isaac Corporation in the 2026 market environment:

1. Market & Competition

Datadog, Inc.

- Faces intense SaaS market competition with rapid innovation cycles and pricing pressure.

Fair Isaac Corporation

- Operates in a niche analytics market but faces disruption from AI entrants and evolving client demands.

2. Capital Structure & Debt

Datadog, Inc.

- Maintains moderate leverage with debt-to-equity at 0.68, indicating balanced financial risk.

Fair Isaac Corporation

- Shows a problematic debt profile with debt-to-assets at 165%, signaling potential solvency concerns.

3. Stock Volatility

Datadog, Inc.

- Beta of 1.26 implies above-market volatility, typical for tech growth stocks.

Fair Isaac Corporation

- Slightly higher beta at 1.29, reflecting sensitivity to market swings and sector shifts.

4. Regulatory & Legal

Datadog, Inc.

- Potential risks from data privacy laws impacting cloud monitoring services.

Fair Isaac Corporation

- Subject to regulations in financial data and scoring, increasing compliance costs and legal exposure.

5. Supply Chain & Operations

Datadog, Inc.

- Relies on cloud infrastructure providers; outages or price hikes could disrupt services.

Fair Isaac Corporation

- Dependent on software development and data accuracy; operational risks from integration complexity.

6. ESG & Climate Transition

Datadog, Inc.

- Growing pressure to reduce carbon footprint of data centers and improve governance transparency.

Fair Isaac Corporation

- Faces increasing investor demand for sustainable analytics practices and ethical AI deployment.

7. Geopolitical Exposure

Datadog, Inc.

- Global operations expose it to trade tensions and regulatory divergence in key markets.

Fair Isaac Corporation

- International client base subject to geopolitical risks, especially in emerging markets compliance.

Which company shows a better risk-adjusted profile?

Datadog’s biggest risk lies in fierce market competition and high valuation multiples. Fair Isaac’s critical weakness is its stretched capital structure and solvency red flags. Despite Datadog’s moderate debt, its high P/E and low ROIC raise valuation concerns. Fair Isaac’s financial leverage and liquidity gaps increase its vulnerability. Overall, Datadog offers a slightly better risk-adjusted profile, supported by strong Altman Z-scores and manageable debt, while Fair Isaac’s excessive debt signals higher financial risk amid sector uncertainty.

Final Verdict: Which stock to choose?

Datadog’s superpower lies in its rapid revenue and earnings growth, fueled by relentless innovation in cloud monitoring. However, its low return on invested capital versus cost of capital signals a point of vigilance. This stock suits investors chasing aggressive growth and willing to absorb elevated valuation risks.

Fair Isaac Corporation commands a durable competitive moat through its high-efficiency credit scoring platform and strong free cash flow generation. It offers better financial stability compared to Datadog, despite a modest current liquidity position. FICO fits well within a GARP (Growth at a Reasonable Price) portfolio seeking steady profitability with a widening moat.

If you prioritize high-growth potential and can tolerate valuation premiums, Datadog is a compelling choice due to its expanding top-line momentum. However, if you seek durable value creation and stronger capital efficiency, FICO outshines with its sustainable competitive advantage and financial resilience. Each stock aligns with distinct investor profiles demanding different risk-reward balances.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Datadog, Inc. and Fair Isaac Corporation to enhance your investment decisions: