In today’s fast-evolving technology landscape, Datadog, Inc. and DocuSign, Inc. stand out as leaders in software applications, each driving innovation in cloud monitoring and digital agreements respectively. Both companies compete within the broader tech sector, leveraging SaaS platforms to transform how businesses operate. This article will delve into their market positioning and growth strategies to help you decide which stock could be the smarter addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Datadog and DocuSign by providing an overview of these two companies and their main differences.

Datadog Overview

Datadog, Inc. offers a SaaS platform that delivers monitoring and analytics for developers, IT operations, and business users across cloud environments globally. Its integrated platform covers infrastructure monitoring, application performance, log management, and security, providing real-time observability and collaboration tools. Founded in 2010 and headquartered in New York City, Datadog is positioned as a key player in cloud-based software monitoring with a market cap of $41.7B.

DocuSign Overview

DocuSign, Inc. provides electronic signature software and digital agreement management solutions internationally. Its offerings include AI-driven contract lifecycle management, interactive guided forms, and secure signer identification, serving various sectors including real estate and government agencies. Founded in 2003 and based in San Francisco, DocuSign’s software facilitates digital agreement workflows with a market cap of $11.4B, emphasizing contract automation and compliance.

Key similarities and differences

Both Datadog and DocuSign operate in the software application industry with cloud-based SaaS models, targeting enterprise users to streamline critical business processes. However, Datadog focuses on monitoring and analytics of IT infrastructure and applications, enhancing operational visibility, while DocuSign specializes in digital transaction management and e-signature workflows. Their complementary solutions address different parts of enterprise digital transformation with distinct product suites and customer use cases.

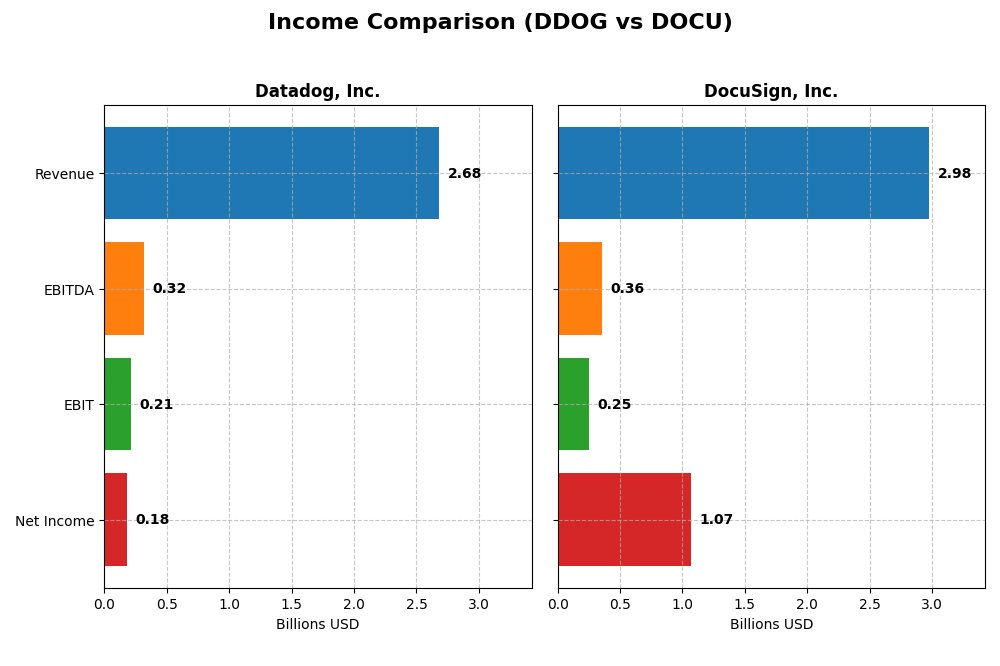

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Datadog, Inc. and DocuSign, Inc. based on their most recent fiscal year figures.

| Metric | Datadog, Inc. (DDOG) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Market Cap | 41.7B | 11.4B |

| Revenue | 2.68B | 2.98B |

| EBITDA | 318M | 357M |

| EBIT | 211M | 249M |

| Net Income | 184M | 1.07B |

| EPS | 0.55 | 5.23 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Datadog, Inc.

Datadog’s revenue increased significantly from $603M in 2020 to $2.68B in 2024, with net income turning positive and rising to $184M in 2024 from losses in prior years. Gross margin remained strong around 81%, while net margin improved to 6.85%. The most recent year showed notable growth in revenue (+26%) and net income (+200%), reflecting improving profitability and operational efficiency.

DocuSign, Inc.

DocuSign’s revenue grew steadily from $1.45B in 2021 to nearly $3B in 2025, with net income swinging from a loss of $243M in 2021 to a substantial profit of $1.07B in 2025. Gross margin stayed favorable near 79%, and net margin expanded sharply to 35.87%. Recent performance indicates solid growth in earnings and margins, though revenue growth slowed to 7.8% in the latest year.

Which one has the stronger fundamentals?

Both companies show favorable income statement evaluations with strong gross margins and improving net margins. Datadog demonstrates higher revenue growth rates and steady margin improvement, while DocuSign exhibits a larger net margin and impressive net income gains. Datadog’s rapid expansion contrasts with DocuSign’s high profitability, reflecting different growth and margin profiles supporting their respective fundamentals.

Financial Ratios Comparison

The table below compares key financial ratios for Datadog, Inc. and DocuSign, Inc. based on their most recent fiscal year data available, providing a snapshot of their financial health and valuation metrics.

| Ratios | Datadog, Inc. (2024) | DocuSign, Inc. (2025) |

|---|---|---|

| ROE | 6.77% | 53.32% |

| ROIC | 1.07% | 9.09% |

| P/E | 261.4 | 18.5 |

| P/B | 17.7 | 9.87 |

| Current Ratio | 2.64 | 0.81 |

| Quick Ratio | 2.64 | 0.81 |

| D/E | 0.68 | 0.06 |

| Debt-to-Assets | 31.8% | 3.1% |

| Interest Coverage | 7.68 | 129 |

| Asset Turnover | 0.46 | 0.74 |

| Fixed Asset Turnover | 6.72 | 7.28 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Datadog, Inc.

Datadog’s financial ratios show a mixed picture with a slightly unfavorable overall assessment. While liquidity ratios such as the current and quick ratios are favorable, profitability indicators like ROE and ROIC are unfavorable, and valuation multiples such as P/E and P/B are high, suggesting potential overvaluation. Datadog does not pay dividends, consistent with its reinvestment strategy and focus on growth in software monitoring and analytics.

DocuSign, Inc.

DocuSign presents a generally favorable ratio profile, with strong net margin and ROE reflecting solid profitability. Its debt levels and interest coverage ratios are favorable, indicating financial strength. However, liquidity ratios are somewhat weak, which may pose short-term concerns. Like Datadog, DocuSign does not pay dividends, likely prioritizing growth investment and technology development in electronic signature solutions.

Which one has the best ratios?

DocuSign holds a slightly favorable stance in its ratio evaluation, outperforming Datadog, which is slightly unfavorable overall. DocuSign’s stronger profitability, lower debt levels, and better interest coverage contrast with Datadog’s higher valuation multiples and weaker returns, despite Datadog’s stronger liquidity. Thus, DocuSign’s financial ratios appear more balanced for investors assessing risk and performance.

Strategic Positioning

This section compares the strategic positioning of Datadog and DocuSign, including market position, key segments, and exposure to technological disruption:

Datadog, Inc.

- Positioned in cloud monitoring with strong competition in SaaS-based infrastructure and application software.

- Focuses on cloud monitoring, application performance, security, and developer observability platforms.

- Faces technological disruption in cloud computing, monitoring automation, and AI-driven analytics solutions.

DocuSign, Inc.

- Positioned in electronic signature software with competition in digital agreement and contract lifecycle management.

- Key revenue from subscription and circulation of e-signature and contract lifecycle management services.

- Exposed to disruption through AI-enhanced contract analysis and digital workflow automation in agreement management.

Datadog vs DocuSign Positioning

Datadog targets diversified cloud monitoring and security segments across IT operations, while DocuSign concentrates on digital agreements and contract management. Datadog’s broader platform contrasts with DocuSign’s specialized subscription-driven business model.

Which has the best competitive advantage?

Datadog shows a slightly unfavorable MOAT with value destruction but improving profitability. DocuSign has a slightly favorable MOAT with growing profitability, indicating marginally better competitive positioning at present.

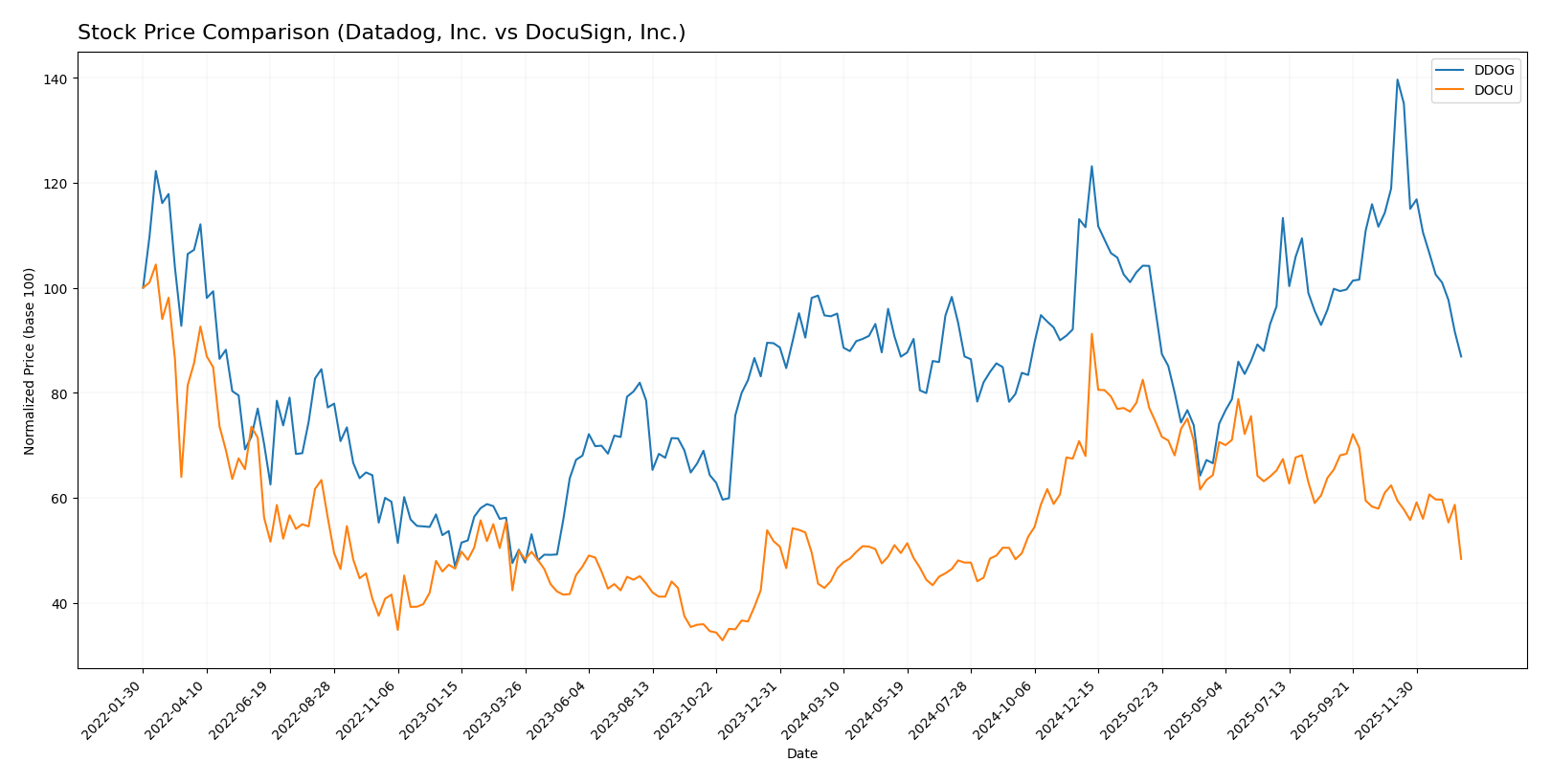

Stock Comparison

The stock prices of Datadog, Inc. (DDOG) and DocuSign, Inc. (DOCU) over the past 12 months reveal contrasting trends, with DDOG experiencing a bearish movement marked by notable volatility, while DOCU shows a bullish but decelerating trend.

Trend Analysis

Datadog, Inc. (DDOG) recorded an 8.1% price decline over the past year, indicating a bearish trend with deceleration. Price volatility is high, with a standard deviation of 18.63, and recent months show accelerated decline.

DocuSign, Inc. (DOCU) posted a 9.63% price increase over the past year, reflecting a bullish trend with deceleration. It experienced lower volatility at 12.98 standard deviation, though recent short-term performance turned negative.

Comparing both stocks, DocuSign delivered the highest market performance over the last 12 months despite recent weakness, outperforming Datadog’s bearish trend in this period.

Target Prices

The current analyst consensus reveals a positive outlook with notable upside potential for both Datadog, Inc. and DocuSign, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Datadog, Inc. | 215 | 105 | 177.67 |

| DocuSign, Inc. | 88 | 70 | 76.86 |

Analysts expect Datadog’s stock to rise significantly above its current price of $119.02, while DocuSign’s consensus target also suggests a meaningful increase from $56.71. This indicates potential growth opportunities for both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Datadog, Inc. and DocuSign, Inc.:

Rating Comparison

Datadog, Inc. Rating

- Rating: C+ indicating a very favorable status.

- Discounted Cash Flow Score: 4, favorable for future cash flow projections.

- ROE Score: 2, moderate efficiency in generating profit from equity.

- ROA Score: 3, moderate effectiveness in utilizing assets to generate earnings.

- Debt To Equity Score: 2, moderate financial risk with debt compared to equity.

- Overall Score: 2, moderate overall financial standing.

DocuSign, Inc. Rating

- Rating: B+ indicating a very favorable status.

- Discounted Cash Flow Score: 5, very favorable for future cash flow projections.

- ROE Score: 4, favorable efficiency in generating profit from equity.

- ROA Score: 4, favorable effectiveness in utilizing assets to generate earnings.

- Debt To Equity Score: 3, moderate financial risk with debt compared to equity.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, DocuSign holds higher ratings and scores across discounted cash flow, ROE, ROA, debt to equity, and overall score compared to Datadog, indicating a stronger analyst evaluation.

Scores Comparison

This section compares the financial scores of Datadog, Inc. and DocuSign, Inc. based on key investment risk and strength indicators:

DDOG Scores

- Altman Z-Score: 11.37, indicating a safe zone.

- Piotroski Score: 6, reflecting an average rating.

DOCU Scores

- Altman Z-Score: 4.43, also in the safe zone.

- Piotroski Score: 5, reflecting an average rating.

Which company has the best scores?

Datadog exhibits a significantly higher Altman Z-Score than DocuSign, suggesting stronger financial stability. Both have average Piotroski Scores, with Datadog slightly ahead. Overall, Datadog shows a more robust financial position based on these scores.

Grades Comparison

Here is a comparison of the recent grades issued by reputable financial institutions for the two companies:

Datadog, Inc. Grades

The following table summarizes recent grades and actions from well-known grading companies for Datadog, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Hold | 2026-01-07 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Truist Securities | Maintain | Hold | 2025-11-07 |

| DA Davidson | Maintain | Buy | 2025-11-07 |

Datadog’s grades predominantly trend positive, with multiple “Buy,” “Outperform,” and “Overweight” ratings, reflecting a generally favorable analyst sentiment.

DocuSign, Inc. Grades

The following table summarizes recent grades and actions from reputable grading companies for DocuSign, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Hold | 2025-12-05 |

| Baird | Maintain | Neutral | 2025-12-05 |

DocuSign’s grades are mostly neutral to hold, indicating that analysts see the stock as fairly valued with limited near-term upside.

Which company has the best grades?

Datadog, Inc. has received markedly better grades, including numerous “Buy” and “Overweight” ratings, compared to DocuSign, Inc.’s predominantly neutral and hold ratings. This distinction suggests that investors might expect stronger growth prospects or performance from Datadog relative to DocuSign based on analyst evaluations.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Datadog, Inc. (DDOG) and DocuSign, Inc. (DOCU) based on recent financial and operational data.

| Criterion | Datadog, Inc. (DDOG) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Diversification | Focused on cloud monitoring; limited product diversification | Strong subscription revenue base with professional services complementing core offerings |

| Profitability | Low profitability; ROIC 1.07%, net margin 6.85%, shedding value | Higher profitability; ROIC 9.09%, net margin 35.87%, slightly favorable value creation |

| Innovation | Growing ROIC trend suggests improving innovation and efficiency | Growing ROIC trend; strong innovation in digital agreements and services |

| Global presence | Moderate global presence, with solid financial stability ratios | Established global footprint but weaker liquidity ratios (current ratio 0.81) |

| Market Share | Smaller market share with high valuation multiples (PE 261.42, PB 17.7) | Larger market share with more reasonable valuation (PE 18.51, PB 9.87) |

Key takeaways: DocuSign demonstrates stronger profitability, market presence, and a more balanced financial profile, while Datadog shows promise with improving returns but currently struggles with value creation and high valuation risks. Investors should weigh DocuSign’s stability against Datadog’s growth potential carefully.

Risk Analysis

Below is a comparative table highlighting key risks for Datadog, Inc. (DDOG) and DocuSign, Inc. (DOCU) as of the most recent fiscal years.

| Metric | Datadog, Inc. (DDOG) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Market Risk | Beta 1.263, higher volatility and exposure to tech sector cycles | Beta 0.994, moderate volatility with stable demand for e-signature solutions |

| Debt Level | Debt-to-Equity 0.68 (neutral), Debt-to-Assets 31.84% (neutral) | Debt-to-Equity 0.06 (favorable), Debt-to-Assets 3.1% (favorable) |

| Regulatory Risk | Moderate, SaaS industry faces data privacy and security regulations | Moderate, e-signature compliance and legal standards globally |

| Operational Risk | Medium, depends on cloud infrastructure reliability and integration | Medium, relies on platform uptime and integration with enterprise systems |

| Environmental Risk | Low, software company with limited direct environmental impact | Low, primarily digital services with minimal environmental footprint |

| Geopolitical Risk | Moderate, international customer base may be affected by trade tensions | Moderate, global operations exposed to geopolitical uncertainties |

Datadog faces higher market volatility and moderate debt levels, increasing financial risk, while DocuSign benefits from a stronger balance sheet and slightly more stable market exposure. Both companies navigate regulatory and operational risks inherent to their software platforms, but environmental impact remains low. Geopolitical factors could affect international revenue streams for both. The most impactful risk for Datadog is market volatility combined with a high P/E ratio, whereas DocuSign’s key risk lies in maintaining compliance across jurisdictions amid evolving regulations.

Which Stock to Choose?

Datadog, Inc. (DDOG) shows a favorable income statement with strong revenue and net income growth over 2020-2024, yet its financial ratios reveal a slightly unfavorable profile due to low ROE and high valuation multiples. Its debt level is moderate, and the rating is very favorable overall.

DocuSign, Inc. (DOCU) displays a favorable income statement with solid profitability and net margin growth, supported by strong ROE and a slightly favorable financial ratios evaluation. The company maintains low debt levels and holds a very favorable rating with moderate overall scores.

Considering ratings and financials, growth-oriented investors might find Datadog’s accelerating income growth attractive despite mixed ratios, while those seeking financial stability and profitability could lean towards DocuSign’s stronger ratio profile and rating. The interpretation depends on individual risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Datadog, Inc. and DocuSign, Inc. to enhance your investment decisions: