Home > Comparison > Healthcare > DHR vs RVTY

The strategic rivalry between Danaher Corporation and Revvity, Inc. shapes the evolving landscape of medical diagnostics and research. Danaher operates as a diversified healthcare conglomerate with broad industrial applications, while Revvity focuses on specialized life sciences and diagnostic solutions. This contrast highlights a battle between scale-driven integration and niche innovation. This analysis aims to identify which company presents the superior risk-adjusted return for a diversified healthcare portfolio.

Table of contents

Companies Overview

Danaher Corporation and Revvity, Inc. stand as major forces in the medical diagnostics and research market, each shaping industry innovation.

Danaher Corporation: Diversified Scientific Innovator

Danaher dominates the medical diagnostics and research sector through three key segments: Life Sciences, Diagnostics, and Environmental & Applied Solutions. It generates revenue by selling instruments, consumables, software, and services globally. In 2026, Danaher’s strategic focus remains on expanding bioprocess technologies and clinical diagnostics to capture pharmaceutical and healthcare growth.

Revvity, Inc.: Precision Life Sciences and Diagnostics

Revvity operates primarily in diagnostics and life sciences markets, generating income from instruments, reagents, software, and analytical services. Their 2026 strategy targets breakthroughs in genomic and diagnostic testing, aiming to support oncology, immunodiagnostics, and early genetic disorder detection with advanced technological platforms.

Strategic Collision: Similarities & Divergences

Both companies emphasize life sciences and diagnostics but differ in scope; Danaher pursues a broad diversified approach while Revvity focuses on specialized genomic and analytic innovations. They compete fiercely in diagnostics instruments and reagents, targeting healthcare and research institutions. Danaher’s scale contrasts with Revvity’s niche precision, creating distinct risk and growth profiles for investors.

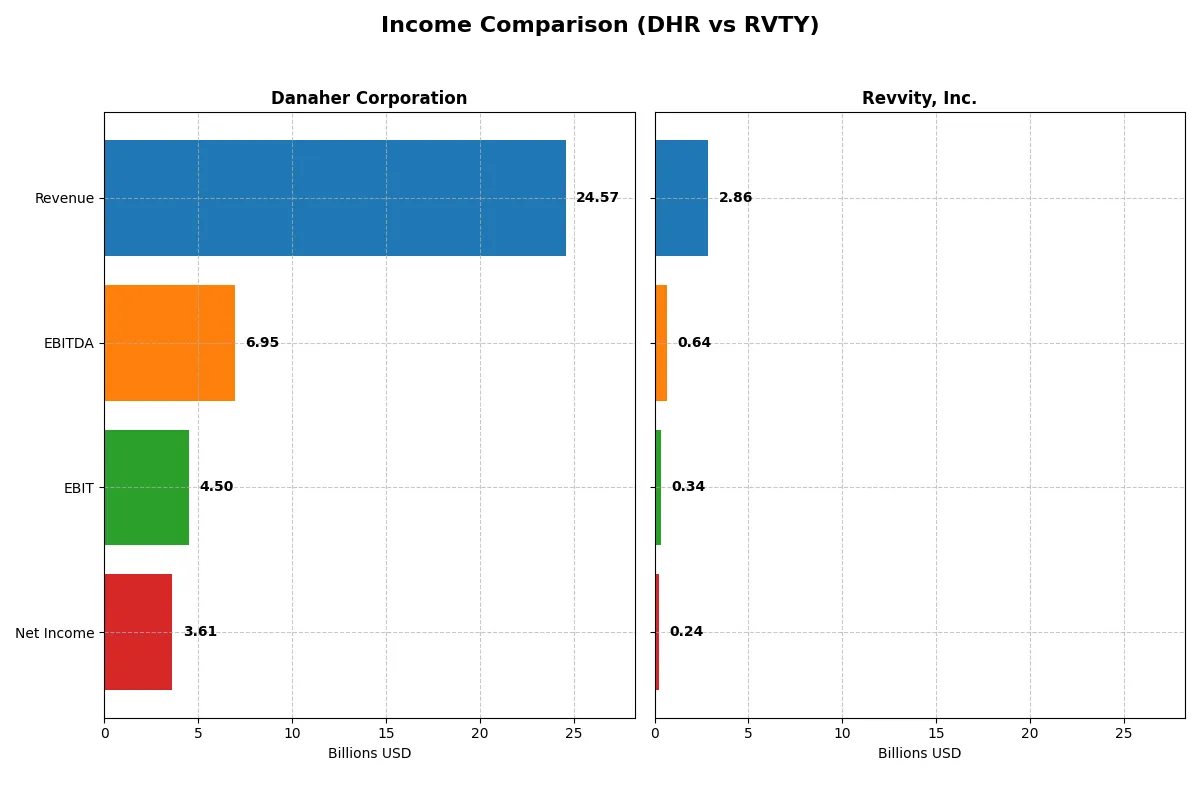

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Danaher Corporation (DHR) | Revvity, Inc. (RVTY) |

|---|---|---|

| Revenue | 24.6B | 2.86B |

| Cost of Revenue | 9.60B | 1.34B |

| Operating Expenses | 9.83B | 1.16B |

| Gross Profit | 14.97B | 1.52B |

| EBITDA | 6.95B | 644M |

| EBIT | 4.50B | 341M |

| Interest Expense | 265M | 92M |

| Net Income | 3.61B | 242M |

| EPS | 5.07 | 2.08 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable business engine over recent years.

Danaher Corporation Analysis

Danaher’s revenue declined 16.6% from 2021 to 2025, dropping to $24.6B in 2025. Net income fell sharply by 43.8% to $3.6B, signaling margin pressure. Despite this, Danaher maintains strong gross (61%) and net margins (14.7%), reflecting solid operational control in 2025, though momentum weakens as EBIT and EPS both contracted last year.

Revvity, Inc. Analysis

Revvity’s revenue shrank 25.4% over five years, reaching $2.86B in 2025. Net income plunged 74.4% to $242M, showing significant earnings deterioration. Gross margin stands at a respectable 53%, but net margin at 8.5% signals tighter profitability. The latest year saw 3.7% revenue growth but a 17.2% EBIT drop, indicating faltering operational efficiency despite modest top-line gains.

Margin Strength vs. Earnings Resilience

Danaher leads with higher margins and a more substantial profit base despite recent declines. Revvity’s steeper revenue and net income contraction underscore greater volatility and weaker scale. Investors seeking stability and margin durability may favor Danaher’s profile, while Revvity’s smaller scale and sharper earnings swings suggest higher risk and less predictable returns.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Danaher Corporation (DHR) | Revvity, Inc. (RVTY) |

|---|---|---|

| ROE | 6.9% | 3.3% |

| ROIC | 5.7% | 2.8% |

| P/E | 44.8 | 45.3 |

| P/B | 3.08 | 1.51 |

| Current Ratio | 1.87 | 1.68 |

| Quick Ratio | 1.51 | 1.40 |

| D/E | 0.35 | 0.46 |

| Debt-to-Assets | 22.1% | 27.7% |

| Interest Coverage | 19.4 | 3.87 |

| Asset Turnover | 0.29 | 0.23 |

| Fixed Asset Turnover | 4.44 | 4.43 |

| Payout ratio | 24.3% | 13.6% |

| Dividend yield | 0.54% | 0.30% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as a company’s DNA, uncovering hidden risks and operational strengths that shape investment decisions.

Danaher Corporation

Danaher posts a solid net margin of 14.7% but a modest ROE of 6.9%, signaling moderate profitability. Its high P/E of 44.8 and P/B of 3.08 suggest the stock is richly valued and somewhat stretched. The company returns value through dividends, although the yield is low at 0.54%, implying a focus on stable income and sustained growth.

Revvity, Inc.

Revvity shows a lower net margin of 8.5% and ROE at 3.3%, indicating weaker profitability and efficiency. Its P/E ratio of 45.3 also points to an expensive stock, yet the P/B at 1.51 is more moderate. Dividends yield only 0.3%, reflecting limited shareholder payouts and potentially prioritizing reinvestment into R&D for future growth.

Premium Valuation vs. Operational Safety

Danaher offers a better balance of operational efficiency and valuation discipline, supported by stronger profitability metrics. Revvity’s lower returns and similar valuation create higher risk with less reward. Investors seeking operational safety may prefer Danaher’s profile, while those betting on growth might consider Revvity’s reinvestment approach.

Which one offers the Superior Shareholder Reward?

I compare Danaher Corporation (DHR) and Revvity, Inc. (RVTY) on dividends, payout ratios, and buybacks. Danaher yields 0.54% with a 24% payout ratio, funding dividends well via strong free cash flow (7.4/share). Revvity’s yield is a modest 0.3%, with a 14% payout ratio, reflecting a cautious distribution amid lower margins. Danaher sustains buybacks aggressively, boosting total returns. Revvity’s buybacks appear less intense, prioritizing reinvestment and growth. Historically, Danaher’s model balances shareholder reward and sustainability, while Revvity’s reinvestment strategy suits its growth phase but carries higher risk. I conclude Danaher offers a more attractive total return profile for 2026 investors.

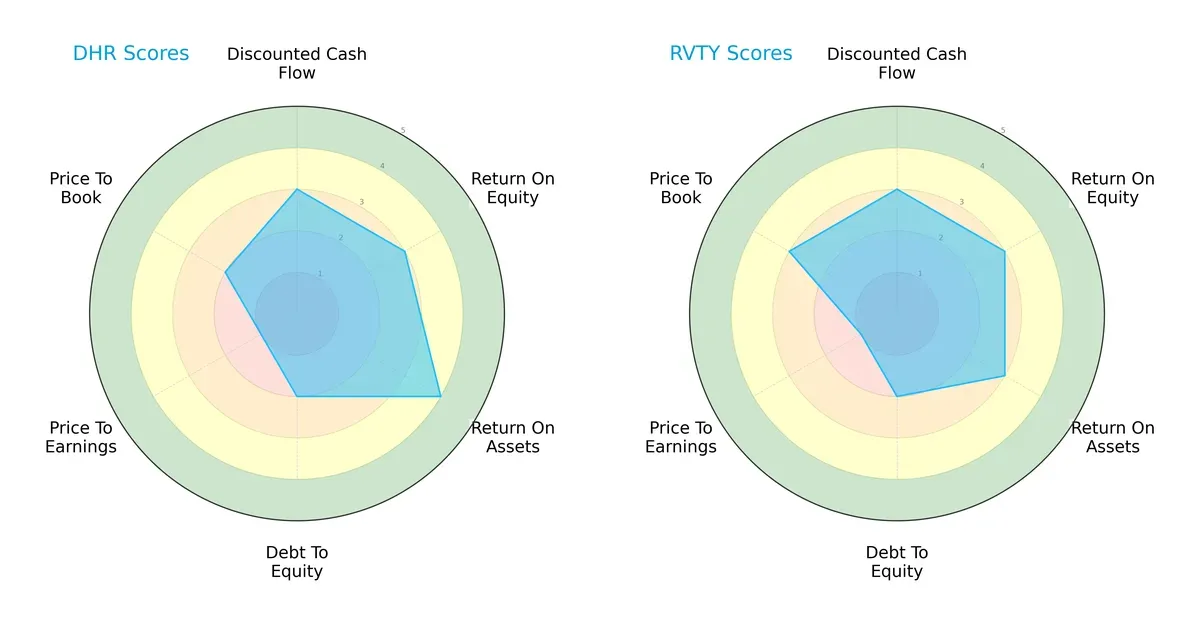

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Danaher Corporation and Revvity, Inc., highlighting their key financial strengths and weaknesses:

Danaher shows a stronger ROA (4 vs. 3) indicating better asset utilization, while both firms share moderate scores in DCF and ROE. Debt/Equity scores are equally unfavorable at 2, signaling leveraged balance sheets. Revvity edges Danaher in Price-to-Book (3 vs. 2), suggesting slightly better valuation metrics. Overall, Danaher has a more balanced operational profile, whereas Revvity leans on valuation appeal.

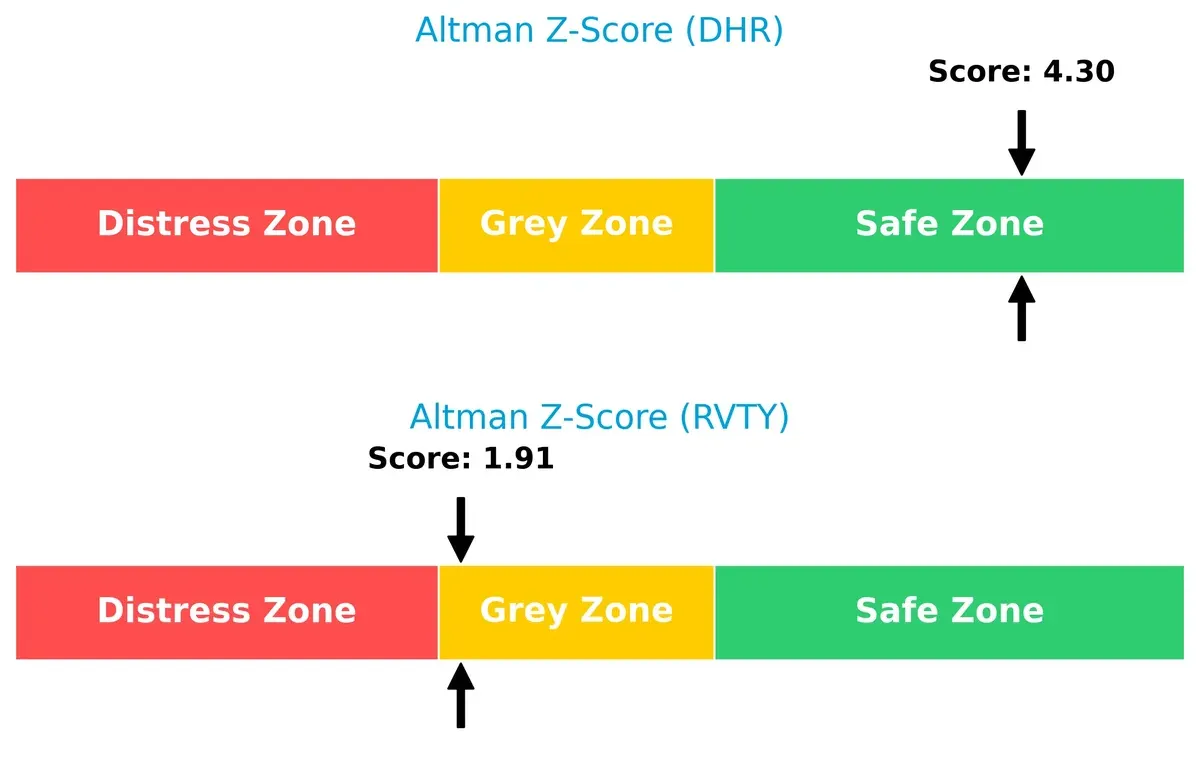

Bankruptcy Risk: Solvency Showdown

Danaher’s Altman Z-Score of 4.30 places it firmly in the safe zone, well above Revvity’s 1.91 in the grey zone. This gap signals Danaher’s stronger long-term solvency and resilience in economic cycles:

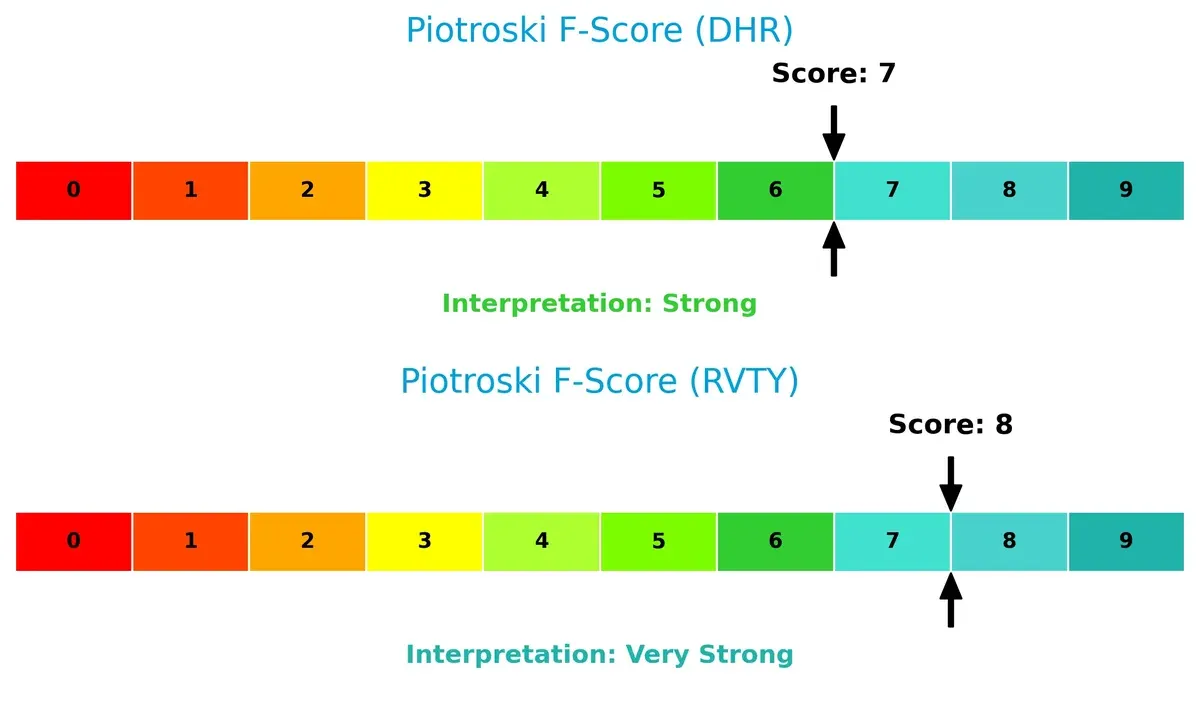

Financial Health: Quality of Operations

Revvity scores an 8 on the Piotroski scale, indicating very strong internal financial health. Danaher’s 7 also reflects strength but with slightly more caution. Neither shows red flags, but Revvity holds a marginal edge in operational quality:

How are the two companies positioned?

This section dissects the operational DNA of Danaher and Revvity by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

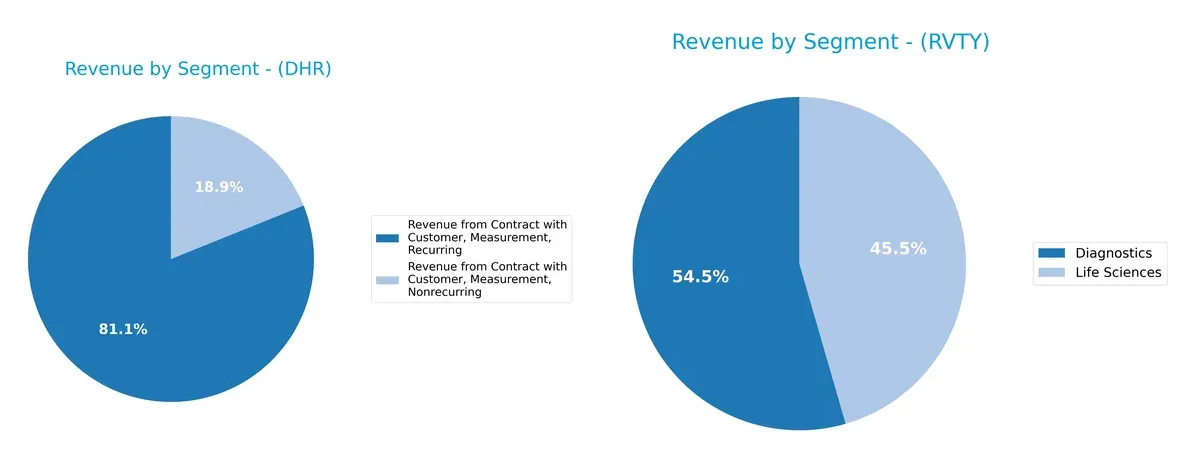

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Danaher Corporation and Revvity, Inc. diversify income streams and where their primary sector bets lie:

Danaher anchors its revenue in two main streams: $19.4B recurring and $4.5B nonrecurring measurement contracts, showing a clear focus but balanced by diversification in past years. Revvity pivots on Diagnostics ($1.5B) and Life Sciences ($1.25B), revealing a tighter, more concentrated portfolio. Danaher’s scale and diversified legacy reduce concentration risk, while Revvity’s narrower base signals higher sector dependency and potential volatility.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Danaher Corporation and Revvity, Inc.:

Danaher Corporation Strengths

- Broad revenue base with recurring Measurement contracts totaling 19.4B USD

- Strong financial health with favorable liquidity and debt ratios

- Global presence spanning North America, China, and other developed markets

- Favorable weighted average cost of capital supporting capital efficiency

- High fixed asset turnover indicating operational efficiency

Revvity, Inc. Strengths

- Favorable capital structure with a low debt-to-assets ratio

- Adequate liquidity ratios supporting short-term obligations

- Geographic diversification including US, China, UK, and other international markets

- Favorable weighted average cost of capital promoting investment returns

Danaher Corporation Weaknesses

- Unfavorable return on equity and price multiples indicating valuation concerns

- Low asset turnover suggesting potential asset underutilization

- Dividend yield below market averages

- Mixed profitability metrics with neutral ROIC

- High price-to-book ratio may reflect overvaluation

Revvity, Inc. Weaknesses

- Unfavorable and low profitability metrics including ROE and ROIC

- Moderate interest coverage ratio raising caution on debt servicing

- Unfavorable price-to-earnings ratio signaling high valuation

- Lower net margin compared to peers

- Dividend yield is minimal, limiting income appeal

Danaher’s strengths lie in its diversified revenue streams and strong balance sheet, while Revvity’s strengths focus on capital structure and geographic spread. Both companies face valuation and profitability challenges, which bear close monitoring in their strategic planning.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole shield protecting long-term profits from relentless competitive erosion. Let’s dissect how each firm defends its turf:

Danaher Corporation: Intangible Assets Powerhouse

Danaher’s moat stems primarily from its intangible assets—patented technologies and brand reputation. This manifests in a historically robust gross margin of 61%, despite recent profit pressures. New bioprocess innovations could deepen its moat, though declining ROIC signals caution in 2026.

Revvity, Inc.: Niche Specialization and Innovation

Revvity relies on specialized diagnostic platforms and proprietary research tools, contrasting Danaher’s broader portfolio. Its 53% gross margin reflects solid but narrower competitive positioning. Innovation in genomic workflows offers growth potential, yet sharply declining ROIC underscores profitability risks.

Intangible Assets vs. Niche Innovation: Who Holds the Deeper Moat?

Both companies destroy value with ROIC below WACC, but Danaher’s broader intangible asset base provides a wider moat. Danaher is better equipped to defend market share amid 2026’s challenges, while Revvity faces steeper hurdles sustaining profitability.

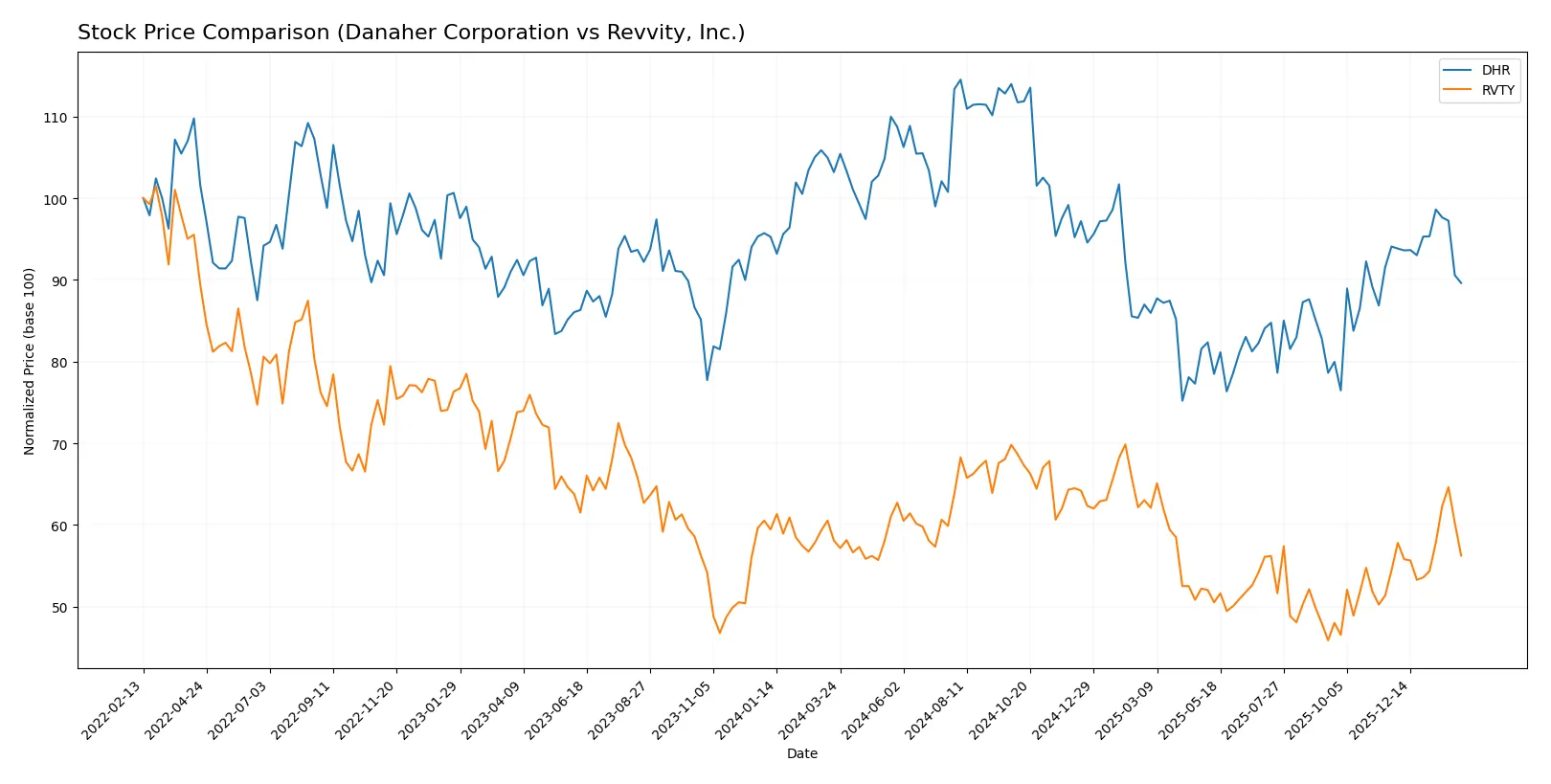

Which stock offers better returns?

Over the past year, both Danaher Corporation and Revvity, Inc. experienced bearish trends with accelerating price declines, showing distinct volatility patterns and volume dynamics.

Trend Comparison

Danaher’s stock declined 13.15% over 12 months, marking an accelerating bearish trend with a high volatility of 26.52 and prices ranging from 182 to 277.

Revvity’s stock fell 3.16% over the same period, also bearish but less severe, with accelerating decline and volatility at 11.37, fluctuating between 83 and 126.

Danaher’s larger drop contrasts Revvity’s milder loss; Revvity delivered the higher market performance despite both showing bearish momentum.

Target Prices

Analysts set clear target price ranges for Danaher Corporation and Revvity, Inc., reflecting cautious optimism.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Danaher Corporation | 220 | 270 | 252.33 |

| Revvity, Inc. | 105 | 129 | 115.14 |

Danaher’s consensus target at 252.33 exceeds its current 216.61 price, signaling upside potential. Revvity’s target consensus of 115.14 also suggests meaningful appreciation from the current 101.59 price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Danaher Corporation Grades

The table below summarizes recent grades from major financial institutions for Danaher Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-01-29 |

| Jefferies | Maintain | Buy | 2026-01-29 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Guggenheim | Maintain | Buy | 2026-01-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-23 |

| Barclays | Maintain | Overweight | 2025-10-22 |

| TD Cowen | Maintain | Buy | 2025-10-22 |

| Rothschild & Co | Downgrade | Neutral | 2025-10-08 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-07 |

Revvity, Inc. Grades

The following grades reflect recent analyst opinions for Revvity, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | Outperform | 2026-02-03 |

| Jefferies | Maintain | Hold | 2026-02-03 |

| Wells Fargo | Maintain | Equal Weight | 2026-02-03 |

| TD Cowen | Maintain | Buy | 2026-02-03 |

| Barclays | Maintain | Overweight | 2026-02-03 |

| JP Morgan | Maintain | Neutral | 2026-02-03 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-10-28 |

| Baird | Maintain | Outperform | 2025-10-28 |

Which company has the best grades?

Danaher Corporation generally holds stronger buy and overweight ratings from top-tier institutions. Revvity, Inc. presents more mixed grades, including hold and neutral opinions. This divergence may influence investor confidence and perceived risk.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Danaher Corporation

- Dominates with diversified Life Sciences and Diagnostics segments, strong global footprint, and high market cap ($153B).

Revvity, Inc.

- Faces intense competition with narrower segment focus and smaller scale ($11.8B market cap).

2. Capital Structure & Debt

Danaher Corporation

- Maintains favorable debt ratios: D/E 0.35, debt/assets 22%, strong interest coverage (17x).

Revvity, Inc.

- Higher leverage: D/E 0.46, debt/assets 27.7%, weaker interest coverage (3.7x) signals tighter debt service capacity.

3. Stock Volatility

Danaher Corporation

- Low beta (0.96) reflects below-market volatility and defensive healthcare exposure.

Revvity, Inc.

- Higher beta (1.09) suggests elevated price swings and market sensitivity.

4. Regulatory & Legal

Danaher Corporation

- Operates in heavily regulated medical diagnostics; established compliance frameworks mitigate risks.

Revvity, Inc.

- Also in regulated diagnostics; smaller scale may increase vulnerability to regulatory changes.

5. Supply Chain & Operations

Danaher Corporation

- Large scale and diversified operations support supply chain resilience and operational flexibility.

Revvity, Inc.

- Smaller scale may limit supply chain bargaining power and increase operational risk.

6. ESG & Climate Transition

Danaher Corporation

- Advanced environmental solutions segment and strong ESG initiatives reduce transition risks.

Revvity, Inc.

- ESG efforts growing but less diversified; climate transition may pose operational and reputational challenges.

7. Geopolitical Exposure

Danaher Corporation

- Global footprint with exposure to diverse regions dilutes geopolitical risks.

Revvity, Inc.

- More concentrated geographic exposure could amplify geopolitical disruptions.

Which company shows a better risk-adjusted profile?

Danaher faces less financial and market volatility risk, supported by strong debt metrics and diversified operations. Revvity’s higher leverage, narrower scale, and elevated stock volatility increase its risk profile. Danaher’s robust interest coverage and Altman Z-score in the safe zone confirm superior financial stability. Revvity’s Altman Z-score in the grey zone signals moderate bankruptcy risk, despite a strong Piotroski score. The key risk for Danaher lies in high valuation multiples, while Revvity’s critical risk is financial leverage and debt servicing capacity. Overall, Danaher offers a more balanced risk-adjusted profile in the challenging 2026 healthcare market.

Final Verdict: Which stock to choose?

Danaher Corporation’s superpower lies in its robust operational efficiency and strong cash flow generation. Despite recent setbacks in growth and profitability, it maintains a solid liquidity position and a sturdy balance sheet. This resilience suits investors with an appetite for steady, long-term industrial exposure in an aggressive growth portfolio.

Revvity, Inc. offers a strategic moat through its niche specialization in life sciences tools, supported by recurring revenue streams. While its profitability and capital returns trail Danaher’s, Revvity presents a comparatively less volatile risk profile with improving cash flow trends. It fits well within a GARP (Growth at a Reasonable Price) strategy seeking targeted innovation plays.

If you prioritize operational strength and proven cash machine dynamics, Danaher outshines as the compelling choice due to its established market presence and financial stability. However, if you seek niche growth opportunities with a more focused innovation edge and slightly better recent price momentum, Revvity offers better stability within a growth-at-a-reasonable-price framework. Both carry risks, especially around declining returns on invested capital, so cautious portfolio sizing is advisable.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Danaher Corporation and Revvity, Inc. to enhance your investment decisions: