Investors seeking exposure to cutting-edge technology often consider Pure Storage, Inc. and D-Wave Quantum Inc., two innovators in the computer hardware sector. Pure Storage excels in enterprise data storage solutions, while D-Wave pioneers quantum computing systems and services. Both companies operate at the forefront of technological advancement, making their comparison crucial for assessing future growth potential. In this article, I will help you determine which company presents the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Pure Storage and D-Wave Quantum by providing an overview of these two companies and their main differences.

Pure Storage Overview

Pure Storage, Inc. focuses on delivering advanced data storage technologies and services globally. Its product range includes FlashArray and FlashBlade solutions designed for block-oriented and unstructured data workloads, respectively. The company emphasizes enterprise-class data services such as data reduction, protection, and encryption, serving traditional workloads and cloud-native environments from its base in Santa Clara, California.

D-Wave Quantum Overview

D-Wave Quantum Inc. specializes in quantum computing systems and related software and services. It offers a suite of quantum products including the fifth-generation Advantage quantum computer and cloud-based Leap service for real-time quantum access. Serving industries like AI, financial services, and life sciences, D-Wave is headquartered in Burnaby, Canada, with a focus on pioneering quantum computing applications worldwide.

Key similarities and differences

Both companies operate in the technology sector within computer hardware, providing specialized computing solutions. Pure Storage targets data storage optimization with a broad portfolio for enterprise and cloud users, while D-Wave Quantum develops cutting-edge quantum computing systems. Pure Storage is significantly larger with 6,000 employees and a market cap of 24.7B USD, compared to D-Wave’s 216 employees and 10B USD market cap, reflecting their differing scales and market focus.

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Pure Storage, Inc. and D-Wave Quantum Inc. based on their most recent fiscal year data.

| Metric | Pure Storage, Inc. (PSTG) | D-Wave Quantum Inc. (QBTS) |

|---|---|---|

| Market Cap | 24.7B | 10.0B |

| Revenue | 3.17B | 8.83M |

| EBITDA | 282M | -138M |

| EBIT | 156M | -140M |

| Net Income | 107M | -144M |

| EPS | 0.33 | -0.75 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Pure Storage, Inc.

Pure Storage has shown a strong upward trend in revenue, increasing 88.11% over 2021-2025, with net income growing 137.84% in the same period. Margins have generally improved, highlighted by a 69.84% gross margin and a 3.37% net margin, both favorable or neutral. In 2025, revenue growth accelerated to 11.92%, with net margin rising 55.55%, indicating improved profitability and operational efficiency.

D-Wave Quantum Inc.

D-Wave Quantum’s revenue grew 71.07% from 2020 to 2024, but net income declined sharply, with a negative net margin of -1629.99%. Its gross margin was favorable at 63.02%, yet EBIT and net margins were unfavorable, reflecting continuing losses. The latest fiscal year saw minimal revenue growth of 0.79% and worsening EBIT and net margin growth, signaling financial challenges despite some operational progress.

Which one has the stronger fundamentals?

Pure Storage demonstrates stronger fundamentals, supported by consistent revenue and net income growth, favorable margin trends, and positive earnings per share expansion. In contrast, D-Wave Quantum faces ongoing profitability issues, with negative margins and declining net income. Pure Storage’s overall income statement evaluation is favorable, while D-Wave’s remains unfavorable, reflecting divergent financial health profiles.

Financial Ratios Comparison

The table below presents key financial ratios for Pure Storage, Inc. (PSTG) and D-Wave Quantum Inc. (QBTS) based on their most recent fiscal year data, offering a snapshot of their financial performance and stability.

| Ratios | Pure Storage, Inc. (PSTG) | D-Wave Quantum Inc. (QBTS) |

|---|---|---|

| ROE | 8.17% | -229.67% |

| ROIC | 2.45% | -45.01% |

| P/E | 206.9 | -11.22 |

| P/B | 16.90 | 25.76 |

| Current Ratio | 1.61 | 6.14 |

| Quick Ratio | 1.58 | 6.08 |

| D/E | 0.22 | 0.61 |

| Debt-to-Assets | 7.09% | 19.20% |

| Interest Coverage | 10.91 | -19.82 |

| Asset Turnover | 0.80 | 0.04 |

| Fixed Asset Turnover | 5.21 | 0.77 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Pure Storage, Inc.

Pure Storage shows a mixed ratio profile with favorable liquidity and leverage metrics, including a strong current ratio of 1.61 and low debt-to-equity at 0.22. However, profitability ratios such as net margin (3.37%), ROE (8.17%), and ROIC (2.45%) are weak, signaling potential earnings challenges. The company does not pay dividends, likely prioritizing reinvestment and growth.

D-Wave Quantum Inc.

D-Wave’s ratios are predominantly unfavorable, with very negative profitability indicators including a net margin of -1629.99% and ROE of -229.67%. The company has a favorable quick ratio and manageable debt-to-assets at 19.2%, but poor asset turnover and interest coverage. It also does not pay dividends, reflecting a high-growth or reinvestment phase.

Which one has the best ratios?

Between the two, Pure Storage presents a more balanced ratio set with several favorable liquidity and leverage metrics, despite weak profitability. In contrast, D-Wave exhibits mostly unfavorable ratios, particularly in profitability and operational efficiency. Thus, Pure Storage’s ratios appear stronger overall based on the available data.

Strategic Positioning

This section compares the strategic positioning of Pure Storage, Inc. and D-Wave Quantum Inc. across Market position, Key segments, and Exposure to technological disruption:

Pure Storage, Inc.

- Established player in data storage hardware with 25B market cap facing typical tech industry competition.

- Focus on enterprise data storage solutions including flash arrays, AI-ready infrastructure, and cloud-native data management.

- Operates in a mature hardware market with incremental innovation in software and cloud integration, moderate disruption risk.

D-Wave Quantum Inc.

- Smaller quantum computing firm with 10B market cap, competing in emerging quantum technology space.

- Specializes in quantum computing systems, software, and services targeting AI, materials science, and financial modeling.

- Operates in cutting-edge quantum computing sector with high potential disruption but still early-stage adoption.

Pure Storage, Inc. vs D-Wave Quantum Inc. Positioning

Pure Storage pursues a diversified approach with broad enterprise data storage products and services, supporting recurring revenue streams. D-Wave focuses on a concentrated niche in quantum computing with specialized solutions and professional services. Each approach offers different scalability and market penetration dynamics.

Which has the best competitive advantage?

Both companies currently show slightly unfavorable MOATs due to ROIC below WACC but with growing profitability trends. Pure Storage’s larger scale and diversified offerings contrast with D-Wave’s niche focus, reflecting different competitive advantage profiles.

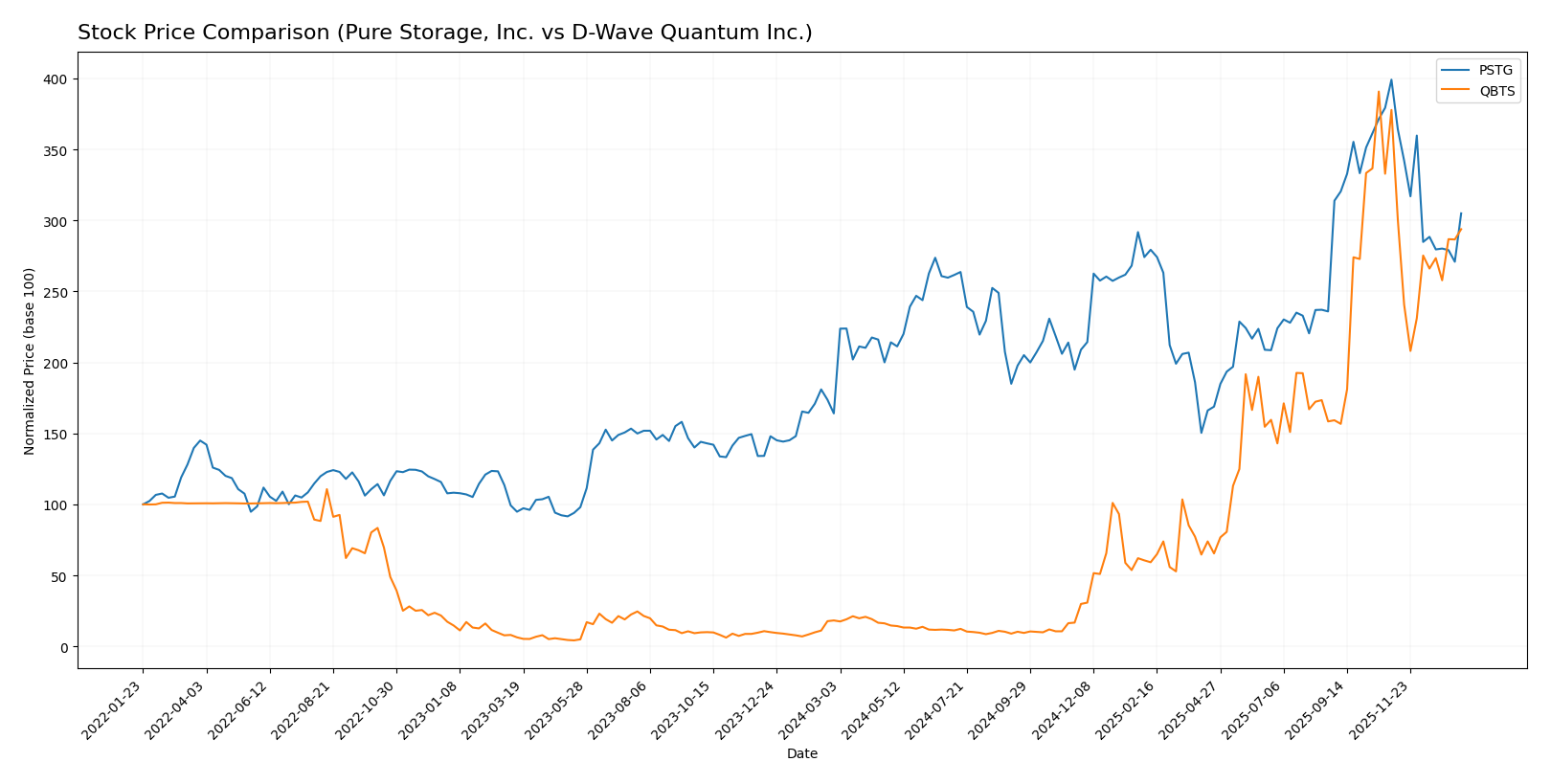

Stock Comparison

The stock price movements of Pure Storage, Inc. (PSTG) and D-Wave Quantum Inc. (QBTS) over the past 12 months reveal strong bullish trends with notable deceleration in momentum and recent declines in price, reflecting shifting trading dynamics.

Trend Analysis

Pure Storage, Inc. (PSTG) showed an 85.88% price increase over the past year, indicating a bullish trend with decelerating momentum. Recent weeks saw a 23.6% price drop and seller dominance in volume, signaling short-term weakness.

D-Wave Quantum Inc. (QBTS) outperformed with a 1510.06% gain over the same period, also bullish but decelerating. The stock experienced a 22.23% recent decline with slightly seller-dominant volume, suggesting a moderate pullback.

Comparing both, QBTS delivered the highest market performance with a substantially larger overall price increase despite similar recent downward pressure.

Target Prices

The current analyst consensus presents a moderately optimistic outlook for both Pure Storage, Inc. and D-Wave Quantum Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Pure Storage, Inc. | 105 | 60 | 91.15 |

| D-Wave Quantum Inc. | 46 | 26 | 38.88 |

Analysts expect Pure Storage’s stock to trade notably above its current price of $75.41, while D-Wave Quantum’s consensus target is also well above its present $28.84, indicating positive growth potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Pure Storage, Inc. (PSTG) and D-Wave Quantum Inc. (QBTS):

Rating Comparison

PSTG Rating

- Rating: B-, evaluated as Very Favorable by analysts.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation outlook.

- ROE Score: 3, reflecting Moderate profitability from shareholders’ equity.

- ROA Score: 3, showing Moderate efficiency in using assets to generate earnings.

- Debt To Equity Score: 3, indicating Moderate financial risk and balance sheet.

- Overall Score: 2, considered Moderate in overall financial standing.

QBTS Rating

- Rating: C-, also considered Very Favorable despite lower scores.

- Discounted Cash Flow Score: 1, rated Very Unfavorable for valuation.

- ROE Score: 1, signaling Very Unfavorable profitability metrics.

- ROA Score: 1, with Very Unfavorable asset utilization efficiency.

- Debt To Equity Score: 4, viewed as Favorable, with lower financial risk.

- Overall Score: 1, rated Very Unfavorable for overall financial health.

Which one is the best rated?

Pure Storage, Inc. (PSTG) holds a higher overall rating (B-) and better scores in discounted cash flow, ROE, ROA, and overall financial standing compared to D-Wave Quantum Inc. (QBTS). However, QBTS has a more favorable debt-to-equity score, indicating lower financial risk in that aspect.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Pure Storage, Inc. and D-Wave Quantum Inc.:

PSTG Scores

- Altman Z-Score: 5.91, indicating a safe financial zone

- Piotroski Score: 5, showing average financial strength

QBTS Scores

- Altman Z-Score: 28.11, indicating a safe financial zone

- Piotroski Score: 4, showing average financial strength

Which company has the best scores?

Based on the provided data, QBTS has a significantly higher Altman Z-Score, indicating stronger financial stability, while PSTG has a slightly higher Piotroski Score. Both companies fall into average financial strength by Piotroski standards.

Grades Comparison

The following presents the latest grades issued by recognized firms for Pure Storage, Inc. and D-Wave Quantum Inc.:

Pure Storage, Inc. Grades

This table summarizes recent grades from major financial institutions for Pure Storage, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Sell | 2025-12-03 |

| Barclays | Maintain | Equal Weight | 2025-12-03 |

| Needham | Maintain | Buy | 2025-12-03 |

| Susquehanna | Downgrade | Neutral | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Wedbush | Maintain | Outperform | 2025-12-03 |

| Lake Street | Maintain | Buy | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-11-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-17 |

The grades for Pure Storage show a mixed outlook with a majority leaning toward moderate to positive ratings, and a single downgrade from Susquehanna reflecting some caution.

D-Wave Quantum Inc. Grades

This table displays the current grades from recognized grading companies for D-Wave Quantum Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2026-01-08 |

| Rosenblatt | Maintain | Buy | 2026-01-07 |

| Benchmark | Maintain | Buy | 2025-11-10 |

| Rosenblatt | Maintain | Buy | 2025-11-07 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Piper Sandler | Maintain | Overweight | 2025-08-08 |

| Benchmark | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

Grades for D-Wave Quantum consistently reflect positive sentiment with multiple buy ratings and no downgrades, indicating strong analyst confidence.

Which company has the best grades?

D-Wave Quantum Inc. has received uniformly positive grades, mostly Buy and Overweight, contrasting with Pure Storage’s more mixed grades including Sell and Neutral ratings. This suggests stronger analyst confidence in D-Wave’s outlook, potentially affecting investor sentiment and portfolio decisions.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses of Pure Storage, Inc. (PSTG) and D-Wave Quantum Inc. (QBTS) based on their latest financial and operational data.

| Criterion | Pure Storage, Inc. (PSTG) | D-Wave Quantum Inc. (QBTS) |

|---|---|---|

| Diversification | Strong diversification with $1.7B product and $1.47B service revenue in 2025 | Limited diversification; mostly professional services ($1.94M) with minor product revenue ($144K) in 2024 |

| Profitability | Low net margin (3.37%), ROIC (2.45%) below WACC (9.65%), indicating value destruction but improving ROIC trend | Negative profitability with net margin -1630%, ROIC -45%, and worsening WACC, shedding value despite ROIC growth |

| Innovation | Consistent investment in product development reflected in strong fixed asset turnover (5.21) | Innovation-focused but low asset turnover (0.77) and high R&D expenses impacting margins |

| Global presence | Established global footprint with balanced product and service sales | Smaller scale with niche quantum computing focus, limited global reach |

| Market Share | Larger market share in data storage sector with steady revenue growth | Emerging player in quantum computing, small market presence |

Key takeaways: Pure Storage exhibits stronger diversification and global presence, though it currently struggles with profitability and value creation. D-Wave Quantum remains an innovative but financially challenged company with limited market scale. Both show improving ROIC trends, signaling potential future gains but with significant risks.

Risk Analysis

Below is a comparative overview of the key risks associated with Pure Storage, Inc. (PSTG) and D-Wave Quantum Inc. (QBTS) based on their latest financial and operational data.

| Metric | Pure Storage, Inc. (PSTG) | D-Wave Quantum Inc. (QBTS) |

|---|---|---|

| Market Risk | Moderate beta at 1.26; exposure to tech sector volatility | Higher beta at 1.56; more volatile due to emerging quantum tech |

| Debt Level | Low debt-to-equity ratio of 0.22; favorable leverage | Moderate debt-to-equity ratio of 0.61; neutral leverage risk |

| Regulatory Risk | US-based, stable regulatory environment | Canadian-based, emerging tech with evolving regulations |

| Operational Risk | Established product lines; moderate operational complexity | Smaller scale, high innovation risk with early-stage tech |

| Environmental Risk | Limited direct environmental impact | Low direct impact, but energy use in quantum computing under scrutiny |

| Geopolitical Risk | US-centric with global sales; moderate exposure | Canadian HQ with global reach; potential export restrictions |

The most impactful risks are market volatility and operational uncertainty. D-Wave’s high beta and negative profitability ratios highlight significant risk due to nascent technology and scaling challenges. Pure Storage has more stable financials but faces valuation concerns and competitive pressure in data storage. Investors should weigh these factors carefully for risk management.

Which Stock to Choose?

Pure Storage, Inc. (PSTG) shows a favorable income evolution with 11.92% revenue growth in 2025 and improved profitability, despite some unfavorable financial ratios such as a high P/E of 206.9 and P/B of 16.9. Debt metrics and liquidity ratios are favorable, and the overall rating is very favorable (B-). The company’s ROIC is below WACC, indicating value destruction, but the ROIC trend is positive.

D-Wave Quantum Inc. (QBTS) displays unfavorable income evolution marked by negative net margin (-1629.99%) and declining profitability, with a high debt burden relative to assets. Most financial ratios are unfavorable except a favorable P/E score and debt-to-assets ratio. The rating remains very favorable (C-) but overall financial health is weak. ROIC is significantly below WACC, also signaling value destruction despite improving ROIC trends.

Investors focused on growth and improving profitability might find Pure Storage’s improving income and moderate rating more aligned with their profile. Conversely, those with a higher risk tolerance and interest in emerging technology could interpret D-Wave Quantum’s volatile financials and high growth potential differently, albeit with greater caution due to its unfavorable ratios and profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Pure Storage, Inc. and D-Wave Quantum Inc. to enhance your investment decisions: