In the fast-evolving world of technology, MongoDB, Inc. and CyberArk Software Ltd. stand out as leaders in the software infrastructure sector. MongoDB excels with its innovative database solutions, while CyberArk specializes in cutting-edge cybersecurity software. Both companies address critical enterprise needs, making their market overlap and innovation strategies worthy of comparison. In this article, I will help you determine which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between MongoDB, Inc. and CyberArk Software Ltd. by providing an overview of these two companies and their main differences.

MongoDB, Inc. Overview

MongoDB, Inc. is a US-based technology company specializing in providing a general-purpose database platform. The company offers solutions such as MongoDB Enterprise Advanced for enterprise customers, MongoDB Atlas as a multi-cloud database-as-a-service, and a free Community Server version. Founded in 2007 and headquartered in New York City, MongoDB positions itself as a key player in database infrastructure with a market cap of approximately 32.5B USD.

CyberArk Software Ltd. Overview

CyberArk Software Ltd., headquartered in Petah Tikva, Israel, focuses on software-based security solutions, including privileged access management and identity and access management services. Serving multiple industries globally, CyberArk offers SaaS solutions that secure privileged credentials and cloud environments. Founded in 1999, CyberArk operates with a market cap of about 22.9B USD and emphasizes cybersecurity infrastructure.

Key similarities and differences

Both MongoDB and CyberArk operate in the software infrastructure industry with a focus on enterprise solutions. MongoDB centers on database management platforms, while CyberArk specializes in cybersecurity and identity management services. They differ in geographic headquarters and market capitalization, with MongoDB being larger. Both companies serve global markets but target distinct technological needs within enterprise IT environments.

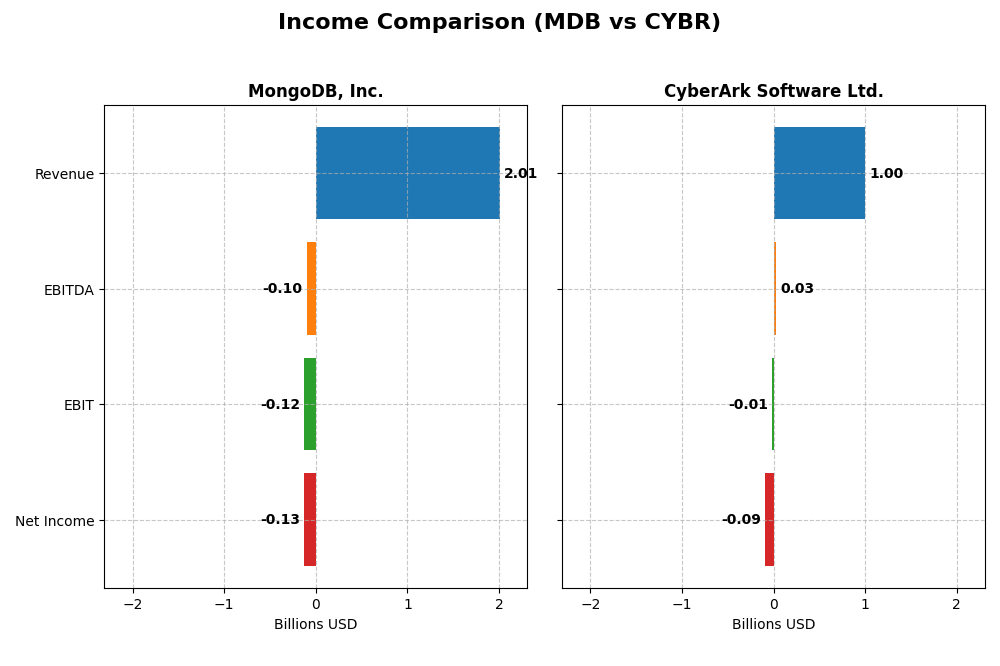

Income Statement Comparison

Below is a side-by-side comparison of MongoDB, Inc. and CyberArk Software Ltd.’s key income statement metrics for their most recent fiscal years.

| Metric | MongoDB, Inc. (MDB) | CyberArk Software Ltd. (CYBR) |

|---|---|---|

| Market Cap | 32.5B | 22.9B |

| Revenue | 2.01B | 1.00B |

| EBITDA | -96.5M | 28.7M |

| EBIT | -123.5M | -13.3M |

| Net Income | -129.1M | -93.5M |

| EPS | -1.73 | -2.12 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

MongoDB, Inc.

MongoDB has shown strong revenue growth, increasing from $590M in 2021 to $2B in 2025, with net income losses narrowing from -$267M to -$129M. Gross margins remain favorable at 73.32%, while EBIT and net margins are negative but improving. The 2025 fiscal year showed a 19.22% revenue increase and a 38.69% net margin improvement, indicating better cost control.

CyberArk Software Ltd.

CyberArk’s revenue rose from $464M in 2020 to $1B in 2024, with gross margins at a favorable 79.18%. However, net income remains negative, widening to -$93M in 2024 from a smaller loss in 2020. EBIT margin is slightly negative at -1.33%. While revenue and gross profit grew strongly in 2024, net margin and EPS declined, reflecting challenges in profitability.

Which one has the stronger fundamentals?

MongoDB displays more consistent improvements in both revenue and net margin over the analyzed period, with an overall favorable income statement evaluation of 85.71%. CyberArk, despite strong top-line growth, struggles with profitability and has a neutral income statement rating of 50%. MongoDB’s combination of growth and margin improvements suggests relatively stronger fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for MongoDB, Inc. and CyberArk Software Ltd. based on their most recent fiscal year data.

| Ratios | MongoDB, Inc. (MDB) | CyberArk Software Ltd. (CYBR) |

|---|---|---|

| ROE | -4.6% | -3.9% |

| ROIC | -7.4% | -2.9% |

| P/E | -158 | -157.5 |

| P/B | 7.32 | 6.21 |

| Current Ratio | 5.20 | 1.48 |

| Quick Ratio | 5.20 | 1.48 |

| D/E (Debt-to-Equity) | 0.013 | 0.012 |

| Debt-to-Assets | 1.1% | 0.9% |

| Interest Coverage | -26.7 | -17.9 |

| Asset Turnover | 0.58 | 0.30 |

| Fixed Asset Turnover | 24.78 | 51.11 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

MongoDB, Inc.

MongoDB exhibits several unfavorable ratios, including negative net margin (-6.43%) and return on equity (-4.64%), signaling profitability challenges. The high current ratio (5.2) is marked unfavorable, suggesting excess liquidity, while low debt levels (D/E 0.01) are favorable. MongoDB does not pay dividends, reflecting a reinvestment strategy focused on growth and R&D, with no share buybacks reported.

CyberArk Software Ltd.

CyberArk shows mixed ratios with a slightly unfavorable global opinion. Negative net margin (-9.34%) and return on equity (-3.94%) indicate profitability pressures. The current ratio (1.48) is neutral, while low leverage (D/E 0.01) is favorable. CyberArk also does not pay dividends, likely prioritizing reinvestment in innovation and acquisitions, with no dividend yield or buybacks disclosed.

Which one has the best ratios?

Both companies face profitability challenges with negative margins and returns, yet CyberArk’s ratios are slightly more balanced, showing fewer unfavorable metrics and a neutral current ratio. MongoDB’s higher liquidity and fixed asset turnover stand out, but overall, both display cautious financial positions with no dividend distributions.

Strategic Positioning

This section compares the strategic positioning of MongoDB and CyberArk including market position, key segments, and exposure to disruption:

MongoDB, Inc. (MDB)

- Large market cap of 32.5B with competitive pressure in software infrastructure

- Focused on database platforms: MongoDB Atlas, subscriptions, and services

- Positioned in cloud and hybrid database services, moderate disruption risk

CyberArk Software Ltd. (CYBR)

- Market cap of 22.9B facing competitive pressure in security software

- Diverse security solutions including privileged access, SaaS, and identity management

- Exposure to cloud security and identity access management disruption

MongoDB, Inc. vs CyberArk Software Ltd. Positioning

MongoDB pursues a concentrated strategy centered on database infrastructure and cloud services, while CyberArk offers a diversified portfolio in software security. MongoDB benefits from rapid growth in cloud databases; CyberArk’s broad security approach targets multiple industries.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC. MongoDB shows improving profitability trends, while CyberArk experiences declining returns, indicating a relatively weaker competitive advantage for CyberArk.

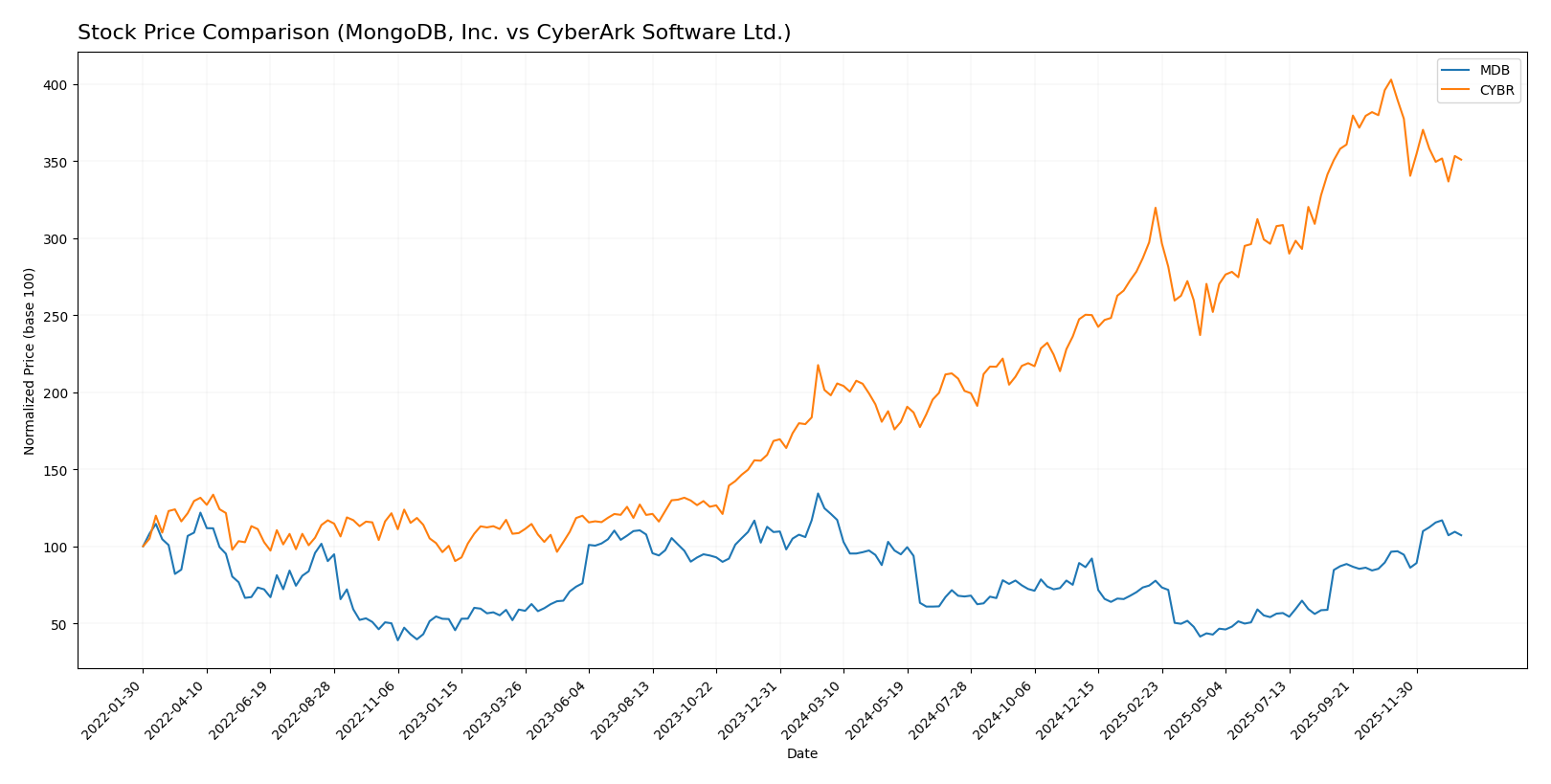

Stock Comparison

The past year saw contrasting stock price movements between MongoDB, Inc. and CyberArk Software Ltd., with notable shifts in their trading dynamics and volume trends that highlight differing investor sentiment and market momentum.

Trend Analysis

MongoDB, Inc. (MDB) experienced a bearish trend over the past 12 months with a price decline of 11.46%, showing acceleration and high volatility with a standard deviation of 72.49. The stock reached a high of 451.52 and a low of 154.39.

CyberArk Software Ltd. (CYBR) displayed a bullish trend over the same period, gaining 77.27% despite deceleration in momentum and higher volatility, indicated by a standard deviation of 82.45. Its price ranged between 227.32 and 520.78.

Comparing both, CyberArk delivered the highest market performance with a strong overall gain, while MongoDB’s stock declined, reflecting divergent investor interest and market dynamics.

Target Prices

Analysts present a bullish consensus for both MongoDB, Inc. and CyberArk Software Ltd., with target prices well above current market levels.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MongoDB, Inc. | 500 | 375 | 445.2 |

| CyberArk Software Ltd. | 520 | 440 | 479.22 |

The target consensus for MongoDB at 445.2 suggests modest upside from the current price of around 399.76 USD. CyberArk’s target consensus of 479.22 also indicates expected growth above its current price of 453.65 USD. Both stocks reflect positive analyst expectations but require close monitoring for risk management.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MongoDB, Inc. and CyberArk Software Ltd.:

Rating Comparison

MDB Rating

- Rating: C, considered Very Favorable overall by analysts.

- Discounted Cash Flow Score: Moderate at 2, indicating balanced future cash flow risk.

- ROE Score: Very Unfavorable at 1, showing low efficiency in generating profit from equity.

- ROA Score: Very Unfavorable at 1, indicating poor asset utilization.

- Debt To Equity Score: Favorable at 4, reflecting stronger financial stability with lower leverage.

- Overall Score: Moderate at 2, reflecting a middling financial standing.

CYBR Rating

- Rating: C-, also considered Very Favorable overall.

- Discounted Cash Flow Score: Moderate at 3, suggesting slightly better cash flow outlook.

- ROE Score: Very Unfavorable at 1, equally low efficiency in profit generation.

- ROA Score: Very Unfavorable at 1, similarly poor asset utilization.

- Debt To Equity Score: Moderate at 2, showing more financial risk due to higher leverage.

- Overall Score: Very Unfavorable at 1, indicating weaker overall financial health.

Which one is the best rated?

Based strictly on the provided data, MongoDB holds higher overall and debt-to-equity scores than CyberArk, indicating better financial stability and a more favorable overall rating. CyberArk shows a better discounted cash flow score but weaker overall financial health.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for MongoDB, Inc. and CyberArk Software Ltd.:

MDB Scores

- Altman Z-Score: 30.24, indicating a strong safe zone

- Piotroski Score: 4, reflecting average financial health

CYBR Scores

- Altman Z-Score: 6.52, also in the safe zone

- Piotroski Score: 3, considered very weak financial health

Which company has the best scores?

Based strictly on the provided data, MDB has a significantly higher Altman Z-Score and a slightly better Piotroski Score than CYBR, suggesting stronger financial stability and average financial health versus CYBR’s very weak status.

Grades Comparison

The grades from multiple reputable grading companies for MongoDB, Inc. and CyberArk Software Ltd. are as follows:

MongoDB, Inc. Grades

The following table summarizes the latest grades assigned by recognized firms for MongoDB, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

Overall, MongoDB’s grades consistently show positive sentiment with multiple Buy and Outperform ratings from top-tier firms.

CyberArk Software Ltd. Grades

The table below presents the most recent grades for CyberArk Software Ltd. from established grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2024-10-22 |

| Keybanc | Maintain | Overweight | 2024-10-18 |

| Mizuho | Maintain | Outperform | 2024-10-17 |

| BTIG | Maintain | Buy | 2024-10-09 |

| Barclays | Maintain | Overweight | 2024-10-07 |

| Wedbush | Maintain | Outperform | 2024-10-01 |

| Jefferies | Maintain | Buy | 2024-09-24 |

| DA Davidson | Maintain | Buy | 2024-08-09 |

| Rosenblatt | Maintain | Buy | 2024-08-09 |

| Susquehanna | Maintain | Positive | 2024-08-09 |

CyberArk’s grades predominantly reflect favorable views, with numerous Outperform and Buy ratings and no Sell or Strong Sell actions.

Which company has the best grades?

Both MongoDB and CyberArk have predominantly Buy and Outperform grades from credible firms, reflecting strong analyst confidence. CyberArk slightly edges with a higher count of Outperform ratings and no Sell recommendations, which may influence investor sentiment toward perceived stability and growth potential.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for MongoDB, Inc. (MDB) and CyberArk Software Ltd. (CYBR) based on the latest available data.

| Criterion | MongoDB, Inc. (MDB) | CyberArk Software Ltd. (CYBR) |

|---|---|---|

| Diversification | Strong subscription growth via MongoDB Atlas and Other Subscription segments totaling over 2B USD in 2025 | Diverse revenue streams including SaaS, Self Hosted Subscription, Maintenance and Support, totaling over 900M USD in 2024 |

| Profitability | Negative net margin (-6.43%) and ROIC (-7.36%), shedding value but with improving ROIC trend | Negative net margin (-9.34%) and ROIC (-2.85%), shedding value with declining ROIC trend |

| Innovation | High fixed asset turnover (24.78) indicating efficient use of assets | Very high fixed asset turnover (51.11), reflecting strong operational efficiency |

| Global presence | Significant global footprint with rapidly growing cloud-based offerings | Established global presence with a strong foothold in cybersecurity markets |

| Market Share | Leading position in database-as-a-service with fast growth in MongoDB Atlas | Strong market share in privileged access management and cybersecurity |

Key takeaways: MongoDB shows promising growth and operational efficiency but currently struggles with value creation. CyberArk maintains operational efficiency and market presence but faces declining profitability, signaling caution for investors.

Risk Analysis

Below is a table summarizing key risks for MongoDB, Inc. (MDB) and CyberArk Software Ltd. (CYBR) as of the most recent fiscal years.

| Metric | MongoDB, Inc. (MDB) | CyberArk Software Ltd. (CYBR) |

|---|---|---|

| Market Risk | High beta (1.38) indicates above-average market volatility risk. | Lower beta (0.92) suggests moderate market volatility risk. |

| Debt level | Very low debt-to-equity (0.01), minimal financial leverage risk. | Very low debt-to-equity (0.01), minimal leverage risk. |

| Regulatory Risk | Moderate, US tech sector exposure with evolving data privacy laws. | Moderate, cybersecurity regulations in multiple jurisdictions including US and Europe. |

| Operational Risk | Negative net margin (-6.43%) and negative ROE imply operational inefficiencies. | Negative net margin (-9.34%) and ROE also signal operational challenges. |

| Environmental Risk | Low, typical for software infrastructure sector with limited direct environmental impact. | Low, software security sector with minimal environmental footprint. |

| Geopolitical Risk | Moderate due to US headquarters and global cloud service footprint. | Elevated, headquartered in Israel with operations in multiple regions, subject to geopolitical tensions. |

Both companies face operational risks due to consistent negative profitability metrics, with CyberArk showing a slightly larger margin of loss. Market risk is higher for MongoDB given its greater beta, while geopolitical risk is more pronounced for CyberArk due to its location and international presence. Debt levels are low for both, reducing financial distress risk.

Recent data shows MongoDB’s Altman Z-Score (30.2) and CyberArk’s (6.5) are both in the safe zone, indicating low bankruptcy risk despite profitability challenges. Investors should weigh operational inefficiencies and regional risks carefully in portfolio allocation.

Which Stock to Choose?

MongoDB, Inc. (MDB) shows a favorable income statement with strong revenue growth of 19.22% in 2025 and an 85.7% favorable income evaluation overall. However, its financial ratios reveal mostly unfavorable profitability and leverage metrics, with a slightly unfavorable MOAT due to value destruction despite growing ROIC. The rating is very favorable (C), supported by a strong debt-to-equity score and a safe Altman Z-Score, yet profitability scores remain weak.

CyberArk Software Ltd. (CYBR) presents a neutral income statement evaluation with a 33.1% revenue growth in 2024 but mixed earnings growth and net margin declines. Its financial ratios are slightly unfavorable, with moderate leverage and weaker asset turnover, and a very unfavorable MOAT reflecting declining profitability. The rating is very favorable (C-), backed by a safe Altman Z-Score but a very weak Piotroski score, indicating financial fragility.

Investors seeking growth with improving profitability might find MongoDB’s favorable income trends and improving MOAT more appealing, while those focused on stability could view CyberArk’s safer financial scores and moderate leverage as more suitable despite its declining profitability. Ultimately, the choice could depend on an investor’s risk tolerance and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MongoDB, Inc. and CyberArk Software Ltd. to enhance your investment decisions: