In the rapidly evolving software infrastructure sector, CyberArk Software Ltd. and Informatica Inc. stand out as key players shaping the future of enterprise technology. CyberArk focuses on advanced cybersecurity solutions, while Informatica leads in AI-powered data management platforms. Both companies address critical needs for digital transformation, but their strategies and market approaches differ significantly. This article will help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between CyberArk Software Ltd. and Informatica Inc. by providing an overview of these two companies and their main differences.

CyberArk Software Ltd. Overview

CyberArk Software Ltd. specializes in software-based security solutions focused on privileged access management and identity security. Founded in 1999 and headquartered in Petah Tikva, Israel, it serves diverse industries including financial services, healthcare, and government agencies. CyberArk markets its products globally through direct sales and partners, positioning itself as a leader in cybersecurity infrastructure with a market cap of approximately 23B USD.

Informatica Inc. Overview

Informatica Inc., founded in 1993 and based in Redwood City, California, develops an AI-powered platform for data management across multi-cloud and hybrid environments. Its offerings include data integration, API management, data quality, and governance products aimed at enterprise clients. Informatica’s solutions support broad data unification and compliance efforts, with a market cap near 7.5B USD, reflecting its significant role in software infrastructure for data.

Key similarities and differences

Both CyberArk and Informatica operate within the software infrastructure industry, targeting enterprise customers with specialized platforms. CyberArk focuses on cybersecurity and privileged access management, while Informatica emphasizes data integration and governance powered by AI. CyberArk’s global security solutions contrast with Informatica’s data-centric approach, highlighting different but complementary niches within technology infrastructure. Their market caps and employee counts also indicate differing scales and operational focuses.

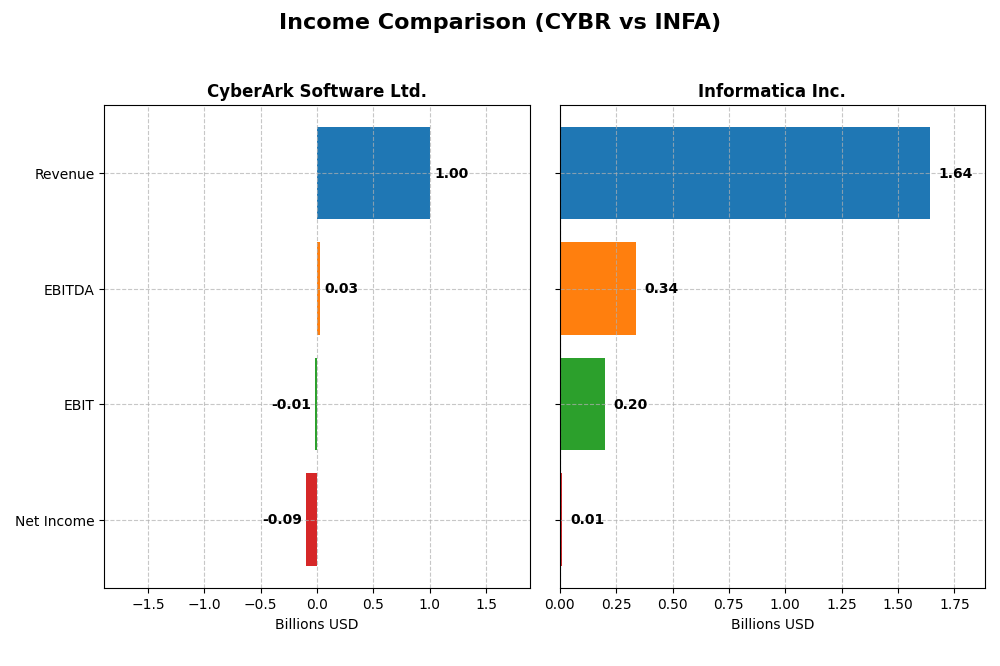

Income Statement Comparison

Below is a factual comparison of the most recent annual income statement metrics for CyberArk Software Ltd. and Informatica Inc. in 2024.

| Metric | CyberArk Software Ltd. | Informatica Inc. |

|---|---|---|

| Market Cap | 22.9B | 7.5B |

| Revenue | 1.00B | 1.64B |

| EBITDA | 28.7M | 339M |

| EBIT | -13.3M | 199M |

| Net Income | -93.5M | 9.9M |

| EPS | -2.12 | 0.0329 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CyberArk Software Ltd.

CyberArk’s revenue showed strong growth, rising from $464M in 2020 to $1.0B in 2024, a 115% increase. However, net income remained negative, deepening losses to -$93M in 2024. Gross margins were robust at 79.2%, but EBIT and net margins stayed unfavorable. The latest year saw revenue growth accelerate, but profitability deteriorated further.

Informatica Inc.

Informatica’s revenue grew steadily from $1.32B in 2020 to $1.64B in 2024, a 24% rise. The company returned to net profitability in 2024 with $10M net income after several loss-making years. Gross margin held strong at 80.1%, with improving EBIT and net margins. Recent growth slowed but margins and profitability improved significantly in 2024.

Which one has the stronger fundamentals?

Informatica demonstrates stronger fundamentals with consistent revenue growth, positive net income, and improving margins. CyberArk shows impressive revenue growth but continues to struggle with losses and negative margins. Informatica’s favorable margin trends and return to profitability contrast with CyberArk’s ongoing net income challenges.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CyberArk Software Ltd. (CYBR) and Informatica Inc. (INFA) based on their latest fiscal year 2024 data.

| Ratios | CyberArk Software Ltd. (CYBR) | Informatica Inc. (INFA) |

|---|---|---|

| ROE | -3.94% | 0.43% |

| ROIC | -2.85% | 0.56% |

| P/E | -157.49 | 787.95 |

| P/B | 6.21 | 3.39 |

| Current Ratio | 1.48 | 1.82 |

| Quick Ratio | 1.48 | 1.82 |

| D/E (Debt-to-Equity) | 0.012 | 0.81 |

| Debt-to-Assets | 0.009 | 0.35 |

| Interest Coverage | -17.90 | 0.87 |

| Asset Turnover | 0.30 | 0.31 |

| Fixed Asset Turnover | 51.11 | 8.75 |

| Payout ratio | 0 | 0.12% |

| Dividend yield | 0 | 0.00015% |

Interpretation of the Ratios

CyberArk Software Ltd.

CyberArk’s 2024 ratios show several weaknesses, including negative net margin (-9.34%) and return on equity (-3.94%), indicating profitability challenges. Its price-to-earnings ratio is favorable due to a negative value, but the price-to-book ratio of 6.21 signals potential overvaluation. The company does not pay dividends, reflecting a reinvestment focus or growth strategy without shareholder payouts.

Informatica Inc.

No ratio data is available for Informatica, preventing a detailed financial evaluation. As such, no assessment of profitability, valuation, liquidity, or leverage can be made. Similarly, no information on dividends or share repurchases is provided, leaving shareholder return aspects unclear.

Which one has the best ratios?

Based on the available data, CyberArk presents a mixed profile with more unfavorable than favorable indicators, leading to a slightly unfavorable overall assessment. Informatica lacks ratio data entirely, making a comparative judgment impossible. Therefore, only CyberArk’s partial ratio picture can be considered in this analysis.

Strategic Positioning

This section compares the strategic positioning of CyberArk and Informatica, focusing on market position, key segments, and exposure to technological disruption:

CyberArk

- Leading software security provider in privileged access management, facing moderate competition.

- Key segments: SaaS security, self-hosted subscriptions, maintenance, and professional services.

- Positioned in security software with robust cloud and identity solutions, moderate disruption risk.

Informatica

- Data management platform leader with broad AI integration, competing in enterprise multi-cloud.

- Focuses on subscription and professional services for data integration, governance, and APIs.

- AI-powered data platform exposed to rapid innovation in cloud and data governance technologies.

CyberArk vs Informatica Positioning

CyberArk concentrates on cybersecurity software with diversified product formats, while Informatica offers a concentrated AI-driven data management platform. CyberArk’s strength lies in security niche breadth, whereas Informatica emphasizes cloud data integration and governance.

Which has the best competitive advantage?

CyberArk shows a very unfavorable moat with declining ROIC and value destruction, while Informatica’s moat cannot be assessed due to missing data, leaving CyberArk’s competitive advantage questionable based on available information.

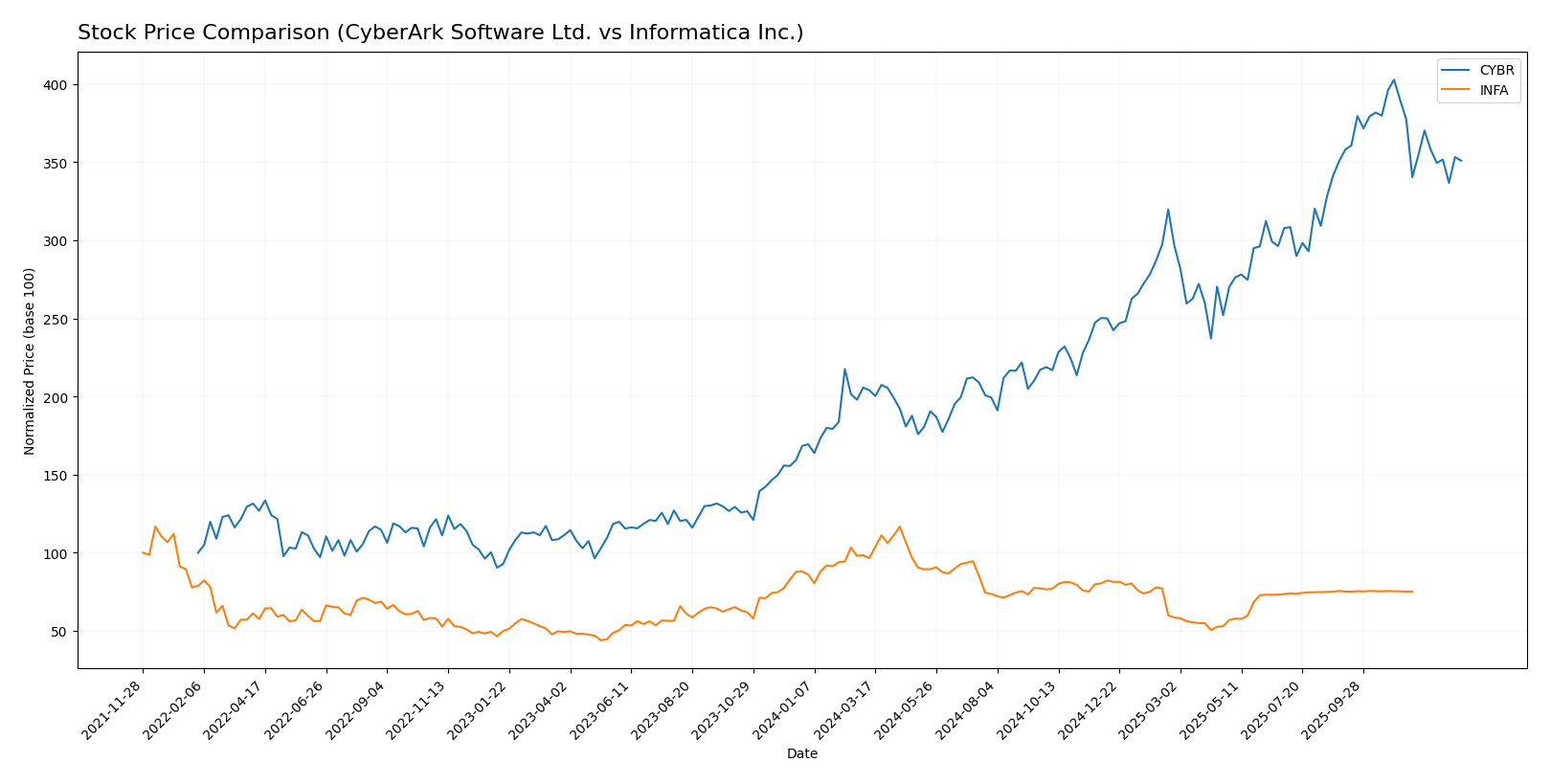

Stock Comparison

The stock price movements over the past year reveal contrasting dynamics, with CyberArk Software Ltd. showing a strong overall upward trend despite recent pullbacks, while Informatica Inc. experienced a declining trend with signs of stabilization in the latest period.

Trend Analysis

CyberArk Software Ltd. posted a 77.27% price increase over the past 12 months, indicating a bullish trend with deceleration. The stock saw a high of 520.78 and a low of 227.32, alongside significant volatility (std deviation 82.45).

Informatica Inc. showed a -12.68% decline over the same period, marking a bearish trend with acceleration. Price volatility was low (std deviation 4.46), and recent activity suggests a near-neutral short-term trend.

Comparing both, CyberArk outperformed Informatica, delivering the highest market performance with a substantial positive price change versus Informatica’s decline.

Target Prices

The current analyst consensus presents a moderately optimistic outlook for CyberArk Software Ltd. and a stable outlook for Informatica Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CyberArk Software Ltd. | 520 | 440 | 479.22 |

| Informatica Inc. | 27 | 27 | 27 |

For CyberArk, target prices suggest a potential upside of about 5.3% from the current price of $453.65, indicating cautious optimism. Informatica’s target consensus matches its recent price, implying a stable valuation with limited expected price movement.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CyberArk Software Ltd. and Informatica Inc.:

Rating Comparison

CyberArk Rating

- Rating: C- rated as Very Favorable by analysts.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation perspective.

- ROE Score: 1, considered Very Unfavorable, showing weak profitability from equity.

- ROA Score: 1, Very Unfavorable, reflecting poor asset utilization.

- Debt To Equity Score: 2, Moderate financial risk with balanced debt levels.

- Overall Score: 1, Very Unfavorable, suggesting weak overall financial health.

Informatica Rating

- No rating data available.

- No data available.

- No data available.

- No data available.

- No data available.

- No data available.

Which one is the best rated?

Based on the provided data, CyberArk has a complete set of ratings and scores, though mostly unfavorable except for a moderate DCF score. Informatica lacks any rating data, so CyberArk is the only company with an evaluable rating here.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CyberArk Software Ltd. and Informatica Inc.:

CYBR Scores

- Altman Z-Score: 6.52, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 3, rated very weak, suggesting poor financial strength.

INFA Scores

- Altman Z-Score: 1.94, in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 6, rated average, indicating moderate financial health.

Which company has the best scores?

CyberArk has a stronger Altman Z-Score, indicating greater financial safety, while Informatica holds a better Piotroski Score reflecting stronger financial health. Each company shows strengths in different score categories.

Grades Comparison

The comparison of grades for CyberArk Software Ltd. and Informatica Inc. is as follows:

CyberArk Software Ltd. Grades

The table below presents recent grades from reputable grading companies for CyberArk Software Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | maintain | Outperform | 2024-10-22 |

| Keybanc | maintain | Overweight | 2024-10-18 |

| Mizuho | maintain | Outperform | 2024-10-17 |

| BTIG | maintain | Buy | 2024-10-09 |

| Barclays | maintain | Overweight | 2024-10-07 |

| Wedbush | maintain | Outperform | 2024-10-01 |

| Jefferies | maintain | Buy | 2024-09-24 |

| DA Davidson | maintain | Buy | 2024-08-09 |

| Rosenblatt | maintain | Buy | 2024-08-09 |

| Susquehanna | maintain | Positive | 2024-08-09 |

Overall, CyberArk maintains a strong positive rating trend with multiple “Buy,” “Outperform,” and “Overweight” grades from respected firms.

Informatica Inc. Grades

The table below presents recent grades from reputable grading companies for Informatica Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | downgrade | Neutral | 2025-08-07 |

| UBS | maintain | Neutral | 2025-08-07 |

| Baird | maintain | Neutral | 2025-05-28 |

| JP Morgan | downgrade | Neutral | 2025-05-28 |

| RBC Capital | maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | maintain | Equal Weight | 2025-05-28 |

| Truist Securities | downgrade | Hold | 2025-05-28 |

| RBC Capital | maintain | Sector Perform | 2025-05-27 |

| UBS | maintain | Neutral | 2025-05-16 |

Informatica’s ratings show a consistent trend toward more cautious positions, with multiple downgrades leading to “Neutral,” “Hold,” and “Sector Perform” grades.

Which company has the best grades?

CyberArk Software Ltd. consistently receives higher and more positive grades such as “Buy,” “Outperform,” and “Overweight,” whereas Informatica Inc.’s ratings have shifted downward to mostly “Neutral,” “Hold,” and “Sector Perform.” This disparity may influence investors’ perception of relative growth and risk opportunities between the two companies.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for CyberArk Software Ltd. (CYBR) and Informatica Inc. (INFA) based on the most recent available data.

| Criterion | CyberArk Software Ltd. (CYBR) | Informatica Inc. (INFA) |

|---|---|---|

| Diversification | Moderate product diversification with SaaS and subscription growth; some reliance on maintenance revenue | Strong focus on cloud and subscription services; professional services growing |

| Profitability | Unfavorable profitability metrics; negative net margin (-9.34%), ROE (-3.94%), and ROIC (-2.85%) | Data unavailable for profitability evaluation |

| Innovation | Significant SaaS revenue growth signals innovation in cloud offerings | Data unavailable, but strong subscription growth implies cloud innovation |

| Global presence | Established international presence with diversified customer base | Established global footprint, leveraging cloud and subscription models |

| Market Share | Growing SaaS and subscription segments indicate expanding market share | Subscription revenue surpasses $1B, suggesting strong market presence |

Key takeaways: CyberArk shows promising innovation and diversification in SaaS but struggles with profitability and value creation, indicated by declining ROIC and negative margins. Informatica’s strong subscription revenue hints at robust market position and innovation, though detailed financial data is missing. Investors should weigh CyberArk’s growth potential against its current financial challenges, while seeking more data on Informatica for a complete assessment.

Risk Analysis

Below is a comparative table summarizing key risk factors for CyberArk Software Ltd. (CYBR) and Informatica Inc. (INFA) based on the most recent data from 2024-2026.

| Metric | CyberArk Software Ltd. (CYBR) | Informatica Inc. (INFA) |

|---|---|---|

| Market Risk | Moderate beta 0.915; tech sector volatility | Higher beta 1.135; exposed to cloud and AI market shifts |

| Debt level | Very low debt-to-equity 0.01; strong balance sheet | Data unavailable; moderate Altman Z-score indicates some leverage concerns |

| Regulatory Risk | Moderate; operates globally including US and Israel, subject to data privacy regulations | Moderate; US-based with extensive data governance exposure |

| Operational Risk | Medium; reliance on cybersecurity innovation and SaaS delivery | Medium; complexity in multi-cloud data integration products |

| Environmental Risk | Low; primarily software business with limited direct environmental impact | Low; software-focused with minimal environmental footprint |

| Geopolitical Risk | Moderate; headquartered in Israel with international sales | Moderate; US headquarters but global operations may face geopolitical tensions |

In summary, CyberArk shows a strong financial footing with very low debt and a safe Altman Z-score, but faces operational and geopolitical risks due to its cybersecurity niche and global presence. Informatica’s elevated market risk and grey zone Altman Z-score suggest moderate financial and market vulnerabilities, though it benefits from a diversified SaaS platform. Investors should weigh CyberArk’s stable balance sheet against its innovation dependency, while monitoring Informatica’s financial health and regulatory landscape closely.

Which Stock to Choose?

CyberArk Software Ltd. (CYBR) shows strong revenue growth of 33.1% in 2024 but suffers from negative profitability metrics including a -9.34% net margin and declining returns on equity and invested capital. Its debt levels are low, and the overall rating is very favorable despite a slightly unfavorable financial ratios evaluation.

Informatica Inc. (INFA) reports more modest revenue growth at 2.81% in 2024 with generally positive profitability indicators such as a 12.15% EBIT margin and a slight positive net margin. While financial ratios data is incomplete, its Altman Z-Score places it in a grey zone for bankruptcy risk, and the Piotroski Score is average, suggesting moderate financial health.

For investors prioritizing growth and willing to tolerate volatility, CyberArk’s substantial revenue expansion and very favorable rating might appear attractive despite profitability challenges. Conversely, those favoring stability and moderate profitability may find Informatica’s consistent margins and average financial scores more aligned with a risk-averse profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CyberArk Software Ltd. and Informatica Inc. to enhance your investment decisions: