In the dynamic world of technology, CyberArk Software Ltd. and GoDaddy Inc. stand out as influential players in software infrastructure. CyberArk specializes in advanced cybersecurity solutions, while GoDaddy excels in cloud-based digital presence and hosting services. Both companies address critical aspects of digital security and online identity, making their comparison vital for investors. In this article, I will help you identify which company offers the most compelling opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between CyberArk Software Ltd. and GoDaddy Inc. by providing an overview of these two companies and their main differences.

CyberArk Overview

CyberArk Software Ltd. develops and markets software-based security solutions, focusing on privileged access management and identity security to protect organizations from cyber threats. Operating globally, it serves multiple industries including financial services, healthcare, and government agencies. Founded in 1999 and headquartered in Israel, CyberArk emphasizes risk-based credential security and cloud entitlement management in its product portfolio.

GoDaddy Overview

GoDaddy Inc. designs and develops cloud-based technology products, primarily targeting domain registration, website hosting, and online presence tools for small businesses and individuals. The company also offers marketing services, business applications, and payment facilitation. Established in 2014 and based in Arizona, GoDaddy focuses on empowering customers to create and manage digital identities and e-commerce capabilities across the United States and internationally.

Key similarities and differences

Both CyberArk and GoDaddy operate in the software infrastructure sector and provide cloud-related services internationally. However, CyberArk specializes in cybersecurity and identity management solutions aimed at protecting privileged access, while GoDaddy centers on digital presence products such as domain registration, web hosting, and marketing tools. Their client bases differ, with CyberArk serving large enterprises and government, and GoDaddy targeting small businesses and individual users.

Income Statement Comparison

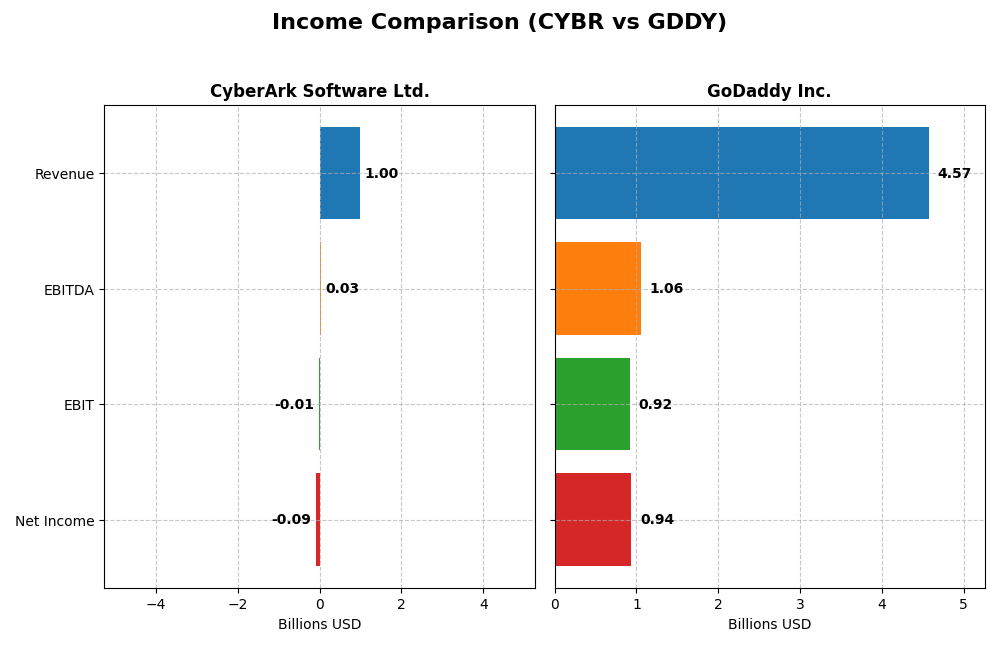

The table below presents a side-by-side comparison of key income statement metrics for CyberArk Software Ltd. and GoDaddy Inc. for the fiscal year 2024.

| Metric | CyberArk Software Ltd. (CYBR) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Cap | 22.9B | 14.5B |

| Revenue | 1.00B | 4.57B |

| EBITDA | 29M | 1.06B |

| EBIT | -13M | 924M |

| Net Income | -93M | 937M |

| EPS | -2.12 | 6.63 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CyberArk Software Ltd.

CyberArk’s revenue grew strongly by 115% from 2020 to 2024, reaching $1.0B in 2024, but net income remained negative, worsening overall with a -1523% decline. Gross margins stayed favorable around 79%, yet EBIT and net margins were negative, reflecting ongoing losses. The latest year shows solid revenue growth of 33%, but net margins deteriorated further, indicating profitability challenges.

GoDaddy Inc.

GoDaddy displayed steady revenue growth of 38% over the five-year period, reaching $4.57B in 2024. Net income rose substantially by 289%, with net margins improving to a favorable 20.5%. Gross margin held steady near 64%, and EBIT margin was healthy at 20.2%. The most recent year saw moderate revenue growth of 7.5%, though net margin and EPS declined, suggesting some pressure on profitability.

Which one has the stronger fundamentals?

GoDaddy shows stronger fundamentals overall, with consistent positive net income growth, favorable margins, and profitability improvements. In contrast, CyberArk, despite impressive revenue gains and robust gross margins, continues to report losses and negative net margins. GoDaddy’s financials indicate more stable and profitable operations compared to CyberArk’s ongoing earnings challenges.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CyberArk Software Ltd. (CYBR) and GoDaddy Inc. (GDDY) based on their most recent full fiscal year data from 2024.

| Ratios | CyberArk Software Ltd. (CYBR) | GoDaddy Inc. (GDDY) |

|---|---|---|

| ROE | -3.94% | 135.37% |

| ROIC | -2.85% | 16.02% |

| P/E | -157.49 | 29.76 |

| P/B | 6.21 | 40.28 |

| Current Ratio | 1.48 | 0.72 |

| Quick Ratio | 1.48 | 0.72 |

| D/E (Debt-to-Equity) | 0.01 | 5.63 |

| Debt-to-Assets | 0.01 | 0.47 |

| Interest Coverage | -17.90 | 5.64 |

| Asset Turnover | 0.30 | 0.56 |

| Fixed Asset Turnover | 51.11 | 22.22 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

CyberArk Software Ltd.

CyberArk shows a mixed profile with 35.71% favorable and 50% unfavorable ratios, indicating a slightly unfavorable overall stance. Key weaknesses include negative net margin (-9.34%) and return on equity (-3.94%), alongside poor interest coverage (-3.27). The company maintains a low debt level (debt to assets 0.88%) and a solid quick ratio (1.48). CyberArk does not pay dividends, likely due to ongoing reinvestment in R&D and operational challenges.

GoDaddy Inc.

GoDaddy presents a more balanced ratio set with 42.86% favorable and 42.86% unfavorable, leading to a neutral overall evaluation. It boasts strong profitability metrics such as a 20.49% net margin and 135.37% return on equity, though valuation ratios (PE 29.76, PB 40.28) and liquidity (current ratio 0.72) raise concerns. The company also does not distribute dividends, possibly prioritizing growth and acquisitions over shareholder payouts.

Which one has the best ratios?

Comparing both, GoDaddy’s ratios are relatively stronger in profitability and coverage metrics, despite some valuation and liquidity concerns. CyberArk struggles with profitability and cash flow metrics but benefits from low leverage and better liquidity. Overall, GoDaddy’s neutral rating contrasts with CyberArk’s slightly unfavorable profile, indicating GoDaddy currently has the more balanced ratio performance.

Strategic Positioning

This section compares the strategic positioning of CyberArk Software Ltd. and GoDaddy Inc., focusing on Market position, Key segments, and exposure to technological disruption:

CyberArk Software Ltd.

- Operates globally in software security with competitive pressure in infrastructure security.

- Key segments include SaaS security solutions, self-hosted subscriptions, maintenance, and professional services.

- Faces disruption from cloud security innovations and evolving identity management technologies.

GoDaddy Inc.

- Leading in cloud-based technology with pressure in domain and hosting services.

- Core platform and applications/commerce drive growth, serving small businesses and individuals.

- Exposed to cloud hosting and online marketing technological shifts impacting digital presence.

CyberArk Software Ltd. vs GoDaddy Inc. Positioning

CyberArk focuses on diversified security software solutions across multiple industries, while GoDaddy concentrates on cloud-based digital identity and hosting services. CyberArk’s approach targets enterprise security; GoDaddy emphasizes small business online presence and commerce.

Which has the best competitive advantage?

GoDaddy exhibits a very favorable moat with growing ROIC and value creation, indicating a durable competitive advantage. CyberArk shows very unfavorable moat evaluation with declining ROIC and value destruction, reflecting weaker competitive strength.

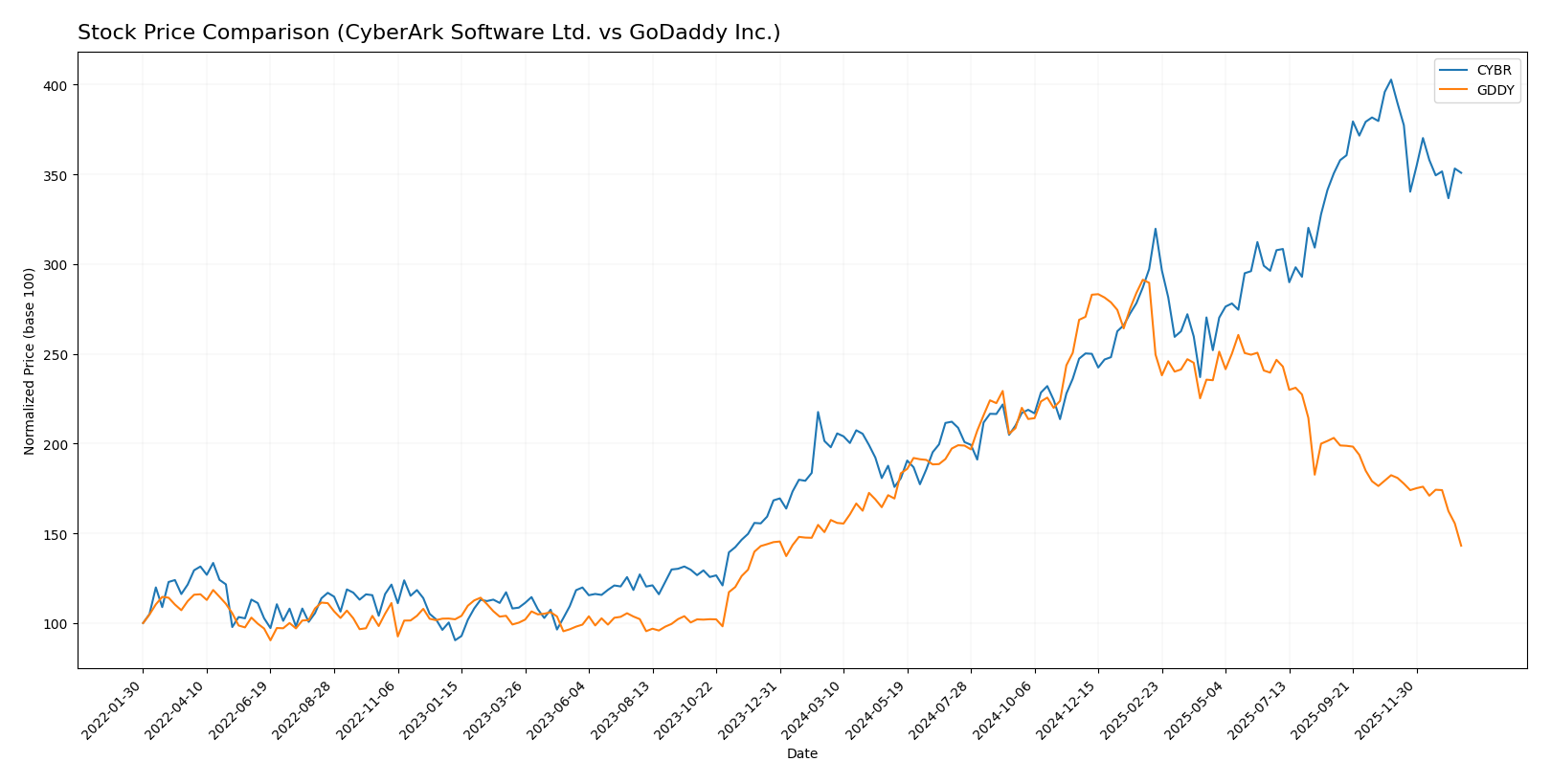

Stock Comparison

The stock prices of CyberArk Software Ltd. and GoDaddy Inc. have exhibited contrasting movements over the past 12 months, with CyberArk showing strong gains despite recent weakness, while GoDaddy has faced consistent declines with decelerating bearish momentum.

Trend Analysis

CyberArk Software Ltd. experienced a bullish trend over the past year with a 77.27% price increase, though the growth rate has decelerated. The stock showed significant volatility, ranging from a low of 227.32 to a high of 520.78.

GoDaddy Inc. displayed a bearish trend with a 9.09% decline over the same period, also with decelerating momentum. Its price fluctuated between 104.46 and 212.65, exhibiting lower volatility compared to CyberArk.

Comparing both, CyberArk delivered the highest market performance with a strong positive price change, while GoDaddy’s stock trended downward over the past 12 months.

Target Prices

Analysts present a clear consensus on target prices for CyberArk Software Ltd. and GoDaddy Inc., indicating expected price ranges and potential upside.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CyberArk Software Ltd. | 520 | 440 | 479.22 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

The consensus target for CyberArk Software Ltd. is about 5.6% above the current price of 453.65 USD, suggesting moderate upside potential. GoDaddy’s consensus target is significantly higher than its current price of 104.46 USD, indicating substantial expected growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for CyberArk Software Ltd. and GoDaddy Inc.:

Rating Comparison

CYBR Rating

- Rating: C- indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: Moderate at 3, showing fair valuation.

- ROE Score: Very unfavorable at 1, reflecting low profitability from equity.

- ROA Score: Very unfavorable at 1, showing poor asset utilization.

- Debt To Equity Score: Moderate at 2, indicating medium financial risk.

- Overall Score: Very unfavorable at 1, signaling weak overall financial health.

GDDY Rating

- Rating: B+ indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: Very favorable at 5, indicating undervaluation.

- ROE Score: Very favorable at 5, reflecting high profitability from equity.

- ROA Score: Favorable at 4, showing effective asset utilization.

- Debt To Equity Score: Very unfavorable at 1, indicating higher financial risk.

- Overall Score: Moderate at 3, indicating average financial health.

Which one is the best rated?

GoDaddy Inc. is better rated overall with a B+ rating and higher scores in discounted cash flow, ROE, and ROA. CyberArk holds a C- rating with weaker financial scores across most categories except debt-to-equity.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CyberArk Software Ltd. and GoDaddy Inc.:

CyberArk Scores

- Altman Z-Score: 6.52, indicating a safe financial zone with very low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

GoDaddy Scores

- Altman Z-Score: 1.53, signaling financial distress and a high bankruptcy risk.

- Piotroski Score: 8, considered very strong financial health.

Which company has the best scores?

CyberArk shows a much stronger Altman Z-Score, indicating financial stability, while GoDaddy has a significantly better Piotroski Score, reflecting stronger financial health. The scores show contrasting strengths between the two companies.

Grades Comparison

Here is the detailed grades comparison for CyberArk Software Ltd. and GoDaddy Inc.:

CyberArk Software Ltd. Grades

The following table summarizes recent analyst grades for CyberArk Software Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2024-10-22 |

| Keybanc | Maintain | Overweight | 2024-10-18 |

| Mizuho | Maintain | Outperform | 2024-10-17 |

| BTIG | Maintain | Buy | 2024-10-09 |

| Barclays | Maintain | Overweight | 2024-10-07 |

| Wedbush | Maintain | Outperform | 2024-10-01 |

| Jefferies | Maintain | Buy | 2024-09-24 |

| DA Davidson | Maintain | Buy | 2024-08-09 |

| Rosenblatt | Maintain | Buy | 2024-08-09 |

| Susquehanna | Maintain | Positive | 2024-08-09 |

Overall, CyberArk’s grades consistently indicate positive outlooks with a predominance of Buy and Outperform ratings across multiple reputable firms.

GoDaddy Inc. Grades

The following table summarizes recent analyst grades for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

GoDaddy’s grades show a mixed consensus with several Buy ratings but also multiple Neutral and Hold opinions, reflecting a more cautious market stance.

Which company has the best grades?

CyberArk Software Ltd. has received predominantly strong Buy and Outperform grades, indicating a generally more favorable analyst outlook than GoDaddy Inc., whose ratings are more mixed with a balance of Buy, Hold, and Neutral opinions. This contrast may influence investors differently based on their risk tolerance and growth expectations.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses of CyberArk Software Ltd. (CYBR) and GoDaddy Inc. (GDDY) based on the most recent financial and operational data.

| Criterion | CyberArk Software Ltd. (CYBR) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Moderate product mix with focus on SaaS (USD 469M) and Self Hosted Subscription (USD 265M) | Strong revenue diversification: Core Platform (USD 2.92B) and Applications & Commerce (USD 1.65B) |

| Profitability | Negative net margin (-9.34%), negative ROIC (-2.85%), value destroying | High net margin (20.49%), strong ROIC (16.02%), value creating |

| Innovation | Declining ROIC trend indicates challenges in sustaining profitability and innovation | Growing ROIC and strong economic moat suggest robust innovation and competitive advantage |

| Global presence | Limited data, but smaller scale revenue implies less global reach | Large scale revenue and diversified services indicate strong global footprint |

| Market Share | Niche player in cybersecurity with specialization | Leading market position in web services and domain registration |

Key takeaways: GoDaddy demonstrates a durable competitive advantage with strong profitability and diversified revenue streams, making it a more attractive investment. CyberArk struggles with profitability and value creation, signaling caution for investors despite its niche in cybersecurity.

Risk Analysis

Below is a comparative table of key risks for CyberArk Software Ltd. (CYBR) and GoDaddy Inc. (GDDY) based on the most recent 2024 data:

| Metric | CyberArk Software Ltd. (CYBR) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | Moderate (Beta 0.915) | Moderate (Beta 0.948) |

| Debt level | Very Low (D/E 0.01) | High (D/E 5.63) |

| Regulatory Risk | Moderate (Tech sector, global) | Moderate (Tech sector, US focus) |

| Operational Risk | Moderate (Security software) | Moderate (Cloud services) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Elevated (Israel-based HQ) | Moderate (US-based HQ) |

The most impactful risks are GoDaddy’s high debt level, which increases financial vulnerability, and CyberArk’s geopolitical exposure due to its Israeli headquarters in a region with ongoing tensions. Both companies face moderate market and regulatory risks typical of the technology infrastructure sector. Investors should weigh CyberArk’s strong balance sheet against its slightly weaker profitability metrics.

Which Stock to Choose?

CyberArk Software Ltd. (CYBR) exhibits a strong revenue growth of 33.1% in 2024 with a favorable gross margin of 79.18%, but profitability metrics like net margin (-9.34%) and ROE (-3.94%) remain unfavorable. Its debt levels are low, supported by a favorable debt-to-equity ratio (0.01), yet the overall financial ratios evaluation is slightly unfavorable, and the rating is very favorable (C-). The company’s economic moat is very unfavorable due to declining ROIC compared to WACC indicating value destruction.

GoDaddy Inc. (GDDY) shows moderate revenue growth (7.5%) with a favorable net margin of 20.49% and strong profitability ratios, including ROE at 135.37%. However, it carries higher debt (debt-to-equity 5.63) and a current ratio below 1 (0.72), reflecting some liquidity concerns. Its financial ratios evaluation is neutral, and the rating is very favorable (B+). GDDY’s moat evaluation is very favorable, with growing ROIC exceeding WACC, signaling value creation and sustained competitive advantage.

For investors prioritizing growth potential, CYBR’s rapid revenue expansion and low leverage might appear attractive despite profitability challenges and a negative moat. Conversely, GDDY could be more appealing for those focused on quality and value creation, given its favorable profitability ratios and strong economic moat, despite higher leverage and liquidity risk. The choice might depend on individual risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CyberArk Software Ltd. and GoDaddy Inc. to enhance your investment decisions: