Home > Comparison > Healthcare > CVS vs ELV

The strategic rivalry between CVS Health Corporation and Elevance Health Inc. shapes the future of the healthcare plans sector. CVS operates a vast, integrated model combining retail pharmacy with healthcare benefits, while Elevance focuses on comprehensive health benefits with a digital-first approach. This head-to-head highlights a battle between scale-driven integration and innovation-led growth. This analysis will identify which trajectory offers superior risk-adjusted returns for a diversified portfolio in today’s evolving healthcare landscape.

Table of contents

Companies Overview

CVS Health Corporation and Elevance Health Inc. both command significant positions in the U.S. healthcare plans market.

CVS Health Corporation: Integrated Healthcare Services Leader

CVS Health Corporation dominates the healthcare plans sector through its diversified business model spanning pharmacy services, health care benefits, and retail operations. Its core revenue engine combines health insurance offerings with pharmacy benefit management and retail pharmacy sales. In 2026, CVS focuses strategically on expanding its retail footprint and enhancing integrated care through MinuteClinic and specialty pharmacy services.

Elevance Health Inc.: Comprehensive Care Solutions Provider

Elevance Health Inc. positions itself as a health benefits powerhouse connecting consumers to a broad range of medical, digital, and behavioral health services. It generates revenue by underwriting health plans for roughly 118 million members and delivering care management solutions. Elevance’s 2026 strategy emphasizes holistic care integration and digital innovation to improve patient outcomes across the care continuum.

Strategic Collision: Similarities & Divergences

Both companies leverage healthcare plans as their core but diverge in approach: CVS blends retail and insurance vertically while Elevance focuses on broad care coordination and digital tools. They battle primarily for market share in the insurance and pharmacy benefits arena. CVS offers a more tangible retail presence; Elevance relies on scale and care integration. Their investment profiles differ by CVS’s asset-heavy retail model versus Elevance’s service-oriented platform.

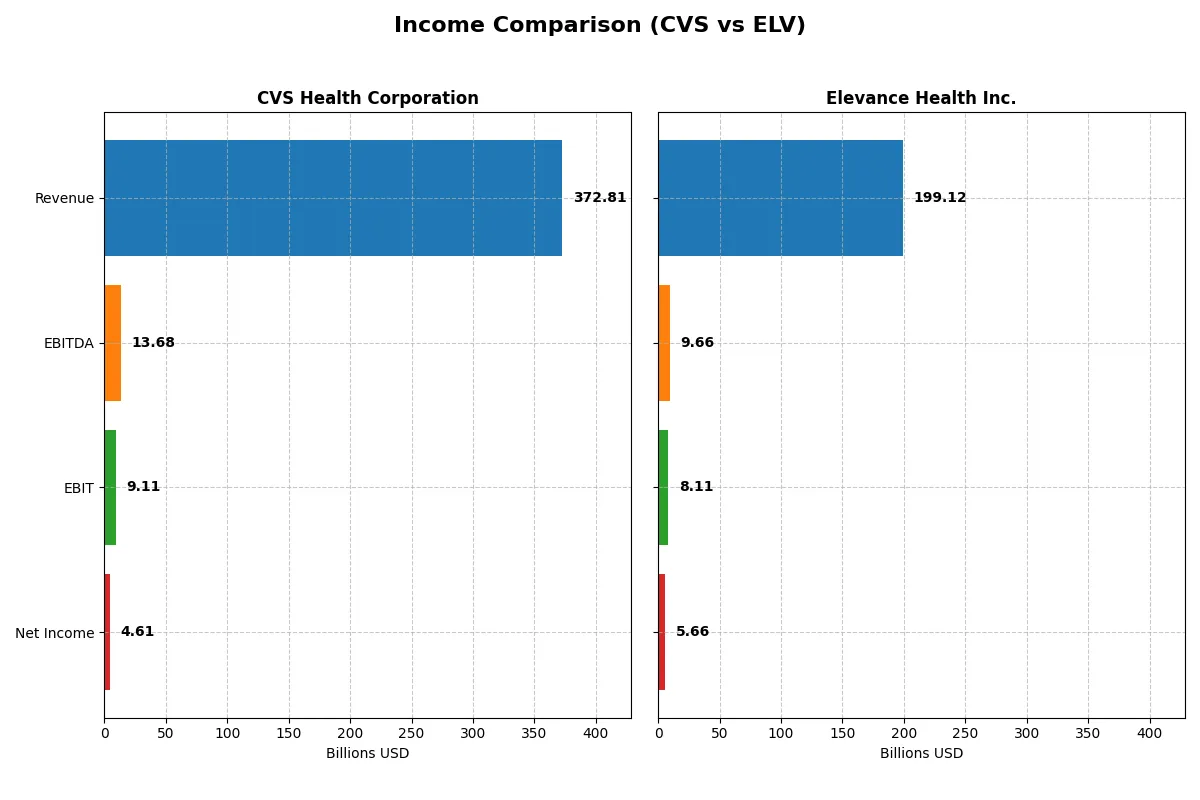

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | CVS Health Corporation (CVS) | Elevance Health Inc. (ELV) |

|---|---|---|

| Revenue | 373B | 177B |

| Cost of Revenue | 321B | 128B |

| Operating Expenses | 43B | 40B |

| Gross Profit | 51B | 49B |

| EBITDA | 13.7B | 10.5B |

| EBIT | 9.1B | 9.1B |

| Interest Expense | 3.0B | 1.2B |

| Net Income | 4.6B | 6.0B |

| EPS | 3.66 | 25.81 |

| Fiscal Year | 2024 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability of two healthcare giants over recent years.

CVS Health Corporation Analysis

CVS’s revenue rose steadily from 268.7B in 2020 to 372.8B in 2024, reflecting solid top-line growth of nearly 39% over five years. However, net income declined sharply by 36%, falling to 4.6B in 2024. Gross margins narrowed slightly to 13.8%, and net margin compressed to 1.24%. The latest year showed weakening profitability and a 34% drop in EBIT, signaling margin pressure and operational challenges.

Elevance Health Inc. Analysis

Elevance’s revenue expanded impressively from 138.6B in 2021 to 199.1B in 2025, a 44% increase over five years, with a favorable 12.6% growth rate between 2024 and 2025. Net income dropped modestly by 7% to 5.7B in 2025. Its gross margin at 25.6% vastly outpaces CVS, while net margin stands at 2.84%. Although EBIT declined by 11% last year, Elevance maintains stronger profitability and operational leverage.

Margin Efficiency vs. Revenue Growth

Elevance Health offers superior margin efficiency with a gross margin nearly double CVS’s, despite slightly slower EPS growth. CVS achieves larger revenue scale but suffers from deteriorating profitability and margin contraction. For investors prioritizing sustainable earnings and margin health, Elevance’s profile appears more attractive and operationally robust.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the following companies:

| Ratios | CVS Health Corporation (CVS) | Elevance Health Inc. (ELV) |

|---|---|---|

| ROE | 6.11% (2024) | 14.47% (2024) |

| ROIC | 3.61% (2024) | 296.47% (2024) |

| P/E | 12.2x (2024) | 14.4x (2024) |

| P/B | 0.75x (2024) | 2.08x (2024) |

| Current Ratio | 0.81 (2024) | 1.54 (2025) |

| Quick Ratio | 0.60 (2024) | 1.54 (2025) |

| D/E | 1.10 (2024) | 0.73 (2025) |

| Debt-to-Assets | 32.7% (2024) | 26.4% (2025) |

| Interest Coverage | 2.88x (2024) | 4.99x (2025) |

| Asset Turnover | 1.47 (2024) | 1.64 (2025) |

| Fixed Asset Turnover | 12.9 (2024) | 42.5 (2025) |

| Payout ratio | 73.1% (2024) | 27.0% (2025) |

| Dividend yield | 5.97% (2024) | 1.97% (2025) |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence through profitability, valuation, and financial health metrics.

CVS Health Corporation

CVS shows modest profitability with a 6.11% ROE and a low 1.24% net margin, signaling operational challenges. Its valuation appears attractive, with a P/E of 12.25 and a P/B below 1, suggesting the stock is undervalued. The company offers a solid 5.97% dividend yield, providing steady shareholder returns despite weak liquidity ratios.

Elevance Health Inc.

Elevance delivers superior profitability, with a 12.9% ROE and a net margin of 2.85%. Its valuation is fair, sporting a P/E of 13.73 and a P/B of 1.77, reflecting moderate market confidence. Strong liquidity and debt metrics support financial stability. The dividend yield is modest at 1.97%, consistent with a balanced growth and income approach.

Valuation Discipline vs. Operational Strength

Elevance Health outperforms CVS in profitability and financial health, while CVS offers a more attractive valuation and higher dividend yield. Investors prioritizing risk management may prefer Elevance’s profile. Those seeking income and value might find CVS more fitting.

Which one offers the Superior Shareholder Reward?

I see CVS Health delivers a robust 5.97% dividend yield with a high payout ratio near 73%, signaling strong income but limited reinvestment. Its buyback activity is moderate, supporting shareholder returns without overstretching. Elevance Health yields 1.97% with a low 25% payout, prioritizing reinvestment in growth and acquisitions, complemented by aggressive buybacks fueling capital appreciation. Historically, CVS’s income-focused model suits dividend seekers but risks sustainability amid tight free cash flow coverage. Elevance’s balanced approach underpins long-term value, offering a superior total return profile in 2026 due to growth and capital return synergy. I favor Elevance for total shareholder reward in the current cycle.

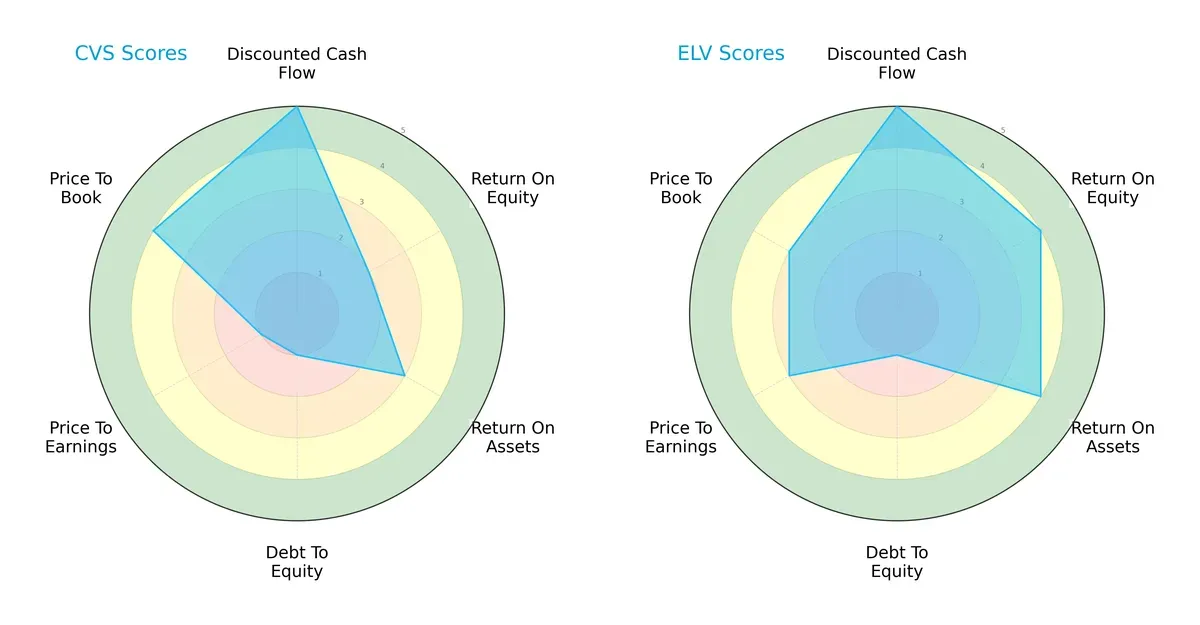

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of CVS Health Corporation and Elevance Health Inc., highlighting their core financial strengths and weaknesses:

CVS and Elevance both excel in discounted cash flow with top scores of 5, signaling strong future cash flow projections. Elevance outperforms CVS in return on equity (4 vs. 2) and return on assets (4 vs. 3), indicating more efficient profit generation and asset use. Both firms carry high financial risk with a weak debt-to-equity score of 1. CVS suffers from valuation concerns, scoring poorly on price-to-earnings (1) but fares better on price-to-book (4). Elevance shows a more balanced profile, blending profitability and valuation metrics effectively, while CVS relies more heavily on valuation bargains.

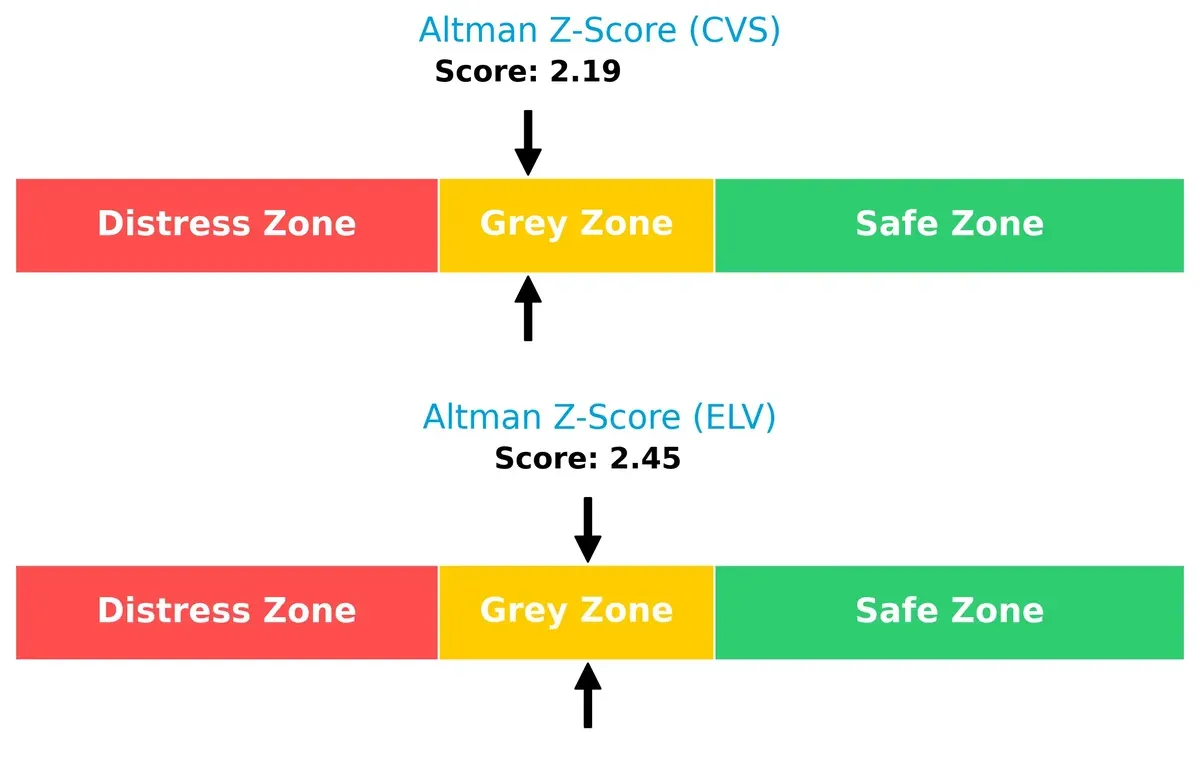

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both companies in the grey zone, signaling moderate bankruptcy risk in this cycle:

CVS scores 2.19, slightly lower than Elevance’s 2.45, implying CVS faces marginally higher financial distress risk. Neither company is in the safe zone, so investors should monitor liquidity and leverage closely amid sector volatility.

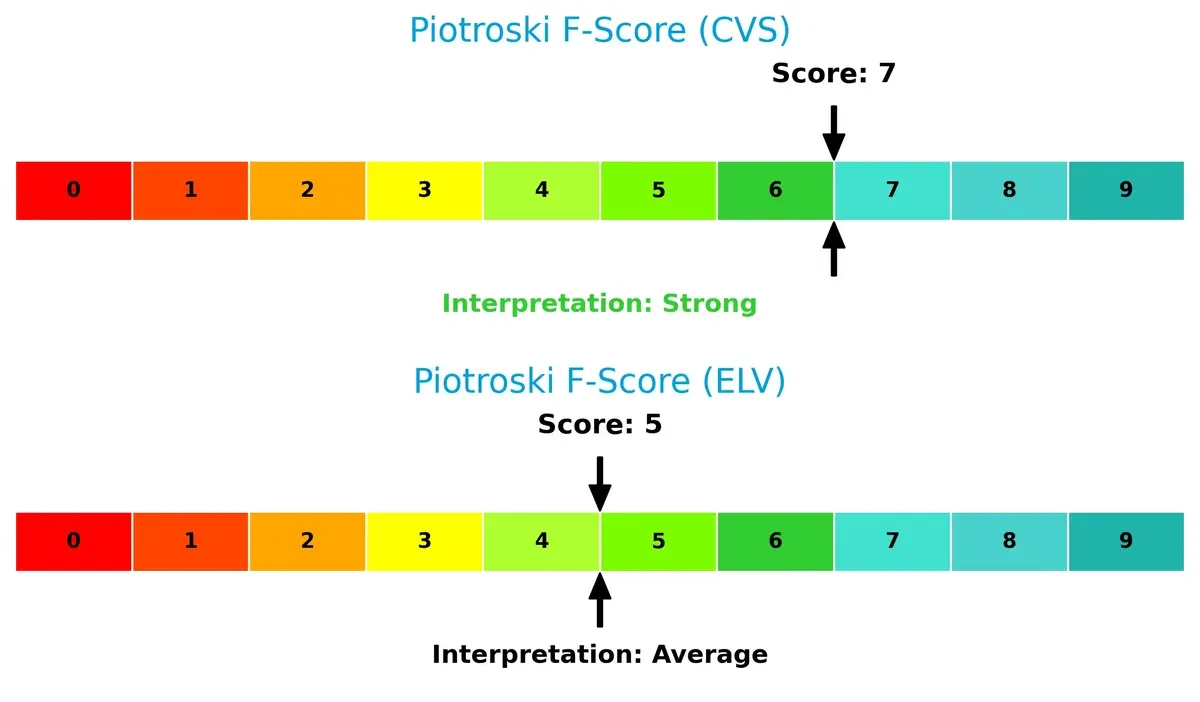

Financial Health: Quality of Operations

CVS leads with a Piotroski F-Score of 7, indicating strong financial health, while Elevance’s score of 5 signals average operational quality and potential red flags:

CVS’s higher score reflects better profitability, efficiency, and lower financial risk. Elevance’s moderate score suggests room for improvement in internal metrics, warranting caution despite its favorable market positioning.

How are the two companies positioned?

This section dissects CVS and ELV’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

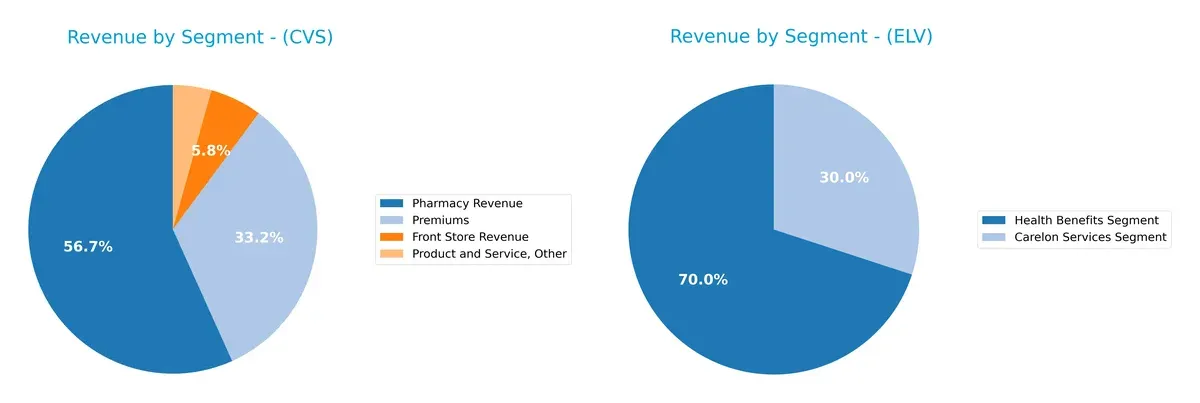

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how CVS Health Corporation and Elevance Health Inc. diversify their income streams and where their primary sector bets lie:

CVS anchors its revenue in Pharmacy ($210B) and Premiums ($123B), with Front Store adding $21.5B, showing moderate diversification. Elevance pivots mainly on Health Benefits ($167B) and Carelon Services ($71.7B), displaying a more concentrated but focused mix. CVS’s breadth suggests ecosystem lock-in, while Elevance’s concentration implies targeted infrastructure dominance but exposes it to segment-specific risks.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of CVS Health Corporation and Elevance Health Inc.:

CVS Strengths

- Diverse revenue from Pharmacy, Premiums, Front Store segments

- Favorable asset and fixed asset turnover rates

- Attractive PE and PB ratios indicating market valuation appeal

ELV Strengths

- Strong revenue from Carelon Services and Health Benefits segments

- Favorable liquidity ratios and lower leverage

- High fixed asset turnover and interest coverage ratios

CVS Weaknesses

- Low profitability metrics including net margin, ROE, and ROIC

- Poor liquidity ratios below 1

- Elevated debt-to-equity ratio indicates higher leverage

ELV Weaknesses

- Net margin remains unfavorable despite other positives

- Price-to-book ratio is neutral, suggesting valuation concerns

- Moderate ROE and ROIC with room for improvement

CVS shows strength in diversified revenue streams and efficient asset use but suffers from weak profitability and liquidity. Elevance Health demonstrates stronger financial health and operational efficiency but needs to improve profitability metrics. Each company’s strategy must address these contrasting financial profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole barrier protecting long-term profits from relentless competition erosion. Let’s dissect how CVS Health and Elevance Health defend their turf:

CVS Health Corporation: Integrated Healthcare Network Moat

CVS leverages scale and service integration, creating switching costs through its pharmacy and health benefit segments. However, declining ROIC and squeezed margins signal weakening financial defensibility in 2026.

Elevance Health Inc.: Data-Driven Care Management Moat

Elevance’s moat centers on advanced data analytics optimizing care pathways, boosting margins beyond CVS. Despite a slight ROIC decline, its higher gross margin and revenue growth imply steadier competitive resilience.

Verdict: Scale Integration vs. Analytics Precision

CVS’s integrated model offers broad scale but suffers from value erosion and shrinking returns. Elevance’s data-driven precision builds a deeper moat with superior profitability metrics. I see Elevance better poised to sustain its market share amid healthcare complexities.

Which stock offers better returns?

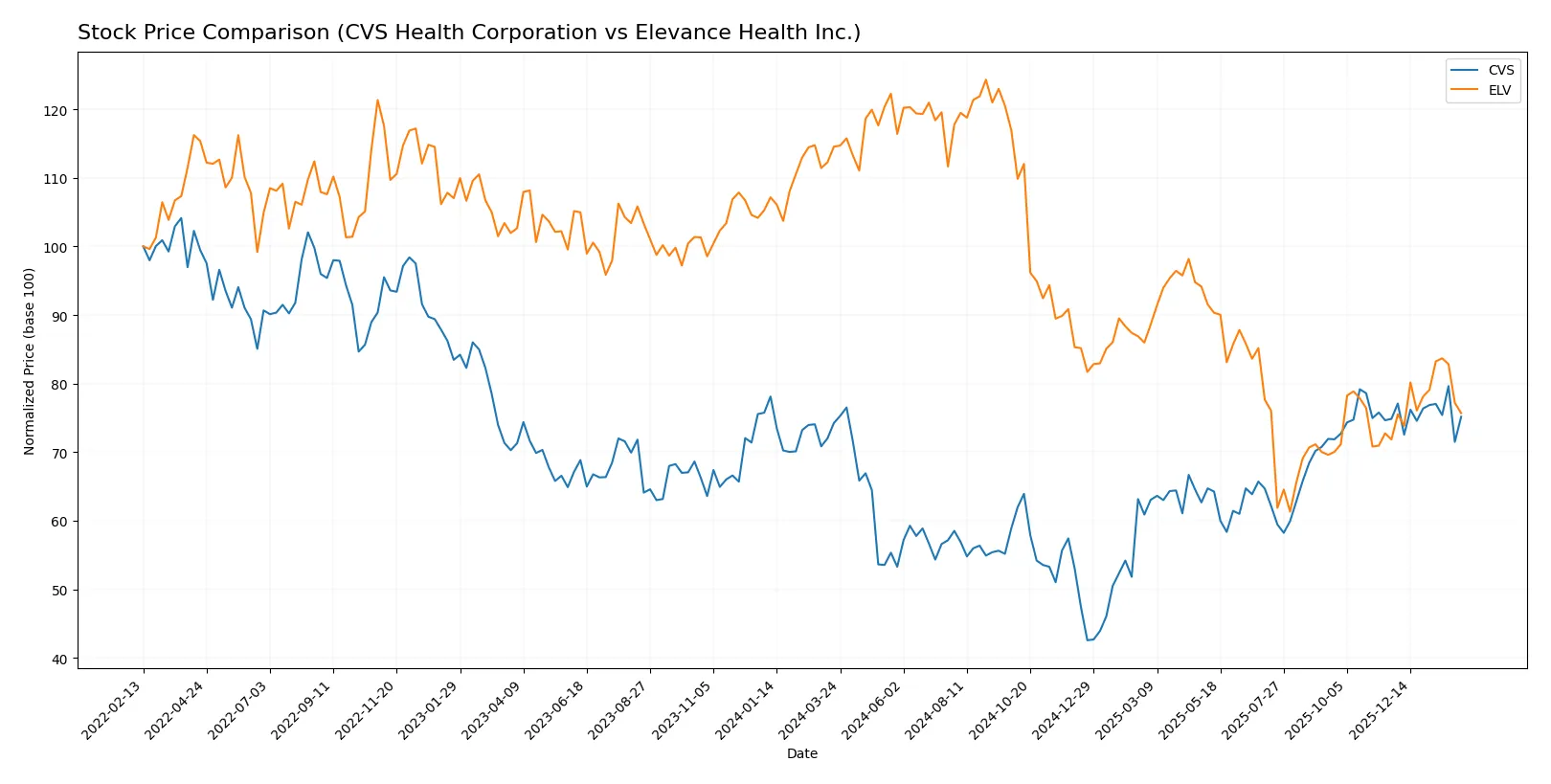

Over the past year, CVS Health Corporation showed a modest price increase with decelerating momentum, while Elevance Health Inc. experienced a sharp decline followed by recent strong gains.

Trend Comparison

CVS’s stock rose 1.23% over the last 12 months, marking a bullish trend with decelerating growth. The price ranged between 44.36 and 83.01, with moderate volatility (9.42 std dev).

Elevance Health’s stock dropped 33.93% over the same period, signaling a bearish trend with accelerating downside. Despite this, the last quarter saw a 5.36% rebound amid high volatility (82.59 std dev).

CVS delivered the highest market performance overall, with a mild upward trend versus Elevance Health’s steep annual decline despite recent recovery.

Target Prices

Analysts present a bullish consensus on both CVS Health Corporation and Elevance Health Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| CVS Health Corporation | 90 | 103 | 94.92 |

| Elevance Health Inc. | 332 | 425 | 387.14 |

The consensus target prices for CVS and Elevance exceed their current prices of 78.35 and 338.98 respectively, signaling analyst expectations for meaningful upside potential. This suggests confidence in their healthcare plans amid evolving market dynamics.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent grades assigned by reputable financial institutions for both companies:

CVS Health Corporation Grades

This table presents recent grades given to CVS by major grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | maintain | Buy | 2026-01-28 |

| B of A Securities | maintain | Buy | 2026-01-27 |

| JP Morgan | maintain | Overweight | 2025-12-17 |

| Bernstein | maintain | Market Perform | 2025-12-12 |

| Morgan Stanley | maintain | Overweight | 2025-12-10 |

| Truist Securities | maintain | Buy | 2025-12-10 |

| Barclays | maintain | Overweight | 2025-12-10 |

| Piper Sandler | maintain | Overweight | 2025-12-10 |

| Mizuho | maintain | Outperform | 2025-12-10 |

| UBS | maintain | Buy | 2025-12-10 |

Elevance Health Inc. Grades

Below are the latest grades issued to Elevance Health by notable grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Overweight | 2026-02-02 |

| Truist Securities | maintain | Buy | 2026-02-02 |

| Barclays | maintain | Overweight | 2026-01-30 |

| Wells Fargo | maintain | Overweight | 2026-01-30 |

| Guggenheim | maintain | Buy | 2026-01-29 |

| Guggenheim | maintain | Buy | 2026-01-22 |

| Wolfe Research | upgrade | Outperform | 2026-01-08 |

| Wells Fargo | maintain | Overweight | 2026-01-07 |

| Barclays | maintain | Overweight | 2026-01-05 |

| Deutsche Bank | downgrade | Hold | 2025-12-19 |

Which company has the best grades?

Both CVS and Elevance Health receive predominantly positive grades, with many “Buy,” “Overweight,” and “Outperform” ratings. CVS shows more consistency without downgrades. Elevance has an upgrade to “Outperform” but also a recent downgrade to “Hold.” Investors may consider CVS’s steadier grade profile as a sign of broader analyst confidence.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

CVS Health Corporation

- Faces intense competition from integrated health plans and retail pharmacies; margin pressure persists due to price sensitivity.

Elevance Health Inc.

- Operates in a competitive insurance market with strong digital health initiatives; maintains solid market share but innovation pressure remains high.

2. Capital Structure & Debt

CVS Health Corporation

- High debt-to-equity ratio at 1.1 signals elevated leverage risk; interest coverage is moderate at 3.08 times.

Elevance Health Inc.

- Lower leverage with debt-to-equity at 0.73 and strong interest coverage of 5.79, indicating healthier financial flexibility.

3. Stock Volatility

CVS Health Corporation

- Beta at 0.50 reflects low volatility, offering defensive stability amid healthcare sector fluctuations.

Elevance Health Inc.

- Similar beta at 0.50, suggesting comparable low volatility and stable investor confidence.

4. Regulatory & Legal

CVS Health Corporation

- Subject to complex healthcare regulations and potential legal actions around pharmacy benefits management.

Elevance Health Inc.

- Faces regulatory scrutiny related to insurance practices and data privacy amid healthcare reform pressures.

5. Supply Chain & Operations

CVS Health Corporation

- Relies heavily on retail pharmacy network; operational risks include distribution disruptions and labor shortages.

Elevance Health Inc.

- Operational model centers on digital and insurance services; less exposed to physical supply chain risks but reliant on IT infrastructure.

6. ESG & Climate Transition

CVS Health Corporation

- Moderate ESG initiatives; climate transition risks include energy use in retail footprint and pharmaceutical waste management.

Elevance Health Inc.

- Stronger ESG focus in community health and sustainability programs; climate risks mitigated by service-based model.

7. Geopolitical Exposure

CVS Health Corporation

- Primarily US-focused with limited international exposure, reducing geopolitical risk but increasing domestic policy sensitivity.

Elevance Health Inc.

- Also US-centric; geopolitical risk mainly tied to healthcare policy changes and trade impacts on pharmaceutical pricing.

Which company shows a better risk-adjusted profile?

Elevance Health’s lower leverage, stronger interest coverage, and favorable liquidity ratios give it a better risk-adjusted profile. CVS’s high debt and weaker liquidity ratios present notable financial risks. CVS’s operational dependence on physical retail contrasts with Elevance’s more resilient digital and insurance platform. The most impactful risk for CVS is its elevated leverage, which raises financial vulnerability. For Elevance, regulatory and legal pressures remain the primary concern amid ongoing healthcare reforms. Elevance’s improved capital structure and operational model justify its superior risk standing despite similar market volatility.

Final Verdict: Which stock to choose?

CVS Health Corporation’s superpower lies in its operational scale and efficiency, delivering steady cash flow despite a challenging profitability environment. Its main point of vigilance is the deteriorating return on invested capital, signaling potential value erosion. CVS might suit a portfolio focused on income and defensive stability over growth.

Elevance Health Inc. benefits from a strategic moat rooted in a robust asset turnover and solid return on equity, reflecting efficient capital use and competitive positioning. Compared to CVS, Elevance offers a safer liquidity profile but bears the risk of declining profitability trends. It fits well in a GARP (Growth at a Reasonable Price) portfolio aiming for balanced risk and growth.

If you prioritize stable cash generation and dividend income, CVS is the compelling choice due to its resilient operational efficiency and yield profile. However, if you seek growth with stronger capital efficiency and a healthier balance sheet, Elevance outshines with better stability and moderate valuation. Both carry risks tied to profitability trends, requiring careful monitoring.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CVS Health Corporation and Elevance Health Inc. to enhance your investment decisions: