Home > Comparison > Real Estate > CCI vs WY

The strategic rivalry between Crown Castle Inc. and Weyerhaeuser Company shapes the competitive landscape of the Real Estate sector. Crown Castle operates as a capital-intensive REIT specializing in communications infrastructure, while Weyerhaeuser focuses on sustainable timberland management and wood product manufacturing. This analysis explores their contrasting operational models and evaluates which trajectory offers superior risk-adjusted returns for a diversified portfolio in today’s complex market environment.

Table of contents

Companies Overview

Crown Castle and Weyerhaeuser dominate distinct niches within the U.S. real estate investment trust sector.

Crown Castle Inc.: Communications Infrastructure Leader

Crown Castle excels as a REIT specializing in communications infrastructure. It generates revenue by owning and leasing over 40,000 cell towers and 80,000 route miles of fiber nationwide. The company’s 2026 strategy focuses on expanding fiber solutions to support the explosive demand for wireless data across major U.S. markets.

Weyerhaeuser Company: Timberland and Wood Products Giant

Weyerhaeuser stands as a REIT rooted in sustainable timberland ownership and wood product manufacturing. Its core revenue comes from managing 11M acres of timberlands and producing wood products for North America. The firm prioritizes sustainable forestry practices while maintaining steady manufacturing output in 2026, reinforcing its market position.

Strategic Collision: Similarities & Divergences

Both companies operate as specialty REITs but diverge sharply in business philosophy—Crown Castle invests in digital infrastructure, while Weyerhaeuser focuses on natural resources and manufacturing. They compete indirectly for real estate capital but face distinct market dynamics. Crown Castle offers stable, tech-driven cash flows; Weyerhaeuser provides exposure to cyclical timber and commodity markets.

Income Statement Comparison

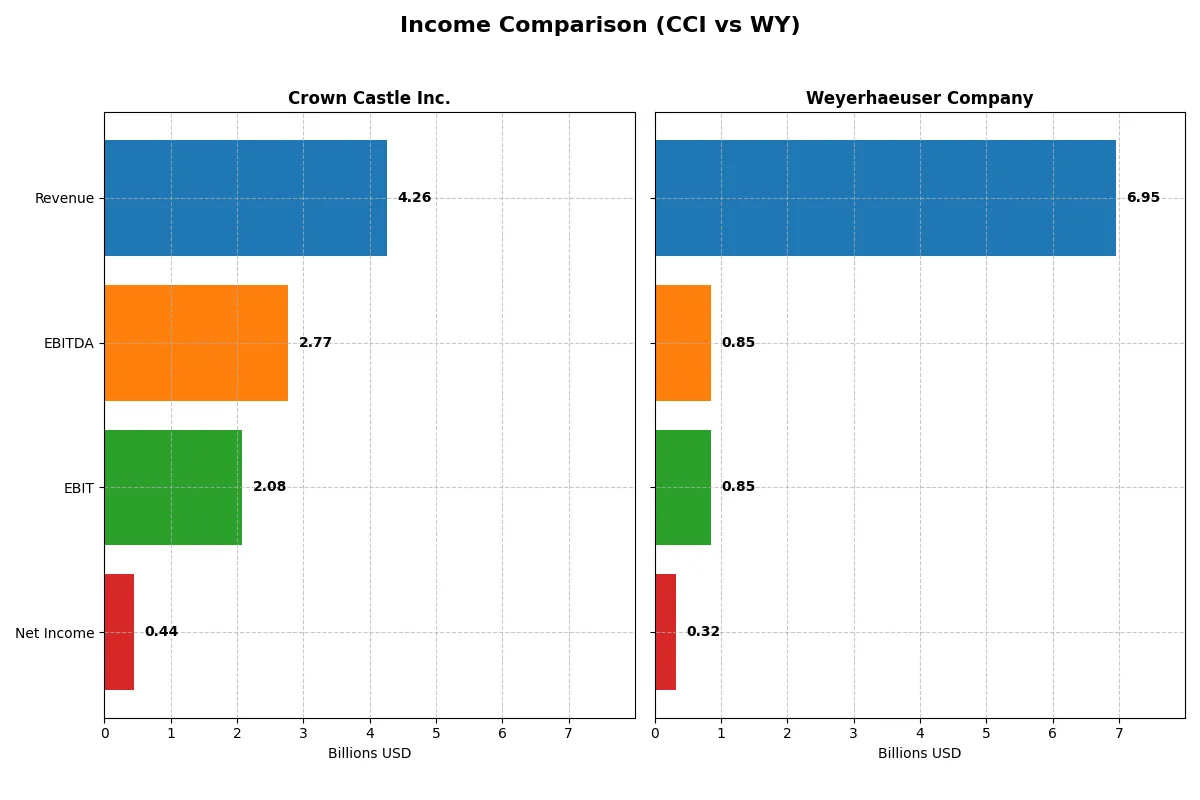

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Crown Castle Inc. (CCI) | Weyerhaeuser Company (WY) |

|---|---|---|

| Revenue | 4.27B | 6.95B |

| Cost of Revenue | 1.45B | 5.88B |

| Operating Expenses | 739M | 343M |

| Gross Profit | 2.82B | 1.07B |

| EBITDA | 2.77B | 854M |

| EBIT | 2.08B | 854M |

| Interest Expense | 959M | 273M |

| Net Income | 444M | 324M |

| EPS | 1.02 | 0.44 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the operational efficiency and profitability trends of two major players in their industries.

Crown Castle Inc. Analysis

Crown Castle’s revenue shows a steep 35% decline in 2025, falling to $4.3B from $6.6B in 2024. Despite revenue pressure, gross margin remains strong at 66%, and net margin recovers to 10.4%, signaling improved operational efficiency. EBIT surges by 170%, reflecting momentum in core profit generation amid cost containment.

Weyerhaeuser Company Analysis

Weyerhaeuser’s revenue drops modestly by 2.4% to $6.95B in 2025. Gross margin stands at a low 15.4%, but EBIT margin at 12.3% remains favorable, showing solid operating control. Net margin slips to 4.7%, impacted by declining EPS and an 18.5% fall in earnings, highlighting challenges in sustaining bottom-line growth.

Margin Dominance vs. Revenue Resilience

Crown Castle leads with superior margins and a sharp EBIT rebound despite revenue headwinds, while Weyerhaeuser maintains steadier revenue but weaker profitability. Crown Castle’s profile appeals more to investors seeking margin strength and operational turnaround, contrasting with Weyerhaeuser’s more vulnerable earnings amid stable top-line performance.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Crown Castle Inc. (CCI) | Weyerhaeuser Company (WY) |

|---|---|---|

| ROE | 29.35% | 3.44% |

| ROIC | -9.34% | 2.93% |

| P/E | -10.09 | 51.78 |

| P/B | -296.16 | 2.11 |

| Current Ratio | 0.50 | 1.79 |

| Quick Ratio | 0.50 | 1.17 |

| D/E (Debt-to-Equity) | -222.65 | 0.53 |

| Debt-to-Assets | 90.46% | 30.87% |

| Interest Coverage | -3.26 | 2.55 |

| Asset Turnover | 0.20 | 0.43 |

| Fixed Asset Turnover | 0.31 | 0.49 |

| Payout Ratio | -69.92% | 172.73% |

| Dividend Yield | 6.93% | 3.34% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, unveiling hidden risks and operational strengths that guide investors through complex markets.

Crown Castle Inc.

Crown Castle exhibits a strikingly high ROE of 2934.6%, signaling exceptional shareholder returns despite a steeply negative net margin of -59.4%. The P/E ratio is favorable at -10.1, suggesting undervaluation, yet a low current ratio of 0.5 flags liquidity risks. The 6.9% dividend yield offers steady income, balancing reinvestment concerns amid mixed profitability.

Weyerhaeuser Company

Weyerhaeuser posts modest profitability with a 3.4% ROE and net margin of 4.7%, reflecting operational challenges. Its P/E ratio at 52.9 marks the stock as expensive relative to earnings. The current ratio of 1.29 indicates solid liquidity. A 3.5% dividend yield highlights shareholder returns, while neutral leverage metrics suggest prudent financial management.

Valuation Stretch vs. Operational Strength

Crown Castle’s extraordinary ROE contrasts with liquidity red flags, while Weyerhaeuser’s valuation appears stretched despite better liquidity and modest profitability. Investors prioritizing growth and income may lean toward Crown Castle’s returns; those valuing stability might find Weyerhaeuser’s profile more fitting.

Which one offers the Superior Shareholder Reward?

I find Crown Castle (CCI) offers a higher dividend yield at 6.93% compared to Weyerhaeuser’s (WY) 3.54%. However, CCI’s payout ratio is unsustainable at -69.9%, while WY’s payout hovers around 172% to 187%. CCI’s free cash flow per share is $3.97 with moderate buybacks, but heavy debt and negative earnings cloud sustainability. WY reinvests more conservatively, with steady dividends and less aggressive buybacks, supported by stronger operating margins and healthier leverage. Historically, I’ve seen WY’s balanced capital allocation create durable shareholder value. In 2026, WY’s distribution model offers a more reliable total return profile despite lower yield.

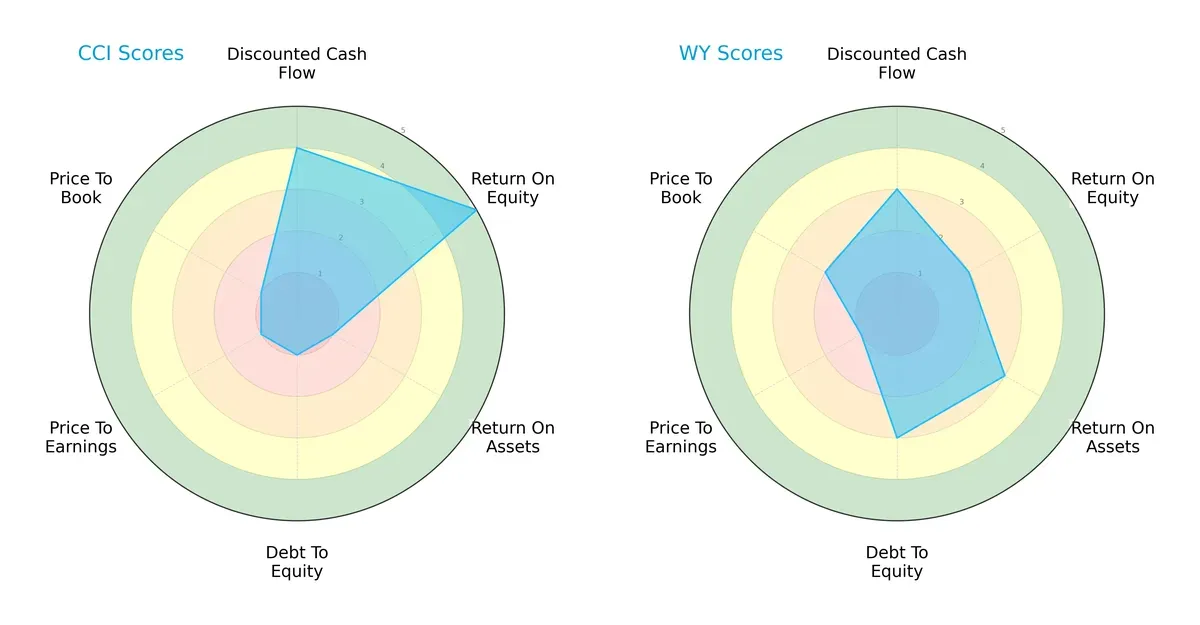

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Crown Castle Inc. and Weyerhaeuser Company, highlighting their financial strengths and vulnerabilities:

Crown Castle excels in Return on Equity (5 vs. 2) and Discounted Cash Flow (4 vs. 3), signaling strong profitability and valuation appeal. However, its Return on Assets, Debt/Equity, and valuation multiples are weak (all scored 1), indicating asset inefficiency and financial risk. Weyerhaeuser shows a more balanced profile with moderate scores in asset use (3) and leverage (3), though it lacks Crown Castle’s ROE edge. Overall, Crown Castle leans on profitability while Weyerhaeuser maintains steadier financial health.

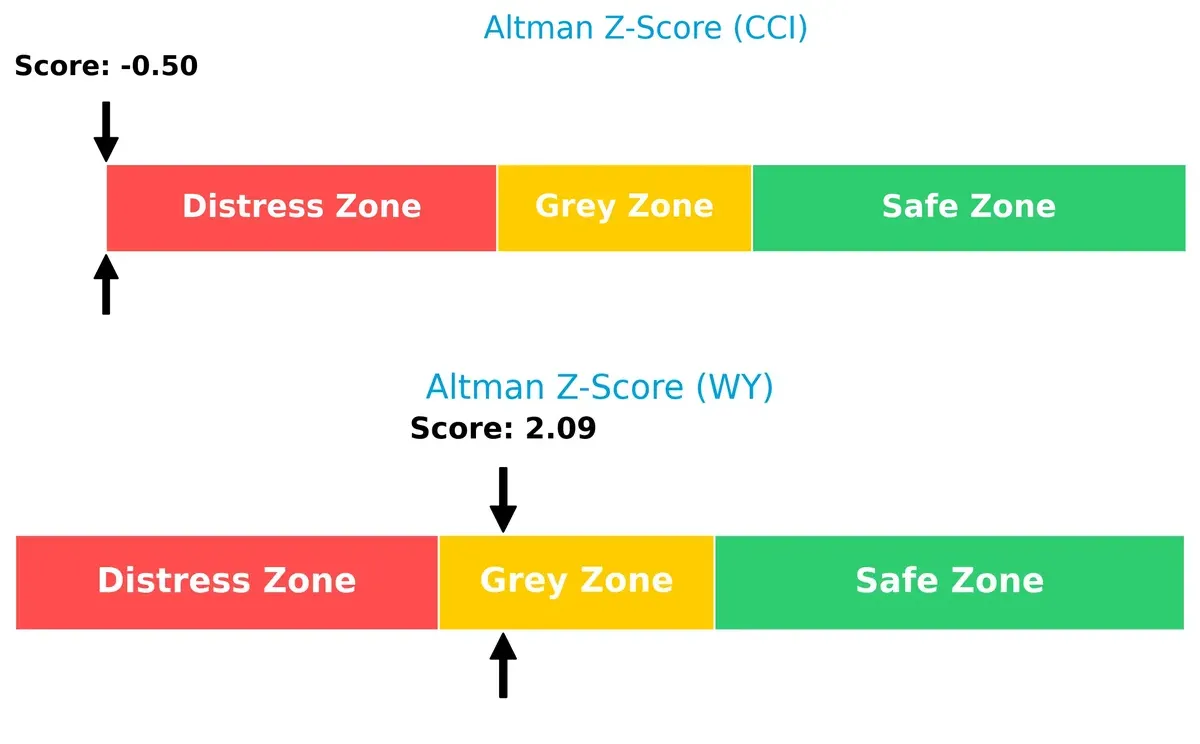

Bankruptcy Risk: Solvency Showdown

Crown Castle’s Altman Z-Score in the distress zone (-0.5) contrasts sharply with Weyerhaeuser’s grey zone score (2.1), implying a higher bankruptcy risk for Crown Castle in this cycle:

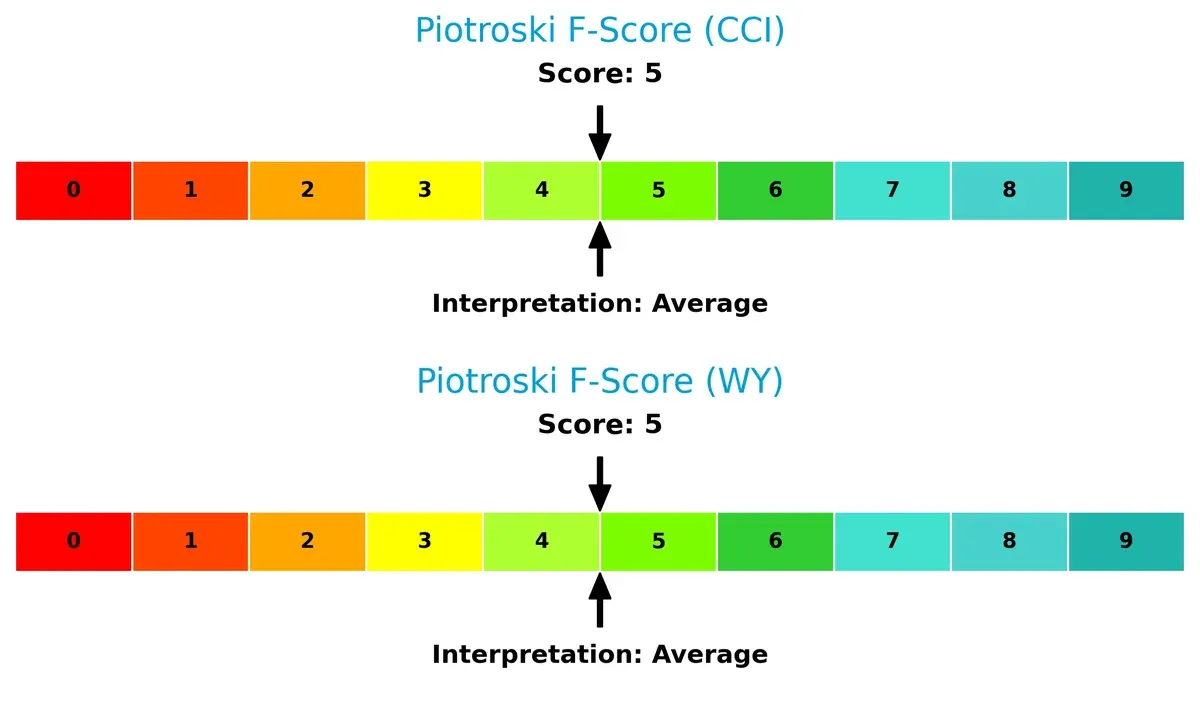

Financial Health: Quality of Operations

Both companies share an average Piotroski F-Score of 5, suggesting moderate operational quality with no clear red flags in internal financial metrics:

How are the two companies positioned?

This section dissects CCI and WY’s operational DNA by comparing their revenue distribution and internal dynamics, including strengths and weaknesses. The objective is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

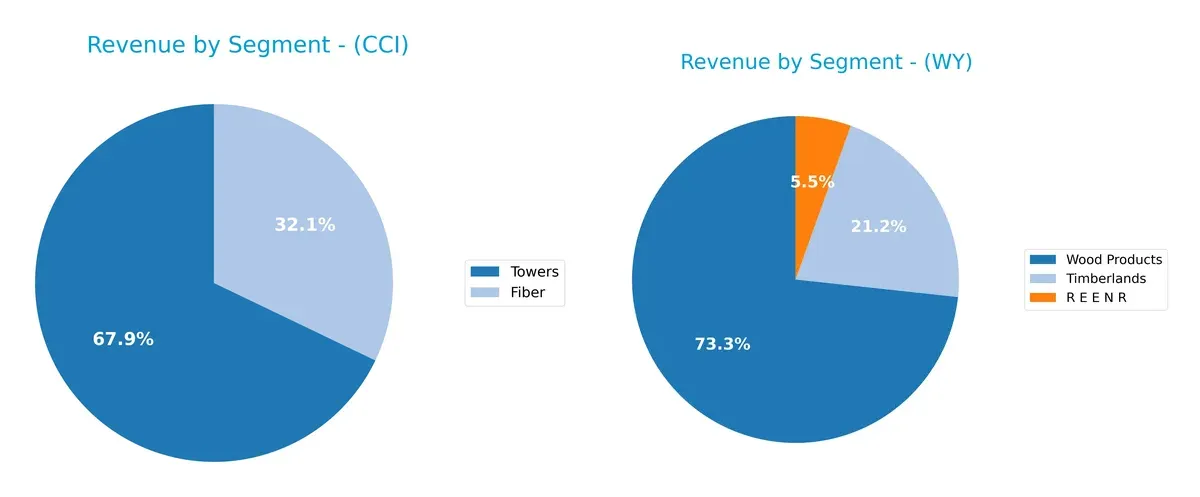

Revenue Segmentation: The Strategic Mix

This comparison dissects how Crown Castle Inc. and Weyerhaeuser Company diversify their income streams and where their primary sector bets lie:

Crown Castle anchors revenue predominantly in Towers, generating $4.46B in 2024, with Fiber trailing at $2.11B. This concentration signals infrastructure dominance but raises concentration risk. Weyerhaeuser displays a more diversified mix: Wood Products lead at $5.22B, Timberlands contribute $1.51B, and REENR adds $391M. This spread reduces dependency on a single segment and leverages an integrated forest products ecosystem.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Crown Castle Inc. and Weyerhaeuser Company:

CCI Strengths

- Diversified revenue from Fiber and Towers segments

- Strong ROE at 2934.59%

- Favorable PE and PB ratios

- High dividend yield at 6.93%

- Established US and Australia presence

WY Strengths

- Diversified revenue including Timberlands and Wood Products

- Favorable WACC at 7.67%

- Neutral to favorable liquidity ratios

- Moderate debt levels with neutral debt-to-assets

- Favorable dividend yield at 3.54%

CCI Weaknesses

- Negative net margin at -59.42%

- Negative ROIC at -9.34%

- Low current and quick ratios at 0.5

- High debt-to-assets at 90.46%

- Low asset and fixed asset turnover

WY Weaknesses

- Unfavorable net margin at 4.69%

- Low ROE at 3.44% and ROIC at 2.93%

- High PE ratio at 52.88

- Unfavorable asset turnover at 0.42

- Limited geographic diversification outside US and Canada

CCI shows strong profitability metrics like ROE but struggles with profitability and liquidity, signaling financial risks. WY maintains better liquidity and moderate leverage but faces challenges in profitability and valuation. Both companies exhibit slightly unfavorable overall financial ratios, highlighting areas for strategic focus.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only shield that protects long-term profits from relentless competitive erosion. Let’s examine how these firms defend their turf:

Crown Castle Inc.: Infrastructure Network Effect Moat

Crown Castle’s moat stems from its vast network of 40,000+ cell towers and 80,000 route miles of fiber. This scale drives high ROIC and margin stability, despite recent revenue pressure. Expansion into small cells deepens their defensibility in 2026.

Weyerhaeuser Company: Asset-Intensive Timberland Moat

Weyerhaeuser relies on extensive timberland ownership and sustainable forestry, a tangible asset moat contrasting Crown Castle’s network. However, ROIC below WACC signals value destruction, limiting its competitive leverage in 2026 despite market diversification.

Network Scale vs. Physical Asset Base: Which Moat Holds Stronger?

Crown Castle’s network effect moat offers a wider economic moat than Weyerhaeuser’s asset-heavy timberland base. I see Crown Castle as better equipped to defend market share amid evolving tech demands, while Weyerhaeuser faces mounting profitability challenges.

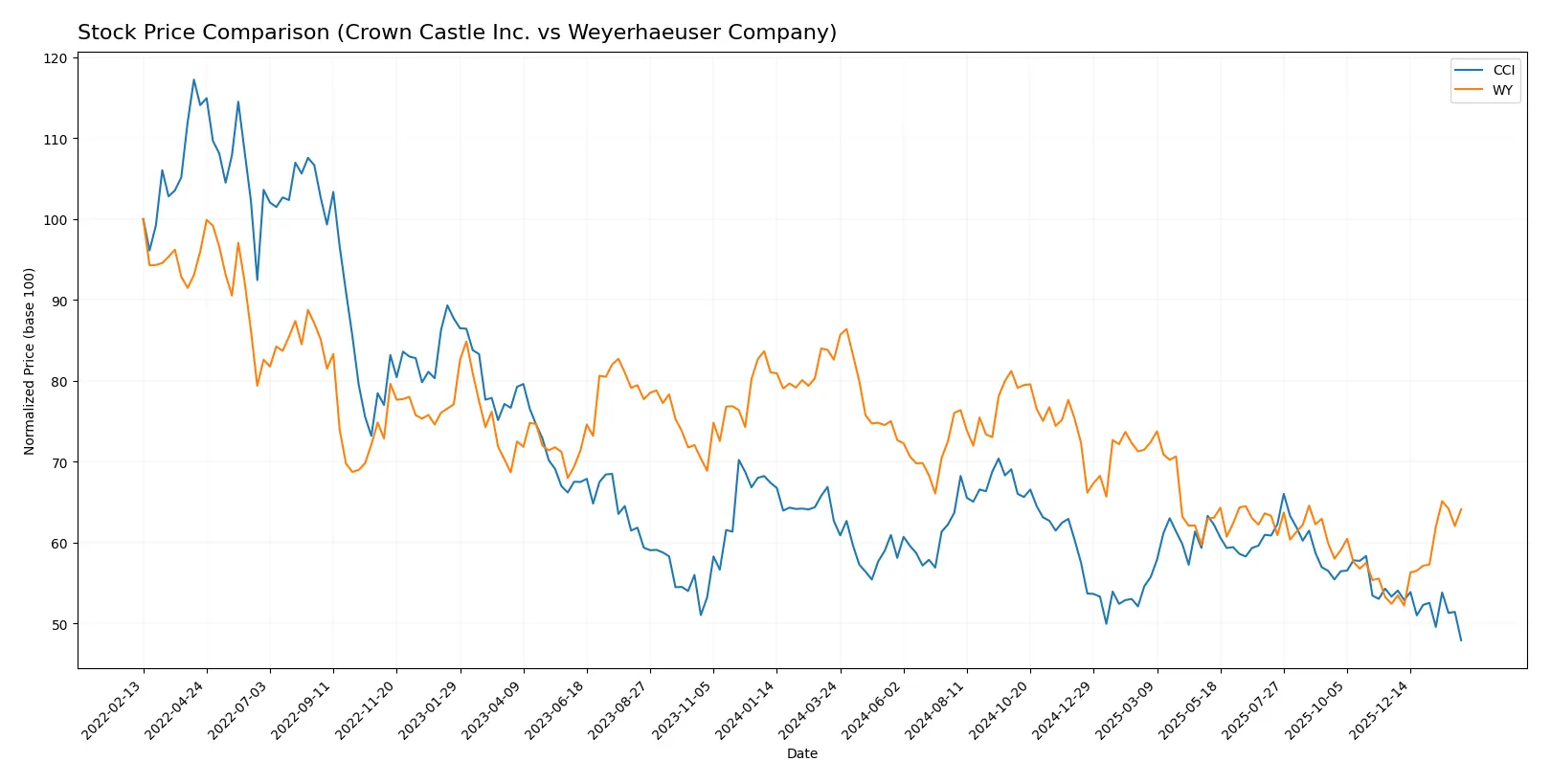

Which stock offers better returns?

Over the past 12 months, Crown Castle Inc. and Weyerhaeuser Company exhibited contrasting trading dynamics, with both stocks showing significant price fluctuations and differing recent momentum.

Trend Comparison

Crown Castle Inc. shows a bearish trend with a 23.53% price decline over the past year, decelerating after peaking at 118.85 and hitting a low of 80.88. Recent months reflect a continued decline of 10.14%.

Weyerhaeuser Company also faces a bearish yearly trend, down 22.4%, but with accelerating momentum. Its price ranged between 21.69 and 35.91. Recently, it rebounded strongly, gaining 22.31% since late 2025.

WY’s recent surge contrasts with CCI’s ongoing decline, delivering the stronger market performance in the most recent quarter despite both showing negative annual returns.

Target Prices

Analysts present a constructive target price consensus for both Crown Castle Inc. and Weyerhaeuser Company.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Crown Castle Inc. | 91 | 127 | 106.5 |

| Weyerhaeuser Company | 28 | 33 | 30.2 |

The targets suggest upside potential: Crown Castle’s consensus is 32% above its $80.88 price, while Weyerhaeuser’s consensus exceeds its $26.64 price by about 13%. Analysts expect meaningful appreciation relative to current market levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Crown Castle Inc. Grades

Here are the recent grades from major financial institutions for Crown Castle Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-06 |

| UBS | Maintain | Buy | 2026-02-05 |

| Scotiabank | Maintain | Sector Perform | 2026-02-05 |

| Wells Fargo | Maintain | Overweight | 2026-02-05 |

| JP Morgan | Maintain | Neutral | 2026-02-05 |

| Jefferies | Maintain | Buy | 2026-02-04 |

| Keybanc | Maintain | Overweight | 2026-01-21 |

| UBS | Maintain | Buy | 2026-01-20 |

| Goldman Sachs | Maintain | Neutral | 2026-01-20 |

| Scotiabank | Maintain | Sector Perform | 2026-01-14 |

Weyerhaeuser Company Grades

Below are the latest grades from recognized grading firms for Weyerhaeuser Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Buy | 2026-02-02 |

| Truist Securities | Maintain | Hold | 2026-02-02 |

| Citigroup | Maintain | Buy | 2026-01-14 |

| Truist Securities | Maintain | Hold | 2026-01-06 |

| CIBC | Maintain | Outperform | 2025-12-12 |

| B of A Securities | Downgrade | Neutral | 2025-11-17 |

| JP Morgan | Maintain | Overweight | 2025-11-14 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| RBC Capital | Maintain | Outperform | 2025-11-03 |

| DA Davidson | Maintain | Buy | 2025-11-03 |

Which company has the best grades?

Crown Castle Inc. generally receives stable Buy and Overweight ratings, indicating consistent confidence. Weyerhaeuser shows a mix of Buy, Outperform, and some Hold ratings, with one recent downgrade. Crown Castle’s steadier grades suggest a more uniformly positive institutional outlook, potentially implying lower rating volatility for investors.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Crown Castle Inc. and Weyerhaeuser Company in the 2026 market environment:

1. Market & Competition

Crown Castle Inc.

- Dominates U.S. communications infrastructure but faces tech disruption risks.

Weyerhaeuser Company

- Large timberland owner with exposure to volatile wood product markets.

2. Capital Structure & Debt

Crown Castle Inc.

- High debt-to-assets ratio at 90.46% raises financial strain concerns.

Weyerhaeuser Company

- Moderate leverage with 33.54% debt-to-assets, showing healthier balance sheet.

3. Stock Volatility

Crown Castle Inc.

- Beta near 1 (0.984) denotes market-level volatility.

Weyerhaeuser Company

- Slightly more volatile with beta at 1.033, marginally riskier stock.

4. Regulatory & Legal

Crown Castle Inc.

- Subject to telecom regulations impacting infrastructure deployment.

Weyerhaeuser Company

- Faces environmental regulations tied to sustainable forestry practices.

5. Supply Chain & Operations

Crown Castle Inc.

- Fiber and tower operations dependent on tech upgrades and permits.

Weyerhaeuser Company

- Timber harvesting and wood product manufacturing reliant on natural resource cycles.

6. ESG & Climate Transition

Crown Castle Inc.

- Exposure to energy usage and infrastructure sustainability concerns.

Weyerhaeuser Company

- Listed on Dow Jones Sustainability Index; strong ESG focus but climate risks remain.

7. Geopolitical Exposure

Crown Castle Inc.

- Primarily domestic U.S. operations, limiting international geopolitical risks.

Weyerhaeuser Company

- Manages timberlands in U.S. and Canada, faces cross-border regulatory challenges.

Which company shows a better risk-adjusted profile?

Weyerhaeuser’s moderate leverage and grey zone Altman Z-Score suggest better financial stability than Crown Castle’s high debt and distress zone score. Crown Castle’s largest risk lies in excessive debt burden, increasing bankruptcy risk. Weyerhaeuser’s main threat comes from commodity price swings affecting net margins. Despite both facing slightly unfavorable ratios, Weyerhaeuser’s balanced capital structure and sustainability credentials offer a superior risk-adjusted profile. Notably, Crown Castle’s 90% debt-to-assets ratio signals urgent caution for investors.

Final Verdict: Which stock to choose?

Crown Castle Inc. (CCI) excels as a cash generator with a powerful return on equity, showcasing strong capital allocation despite operational challenges. Its significant leverage and liquidity constraints remain points of vigilance. CCI suits investors targeting aggressive growth with tolerance for financial complexity.

Weyerhaeuser Company (WY) holds a solid strategic moat rooted in its tangible asset base and operational stability. Its conservative balance sheet and moderate dividend yield offer comparatively better financial safety than CCI. WY appeals to investors seeking growth at a reasonable price with more defensive characteristics.

If you prioritize high-return growth fueled by efficient equity deployment, CCI is the compelling choice despite its leverage risks. However, if you seek steadier income and balance sheet resilience, WY offers better stability and a tangible asset moat. Both present analytical scenarios requiring careful risk management aligned with your investment profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Crown Castle Inc. and Weyerhaeuser Company to enhance your investment decisions: