Home > Comparison > Real Estate > CCI vs SBAC

The strategic rivalry between Crown Castle Inc. and SBA Communications Corporation shapes the wireless infrastructure segment within real estate. Crown Castle operates a vast fiber and cell tower network across U.S. markets, emphasizing scale and diversified infrastructure. SBA Communications focuses on site leasing and development services across the Americas and South Africa, leveraging multi-tenant communication sites. This analysis will assess which operational model delivers superior risk-adjusted returns for a diversified portfolio in this niche specialty REIT sector.

Table of contents

Companies Overview

Crown Castle and SBA Communications are pivotal players in the U.S. wireless infrastructure market.

Crown Castle Inc.: Nationwide Communications Backbone

Crown Castle owns and operates more than 40,000 cell towers and 80,000 route miles of fiber. Its core revenue stems from leasing this extensive infrastructure to wireless providers. In 2026, the company focuses on expanding fiber solutions to support growing data demands across major U.S. markets.

SBA Communications Corporation: Pan-American Infrastructure Leader

SBA Communications excels as a leading owner and operator of wireless infrastructure across the Americas and South Africa. It generates revenue primarily through site leasing and development services, emphasizing long-term antenna space leases. The 2026 strategy aims at building better wireless networks via multi-tenant communication sites.

Strategic Collision: Similarities & Divergences

Both firms specialize in wireless infrastructure leasing but differ in geographic scope. Crown Castle anchors itself in the U.S. with a fiber-heavy portfolio. SBA pursues diverse international markets and site development services. They compete fiercely for carrier leases, yet their distinct footprints and service mixes create unique investment profiles.

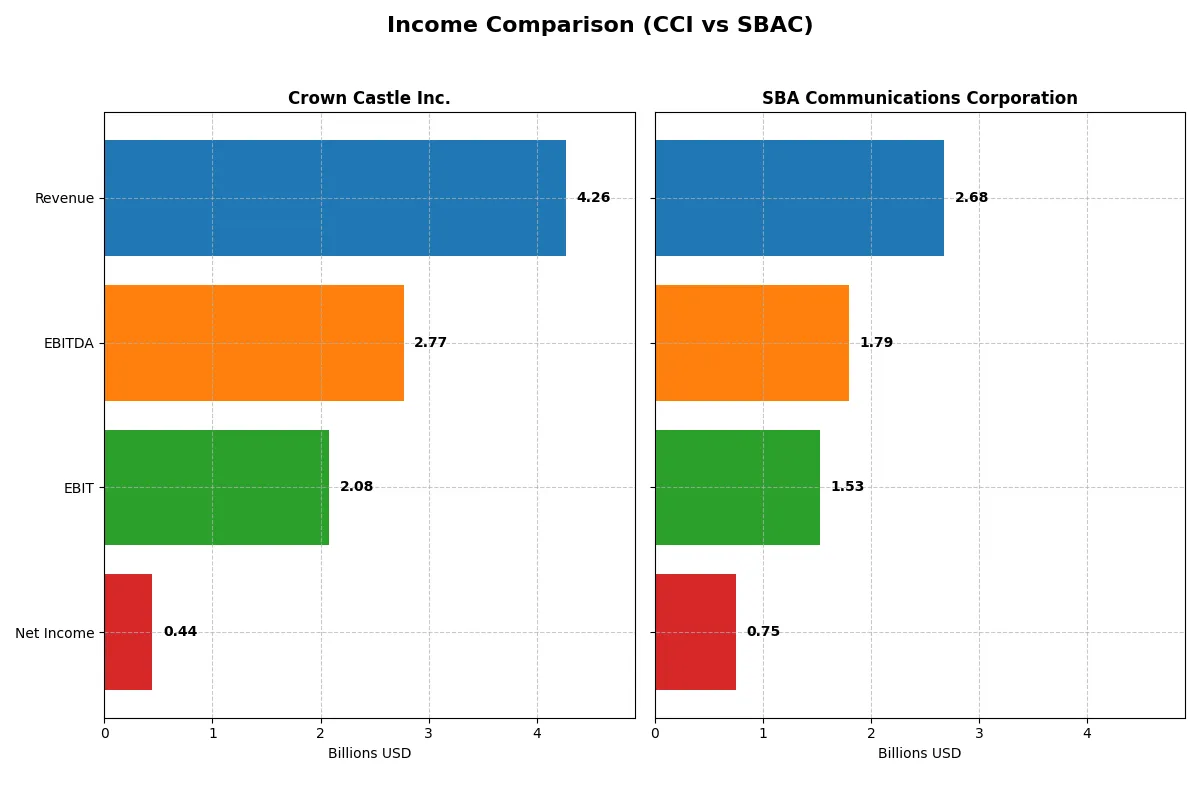

Income Statement Comparison

This comparison dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Crown Castle Inc. (CCI) | SBA Communications Corporation (SBAC) |

|---|---|---|

| Revenue | 4.27B | 2.68B |

| Cost of Revenue | 1.45B | 608M |

| Operating Expenses | 739M | 636M |

| Gross Profit | 2.82B | 2.07B |

| EBITDA | 2.77B | 1.79B |

| EBIT | 2.08B | 1.53B |

| Interest Expense | 959M | 0 |

| Net Income | 444M | 750M |

| EPS | 1.02 | 6.96 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability trajectory of Crown Castle Inc. and SBA Communications Corporation.

Crown Castle Inc. Analysis

Crown Castle’s revenue declined sharply from 7B in 2023 to 4.3B in 2025, reflecting a tough market environment. Net income swung from a strong 1.5B profit in 2023 to a modest 444M in 2025, signaling margin pressure. Gross margin remains solid at 66%, but interest expense weighs heavily, reducing net margin to 10.4%. Recent earnings show a rebound in operational efficiency despite falling top line.

SBA Communications Corporation Analysis

SBA Communications exhibits steady revenue growth, reaching 2.7B in 2024 with a slight 1% dip from prior year. Net income surged from 502M in 2023 to 750M in 2024, reflecting robust margin expansion. Gross margin stands impressively at 77%, and net margin at 28%, benefiting from zero interest expense. The company demonstrates strong profitability momentum and operational leverage.

Margin Power vs. Revenue Scale

SBA Communications outperforms Crown Castle with superior profit margins and consistent net income growth, driven by efficient cost management and zero interest burden. Crown Castle’s larger revenue base struggles with higher leverage and volatile earnings. For investors, SBA’s high-margin, steadily growing profile offers clearer earnings quality amidst market challenges.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Crown Castle Inc. (CCI) | SBA Communications Corporation (SBAC) |

|---|---|---|

| ROE | 29.35% | -14.67% |

| ROIC | -9.34% | 12.57% |

| P/E | -10.09 | 29.37 |

| P/B | -296.16 | -4.31 |

| Current Ratio | 0.50 | 1.10 |

| Quick Ratio | 0.50 | 1.10 |

| D/E (Debt-to-Equity) | -222.65 | -3.08 |

| Debt-to-Assets | 90.46% | 138.00% |

| Interest Coverage | -3.26 | 0 |

| Asset Turnover | 0.20 | 0.23 |

| Fixed Asset Turnover | 0.31 | 0.42 |

| Payout ratio | -69.92% | 56.59% |

| Dividend yield | 6.93% | 1.93% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and revealing operational excellence that raw numbers alone cannot show.

Crown Castle Inc.

Crown Castle displays a strikingly high ROE at 2935%, signaling strong shareholder profitability despite a deeply negative net margin of -59%. The stock trades at a favorable negative P/E and P/B, suggesting undervaluation or accounting distortions. Dividend yield stands neutral at 6.9%, reflecting steady shareholder returns amid limited reinvestment in R&D.

SBA Communications Corporation

SBA Communications posts a solid net margin of 27.97% and a favorable ROIC of 12.57%, yet suffers a negative ROE of -14.7%. Its valuation appears stretched with a P/E of 29.4, indicating premium pricing. The company balances modest 1.9% dividend yield with efficient capital allocation, supported by strong interest coverage and liquidity ratios.

Premium Valuation vs. Operational Safety

SBA Communications offers a healthier profitability profile with efficient capital use but at a premium valuation. Crown Castle shows exceptional ROE amid valuation quirks and dividend income. Investors favoring growth and operational resilience may lean toward SBA, while income seekers might find Crown Castle’s yield attractive despite financial risks.

Which one offers the Superior Shareholder Reward?

I compare Crown Castle Inc. (CCI) and SBA Communications Corporation (SBAC) on dividends, payout ratios, and buybacks. CCI yields 6.9% with a negative payout ratio, signaling recent earnings volatility but strong dividend coverage by free cash flow (65%). SBAC yields 1.9% with a conservative 56% payout, prioritizing buybacks and reinvestment. CCI’s buyback intensity is moderate; SBAC’s free cash flow funds larger buybacks, supporting total return. Historically, CCI’s high yield contrasts with SBAC’s growth-driven model. I view SBAC’s balanced payout and stronger free cash flow coverage as more sustainable. For 2026, SBAC offers a superior total return profile combining yield, buybacks, and growth.

Comparative Score Analysis: The Strategic Profile

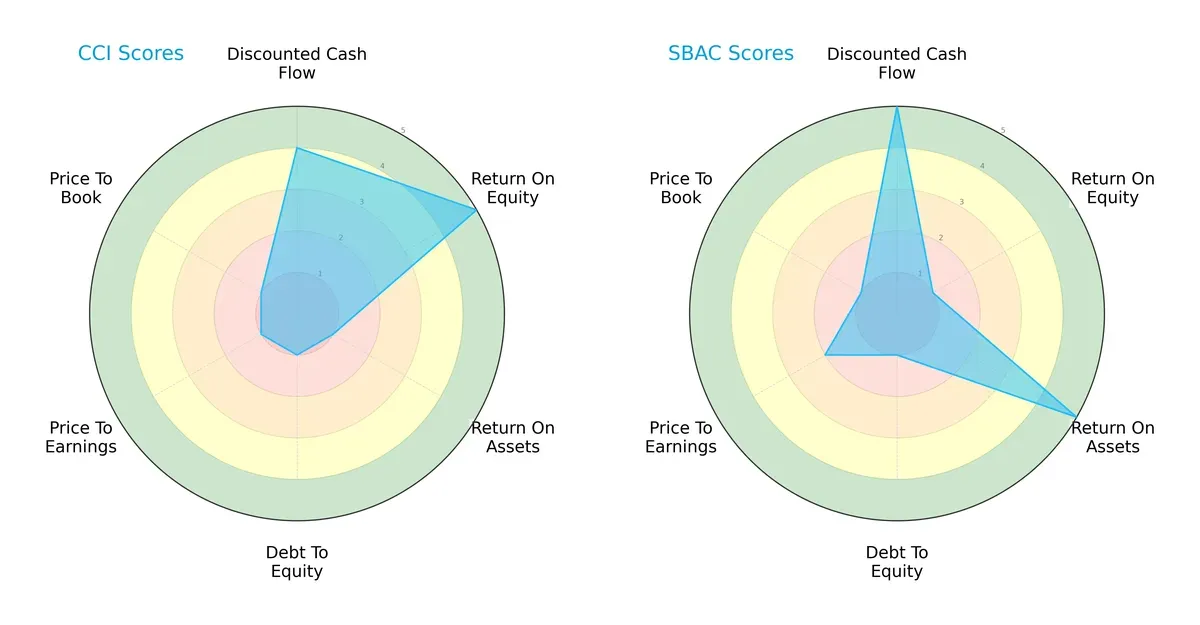

The radar chart reveals the fundamental DNA and trade-offs of Crown Castle Inc. and SBA Communications Corporation:

Crown Castle excels in Return on Equity with a score of 5 but struggles with asset efficiency and valuation metrics, scoring 1 in ROA, Debt/Equity, P/E, and P/B. SBA Communications dominates in ROA with a 5 and leads in discounted cash flow at 5, but suffers a weak ROE of 1. Both firms share a poor Debt/Equity score of 1, signaling leverage concerns. SBA presents a more balanced operational profile, while Crown Castle relies heavily on shareholder returns.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap between Crown Castle (-0.5) and SBA Communications (0.4) places both in the distress zone, implying elevated bankruptcy risk in this cycle:

Both companies face significant solvency challenges. Historically, firms in this zone require urgent capital structure adjustments to survive downturns. I view SBA’s slightly higher score as marginally more resilient but still risky.

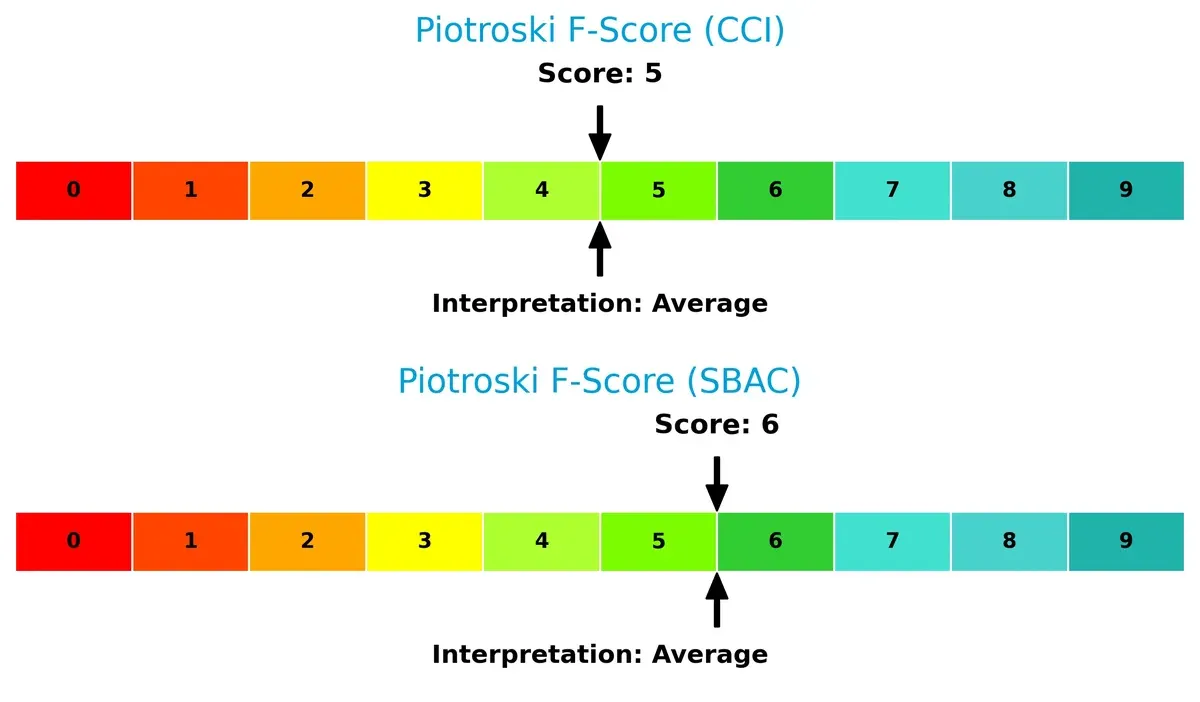

Financial Health: Quality of Operations

Piotroski F-Scores of 5 for Crown Castle and 6 for SBA Communications indicate average financial health with no glaring red flags:

Neither company achieves strong operational robustness. SBA’s edge by one point suggests slightly better earnings quality and balance sheet management. Investors should monitor these scores closely as they reflect internal financial discipline crucial for long-term stability.

How are the two companies positioned?

This section dissects the operational DNA of CCI and SBAC by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

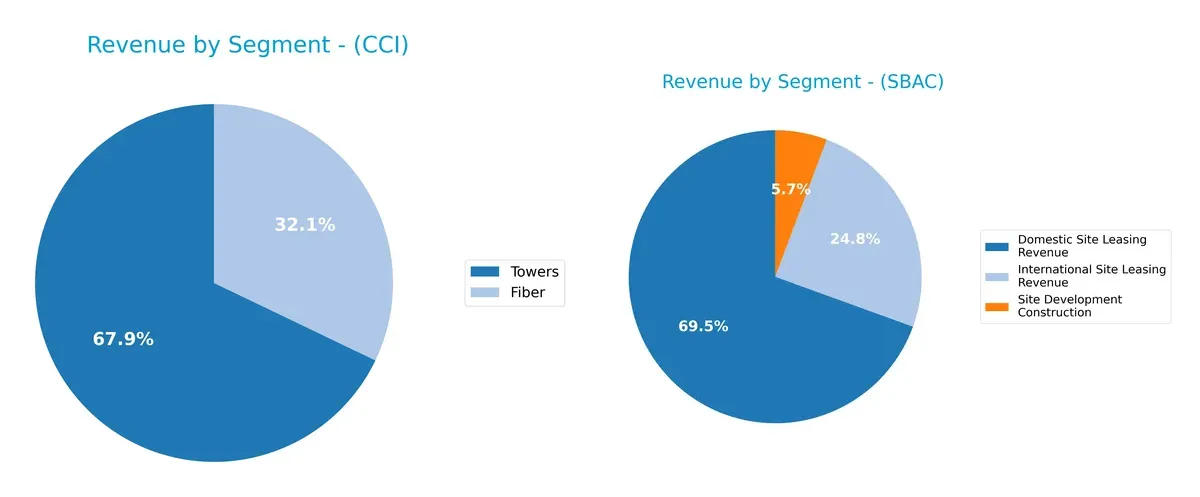

Revenue Segmentation: The Strategic Mix

This comparison dissects how Crown Castle Inc. and SBA Communications diversify their income streams and where their primary sector bets lie:

Crown Castle anchors revenue in Towers with $4.46B in 2024, complemented by $2.11B from Fiber, showing moderate diversification. SBA Communications leans heavily on Domestic Site Leasing at $1.86B but balances with $665M International and $153M Construction revenues. Crown Castle’s mix suggests infrastructure dominance with a fiber growth angle. SBA’s segmentation reveals a strategic focus on leasing ecosystems, but with less reliance on a single segment, it lowers concentration risk.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Crown Castle Inc. (CCI) and SBA Communications Corporation (SBAC):

CCI Strengths

- Strong ROE at 2934.59%

- Favorable PE and PB ratios

- Significant fiber and towers revenue mix

- Large U.S. market presence with Australia exposure

SBAC Strengths

- Favorable net margin at 27.97%

- Positive ROIC at 12.57% beating WACC at 5.6%

- Strong debt-to-equity and interest coverage

- Diversified revenue streams including international sites and construction

CCI Weaknesses

- Negative net margin (-59.42%) and ROIC (-9.34%)

- High debt-to-assets ratio at 90.46%

- Low current and quick ratios (0.5)

- Unfavorable asset and fixed asset turnover ratios

SBAC Weaknesses

- Negative ROE (-14.67%)

- High debt-to-assets ratio at 138%

- Unfavorable asset and fixed asset turnover

- Elevated PE ratio at 29.37 despite weaker profitability

Both companies show mixed financial profiles. CCI exhibits strong shareholder returns but struggles operationally and with leverage. SBAC delivers solid profitability and capital efficiency but faces elevated leverage and valuation concerns. These factors must shape each company’s strategic focus on financial health and growth.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true defense against long-term profit erosion from competition. Let’s dissect the moat dynamics of two wireless infrastructure giants:

Crown Castle Inc.: Scale and Infrastructure Dominance

Crown Castle’s moat centers on its vast fiber and tower network, creating high switching costs. Its financials show stable margins but a declining ROIC trend warns of margin pressure. New 5G deployments may deepen its moat if capex is wisely allocated.

SBA Communications Corporation: Efficient Capital Allocation and Growth

SBA’s competitive edge lies in superior capital efficiency and growing ROIC, signaling robust value creation. Unlike Crown Castle, SBA maintains higher margins and expanding profitability, supported by strategic site developments and geographic diversification.

Infrastructure Scale vs. Capital Efficiency: The Moat Verdict

SBA Communications possesses the deeper moat, evidenced by a rising ROIC 7% above WACC and strong margin expansion. Crown Castle’s scale is formidable but declining ROIC signals vulnerability. SBA is better positioned to defend and grow market share in 2026.

Which stock offers better returns?

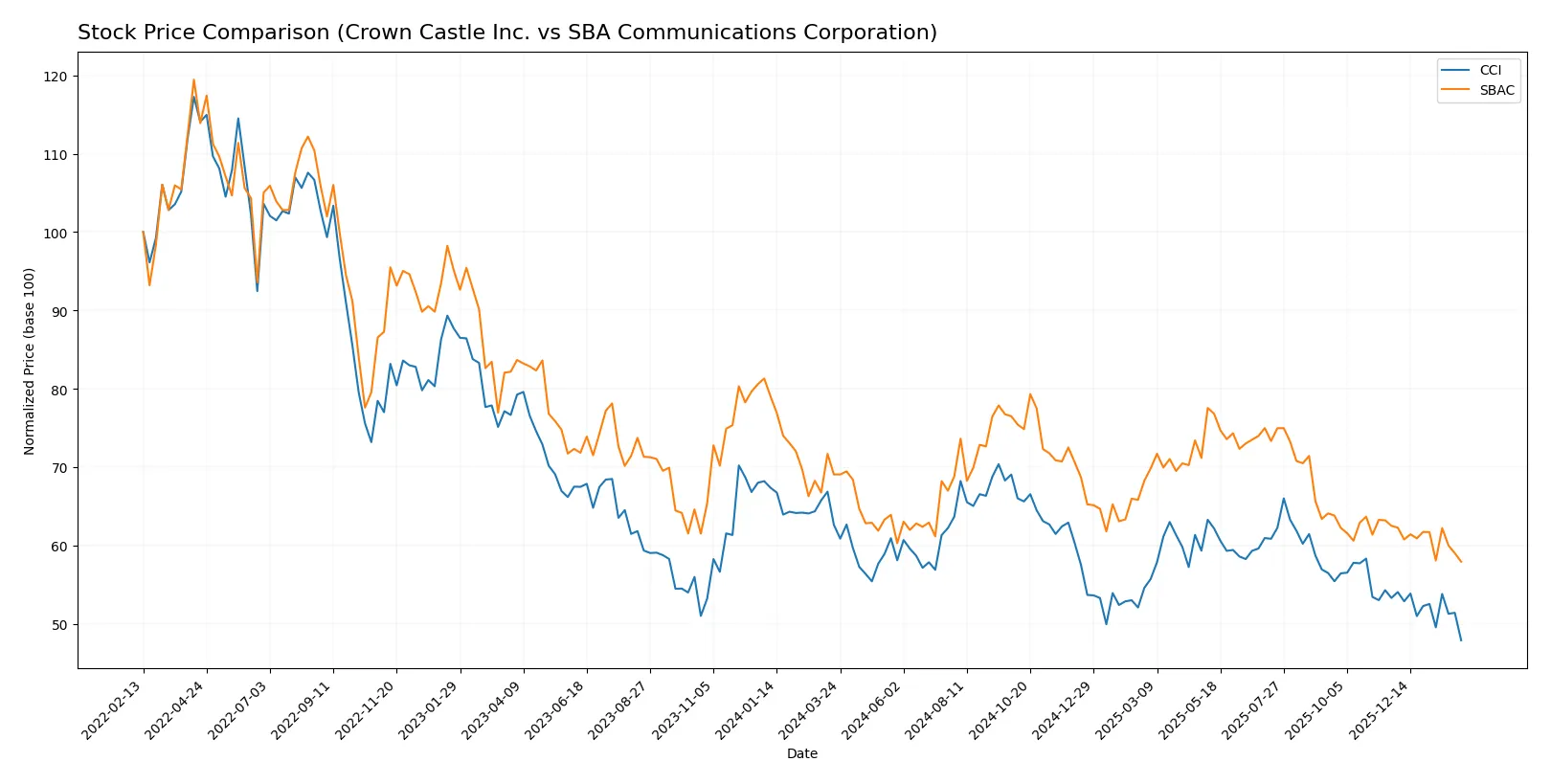

Over the past year, both Crown Castle Inc. and SBA Communications Corporation experienced significant price declines, with bearish trends marked by decelerating momentum and notable volatility.

Trend Comparison

Crown Castle Inc. shows a bearish trend over the past 12 months with a -23.53% price change and decelerating decline. The stock hit a high of 118.85 and a low of 80.88, with moderate volatility (std dev 8.21).

SBA Communications Corporation also exhibits a bearish trend, dropping -16.12% over the same period. Its price volatility is higher (std dev 17.13), with a high of 247.47 and a low of 180.74, and the decline is decelerating.

Between these two, Crown Castle Inc. delivered the larger price drop, indicating SBA Communications Corporation has outperformed in relative market performance.

Target Prices

Analysts present a moderately bullish consensus for Crown Castle Inc. and SBA Communications Corporation, reflecting growth potential in specialty REITs.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Crown Castle Inc. | 91 | 127 | 106.5 |

| SBA Communications Corporation | 205 | 260 | 224.8 |

Crown Castle’s consensus target sits 32% above its current price of 80.88, signaling upside potential. SBA Communications shows a more aggressive target, 24% above the current 180.74, indicating strong analyst confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Crown Castle Inc. Grades

The following table summarizes recent institutional grades for Crown Castle Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-06 |

| UBS | Maintain | Buy | 2026-02-05 |

| Scotiabank | Maintain | Sector Perform | 2026-02-05 |

| Wells Fargo | Maintain | Overweight | 2026-02-05 |

| JP Morgan | Maintain | Neutral | 2026-02-05 |

| Jefferies | Maintain | Buy | 2026-02-04 |

| Keybanc | Maintain | Overweight | 2026-01-21 |

| UBS | Maintain | Buy | 2026-01-20 |

| Goldman Sachs | Maintain | Neutral | 2026-01-20 |

| Scotiabank | Maintain | Sector Perform | 2026-01-14 |

SBA Communications Corporation Grades

Below is the recent institutional grading overview for SBA Communications Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-20 |

| Scotiabank | Maintain | Sector Perform | 2026-01-14 |

| JP Morgan | Maintain | Neutral | 2026-01-12 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-16 |

| Barclays | Maintain | Overweight | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-17 |

| RBC Capital | Maintain | Outperform | 2025-11-10 |

| BMO Capital | Maintain | Market Perform | 2025-11-04 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-20 |

Which company has the best grades?

Crown Castle holds more consistent Buy ratings from major banks, while SBA Communications shows a wider range of ratings, including Outperform and Market Perform. Investors may view Crown Castle’s steadier Buy consensus as a sign of institutional confidence.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Crown Castle Inc. and SBA Communications Corporation in the 2026 market environment:

1. Market & Competition

Crown Castle Inc.

- Operates 40,000+ cell towers and 80,000 route miles of fiber; faces intense competition in U.S. specialty REITs.

SBA Communications Corporation

- Leading wireless infrastructure owner in Americas and South Africa; diversifies markets but competes on multiple continents.

2. Capital Structure & Debt

Crown Castle Inc.

- Debt-to-assets at 90.46% signals high leverage; current ratio weak at 0.5 warns of liquidity risks.

SBA Communications Corporation

- Even higher debt-to-assets at 138% raises red flags; current ratio of 1.1 offers moderate liquidity comfort.

3. Stock Volatility

Crown Castle Inc.

- Beta near 0.98 indicates market-correlated volatility; trading range between 77.01-115.76 suggests moderate price swings.

SBA Communications Corporation

- Lower beta at 0.87 shows slightly less volatility; wider range 177.49-245.16 points to greater price variability.

4. Regulatory & Legal

Crown Castle Inc.

- U.S.-focused REIT subject to evolving telecom regulations; potential for zoning and environmental compliance challenges.

SBA Communications Corporation

- Operates across multiple countries, heightening exposure to diverse regulatory regimes and legal frameworks.

5. Supply Chain & Operations

Crown Castle Inc.

- Owns extensive fiber network, supporting operational resilience but vulnerable to infrastructure disruptions.

SBA Communications Corporation

- Multi-tenant sites require complex site development; cross-border operations increase operational complexity.

6. ESG & Climate Transition

Crown Castle Inc.

- Large asset base creates significant energy demand; climate transition may pressure operational costs.

SBA Communications Corporation

- Exposure to multiple jurisdictions demands robust ESG strategies; climate risks may affect site development.

7. Geopolitical Exposure

Crown Castle Inc.

- Primarily U.S. operations limit geopolitical risk but concentrate exposure to domestic policy shifts.

SBA Communications Corporation

- Geographic diversity including South Africa increases geopolitical risk but offers market diversification.

Which company shows a better risk-adjusted profile?

Crown Castle’s highest risk is its heavy leverage and poor liquidity, signaling financial distress. SBA Communications carries extreme debt and regulatory complexity but shows better operational diversification. SBA’s slightly favorable ratio profile and stronger DCF score suggest a better risk-adjusted stance despite leverage concerns. Recent data show Crown Castle’s Altman Z-score deep in distress, underscoring urgent balance sheet risks.

Final Verdict: Which stock to choose?

Crown Castle Inc. (CCI) shines as a powerhouse of operational efficiency and robust return on equity, demonstrating its ability to generate shareholder value despite cyclical pressures. Its main point of vigilance lies in liquidity constraints, signaling potential short-term balance sheet stress. This stock suits investors with an aggressive growth appetite willing to tolerate volatility.

SBA Communications Corporation (SBAC) boasts a strategic moat rooted in strong free cash flow generation and a growing return on invested capital, reflecting effective capital allocation and competitive positioning. Relative to CCI, SBAC offers a more balanced safety profile, appealing to investors seeking Growth at a Reasonable Price (GARP) with moderate risk tolerance.

If you prioritize aggressive growth and superior equity returns, CCI is the compelling choice due to its operational leverage and shareholder value creation. However, if you seek stability and a sustainable competitive advantage with steady cash flow, SBAC offers better stability and a very favorable moat, making it attractive for risk-aware growth investors.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Crown Castle Inc. and SBA Communications Corporation to enhance your investment decisions: