In the dynamic world of cloud security, CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) stand out as leading innovators transforming how businesses protect their digital assets. Both operate in the software infrastructure space, focusing on advanced cloud-delivered security solutions that address evolving cyber threats. Their overlapping markets and distinct innovation strategies make them compelling candidates for investors. This article will help you decide which company offers the most promising investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike and Zscaler by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. focuses on cloud-delivered protection across endpoints, cloud workloads, identity, and data. The company offers threat intelligence, managed security services, IT operations management, threat hunting, Zero Trust identity protection, and log management. Headquartered in Austin, Texas, CrowdStrike primarily sells subscriptions to its Falcon platform and cloud modules, serving customers globally since its incorporation in 2011.

Zscaler Overview

Zscaler, Inc. operates as a cloud security company providing secure access solutions for users, servers, IoT devices, and applications, including SaaS and private cloud environments. Its offerings include digital experience measurement and workload segmentation to prevent threats and ensure compliance. Founded in 2007 and based in San Jose, California, Zscaler serves diverse industries with a range of cloud security platform modules.

Key similarities and differences

Both CrowdStrike and Zscaler operate in the software infrastructure industry, specializing in cloud security solutions with subscription-based models. While CrowdStrike emphasizes endpoint and identity protection through its Falcon platform, Zscaler focuses on secure access and segmentation for cloud and data center applications. The companies differ in scale, with CrowdStrike having a market cap of 113B and 10K employees versus Zscaler’s 34B market cap and 7.3K employees.

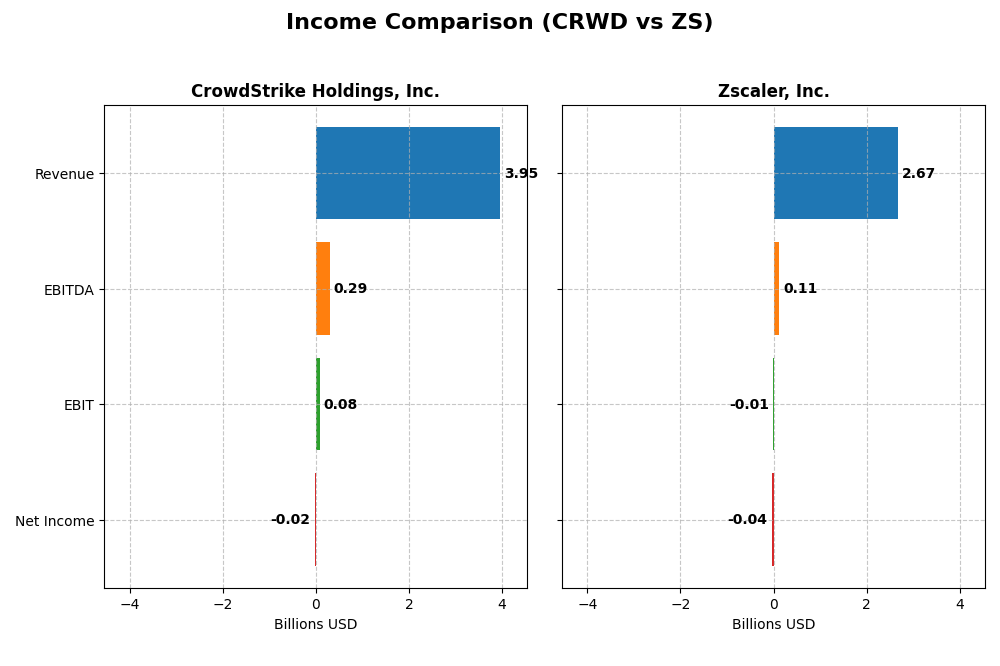

Income Statement Comparison

The table below presents the key income statement metrics for CrowdStrike Holdings, Inc. and Zscaler, Inc. for their most recent fiscal years, allowing a straightforward comparison of their financial performance.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | Zscaler, Inc. (ZS) |

|---|---|---|

| Market Cap | 113B | 34.4B |

| Revenue | 3.95B | 2.67B |

| EBITDA | 295M | 112M |

| EBIT | 81M | -8.8M |

| Net Income | -19.3M | -41.5M |

| EPS | -0.08 | -0.27 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

CrowdStrike exhibited strong revenue growth from 2021 to 2025, rising by over 350%, with gross margins remaining favorable around 75%. However, net income showed fluctuations, culminating in a slight loss of $19M in 2025, despite an overall positive margin trend. The latest year saw revenue growth slow to 29%, while EBIT and net margin deteriorated, indicating rising operating expenses and pressure on profitability.

Zscaler, Inc.

Zscaler also experienced robust revenue growth, increasing nearly 300% over five years, with a favorable gross margin near 77%. Unlike CrowdStrike, Zscaler maintained a consistently negative EBIT margin, though it improved by 45% in 2025. The latest fiscal year showed positive growth across revenue, EBIT, and net margin, reflecting improved operational efficiency despite a net loss of $41M and continued pressure on profitability.

Which one has the stronger fundamentals?

Both companies demonstrate favorable revenue and gross margin growth, but Zscaler shows a higher percentage of favorable income statement metrics, including improvements in EBIT and net margin growth in the latest year. CrowdStrike, while growing revenue faster, faces recent margin compression and net losses. Zscaler’s consistency in improving profitability metrics suggests relatively stronger fundamentals based on income statement trends.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) based on their most recent fiscal year data.

| Ratios | CrowdStrike Holdings, Inc. (CRWD) | Zscaler, Inc. (ZS) |

|---|---|---|

| ROE | -0.59% | -2.31% |

| ROIC | 0.70% | -3.18% |

| P/E | -5056 | -1063 |

| P/B | 29.7 | 24.5 |

| Current Ratio | 1.67 | 2.01 |

| Quick Ratio | 1.67 | 2.01 |

| D/E (Debt-to-Equity) | 0.24 | 1.00 |

| Debt-to-Assets | 9.1% | 28.0% |

| Interest Coverage | -4.58 | -13.49 |

| Asset Turnover | 0.45 | 0.42 |

| Fixed Asset Turnover | 4.76 | 4.22 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike’s financial ratios present a mixed picture with 43% favorable and 43% unfavorable metrics, leading to a neutral overall assessment. Key concerns include negative net margin (-0.49%) and negative return on equity (-0.59%), while liquidity ratios (current and quick) are strong at 1.67. The company does not pay dividends, likely prioritizing reinvestment and growth given its negative earnings and high valuation multiples.

Zscaler, Inc.

Zscaler’s ratios show a slightly unfavorable stance with 50% unfavorable and 36% favorable ratios. Negative profitability indicators such as net margin (-1.55%) and return on equity (-2.31%) are notable drawbacks, although liquidity ratios remain solid at about 2.0. Like CrowdStrike, Zscaler does not offer dividends, reflecting a focus on growth and reinvestment rather than shareholder payouts amid ongoing losses.

Which one has the best ratios?

Comparing both, CrowdStrike holds a more balanced ratio profile with a neutral global opinion, whereas Zscaler’s ratios lean slightly unfavorable. CrowdStrike’s better debt management and liquidity contrast with Zscaler’s weaker profitability and interest coverage, making CrowdStrike’s financial ratios relatively stronger within this comparison.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and Zscaler, including market position, key segments, and exposure to technological disruption:

CrowdStrike

- Leading market cap of 113B with competitive pressure in cloud-delivered security

- Key drivers are subscriptions to Falcon platform and professional services

- Exposure through cloud workloads, identity protection, and log management

Zscaler

- Market cap of 34B, competing in cloud security with a focus on secure access and workload segmentation

- Main segment is cloud security solutions including Internet access and private access subscriptions

- Exposure via SaaS security, cloud workload segmentation, and digital experience monitoring

CrowdStrike vs Zscaler Positioning

CrowdStrike is more diversified with cloud endpoint protection and identity services, while Zscaler focuses on cloud security access and segmentation. CrowdStrike’s broader product range contrasts with Zscaler’s concentrated cloud security niche.

Which has the best competitive advantage?

Both companies show growing ROIC but remain value destroyers, indicating no strong economic moat currently. CrowdStrike’s larger market cap and diversification may offer scale, but neither has demonstrated sustainable value creation.

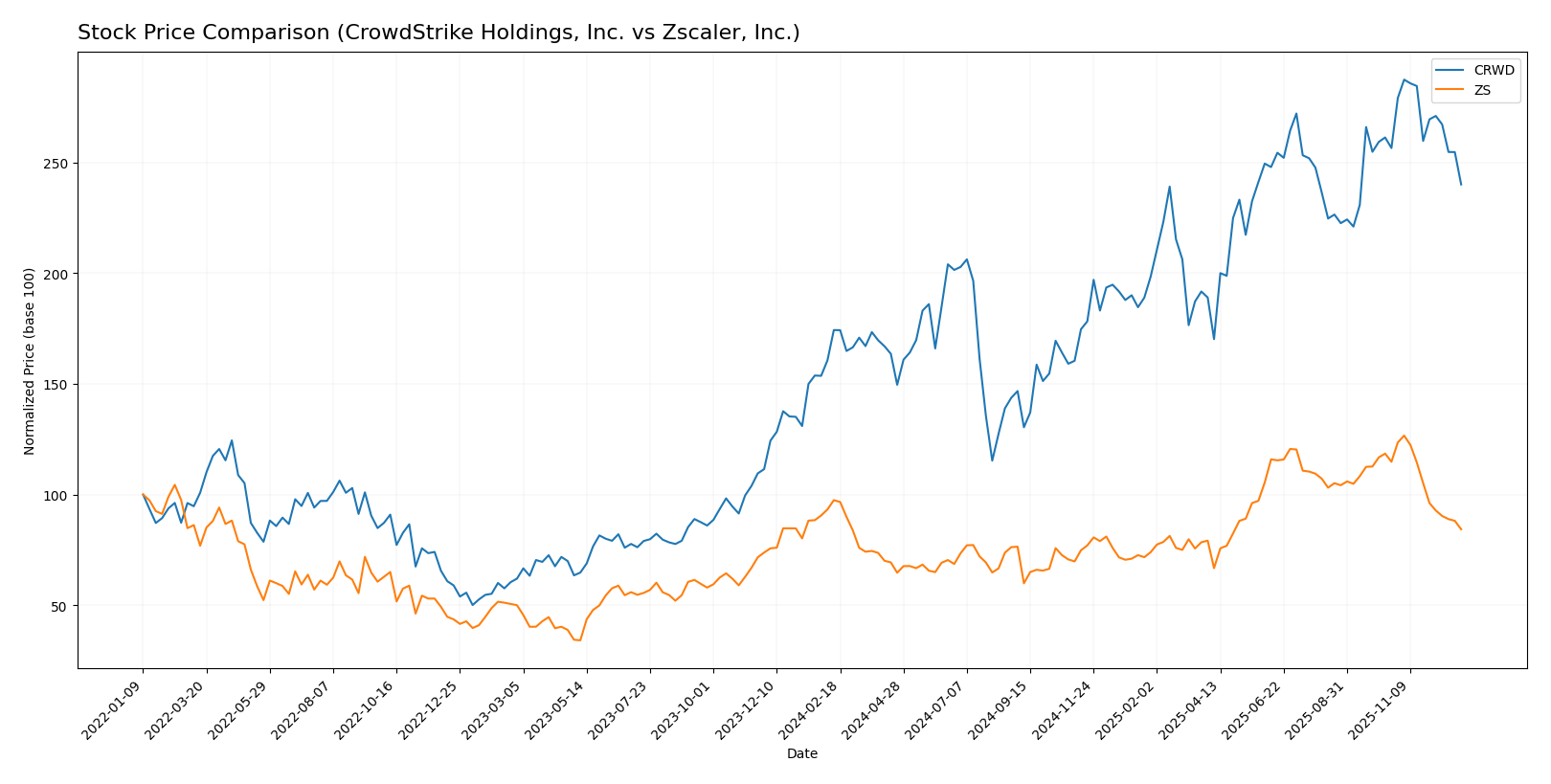

Stock Comparison

The stock price movements of CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) over the past 12 months reveal contrasting trends, marked by significant price shifts and evolving trading volumes that highlight differing investor sentiment and market dynamics.

Trend Analysis

CrowdStrike Holdings, Inc. (CRWD) exhibited a bullish trend over the past 12 months with a 37.72% price increase, though this growth showed signs of deceleration. The stock’s price ranged from a low of 217.89 to a high of 543.01, with high volatility reflected in a standard deviation of 80.21.

Zscaler, Inc. (ZS) experienced a bearish trend over the same period, with a 13.48% decrease in price and decelerating downward momentum. The stock fluctuated between 156.78 and 331.14, displaying moderate volatility with a standard deviation of 47.29.

Comparing the two, CrowdStrike delivered the highest market performance over the past year, outperforming Zscaler by a substantial margin in price appreciation despite recent short-term declines for both stocks.

Target Prices

The current analyst consensus presents a cautiously optimistic outlook for both CrowdStrike Holdings, Inc. and Zscaler, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 548.07 |

| Zscaler, Inc. | 360 | 264 | 319.6 |

For CrowdStrike, the consensus target price of 548.07 USD suggests upside potential of about 21% from the current price of 453.58 USD. Zscaler’s consensus target of 319.6 USD indicates significant upside compared to its current price of 220.57 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. and Zscaler, Inc.:

Rating Comparison

CRWD Rating

- Rating: C with a very favorable evaluation.

- Discounted Cash Flow Score: 4, indicating favorable future cash flow prospects.

- ROE Score: 1, considered very unfavorable in generating profit from equity.

- ROA Score: 1, very unfavorable for asset utilization efficiency.

- Debt To Equity Score: 3, moderate financial risk with balanced leverage.

- Overall Score: 2, moderate summary financial standing.

ZS Rating

- Rating: C- with a very favorable evaluation.

- Discounted Cash Flow Score: 4, also favorable for future cash flow valuation.

- ROE Score: 1, similarly very unfavorable in shareholder profit generation.

- ROA Score: 1, also very unfavorable in utilizing assets to generate earnings.

- Debt To Equity Score: 1, very unfavorable indicating higher financial risk.

- Overall Score: 1, very unfavorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, CRWD is better rated overall with a higher overall score (2 vs 1) and a stronger debt-to-equity score (3 vs 1), despite both having similar unfavorable profitability scores.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score of CrowdStrike and Zscaler:

CrowdStrike Scores

- Altman Z-Score: 13.54, indicating a strong safe zone.

- Piotroski Score: 4, showing average financial strength.

Zscaler Scores

- Altman Z-Score: 5.24, indicating a safe zone.

- Piotroski Score: 3, indicating very weak strength.

Which company has the best scores?

Based on the provided data, CrowdStrike has a higher Altman Z-Score and a better Piotroski Score than Zscaler, reflecting stronger overall financial stability and average financial health compared to Zscaler’s very weak Piotroski rating.

Grades Comparison

Here is a comparison of recent grades assigned to CrowdStrike Holdings, Inc. and Zscaler, Inc.:

CrowdStrike Holdings, Inc. Grades

The table below shows recent grades given by recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-03 |

| Macquarie | Maintain | Neutral | 2025-12-03 |

| DA Davidson | Maintain | Buy | 2025-12-03 |

| Citizens | Maintain | Market Outperform | 2025-12-03 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

CrowdStrike’s grades predominantly indicate positive sentiment, with a majority of “Buy” and “Outperform” ratings maintained recently.

Zscaler, Inc. Grades

The following table summarizes recent grades from reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Upgrade | Outperform | 2025-12-16 |

| Bernstein | Downgrade | Market Perform | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-12-01 |

| UBS | Maintain | Buy | 2025-11-26 |

| Bernstein | Maintain | Outperform | 2025-11-26 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-26 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Stifel | Maintain | Buy | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Mizuho | Maintain | Neutral | 2025-11-26 |

Zscaler’s grades are generally favorable, although they show some recent variability with an upgrade and a downgrade noted.

Which company has the best grades?

Both CrowdStrike and Zscaler have predominantly positive grades from major financial institutions. CrowdStrike’s grades show consistent “Buy” and “Outperform” ratings, while Zscaler’s grades include a mix of “Buy,” “Outperform,” and one recent downgrade to “Market Perform.” This suggests CrowdStrike holds a slightly stronger consensus, potentially indicating more stable analyst confidence, which could influence investor sentiment and portfolio risk management.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses between CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) based on their latest financial and operational data.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | Zscaler, Inc. (ZS) |

|---|---|---|

| Diversification | Revenue primarily from Subscription and Circulation (3.76B in 2025) with growing Professional Services (192M); moderate product diversification | Single main segment generating 2.67B revenue; less diversified product line |

| Profitability | Negative net margin (-0.49%), negative ROE (-0.59%), but improving ROIC (0.7%); slightly unfavorable value creation | More negative profitability metrics: net margin -1.55%, ROE -2.31%, ROIC -3.18%; shedding value but improving |

| Innovation | Strong growth in ROIC (+113%), indicating improving capital efficiency and innovation capacity | ROIC growth (+76%) also positive, but overall value destruction calls for caution on innovation payoffs |

| Global presence | Large and growing subscription base suggests strong global footprint | Significant revenue but less diversified globally, risk of concentration |

| Market Share | Leading position in cybersecurity subscriptions with fast revenue growth and good fixed asset turnover (4.76) | Competitive player with solid revenue but lower asset turnover (4.22) and higher debt-to-assets ratio |

Key takeaways: Both CRWD and ZS face challenges in profitability and are currently shedding value, but each shows improving ROIC trends indicating strengthening operational efficiency. CrowdStrike benefits from a more diversified revenue base and stronger asset management, while Zscaler requires cautious monitoring due to higher leverage and negative profitability metrics. Investors should weigh growth potential against ongoing value destruction risk.

Risk Analysis

Below is a comparison table of key risk factors for CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) as of 2025.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | Zscaler, Inc. (ZS) |

|---|---|---|

| Market Risk | Beta 1.09, moderate volatility | Beta 1.07, moderate volatility |

| Debt level | Low debt-to-equity 0.24, favorable | Moderate debt-to-equity 1.0, neutral |

| Regulatory Risk | Moderate, tech sector compliance | Moderate, cloud security regulations |

| Operational Risk | Medium, cloud service dependency | Medium, reliance on SaaS platform |

| Environmental Risk | Low, mostly digital operations | Low, digital/cloud focus |

| Geopolitical Risk | Medium, global customer base | Medium, global customer base |

The most impactful risks for both companies are operational and regulatory risks due to their reliance on cloud infrastructure and evolving cybersecurity regulations. Zscaler’s higher debt level and unfavorable interest coverage indicate elevated financial risk, while CrowdStrike’s strong liquidity and low debt reduce its financial vulnerability. Both operate in a volatile market environment with beta close to 1.1, implying moderate market risk exposure.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) shows strong income growth with a 352% revenue increase over 2021-2025 and a favorable global income statement. Its financial ratios are mixed, with 43% favorable and 43% unfavorable, reflecting moderate profitability and low debt. The company’s rating is very favorable, supported by a safe zone Altman Z-Score but average Piotroski score, indicating stable financial health despite some challenges.

Zscaler, Inc. (ZS) also reports favorable income growth and a positive income statement with 86% favorable metrics. However, its financial ratios are slightly unfavorable, with 36% favorable and 50% unfavorable ratios, reflecting weaker profitability and higher debt. ZS holds a very favorable rating overall, with a safe zone Altman Z-Score but a very weak Piotroski score, suggesting financial stability but operational weaknesses.

Investors focused on growth and revenue expansion might find CRWD’s improving profitability and balanced financial ratios appealing, while those prioritizing stable income statements and cautious debt profiles may see ZS as a potential option. The choice may depend on tolerance for financial ratio variability versus income statement consistency.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and Zscaler, Inc. to enhance your investment decisions: