Home > Comparison > Technology > CRWD vs VRSN

The strategic rivalry between CrowdStrike Holdings, Inc. and VeriSign, Inc. shapes the evolution of the technology sector. CrowdStrike operates as a high-growth cloud security platform focused on endpoint and identity protection. VeriSign commands critical internet infrastructure through domain registry services, emphasizing stability and resilience. This head-to-head contrasts dynamic innovation versus entrenched market control. This analysis aims to identify which trajectory offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

CrowdStrike and VeriSign both occupy critical roles in the technology infrastructure landscape, shaping internet security and stability worldwide.

CrowdStrike Holdings, Inc.: Cybersecurity Innovator

CrowdStrike dominates the cybersecurity sector with its cloud-delivered endpoint protection platform. It generates revenue primarily through subscriptions to its Falcon platform and cloud modules, sold via direct and channel sales. In 2026, CrowdStrike focuses on expanding its threat intelligence and Zero Trust identity protection services to counter evolving cyber threats.

VeriSign, Inc.: Internet Infrastructure Pillar

VeriSign leads as a domain name registry and internet infrastructure provider, supporting the .com and .net domains essential for global e-commerce. Its revenue stems from registration and resolution services, backed by maintaining critical internet root servers. In 2026, VeriSign emphasizes enhancing the security and resiliency of internet navigation and domain name services.

Strategic Collision: Similarities & Divergences

Both firms operate within software infrastructure but diverge sharply in focus. CrowdStrike pursues a dynamic, subscription-based cybersecurity model, while VeriSign secures foundational internet infrastructure through registry services. Their primary battleground lies in internet security and stability, but their investment profiles differ: CrowdStrike channels growth in cloud security innovation, whereas VeriSign offers stability anchored in critical internet assets.

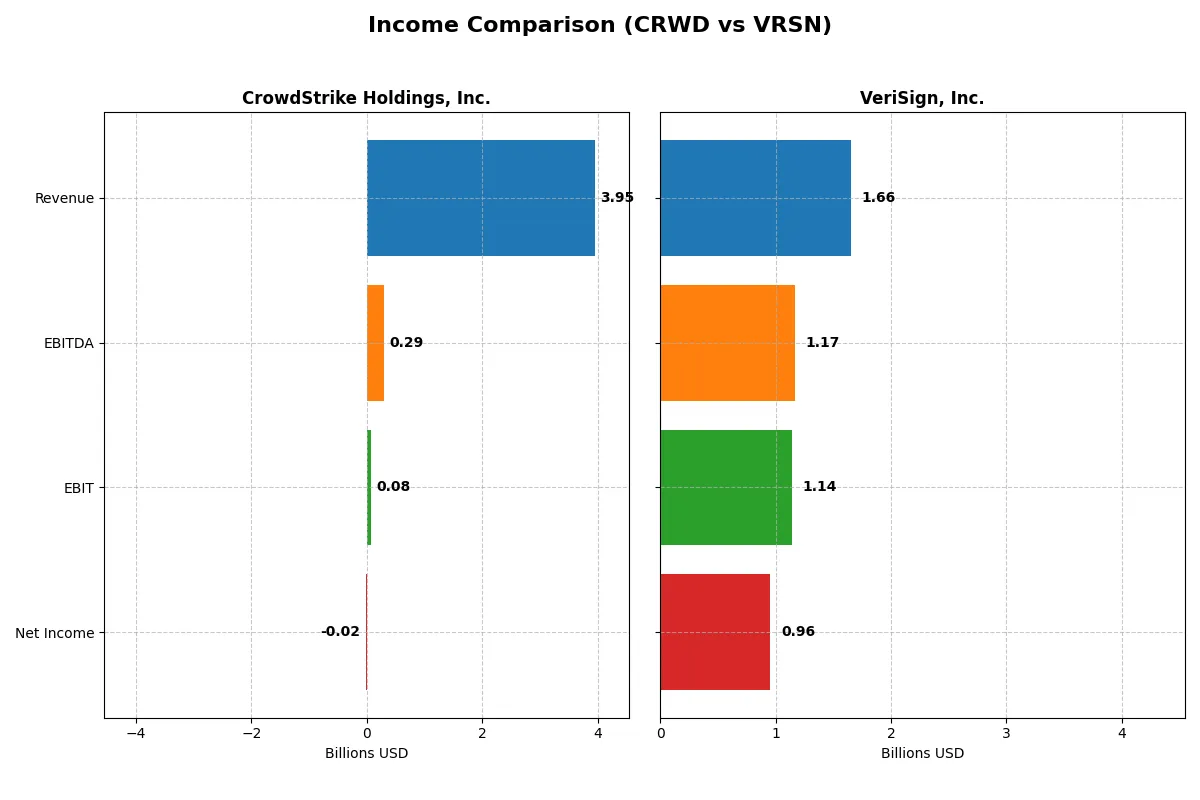

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | CrowdStrike Holdings, Inc. (CRWD) | VeriSign, Inc. (VRSN) |

|---|---|---|

| Revenue | 3.95B | 1.66B |

| Cost of Revenue | 991M | 196M |

| Operating Expenses | 3.08B | 339M |

| Gross Profit | 2.96B | 1.46B |

| EBITDA | 295M | 1.17B |

| EBIT | 81M | 1.14B |

| Interest Expense | 26M | 77M |

| Net Income | -19M | 955M |

| EPS | -0.08 | 8.83 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes how efficiently each company converts sales into profits and manages costs across recent market cycles.

CrowdStrike Holdings, Inc. Analysis

CrowdStrike’s revenue surged 29% last year, reaching $3.95B, reflecting strong top-line momentum. Its gross margin remains healthy at nearly 75%, yet net margins turned negative at -0.5%, signaling rising expenses outpacing profits. Despite a positive five-year net income growth of 79%, 2025 saw a net loss of $19M, reflecting a challenging efficiency phase.

VeriSign, Inc. Analysis

VeriSign posted steady revenue growth of 6.4% to $1.66B in 2025, supported by an outstanding gross margin of 88%. Its EBIT margin exceeds 68%, and net income soared to $956M, delivering a robust 58% net margin. Over five years, revenue and net income grew moderately, with consistent profitability and margin expansion reinforcing operational excellence.

Margin Leadership vs. Growth Volatility

VeriSign leads with superior profitability and margin stability, translating efficient cost control into strong bottom-line results. CrowdStrike impresses with rapid revenue growth but struggles to maintain profitability amid rising operating expenses. For investors, VeriSign offers a steady, high-margin profile, while CrowdStrike presents a higher-risk growth story with potential margin recovery needed.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | CrowdStrike (CRWD) | VeriSign (VRSN) |

|---|---|---|

| ROE | -0.59% | -64.84% |

| ROIC | 0.70% | -151.96% |

| P/E | -5055.7 | 23.49 |

| P/B | 29.71 | -15.23 |

| Current Ratio | 1.67 | 0.49 |

| Quick Ratio | 1.67 | 0.49 |

| D/E | 0.24 | -1.21 |

| Debt-to-Assets | 9.07% | 265.55% |

| Interest Coverage | -4.58 | 14.56 |

| Asset Turnover | 0.45 | 2.46 |

| Fixed Asset Turnover | 4.76 | 7.75 |

| Payout Ratio | 0 | 22.52% |

| Dividend Yield | 0 | 0.96% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence that guide investors through complexity.

CrowdStrike Holdings, Inc.

CrowdStrike shows weak profitability with negative ROE (-0.59%) and net margin (-0.49%), signaling operational challenges. Its valuation appears stretched with a high P/B ratio of 29.71 despite a favorable P/E due to negative earnings. The company reinvests heavily in R&D rather than paying dividends, reflecting a growth-focused strategy amid efficiency headwinds.

VeriSign, Inc.

VeriSign delivers strong net margins (57.68%) but suffers from a negative ROE (-64.84%), highlighting uneven returns to equity holders. Its P/E of 23.49 is neutral, and balance sheet risks emerge with a low current ratio (0.49). VeriSign offers a modest dividend yield of 0.96%, maintaining steady shareholder returns despite some financial leverage concerns.

Operational Efficiency vs. Balance Sheet Stability

VeriSign offers superior operational margins and moderate valuation but shows balance sheet weaknesses. CrowdStrike struggles with profitability and valuation stretch but maintains financial stability and reinvests for growth. VeriSign suits income-seeking investors; CrowdStrike fits those prioritizing growth with manageable liquidity risks.

Which one offers the Superior Shareholder Reward?

I observe VeriSign (VRSN) delivers superior shareholder rewards compared to CrowdStrike (CRWD) in 2026. VeriSign pays a modest dividend yield near 0.96%, with a sustainable payout ratio around 22.5%, backed by strong free cash flow coverage. Its consistent buyback activity complements dividends, boosting total returns. Conversely, CrowdStrike pays no dividends and funds growth primarily through reinvestment, with no buybacks, reflecting its growth-stage status. VeriSign’s mature, cash-generative model offers more reliable and sustainable shareholder returns, outperforming CrowdStrike’s high-valuation, reinvestment-driven strategy in total return potential.

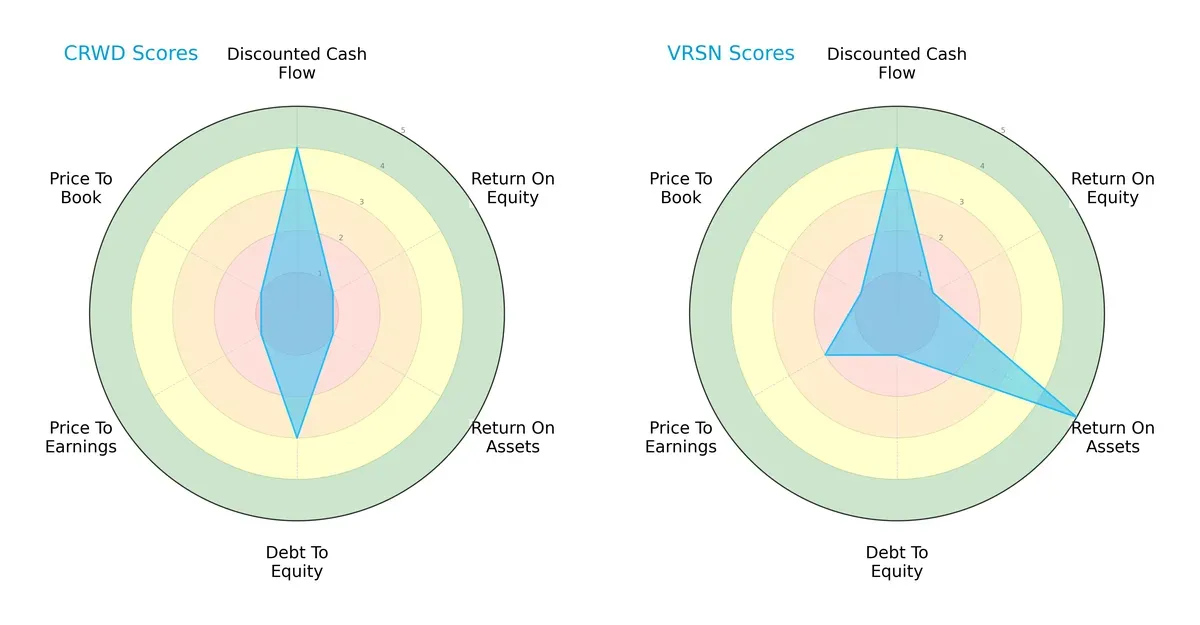

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of CrowdStrike Holdings, Inc. and VeriSign, Inc., highlighting their financial strengths and vulnerabilities:

CrowdStrike shows robust discounted cash flow but struggles with profitability metrics like ROE and ROA, scoring very unfavorably. VeriSign balances a very strong asset utilization (ROA) with weaker debt management. VeriSign’s profile is more balanced, while CrowdStrike relies heavily on cash flow projections despite operational inefficiencies.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap signals starkly different solvency outlooks for these firms in 2026:

CrowdStrike’s Z-score of 11.36 places it well within the safe zone, indicating strong financial resilience. VeriSign’s score of -12.09 is deeply in the distress zone, raising red flags about its long-term survival prospects despite operational strengths.

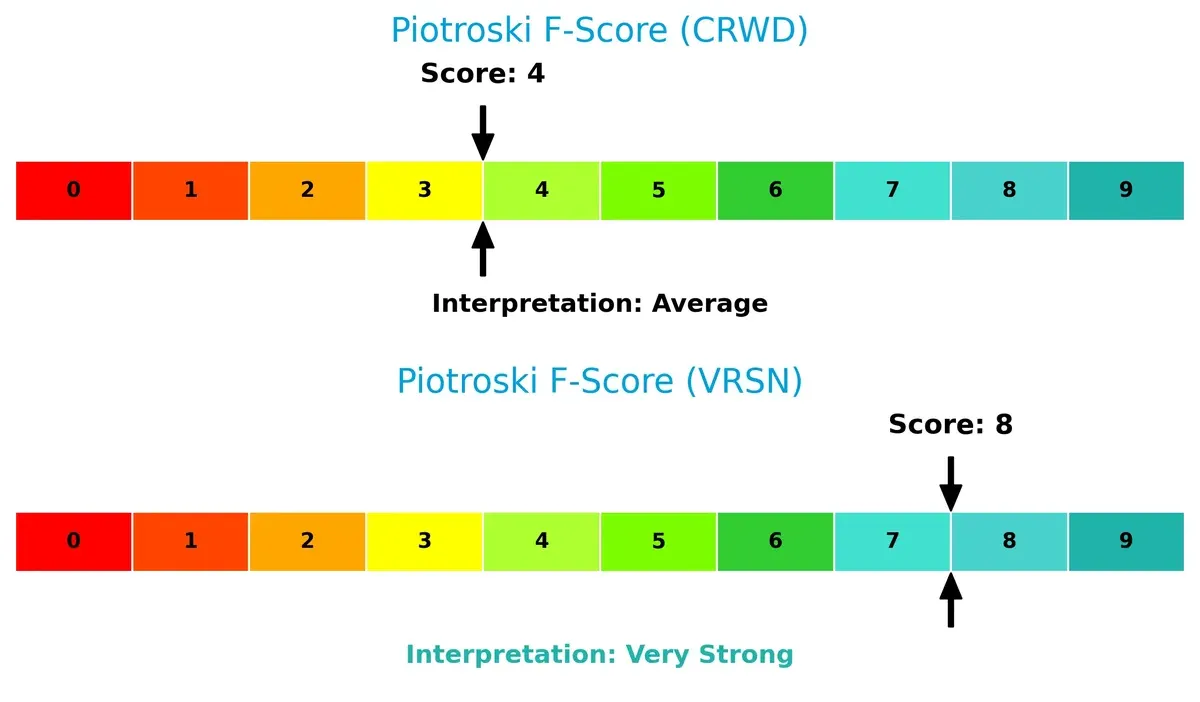

Financial Health: Quality of Operations

Piotroski F-Scores paint a contrasting picture of operational health and internal financial quality:

VeriSign’s score of 8 suggests robust financial health and efficient capital allocation. CrowdStrike’s score of 4 reveals average financial strength, suggesting internal metrics warrant caution compared to VeriSign’s superior quality signals.

How are the two companies positioned?

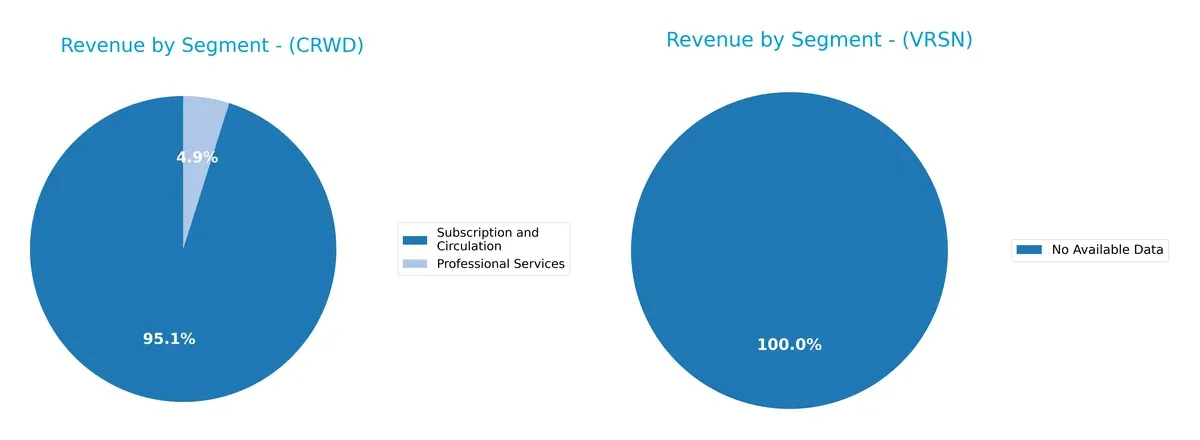

This section dissects the operational DNA of CrowdStrike and VeriSign by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which business model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how CrowdStrike Holdings, Inc. and VeriSign, Inc. diversify their income streams and highlights their primary sector bets:

CrowdStrike anchors its revenue in Subscription and Circulation, generating $3.76B in 2025, dwarfing its $192M Professional Services segment. VeriSign lacks available data for segmentation. CrowdStrike’s heavy reliance on subscriptions signals strong ecosystem lock-in, but also concentration risk. Its limited diversification contrasts with firms balancing multiple sizable streams, exposing it to shifts in subscription demand or competitive pressure.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of CrowdStrike Holdings, Inc. and VeriSign, Inc.:

CrowdStrike Strengths

- Diverse revenue from subscription and professional services

- Strong U.S. market presence with growing Asia Pacific and EMEA sales

- Favorable liquidity ratios with current and quick ratio at 1.67

VeriSign Strengths

- High net margin of 57.68% indicating strong profitability

- Favorable asset turnover and fixed asset turnover ratios

- High interest coverage ratio of 14.81 supports debt servicing

CrowdStrike Weaknesses

- Negative net margin and ROE indicating unprofitable operations

- ROIC below WACC at 0.7% signals weak capital returns

- High price-to-book ratio at 29.71 suggests overvaluation risk

- Asset turnover ratio of 0.45 is low, hinting at inefficient asset use

VeriSign Weaknesses

- Negative ROE and ROIC reflect poor capital efficiency

- Very low current and quick ratios at 0.49 imply liquidity concerns

- Debt to assets ratio extremely high at 265.55% signals financial risk

- Dividend yield unfavorable despite positive earnings

CrowdStrike’s strengths lie in its revenue diversification and solid liquidity, but profitability and capital efficiency remain challenges. VeriSign benefits from strong profitability and asset utilization but faces significant liquidity and leverage risks that could impact its financial stability.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from the erosion of competition. Let’s analyze two moats in tech infrastructure:

CrowdStrike Holdings, Inc.: Dynamic Security Platform with Network Effects

CrowdStrike’s moat stems from network effects and subscription switching costs. Its high gross margin (~75%) shows pricing power, but negative net margin signals reinvestment. Expanding cloud modules in 2026 could deepen this moat.

VeriSign, Inc.: Dominant Domain Registry with Intangible Assets

VeriSign’s moat relies on regulatory-backed intangible assets and monopolistic control over .com/.net domains. It commands 88% gross margin and 58% net margin, reflecting exceptional profitability. However, declining ROIC warns of emerging operational challenges.

Dynamic Network Effects vs. Regulatory Monopoly: Who Defends Better?

CrowdStrike shows a growing ROIC trend despite current value destruction, signaling improving competitive strength. VeriSign’s fortress is deeper but its declining ROIC and profitability raise caution. I see CrowdStrike better positioned to defend market share long term.

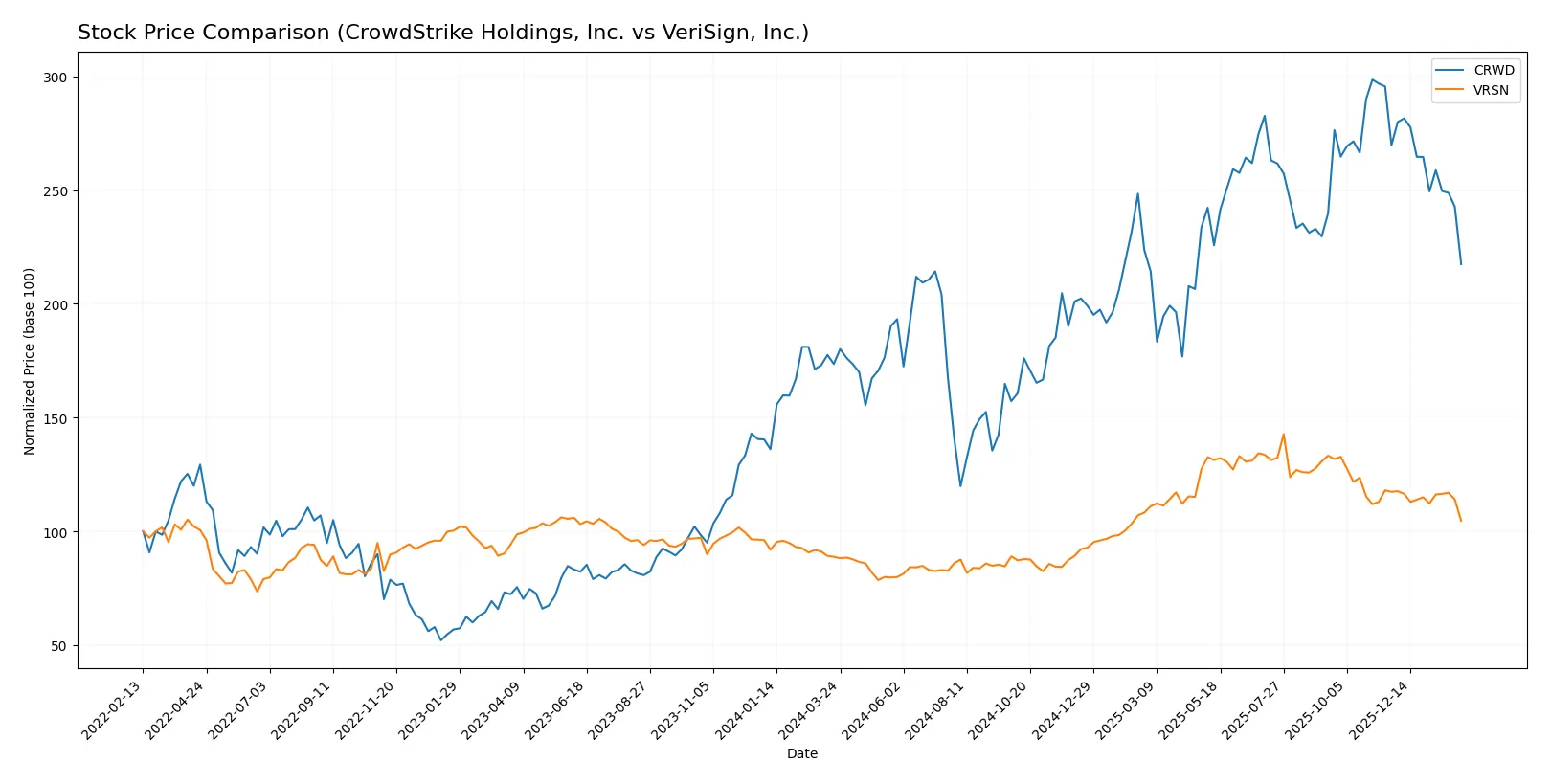

Which stock offers better returns?

The past year featured robust gains for both CrowdStrike and VeriSign, with CrowdStrike showing a stronger overall rise but recent deceleration in price momentum.

Trend Comparison

CrowdStrike’s stock rose 25.3% over the past 12 months, marking a bullish trend with decelerating momentum. It ranged between $217.89 and $543.01, showing high volatility (std dev 79.96).

VeriSign’s stock increased 17.83% in the same period, also bullish but with deceleration. It traded from $168.32 to $305.79, with moderate volatility (std dev 40.67).

CrowdStrike outperformed VeriSign by delivering higher total gains, despite both stocks showing recent downward price pressure since November 2025.

Target Prices

Analysts present a strong consensus with clear upside potential for these technology infrastructure leaders.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 353 | 706 | 551.26 |

| VeriSign, Inc. | 325 | 325 | 325 |

CrowdStrike’s target consensus implies a 40% upside from the current 395.5 price, reflecting high growth expectations. VeriSign’s target price at 325 suggests a 45% premium over its 224.17 stock price, highlighting confidence in its domain services moat.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

CrowdStrike Holdings, Inc. Grades

The following table summarizes recent grades from reputable institutions for CrowdStrike Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Macquarie | Maintain | Neutral | 2026-01-27 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Citigroup | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

VeriSign, Inc. Grades

The following table summarizes recent grades from reputable institutions for VeriSign, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2026-01-06 |

| Baird | Maintain | Outperform | 2025-07-01 |

| Baird | Maintain | Outperform | 2025-04-25 |

| Baird | Maintain | Outperform | 2025-04-01 |

| Citigroup | Maintain | Buy | 2025-02-04 |

| Citigroup | Maintain | Buy | 2025-01-03 |

| Baird | Upgrade | Outperform | 2024-12-09 |

| Baird | Maintain | Neutral | 2024-06-27 |

| Baird | Maintain | Neutral | 2024-04-26 |

| Citigroup | Maintain | Buy | 2024-04-02 |

Which company has the best grades?

CrowdStrike has mostly Buy ratings with some neutral and sector weight grades. VeriSign consistently earns Outperform and Buy grades, indicating a slightly stronger institutional endorsement. This difference may influence investors seeking more bullish analyst sentiment.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing CrowdStrike Holdings, Inc. and VeriSign, Inc. in the 2026 market environment:

1. Market & Competition

CrowdStrike Holdings, Inc.

- Faces intense competition in cloud security with fast innovation cycles and evolving cyber threats.

VeriSign, Inc.

- Dominates domain registry with few direct competitors but faces pressure from emerging decentralized web technologies.

2. Capital Structure & Debt

CrowdStrike Holdings, Inc.

- Maintains low debt-to-equity (0.24), signaling prudent leverage and moderate financial risk.

VeriSign, Inc.

- Exhibits extremely high debt-to-assets (265.55%), indicating risky capital structure and potential solvency concerns.

3. Stock Volatility

CrowdStrike Holdings, Inc.

- Beta near 1.03 reflects market-correlated volatility typical for tech growth stocks.

VeriSign, Inc.

- Lower beta at 0.75 suggests less volatility but recent price drop (-7.6%) raises short-term risk.

4. Regulatory & Legal

CrowdStrike Holdings, Inc.

- Subject to data privacy regulations and cybersecurity standards globally, increasing compliance costs.

VeriSign, Inc.

- Must comply with internet governance policies and potential antitrust scrutiny due to market dominance.

5. Supply Chain & Operations

CrowdStrike Holdings, Inc.

- Relies on cloud infrastructure providers; risks include outages and service disruptions.

VeriSign, Inc.

- Operates critical internet infrastructure with high reliability but concentrated operational risk.

6. ESG & Climate Transition

CrowdStrike Holdings, Inc.

- Increasing focus on sustainable cloud operations and data center energy efficiency.

VeriSign, Inc.

- Faces pressure to enhance energy efficiency of servers and reduce carbon footprint.

7. Geopolitical Exposure

CrowdStrike Holdings, Inc.

- Global footprint exposes it to geopolitical tensions affecting cybersecurity demand and regulations.

VeriSign, Inc.

- US-based with global domain services exposes VeriSign to geopolitical risks in internet governance.

Which company shows a better risk-adjusted profile?

CrowdStrike confronts fierce competition and negative profitability but boasts a strong balance sheet and safer capital structure. VeriSign enjoys market dominance and profitability yet suffers from dangerous leverage and financial distress signals. Recent data show VeriSign’s Altman Z-Score in distress zone, while CrowdStrike remains in a safe zone, reinforcing my caution. Overall, CrowdStrike offers a more balanced risk-adjusted profile despite near-term earnings headwinds.

Final Verdict: Which stock to choose?

CrowdStrike’s superpower lies in its rapid revenue growth and expanding profitability, signaling a rising force in cybersecurity innovation. Its main point of vigilance is the lingering value destruction, reflected in ROIC below WACC, which tempers enthusiasm. It fits well in aggressive growth portfolios seeking market disruption potential.

VeriSign commands a strategic moat through its entrenched domain name registry dominance, providing recurring revenue and strong cash flow. Compared to CrowdStrike, it offers better income quality and stability despite some balance sheet concerns like a low current ratio. This makes it suitable for GARP investors valuing consistent cash generation and market leadership.

If you prioritize high growth and innovation potential, CrowdStrike is the compelling choice due to accelerating revenue and improving profitability trends. However, if you seek income stability and a durable competitive moat, VeriSign offers better stability and recurring revenue benefits despite valuation and capital structure challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and VeriSign, Inc. to enhance your investment decisions: