In today’s fast-evolving technology landscape, CrowdStrike Holdings, Inc. (CRWD) and UiPath Inc. (PATH) stand out as leaders in software infrastructure, each driving innovation in cybersecurity and automation respectively. Both companies serve enterprise clients with cutting-edge cloud-based solutions, making them direct competitors for investor attention. This article will analyze their market positions and growth strategies to help you identify which stock might enhance your portfolio.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike and UiPath by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. is a leader in cloud-delivered protection focusing on endpoints, cloud workloads, identity, and data security. The company offers threat intelligence, managed security, and Zero Trust identity protection primarily through its Falcon platform. Established in 2011 and based in Austin, Texas, CrowdStrike serves a global customer base and operates in the software infrastructure industry, with a market cap of $114B.

UiPath Overview

UiPath Inc. specializes in robotic process automation (RPA), delivering an end-to-end automation platform that integrates AI, low-code development, and centralized management tools. Founded in 2005 and headquartered in New York City, UiPath targets sectors like banking and healthcare, focusing on automating business processes. It operates in the software infrastructure industry with a market cap of $7.7B, concentrating on the US, Romania, and Japan markets.

Key similarities and differences

Both companies operate in the software infrastructure sector, emphasizing automation and security through advanced cloud-based platforms. CrowdStrike focuses on cybersecurity and threat protection, while UiPath centers on process automation using RPA and AI technologies. They differ significantly in scale, with CrowdStrike’s market cap and employee base notably larger, reflecting distinct market positioning and product offerings within technology.

Income Statement Comparison

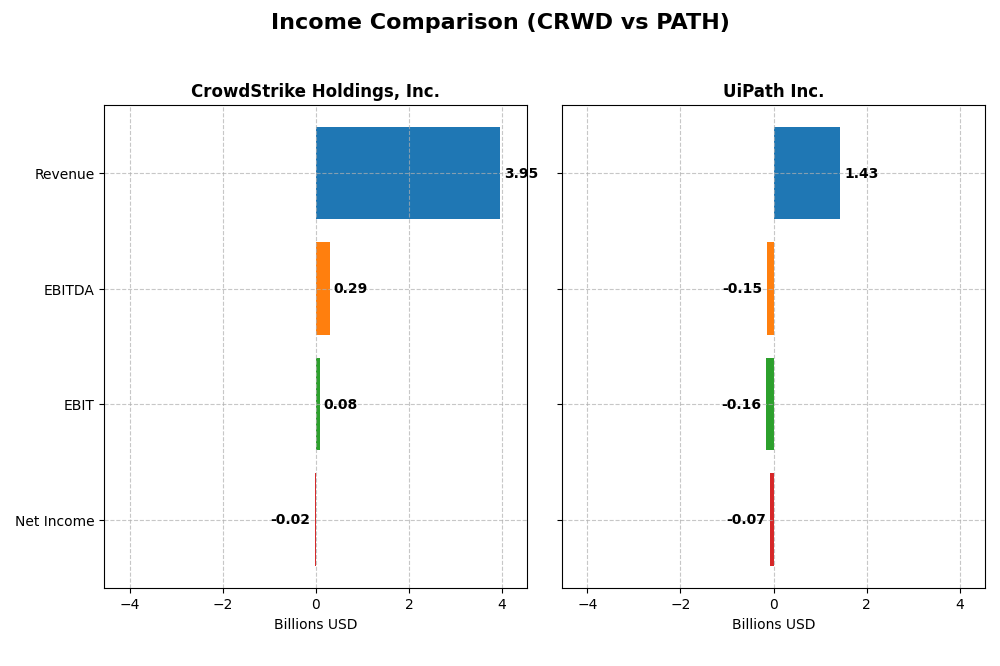

Below is a comparison of key income statement metrics for CrowdStrike Holdings, Inc. and UiPath Inc. for the fiscal year 2025.

| Metric | CrowdStrike Holdings, Inc. | UiPath Inc. |

|---|---|---|

| Market Cap | 114.4B | 7.7B |

| Revenue | 3.95B | 1.43B |

| EBITDA | 295M | -145M |

| EBIT | 81M | -163M |

| Net Income | -19M | -74M |

| EPS | -0.079 | -0.13 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

CrowdStrike’s revenue surged from $874M in 2021 to $3.95B in 2025, reflecting robust growth. Net income recovered from a loss of $93M in 2021 to a slight loss of $19M in 2025, after a peak profit in 2024. Gross margins remained strong near 75%, but net margins turned negative in 2025, indicating pressure on profitability despite revenue gains.

UiPath Inc.

UiPath’s revenue climbed steadily from $608M in 2021 to $1.43B in 2025, with modest net income losses narrowing from $92M to $74M. Gross margins improved to 82.7%, while EBIT margins remained negative around -11%. The company showed favorable improvements in net margin and EPS growth in 2025, signaling gradual operational efficiency gains.

Which one has the stronger fundamentals?

Both companies show favorable revenue growth and strong gross margins, but CrowdStrike exhibits higher absolute revenue and a more volatile net income trend. UiPath has a smaller scale but consistent margin improvement and less volatile net losses. CrowdStrike’s margin pressure contrasts with UiPath’s steady operational improvements, highlighting different risk and growth profiles.

Financial Ratios Comparison

The table below presents key financial ratios for CrowdStrike Holdings, Inc. and UiPath Inc. for the fiscal year 2025, offering a snapshot of their recent financial performance and stability.

| Ratios | CrowdStrike Holdings, Inc. (CRWD) | UiPath Inc. (PATH) |

|---|---|---|

| ROE | -0.59% | -3.99% |

| ROIC | 0.70% | -7.41% |

| P/E | -5056 | -108 |

| P/B | 29.71 | 4.31 |

| Current Ratio | 1.67 | 2.93 |

| Quick Ratio | 1.67 | 2.93 |

| D/E | 0.24 | 0.04 |

| Debt-to-Assets | 9.07% | 2.72% |

| Interest Coverage | -4.58 | 0 |

| Asset Turnover | 0.45 | 0.50 |

| Fixed Asset Turnover | 4.76 | 14.41 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike shows a mixed ratio profile with favorable liquidity and leverage metrics, including a current ratio of 1.67 and debt-to-equity at 0.24. However, profitability ratios like net margin (-0.49%) and return on equity (-0.59%) are unfavorable, reflecting challenges in profitability. The company does not pay dividends, likely due to reinvestment in growth and innovation, with no dividend yield or payout concerns.

UiPath Inc.

UiPath’s ratios indicate weaker profitability with a net margin of -5.15% and return on equity at -3.99%, both unfavorable. Liquidity is strong, with a current ratio of 2.93 and low debt-to-equity of 0.04, but interest coverage is zero, signaling potential risk. UiPath also does not pay dividends, consistent with its ongoing investment in R&D and expansion during a high growth phase.

Which one has the best ratios?

Both companies exhibit significant profitability challenges, but CrowdStrike’s balance of favorable liquidity and moderate leverage with a neutral overall rating contrasts with UiPath’s slightly unfavorable profile and zero interest coverage. Therefore, while both face risks, CrowdStrike’s ratios appear somewhat more balanced in this comparison.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and UiPath, including market position, key segments, and exposure to technological disruption:

CrowdStrike Holdings, Inc.

- Leading cloud-delivered endpoint and workload protection with strong global presence and moderate competitive pressure.

- Primarily driven by subscription services for cybersecurity and professional services supporting the Falcon platform.

- Exposure to evolving cybersecurity threats requiring continuous innovation in cloud and identity protection technologies.

UiPath Inc.

- Focused on robotic process automation with significant activity in the US, Romania, and Japan amid competitive software markets.

- Revenue driven by licenses, subscription services, and professional services for end-to-end automation platforms.

- Faces technological disruption through AI integration and automation innovation, demanding agile platform enhancements.

CrowdStrike vs UiPath Positioning

CrowdStrike concentrates on cybersecurity subscriptions globally, benefiting from recurring revenue but facing intense sector competition. UiPath diversifies across licenses, subscriptions, and services in automation, addressing multiple industries but with a narrower geographic focus.

Which has the best competitive advantage?

Both companies are slightly unfavorable in MOAT evaluation, shedding value despite growing ROIC trends. CrowdStrike shows a smaller gap between ROIC and WACC, indicating a relatively stronger but still challenged competitive advantage.

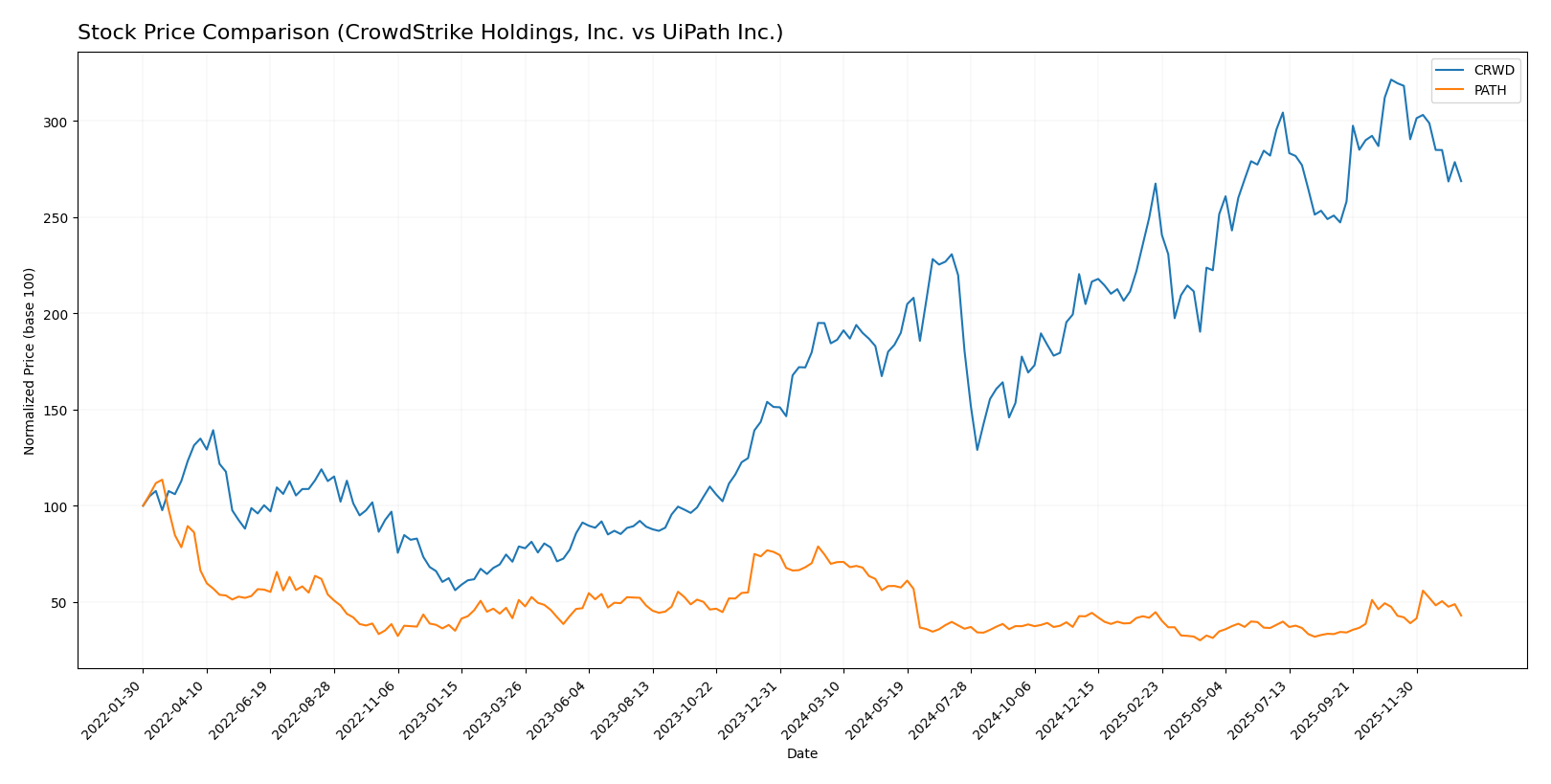

Stock Comparison

The stock price movements over the past year reveal contrasting trends for CrowdStrike Holdings, Inc. and UiPath Inc., with significant price appreciation for CrowdStrike and a marked decline for UiPath, reflecting divergent trading dynamics and market sentiment.

Trend Analysis

CrowdStrike Holdings, Inc. exhibited a bullish trend over the past 12 months with a 45.71% price increase, though the trend shows deceleration. Price volatility was high, with a standard deviation of 80.53, and prices ranged between 217.89 and 543.01.

UiPath Inc. experienced a bearish trend with a 38.53% price decline during the same period, accompanied by accelerating downward momentum. The stock demonstrated low volatility, with a standard deviation of 3.33, and prices fluctuated between 10.04 and 23.66.

Comparing both stocks, CrowdStrike delivered the highest market performance with a strong positive return, while UiPath showed a significant negative price change, indicating divergent investor confidence and market trends.

Target Prices

Analysts present a clear consensus on target prices for CrowdStrike Holdings, Inc. and UiPath Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| UiPath Inc. | 19 | 14 | 16.6 |

The target consensus for CrowdStrike at 553.47 USD significantly exceeds its current price near 453.88 USD, indicating bullish analyst expectations. UiPath’s consensus target of 16.6 USD also suggests moderate upside potential over its current price around 14.34 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. and UiPath Inc.:

Rating Comparison

CRWD Rating

- Rating: C, considered very favorable overall.

- Discounted Cash Flow Score: 4, favorable, indicating good valuation prospects.

- ROE Score: 1, very unfavorable, indicating poor profit generation from equity.

- ROA Score: 1, very unfavorable, reflecting weak asset utilization.

- Debt To Equity Score: 3, moderate, indicating average financial risk.

- Overall Score: 2, moderate overall financial standing.

PATH Rating

- Rating: B+, considered very favorable overall.

- Discounted Cash Flow Score: 3, moderate, suggesting average valuation.

- ROE Score: 4, favorable, showing efficient profit generation from equity.

- ROA Score: 4, favorable, demonstrating effective asset utilization.

- Debt To Equity Score: 4, favorable, reflecting stronger balance sheet.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Based on the provided data, PATH is better rated with a B+ rating and stronger scores in ROE, ROA, and debt-to-equity, while CRWD has a lower C rating and weaker profitability metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CrowdStrike Holdings and UiPath Inc.:

CrowdStrike Scores

- Altman Z-Score: 12.38, indicating a safe zone, very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

UiPath Scores

- Altman Z-Score: 5.27, also in the safe zone, low bankruptcy risk.

- Piotroski Score: 7, showing strong financial health.

Which company has the best scores?

Based on the provided scores, CrowdStrike has a higher Altman Z-Score, indicating stronger bankruptcy safety, while UiPath has a better Piotroski Score, reflecting stronger financial health. Each company leads in a different metric.

Grades Comparison

Here is a detailed comparison of recent grades assigned to CrowdStrike Holdings, Inc. and UiPath Inc.:

CrowdStrike Holdings, Inc. Grades

The following table summarizes the latest grades from verified grading companies for CrowdStrike Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

The overall trend for CrowdStrike shows a predominance of buy and overweight ratings with a few stable equal weight and sector weight grades, reflecting generally positive analyst sentiment.

UiPath Inc. Grades

The following table summarizes the latest grades from verified grading companies for UiPath Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-10 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-09 |

| DA Davidson | Maintain | Neutral | 2025-12-05 |

| Canaccord Genuity | Maintain | Buy | 2025-12-04 |

| Mizuho | Maintain | Neutral | 2025-12-04 |

| RBC Capital | Maintain | Sector Perform | 2025-12-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-04 |

| Evercore ISI Group | Maintain | In Line | 2025-12-04 |

Grades for UiPath are mostly hold, equal weight, or sector perform with one buy rating, indicating a more cautious analyst outlook.

Which company has the best grades?

CrowdStrike Holdings, Inc. has received stronger and more frequent buy and overweight grades compared to UiPath Inc., whose ratings mostly reflect hold or sector perform. This difference could imply higher analyst confidence in CrowdStrike’s growth prospects and may affect investor sentiment accordingly.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for CrowdStrike Holdings, Inc. (CRWD) and UiPath Inc. (PATH) based on the most recent financial and operational data.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | UiPath Inc. (PATH) |

|---|---|---|

| Diversification | Primarily subscription-based with growing professional services; moderate product range | Balanced revenue from licenses, subscriptions, and professional services; more diversified segments |

| Profitability | Negative net margin (-0.49%) and ROE (-0.59%), slight ROIC growth but still unfavorable | Larger negative net margin (-5.15%) and ROE (-3.99%), declining ROIC, profitability challenges persist |

| Innovation | Strong innovation evident in growing ROIC trend (+114%), industry-leading cybersecurity solutions | Innovation reflected in growing ROIC (+65%), advanced automation and AI capabilities but slower growth |

| Global presence | Extensive global footprint with significant revenue increase in subscription services (3.76B USD in 2025) | Global reach with solid license and subscription revenues (about 1.39B USD combined in 2025) |

| Market Share | Strong market position in cybersecurity with high subscription growth | Growing market share in automation software, but competitive pressures remain high |

Key takeaway: Both companies are currently shedding value but show promising ROIC growth trends, indicating improving profitability. CrowdStrike demonstrates stronger subscription revenue growth and innovation, while UiPath benefits from diversified revenue streams but faces more significant profitability challenges. Investors should weigh growth potential against ongoing value destruction risks carefully.

Risk Analysis

Below is a comparative table summarizing key risks for CrowdStrike Holdings, Inc. (CRWD) and UiPath Inc. (PATH) based on the latest 2025 data:

| Metric | CrowdStrike Holdings, Inc. (CRWD) | UiPath Inc. (PATH) |

|---|---|---|

| Market Risk | Moderate (Beta 1.03; tech sector volatility) | Moderate (Beta 1.08; RPA market fluctuations) |

| Debt level | Low (Debt-to-Equity 0.24; Debt-to-Assets 9.07%) | Very Low (Debt-to-Equity 0.04; Debt-to-Assets 2.72%) |

| Regulatory Risk | Moderate (Cybersecurity regulations evolving) | Moderate (Compliance in automation and AI) |

| Operational Risk | Moderate (Complex cloud platform; rapid innovation) | Moderate (Integration challenges; scaling issues) |

| Environmental Risk | Low (Software industry; minimal direct impact) | Low (Software industry; minimal direct impact) |

| Geopolitical Risk | Moderate (Global customer base; US tech tensions) | Moderate (US, Romania, Japan presence; geopolitical exposure) |

Synthesis: Both companies face moderate market and regulatory risks typical of fast-evolving tech sectors. CrowdStrike’s operational complexity and UiPath’s scaling challenges are key operational risks. Debt levels are conservative, reducing financial risk. Geopolitical exposure is notable given their international footprints, especially amid rising global tech tensions. Caution advised due to their negative net margins and mixed profitability metrics.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) shows strong income growth with a 29.39% revenue increase in 2025 and a favorable long-term net income growth of 79.2%. The company has mixed financial ratios, with 42.86% favorable and 42.86% unfavorable metrics, including a solid current ratio of 1.67 and low debt levels. Profitability remains weak with negative net margin (-0.49%) and ROE (-0.59%). Its rating is very favorable overall despite some unfavorable valuation ratios.

UiPath Inc. (PATH) reports moderate revenue growth of 9.3% in 2025 and favorable long-term income improvements, with 78.57% favorable income statement measures. Its financial ratios appear slightly unfavorable, with 42.86% favorable but 50% unfavorable ratios, though liquidity and debt metrics are strong. Profitability is challenged, showing a negative net margin (-5.15%) and ROE (-3.99%). PATH’s rating is very favorable with solid returns on equity and assets.

Considering ratings and overall financial profiles, CRWD might appeal to investors seeking growth potential supported by strong revenue and income expansion, despite profitability challenges. Conversely, PATH could be more aligned with investors prioritizing improving income quality and strong liquidity in a company with a slightly unfavorable ratio profile. Both companies are shedding value but show improving profitability trends, suggesting different risk tolerances could influence preference.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and UiPath Inc. to enhance your investment decisions: