CrowdStrike Holdings, Inc. and Synopsys, Inc. are two prominent players in the software infrastructure sector, each driving innovation in cybersecurity and electronic design automation respectively. While CrowdStrike focuses on cloud-delivered endpoint protection, Synopsys excels in integrated circuit design tools and IP solutions. Their market overlap in technology innovation makes them compelling candidates for comparison. In this article, I will help you determine which company presents the most appealing investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike and Synopsys by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. specializes in cloud-delivered protection for endpoints, cloud workloads, identity, and data. The company offers a range of cybersecurity services including threat intelligence, managed security, IT operations management, and Zero Trust identity protection. Founded in 2011 and based in Austin, Texas, CrowdStrike primarily sells subscriptions to its Falcon platform globally through a direct sales team and channel partners.

Synopsys Overview

Synopsys, Inc. develops electronic design automation software products for designing and testing integrated circuits. Its offerings include digital design solutions, verification platforms, FPGA design products, and intellectual property for various applications. Headquartered in Mountain View, California, Synopsys serves industries such as electronics, financial services, automotive, and medicine, employing 20,000 people since its founding in 1986.

Key similarities and differences

Both companies operate in the software infrastructure industry and focus on serving enterprise clients with specialized technology solutions. CrowdStrike concentrates on cybersecurity through cloud-based services, while Synopsys provides design automation and IP products for semiconductor and electronic systems. Their business models vary, with CrowdStrike relying on subscription sales for cybersecurity, whereas Synopsys offers a broader portfolio of software tools and IP products for chip design and verification.

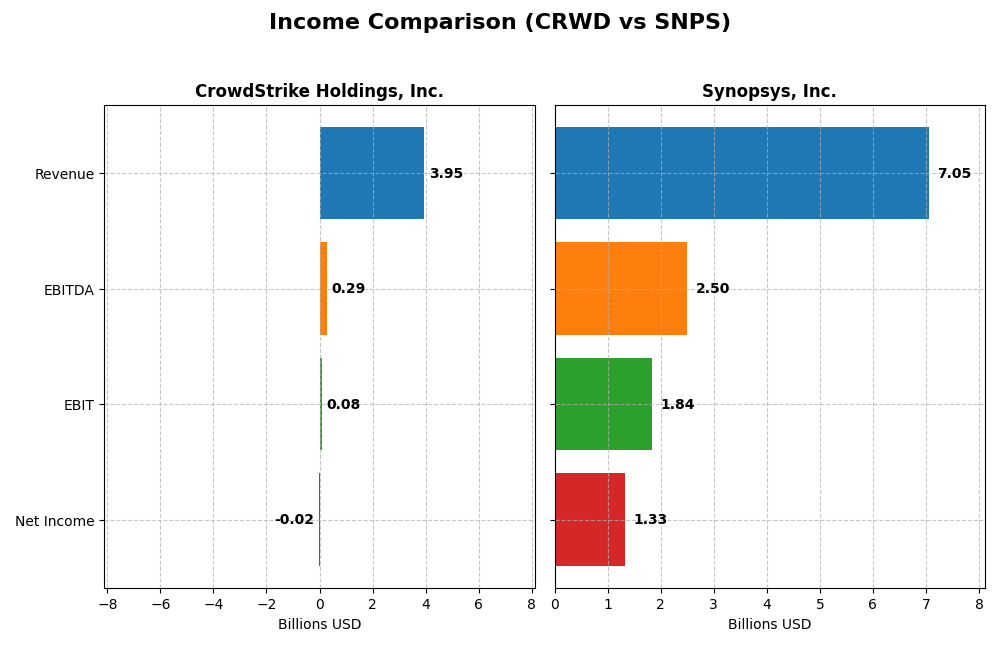

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for CrowdStrike Holdings, Inc. and Synopsys, Inc. for their most recent fiscal year.

| Metric | CrowdStrike Holdings, Inc. | Synopsys, Inc. |

|---|---|---|

| Market Cap | 114.4B | 98.8B |

| Revenue | 3.95B | 7.05B |

| EBITDA | 295M | 2.50B |

| EBIT | 81M | 1.84B |

| Net Income | -19.3M | 1.33B |

| EPS | -0.08 | 8.13 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

CrowdStrike’s revenue soared from 874M in 2021 to 3.95B in 2025, reflecting a robust 352% growth over five years. Net income fluctuated, with losses in most years but a positive 89M in 2024 before declining again to -19M in 2025. Gross margins remained strong near 75%, while net margins turned negative in 2025. The latest year saw strong revenue growth (29%) but a sharp decline in EBIT and net income margins.

Synopsys, Inc.

Synopsys steadily increased revenue from 4.2B in 2021 to 7.05B in 2025, a 68% rise over five years. Net income also expanded significantly, reaching 1.33B in 2025 despite some volatility. Gross margins improved to nearly 77%, with EBIT and net margins at 26% and 19% respectively in 2025, showing solid profitability. The most recent year featured healthy revenue and EBIT growth but a notable drop in net margin and EPS growth.

Which one has the stronger fundamentals?

Both companies exhibit favorable revenue growth and strong gross margins, but Synopsys shows superior profitability with higher EBIT and net margins, albeit with some recent margin pressure. CrowdStrike demonstrates rapid revenue expansion but struggles with consistent profitability and net margin stability. Overall, Synopsys presents stronger earnings fundamentals, while CrowdStrike’s growth is offset by recent earnings volatility.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CrowdStrike Holdings, Inc. and Synopsys, Inc. based on their most recent fiscal year data.

| Ratios | CrowdStrike Holdings, Inc. (2025) | Synopsys, Inc. (2025) |

|---|---|---|

| ROE | -0.59% | 4.72% |

| ROIC | 0.70% | 1.97% |

| P/E | -5055.7 | 54.36 |

| P/B | 29.71 | 2.57 |

| Current Ratio | 1.67 | 1.62 |

| Quick Ratio | 1.67 | 1.52 |

| D/E (Debt-to-Equity) | 0.24 | 0.50 |

| Debt-to-Assets | 9.07% | 29.64% |

| Interest Coverage | -4.58 | 2.05 |

| Asset Turnover | 0.45 | 0.15 |

| Fixed Asset Turnover | 4.76 | 5.04 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike shows a mixed ratio profile with strong liquidity (current and quick ratios at 1.67) and low debt levels (debt to equity 0.24), but weak profitability indicators including negative net margin (-0.49%) and return on equity (-0.59%). The high price-to-book ratio (29.71) highlights market valuation concerns. CrowdStrike does not pay dividends, likely due to ongoing reinvestment and growth strategies.

Synopsys, Inc.

Synopsys presents a balanced ratio set with a favorable net margin of 18.96% and solid liquidity ratios, though return on equity (4.72%) and return on invested capital (1.97%) remain moderate. Its price-to-earnings ratio at 54.36 is high, reflecting valuation risks. Synopsys also does not pay dividends, potentially prioritizing R&D and acquisitions to sustain growth.

Which one has the best ratios?

Both companies display a neutral global ratio opinion with a similar balance of favorable and unfavorable metrics. CrowdStrike excels in liquidity and low leverage but struggles with profitability, while Synopsys achieves better margins and asset turnover but has higher valuation multiples and moderate returns. Neither company currently distributes dividends, reflecting growth or reinvestment priorities.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and Synopsys, focusing on market position, key segments, and exposure to technological disruption:

CrowdStrike Holdings, Inc.

- Leading cloud-delivered cybersecurity provider facing strong competition in software infrastructure sector.

- Key segments: subscription-based Falcon platform and professional services driving revenue growth.

- Positioned in cybersecurity with cloud-native solutions, moderately exposed to rapid tech changes in security.

Synopsys, Inc.

- Established electronic design automation software vendor with significant market presence and competition.

- Diverse segments: license and maintenance, technology services, and IP solutions across multiple industries.

- Focused on semiconductor design automation, exposed to innovation cycles in chip design technologies.

CrowdStrike vs Synopsys Positioning

CrowdStrike focuses on a concentrated cybersecurity subscription model leveraging cloud platforms, while Synopsys pursues a diversified product portfolio across electronic design automation and IP licensing. CrowdStrike benefits from recurring revenues, Synopsys from broad industry applications, each facing distinct competitive pressures.

Which has the best competitive advantage?

Both companies are currently shedding value as ROIC is below WACC; however, CrowdStrike shows a growing ROIC trend indicating improving profitability, whereas Synopsys faces declining profitability, reflecting a weaker competitive moat.

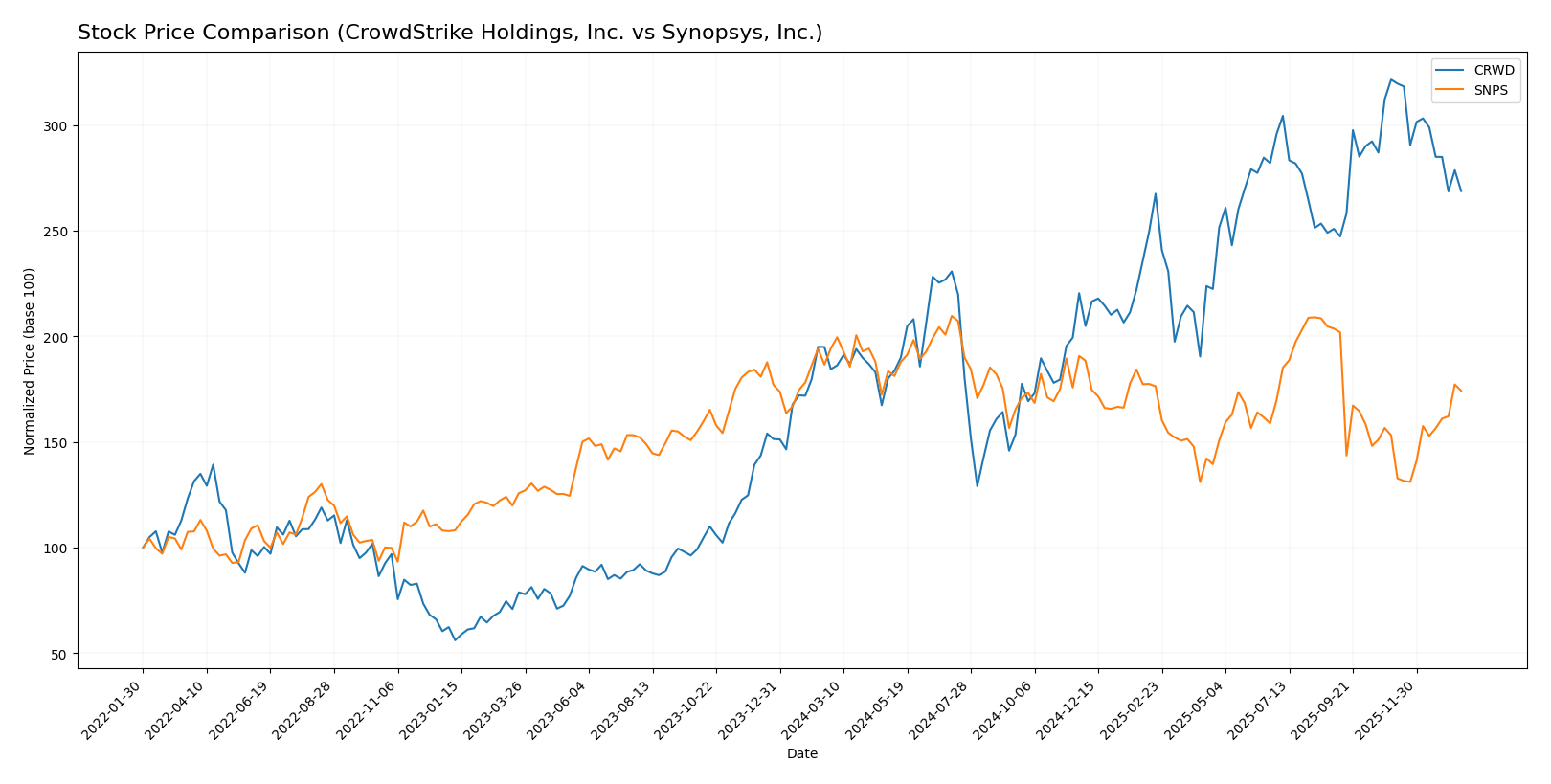

Stock Comparison

The past year witnessed significant price movements for CrowdStrike Holdings, Inc. (CRWD) and Synopsys, Inc. (SNPS), with CRWD showing a strong overall gain despite recent declines, while SNPS faced an overall downturn but showed signs of recovery late in the period.

Trend Analysis

CrowdStrike’s stock demonstrated a bullish trend over the past 12 months, rising 45.71%, though the upward momentum decelerated. The stock fluctuated between a low of 217.89 and a high of 543.01, with high volatility (std deviation 80.53). Recent months showed a 16.41% price decline, indicating a short-term bearish correction.

Synopsys experienced a bearish trend over the same period, falling 10.31%, despite accelerating downward pressure. Its price ranged from 388.13 to 621.3, with moderate volatility (std deviation 58.85). Recently, the stock rebounded 13.77%, suggesting a short-term recovery phase.

Comparing both, CrowdStrike outperformed Synopsys over the full year with a substantial positive return, while Synopsys lagged with an overall loss despite recent gains.

Target Prices

Analysts show a positive outlook with solid target price consensus for both CrowdStrike Holdings, Inc. and Synopsys, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| Synopsys, Inc. | 600 | 425 | 530 |

The target consensus for CrowdStrike at 553.47 USD exceeds its current price of 453.88 USD, suggesting upside potential. Synopsys also shows bullish expectations with a consensus target of 530 USD, above its current 516.31 USD price. Both stocks indicate possible appreciation according to analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. and Synopsys, Inc.:

Rating Comparison

CRWD Rating

- Rating: C, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation outlook.

- ROE Score: 1, assessed as Very Unfavorable, reflecting low profitability from equity.

- ROA Score: 1, Very Unfavorable, showing poor asset utilization.

- Debt To Equity Score: 3, Moderate financial risk due to debt levels.

- Overall Score: 2, Moderate overall financial standing.

SNPS Rating

- Rating: B-, also considered Very Favorable by analysts.

- Discounted Cash Flow Score: 3, showing a Moderate valuation outlook.

- ROE Score: 3, Moderate, indicating more efficient profit generation.

- ROA Score: 3, Moderate, suggesting better asset efficiency.

- Debt To Equity Score: 2, Moderate but slightly better financial stability.

- Overall Score: 3, Moderate but higher overall financial score.

Which one is the best rated?

Based strictly on the provided data, Synopsys (SNPS) has a higher overall score (3 vs. 2) and better profitability and asset utilization scores (ROE and ROA at 3 vs. 1 for CrowdStrike). Despite both being rated Very Favorable, SNPS shows a stronger financial profile.

Scores Comparison

The scores comparison between CrowdStrike Holdings, Inc. and Synopsys, Inc. is as follows:

CRWD Scores

- Altman Z-Score: 12.38, indicating a safe financial zone with very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength and value potential.

SNPS Scores

- Altman Z-Score: 3.54, also in the safe zone but much closer to the grey zone threshold.

- Piotroski Score: 4, similarly indicating average financial health and investment appeal.

Which company has the best scores?

Based strictly on the data, CRWD has a significantly higher Altman Z-Score than SNPS, placing it deeper into the safe zone. Both companies share the same Piotroski Score, reflecting similar average financial strength.

Grades Comparison

The following tables summarize the recent grades assigned to CrowdStrike Holdings, Inc. and Synopsys, Inc. by reputable grading companies:

CrowdStrike Holdings, Inc. Grades

This table presents recent analyst grades and rating changes for CrowdStrike Holdings, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

Overall, CrowdStrike’s grades predominantly reflect buy and overweight ratings, with a few holds and sector weight adjustments, indicating generally positive analyst sentiment.

Synopsys, Inc. Grades

This table presents recent analyst grades and rating changes for Synopsys, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Piper Sandler | Maintain | Overweight | 2025-12-11 |

| Needham | Maintain | Buy | 2025-12-11 |

| B of A Securities | Upgrade | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-11 |

| Rosenblatt | Upgrade | Buy | 2025-12-09 |

Synopsys shows mostly buy and overweight ratings with a recent downgrade to neutral by Piper Sandler, suggesting a broadly positive but slightly cautious outlook.

Which company has the best grades?

Both CrowdStrike and Synopsys hold predominantly buy and overweight ratings, but CrowdStrike has a slightly higher number of buy ratings and fewer recent downgrades. This difference may indicate stronger analyst conviction in CrowdStrike’s near-term prospects, potentially affecting investor confidence and portfolio positioning.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for CrowdStrike Holdings, Inc. and Synopsys, Inc. based on the latest available data.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | Synopsys, Inc. (SNPS) |

|---|---|---|

| Diversification | Focused primarily on cybersecurity subscriptions and professional services; moderate diversification within security services. | Diverse revenue streams including licenses, maintenance, technology services, and products; broader product segmentation. |

| Profitability | Negative net margin (-0.49%) and ROE (-0.59%) indicate current profitability challenges despite growing ROIC trend. | Positive net margin (18.96%) but low ROE (4.72%) and declining ROIC reflect mixed profitability performance. |

| Innovation | Strong growth in ROIC (+114%) signals improving operational efficiency and innovation potential despite current value destruction. | Declining ROIC (-82%) suggests challenges in sustaining innovation and operational returns. |

| Global presence | Growing revenue with strong subscription growth ($3.76B in 2025) indicates expanding global reach in cybersecurity. | Large and stable revenue base ($3.49B in license and maintenance in 2025) supports widespread global footprint. |

| Market Share | Increasing subscription base signals expanding market share in cybersecurity niche. | Established market position in electronic design automation with diverse offerings maintains competitive market share. |

In summary, CrowdStrike shows promising growth and innovation potential but faces profitability and value creation challenges. Synopsys maintains solid revenue and profitability but struggles with declining returns on invested capital, signaling caution for future growth expectations. Both companies exhibit strengths that investors should weigh carefully against their weaknesses.

Risk Analysis

Below is a comparative table highlighting key risks for CrowdStrike Holdings, Inc. (CRWD) and Synopsys, Inc. (SNPS) based on recent 2025 data:

| Metric | CrowdStrike Holdings, Inc. (CRWD) | Synopsys, Inc. (SNPS) |

|---|---|---|

| Market Risk | Beta 1.03, moderate market sensitivity | Beta 1.12, slightly higher market volatility |

| Debt level | Low debt-to-equity 0.24, favorable | Moderate debt-to-equity 0.50, moderate risk |

| Regulatory Risk | Moderate, cybersecurity regulations evolving | Moderate, IP and tech compliance critical |

| Operational Risk | Risk from rapid tech changes, negative net margin (-0.49%) | Risk in complex software delivery, positive net margin (18.96%) |

| Environmental Risk | Low, typical for software sector | Low, typical for software sector |

| Geopolitical Risk | Moderate, global exposure to US tech policies | Moderate, global semiconductor supply chain exposure |

The most impactful risks for these companies are operational and market risks. CrowdStrike faces challenges with profitability and rapid innovation demands, while Synopsys must manage complex product cycles and competitive pressures. Both show moderate exposure to geopolitical and regulatory uncertainty.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) has shown strong income growth with a 29.39% one-year revenue increase and an overall 352.13% rise since 2021. Despite favorable gross margins and solid liquidity ratios, its profitability remains negative with a -0.49% net margin and an unfavorable ROE of -0.59%. The company carries low debt levels and holds a very favorable rating, although some financial ratios balance between favorable and unfavorable, resulting in a neutral global ratios opinion.

Synopsys, Inc. (SNPS) posts favorable income metrics with a 15.12% revenue growth over one year and a 67.79% increase overall since 2021. It delivers strong profitability, reflected in an 18.89% net margin and a moderate ROE of 4.72%. SNPS exhibits moderate debt and stable liquidity, with a very favorable rating as well. Its financial ratios are evenly split between favorable, unfavorable, and neutral, also yielding a neutral global ratios assessment.

For investors prioritizing growth potential, CRWD’s robust revenue expansion and improving profitability might appear attractive, despite current losses and mixed ratios. Conversely, SNPS’s stable profitability, moderate returns, and financial steadiness could be more appealing to those seeking quality and moderate risk. Ultimately, the choice could hinge on the investor’s risk tolerance and investment strategy, balancing growth ambitions against financial stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and Synopsys, Inc. to enhance your investment decisions: