In today’s rapidly evolving technology landscape, choosing the right company to invest in requires careful analysis of industry leaders. CrowdStrike Holdings, Inc. and StoneCo Ltd. both operate within the software infrastructure sector, yet they target distinct markets with innovative approaches—cybersecurity and fintech solutions, respectively. This comparison explores their unique strategies and market positions, helping you determine which presents the most compelling investment opportunity. Let’s dive into the details to guide your decision.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike Holdings, Inc. and StoneCo Ltd. by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. focuses on cloud-delivered protection for endpoints, cloud workloads, identity, and data. It offers threat intelligence, managed security services, IT operations management, and Zero Trust identity protection through its Falcon platform. Founded in 2011 and based in Austin, Texas, CrowdStrike serves a global customer base, primarily selling subscriptions via direct sales and channel partners. The company operates in the software infrastructure industry.

StoneCo Overview

StoneCo Ltd. provides financial technology solutions to merchants and partners for electronic commerce in Brazil. Its offerings include in-store, online, and mobile payment solutions distributed through Stone Hubs and a dedicated sales team. Founded in 2000 and headquartered in the Cayman Islands, StoneCo serves over 1.7M clients, mainly small and medium businesses. It operates as a subsidiary of HR Holdings, LLC, within the technology sector.

Key similarities and differences

Both CrowdStrike and StoneCo operate in the technology sector and focus on software infrastructure. CrowdStrike specializes in cybersecurity and cloud protection services globally, while StoneCo targets financial technology solutions primarily in Brazil. CrowdStrike’s business centers on subscription-based security platforms, whereas StoneCo emphasizes payment solutions and merchant services. Their geographic focus and core offerings differ significantly despite their shared industry classification.

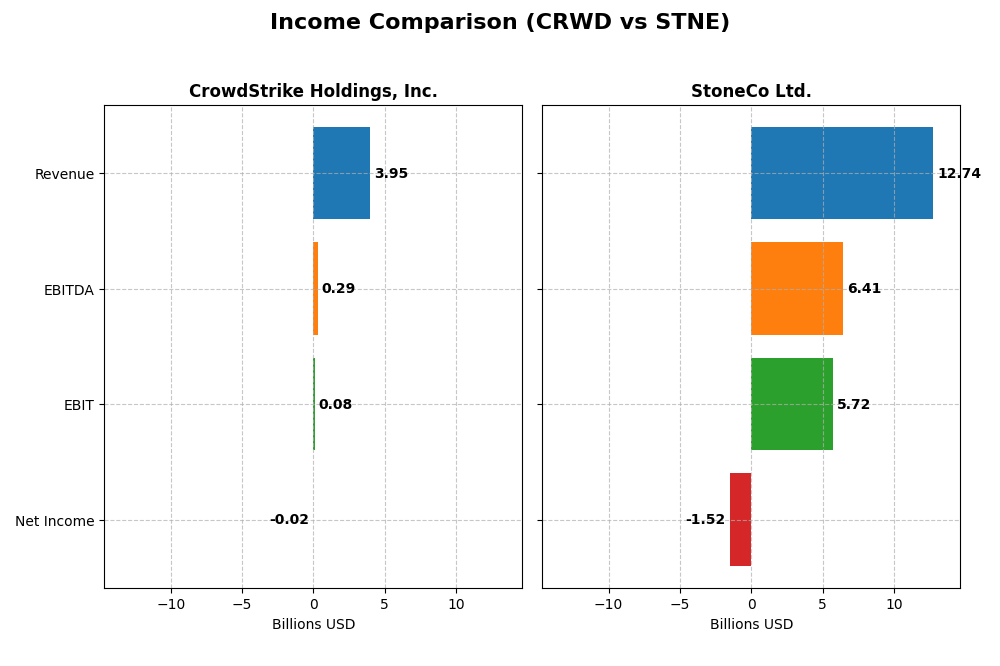

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for CrowdStrike Holdings, Inc. (CRWD) and StoneCo Ltd. (STNE) for their most recent fiscal years.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Cap | 114.4B USD | 3.9B USD |

| Revenue | 3.95B USD | 12.7B BRL |

| EBITDA | 295M USD | 6.41B BRL |

| EBIT | 81M USD | 5.72B BRL |

| Net Income | -19.3M USD | -1.52B BRL |

| EPS | -0.08 USD | -5.02 BRL |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

From 2021 to 2025, CrowdStrike’s revenue grew significantly, reaching $3.95B in 2025, reflecting a 352% increase over the period. Despite solid gross margins near 75%, net income remained negative in 2025 at -$19M, driven by increasing operating expenses. The latest year saw revenue growth slow but margins remained stable, with EBIT margin barely above 2%.

StoneCo Ltd.

StoneCo experienced steady revenue growth, hitting BRL 12.74B in 2024, a 302% rise since 2020. Gross and EBIT margins were strong, with EBIT margin at 44.9% in 2024. However, net income turned negative at -BRL 1.52B due to heavy other expenses impacting net margin, which was -11.9%. Recent growth in revenue and EBIT was favorable, but net margin deteriorated sharply.

Which one has the stronger fundamentals?

Both companies show favorable revenue growth and gross margins, yet CrowdStrike’s margins are slim with recent net losses, while StoneCo posts robust EBIT margins but substantial net losses from other expenses. CrowdStrike’s net income growth is positive over the long term, contrasting with StoneCo’s declining net income. Overall, CrowdStrike demonstrates more balanced fundamentals despite challenges.

Financial Ratios Comparison

This table presents key financial ratios for CrowdStrike Holdings, Inc. and StoneCo Ltd., reflecting their latest fiscal year performances for comparison.

| Ratios | CrowdStrike Holdings, Inc. (2025) | StoneCo Ltd. (2024) |

|---|---|---|

| ROE | -0.59% | -12.87% |

| ROIC | 0.70% | 22.41% |

| P/E | -5056 | -9.84 |

| P/B | 29.71 | 1.27 |

| Current Ratio | 1.67 | 1.37 |

| Quick Ratio | 1.67 | 1.37 |

| D/E (Debt-to-Equity) | 0.24 | 1.10 |

| Debt-to-Assets | 9.07% | 23.53% |

| Interest Coverage | -4.58 | 5.57 |

| Asset Turnover | 0.45 | 0.23 |

| Fixed Asset Turnover | 4.76 | 6.95 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike displays a mixed financial profile with 43% favorable and 43% unfavorable ratios, leading to a neutral overall rating. Key concerns include negative net margin (-0.49%) and return on equity (-0.59%), alongside a very high price-to-book ratio (29.71). Liquidity measures such as current and quick ratios stand strong at 1.67. The company does not pay dividends, consistent with its high valuation and possible reinvestment focus.

StoneCo Ltd.

StoneCo shows a slightly favorable ratio profile with 50% favorable indicators, despite negative net margin (-11.89%) and return on equity (-12.87%). The firm benefits from strong return on invested capital (22.41%) and a low price-to-book ratio (1.27). Liquidity ratios are decent but more moderate. Like CrowdStrike, StoneCo does not pay dividends, likely due to its current loss-making status and prioritization of growth or investments.

Which one has the best ratios?

StoneCo’s ratios lean slightly more favorable, supported by solid returns on invested capital and manageable valuation multiples. CrowdStrike presents more balance between strengths and weaknesses but suffers from weak profitability metrics and stretched valuation. Both companies have zero dividend yield, reflecting reinvestment or growth strategies rather than shareholder payouts.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and StoneCo including market position, key segments, and exposure to technological disruption:

CrowdStrike Holdings, Inc.

- Leading cloud-delivered cybersecurity provider facing moderate competitive pressure in infrastructure software.

- Key business drivers are subscription sales of Falcon platform and professional services in cybersecurity.

- Positioned in a fast-evolving cybersecurity sector with continuous innovation mitigating disruption risks.

StoneCo Ltd.

- Financial technology provider focused on Brazil’s SMBs with higher competitive pressure and regional focus.

- Core segments include electronic commerce solutions for merchants via Stone Hubs and technology partnerships.

- Operates in fintech with digital payment innovation but exposed to evolving e-commerce and payment technologies.

CrowdStrike vs StoneCo Positioning

CrowdStrike’s strategy is concentrated on cloud security subscriptions and professional services globally, while StoneCo adopts a more diversified fintech approach focused on Brazil’s SMBs and integrated partners, each with distinct market and innovation challenges.

Which has the best competitive advantage?

StoneCo shows a very favorable moat with ROIC well above WACC and strong growth, indicating a durable competitive advantage. CrowdStrike’s moat is slightly unfavorable, shedding value despite growing profitability.

Stock Comparison

The stock price movements of CrowdStrike Holdings, Inc. (CRWD) and StoneCo Ltd. (STNE) over the past 12 months reveal contrasting trends, with CRWD showing a strong overall gain despite recent weakness, while STNE has experienced a notable decline amid increasing trading volume.

Trend Analysis

CrowdStrike Holdings, Inc. exhibited a bullish trend over the past year with a 45.71% price increase, though the upward momentum has decelerated. The stock reached a high of 543.01 and a low of 217.89, with overall volatility at a standard deviation of 80.53.

StoneCo Ltd. showed a bearish trend with a 13.9% price decrease over the same period and decelerating downward momentum. The stock’s price ranged from 7.85 to 19.4, with relatively low volatility measured at a 2.92 standard deviation.

Comparing the two, CrowdStrike outperformed StoneCo significantly in market performance during the past year, delivering a strong positive return while StoneCo’s stock declined.

Target Prices

The current target price consensus for CrowdStrike Holdings, Inc. and StoneCo Ltd. shows a mixed outlook.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| StoneCo Ltd. | 20 | 20 | 20 |

Analysts expect CrowdStrike’s stock price to rise significantly from its current 453.88 USD, reflecting strong growth potential. StoneCo’s target consensus is steady at 20 USD, indicating limited upside compared to its current 14.49 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. and StoneCo Ltd.:

Rating Comparison

CRWD Rating

- Rating: C, assessed as Very Favorable overall rating.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation on future cash flows.

- ROE Score: 1, considered Very Unfavorable, showing weak profit generation from equity.

- ROA Score: 1, considered Very Unfavorable, indicating poor asset utilization.

- Debt To Equity Score: 3, Moderate financial risk with a balanced debt profile.

- Overall Score: 2, Moderate overall financial standing.

STNE Rating

- Rating: C, assessed as Very Favorable overall rating.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation on future cash flows.

- ROE Score: 1, considered Very Unfavorable, showing weak profit generation from equity.

- ROA Score: 1, considered Very Unfavorable, indicating poor asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, suggesting high financial risk.

- Overall Score: 2, Moderate overall financial standing.

Which one is the best rated?

Both companies share the same overall rating (C) and moderate overall score (2). CRWD shows a more favorable discounted cash flow and debt-to-equity profile, whereas STNE has a weaker debt-to-equity score but a moderate price-to-book score not reflected here. Based strictly on provided data, CRWD is slightly better rated in valuation and financial risk metrics.

Scores Comparison

Here is a comparison of the financial scores for CrowdStrike and StoneCo:

CRWD Scores

- Altman Z-Score: 12.38 indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

STNE Scores

- Altman Z-Score: 1.02 indicating distress zone, high bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

Which company has the best scores?

Based on the provided scores, CrowdStrike has a significantly higher Altman Z-Score, placing it in the safe zone, while StoneCo falls in the distress zone. Both companies have average Piotroski Scores, with StoneCo slightly higher.

Grades Comparison

Here is the recent grading overview from reputable financial institutions for both companies:

CrowdStrike Holdings, Inc. Grades

The following table summarizes recent grades assigned to CrowdStrike by established grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

Overall, CrowdStrike’s grades show a strong buy consensus with minor downgrades and several upgrades, indicating a generally positive analyst outlook.

StoneCo Ltd. Grades

This table presents recent grades for StoneCo from recognized grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Buy | 2025-10-14 |

| B of A Securities | Maintain | Buy | 2025-09-09 |

| UBS | Maintain | Buy | 2025-08-29 |

| JP Morgan | Maintain | Overweight | 2025-07-16 |

| Barclays | Maintain | Equal Weight | 2025-05-12 |

| Barclays | Maintain | Equal Weight | 2025-04-23 |

| Citigroup | Upgrade | Buy | 2025-04-22 |

| Barclays | Maintain | Equal Weight | 2025-03-21 |

| Morgan Stanley | Maintain | Underweight | 2025-03-21 |

| Goldman Sachs | Maintain | Buy | 2025-02-06 |

StoneCo’s grades reflect a solid buy consensus with some mixed opinions, including equal weight and underweight ratings, suggesting cautious optimism among analysts.

Which company has the best grades?

CrowdStrike has received a higher number of consistent buy and outperform grades compared to StoneCo, which shows more mixed ratings including equal and underweight. This could imply stronger analyst confidence in CrowdStrike’s performance potential, affecting investor perceptions of relative risk and growth prospects.

Strengths and Weaknesses

The table below summarizes key strengths and weaknesses of CrowdStrike Holdings, Inc. (CRWD) and StoneCo Ltd. (STNE) based on their diversification, profitability, innovation, global presence, and market share, using the most recent data available as of 2026.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | StoneCo Ltd. (STNE) |

|---|---|---|

| Diversification | Primarily focused on cybersecurity subscriptions with growing professional services; limited product diversification | Focused on digital payments in Brazil; less diversified product portfolio |

| Profitability | Negative net margin (-0.49%) and ROE (-0.59%), slight value destruction but improving ROIC trend | Negative net margin (-11.89%) and ROE (-12.87%), strong ROIC (22.41%) indicates value creation |

| Innovation | Strong innovation in cybersecurity technology, supported by high fixed asset turnover | Innovative in fintech and payment solutions, with robust fixed asset turnover |

| Global presence | Strong global footprint in cybersecurity markets | Primarily operating in Brazil, limited global reach |

| Market Share | Leading player in cybersecurity subscriptions with rapid revenue growth | Significant market share in Brazilian payment processing, expanding presence |

Key takeaways: CrowdStrike shows strong innovation and global reach but struggles with profitability and diversification. StoneCo displays a durable competitive advantage with growing profitability despite narrow geographic focus and current margin pressures. Investors should weigh growth potential against current profitability challenges.

Risk Analysis

The following table summarizes key risks for CrowdStrike Holdings, Inc. (CRWD) and StoneCo Ltd. (STNE) based on the most recent available data.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Risk | Moderate (Beta 1.03) | High (Beta 1.84) |

| Debt level | Low (Debt/Equity 0.24) | High (Debt/Equity 1.10) |

| Regulatory Risk | Moderate (US tech regulations) | High (Brazilian fintech laws) |

| Operational Risk | Moderate (cloud security sector) | Moderate (payments platform) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Low (US-based) | High (operates in Brazil, Cayman Islands) |

The most likely and impactful risks are StoneCo’s high market volatility and elevated debt level, coupled with its exposure to complex regulatory and geopolitical environments in Brazil. CrowdStrike shows more stability but faces profitability challenges and moderate market risk given its tech industry position. Both companies require cautious risk monitoring.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) shows a favorable income statement with a 29.4% revenue growth in 2025 and a global income statement opinion marked as favorable. However, its profitability ratios such as net margin and ROE are unfavorable, despite a solid current ratio and low debt levels. The company’s ROIC is below WACC, indicating value destruction, though it exhibits a growing ROIC trend, resulting in a slightly unfavorable moat rating. Its overall rating is very favorable, supported by a safe Altman Z-score, but some profitability and valuation metrics remain weak.

StoneCo Ltd. (STNE) displays a mixed financial profile with favorable gross and EBIT margins, yet a negative net margin and ROE, leading to some unfavorable profitability ratios. It maintains moderate liquidity and a higher debt ratio compared to CRWD. StoneCo’s ROIC exceeds its WACC by a significant margin, signaling value creation and a very favorable moat rating. Despite this, it suffers from a distress zone Altman Z-score, reflecting financial risk. Its overall rating is also very favorable, with a slightly favorable global ratio opinion.

For investors, the choice might depend on risk tolerance and investment strategy. Those focused on durable competitive advantages and value creation might find StoneCo’s strong ROIC and moat appealing, despite financial risks. Conversely, investors prioritizing revenue growth and liquidity could see CrowdStrike’s expanding income and stable balance sheet as favorable, even with its current profitability challenges. Each profile could interpret these factors differently based on their investment objectives.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and StoneCo Ltd. to enhance your investment decisions: