Oracle Corporation and CrowdStrike Holdings, Inc. are two prominent players in the software infrastructure sector, both headquartered in Austin, Texas. Oracle, a long-established giant, offers a diverse portfolio spanning cloud applications and enterprise databases. In contrast, CrowdStrike is a newer innovator specializing in cloud-delivered cybersecurity solutions. This comparison explores their market positions and innovation strategies to help you decide which company holds greater investment potential today.

Table of contents

Companies Overview

I will begin the comparison between Oracle and CrowdStrike by providing an overview of these two companies and their main differences.

Oracle Overview

Oracle Corporation is a leader in enterprise information technology, offering a broad range of cloud software applications, infrastructure technologies, and hardware products. Its portfolio includes Oracle Fusion cloud ERP, performance management, and industry-specific solutions, along with database and middleware technologies. Founded in 1977 and headquartered in Austin, Texas, Oracle serves diverse industries and government agencies globally.

CrowdStrike Overview

CrowdStrike Holdings, Inc. specializes in cloud-delivered cybersecurity protection across endpoints, cloud workloads, and identity. Its Falcon platform provides threat intelligence, managed security, Zero Trust identity protection, and log management through subscription sales. Incorporated in 2011 and based in Austin, Texas, CrowdStrike primarily reaches customers via direct sales and channel partners worldwide.

Key similarities and differences

Both Oracle and CrowdStrike operate in the software infrastructure industry with headquarters in Austin, Texas, and rely heavily on cloud technologies. Oracle has a significantly larger market cap and employee base, reflecting its extensive product range, including hardware, while CrowdStrike focuses exclusively on cybersecurity services delivered primarily through subscriptions. Their business models differ in scale and specialization within the technology sector.

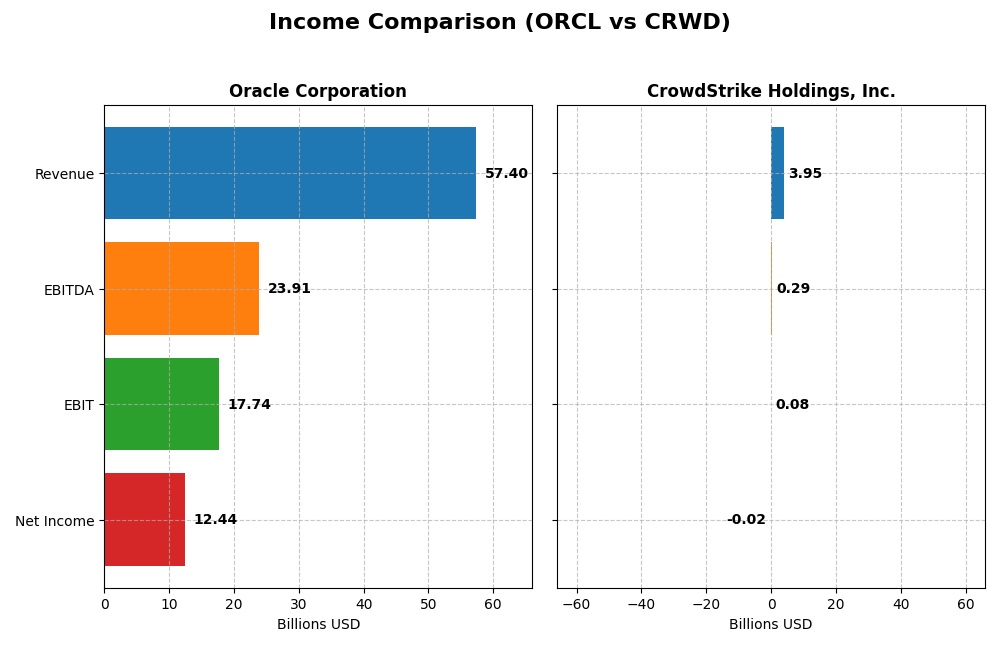

Income Statement Comparison

This table presents the key income statement metrics for Oracle Corporation and CrowdStrike Holdings, Inc. for the most recent fiscal year available.

| Metric | Oracle Corporation | CrowdStrike Holdings, Inc. |

|---|---|---|

| Market Cap | 549B | 114B |

| Revenue | 57.4B | 3.95B |

| EBITDA | 23.9B | 295M |

| EBIT | 17.7B | 81M |

| Net Income | 12.4B | -19.3M |

| EPS | 4.46 | -0.079 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Oracle Corporation

Oracle’s revenue steadily increased from $40.5B in 2021 to $57.4B in 2025, showing a strong growth trend. Net income peaked in 2021 at $13.7B but declined to $12.4B in 2025, indicating some pressure on profitability. Margins remained robust, with a gross margin of 70.5% and a net margin of 21.7% in 2025, reflecting efficient cost control and solid operating leverage.

CrowdStrike Holdings, Inc.

CrowdStrike’s revenue showed rapid growth from $874M in 2021 to $3.95B in 2025, a more than fourfold increase. However, net income has been volatile, with a net loss in 2025 of $19M despite prior profitability in 2024. The gross margin remained high at 74.9%, but the net margin was negative at -0.5%, highlighting high operating expenses and margin pressure in the latest year.

Which one has the stronger fundamentals?

Oracle demonstrates stronger fundamentals with stable, favorable margins and consistent revenue growth, though its net income has slightly declined. CrowdStrike shows impressive revenue and net income growth overall but faces recent challenges with losses and margin compression. Oracle’s profitability and margin stability present a more balanced financial profile compared to CrowdStrike’s high-growth but less consistent earnings.

Financial Ratios Comparison

The table below presents a selection of key financial ratios for Oracle Corporation and CrowdStrike Holdings, Inc., reflecting their latest fiscal year data for a direct comparison.

| Ratios | Oracle Corporation (ORCL) | CrowdStrike Holdings, Inc. (CRWD) |

|---|---|---|

| ROE | 60.8% | -0.59% |

| ROIC | 10.9% | 0.70% |

| P/E | 37.1 | -5056 |

| P/B | 22.6 | 29.7 |

| Current Ratio | 0.75 | 1.67 |

| Quick Ratio | 0.75 | 1.67 |

| D/E (Debt-to-Equity) | 5.09 | 0.24 |

| Debt-to-Assets | 61.8% | 9.1% |

| Interest Coverage | 4.94 | -4.58 |

| Asset Turnover | 0.34 | 0.45 |

| Fixed Asset Turnover | 1.32 | 4.76 |

| Payout Ratio | 38.1% | 0% |

| Dividend Yield | 1.03% | 0% |

Interpretation of the Ratios

Oracle Corporation

Oracle displays strong profitability ratios with a net margin of 21.68% and an impressive return on equity at 60.84%, signaling efficient capital use. However, liquidity ratios are weak, with a current ratio of 0.75, and leverage is high, indicated by a debt-to-equity ratio over 5. Oracle pays dividends with a 1.03% yield, reflecting moderate shareholder returns.

CrowdStrike Holdings, Inc.

CrowdStrike shows several weak profitability measures, including a negative net margin and return on equity, reflecting ongoing losses. Its liquidity and leverage ratios are healthy, with a current ratio of 1.67 and low debt-to-equity at 0.24. The company does not pay dividends, likely due to reinvestment in growth and R&D priorities, consistent with its high expense ratios.

Which one has the best ratios?

Oracle’s ratios present strong earnings and returns but are offset by unfavorable liquidity and leverage metrics. CrowdStrike’s financials reveal challenges in profitability but maintain solid liquidity and low debt. Oracle’s overall ratio profile is unfavorable, while CrowdStrike’s is neutral, reflecting a balance between weaknesses and financial stability.

Strategic Positioning

This section compares the strategic positioning of Oracle Corporation and CrowdStrike Holdings, Inc., including their market position, key segments, and exposure to technological disruption:

Oracle Corporation

- Large market cap of $549B, facing competitive pressure in software infrastructure sector.

- Diverse revenue streams: cloud and license $49B, hardware $3B, services $5B in 2025.

- Exposure to disruption includes cloud computing, autonomous database, blockchain, IoT innovations.

CrowdStrike Holdings, Inc.

- Market cap $114B, positioned in cloud-delivered protection with moderate competitive pressure.

- Revenue driven mainly by subscriptions $3.76B, with smaller professional services $192M.

- Focused on cloud security, threat intelligence, Zero Trust identity protection, and managed services.

Oracle Corporation vs CrowdStrike Holdings, Inc. Positioning

Oracle adopts a diversified approach with multiple product lines and industries, offering broad cloud and hardware solutions. CrowdStrike concentrates on cloud security services, emphasizing subscription-based growth. Oracle’s scale and variety contrast with CrowdStrike’s specialized, niche focus.

Which has the best competitive advantage?

Both companies currently shed value (ROIC below WACC) with Oracle showing declining profitability and CrowdStrike improving profitability. Neither demonstrates a strong moat yet, reflecting slightly unfavorable competitive advantage statuses.

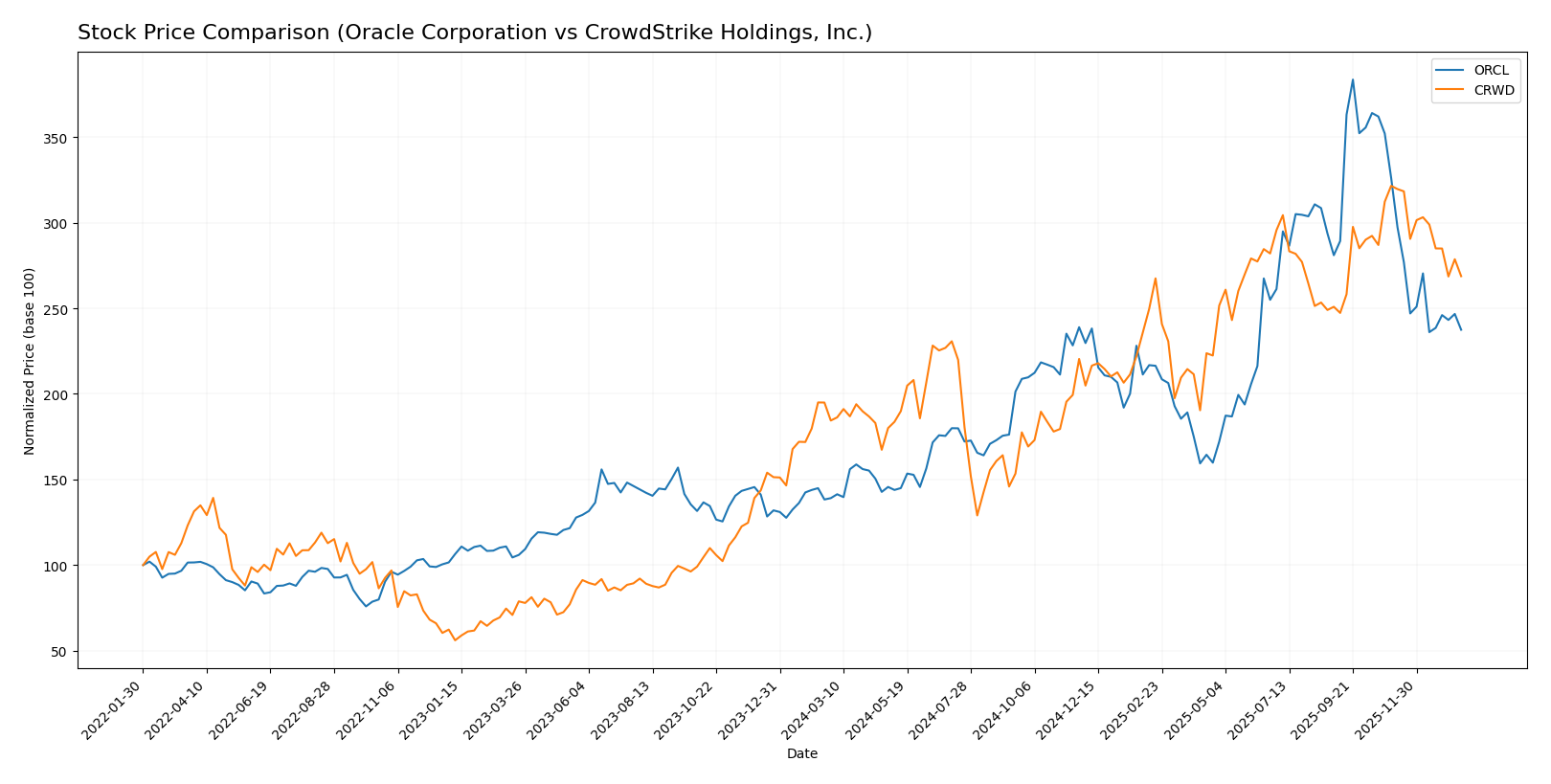

Stock Comparison

The past year showcased notable bullish trends for both Oracle Corporation and CrowdStrike Holdings, Inc., with Oracle displaying stronger gains but recent short-term declines impacting both stocks’ momentum.

Trend Analysis

Oracle Corporation’s stock exhibited a strong bullish trend over the past 12 months, rising 70.69%, though with decelerating momentum. The price ranged between 111.95 and 308.66, with significant volatility (std deviation 49.0). Recent months show a bearish correction of -27.23%.

CrowdStrike Holdings, Inc. maintained a bullish trend with a 45.71% increase over the same period, also decelerating. Its price fluctuated from 217.89 to 543.01, with higher volatility (std deviation 80.53). The recent trend shows a -16.41% decline.

Comparing both, Oracle delivered the highest market performance with a larger overall gain despite stronger recent downward pressure, while CrowdStrike experienced more volatility and a milder price increase.

Target Prices

The current consensus target prices from verified analysts show promising upside potential for both Oracle Corporation and CrowdStrike Holdings, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Oracle Corporation | 400 | 175 | 314.08 |

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

Analysts expect Oracle’s stock to rise significantly from its current price of $191.09, while CrowdStrike’s consensus target price of $553.47 suggests a strong potential gain over its current price of $453.88.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Oracle Corporation and CrowdStrike Holdings, Inc.:

Rating Comparison

Oracle Corporation Rating

- Rating: B, indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: Moderate at 3, suggesting fair valuation.

- ROE Score: Very favorable at 5, showing strong profit generation from equity.

- ROA Score: Favorable at 4, reflecting effective asset utilization.

- Debt To Equity Score: Very unfavorable at 1, highlighting higher financial risk.

- Overall Score: Moderate at 3, reflecting an average financial standing.

CrowdStrike Holdings, Inc. Rating

- Rating: C, also considered very favorable overall.

- Discounted Cash Flow Score: Favorable at 4, indicating better valuation.

- ROE Score: Very unfavorable at 1, indicating weak profit generation.

- ROA Score: Very unfavorable at 1, showing poor asset utilization.

- Debt To Equity Score: Moderate at 3, indicating balanced financial risk.

- Overall Score: Moderate at 2, slightly lower financial standing.

Which one is the best rated?

Oracle has a better overall rating and stronger profitability scores (ROE and ROA) but carries higher financial risk with its debt-to-equity ratio. CrowdStrike shows a better discounted cash flow score and balanced debt level but weaker profitability metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Oracle Corporation and CrowdStrike Holdings, Inc.:

Oracle Corporation Scores

- Altman Z-Score: 2.43, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 5, reflecting average financial strength.

CrowdStrike Holdings, Inc. Scores

- Altman Z-Score: 12.38, indicating very low bankruptcy risk in the safe zone.

- Piotroski Score: 4, reflecting average financial strength.

Which company has the best scores?

Based strictly on the provided data, CrowdStrike has a significantly higher Altman Z-Score, placing it well within the safe zone, while Oracle is in the grey zone. Both have average Piotroski Scores, with Oracle slightly higher at 5 compared to CrowdStrike’s 4.

Grades Comparison

Here is a comparison of recent and reliable grades for Oracle Corporation and CrowdStrike Holdings, Inc.:

Oracle Corporation Grades

The following table summarizes the recent grades assigned to Oracle Corporation by reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-05 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-12-12 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| UBS | Maintain | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-11 |

| JP Morgan | Maintain | Neutral | 2025-12-11 |

| DA Davidson | Maintain | Neutral | 2025-12-11 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-11 |

Oracle’s grades predominantly reflect a positive outlook, with multiple “Buy” and “Overweight” ratings alongside some “Neutral” and “Sector Perform” assessments, indicating a balanced but generally favorable consensus.

CrowdStrike Holdings, Inc. Grades

The following table shows recent grades assigned to CrowdStrike Holdings, Inc. by established grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

CrowdStrike’s ratings show a strong “Buy” bias with some recent upgrades, though there is a recent downgrade to “Sector Weight” from Keybanc, suggesting a cautiously optimistic but somewhat mixed view.

Which company has the best grades?

Both Oracle and CrowdStrike have received predominantly positive grades, with “Buy” ratings leading for each. Oracle’s grades are steadier with no recent downgrades, while CrowdStrike shows more volatility with upgrades and a recent downgrade. Investors may perceive Oracle as more consistently favored, potentially implying lower short-term rating risk compared to CrowdStrike.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Oracle Corporation and CrowdStrike Holdings, Inc., based on their latest financial and market data.

| Criterion | Oracle Corporation (ORCL) | CrowdStrike Holdings, Inc. (CRWD) |

|---|---|---|

| Diversification | Highly diversified with strong Cloud & License business ($49.2B) plus Hardware ($2.9B) and Services ($5.2B) segments | Focused primarily on Subscription and Professional Services; less diversified |

| Profitability | Strong profitability with 21.7% net margin and 60.8% ROE; ROIC at 10.9% above WACC (10.3%) but declining trend | Negative net margin (-0.5%) and ROE (-0.6%); very low ROIC (0.7%) below WACC (8.6%) but improving |

| Innovation | Moderate innovation with stable but slightly unfavorable economic moat; legacy systems transitioning to cloud | High innovation with rapidly growing ROIC and rising profitability potential; emerging cybersecurity leader |

| Global presence | Established global footprint as a mature enterprise software provider | Expanding global presence focused on cybersecurity markets |

| Market Share | Large market share in enterprise software and database systems | Growing market share in endpoint security and cloud-native protection |

Oracle’s diversified business model and strong profitability provide stability, but its declining ROIC trend is a caution. CrowdStrike shows promising growth and innovation but still operates at a loss with less diversification, indicating higher risk.

Risk Analysis

Below is a comparison of key risks for Oracle Corporation and CrowdStrike Holdings, Inc. based on the most recent data from 2025.

| Metric | Oracle Corporation (ORCL) | CrowdStrike Holdings, Inc. (CRWD) |

|---|---|---|

| Market Risk | High beta 1.65, price range 119-346 USD | Moderate beta 1.03, price range 298-567 USD |

| Debt level | High leverage: D/E 5.09, Debt/assets 61.8% | Low leverage: D/E 0.24, Debt/assets 9.1% |

| Regulatory Risk | Moderate, operates globally with exposure to software and cloud regulations | Moderate, cybersecurity industry under increasing regulatory scrutiny |

| Operational Risk | Large scale with 159K employees, complexity in cloud and software products | Smaller scale (10K employees), reliance on subscription model and cloud operations |

| Environmental Risk | Moderate, hardware production and data centers contribute to footprint | Low to moderate, mostly cloud-based services with lower direct environmental impact |

| Geopolitical Risk | Exposure in diverse global markets, sensitive to US-China tech tensions | Exposure to global cyber threat landscape, geopolitical tensions affect cybersecurity demand |

The most impactful risks currently lie in Oracle’s high debt level and market volatility, which could pressure financial stability despite strong profitability. CrowdStrike’s risks center on operational execution and regulatory compliance in a fast-evolving cybersecurity landscape, though its low debt reduces financial risk. Both companies face geopolitical uncertainties affecting technology sectors.

Which Stock to Choose?

Oracle Corporation (ORCL) shows steady income growth with favorable net margin (21.68%) and ROE (60.84%) but carries high debt levels and unfavorable liquidity ratios; its overall rating is very favorable (B), despite a slightly unfavorable MOAT due to declining ROIC.

CrowdStrike Holdings, Inc. (CRWD) exhibits strong revenue growth and improving profitability trends but reports negative net margin (-0.49%) and returns with a neutral overall financial ratio evaluation; rating stands at very favorable (C), while its MOAT is slightly unfavorable though ROIC is increasing.

Investors seeking stability and strong current profitability might view Oracle as more favorable, whereas those focused on growth potential and improving returns could find CrowdStrike’s profile more appealing, reflecting differing risk tolerances and investment strategies.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Oracle Corporation and CrowdStrike Holdings, Inc. to enhance your investment decisions: