In the fast-evolving world of cybersecurity, CrowdStrike Holdings, Inc. and Okta, Inc. stand out as leading innovators delivering critical software infrastructure solutions. Both companies focus on cloud-based security and identity management, targeting overlapping markets with complementary approaches to protecting enterprises. This comparison will explore their strengths and strategies to help you decide which stock might be the most compelling addition to your investment portfolio. Let’s uncover which company offers the best opportunity for investors today.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike Holdings, Inc. and Okta, Inc. by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. delivers cloud-based protection focused on endpoints, cloud workloads, identity, and data security. The company offers a range of services including threat intelligence, managed security, IT operations management, and Zero Trust identity protection. It primarily sells subscriptions to its Falcon platform through a direct sales force and channel partners, serving a global customer base from its headquarters in Austin, Texas.

Okta Overview

Okta, Inc. specializes in identity solutions for enterprises, SMBs, government agencies, and other organizations worldwide. Its core offering, the Okta Identity Cloud, includes products such as Single Sign-On, Multi-Factor Authentication, Lifecycle Management, and API Access Management. Okta also provides Auth0 products for enhanced authentication and security. The company markets its services directly and through channel partners from its base in San Francisco, California.

Key similarities and differences

Both CrowdStrike and Okta operate in the software infrastructure sector, focusing on cloud-delivered security solutions. While CrowdStrike emphasizes endpoint and workload protection, Okta centers on identity and access management services. Both companies sell primarily via direct and channel sales, but their target customer segments and specific product offerings differ, reflecting distinct approaches within the broader cybersecurity landscape.

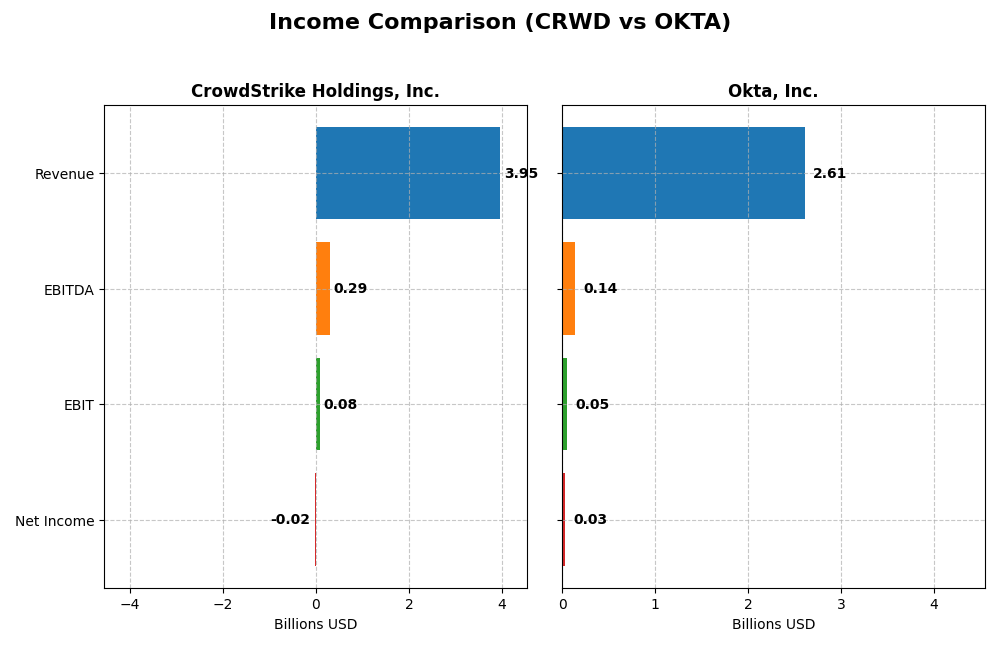

Income Statement Comparison

The table below compares the key income statement metrics for CrowdStrike Holdings, Inc. and Okta, Inc. for the fiscal year 2025, providing a snapshot of their financial performance.

| Metric | CrowdStrike Holdings, Inc. | Okta, Inc. |

|---|---|---|

| Market Cap | 114.4B | 15.2B |

| Revenue | 3.95B | 2.61B |

| EBITDA | 295M | 139M |

| EBIT | 81M | 51M |

| Net Income | -19.3M | 28M |

| EPS | -0.08 | 0.17 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

CrowdStrike’s revenue exhibited strong growth, surging by 29.4% in 2025 and 352.1% over 2021-2025. Despite favorable gross margin near 75%, net income turned negative in 2025 at -$19M, a decline from $89M in 2024, reflecting a net margin contraction. Operating expenses rose proportionally with revenue, pressuring EBIT, which fell 45.6% in the latest year.

Okta, Inc.

Okta showed steady revenue increases, with 15.3% growth in 2025 and overall 212.6% since 2021. Gross margin remained strong at 76.3%, and net income improved to $28M in 2025 from a loss of $355M in 2024, leading to positive net margin of 1.1%. EBIT surged 115.5%, supported by controlled operating expenses relative to revenue growth.

Which one has the stronger fundamentals?

Okta demonstrates stronger fundamentals with consistent revenue growth, improving profitability, and positive net margins in 2025. CrowdStrike, while growing rapidly, saw a net loss and margin compression recently, despite favorable long-term trends. Okta’s overall higher proportion of favorable income statement metrics and margin improvements suggest more stable earnings quality.

Financial Ratios Comparison

The table below presents the most recent financial ratios for CrowdStrike Holdings, Inc. and Okta, Inc., reflecting their fiscal year 2025 performance to facilitate a straightforward comparison.

| Ratios | CrowdStrike Holdings, Inc. (CRWD) | Okta, Inc. (OKTA) |

|---|---|---|

| ROE | -0.59% | 0.44% |

| ROIC | 0.70% | -0.61% |

| P/E | -5055.7 | 570.6 |

| P/B | 29.71 | 2.49 |

| Current Ratio | 1.67 | 1.35 |

| Quick Ratio | 1.67 | 1.35 |

| D/E | 0.24 | 0.15 |

| Debt-to-Assets | 9.07% | 10.09% |

| Interest Coverage | -4.58 | -14.8 |

| Asset Turnover | 0.45 | 0.28 |

| Fixed Asset Turnover | 4.76 | 22.31 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike shows a mixed ratio profile with favorable liquidity (current and quick ratios at 1.67) and low leverage (debt to equity at 0.24). However, profitability metrics such as net margin (-0.49%) and return on equity (-0.59%) are unfavorable, raising concerns about earnings efficiency. The company does not pay dividends, reflecting a reinvestment focus typical of a growth phase.

Okta, Inc.

Okta’s ratios also reveal a balanced picture, with favorable debt management (debt to equity 0.15) and strong interest coverage (10.2), but weak profitability indicators like a low net margin (1.07%) and a negative return on invested capital (-0.61%). Okta does not distribute dividends, likely prioritizing growth investments over shareholder payouts in its developmental stage.

Which one has the best ratios?

Both companies exhibit an equal share of favorable and unfavorable ratios, resulting in a neutral overall assessment. CrowdStrike’s liquidity and leverage are solid, while Okta excels in interest coverage and cost control. Profitability challenges persist for both, and neither offers dividends, reflecting their growth-oriented strategies in a competitive industry.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and Okta, focusing on market position, key segments, and exposure to disruption:

CrowdStrike Holdings, Inc.

- Leading in cloud-delivered endpoint and workload protection; faces strong competition in cybersecurity software.

- Revenue driven by subscriptions to Falcon platform and professional services; broad cloud security and IT operations focus.

- Positioned in cloud security with Zero Trust and threat intelligence; technological advances critical for competitiveness.

Okta, Inc.

- Focused on identity solutions for enterprises and public sectors; competes in identity management market.

- Revenue mainly from subscription services and technology support; emphasizes identity cloud and Auth0 products.

- Focused on adaptive multi-factor authentication and API security; must innovate to counter evolving identity threats.

CrowdStrike vs Okta Positioning

CrowdStrike offers a diversified cloud security platform including endpoint and identity protection, while Okta concentrates on identity and access management. CrowdStrike’s broad scope may capture varied security needs, whereas Okta’s specialization targets identity-focused solutions with depth.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOAT status with ROIC below WACC but improving profitability. Neither currently creates strong economic value, indicating cautious assessment of their competitive advantages in 2026.

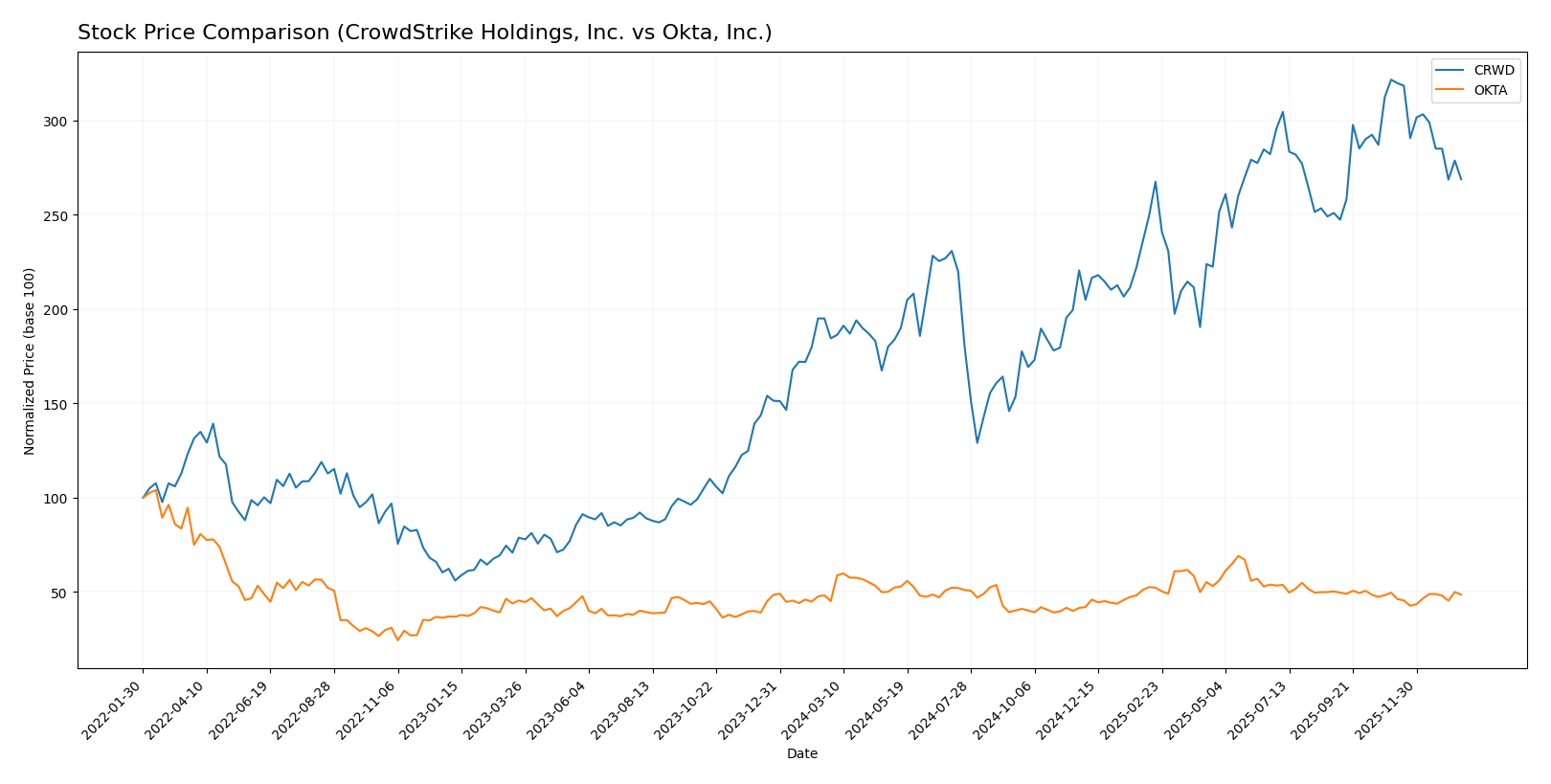

Stock Comparison

The stock price movements over the past 12 months reveal notable bullish trends for both CrowdStrike Holdings, Inc. and Okta, Inc., with distinct dynamics in price acceleration and volume behavior.

Trend Analysis

CrowdStrike Holdings, Inc. (CRWD) shows a bullish trend with a 45.71% price increase over the past year, though the pace has decelerated. The stock reached a high of 543.01 and a low of 217.89, displaying high volatility with an 80.53 standard deviation.

Okta, Inc. (OKTA) also exhibits a bullish trend with a 7.58% gain over the same period, accompanied by accelerating momentum. The price ranged between 72.24 and 127.3, with lower volatility at an 11.38 standard deviation.

Comparing both, CrowdStrike delivered the highest market performance with a significantly larger price increase despite recent deceleration, while Okta’s trend is more moderate but accelerating.

Target Prices

The target price consensus from verified analysts indicates promising upside potential for both CrowdStrike Holdings, Inc. and Okta, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| Okta, Inc. | 140 | 60 | 110.67 |

Analysts expect CrowdStrike’s stock to appreciate significantly from the current price of 453.88 USD, while Okta’s consensus target price of 110.67 USD also suggests a notable potential increase from its current 89.55 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. (CRWD) and Okta, Inc. (OKTA):

Rating Comparison

CRWD Rating

- Rating: C, considered Very Favorable overall

- Discounted Cash Flow Score: 4, Favorable valuation insight

- ROE Score: 1, Very Unfavorable efficiency in equity use

- ROA Score: 1, Very Unfavorable asset utilization

- Debt To Equity Score: 3, Moderate financial risk

- Overall Score: 2, Moderate financial standing

OKTA Rating

- Rating: B, considered Very Favorable overall

- Discounted Cash Flow Score: 4, Favorable valuation insight

- ROE Score: 2, Moderate efficiency in equity use

- ROA Score: 3, Moderate asset utilization

- Debt To Equity Score: 4, Favorable financial risk

- Overall Score: 3, Moderate financial standing

Which one is the best rated?

Based strictly on the provided data, OKTA holds a higher rating (B) and overall score (3) compared to CRWD’s rating (C) and overall score (2). OKTA also performs better on return on equity, return on assets, and debt to equity scores, indicating a stronger financial profile.

Scores Comparison

The comparison of CrowdStrike and Okta scores highlights their financial stability and strength as follows:

CRWD Scores

- Altman Z-Score: 12.38, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

OKTA Scores

- Altman Z-Score: 4.15, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 8, reflecting very strong financial strength.

Which company has the best scores?

Okta shows a lower but safe Altman Z-Score and a much stronger Piotroski Score than CrowdStrike. Based on these scores, Okta demonstrates stronger financial health overall.

Grades Comparison

The grades provided by reputable financial institutions for CrowdStrike Holdings, Inc. and Okta, Inc. are detailed as follows:

CrowdStrike Holdings, Inc. Grades

This table presents recent grades and actions from verified grading companies for CrowdStrike Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

The overall trend for CrowdStrike is positive, with multiple buy ratings maintained or upgraded, though one downgrade to sector weight occurred recently.

Okta, Inc. Grades

This table shows the latest grades and rating actions from verified grading companies for Okta, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stephens & Co. | Upgrade | Overweight | 2026-01-14 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Jefferies | Upgrade | Buy | 2025-12-16 |

| Needham | Maintain | Buy | 2025-12-12 |

| BTIG | Maintain | Buy | 2025-12-04 |

| Susquehanna | Maintain | Neutral | 2025-12-03 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-03 |

| Scotiabank | Maintain | Sector Perform | 2025-12-03 |

Okta’s grades show a stable to positive trend, with upgrades to overweight and buy ratings and no downgrades in the recent period.

Which company has the best grades?

Both companies hold a consensus “Buy” rating, but CrowdStrike displays more consistent buy ratings with fewer neutral or sector-weighted opinions, while Okta has a broader mix of overweight and neutral ratings. Investors might observe that CrowdStrike’s generally stronger buy consensus could indicate relatively higher confidence from analysts.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of CrowdStrike Holdings, Inc. (CRWD) and Okta, Inc. (OKTA) based on recent financial and operational data.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | Okta, Inc. (OKTA) |

|---|---|---|

| Diversification | Revenue mainly from Subscription & Services; strong growth in subscription (3.76B in 2025) | Revenue dominated by Subscription & Tech Services; less diversified but steady growth (2.56B subscription in 2025) |

| Profitability | Negative net margin (-0.49%) and ROE (-0.59%); ROIC slightly positive (0.7%) but below WACC (8.64%) | Negative ROIC (-0.61%) and low profitability; net margin slightly positive (1.07%) but overall value shedding |

| Innovation | Growing ROIC trend (+114%) indicates improving efficiency and innovation potential | Rising ROIC trend (+92%) signals improving profitability despite current losses |

| Global presence | Strong market presence with increasing subscription base, leveraging professional services | Expanding global footprint but smaller overall revenue base compared to CRWD |

| Market Share | Larger market share reflected in higher revenues and service segments | Smaller market share; competitive but growing subscription revenue |

Key takeaways: Both companies are currently shedding value with ROIC below WACC, indicating profitability challenges. However, they show promising ROIC growth trends, suggesting improving operational efficiency. CrowdStrike leads in revenue size and diversification, while Okta is making steady gains in innovation and profitability. Caution is advised, but both warrant monitoring for potential turnaround.

Risk Analysis

Below is a comparative table highlighting key risks for CrowdStrike Holdings, Inc. (CRWD) and Okta, Inc. (OKTA) based on the most recent 2025 data:

| Metric | CrowdStrike Holdings, Inc. (CRWD) | Okta, Inc. (OKTA) |

|---|---|---|

| Market Risk | Beta 1.03 indicates moderate market volatility exposure | Beta 0.76 suggests lower volatility compared to market |

| Debt level | Debt-to-Equity 0.24 (favorable) and Debt-to-Assets 9.07% | Debt-to-Equity 0.15 (favorable) and Debt-to-Assets 10.09% |

| Regulatory Risk | Moderate, due to cybersecurity industry regulations globally | Moderate, with identity management regulations impacting operations |

| Operational Risk | Scaling challenges with 10K+ employees; platform integration complexity | Operational risk from integration of Auth0 and service scalability |

| Environmental Risk | Low direct impact; tech sector with minimal environmental footprint | Low direct impact; similar sector profile as CRWD |

| Geopolitical Risk | Exposure to global markets and cyber threat landscapes | Global customer base but somewhat less volatile geopolitical exposure |

Synthesis: Both companies face notable operational and regulatory risks given their roles in cybersecurity and identity management. CrowdStrike’s slightly higher market volatility and integration complexities may pose greater short-term challenges. Okta’s strong financial health and lower beta reduce some risk, but valuation concerns remain significant.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) shows strong revenue growth of 29.4% in 2025 and a favorable global income statement evaluation. However, its profitability ratios remain unfavorable with a negative net margin of -0.49% and return on equity at -0.59%. The company has a healthy current ratio of 1.67 and low debt-to-equity of 0.24, but its overall financial ratios evaluation is neutral. Its economic moat rating suggests value destruction despite growing ROIC, and the rating is very favorable with some moderate scores.

Okta, Inc. (OKTA) also exhibits favorable income growth with 15.3% revenue increase and a strong 85.7% favorable income statement rating. Profitability ratios are slightly better but remain unfavorable overall, with net margin at 1.07% and return on equity at 0.44%. Debt metrics are solid with debt-to-equity at 0.15 and interest coverage favorable. Financial ratios evaluation is neutral, while its moat rating indicates value destruction with improving profitability. Its rating is very favorable, supported by a strong Piotroski score.

Investors prioritizing strong income growth and improving profitability might find Okta’s consistent positive margin growth and strong financial scores more appealing, especially given its safer leverage profile. Conversely, those focusing on higher revenue expansion and current liquidity measures could interpret CrowdStrike’s robust top-line growth and solid current ratios as favorable despite its profitability challenges. Both companies show slight value destruction but improving returns, suggesting a nuanced choice depending on risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and Okta, Inc. to enhance your investment decisions: