In the fast-evolving world of software infrastructure, CrowdStrike Holdings, Inc. (CRWD) and Nutanix, Inc. (NTNX) stand out as prominent players driving innovation. Both companies specialize in cloud and enterprise solutions, targeting overlapping markets with distinct approaches to cybersecurity and cloud management. This comparison aims to help investors understand which company presents a more compelling opportunity in 2026. Let’s explore their strengths and growth potential to identify the smarter choice for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike and Nutanix by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. provides cloud-delivered protection across endpoints, cloud workloads, identity, and data. Its flagship Falcon platform offers threat intelligence, managed security services, IT operations management, and Zero Trust identity protection. Founded in 2011 and based in Austin, Texas, CrowdStrike operates globally and primarily sells subscriptions through a direct sales team and channel partners, positioning itself as a leader in cybersecurity infrastructure software.

Nutanix Overview

Nutanix, Inc. delivers an enterprise cloud platform with virtualization, storage, networking, and security services. Its portfolio includes solutions like Acropolis Hypervisor, Kubernetes management with Karbon, cloud governance, and desktop-as-a-service through Nutanix Frame. Founded in 2009 and headquartered in San Jose, California, Nutanix serves diverse industries worldwide, offering integrated cloud and hybrid cloud orchestration, automation, and consulting services.

Key similarities and differences

Both companies operate in the Software – Infrastructure industry, focusing on cloud and enterprise IT solutions. CrowdStrike specializes in cybersecurity and threat protection, predominantly through subscriptions to its security platform. Nutanix emphasizes cloud infrastructure management and hybrid cloud orchestration with a broad product suite covering virtualization and application lifecycle services. Their business models differ in specialization, with CrowdStrike centered on security and Nutanix on cloud infrastructure integration.

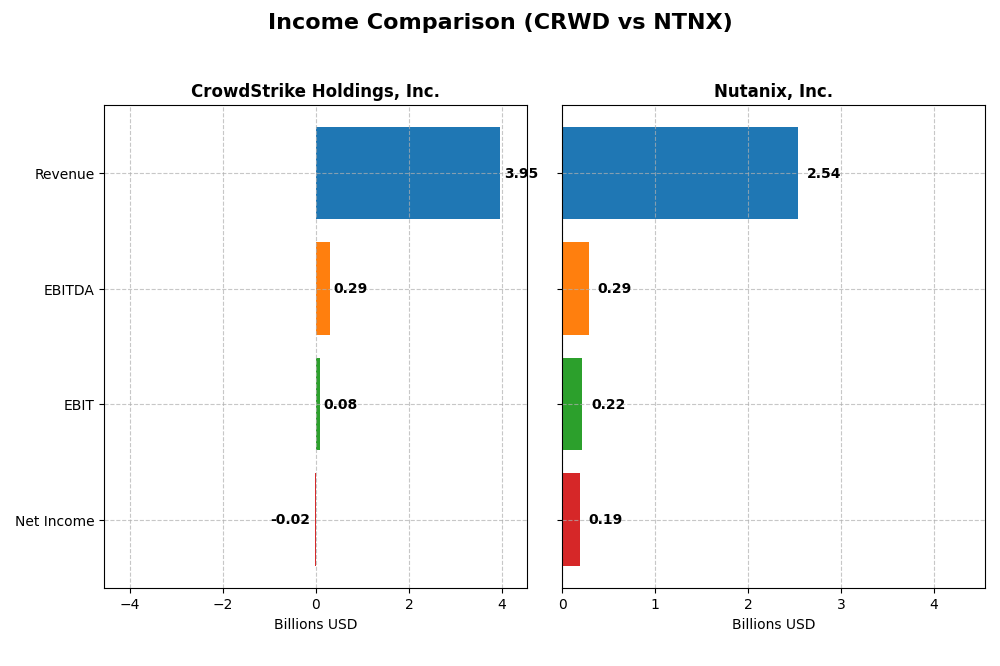

Income Statement Comparison

The table below compares key income statement metrics for CrowdStrike Holdings, Inc. and Nutanix, Inc. for the fiscal year 2025, providing a snapshot of their financial performance.

| Metric | CrowdStrike Holdings, Inc. | Nutanix, Inc. |

|---|---|---|

| Market Cap | 114.4B | 12.4B |

| Revenue | 3.95B | 2.54B |

| EBITDA | 295M | 293M |

| EBIT | 81M | 220M |

| Net Income | -19.3M | 188M |

| EPS | -0.08 | 0.70 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

From 2021 to 2025, CrowdStrike’s revenue surged by 352%, yet net income fluctuated, ending slightly negative in 2025. Gross margins remained strong at approximately 75%, though EBIT margins hovered near zero, reflecting high operating expenses. In 2025, revenue growth remained robust at 29%, but net margin deteriorated, indicating rising costs offsetting sales gains.

Nutanix, Inc.

Nutanix displayed steady revenue growth of 82% over five years, with net income improving significantly to a positive 7.4% net margin in 2025. Gross margin was notably higher than CrowdStrike’s, around 87%, and EBIT margin improved markedly. The latest fiscal year showed healthy revenue and profit growth, with EBIT and net margins expanding strongly, suggesting enhanced operational efficiency.

Which one has the stronger fundamentals?

Nutanix reports a more consistent improvement in profitability metrics, notably net and EBIT margins, alongside solid revenue growth. CrowdStrike shows impressive revenue expansion but struggles with profitability, reflected in its negative net margin in 2025. Nutanix’s broader favorable income statement indicators suggest comparatively stronger fundamentals based on available financial data.

Financial Ratios Comparison

Below is a comparison of key financial ratios for CrowdStrike Holdings, Inc. (CRWD) and Nutanix, Inc. (NTNX) based on their most recent fiscal year data.

| Ratios | CrowdStrike Holdings, Inc. (2025) | Nutanix, Inc. (2025) |

|---|---|---|

| ROE | -0.59% | -27.12% |

| ROIC | 0.70% | 8.11% |

| P/E | -5055.7 | 106.7 |

| P/B | 29.71 | -28.95 |

| Current Ratio | 1.67 | 1.72 |

| Quick Ratio | 1.67 | 1.72 |

| D/E (Debt-to-Equity) | 0.24 | -2.14 |

| Debt-to-Assets | 9.07% | 45.16% |

| Interest Coverage | -4.58 | 8.75 |

| Asset Turnover | 0.45 | 0.77 |

| Fixed Asset Turnover | 4.76 | 9.15 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike’s ratios show a mixed picture, with strong liquidity (current and quick ratios at 1.67) and low leverage (debt-to-equity 0.24), but weak profitability metrics like a negative net margin (-0.49%) and return on equity (-0.59%). The price-to-earnings ratio is unusually favorable due to negative earnings, while asset turnover is low. The company does not pay dividends, reflecting its reinvestment strategy in growth and R&D.

Nutanix, Inc.

Nutanix presents stronger liquidity (current and quick ratios at 1.72) and favorable leverage with a negative debt-to-equity ratio (-2.14), indicating net cash position, though debt to assets is moderately high at 45.16%. Profitability shows concerns with negative return on equity (-27.12%) and an unfavorable price-to-earnings at 106.74. Nutanix also does not pay dividends, likely prioritizing growth and acquisitions over shareholder payouts.

Which one has the best ratios?

Nutanix has a slightly more favorable overall ratio profile with 50% favorable ratios and stronger coverage ratios, while CrowdStrike shows a balanced split between favorable and unfavorable metrics. Nutanix’s strong liquidity and low leverage contrast with weaker profitability, whereas CrowdStrike’s profitability and valuation metrics remain challenged despite solid liquidity.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and Nutanix in terms of market position, key segments, and exposure to technological disruption:

CrowdStrike Holdings, Inc.

- Leading cloud-delivered cybersecurity provider facing strong competition in software infrastructure sector.

- Revenue mainly driven by subscription sales of Falcon platform and professional services globally.

- Positioned in cybersecurity with cloud-native threat intelligence, less exposed to traditional tech disruption.

Nutanix, Inc.

- Enterprise cloud platform provider with moderate competitive pressure in hybrid cloud and virtualization markets.

- Diverse product suite including virtualization, storage, Kubernetes management, and cloud governance services.

- Focused on hybrid cloud orchestration and automation, subject to evolving cloud-native technologies and competition.

CrowdStrike vs Nutanix Positioning

CrowdStrike’s strategy centers on a concentrated cybersecurity subscription model with global reach, offering high scalability but with competitive pressure. Nutanix adopts a diversified cloud platform approach, spanning multiple enterprise IT segments, which may reduce risk but increase operational complexity.

Which has the best competitive advantage?

Nutanix holds a very favorable MOAT with growing ROIC above WACC, indicating durable competitive advantage. CrowdStrike shows a slightly unfavorable MOAT, shedding value despite increasing profitability, signaling weaker capital efficiency.

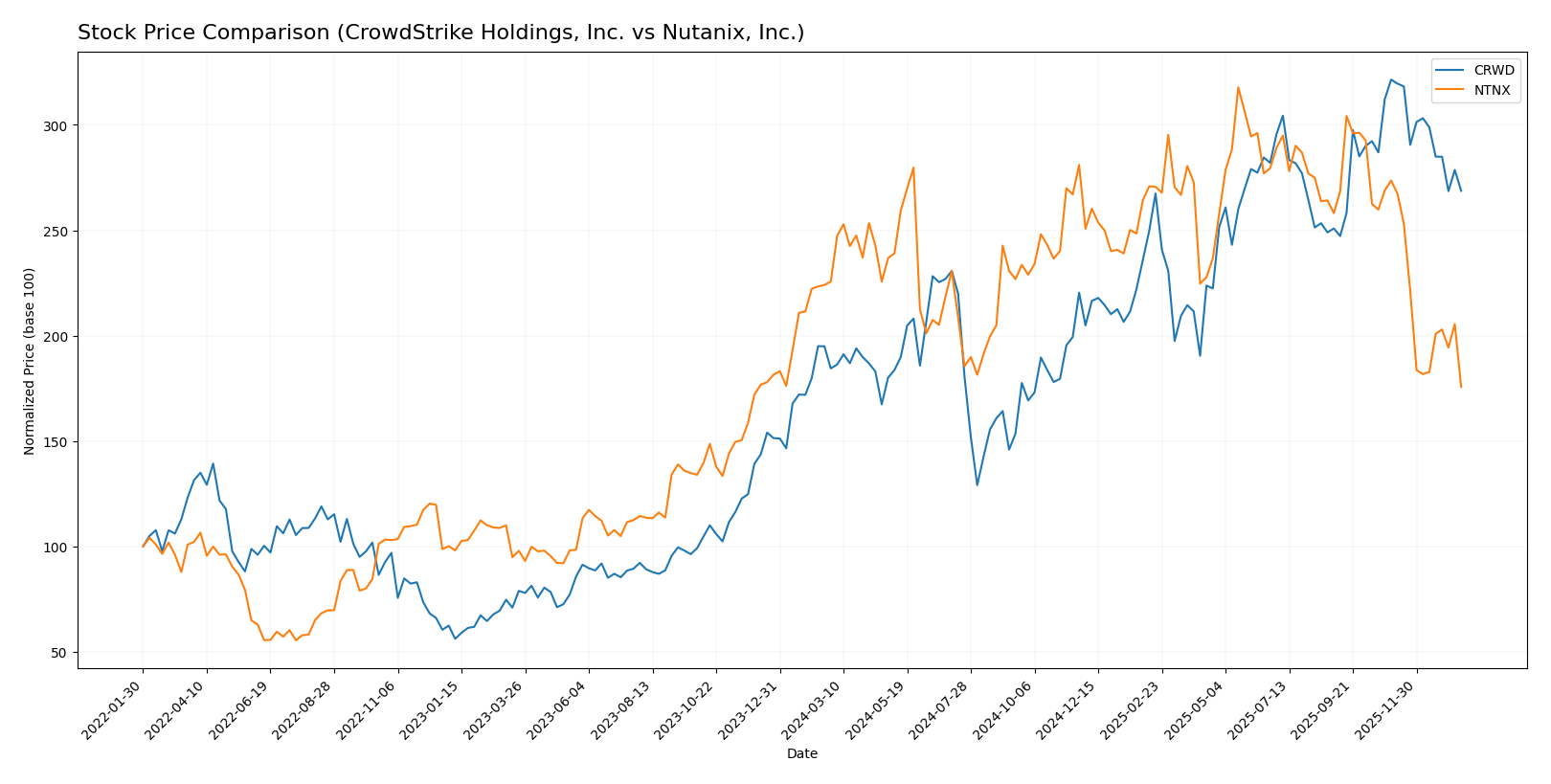

Stock Comparison

The stock price movements for CrowdStrike Holdings, Inc. and Nutanix, Inc. over the past year reveal contrasting trading dynamics, with CrowdStrike showing a strong overall rise despite recent pullbacks, while Nutanix demonstrates a consistent decline.

Trend Analysis

CrowdStrike Holdings, Inc. experienced a bullish trend over the past 12 months with a 45.71% price increase, although the rate of growth has decelerated. The stock reached a high of 543.01 and a low of 217.89.

Nutanix, Inc. showed a bearish trend over the same period, with a 22.16% decrease in price and decelerating downward momentum. The stock fluctuated between 82.77 at its highest and 45.74 at its lowest.

Comparing both stocks, CrowdStrike delivered the highest market performance with a significant positive gain, while Nutanix’s stock declined, indicating a negative market trend for that company.

Target Prices

The target price consensus for CrowdStrike Holdings, Inc. and Nutanix, Inc. reflects moderate to strong upside potential according to analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| Nutanix, Inc. | 90 | 53 | 64.67 |

Analysts expect CrowdStrike’s stock to rise significantly from its current price of 453.88 USD, while Nutanix shows potential for moderate gains from 45.74 USD, indicating generally positive outlooks.

Analyst Opinions Comparison

This section compares the analysts’ ratings and financial scores for CrowdStrike Holdings, Inc. (CRWD) and Nutanix, Inc. (NTNX):

Rating Comparison

CRWD Rating

- Rating: C, evaluated as Very Favorable

- Discounted Cash Flow Score: 4, considered Favorable

- ROE Score: 1, marked as Very Unfavorable

- ROA Score: 1, marked as Very Unfavorable

- Debt To Equity Score: 3, considered Moderate

- Overall Score: 2, considered Moderate

NTNX Rating

- Rating: C+, evaluated as Very Favorable

- Discounted Cash Flow Score: 4, considered Favorable

- ROE Score: 1, marked as Very Unfavorable

- ROA Score: 4, marked as Favorable

- Debt To Equity Score: 1, marked as Very Unfavorable

- Overall Score: 2, considered Moderate

Which one is the best rated?

Based strictly on the provided data, NTNX holds a slightly better rating (C+) compared to CRWD’s (C). While both share moderate overall scores and favorable DCF scores, NTNX outperforms CRWD notably in ROA but scores worse in debt-to-equity.

Scores Comparison

Here is a comparison of CrowdStrike and Nutanix scores based on Altman Z-Score and Piotroski Score:

CRWD Scores

- Altman Z-Score of 12.38, indicating a safe zone for bankruptcy risk.

- Piotroski Score of 4, categorized as average financial strength.

NTNX Scores

- Altman Z-Score of 1.48, placing the company in the distress zone.

- Piotroski Score of 6, also considered average financial strength.

Which company has the best scores?

CrowdStrike shows a significantly higher Altman Z-Score, indicating lower bankruptcy risk. Nutanix has a better Piotroski Score, but both are rated average. Overall, CrowdStrike’s scores suggest stronger financial stability.

Grades Comparison

Here is a detailed comparison of recent grades for CrowdStrike Holdings, Inc. and Nutanix, Inc.:

CrowdStrike Holdings, Inc. Grades

The table below shows recent grades from reputable financial institutions for CrowdStrike Holdings, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

CrowdStrike’s grades predominantly indicate Buy or Overweight ratings, with occasional downgrades to Sector Weight, showing a generally positive outlook with some cautious adjustments.

Nutanix, Inc. Grades

Below is a summary of recent grades from recognized grading firms for Nutanix, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Downgrade | Equal Weight | 2026-01-15 |

| Morgan Stanley | Downgrade | Equal Weight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Goldman Sachs | Maintain | Buy | 2025-11-28 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-26 |

| Morgan Stanley | Maintain | Overweight | 2025-11-26 |

| Keybanc | Maintain | Overweight | 2025-11-26 |

| Piper Sandler | Maintain | Overweight | 2025-11-26 |

Nutanix shows a mix of ratings mostly in the Overweight and Buy categories, with recent downgrades to Equal Weight, reflecting some market caution.

Which company has the best grades?

CrowdStrike has received more consistent Buy and Overweight grades, while Nutanix’s recent downgrades to Equal Weight suggest more caution. This divergence could influence investors’ perception of growth potential and risk for each stock.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for CrowdStrike Holdings, Inc. (CRWD) and Nutanix, Inc. (NTNX) based on the most recent financial and operational data.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | Nutanix, Inc. (NTNX) |

|---|---|---|

| Diversification | Focused largely on subscription and professional services with steady growth; limited product range | Balanced revenue from subscription, professional services, and product sales, offering more diversification |

| Profitability | Negative net margin (-0.49%) and ROE (-0.59%); ROIC slightly positive but unfavorable; value shedding | Positive net margin (7.42%) and ROIC (8.11%); however, negative ROE (-27.12%); overall creating value |

| Innovation | Strong innovation reflected in growing ROIC trend (+114%), but still shedding value | Durable competitive advantage with growing ROIC (+117%), indicating solid innovation and profitability |

| Global presence | Strong global footprint with rapidly increasing subscription revenue (3.76B in 2025) | Global reach with diversified products and services totaling above 1.9B in subscription and services revenue |

| Market Share | Leading position in cybersecurity subscriptions but challenged by high price-to-book ratio (29.71) | Competitive market share with favorable price-to-book ratio (-28.95) and improving asset turnover (0.77) |

Key takeaways: CrowdStrike excels in subscription growth and innovation but struggles with profitability and value creation currently. Nutanix shows a more balanced portfolio, improving profitability, and a durable competitive moat, making it slightly more favorable for investors focused on sustainable value.

Risk Analysis

Below is a comparison of key risks for CrowdStrike Holdings, Inc. (CRWD) and Nutanix, Inc. (NTNX) based on the most recent data from 2025.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | Nutanix, Inc. (NTNX) |

|---|---|---|

| Market Risk | Beta 1.03, exposed to tech sector volatility | Beta 0.49, lower market sensitivity |

| Debt level | Low debt-to-equity 0.24, favorable | Negative debt-to-equity (-2.14), favorable but complex |

| Regulatory Risk | Moderate, cybersecurity regulations evolving | Moderate, cloud software compliance requirements |

| Operational Risk | High reliance on subscription growth and innovation | Medium, diverse product portfolio but competitive market |

| Environmental Risk | Low direct impact, primarily software services | Low direct impact, software infrastructure focus |

| Geopolitical Risk | Moderate, global customer base | Moderate, international operations |

The most significant risks for CrowdStrike lie in operational challenges to sustain growth and market volatility. Nutanix faces financial distress signals from its Altman Z-Score and must manage competitive pressure and regulatory compliance carefully. Both companies show moderate exposure to geopolitical and regulatory risks given their global presence.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) shows strong revenue growth of 29.39% in 2025 and a favorable overall income statement with 57.14% positive metrics. Despite unfavorable profitability ratios and a net margin of -0.49%, it maintains low debt levels and a very favorable rating, reflecting a stable balance sheet but mixed operational efficiency.

Nutanix, Inc. (NTNX) reports favorable income metrics with 92.86% positive indicators, including a 7.42% net margin and 18.11% revenue growth in 2025. Its financial ratios are slightly favorable with moderate leverage but unfavorable return on equity. The company’s rating is also very favorable, though it faces higher debt levels and a distress-zone Altman Z-Score.

For investors, Nutanix might appear more attractive for those focusing on income statement strength and value creation, given its positive ROIC exceeding WACC. Conversely, CrowdStrike could suit those prioritizing low debt and overall financial stability despite weaker profitability. The choice could depend on an investor’s risk tolerance and preference for growth versus financial conservatism.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and Nutanix, Inc. to enhance your investment decisions: