CrowdStrike Holdings, Inc. and MongoDB, Inc. are two leading players in the software infrastructure sector, each driving innovation in cybersecurity and database technology, respectively. While CrowdStrike focuses on cloud-delivered endpoint protection and threat intelligence, MongoDB specializes in flexible, multi-cloud database platforms. Their overlapping interests in cloud solutions and enterprise software make this comparison timely. In this article, I will help you identify which company offers the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike and MongoDB by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. focuses on cloud-delivered protection for endpoints and cloud workloads, identity, and data. Its flagship Falcon platform offers threat intelligence, managed security, IT operations, threat hunting, and Zero Trust identity protection. Founded in 2011 and based in Austin, Texas, CrowdStrike operates globally, primarily selling subscriptions through a direct sales team and channel partners, positioning itself as a leader in cybersecurity infrastructure.

MongoDB Overview

MongoDB, Inc. delivers a general purpose database platform worldwide, with offerings including MongoDB Enterprise Advanced, MongoDB Atlas cloud service, and a free Community Server. Founded in 2007 and headquartered in New York City, it provides commercial database solutions for cloud, on-premises, and hybrid environments, along with consulting and training services. MongoDB emphasizes flexibility and developer accessibility in infrastructure software.

Key similarities and differences

Both CrowdStrike and MongoDB operate within the technology sector under software infrastructure, serving global markets with subscription-based business models. CrowdStrike specializes in cybersecurity solutions, while MongoDB focuses on database platforms. CrowdStrike’s services emphasize security and identity protection, whereas MongoDB centers on data management and cloud database services, reflecting distinct but complementary roles in enterprise IT.

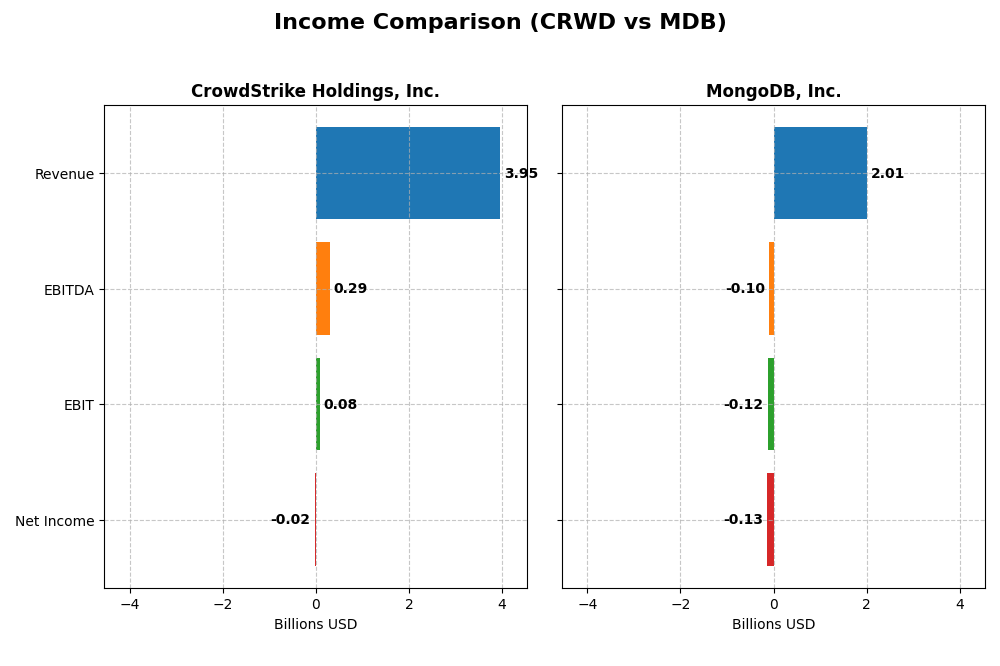

Income Statement Comparison

Below is a comparison of the most recent fiscal year income statement metrics for CrowdStrike Holdings, Inc. and MongoDB, Inc., highlighting key financial figures.

| Metric | CrowdStrike Holdings, Inc. | MongoDB, Inc. |

|---|---|---|

| Market Cap | 114.4B | 32.5B |

| Revenue | 3.95B | 2.01B |

| EBITDA | 295M | -97M |

| EBIT | 81M | -124M |

| Net Income | -19M | -129M |

| EPS | -0.08 | -1.73 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

From 2021 to 2025, CrowdStrike’s revenue showed strong growth, rising from 874M to 3.95B, with a favorable gross margin near 75%. However, its net income fluctuated, turning negative in the latest fiscal year with a net margin of -0.49%. The most recent year saw revenue surge by 29.4%, but operating expenses grew commensurately, compressing EBIT and EPS margins.

MongoDB, Inc.

MongoDB’s revenue grew consistently from 590M in 2021 to 2.01B in 2025, maintaining a solid gross margin above 73%. Despite negative net income across the period, the company improved its net margin and EPS in the latest year, with a 19.2% revenue increase and favorable operating expense control. EBIT margin remains negative at -6.16%, though showing improvement.

Which one has the stronger fundamentals?

CrowdStrike boasts higher revenue and gross margin stability with a positive overall income statement outlook, yet faces recent net income pressure. MongoDB shows consistent growth with improving profitability metrics and better control over expenses, despite remaining unprofitable. MongoDB’s higher percentage of favorable income statement indicators suggests comparatively stronger fundamental momentum.

Financial Ratios Comparison

The table below compares key financial ratios for the fiscal year 2025 of CrowdStrike Holdings, Inc. (CRWD) and MongoDB, Inc. (MDB), reflecting profitability, liquidity, leverage, efficiency, and dividend metrics.

| Ratios | CrowdStrike Holdings, Inc. (CRWD) | MongoDB, Inc. (MDB) |

|---|---|---|

| ROE | -0.59% | -4.64% |

| ROIC | 0.70% | -7.36% |

| P/E | -5056 | -158 |

| P/B | 29.71 | 7.32 |

| Current Ratio | 1.67 | 5.20 |

| Quick Ratio | 1.67 | 5.20 |

| D/E | 0.24 | 0.01 |

| Debt-to-Assets | 9.07% | 1.06% |

| Interest Coverage | -4.58 | -26.70 |

| Asset Turnover | 0.45 | 0.58 |

| Fixed Asset Turnover | 4.76 | 24.78 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike exhibits a mix of favorable and unfavorable ratios, reflecting a neutral overall financial position. Key strengths include a solid current ratio of 1.67 and a low debt-to-equity ratio of 0.24, indicating good liquidity and manageable leverage. However, negative net margin and return on equity highlight profitability concerns. The company does not pay dividends, likely prioritizing growth and reinvestment in R&D.

MongoDB, Inc.

MongoDB shows more unfavorable ratios, with a negative net margin of -6.43% and a weak return on equity at -4.64%, signaling profitability challenges. Despite a strong quick ratio of 5.2 and minimal debt levels, its interest coverage is negative, indicating financial stress. MongoDB also does not pay dividends, reflecting a focus on reinvestment and growth rather than shareholder returns.

Which one has the best ratios?

Between the two, CrowdStrike demonstrates a more balanced ratio profile with an equal share of favorable and unfavorable metrics, whereas MongoDB faces a higher proportion of unfavorable ratios and a negative overall outlook. CrowdStrike’s better liquidity and manageable leverage contrast with MongoDB’s financial stress indicators, suggesting CrowdStrike has the relatively stronger ratios in this comparison.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and MongoDB, focusing on Market position, Key segments, and Exposure to technological disruption:

CrowdStrike Holdings, Inc.

- Leading in cloud-delivered endpoint and cloud workload security with strong competitive pressure.

- Revenue mainly from subscription services in cybersecurity and professional services.

- Positioned in cybersecurity with cloud-native solutions, exposed to evolving technology threats.

MongoDB, Inc.

- Provides general purpose database platforms with moderate competitive pressure.

- Revenue diversified across cloud database services, other subscriptions, and consulting.

- Focused on database technology with cloud and hybrid deployment exposure to tech disruption.

CrowdStrike vs MongoDB Positioning

CrowdStrike focuses on cloud security subscriptions with professional services, while MongoDB centers on multi-cloud database platforms and consulting. CrowdStrike’s approach is more concentrated on security, whereas MongoDB’s revenue streams are more diversified across database solutions.

Which has the best competitive advantage?

Both companies show growing ROIC trends but are shedding value relative to WACC. Their slight unfavorable MOAT status indicates limited competitive advantage sustainability based on current return on invested capital metrics.

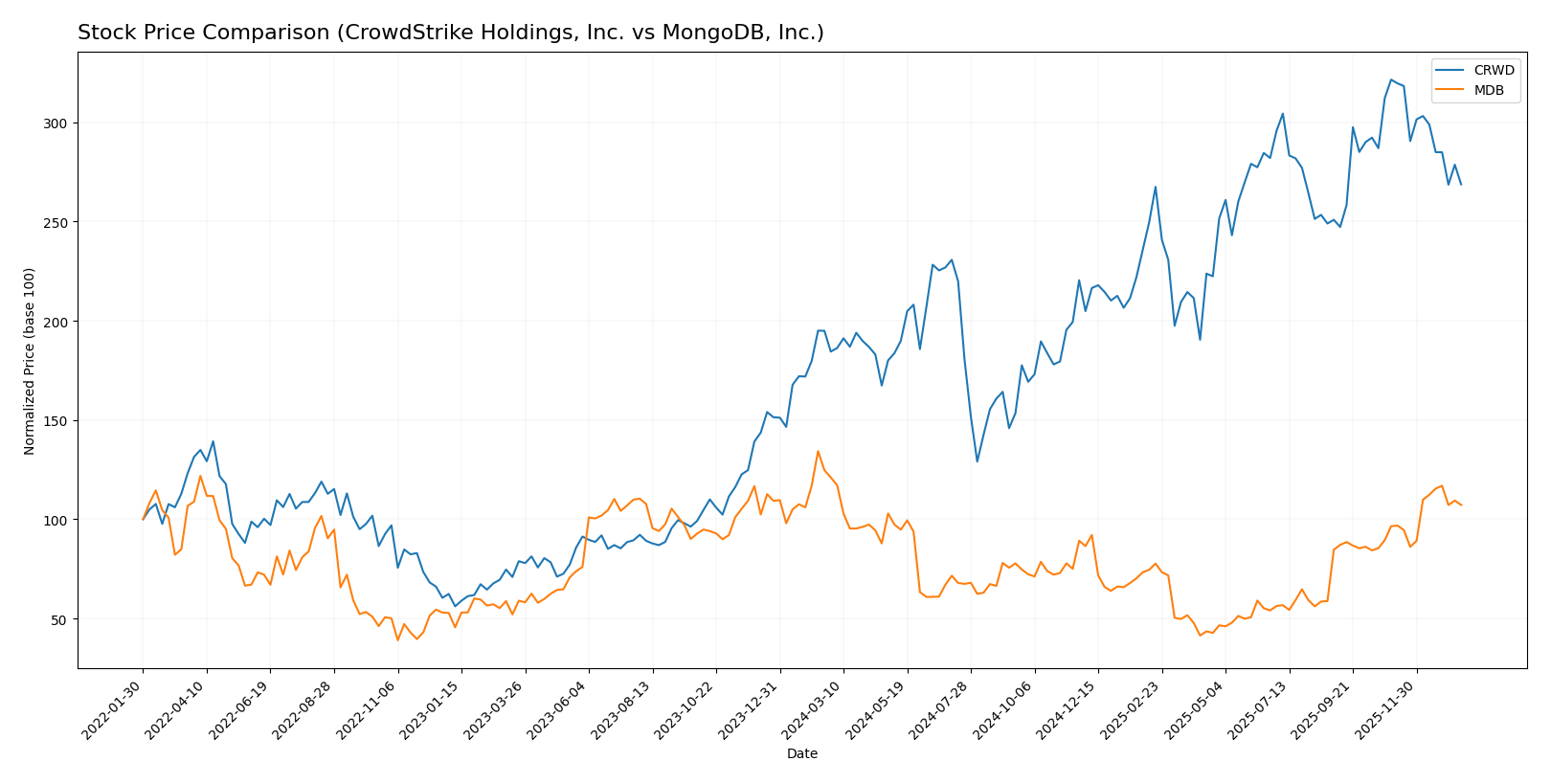

Stock Comparison

The stock price chart highlights significant price movements and contrasting trading dynamics between CrowdStrike Holdings, Inc. and MongoDB, Inc. over the past 12 months, reflecting divergent market sentiment and volume trends.

Trend Analysis

CrowdStrike Holdings, Inc. experienced a bullish trend over the past 12 months with a 45.71% price increase, marked by deceleration and a high volatility level (std deviation 80.53). Recent months show a -16.41% decline, indicating short-term bearishness.

MongoDB, Inc. showed a bearish trend over the same period with an 11.46% price drop and accelerating downward momentum, though recent data reveal an 11.1% price increase and a short-term bullish reversal.

Comparing the two, CrowdStrike’s stock delivered the highest market performance over the past year, despite recent weakness, outperforming MongoDB’s overall negative trend.

Target Prices

The current analyst consensus presents optimistic target prices for both CrowdStrike Holdings, Inc. and MongoDB, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| MongoDB, Inc. | 500 | 375 | 445.2 |

Analysts expect CrowdStrike’s price to rise significantly above the current 453.88 USD, while MongoDB shows upside potential compared to its current 399.76 USD share price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. (CRWD) and MongoDB, Inc. (MDB):

Rating Comparison

CRWD Rating

- Rating: C, considered Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation based on future cash flows.

- ROE Score: 1, rated Very Unfavorable for efficiency in generating profit from equity.

- ROA Score: 1, Very Unfavorable, showing weak asset utilization.

- Debt To Equity Score: 3, Moderate risk with balanced debt compared to equity.

- Overall Score: 2, Moderate overall financial standing.

MDB Rating

- Rating: C, also classified as Very Favorable.

- Discounted Cash Flow Score: 2, a Moderate valuation assessment.

- ROE Score: 1, also Very Unfavorable in this key profitability metric.

- ROA Score: 1, similarly Very Unfavorable for asset efficiency.

- Debt To Equity Score: 4, Favorable, indicating lower financial risk from debt levels.

- Overall Score: 2, Moderate overall financial standing as well.

Which one is the best rated?

Both CRWD and MDB share the same overall rating of C and an overall score of 2, classified as Moderate. CRWD has a stronger discounted cash flow score, while MDB has a better debt-to-equity score. Neither company outperforms the other decisively across all metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

CRWD Scores

- Altman Z-Score: 12.38, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength and investment potential.

MDB Scores

- Altman Z-Score: 30.24, showing a strong safe zone with very low bankruptcy risk.

- Piotroski Score: 4, also indicating average financial strength and investment potential.

Which company has the best scores?

Both CRWD and MDB are in the safe zone for Altman Z-Score, with MDB showing a notably higher score. Their Piotroski Scores are identical at 4, indicating similar average financial strength. MDB leads slightly in financial stability.

Grades Comparison

Here is a comparison of the recent grades assigned to CrowdStrike Holdings, Inc. and MongoDB, Inc.:

CrowdStrike Holdings, Inc. Grades

This table shows the latest grades from recognized financial institutions for CrowdStrike Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

Overall, CrowdStrike’s grades are predominantly Buy and Overweight, with a few upgrades and only one downgrade to Sector Weight, indicating generally positive analyst sentiment.

MongoDB, Inc. Grades

This table presents the recent grades given to MongoDB, Inc. by established financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

MongoDB’s grades are consistently Buy or Outperform with no downgrades, reflecting strong and stable confidence from analysts.

Which company has the best grades?

Both CrowdStrike and MongoDB carry a consensus Buy rating, but MongoDB shows a more stable pattern with solely maintained positive ratings and no recent downgrades. This may suggest steadier analyst confidence, which investors might consider when assessing risk and potential in their portfolios.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for CrowdStrike Holdings, Inc. (CRWD) and MongoDB, Inc. (MDB) based on their latest financial and operational data.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | MongoDB, Inc. (MDB) |

|---|---|---|

| Diversification | Moderate: Mainly subscription-driven with growing professional services (3.76B subscription in 2025) | Moderate: Strong MongoDB Atlas revenue (1.41B), plus other subscriptions and services |

| Profitability | Low: Slightly unfavorable margins, ROIC 0.7%, ROE -0.59%, net margin -0.49% | Low: Negative margins and ROIC -7.36%, ROE -4.64%, net margin -6.43% |

| Innovation | High: Growing ROIC trend +114%, indicating improving profitability | High: Positive ROIC trend +63%, signaling improving business efficiency |

| Global presence | Strong: Large subscription base and expanding services globally | Strong: Expanding cloud services globally with Atlas platform |

| Market Share | Significant in cybersecurity market, strong recurring revenue growth | Significant in NoSQL databases, strong Atlas adoption growth |

Key takeaways: Both companies show strong innovation and growth potential with improving ROIC trends despite current profitability challenges. CrowdStrike benefits from a more favorable capital efficiency and liquidity profile, while MongoDB faces more pronounced profitability headwinds but maintains robust revenue growth and market presence. Investors should weigh growth prospects against near-term profit risks carefully.

Risk Analysis

Below is a comparative risk assessment table for CrowdStrike Holdings, Inc. (CRWD) and MongoDB, Inc. (MDB) based on their most recent financial and operational data from 2025.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | MongoDB, Inc. (MDB) |

|---|---|---|

| Market Risk | Beta 1.03 indicates moderate volatility; high valuation multiples increase sensitivity to market shifts. | Beta 1.38 suggests higher volatility; vulnerability to tech sector swings. |

| Debt level | Debt-to-equity 0.24, low leverage, favorable debt coverage. | Very low debt-to-equity 0.01, strong balance sheet, minimal financial risk. |

| Regulatory Risk | Exposure to evolving cybersecurity regulations globally; moderate risk. | Database industry regulations and data privacy laws pose moderate risk. |

| Operational Risk | Negative net margin (-0.49%) and ROE (-0.59%) indicate operational challenges. | Larger negative margins (-6.43%) and ROE (-4.64%) reflect operational inefficiencies. |

| Environmental Risk | Limited direct environmental impact; moderate risk from data center energy use. | Similar profile with moderate environmental considerations. |

| Geopolitical Risk | Global customer base exposes it to trade tensions and geopolitical instability. | Also globally exposed; sensitive to US-China tech tensions and data laws. |

CrowdStrike faces moderate market risk with operational performance showing slight losses, while maintaining manageable debt. MongoDB experiences higher volatility and operational inefficiencies, despite a stronger balance sheet. The most impactful risks for both are operational losses and market volatility, requiring cautious evaluation before investing.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) shows strong revenue growth of 29.4% in 2025 and a favorable global income statement evaluation. Its financial ratios are mixed, with 43% favorable and 43% unfavorable, and it carries low debt with a net debt to EBITDA of -12. The company is shedding value but improving profitability, earning a very favorable rating.

MongoDB, Inc. (MDB) reports 19.2% revenue growth in 2025 and an overall favorable income statement evaluation. Its financial ratios are less favorable, with 36% positive and 57% negative assessments, but it maintains very low debt levels. MDB is also shedding value despite growing ROIC, and holds a very favorable rating.

Investors seeking growth with moderate financial stability might find CRWD’s improving profitability and favorable income trends more appealing. Conversely, those prioritizing companies with stronger liquidity and cautious valuations could view MDB’s financial profile and growth trajectory as indicative of potential opportunity.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and MongoDB, Inc. to enhance your investment decisions: