In today’s fast-evolving technology sector, choosing the right software infrastructure company can be challenging yet rewarding. CrowdStrike Holdings, Inc. and Informatica Inc. both innovate in cloud-based solutions, with CrowdStrike focusing on cybersecurity and Informatica specializing in AI-powered data management. Their overlapping markets and distinct growth strategies make them compelling candidates for investors. This article will help you decide which company holds the most promise for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike and Informatica by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. is a leader in cloud-delivered cybersecurity solutions, focusing on protection across endpoints, cloud workloads, identity, and data. Founded in 2011 and based in Austin, Texas, CrowdStrike markets its Falcon platform through direct sales and channel partners. The company serves a global customer base, positioning itself at the forefront of threat intelligence, managed security, and zero trust identity protection within the software infrastructure industry.

Informatica Overview

Informatica Inc. develops an AI-powered platform for enterprise-scale data management, enabling multi-cloud and hybrid system integration. Founded in 1993 and headquartered in Redwood City, California, Informatica offers a comprehensive suite of data integration, quality, governance, and master data management products. Its platform helps organizations unify and govern business-critical data, supporting analytics, compliance, and application integration in the software infrastructure sector.

Key similarities and differences

Both CrowdStrike and Informatica operate within the software infrastructure industry, offering cloud-based platforms that enhance enterprise operations through security and data management respectively. CrowdStrike centers on cybersecurity services with a subscription model focused on threat detection and identity protection. In contrast, Informatica emphasizes data integration and AI-driven data governance tools, with a wider scope in data management and application integration. Their business models reflect distinct yet complementary approaches to enterprise technology needs.

Income Statement Comparison

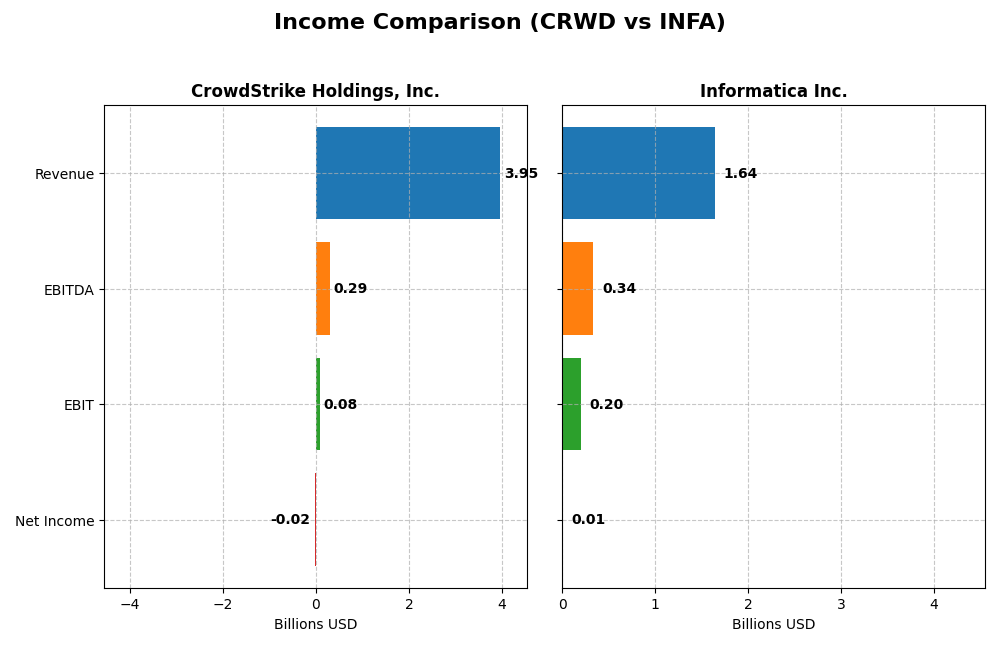

This table presents a side-by-side comparison of the most recent fiscal year income statement metrics for CrowdStrike Holdings, Inc. and Informatica Inc.

| Metric | CrowdStrike Holdings, Inc. | Informatica Inc. |

|---|---|---|

| Market Cap | 114.4B | 7.54B |

| Revenue | 3.95B | 1.64B |

| EBITDA | 295M | 339M |

| EBIT | 81M | 199M |

| Net Income | -19.3M | 9.93M |

| EPS | -0.08 | 0.033 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

CrowdStrike showed strong revenue growth from 2021 to 2025, increasing by over 350%, with a gross margin near 75%, reflecting efficient cost control. However, net income turned negative in 2025 after positive earnings in 2024, causing net margin deterioration. Despite a 29% revenue rise in 2025, EBIT and net margins declined, indicating rising operating expenses impacting profitability.

Informatica Inc.

Informatica’s revenue grew moderately by 24% from 2020 to 2024, maintaining a high gross margin above 80%. EBIT margin improved significantly to over 12% in 2024, supported by controlled operating expenses. The 2024 fiscal year saw modest revenue growth of 2.8%, but marked improvements in EBIT and net margin, reflecting better operational efficiency and profitability gains.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement trends, with CrowdStrike delivering rapid top-line growth but facing recent profitability challenges, whereas Informatica shows more stable revenue growth and stronger margin improvements. Informatica’s higher EBIT margin and positive net margin contrast with CrowdStrike’s negative net margin in 2025. Overall, Informatica presents more consistent profitability metrics, while CrowdStrike emphasizes aggressive expansion.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for CrowdStrike Holdings, Inc. and Informatica Inc., reflecting their fiscal year 2024 performances.

| Ratios | CrowdStrike Holdings, Inc. (CRWD) | Informatica Inc. (INFA) |

|---|---|---|

| ROE | 3.9% | 0.4% |

| ROIC | -0.04% | 0.56% |

| P/E | 781.4 | 787.9 |

| P/B | 30.3 | 3.39 |

| Current Ratio | 1.67 | 1.82 |

| Quick Ratio | 1.67 | 1.82 |

| D/E (Debt-to-Equity) | 0.34 | 0.81 |

| Debt-to-Assets | 12.0% | 35.2% |

| Interest Coverage | -0.08 | 0.87 |

| Asset Turnover | 0.46 | 0.31 |

| Fixed Asset Turnover | 4.57 | 8.75 |

| Payout ratio | 0% | 0.12% |

| Dividend yield | 0% | 0.00015% |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike shows a mixed ratio profile with 43% favorable and 43% unfavorable metrics, reflecting a neutral overall stance. Key concerns include negative net margin (-0.49%) and return on equity (-0.59%), indicating profitability challenges. The company maintains a strong current ratio (1.67) and low debt levels (debt to assets at 9.07%). CrowdStrike does not pay dividends, likely due to ongoing reinvestment in growth and R&D.

Informatica Inc.

Informatica lacks available data for key financial ratios, key metrics, and valuation measures, preventing a comprehensive ratio analysis. This absence restricts insights into profitability, liquidity, and capital structure. Informatica also does not pay dividends, possibly reflecting reinvestment priorities or growth phase focus, but without financial ratios, a detailed interpretation is not possible.

Which one has the best ratios?

Based on the available data, CrowdStrike presents a balanced but somewhat mixed ratio profile with notable weaknesses in profitability yet strengths in liquidity and leverage. Informatica’s missing data precludes a valid comparison. Therefore, CrowdStrike’s ratios provide more insight, though with caution due to its unfavorable profit metrics.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and Informatica, focusing on Market position, Key segments, and Exposure to technological disruption:

CrowdStrike

- Leading cybersecurity platform with strong market cap and competitive pressure in software infrastructure.

- Key revenue from subscription services on Falcon platform; professional services are a smaller segment.

- Operates in cloud-delivered endpoint protection; exposed to rapid cybersecurity tech evolution.

Informatica

- Data management platform focusing on AI-powered multi-cloud and hybrid enterprise solutions.

- Diverse data products including integration, quality, governance, and customer 360 solutions.

- AI-driven data management platform exposed to evolving AI and cloud integration technologies.

CrowdStrike vs Informatica Positioning

CrowdStrike shows a concentrated focus on cybersecurity subscriptions, leveraging cloud delivery, while Informatica offers a diversified suite of AI-powered data management products. CrowdStrike’s specialization contrasts with Informatica’s broader product ecosystem.

Which has the best competitive advantage?

CrowdStrike’s MOAT evaluation shows slightly unfavorable value creation but improving profitability, indicating a modest competitive advantage. Informatica’s MOAT data is unavailable, preventing a direct competitive advantage comparison.

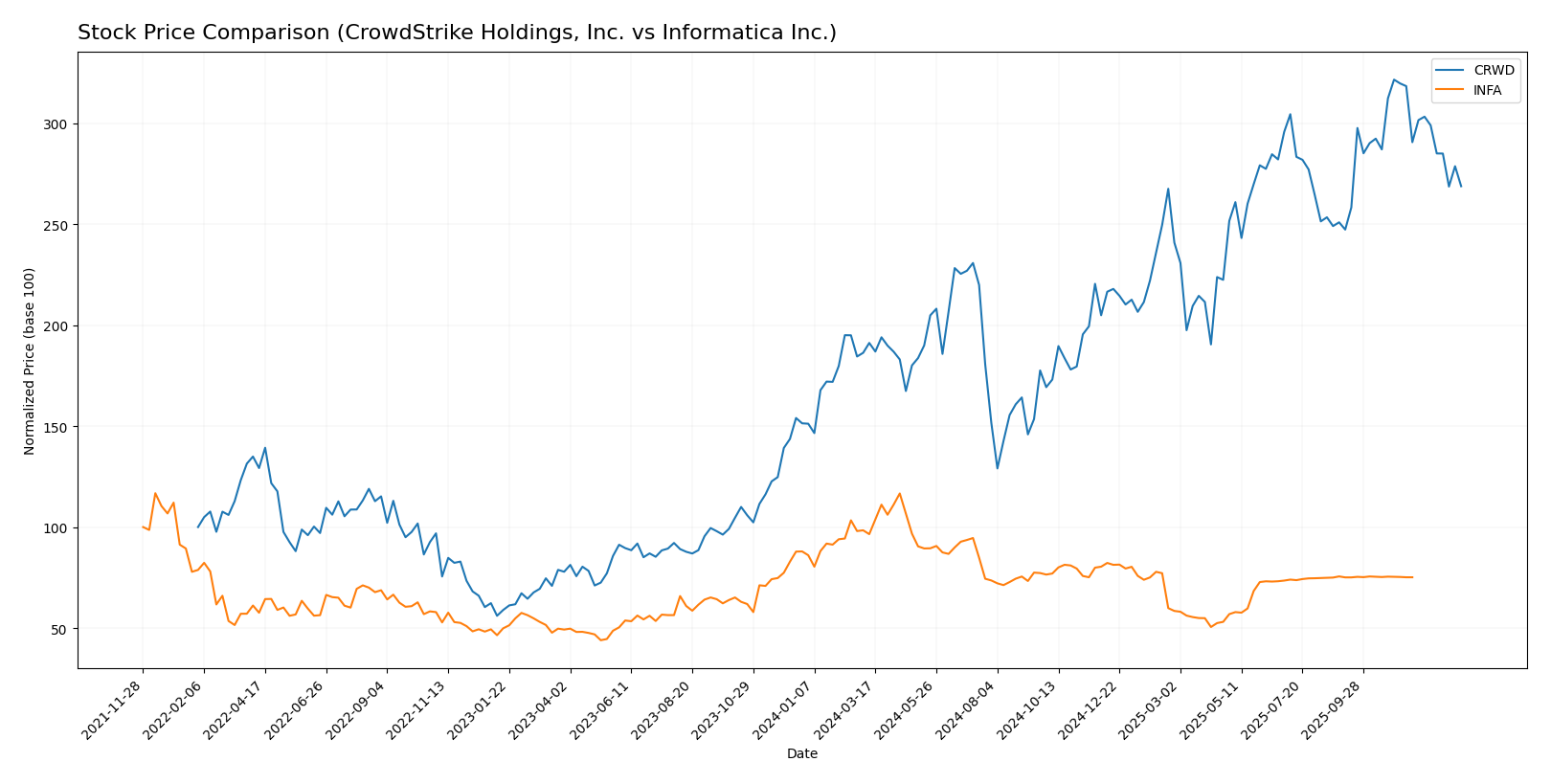

Stock Comparison

The stock price movements of CrowdStrike Holdings, Inc. (CRWD) and Informatica Inc. (INFA) over the past 12 months reveal divergent trading dynamics, with CRWD showing a strong overall gain despite recent pullbacks, while INFA has faced a consistent decline with some stabilization toward the end of the period.

Trend Analysis

CrowdStrike’s stock price increased by 45.71% over the past year, indicating a bullish trend with deceleration. The price ranged between 217.89 and 543.01, featuring high volatility with a standard deviation of 80.53. Recent months saw a 16.41% decrease.

Informatica’s stock declined by 12.68% over the same period, marking a bearish trend with acceleration. Price fluctuations were limited between 16.67 and 38.48 with low volatility (std deviation 4.46). The recent trend was neutral, with a marginal 0.08% gain.

Comparing both, CrowdStrike delivered the highest market performance over the last year, showing significant appreciation versus Informatica’s sustained decline.

Target Prices

The analyst consensus reveals a bullish outlook for CrowdStrike Holdings, Inc., while Informatica Inc. shows a stable target price.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| Informatica Inc. | 27 | 27 | 27 |

For CrowdStrike, the consensus target price of 553.47 USD is notably higher than its current price of 453.88 USD, indicating potential upside. Informatica’s target price matches its current price of 24.79 USD, reflecting neutral analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. and Informatica Inc.:

Rating Comparison

CRWD Rating

- Rating: C, assessed as Very Favorable overall.

- Discounted Cash Flow Score: 4, indicating Favorable value.

- ROE Score: 1, considered Very Unfavorable for profitability.

- ROA Score: 1, rated Very Unfavorable for asset efficiency.

- Debt To Equity Score: 3, Moderate financial risk level.

- Overall Score: 2, categorized as Moderate overall rating.

INFA Rating

- No rating data available.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

Which one is the best rated?

Based strictly on the provided data, CrowdStrike holds a clear advantage with a complete rating profile, including a Very Favorable overall rating and a Favorable DCF score. Informatica lacks any available ratings or scores for comparison.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score of CrowdStrike (CRWD) and Informatica (INFA):

CRWD Scores

- Altman Z-Score: 12.38, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 4, categorized as average financial strength.

INFA Scores

- Altman Z-Score: 1.94, placing it in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 6, also indicating average financial strength.

Which company has the best scores?

Based on the provided data, CRWD has a significantly higher Altman Z-Score, suggesting better financial stability. INFA has a higher Piotroski Score but both companies are rated average in this metric. Overall, CRWD’s scores indicate stronger financial health.

Grades Comparison

Here is a comparison of the latest financial grades for CrowdStrike Holdings, Inc. and Informatica Inc.:

CrowdStrike Holdings, Inc. Grades

The following table summarizes recent grades assigned by reputable financial institutions for CrowdStrike Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

CrowdStrike’s grades predominantly reflect a positive outlook, with most institutions maintaining or upgrading to Buy ratings, though a few more cautious views are present.

Informatica Inc. Grades

The following table summarizes recent grades assigned by reputable financial institutions for Informatica Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Informatica’s grades show a generally neutral to cautious consensus, with multiple downgrades and no Buy ratings in recent updates.

Which company has the best grades?

CrowdStrike Holdings, Inc. has received consistently higher grades, predominantly Buy and Overweight ratings, compared to Informatica Inc., which mostly holds Neutral and Hold ratings. This suggests that investors might perceive CrowdStrike as having stronger growth prospects or better market positioning relative to Informatica.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses of CrowdStrike Holdings, Inc. (CRWD) and Informatica Inc. (INFA) based on the most recent data available.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | Informatica Inc. (INFA) |

|---|---|---|

| Diversification | Moderate: Primarily subscription-based with growing professional services segment (3.76B and 192M in 2025) | Moderate: Mix of subscription and license/service revenue, with significant professional services (1.1B subscription, 78M services in 2024) |

| Profitability | Weak: Negative net margin (-0.49%) and ROE (-0.59%); ROIC slightly positive but below WACC, indicating value destruction | Data unavailable; unable to assess profitability precisely |

| Innovation | Strong: High ROIC growth trend (+114%) suggests improving operational efficiency and innovation | Data unavailable; innovation assessment limited |

| Global presence | Strong: Large and growing subscription base indicates wide-reaching customer adoption | Moderate: Established presence in data management and integration markets, but less visibility on global reach |

| Market Share | Growing: Subscription revenue increased sharply from 436M in 2020 to 3.76B in 2025, signaling strong market traction | Stable: License and service revenues steady but with slower growth compared to CRWD |

Key takeaway: CrowdStrike demonstrates rapid revenue growth and improving operational metrics but still struggles with profitability and value creation. Informatica’s financial details are limited, making definitive assessment difficult, though its diversified revenue streams indicate steady market positioning. Investors should weigh CrowdStrike’s growth potential against its current profitability challenges while seeking more data on Informatica.

Risk Analysis

Below is a comparison of key risks for CrowdStrike Holdings, Inc. (CRWD) and Informatica Inc. (INFA) based on the most recent data available for 2025.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | Informatica Inc. (INFA) |

|---|---|---|

| Market Risk | Beta 1.03, moderate volatility | Beta 1.14, slightly higher volatility |

| Debt level | Low debt-to-equity 0.24, low leverage | Data unavailable |

| Regulatory Risk | Moderate, tech industry compliance and data privacy concerns | Moderate, data governance regulations apply |

| Operational Risk | High due to cybersecurity threats and innovation pace | Moderate, AI platform complexity |

| Environmental Risk | Low, primarily software services | Low, software services with cloud operations |

| Geopolitical Risk | Moderate, global customer base exposure | Moderate, U.S.-centric but global clients |

CrowdStrike faces notable operational risks linked to cybersecurity threats and innovation demands, with moderate market risk and solid financial stability (low debt, favorable liquidity). Informatica shows slightly more market volatility and remains in a grey zone for financial distress with limited debt data, posing some uncertainty. The most impactful risk for CrowdStrike is operational, while for Informatica, market and regulatory risks warrant close attention.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) has shown strong revenue growth of 29.4% in 2025 with a favorable gross margin near 75%. Despite negative net margin and return on equity, it maintains a low debt level and a solid current ratio of 1.67. Its global ratio evaluation is neutral, and the company has a slightly unfavorable moat due to ROIC below WACC but improving profitability. CRWD holds a very favorable overall rating with moderate financial scores and a bullish long-term price trend.

Informatica Inc. (INFA) reports a favorable gross margin above 80% and a positive EBIT margin of 12.15%. Its net margin is neutral at 0.61%, with moderate debt levels and a current ratio of 1.82. Income statement growth is modest but mostly favorable over the period. The company’s Altman Z-Score places it in the grey zone, indicating moderate financial risk. INFA has experienced a bearish overall price trend but a stable recent price movement.

For investors prioritizing strong income growth and a favorable rating, CRWD might appear more attractive given its robust revenue expansion and improving profitability despite some financial ratio challenges. Conversely, those with a focus on steadier margins and moderate financial risk may find INFA’s profile more suitable. The choice could depend on the investor’s risk tolerance and strategic focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and Informatica Inc. to enhance your investment decisions: