In the fast-evolving technology sector, selecting the right company to invest in can be challenging yet rewarding. CrowdStrike Holdings, Inc. (CRWD) and GoDaddy Inc. (GDDY) both operate within the software infrastructure industry but target distinct niches—cybersecurity and cloud-based digital identity services, respectively. Their innovation strategies and market approaches create a compelling comparison. Join me as we analyze which company stands out as the more promising investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike Holdings, Inc. and GoDaddy Inc. by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. is a leading provider of cloud-delivered protection focusing on endpoints, cloud workloads, identity, and data security. The company offers a range of products including threat intelligence, managed security services, and Zero Trust identity protection. Founded in 2011 and based in Austin, Texas, CrowdStrike primarily sells subscriptions to its Falcon platform globally through a direct sales team and channel partners.

GoDaddy Overview

GoDaddy Inc. specializes in cloud-based technology products aimed at establishing and securing digital identities, primarily serving small businesses and individuals. Its offerings include domain registration, website hosting, marketing tools, security products, and business applications. Incorporated in 2014 and headquartered in Tempe, Arizona, GoDaddy provides a broad suite of services to support online presence, e-commerce, and digital marketing.

Key similarities and differences

Both CrowdStrike and GoDaddy operate in the technology sector, focusing on software infrastructure with cloud-based solutions. While CrowdStrike centers on cybersecurity and threat protection for enterprises, GoDaddy targets digital identity and website management for small businesses and individuals. Their business models share subscription revenue streams but differ significantly in customer focus and service portfolios.

Income Statement Comparison

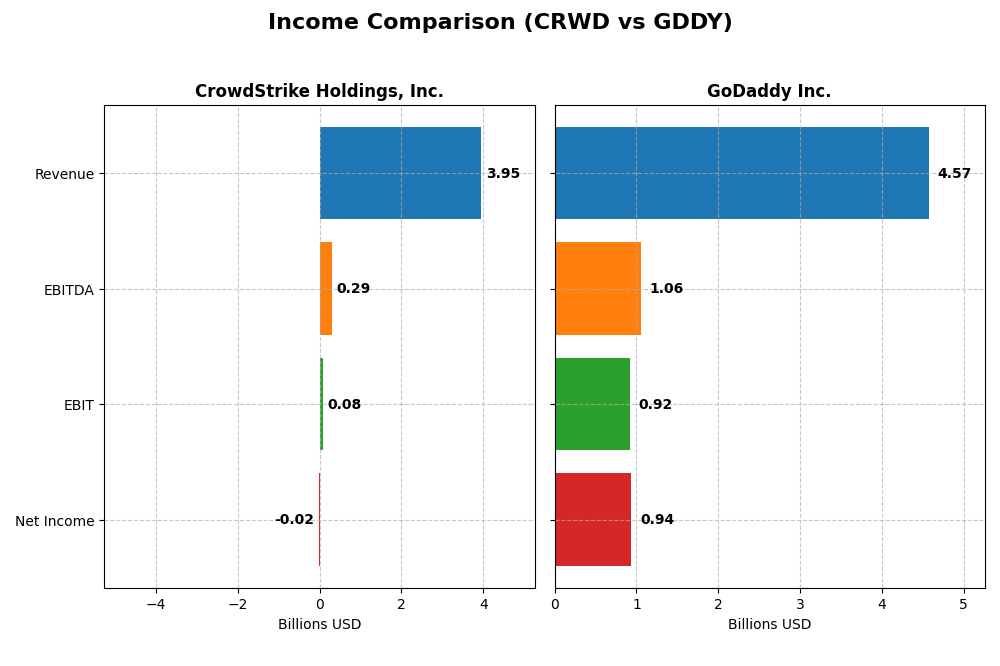

This table presents a side-by-side comparison of key income statement metrics for CrowdStrike Holdings, Inc. and GoDaddy Inc. for their most recent fiscal years.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Cap | 114.4B | 14.5B |

| Revenue | 3.95B | 4.57B |

| EBITDA | 295M | 1.06B |

| EBIT | 81M | 924M |

| Net Income | -19.3M | 937M |

| EPS | -0.08 | 6.63 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

CrowdStrike experienced strong revenue growth from 2021 to 2025, reaching $3.95B in 2025, with a notable 29.4% increase year-over-year. Gross margins remained high at 74.9%, but net income turned negative in 2025, posting a slight loss of $19M despite prior positive earnings. Operating expenses grew in line with revenue, pressuring EBIT and net margins in the latest year.

GoDaddy Inc.

GoDaddy’s revenue steadily increased over the 2020-2024 period, attaining $4.57B in 2024, a 7.5% rise from the previous year. The company maintained favorable gross and EBIT margins at 63.9% and 20.2%, respectively. Although net income grew substantially overall, it declined by 36.6% in 2024 to $937M, reflecting margin compression despite operational efficiencies.

Which one has the stronger fundamentals?

Both companies show favorable income statement trends, but GoDaddy exhibits stronger profitability metrics with consistent positive net margins around 20%, higher EBIT margins, and significant net income growth over the period. CrowdStrike shows impressive revenue expansion and gross margins but faces challenges with recent net losses and margin declines. Overall, GoDaddy’s fundamentals appear more robust based on income statement stability and profitability.

Financial Ratios Comparison

The table below presents a comparative overview of key financial ratios for CrowdStrike Holdings, Inc. and GoDaddy Inc. based on their most recent fiscal year data.

| Ratios | CrowdStrike Holdings, Inc. (2025) | GoDaddy Inc. (2024) |

|---|---|---|

| ROE | -0.59% | 135.37% |

| ROIC | 0.70% | 16.02% |

| P/E | -5055.7 | 29.76 |

| P/B | 29.71 | 40.28 |

| Current Ratio | 1.67 | 0.72 |

| Quick Ratio | 1.67 | 0.72 |

| D/E (Debt-to-Equity) | 0.24 | 5.63 |

| Debt-to-Assets | 9.07% | 47.29% |

| Interest Coverage | -4.58 | 5.64 |

| Asset Turnover | 0.45 | 0.56 |

| Fixed Asset Turnover | 4.76 | 22.22 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike shows a mixed financial profile with strong liquidity (current and quick ratios at 1.67) and low leverage (debt/equity 0.24), but weak profitability as net margin (-0.49%) and ROE (-0.59%) are unfavorable. Asset turnover is low at 0.45, indicating efficiency concerns. The company does not pay dividends, likely reinvesting earnings to support growth and R&D.

GoDaddy Inc.

GoDaddy exhibits strong profitability metrics, with a net margin of 20.49% and ROE of 135.37%, but weak liquidity (current ratio 0.72) and high debt/equity ratio of 5.63, which may signal financial risk. Asset turnover is moderate at 0.56. Like CrowdStrike, GoDaddy does not distribute dividends, possibly focusing on reinvestment and acquisitions to fuel expansion.

Which one has the best ratios?

Both companies present a balanced mix of strengths and weaknesses, resulting in a neutral overall rating. CrowdStrike benefits from solid liquidity and low leverage but struggles with profitability, while GoDaddy demonstrates robust profit returns yet faces liquidity and leverage challenges. Neither pays dividends, reflecting growth-oriented strategies.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and GoDaddy, including Market position, Key segments, and Exposure to technological disruption:

CrowdStrike

- Leading cloud-delivered cybersecurity provider facing competition in software infrastructure sector.

- Focused on subscription sales of Falcon platform, professional services; key drivers are cybersecurity and IT management.

- Positioned in evolving cybersecurity with potential vulnerability to rapid tech changes in cloud and identity protection.

GoDaddy

- Established cloud-based technology provider with competitive pressure in domain registration and hosting.

- Diverse offerings including domain registration, hosting, business applications, and digital marketing tools.

- Exposure to disruption in cloud services and online presence management, adapting with integrated digital tools.

CrowdStrike vs GoDaddy Positioning

CrowdStrike concentrates on cybersecurity subscriptions and services, while GoDaddy offers a diversified portfolio of domain, hosting, and business applications. CrowdStrike’s specialization provides focused growth, GoDaddy’s breadth targets multiple customer needs but may dilute focus.

Which has the best competitive advantage?

GoDaddy demonstrates a very favorable moat with ROIC exceeding WACC and growing profitability, indicating durable competitive advantage. CrowdStrike shows slightly unfavorable moat status, shedding value despite improving ROIC trends.

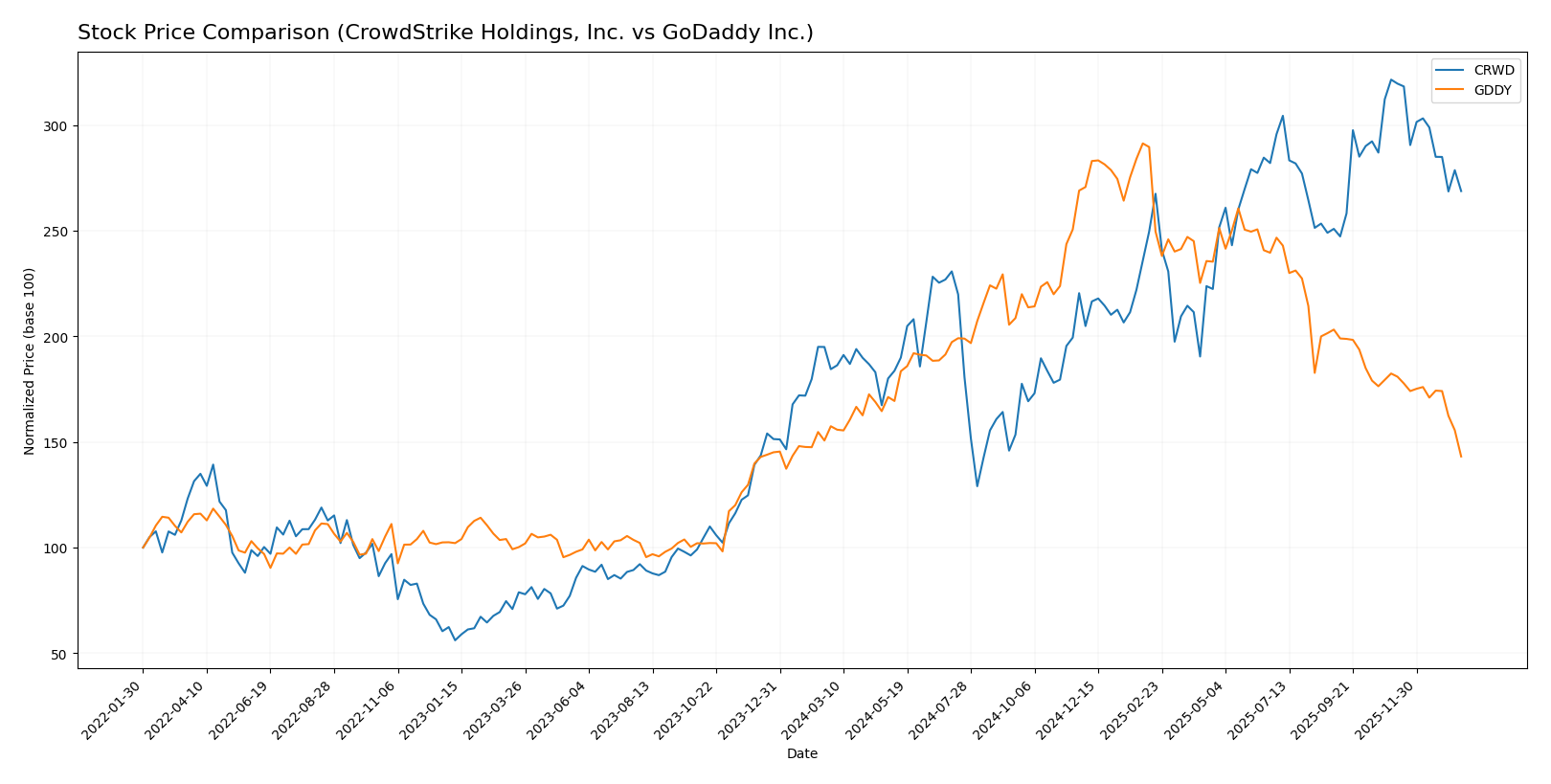

Stock Comparison

The stock price chart highlights significant divergence in performance between CrowdStrike Holdings, Inc. and GoDaddy Inc. over the past 12 months, with CrowdStrike demonstrating strong gains despite recent pullbacks, while GoDaddy has trended downward overall.

Trend Analysis

CrowdStrike Holdings, Inc. exhibited a bullish trend over the past 12 months with a 45.71% price increase, though momentum has decelerated recently with a 16.41% decline since November 2025. Volatility remains high with a standard deviation of 80.53.

GoDaddy Inc. showed a bearish trend over the same period, with a 9.09% price drop and decelerating trend. The stock’s recent decline accelerated, falling 21.54% since November 2025, with lower volatility at 27.35 standard deviation.

Comparing trends, CrowdStrike delivered the highest market performance over the past year, outperforming GoDaddy both in price appreciation and overall trend strength.

Target Prices

Analysts provide a clear consensus on target prices for CrowdStrike Holdings, Inc. and GoDaddy Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

The target consensus for CrowdStrike suggests a strong upside potential from its current price of 453.88 USD, while GoDaddy’s consensus indicates a moderate increase from its current 104.46 USD. Analysts expect growth but with varying risk ranges.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. (CRWD) and GoDaddy Inc. (GDDY):

Rating Comparison

CRWD Rating

- Rating: C, considered Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation based on cash flow.

- ROE Score: 1, Very Unfavorable, showing low efficiency in generating profit from equity.

- ROA Score: 1, Very Unfavorable, indicating poor asset utilization.

- Debt To Equity Score: 3, Moderate, suggesting moderate financial risk.

- Overall Score: 2, Moderate overall financial standing.

GDDY Rating

- Rating: B+, also Very Favorable in analysts’ view.

- Discounted Cash Flow Score: 5, rated Very Favorable, indicating strong cash flow prospects.

- ROE Score: 5, Very Favorable, showing high efficiency in using shareholders’ equity.

- ROA Score: 4, Favorable, demonstrating effective use of assets to generate earnings.

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk due to debt.

- Overall Score: 3, Moderate, but higher than CRWD in overall financial health.

Which one is the best rated?

Based strictly on the provided data, GDDY is better rated overall, showing stronger scores in discounted cash flow, return on equity, and return on assets, despite a weaker debt-to-equity score compared to CRWD.

Scores Comparison

This section compares the Altman Z-Score and Piotroski Score of the two companies:

CRWD Scores

- Altman Z-Score: 12.38, in the safe zone, indicating very low bankruptcy risk.

- Piotroski Score: 4, average financial strength, indicating moderate health.

GDDY Scores

- Altman Z-Score: 1.53, in the distress zone, indicating high bankruptcy risk.

- Piotroski Score: 8, very strong financial strength, indicating robust health.

Which company has the best scores?

CRWD has a much higher Altman Z-Score, indicating lower bankruptcy risk, while GDDY exhibits a stronger Piotroski Score, reflecting better financial strength. Each company leads in one score based on the data provided.

Grades Comparison

Here is the grades comparison for CrowdStrike Holdings, Inc. and GoDaddy Inc.:

CrowdStrike Holdings, Inc. Grades

The following table summarizes recent grades from recognized grading companies for CrowdStrike Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

Overall, CrowdStrike’s grades reflect a predominantly positive outlook with multiple buy ratings and some sector weight or equal weight ratings, indicating cautious optimism.

GoDaddy Inc. Grades

The following table summarizes recent grades from recognized grading companies for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

GoDaddy’s grades show a mixed but generally stable outlook, with several buy and overweight ratings balanced by neutral and hold assessments.

Which company has the best grades?

CrowdStrike has received a stronger consensus with a higher number of buy ratings and upgrades compared to GoDaddy’s mix of buy, hold, and neutral grades. This suggests investors see greater growth or value potential in CrowdStrike, while GoDaddy’s more moderate grades reflect steady but less bullish expectations.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of CrowdStrike Holdings, Inc. (CRWD) and GoDaddy Inc. (GDDY) based on their latest financial and operational data.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Focused on cybersecurity with growing subscription revenues; limited product diversification | Broad product portfolio including Core Platform and Applications & Commerce segments |

| Profitability | Currently unprofitable with negative net margin (-0.49%) and ROE (-0.59%) | Strong profitability with net margin at 20.49% and ROE at 135.37% |

| Innovation | Demonstrates growing ROIC trend but still shedding value (ROIC – WACC: -7.94%) | Durable competitive advantage with very favorable ROIC vs WACC (+8.60%) |

| Global presence | Expanding through subscriptions and professional services globally | Established global presence in domain registration and hosting services |

| Market Share | Growing subscription base but faces competitive pressures | Large market share in web services with consistent revenue growth |

Key takeaway: GoDaddy exhibits a robust and profitable business model with a wide product range and strong competitive moat, while CrowdStrike is in a growth phase with improving profitability but currently not value-creating, implying higher risk for investors.

Risk Analysis

The table below summarizes key risk factors for CrowdStrike Holdings, Inc. (CRWD) and GoDaddy Inc. (GDDY) based on the latest available data for 2025 and 2024 respectively.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | Beta 1.03, moderate volatility | Beta 0.95, slightly less volatile |

| Debt level | Low debt/equity 0.24, favorable | High debt/equity 5.63, unfavorable |

| Regulatory Risk | Moderate, tech sector compliance | Moderate, domain & hosting regulations |

| Operational Risk | Medium, reliant on cloud platform | Medium, diverse cloud products |

| Environmental Risk | Low, minimal direct impact | Low, limited exposure |

| Geopolitical Risk | Moderate, global customer base | Moderate, US-centric but international |

In synthesis, both companies face moderate market and regulatory risks typical of the technology infrastructure sector. CrowdStrike’s low debt and strong liquidity mitigate financial risk, despite its unfavorable profitability ratios. GoDaddy, while showing strong profitability and a very strong Piotroski score, carries significant debt burden and a lower liquidity profile, increasing financial risk. The most impactful risk for GoDaddy is its high leverage, while for CrowdStrike, operational execution and profitability remain areas to watch carefully.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) shows a favorable income statement with 29.4% revenue growth in 2025 and a 57% favorable income evaluation overall. Its financial ratios are mixed, with 43% favorable and 43% unfavorable ratings, a low debt ratio, and a moderate credit rating of C. The company is slightly value-destroying as ROIC remains below WACC, despite improving profitability.

GoDaddy Inc. (GDDY) presents a strong income statement with 78.6% favorable ratings and solid profitability metrics, including a 20.5% net margin and 7.5% revenue growth in 2024. Financial ratios are equally balanced at 43% favorable and 43% unfavorable, but with higher leverage and a better credit rating of B+. The company creates value with ROIC well above WACC and a durable competitive advantage.

Investors focused on growth might find CRWD’s accelerating revenue and improving profitability attractive, while those prioritizing value creation and financial strength might see GDDY as more favorable given its strong ROIC, higher income quality, and superior ratings. Risk-averse investors may weigh GDDY’s value-creation moat against CRWD’s mixed financial profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and GoDaddy Inc. to enhance your investment decisions: