In the fast-evolving world of cybersecurity, choosing the right investment requires understanding market leaders and innovators. CrowdStrike Holdings, Inc. and CyberArk Software Ltd. both operate in the software infrastructure sector, focusing on security solutions that protect enterprises from growing digital threats. While CrowdStrike excels in cloud-delivered endpoint protection, CyberArk specializes in privileged access management and identity security. This article will help you decide which company offers the most compelling opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike and CyberArk by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. delivers cloud-based protection for endpoints, cloud workloads, identity, and data. Its offerings include threat intelligence, managed security, threat hunting, Zero Trust identity protection, and log management. Founded in 2011 and based in Austin, Texas, CrowdStrike primarily sells subscription access to its Falcon platform globally through direct sales and channel partners.

CyberArk Overview

CyberArk Software Ltd. develops and markets software security solutions internationally, focusing on privileged access management and identity services. Founded in 1999 and headquartered in Petah Tikva, Israel, CyberArk serves various industries including financial services and healthcare. The company distributes its products via direct sales, distributors, and managed service providers, emphasizing cloud and endpoint privilege security.

Key similarities and differences

Both CrowdStrike and CyberArk operate in the software infrastructure sector with a focus on cybersecurity solutions. CrowdStrike emphasizes cloud-delivered endpoint protection and Zero Trust identity, while CyberArk specializes in privileged access security and identity management services. CrowdStrike has a larger market cap and workforce, contrasting with CyberArk’s broader product suite targeting privileged access across multiple environments.

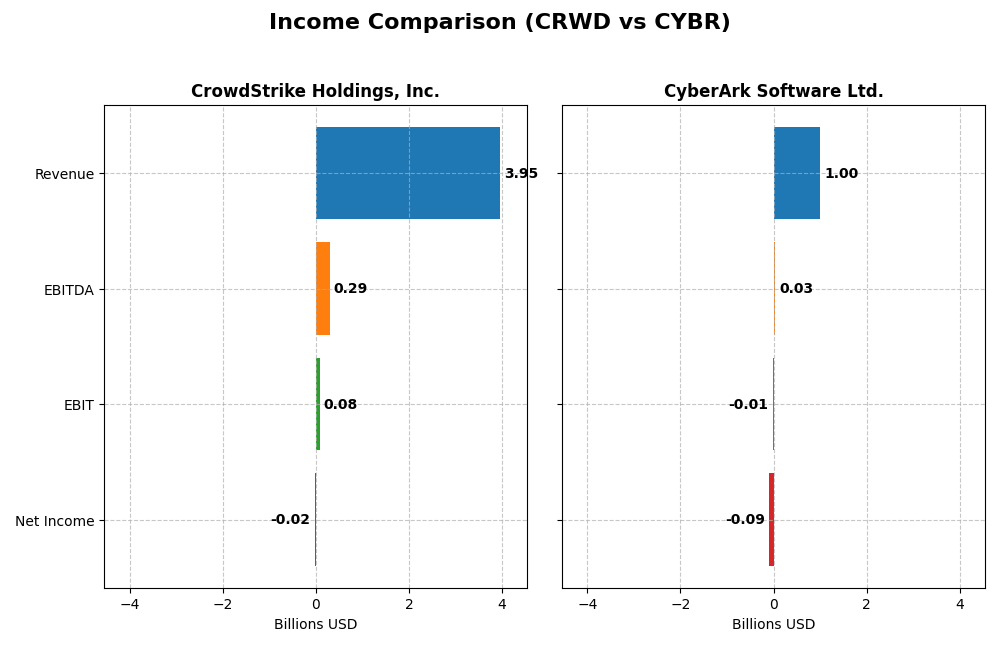

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for CrowdStrike Holdings, Inc. and CyberArk Software Ltd. for their most recent fiscal years.

| Metric | CrowdStrike Holdings, Inc. | CyberArk Software Ltd. |

|---|---|---|

| Market Cap | 114.4B | 22.9B |

| Revenue | 3.95B | 1.00B |

| EBITDA | 295M | 29M |

| EBIT | 81M | -13M |

| Net Income | -19M | -93M |

| EPS | -0.08 | -2.12 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

CrowdStrike exhibited strong revenue growth, surging 352% from 2021 to 2025, with gross margin steady near 75%. However, net income fluctuated, turning negative in 2025 at -$19M despite prior profits. Operating expenses rose in tandem with revenue, pressuring EBIT margin which remained low. The latest year showed solid top-line gains but squeezed profitability and EPS declines.

CyberArk Software Ltd.

CyberArk’s revenue climbed 115% over 2020-2024, supported by a high gross margin around 79%. Yet, net income deteriorated substantially, hitting a -$93M loss in 2024, with a negative EBIT margin. Operating expense growth was controlled relative to revenue, improving EBIT year-on-year. The recent year reflected robust revenue and gross profit expansion but persistent net losses and margin weakness.

Which one has the stronger fundamentals?

CrowdStrike’s fundamentals appear more favorable overall, supported by stronger revenue growth and a positive net income trajectory over the longer term, despite a recent dip. Its gross margin and interest expense ratios are favorable, whereas CyberArk struggles with deepening net losses and EBIT deficits. CyberArk shows operational improvements but faces more pronounced margin challenges, resulting in a neutral overall income statement outlook.

Financial Ratios Comparison

The table below presents a snapshot of key financial ratios for CrowdStrike Holdings, Inc. and CyberArk Software Ltd. based on their most recent fiscal year data, aiding in a straightforward comparison.

| Ratios | CrowdStrike Holdings, Inc. (2025) | CyberArk Software Ltd. (2024) |

|---|---|---|

| ROE | -0.59% | -3.94% |

| ROIC | 0.70% | -2.85% |

| P/E | -5055.7 | -157.5 |

| P/B | 29.7 | 6.21 |

| Current Ratio | 1.67 | 1.48 |

| Quick Ratio | 1.67 | 1.48 |

| D/E | 0.24 | 0.01 |

| Debt-to-Assets | 9.07% | 0.88% |

| Interest Coverage | -4.58 | -17.90 |

| Asset Turnover | 0.45 | 0.30 |

| Fixed Asset Turnover | 4.76 | 51.11 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike shows a mixed ratio profile with favorable liquidity (current and quick ratios at 1.67) and low leverage (debt-to-equity at 0.24), but faces challenges including negative net margin (-0.49%) and return on equity (-0.59%). Asset turnover is weak at 0.45, despite strong fixed asset turnover of 4.76. The company does not pay dividends, reflecting a reinvestment strategy typical for its growth phase.

CyberArk Software Ltd.

CyberArk’s ratios reveal weaknesses in profitability with a net margin of -9.34% and negative returns on equity (-3.94%) and invested capital (-2.85%). Liquidity ratios are moderate with a current ratio of 1.48 and a favorable quick ratio. Debt levels are minimal (debt-to-assets 0.88%). No dividends are paid, consistent with ongoing investment in R&D and growth initiatives. Interest coverage is unfavorable at -3.27.

Which one has the best ratios?

Overall, CrowdStrike has a more balanced ratio set with a higher proportion of favorable metrics (42.86%) versus CyberArk’s 35.71%. CrowdStrike’s stronger liquidity and leverage ratios contrast with CyberArk’s deeper profitability concerns and weaker interest coverage. Both companies share lack of dividend payments, aligning with their growth and reinvestment focus.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and CyberArk, focusing on market position, key segments, and exposure to technological disruption:

CrowdStrike Holdings, Inc.

- Leading market cap of $114B with strong competitive pressure in cloud security.

- Key business drivers: subscription sales for cloud-delivered endpoint protection and professional services.

- Positioned in cloud-delivered protection with potential disruption from emerging cyber threats and identity tech.

CyberArk Software Ltd.

- Smaller $23B market cap, competing in privileged access management segments.

- Diverse revenue from SaaS, subscriptions, maintenance, and licenses in identity/security management.

- Exposure to disruption in privileged access and cloud entitlement management technologies.

CrowdStrike vs CyberArk Positioning

CrowdStrike shows a concentrated focus on cloud endpoint and identity protection subscriptions, driving rapid growth. CyberArk has a more diversified product mix across SaaS, support, and licenses but faces challenges in maintaining profitability.

Which has the best competitive advantage?

Both companies are shedding value per ROIC vs. WACC analysis, but CrowdStrike’s improving ROIC trend suggests a slightly better moat compared to CyberArk’s declining profitability and very unfavorable moat status.

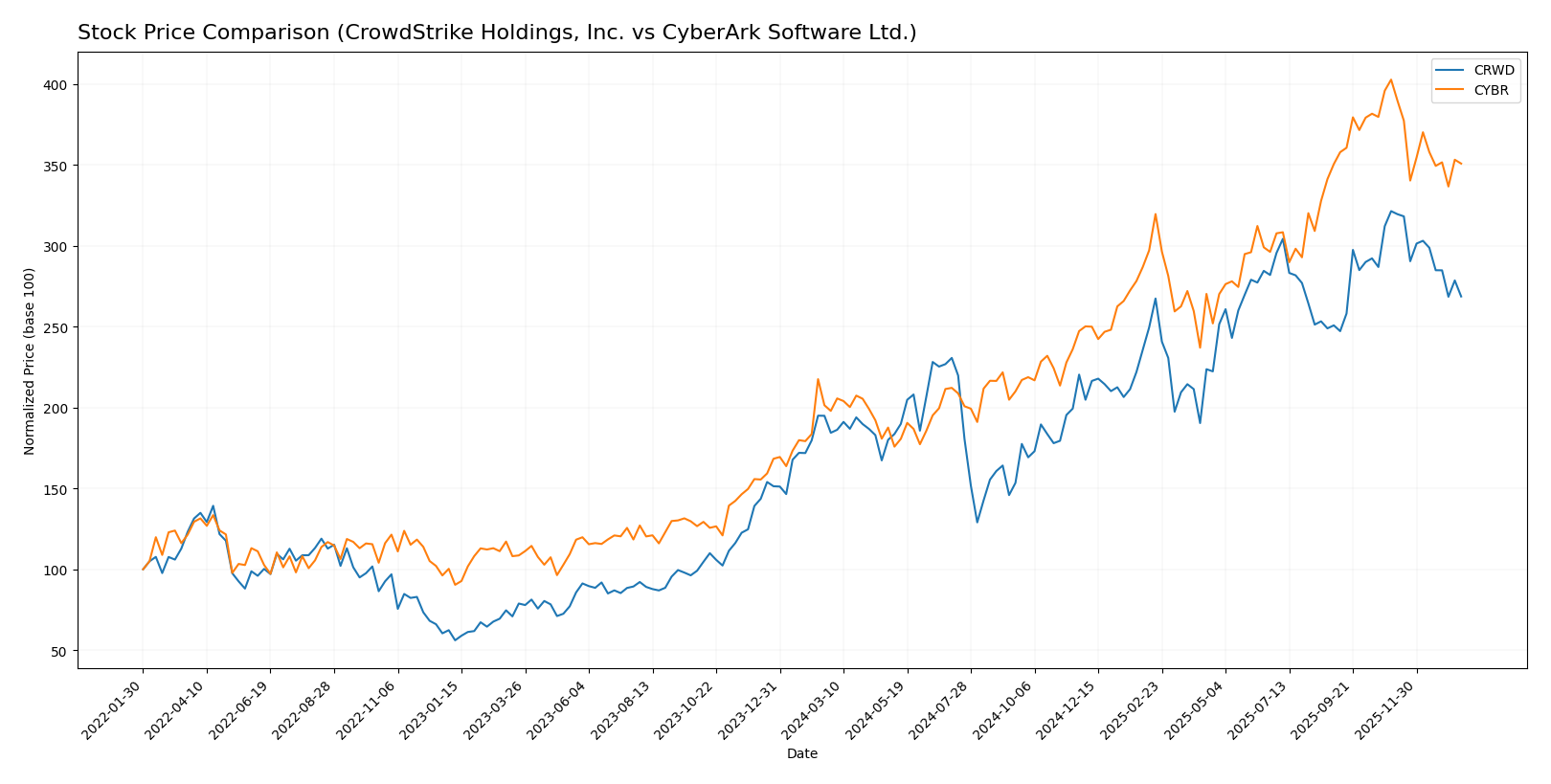

Stock Comparison

The stock price movements of CrowdStrike Holdings, Inc. (CRWD) and CyberArk Software Ltd. (CYBR) over the past year reveal significant bullish trends with recent deceleration and short-term declines, reflecting evolving trading dynamics.

Trend Analysis

CrowdStrike Holdings, Inc. (CRWD) exhibited a 45.71% price increase over the past 12 months, indicating a bullish trend with deceleration. The stock reached a high of 543.01 and a low of 217.89, with notable volatility (std. dev. 80.53).

CyberArk Software Ltd. (CYBR) showed a stronger bullish trend with a 77.27% price increase over the same period, also with deceleration. Its price ranged from 227.32 to 520.78, exhibiting similar volatility (std. dev. 82.45).

Comparing both, CYBR delivered a higher market performance with a 77.27% gain versus CRWD’s 45.71%, despite both experiencing recent short-term price declines and seller dominance.

Target Prices

The current analyst consensus provides a clear range of target prices for both CrowdStrike Holdings, Inc. and CyberArk Software Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| CyberArk Software Ltd. | 520 | 440 | 479.22 |

Analysts expect CrowdStrike’s stock to appreciate significantly above its current price of $453.88, while CyberArk’s consensus target also suggests upside potential from the current $453.65 share price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. and CyberArk Software Ltd.:

Rating Comparison

CRWD Rating

- Rating: C, considered Very Favorable overall by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation based on future cash flows.

- ROE Score: 1, marked as Very Unfavorable, showing low efficiency in generating profit from equity.

- ROA Score: 1, Very Unfavorable, indicating poor asset use to generate earnings.

- Debt To Equity Score: 3, Moderate level of financial risk from debt relative to equity.

- Overall Score: 2, Moderate overall financial performance rating.

CYBR Rating

- Rating: C-, also rated Very Favorable overall by analysts.

- Discounted Cash Flow Score: 3, a Moderate valuation based on future cash flows.

- ROE Score: 1, also Very Unfavorable, showing similarly low profit efficiency.

- ROA Score: 1, Very Unfavorable, similarly indicating poor asset utilization.

- Debt To Equity Score: 2, Moderate but slightly lower score indicating somewhat higher financial risk.

- Overall Score: 1, Very Unfavorable overall financial rating.

Which one is the best rated?

Based strictly on the provided data, CrowdStrike (CRWD) holds a better overall rating and higher discounted cash flow and debt-to-equity scores than CyberArk (CYBR), which has a lower overall score and slightly weaker valuation metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CrowdStrike and CyberArk:

CrowdStrike Scores

- Altman Z-Score: 12.38, indicating a strong safe zone financial position.

- Piotroski Score: 4, reflecting an average financial strength.

CyberArk Scores

- Altman Z-Score: 6.52, also within the safe zone but lower than CrowdStrike.

- Piotroski Score: 3, classified as very weak financial strength.

Which company has the best scores?

Based on the data, CrowdStrike has a higher Altman Z-Score and a better Piotroski Score than CyberArk, indicating stronger overall financial health according to these metrics.

Grades Comparison

Here is a comparison of the latest reliable grades for CrowdStrike Holdings, Inc. and CyberArk Software Ltd.:

CrowdStrike Holdings, Inc. Grades

The following table displays recent grades issued by recognized financial institutions for CrowdStrike Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

Overall, CrowdStrike’s grades mostly indicate a Buy consensus with some variation including Sector Weight and Equal Weight ratings.

CyberArk Software Ltd. Grades

Below is a summary of recent grades from reputable firms for CyberArk Software Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2024-10-22 |

| Keybanc | Maintain | Overweight | 2024-10-18 |

| Mizuho | Maintain | Outperform | 2024-10-17 |

| BTIG | Maintain | Buy | 2024-10-09 |

| Barclays | Maintain | Overweight | 2024-10-07 |

| Wedbush | Maintain | Outperform | 2024-10-01 |

| Jefferies | Maintain | Buy | 2024-09-24 |

| DA Davidson | Maintain | Buy | 2024-08-09 |

| Rosenblatt | Maintain | Buy | 2024-08-09 |

| Susquehanna | Maintain | Positive | 2024-08-09 |

CyberArk’s ratings consistently show strong positive sentiment, predominantly Buy and Outperform grades.

Which company has the best grades?

Both CrowdStrike and CyberArk hold a consensus Buy rating, but CyberArk demonstrates a stronger pattern of Outperform and Overweight grades from multiple firms. This may suggest slightly higher analyst confidence, potentially influencing investor perception and portfolio positioning.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses between CrowdStrike Holdings, Inc. (CRWD) and CyberArk Software Ltd. (CYBR) based on their latest financial performance and strategic positioning.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | CyberArk Software Ltd. (CYBR) |

|---|---|---|

| Diversification | Primarily subscription-based cybersecurity services with growing professional services segment; high reliance on subscription revenue (3.76B in 2025) | More diversified revenue streams including SaaS, self-hosted subscriptions, maintenance, and perpetual licenses, but more legacy license exposure |

| Profitability | Negative net margin (-0.49%) and ROIC (0.7%); slightly unfavorable profitability but improving ROIC trend | Negative net margin (-9.34%) and declining ROIC (-2.85%); profitability deteriorating with value destruction |

| Innovation | Strong innovation evidenced by rapidly growing subscription revenue and improving ROIC trend (+114%) | Innovation slower, with declining ROIC and challenges in transitioning legacy licenses to SaaS |

| Global presence | Significant global presence driving subscription growth | Established global footprint but slower growth and shrinking profitability |

| Market Share | Expanding market share in endpoint security and cloud workload protection | Niche leader in privileged access management but facing competitive pressure |

Key takeaways: CrowdStrike shows promising growth and improving profitability trends despite current value destruction, driven by its dominant cloud subscription model. CyberArk faces more significant challenges with declining profitability and slower innovation, impacted by legacy licensing. Investors should weigh CrowdStrike’s growth potential against CyberArk’s current struggles.

Risk Analysis

Below is a comparative table highlighting key risks associated with CrowdStrike Holdings, Inc. (CRWD) and CyberArk Software Ltd. (CYBR) based on the most recent financial and operational data from 2025 and 2024 respectively:

| Metric | CrowdStrike Holdings, Inc. (CRWD) | CyberArk Software Ltd. (CYBR) |

|---|---|---|

| Market Risk | Moderate (Beta 1.03) | Moderate (Beta 0.92) |

| Debt level | Low (Debt-to-Equity 0.24) | Very Low (Debt-to-Equity 0.01) |

| Regulatory Risk | Moderate (US tech sector scrutiny) | Moderate (International compliance complexity) |

| Operational Risk | Moderate (Scaling cloud services) | Moderate (Global service delivery challenges) |

| Environmental Risk | Low (Primarily software business) | Low (Primarily software business) |

| Geopolitical Risk | Low (US based, global customers) | Moderate (Israeli base, geopolitical tensions in the region) |

The most likely and impactful risks revolve around operational scaling challenges and regulatory scrutiny for both companies, with CyberArk also facing heightened geopolitical risks due to its location. Both firms maintain low debt levels, reducing financial leverage risk, though profitability remains a concern.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) shows favorable income growth with a 29.4% revenue increase in 2025 and a positive long-term net income trend. Despite a negative net margin and ROE, it maintains a solid current ratio of 1.67 and low debt levels, with a neutral global financial ratios opinion and a very favorable overall rating.

CyberArk Software Ltd. (CYBR) experienced strong revenue growth of 33.1% in 2024 but faces challenges with negative net margin and declining profitability ratios. The company has low debt ratios and favorable fixed asset turnover but a slightly unfavorable global financial ratios evaluation and a very favorable rating overall, albeit with weak profitability scores.

For investors prioritizing growth, CRWD’s favorable income trends and improving profitability might appear more attractive, whereas CYBR’s cautious financial ratios and value creation challenges could signal a more conservative profile. The choice could depend on an investor’s tolerance for risk and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and CyberArk Software Ltd. to enhance your investment decisions: