In the dynamic world of construction materials, choosing the right company to invest in requires careful analysis. CRH plc and Martin Marietta Materials, Inc. are two industry leaders with significant market presence and innovation strategies that overlap in supplying essential building products. Both companies play crucial roles in infrastructure and construction markets globally. In this article, I will help you determine which company presents the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between CRH plc and Martin Marietta Materials, Inc. by providing an overview of these two companies and their main differences.

CRH plc Overview

CRH plc, headquartered in Dublin, Ireland, is a leading global provider of building materials solutions. Operating through three segments—Americas Materials Solutions, Americas Building Solutions, and International Solutions—it supplies aggregates, cement, ready-mixed concrete, and asphalt for public infrastructure and residential and commercial construction. With a workforce of 79,800 employees, CRH focuses on complex utility infrastructure and outdoor living solutions across multiple continents.

Martin Marietta Materials, Inc. Overview

Martin Marietta, based in Raleigh, North Carolina, is a natural resource-based building materials company primarily serving the U.S. market and international customers. It offers crushed stone, sand, gravel, ready-mixed concrete, asphalt, and specialty cement for infrastructure, residential, and nonresidential projects. The company also produces magnesia-based chemicals for industrial and environmental applications and employs about 9,400 people, emphasizing chemical products alongside construction materials.

Key similarities and differences

Both companies operate in the construction materials industry, supplying aggregates, cement, concrete, and asphalt mainly for infrastructure and building projects. CRH has a more diversified international presence and a significantly larger workforce, while Martin Marietta focuses heavily on the U.S. market with additional chemical product lines. CRH’s business model includes broader solutions in critical utility infrastructure and outdoor living spaces, contrasting with Martin Marietta’s emphasis on industrial applications of chemical products.

Income Statement Comparison

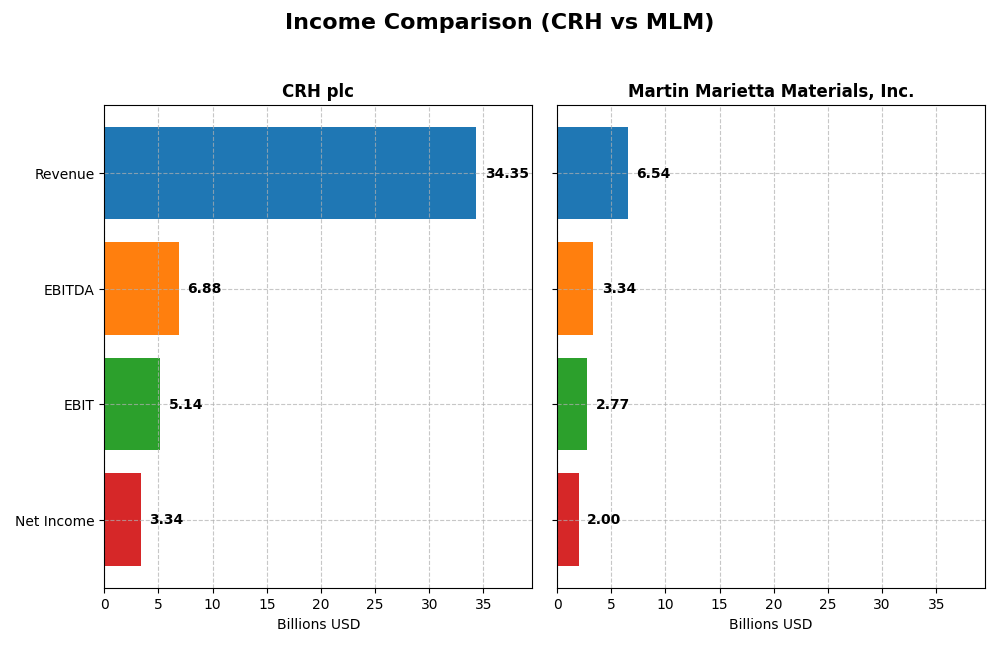

The following table presents a side-by-side comparison of key income statement metrics for CRH plc and Martin Marietta Materials, Inc. for the fiscal year 2024.

| Metric | CRH plc | Martin Marietta Materials, Inc. |

|---|---|---|

| Market Cap | 83.3B | 38.3B |

| Revenue | 34.4B | 6.54B |

| EBITDA | 6.88B | 3.34B |

| EBIT | 5.14B | 2.77B |

| Net Income | 3.34B | 2.00B |

| EPS | 5.06 | 32.50 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CRH plc

CRH plc showed consistent revenue growth from 22B in 2020 to 34.4B in 2024, with net income rising from 916M to 3.34B. Margins improved steadily, with a gross margin of 35.7% and net margin near 9.7% in 2024. The latest year saw an 8.2% revenue increase and a robust 7.7% net margin growth, reflecting strengthened profitability despite slightly rising operating expenses.

Martin Marietta Materials, Inc.

Martin Marietta Materials’ revenue increased from 4.73B in 2020 to 6.54B in 2024, although it declined 3.6% in the last year. Net income expanded from 720M to 2B over five years, supported by a strong net margin of 30.5% in 2024. Despite recent revenue pressure, EBIT and net margin grew substantially by 66.8% and 77% respectively in 2024, signaling improved operational efficiency.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement fundamentals, with CRH showing higher revenue growth and margin stability, while Martin Marietta boasts superior profitability ratios and recent margin expansion. CRH’s broader margin improvements contrast with Martin Marietta’s sharper earnings growth amid revenue decline. Overall, CRH reflects balanced growth and margin consistency, whereas Martin Marietta demonstrates strong profitability gains despite recent top-line softness.

Financial Ratios Comparison

Below is a comparison table of key financial ratios for CRH plc and Martin Marietta Materials, Inc. based on their most recent fiscal year data (2024).

| Ratios | CRH plc | Martin Marietta Materials, Inc. |

|---|---|---|

| ROE | 16.0% | 21.1% |

| ROIC | 8.6% | 12.0% |

| P/E | 18.9 | 15.9 |

| P/B | 3.03 | 3.35 |

| Current Ratio | 1.37 | 2.50 |

| Quick Ratio | 0.91 | 1.40 |

| D/E (Debt to Equity) | 0.71 | 0.61 |

| Debt-to-Assets | 30.2% | 31.9% |

| Interest Coverage | 8.0x | 16.0x |

| Asset Turnover | 0.70 | 0.36 |

| Fixed Asset Turnover | 1.57 | 0.62 |

| Payout ratio | 49.3% | 9.5% |

| Dividend yield | 2.60% | 0.60% |

Interpretation of the Ratios

CRH plc

CRH plc shows a mix of neutral and favorable ratios, with a return on equity at 16.0% and interest coverage at 8.7 indicating solid profitability and debt management. However, the price-to-book ratio of 3.03 is unfavorable, suggesting a potentially high market valuation relative to book value. The dividend yield of 2.6% is favorable, supported by a consistent payout and coverage by free cash flow, with manageable risks of unsustainable distributions.

Martin Marietta Materials, Inc.

Martin Marietta Materials displays stronger profitability metrics, including a net margin of 30.52% and return on equity at 21.1%, both favorable. Its liquidity ratios are also strong, with a current ratio of 2.5 and quick ratio of 1.4. However, lower asset turnover and a dividend yield of 0.6% are unfavorable. The company pays dividends, but the low dividend yield points to modest shareholder returns relative to earnings.

Which one has the best ratios?

Martin Marietta Materials holds more favorable profitability and liquidity ratios than CRH plc but faces weaknesses in asset efficiency and dividend yield. CRH offers more balanced neutrality across ratios with a better dividend yield. Both companies achieve a slightly favorable global evaluation, reflecting strengths in distinct areas without a clear overall superiority.

Strategic Positioning

This section compares the strategic positioning of CRH plc and Martin Marietta Materials, Inc., covering Market position, Key segments, and exposure to technological disruption:

CRH plc

- Large market cap of 83.3B USD, facing competition in international construction materials sector.

- Diverse segments: Americas Materials, Americas Building, International Solutions, infrastructure.

- Exposure to disruption is moderate; no explicit mention of technological threats or innovation.

Martin Marietta Materials, Inc.

- Market cap 38.3B USD, operates mainly in US construction materials with international reach.

- Focused on aggregates, building materials, and magnesia specialties for various industries.

- No direct technological disruption identified; stable in natural resource-based materials.

CRH plc vs Martin Marietta Materials, Inc. Positioning

CRH has a diversified global business across multiple segments, including infrastructure and building solutions, while Martin Marietta concentrates on building materials and specialty chemicals primarily in the US. CRH’s scale offers broad market access, Martin Marietta shows focused product expertise.

Which has the best competitive advantage?

Martin Marietta demonstrates a very favorable moat with ROIC well above WACC and growing profitability, indicating a durable competitive advantage. CRH shows a slightly favorable moat with increasing ROIC but is still shedding value overall.

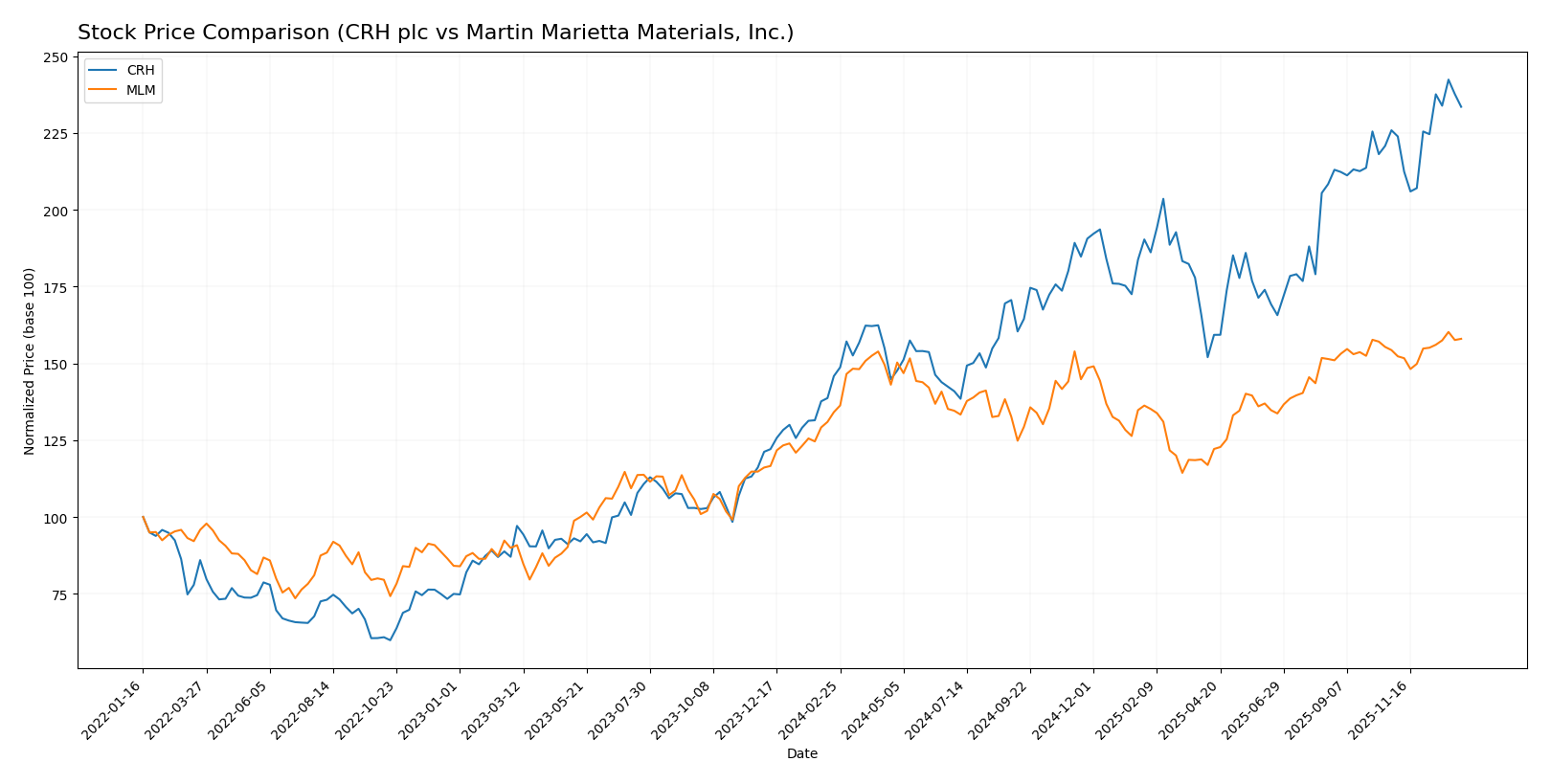

Stock Comparison

The stock price chart highlights significant bullish momentum for both CRH plc and Martin Marietta Materials, Inc. over the past year, with notable price appreciation and dynamic trading volumes reflecting investor interest.

Trend Analysis

CRH plc’s stock recorded a strong bullish trend over the past 12 months, appreciating 60.11% with accelerating gains and a volatility measure of 13.91. It reached a high of 128.94 and a low of 73.67, showing sustained upward momentum.

Martin Marietta Materials, Inc. showed a bullish trend as well, gaining 17.81% over the same period with acceleration and notably higher volatility at 44.3. The stock’s price varied between 460.39 and 645.01, reflecting wider price swings.

Comparing both stocks, CRH plc delivered the highest market performance with a 60.11% gain, outperforming Martin Marietta Materials, Inc.’s 17.81% increase over the past year.

Target Prices

Analysts present a generally positive outlook with target prices indicating moderate upside potential for both CRH plc and Martin Marietta Materials, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CRH plc | 147 | 131 | 138.4 |

| Martin Marietta Materials, Inc. | 730 | 620 | 689.71 |

The consensus target prices for CRH plc and Martin Marietta Materials suggest expected price increases of approximately 11% and 8% respectively compared to their current prices of 124.34 and 635.59 USD. This reflects analysts’ confidence in the companies’ growth prospects within the construction materials sector.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CRH plc and Martin Marietta Materials, Inc.:

Rating Comparison

CRH Rating

- Rating: B, classified as Very Favorable

- Discounted Cash Flow Score: 4, Favorable assessment of future cash flows

- ROE Score: 5, Very Favorable efficiency in generating profit from equity

- ROA Score: 5, Very Favorable asset utilization to generate earnings

- Debt To Equity Score: 1, Very Unfavorable financial risk due to high leverage

- Overall Score: 3, Moderate overall financial standing

MLM Rating

- Rating: B, classified as Very Favorable

- Discounted Cash Flow Score: 4, Favorable assessment of future cash flows

- ROE Score: 4, Favorable efficiency in generating profit from equity

- ROA Score: 5, Very Favorable asset utilization to generate earnings

- Debt To Equity Score: 1, Very Unfavorable financial risk due to high leverage

- Overall Score: 3, Moderate overall financial standing

Which one is the best rated?

Both CRH and MLM share the same overall rating of B and an identical overall score of 3, indicating a moderate standing. CRH scores higher on ROE, while MLM matches CRH on ROA; both have unfavorable debt to equity scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CRH and Martin Marietta Materials, Inc.:

CRH Scores

- Altman Z-Score: 3.47, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

MLM Scores

- Altman Z-Score: 3.82, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Which company has the best scores?

Both CRH and MLM have Altman Z-Scores in the safe zone and identical Piotroski Scores of 7, reflecting similarly strong financial health and low bankruptcy risk based on the provided data.

Grades Comparison

Here is a comparison of the latest available grades for CRH plc and Martin Marietta Materials, Inc.:

CRH plc Grades

The following table shows recent grades assigned to CRH plc by reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-10 |

| DA Davidson | Maintain | Neutral | 2025-11-12 |

| JP Morgan | Maintain | Overweight | 2025-11-11 |

| RBC Capital | Maintain | Outperform | 2025-11-07 |

| Wells Fargo | Maintain | Overweight | 2025-11-07 |

| Barclays | Maintain | Overweight | 2025-10-20 |

| Truist Securities | Maintain | Buy | 2025-10-02 |

| RBC Capital | Maintain | Outperform | 2025-10-01 |

| Bernstein | Maintain | Outperform | 2025-09-11 |

| RBC Capital | Maintain | Outperform | 2025-08-08 |

Overall, CRH plc has consistently received positive grades, mostly “Overweight” and “Outperform,” indicating general confidence by analysts.

Martin Marietta Materials, Inc. Grades

Below is the table of recent grades for Martin Marietta Materials, Inc. from established grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-22 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| Morgan Stanley | Maintain | Overweight | 2025-12-01 |

| Stifel | Maintain | Buy | 2025-11-11 |

| JP Morgan | Maintain | Neutral | 2025-11-11 |

| UBS | Maintain | Buy | 2025-11-07 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-06 |

| Raymond James | Maintain | Outperform | 2025-10-21 |

| Barclays | Maintain | Overweight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-08-12 |

Martin Marietta Materials has predominantly received “Buy,” “Overweight,” and “Outperform” ratings, showing positive analyst sentiment with some moderate views like “Neutral” and “Equal Weight.”

Which company has the best grades?

Both CRH plc and Martin Marietta Materials, Inc. have received positive grades with no “Sell” or “Strong Sell” ratings. Martin Marietta Materials shows a higher number of “Buy” ratings, while CRH plc has a strong presence of “Overweight” and “Outperform” grades. This suggests both companies are well regarded, but Martin Marietta’s broader consensus of “Buy” ratings might indicate slightly stronger analyst enthusiasm, potentially affecting investor confidence and portfolio strategy.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of CRH plc and Martin Marietta Materials, Inc. based on their latest financial and strategic data.

| Criterion | CRH plc | Martin Marietta Materials, Inc. |

|---|---|---|

| Diversification | High product and service mix with €26.7B in products and €8.9B in services (2024) | Focused mainly on building materials with $6.2B revenue; less diversified but specialized |

| Profitability | Moderate net margin (9.7%), ROE 16%, ROIC 8.6%, slightly favorable overall | High net margin (30.5%), ROE 21.1%, ROIC 12%, very favorable profitability metrics |

| Innovation | Neutral — lacks clear competitive moat but improving profitability | Strong competitive advantage with durable moat and growing ROIC |

| Global presence | Significant global footprint with broad product range | Primarily US-focused but strong market position |

| Market Share | Solid market presence in construction materials | Leading position in aggregates and specialty materials in US market |

Key takeaways: Martin Marietta demonstrates a stronger profitability profile and durable competitive advantage, while CRH benefits from greater diversification and a global reach but is still building its moat and improving returns. Investors should weigh CRH’s growth potential against Martin Marietta’s established value creation.

Risk Analysis

Below is a comparison table highlighting key risks for CRH plc and Martin Marietta Materials, Inc. based on the most recent data from 2024–2026.

| Metric | CRH plc | Martin Marietta Materials, Inc. |

|---|---|---|

| Market Risk | Beta 1.20 (moderate volatility) | Beta 1.16 (moderate volatility) |

| Debt Level | Debt/Equity 0.71 (neutral) | Debt/Equity 0.61 (neutral) |

| Regulatory Risk | Exposure across multiple regions including EU and US | Primarily US-focused regulations |

| Operational Risk | Large global footprint with 79.8K employees; complexity in supply chain | Smaller scale with 9.4K employees; more concentrated operations |

| Environmental Risk | Active in cement and aggregates with significant emissions | Similar sector with added magnesia chemicals; environmental compliance critical |

| Geopolitical Risk | Operations in Europe, US, and internationally; some exposure to instability | Mainly US operations; lower geopolitical risk |

In synthesis, both companies face moderate market risk due to their betas above 1. CRH’s broader international exposure increases geopolitical and regulatory risks, while Martin Marietta’s US focus lowers geopolitical risk but concentrates regulatory exposure. Debt levels are manageable for both, but environmental compliance remains a critical and impactful risk given their industry. Operational complexity is higher for CRH, which may affect resilience. Overall, environmental and regulatory risks are the most likely to impact long-term valuation.

Which Stock to Choose?

CRH plc shows a favorable income evolution with a 52.55% revenue growth over five years and a 264.62% net income increase. Its financial ratios are slightly favorable overall, with strong ROE at 16% and good interest coverage, despite some unfavorable valuation metrics. Profitability is solid, with a 9.72% net margin and growing returns on capital, while debt levels are moderate and the rating is very favorable.

Martin Marietta Materials, Inc. presents a favorable but more mixed income profile, with 38.18% revenue growth and 176.7% net income growth over five years, though recent revenue declined. Its financial ratios are slightly favorable but include notable unfavorable valuation and asset turnover ratios. Profitability is higher than CRH’s, with a 30.52% net margin and very favorable ROE, balanced by moderate debt and a very favorable rating.

For investors, Martin Marietta’s very favorable moat and higher profitability might appeal to growth-oriented profiles seeking strong returns, while CRH’s consistent income growth and moderate ratios could be more suitable for those prioritizing stability and improving profitability. Both companies carry a very favorable rating but differ in financial dynamics and risk profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CRH plc and Martin Marietta Materials, Inc. to enhance your investment decisions: