In the fast-evolving communication equipment industry, Motorola Solutions, Inc. (MSI) and Credo Technology Group Holding Ltd (CRDO) stand out as key players with distinct approaches. Motorola Solutions, with its extensive portfolio in mission-critical communications and security, contrasts with Credo’s focus on high-speed connectivity solutions and cutting-edge chip technology. This comparison will help investors identify which company offers the most compelling opportunity in today’s dynamic tech landscape. Let’s explore their strengths and potential.

Table of contents

Companies Overview

I will begin the comparison between Motorola Solutions, Inc. and Credo Technology Group Holding Ltd by providing an overview of these two companies and their main differences.

Motorola Solutions, Inc. Overview

Motorola Solutions, Inc. specializes in mission-critical communications and analytics, serving government, public safety, and commercial customers worldwide. The company operates through two segments: Products and Systems Integration, and Software and Services. It offers a wide range of infrastructure, devices, video security, and software solutions, integrating technology to support private communications networks and mobile workforce management. Founded in 1928, it is headquartered in Chicago and employs 21,000 people.

Credo Technology Group Holding Ltd Overview

Credo Technology Group Holding Ltd provides high-speed connectivity solutions for optical and electrical Ethernet applications globally. Its product portfolio includes integrated circuits, active electrical cables, and SerDes chiplets, leveraging serializer/deserializer and digital signal processor technologies. Additionally, Credo offers intellectual property solutions through SerDes IP licensing. Founded in 2008, the company is based in San Jose, California, with a workforce of approximately 500 employees.

Key similarities and differences

Both Motorola Solutions and Credo operate in the Communication Equipment industry within the technology sector in the US. While Motorola Solutions focuses on comprehensive mission-critical communications with extensive hardware and software services for public safety and commercial sectors, Credo specializes in high-speed connectivity components and IP licensing primarily for Ethernet applications. Motorola’s business is broader and more diversified, whereas Credo is more specialized in semiconductor and connectivity technologies.

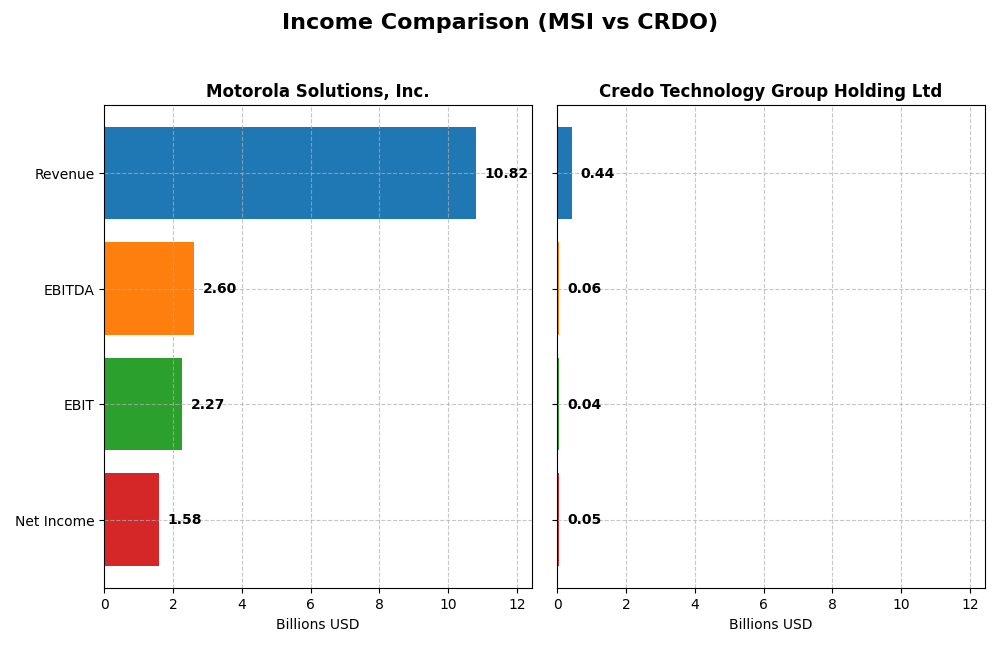

Income Statement Comparison

This table compares the key income statement metrics for Motorola Solutions, Inc. and Credo Technology Group Holding Ltd for their most recent fiscal years.

| Metric | Motorola Solutions, Inc. (MSI) | Credo Technology Group Holding Ltd (CRDO) |

|---|---|---|

| Market Cap | 65.1B | 27.7B |

| Revenue | 10.8B | 437M |

| EBITDA | 2.60B | 60M |

| EBIT | 2.27B | 38M |

| Net Income | 1.58B | 52M |

| EPS | 9.45 | 0.31 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Motorola Solutions, Inc.

Motorola Solutions showed steady revenue growth from 7.4B in 2020 to 10.8B in 2024, with net income rising from 949M to 1.58B over the same period. Margins have generally improved, with a gross margin near 51% and net margin around 15% in 2024. Despite a favorable revenue increase of 8.4% in 2024, net income and EBIT margins declined slightly, indicating some pressure on profitability.

Credo Technology Group Holding Ltd

Credo Technology experienced rapid growth, with revenue surging from 58.7M in 2021 to 437M in 2025, and net income turning positive to 52.2M after prior losses. The gross margin is strong at nearly 65%. In 2025, the company posted significant margin improvements and high growth rates in revenue (126%) and net income (181%), reflecting accelerating operational efficiency and expanding scale.

Which one has the stronger fundamentals?

Both firms present favorable income statement trends, but Motorola Solutions offers consistent profitability and stable margins over a longer period, while Credo displays impressive growth and margin expansion from a smaller base. Motorola’s mature earnings contrast with Credo’s rapid scale-up, making Motorola’s fundamentals appear more stable, yet Credo’s trajectory indicates strong potential if growth persists.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Motorola Solutions, Inc. (MSI) and Credo Technology Group Holding Ltd (CRDO), based on the most recent fiscal year-end data available.

| Ratios | Motorola Solutions, Inc. (2024) | Credo Technology Group Holding Ltd (2025) |

|---|---|---|

| ROE | 92.6% | 7.66% |

| ROIC | 21.6% | 5.01% |

| P/E | 48.9 | 138.2 |

| P/B | 45.3 | 10.6 |

| Current Ratio | 1.28 | 6.62 |

| Quick Ratio | 1.13 | 5.79 |

| D/E (Debt-to-Equity) | 3.85 | 0.02 |

| Debt-to-Assets | 44.9% | 2.0% |

| Interest Coverage | 9.11 | 0 (not available) |

| Asset Turnover | 0.74 | 0.54 |

| Fixed Asset Turnover | 6.97 | 5.54 |

| Payout Ratio | 41.5% | 0% |

| Dividend Yield | 0.85% | 0% |

Interpretation of the Ratios

Motorola Solutions, Inc.

Motorola Solutions exhibits strong profitability ratios, including a high net margin of 14.58% and an exceptional return on equity at 92.6%, indicating effective capital use. However, elevated price-to-earnings (PE) and price-to-book (PB) ratios, alongside a high debt-to-equity ratio of 3.85, suggest valuation and leverage concerns. The company pays dividends, with a modest yield of 0.85%, but this is considered unfavorable in the evaluation.

Credo Technology Group Holding Ltd

Credo Technology shows a favorable net margin of 11.95% but weaker returns on equity (7.66%) and invested capital (5.01%), reflecting moderate profitability. Its weighted average cost of capital (WACC) is high at 16.29%, which may pressure future earnings. The company does not pay dividends, likely focusing on reinvestment and growth, supported by very low debt and a strong quick ratio of 5.79.

Which one has the best ratios?

Motorola Solutions presents a slightly favorable overall ratio profile, balancing strong profitability with some valuation and leverage drawbacks. Credo Technology, while maintaining favorable liquidity and low debt, faces challenges in profitability and cost of capital, resulting in a neutral rating. Thus, Motorola Solutions currently holds a more advantageous ratio standing according to the latest data.

Strategic Positioning

This section compares the strategic positioning of Motorola Solutions, Inc. and Credo Technology Group Holding Ltd in terms of Market position, Key segments, and Exposure to technological disruption:

Motorola Solutions, Inc.

- Leading communication equipment provider with strong global presence and stable market position.

- Diversified segments: Products and Systems Integration; Software and Services for public safety and commercial customers.

- Moderate exposure with established product portfolio in communications and video security.

Credo Technology Group Holding Ltd

- Smaller market cap and higher beta indicate more volatility and competitive pressure.

- Focused on high-speed connectivity solutions, integrated circuits, and IP licensing.

- High exposure to technological disruption due to focus on advanced SerDes and digital signal processors.

Motorola Solutions, Inc. vs Credo Technology Group Holding Ltd Positioning

Motorola Solutions has a diversified approach across hardware and software serving government and commercial sectors, providing stable revenues. Credo is more concentrated on specialized connectivity technologies, implying greater growth potential but also higher risk.

Which has the best competitive advantage?

Motorola Solutions demonstrates a very favorable moat with value creation and growing ROIC, indicating a durable competitive advantage. Credo shows a slightly unfavorable moat, currently shedding value despite improving profitability, implying weaker competitive positioning.

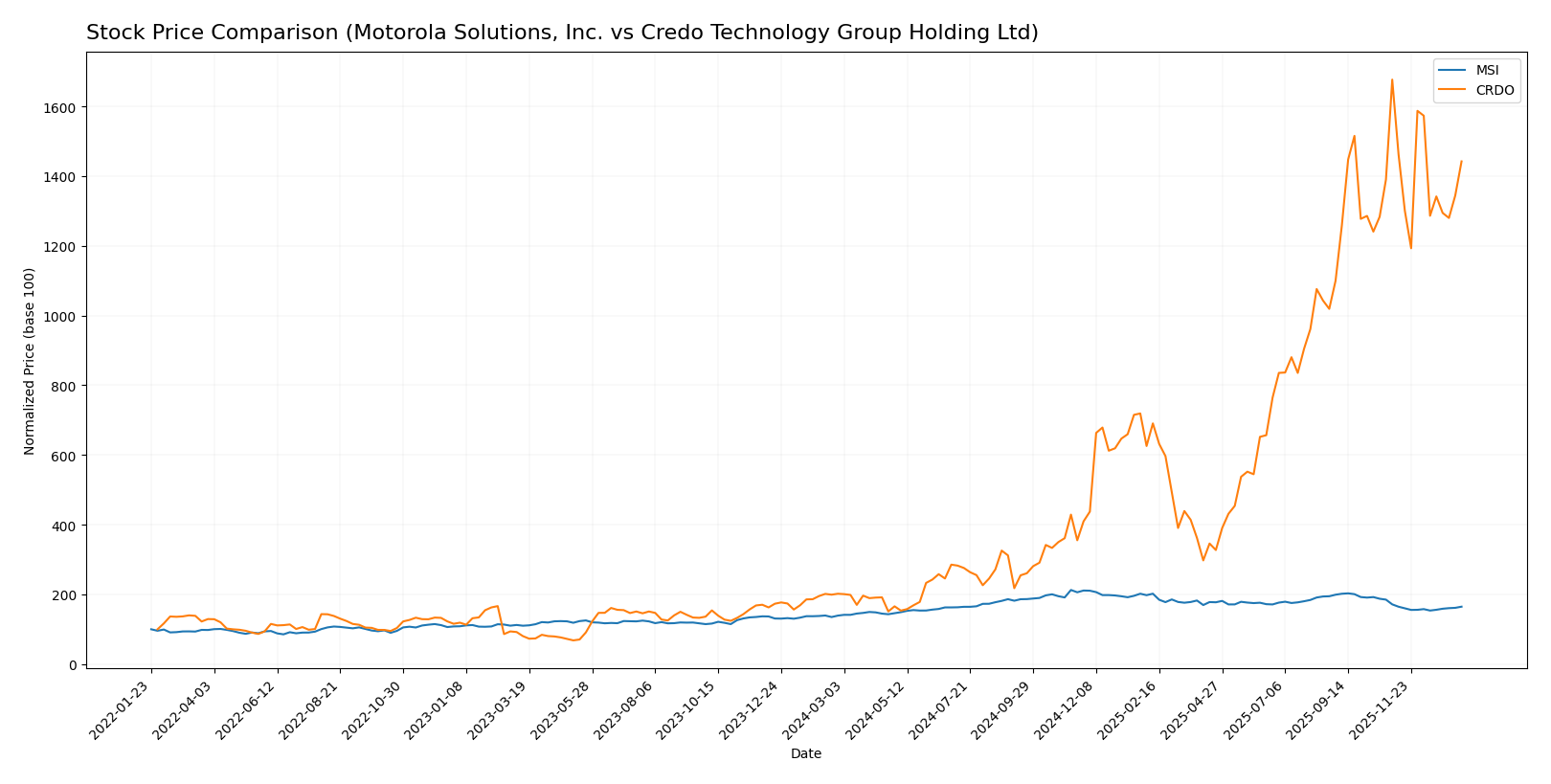

Stock Comparison

The stock price movements of Motorola Solutions, Inc. (MSI) and Credo Technology Group Holding Ltd (CRDO) over the past 12 months reveal significant gains followed by recent declines, highlighting shifting trading dynamics and investor sentiment.

Trend Analysis

Motorola Solutions, Inc. (MSI) showed a bullish trend over the past year with an 18.39% increase but experienced a recent 3.86% decline indicating a short-term bearish correction with decelerating momentum.

Credo Technology Group Holding Ltd (CRDO) recorded a substantial 614.07% price increase over the last 12 months, maintaining a bullish trend overall; however, a recent 13.99% drop suggests a pronounced short-term bearish pullback with deceleration.

Comparing both stocks, CRDO delivered the highest market performance with a much larger overall price gain than MSI, despite both showing recent downward corrections in their stock prices.

Target Prices

The current consensus target prices suggest a positive outlook for both Motorola Solutions, Inc. and Credo Technology Group Holding Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Motorola Solutions, Inc. | 525 | 436 | 469.8 |

| Credo Technology Group Holding Ltd | 250 | 160 | 217.5 |

Analysts expect Motorola Solutions’ stock to trade significantly above its current price of 391 USD, indicating upside potential. Similarly, Credo Technology’s consensus target price is well above its current 161.38 USD, reflecting optimistic market sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Motorola Solutions, Inc. and Credo Technology Group Holding Ltd:

Rating Comparison

Motorola Solutions, Inc. Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a favorable valuation outlook.

- ROE Score: 5, showing very favorable efficiency in generating equity profit.

- ROA Score: 5, demonstrating very effective asset utilization.

- Debt To Equity Score: 1, signaling a very unfavorable financial risk level.

- Overall Score: 3, categorized as moderate overall financial standing.

Credo Technology Group Holding Ltd Rating

- Rating: B, also classified as very favorable.

- Discounted Cash Flow Score: 1, reflecting a very unfavorable valuation.

- ROE Score: 4, a favorable indication of profit generation from equity.

- ROA Score: 5, also very favorable in asset utilization.

- Debt To Equity Score: 4, reflecting favorable financial stability.

- Overall Score: 3, similarly moderate in overall financial assessment.

Which one is the best rated?

Based strictly on provided data, MSI holds a higher rating (B+) and stronger scores in discounted cash flow and ROE, while CRDO shows better debt-to-equity management. Both share equal overall scores, reflecting moderate financial standing.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

MSI Scores

- Altman Z-Score: 3.65, indicating a safe financial zone

- Piotroski Score: 5, showing average financial strength

CRDO Scores

- Altman Z-Score: 100.37, indicating a safe financial zone

- Piotroski Score: 5, showing average financial strength

Which company has the best scores?

Both MSI and CRDO are in the safe zone for Altman Z-Score, but CRDO’s score is significantly higher. Both companies have an identical Piotroski Score of 5, indicating average financial strength.

Grades Comparison

Here is a comparison of the latest reliable grading data for Motorola Solutions, Inc. and Credo Technology Group Holding Ltd:

Motorola Solutions, Inc. Grades

The following table summarizes recent grades assigned by established grading companies for Motorola Solutions, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Upgrade | Overweight | 2026-01-05 |

| Morgan Stanley | Upgrade | Overweight | 2025-12-17 |

| Barclays | Maintain | Overweight | 2025-10-31 |

| Piper Sandler | Maintain | Neutral | 2025-10-31 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-29 |

| Barclays | Maintain | Overweight | 2025-08-08 |

| UBS | Maintain | Buy | 2025-08-08 |

| Barclays | Maintain | Overweight | 2025-05-05 |

| JP Morgan | Maintain | Overweight | 2025-04-17 |

| Barclays | Maintain | Overweight | 2025-02-14 |

Motorola Solutions’ grades mainly show consistent Overweight and Buy recommendations, with recent upgrades indicating growing analyst confidence.

Credo Technology Group Holding Ltd Grades

The following table shows recent grades from reputable grading companies for Credo Technology Group Holding Ltd:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2025-12-02 |

| Needham | Maintain | Buy | 2025-12-02 |

| Mizuho | Maintain | Outperform | 2025-12-02 |

| Roth Capital | Maintain | Buy | 2025-12-02 |

| Barclays | Maintain | Overweight | 2025-12-02 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-07 |

| Barclays | Maintain | Overweight | 2025-09-04 |

| TD Cowen | Maintain | Buy | 2025-09-04 |

| Needham | Maintain | Buy | 2025-09-04 |

Credo Technology Group Holding Ltd’s ratings are predominantly Buy and Overweight, reflecting steady positive analyst sentiment.

Which company has the best grades?

Both Motorola Solutions and Credo Technology Group Holding Ltd hold predominantly Buy and Overweight ratings from multiple reputable grading firms. Motorola Solutions has more upgrade actions recently, which may indicate a stronger upward momentum in analyst outlook compared to Credo. Investors might interpret this as Motorola Solutions showing a slightly more favorable trend in analyst confidence.

Strengths and Weaknesses

Below is a comparison of the key strengths and weaknesses for Motorola Solutions, Inc. (MSI) and Credo Technology Group Holding Ltd (CRDO) based on the most recent data available.

| Criterion | Motorola Solutions, Inc. (MSI) | Credo Technology Group Holding Ltd (CRDO) |

|---|---|---|

| Diversification | Strong product and service mix with $6.45B in products and $4.36B in services (2024). | More concentrated revenues, mainly from product sales ($412M in 2025) and engineering services. |

| Profitability | High profitability: net margin 14.58%, ROIC 21.59%, ROE 92.6%. | Moderate profitability: net margin 11.95%, ROIC 5.01%, ROE 7.66%. |

| Innovation | Durable competitive advantage with growing ROIC (+44.7%), indicating strong innovation and capital efficiency. | Increasing profitability trend (+128% ROIC growth), but currently shedding value; innovation improving but not yet fully profitable. |

| Global presence | Established global presence with diverse government and enterprise clients. | Smaller global footprint, mostly focused on licensing and niche engineering services. |

| Market Share | Significant market share in communication and public safety technology sectors. | Smaller market share, focused on specialized technology segments. |

Key takeaways: Motorola Solutions shows strong diversification, high profitability, and a durable competitive advantage, making it a robust investment candidate. Credo Technology is growing and innovating but still faces challenges in profitability and scale, implying higher risk with potential upside.

Risk Analysis

Below is a comparative table of key risks for Motorola Solutions, Inc. (MSI) and Credo Technology Group Holding Ltd (CRDO) based on the most recent data available for 2025-2026.

| Metric | Motorola Solutions, Inc. (MSI) | Credo Technology Group Holding Ltd (CRDO) |

|---|---|---|

| Market Risk | Moderate (Beta ~1.0, stable industry) | High (Beta ~2.66, volatile price range) |

| Debt level | High (D/E = 3.85, some financial leverage risk) | Low (D/E = 0.02, very conservative) |

| Regulatory Risk | Moderate (public safety & government contracts) | Moderate (global semiconductor regulations) |

| Operational Risk | Moderate (complex integration services) | Moderate (R&D intensive, smaller scale) |

| Environmental Risk | Low (technology hardware sector) | Low (semiconductor components) |

| Geopolitical Risk | Moderate (US and international markets) | Moderate to high (global supply chain exposure) |

The most likely and impactful risks are market volatility for Credo due to its higher beta and semiconductor exposure, and Motorola’s debt leverage which could pressure financial flexibility despite strong profitability. Both face geopolitical and regulatory uncertainties given their global operations.

Which Stock to Choose?

Motorola Solutions, Inc. (MSI) shows a favorable income evolution with 45.9% revenue growth over 2020-2024 and a strong 66.17% net income increase. Its financial ratios are slightly favorable overall, supported by high profitability, moderate debt, and a very favorable B+ rating.

Credo Technology Group Holding Ltd (CRDO) exhibits rapid growth, with 644.12% revenue and 289.68% net income growth over 2021-2025. Its ratio profile is neutral due to mixed profitability and low debt, paired with a very favorable B rating but less efficient capital use.

Investors favoring durable value creation and consistent profitability might view MSI as more attractive due to its very favorable moat and stable income metrics, while those inclined toward high growth potential could find CRDO’s rapid expansion and improving profitability suggestive, despite its slightly unfavorable moat.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Motorola Solutions, Inc. and Credo Technology Group Holding Ltd to enhance your investment decisions: