Inter Parfums, Inc. (IPAR) and Coty Inc. (COTY) are two prominent players in the household and personal products industry, specializing in fragrances and beauty products. Both companies share significant market overlap, offering diverse portfolios of prestige and mass brands, with strong global distribution networks. Their innovative approaches to brand management and market expansion make them compelling subjects for comparison. In this article, I will help you decide which company stands out as the more attractive investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Inter Parfums, Inc. and Coty Inc. by providing an overview of these two companies and their main differences.

Inter Parfums, Inc. Overview

Inter Parfums, Inc. focuses on manufacturing, marketing, and distributing fragrances and related products globally. The company operates through European and United States segments, offering products under multiple luxury and fashion brand names. Headquartered in New York City, Inter Parfums targets department stores, specialty retailers, and e-commerce channels, positioning itself in the household and personal products industry with a market cap of approximately 2.87B USD.

Coty Inc. Overview

Coty Inc. is a global beauty company engaged in producing and distributing prestige fragrances, skincare, and color cosmetics. It serves a wide range of retail channels, including prestige and mass-market outlets, covering roughly 150 countries. Based in New York City, Coty operates under numerous well-known brands and employs around 11,791 people, with a market capitalization near 2.79B USD, also within the household and personal products sector.

Key similarities and differences

Both companies operate in the consumer defensive sector with a focus on fragrances and beauty products, servicing global markets through diverse retail channels. Inter Parfums emphasizes luxury fragrance brands with a smaller workforce, while Coty offers a broader product range including mass cosmetics and skincare and employs significantly more staff. Market capitalizations are comparable, though Coty trades on the NYSE and Inter Parfums on NASDAQ, reflecting differences in scale and distribution strategies.

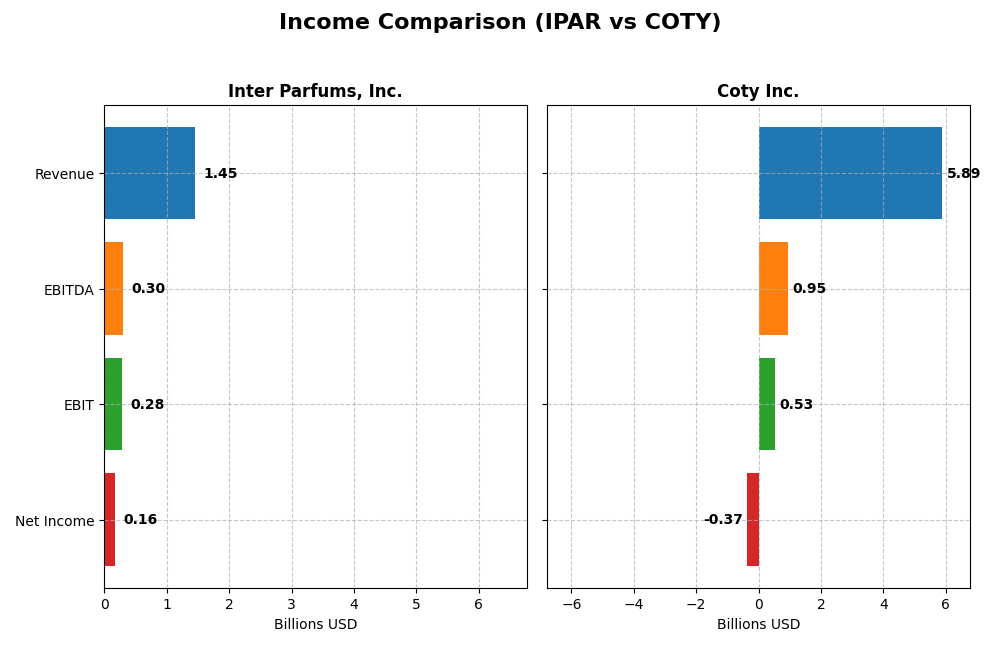

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Inter Parfums, Inc. and Coty Inc. based on their most recent fiscal year data.

| Metric | Inter Parfums, Inc. (IPAR) | Coty Inc. (COTY) |

|---|---|---|

| Market Cap | 2.87B | 2.79B |

| Revenue | 1.45B | 5.89B |

| EBITDA | 305M | 950M |

| EBIT | 276M | 530M |

| Net Income | 164M | -381M |

| EPS | 5.13 | -0.44 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Inter Parfums, Inc.

Inter Parfums displayed consistent revenue growth from $539M in 2020 to $1.45B in 2024, with net income rising from $38M to $164M. Margins remained strong, highlighted by a gross margin of 63.85% and a net margin of 11.32% in 2024. The latest year showed a 10.22% revenue increase and a solid 5.89% EBIT growth, though net margin slightly declined by 2.32%.

Coty Inc.

Coty’s revenue grew from $4.63B in 2021 to $6.11B in 2024 but dropped to $5.89B in 2025. Net income fluctuated significantly, peaking at $508M in 2023 but turning negative to -$368M in 2025, reflecting margin pressures. The gross margin remained favorable at 64.84% in 2025, yet the net margin was deeply negative at -6.24%, with recent year declines in revenue, EBIT, and EPS.

Which one has the stronger fundamentals?

Inter Parfums demonstrates stronger fundamentals, with favorable growth in revenue and net income, stable and robust margins, and positive earnings per share trends. Coty, despite solid gross margins, shows unfavorable net margins, recent negative profitability, and significant declines in earnings and margins overall, indicating weaker income statement health in comparison.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Inter Parfums, Inc. (IPAR) and Coty Inc. (COTY) based on their most recent fiscal data.

| Ratios | Inter Parfums, Inc. (IPAR) 2024 | Coty Inc. (COTY) 2025 |

|---|---|---|

| ROE | 22.1% | -10.0% |

| ROIC | 18.6% | 2.6% |

| P/E | 25.6 | -11.0 |

| P/B | 5.66 | 1.10 |

| Current Ratio | 2.75 | 0.77 |

| Quick Ratio | 1.63 | 0.46 |

| D/E (Debt to Equity) | 0.26 | 1.15 |

| Debt-to-Assets | 13.6% | 35.7% |

| Interest Coverage | 35.6 | 1.06 |

| Asset Turnover | 1.03 | 0.49 |

| Fixed Asset Turnover | 8.14 | 6.04 |

| Payout ratio | 58.4% | -3.6% |

| Dividend yield | 2.28% | 0.33% |

Interpretation of the Ratios

Inter Parfums, Inc.

Inter Parfums exhibits predominantly strong financial ratios with a favorable net margin of 11.32%, ROE at 22.07%, and ROIC at 18.62%, indicating solid profitability and capital efficiency. Liquidity ratios such as a current ratio of 2.75 and low leverage with a debt-to-equity of 0.26 are also positive. The company pays dividends with a 2.28% yield, supported by sustainable free cash flow and moderate payout risks.

Coty Inc.

Coty shows several weak financial ratios, including a negative net margin of -6.24%, negative ROE at -9.98%, and low ROIC of 2.55%, reflecting profitability challenges. Liquidity is a concern with a current ratio of 0.77 and high debt-to-equity of 1.15. The company does not pay dividends, likely due to ongoing restructuring and reinvestment needs, prioritizing debt management and operational recovery.

Which one has the best ratios?

Inter Parfums clearly has the best ratios with 78.57% favorable metrics, strong profitability, and solid liquidity, supporting dividend payments. In contrast, Coty’s ratios are mostly unfavorable at 57.14%, with profitability and liquidity weaknesses and no dividend distribution, reflecting higher financial risk and operational challenges.

Strategic Positioning

This section compares the strategic positioning of Inter Parfums, Inc. and Coty Inc., including market position, key segments, and exposure to technological disruption:

Inter Parfums, Inc.

- Mid-sized market cap with moderate competitive pressure; NASDAQ listed

- Focuses on fragrances and cosmetics under multiple premium brands across Europe and the US

- No explicit mention of technological disruption exposure

Coty Inc.

- Similar market cap with higher trading volume; listed on NYSE

- Diversified beauty portfolio including prestige fragrances, skin care, and mass cosmetics

- No explicit mention of technological disruption exposure

Inter Parfums, Inc. vs Coty Inc. Positioning

Inter Parfums shows a concentrated focus on fragrances and cosmetics with premium brands, while Coty offers a broader beauty product range spanning prestige and mass market. Inter Parfums operates with fewer employees and narrower segment coverage compared to Coty.

Which has the best competitive advantage?

Inter Parfums demonstrates a very favorable moat with value creation and growing ROIC, indicating a durable competitive advantage. Coty currently sheds value despite improving profitability, reflecting a weaker competitive position.

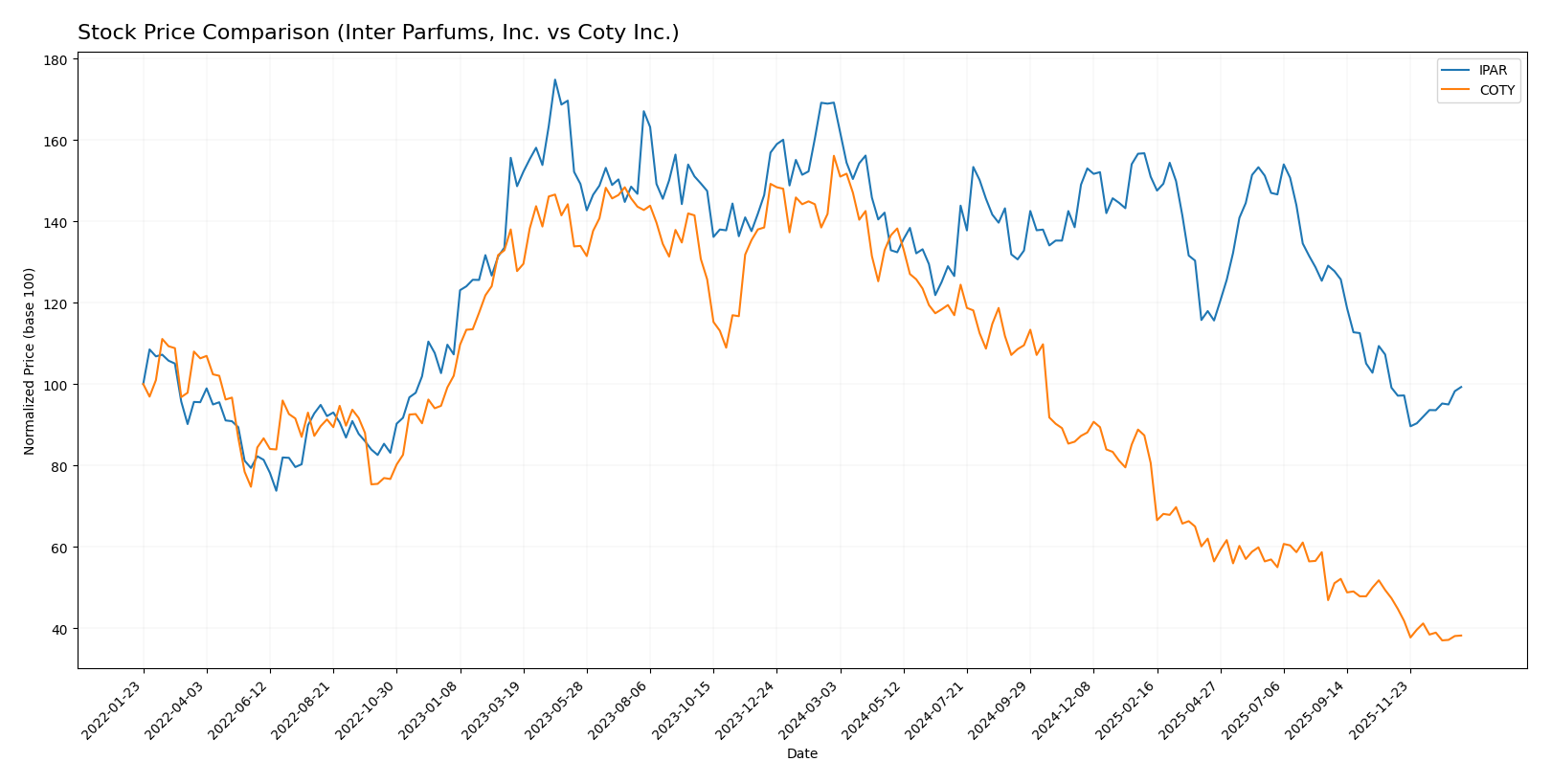

Stock Comparison

The stock price movements of Inter Parfums, Inc. and Coty Inc. over the past 12 months reveal significant declines with differing volatility and recent trading dynamics impacting their market trajectories.

Trend Analysis

Inter Parfums, Inc. experienced a bearish trend over the past year with a sharp price decline of 41.33%. The trend showed acceleration and high volatility, with prices ranging from 80.61 to 152.22.

Coty Inc. also followed a bearish trend, with a more severe price drop of 75.57% over the same period. The trend accelerated amid lower volatility, and prices fluctuated between 3.1 and 13.1.

Comparing both, Inter Parfums delivered a higher market performance despite the negative trend, as Coty’s stock price decline was nearly double in percentage terms over the 12 months analyzed.

Target Prices

The current analyst consensus presents a clear target range for Inter Parfums, Inc. and Coty Inc., reflecting moderate upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Inter Parfums, Inc. | 125 | 103 | 114 |

| Coty Inc. | 10 | 3.5 | 4.95 |

Analysts expect Inter Parfums to trade significantly above its current price of 89.3 USD, while Coty’s consensus target suggests a moderate increase from its current 3.2 USD price level.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Inter Parfums, Inc. and Coty Inc.:

Rating Comparison

Inter Parfums, Inc. Rating

- Rating: B+, considered very favorable overall.

- Discounted Cash Flow Score: Moderate at 3 out of 5.

- ROE Score: Very favorable, highest score of 5.

- ROA Score: Very favorable, highest score of 5.

- Debt To Equity Score: Moderate at 3 out of 5.

- Overall Score: Moderate, rated 3 out of 5.

Coty Inc. Rating

- Rating: C+, also marked very favorable overall.

- Discounted Cash Flow Score: Very favorable at 5 out of 5.

- ROE Score: Very unfavorable, lowest score of 1.

- ROA Score: Very unfavorable, lowest score of 1.

- Debt To Equity Score: Very unfavorable, lowest score of 1.

- Overall Score: Moderate, rated 2 out of 5.

Which one is the best rated?

Inter Parfums holds a higher rating of B+ compared to Coty’s C+. It scores very favorably on ROE and ROA, while Coty’s strengths lie in discounted cash flow. Overall, Inter Parfums is better rated based on the available data.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Inter Parfums, Inc. and Coty Inc.:

IPAR Scores

- Altman Z-Score: 6.12, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, representing average financial strength.

COTY Scores

- Altman Z-Score: 0.01, indicating distress zone and high bankruptcy risk.

- Piotroski Score: 4, representing average financial strength.

Which company has the best scores?

Based on the scores, IPAR exhibits a significantly stronger Altman Z-Score, placing it in the safe zone, whereas COTY is in the distress zone. Both have similar average Piotroski Scores, but IPAR’s financial stability appears stronger overall.

Grades Comparison

Here is a comparison of recent reliable grades assigned to Inter Parfums, Inc. and Coty Inc.:

Inter Parfums, Inc. Grades

The following table shows recent grades from established financial institutions for Inter Parfums, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Downgrade | Neutral | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-19 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Jefferies | Maintain | Buy | 2025-10-28 |

| BWS Financial | Maintain | Buy | 2025-10-22 |

| Canaccord Genuity | Maintain | Buy | 2025-10-21 |

| BWS Financial | Maintain | Buy | 2025-05-07 |

| Piper Sandler | Maintain | Overweight | 2025-04-24 |

| DA Davidson | Maintain | Buy | 2025-03-25 |

| BWS Financial | Maintain | Buy | 2025-03-17 |

Overall, Inter Parfums has predominantly maintained buy ratings, with a single recent downgrade to neutral.

Coty Inc. Grades

The following table presents recent grades from recognized grading companies for Coty Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Downgrade | In Line | 2025-12-23 |

| Citigroup | Maintain | Neutral | 2025-12-17 |

| TD Cowen | Maintain | Hold | 2025-12-12 |

| Berenberg | Downgrade | Hold | 2025-09-10 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-25 |

| RBC Capital | Maintain | Outperform | 2025-08-22 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-22 |

| Goldman Sachs | Maintain | Neutral | 2025-08-22 |

| Barclays | Maintain | Underweight | 2025-08-22 |

| B of A Securities | Maintain | Underperform | 2025-08-22 |

Coty’s ratings show a mixed to cautious stance, with several hold and neutral ratings and a few downgrades.

Which company has the best grades?

Inter Parfums, Inc. has received predominantly buy and overweight grades, indicating generally positive analyst sentiment. Coty Inc.’s grades are more mixed, with several hold and neutral ratings and some downgrades. This contrast suggests Inter Parfums may be viewed as having stronger near-term growth prospects, potentially impacting investor confidence differently between the two.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Inter Parfums, Inc. (IPAR) and Coty Inc. (COTY) based on recent financial and market data.

| Criterion | Inter Parfums, Inc. (IPAR) | Coty Inc. (COTY) |

|---|---|---|

| Diversification | Moderate, focuses mainly on fragrances with selective product lines | High, with multiple segments: Consumer Beauty, Prestige, and previously Luxury and Professional Beauty |

| Profitability | Strong profitability: ROIC 18.62%, net margin 11.32%, ROE 22.07% | Weak profitability: ROIC 2.55%, net margin -6.24%, ROE -9.98% |

| Innovation | Consistent value creation with growing ROIC indicating effective innovation and capital use | Improving ROIC trend but still slightly unfavorable; innovation efforts ongoing but results mixed |

| Global presence | Solid international exposure, especially in Europe (notably France) | Extensive global footprint with broad product reach in beauty segments worldwide |

| Market Share | Niche leader in premium fragrances, smaller scale | Large scale player in multiple beauty categories but facing competitive challenges |

Key takeaways: Inter Parfums exhibits a durable competitive advantage with strong profitability and efficient capital use, making it a value creator. Coty, despite its broader diversification and global presence, struggles with profitability and value creation, though its improving ROIC signals potential turnaround. Investors should weigh IPAR’s stability against COTY’s growth prospects and risk profile.

Risk Analysis

Below is a comparative risk table for Inter Parfums, Inc. (IPAR) and Coty Inc. (COTY) based on the most recent financial and operational data available in 2026.

| Metric | Inter Parfums, Inc. (IPAR) | Coty Inc. (COTY) |

|---|---|---|

| Market Risk | Moderate (Beta 1.24, stable growth) | Moderate (Beta 0.96, volatile performance) |

| Debt level | Low (Debt/Equity 0.26, strong coverage) | High (Debt/Equity 1.15, weak coverage) |

| Regulatory Risk | Low (Consumer products, stable regulations) | Moderate (Global footprint, varying regulations) |

| Operational Risk | Low (Good asset turnover, efficient operations) | High (Lower efficiency, large workforce) |

| Environmental Risk | Moderate (Industry impact, no major issues) | Moderate (Industry impact, no major issues) |

| Geopolitical Risk | Moderate (International markets exposure) | Moderate (Global distribution, political risks) |

Inter Parfums exhibits strong financial health with low debt and efficient operations, reducing its risk profile. Coty faces higher operational and debt risks, with poor profitability and financial distress indicators, making it more vulnerable to market and economic downturns.

Which Stock to Choose?

Inter Parfums, Inc. (IPAR) shows strong income growth and profitability with a very favorable global income statement evaluation. Financial ratios are mostly favorable, reflecting solid profitability and low debt, supported by a very favorable rating and a durable competitive advantage.

Coty Inc. (COTY) presents an unfavorable income statement with declining revenue and profitability, alongside mostly unfavorable financial ratios. The company has higher debt levels and a slightly unfavorable moat, despite a very favorable rating driven by valuation metrics.

For risk-averse or quality-focused investors, IPAR’s strong profitability, solid financial health, and durable value creation might appear more favorable. Conversely, growth-oriented or value-seeking investors who accept higher risk might view COTY’s improving ROIC trend and valuation metrics differently, though its financial challenges remain significant.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Inter Parfums, Inc. and Coty Inc. to enhance your investment decisions: