Home > Comparison > Technology > CPAY vs ODD

The strategic rivalry between Corpay, Inc. and Oddity Tech Ltd. shapes the evolving landscape of technology infrastructure. Corpay operates as a capital-intensive payments platform serving diverse corporate needs globally. In contrast, Oddity Tech pioneers digital-first consumer beauty and wellness brands with a nimble, innovation-driven model. This analysis will assess which company’s growth trajectory offers superior risk-adjusted returns, guiding investors toward the optimal portfolio allocation in this dynamic sector.

Table of contents

Companies Overview

Corpay, Inc. and Oddity Tech Ltd. each drive innovation within the global software infrastructure sector.

Corpay, Inc.: Payment Solutions Powerhouse

Corpay, Inc. dominates business payments with solutions for vehicle expenses, lodging, and corporate outlays. Its core revenue stems from managing accounts payable automation, virtual cards, and cross-border payments. In 2026, the company focuses on expanding its integrated payment ecosystem across multiple continents, leveraging its robust client base and diverse portfolio.

Oddity Tech Ltd.: Digital Beauty Disruptor

Oddity Tech Ltd. leads consumer-tech innovation by digitizing beauty and wellness through its PowerMatch technology. Revenue primarily comes from its digital-first brands like IL MAKIAGE and SpoiledChild. The firm’s 2026 strategy centers on scaling brand penetration in offline-dominated markets by harnessing technology to reshape customer engagement and product personalization.

Strategic Collision: Similarities & Divergences

Both companies operate in software infrastructure but diverge sharply in customer focus—Corpay targets B2B payments, while Oddity Tech serves direct consumers. Their battleground lies in leveraging technology to enhance user experience; Corpay streamlines corporate finance, Oddity Tech reinvents beauty retail. Their investment profiles contrast: Corpay offers a stable, broad-market play, whereas Oddity Tech presents a high-beta, growth-oriented opportunity.

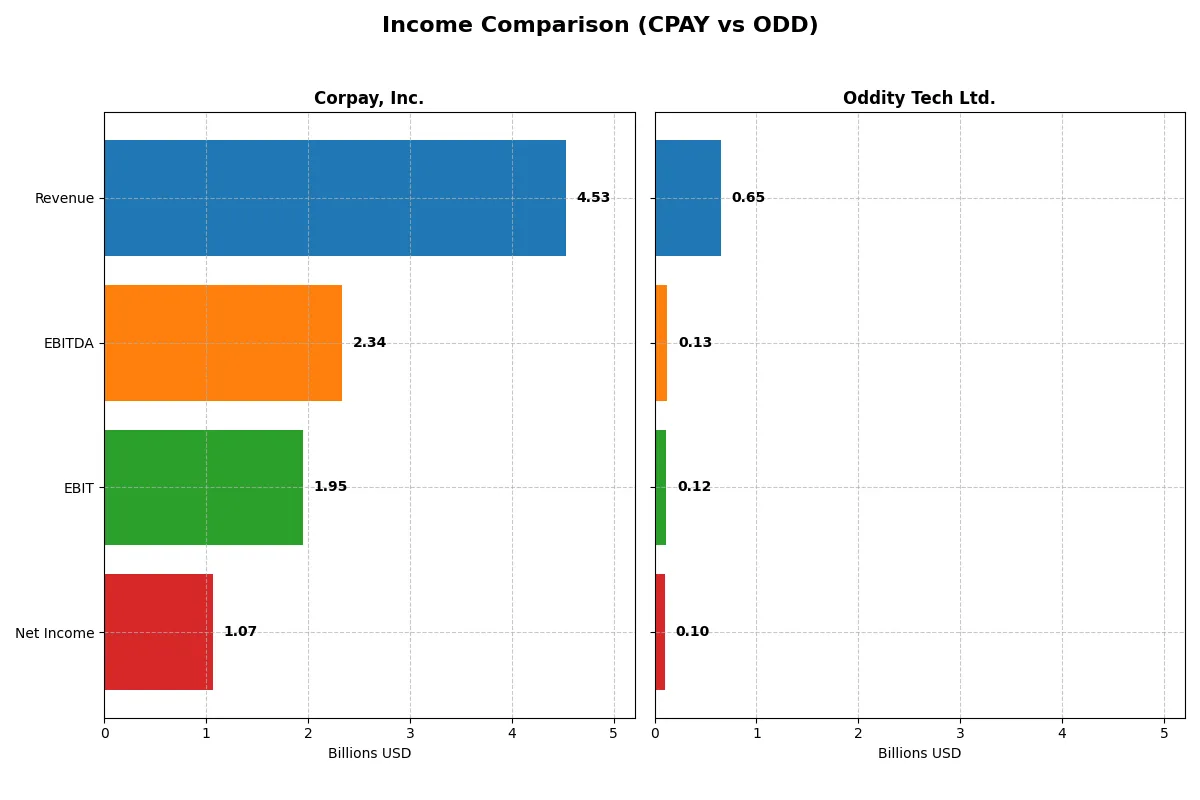

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Corpay, Inc. (CPAY) | Oddity Tech Ltd. (ODD) |

|---|---|---|

| Revenue | 4.53B | 647M |

| Cost of Revenue | 1.36B | 179M |

| Operating Expenses | 1.21B | 353M |

| Gross Profit | 3.17B | 468M |

| EBITDA | 2.34B | 125M |

| EBIT | 1.95B | 116M |

| Interest Expense | 404M | 76K |

| Net Income | 1.07B | 101M |

| EPS | 15.25 | 1.78 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company converts revenue into profit most efficiently, showing the strength of their core business models.

Corpay, Inc. Analysis

Corpay’s revenue grew steadily from 2.8B in 2021 to 4.5B in 2025, with net income rising from 839M to 1.07B. Gross margin remains robust near 70%, while net margin holds a healthy 23.6%. Despite solid top-line momentum, its net margin slightly declined recently, signaling margin pressure despite efficiency gains.

Oddity Tech Ltd. Analysis

Oddity Tech’s revenue expanded rapidly from 223M in 2021 to 647M in 2024. Net income surged from 14M to 101M, supported by a strong gross margin above 72%. EBIT and net margins improved markedly, reflecting accelerating profitability and operational leverage in its growth phase.

Steady Scale vs. Rapid Growth Efficiency

Corpay boasts a larger scale and consistent profitability with high margins, while Oddity Tech delivers faster revenue and earnings growth with improving margins. Corpay’s mature profile offers stable returns; Oddity’s dynamic expansion presents higher growth potential but at a smaller size. Investors must weigh steady income against high momentum growth.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | Corpay, Inc. (CPAY) | Oddity Tech Ltd. (ODD) |

|---|---|---|

| ROE | 27.5% | 36.0% |

| ROIC | 8.8% | 28.6% |

| P/E | 19.7 | 23.7 |

| P/B | 5.4 | 8.5 |

| Current Ratio | 1.0 | 1.8 |

| Quick Ratio | 1.0 | 1.0 |

| D/E | 2.58 | 0.08 |

| Debt-to-Assets | 37.9% | 5.2% |

| Interest Coverage | 4.8 | 1521.1 |

| Asset Turnover | 0.17 | 1.47 |

| Fixed Asset Turnover | 9.6 | 19.4 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational strengths critical for investors’ decision-making.

Corpay, Inc.

Corpay presents a strong ROE of 27.55% and a robust net margin of 23.62%, signaling solid profitability. The P/E ratio at 19.73 appears fair, but a high P/B of 5.43 suggests valuation stretch. The company avoids dividends, likely reinvesting in operational efficiency, yet a low current ratio and high debt-to-equity raise caution on liquidity and leverage.

Oddity Tech Ltd.

Oddity Tech delivers an exceptional ROE of 35.95% and a healthy net margin of 15.69%, showing efficient capital use. Its P/E of 23.75 is neutral, but a steep P/B of 8.54 hints at premium pricing. The balance sheet impresses with low debt and a strong current ratio. Absence of dividends points to growth-focused reinvestment, supported by outstanding interest coverage.

Risk-Reward Balance: Value Discipline vs. Growth Efficiency

Oddity Tech holds a clear edge in operational efficiency and balance sheet strength, with many favorable ratios. Corpay offers solid profitability but carries liquidity and leverage risks. Investors seeking growth with strong financial health may prefer Oddity, while those valuing profitability with moderate risk might consider Corpay’s profile.

Which one offers the Superior Shareholder Reward?

Corpay, Inc. (CPAY) and Oddity Tech Ltd. (ODD) both forgo dividends, focusing on reinvestment and buybacks. CPAY boasts stronger free cash flow (18.5/share) and aggressive buybacks, while ODD’s smaller free cash flow (2.26/share) supports high growth investment. CPAY’s higher payout sustainability and capital efficiency give it the edge in total shareholder return for 2026.

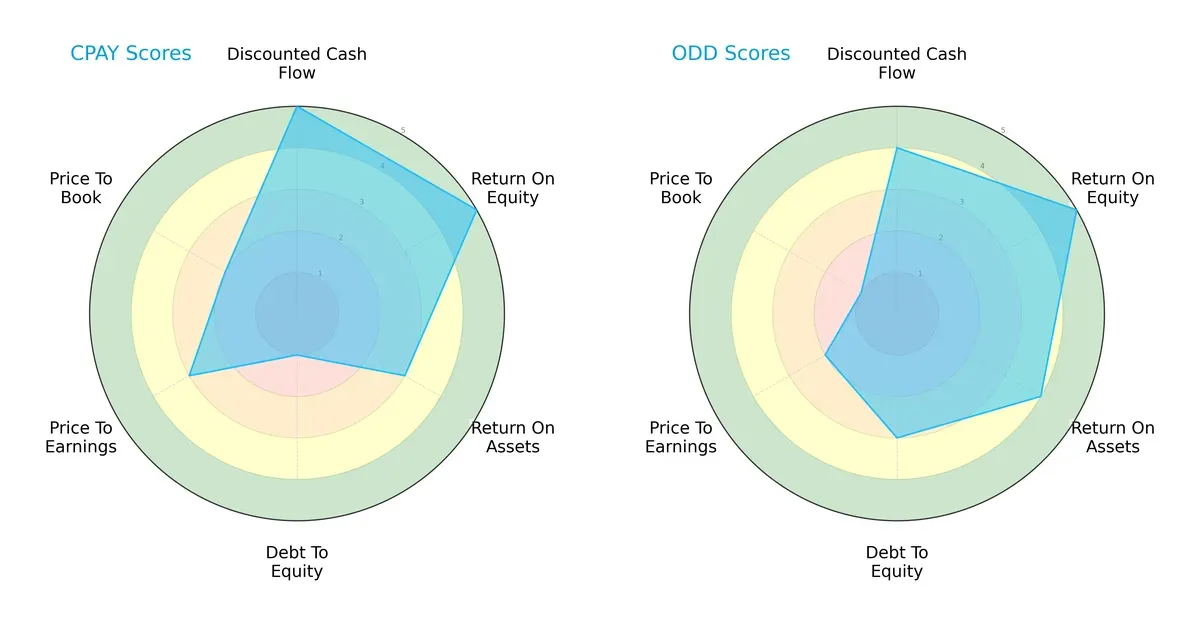

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Corpay, Inc. and Oddity Tech Ltd., illustrating their financial strengths and vulnerabilities:

Corpay excels with a top-tier discounted cash flow (5) and return on equity (5), signaling strong profit generation and valuation support. Oddity Tech matches Corpay’s ROE but delivers better asset use (ROA 4 vs. 3) and a healthier debt profile (3 vs. 1). Corpay’s balance sheet carries higher leverage risk, reflected in a very unfavorable debt-to-equity score. Oddity Tech’s valuation metrics lag, indicating potential overvaluation risks. Overall, Oddity Tech presents a more balanced profile; Corpay depends heavily on its cash flow and equity returns.

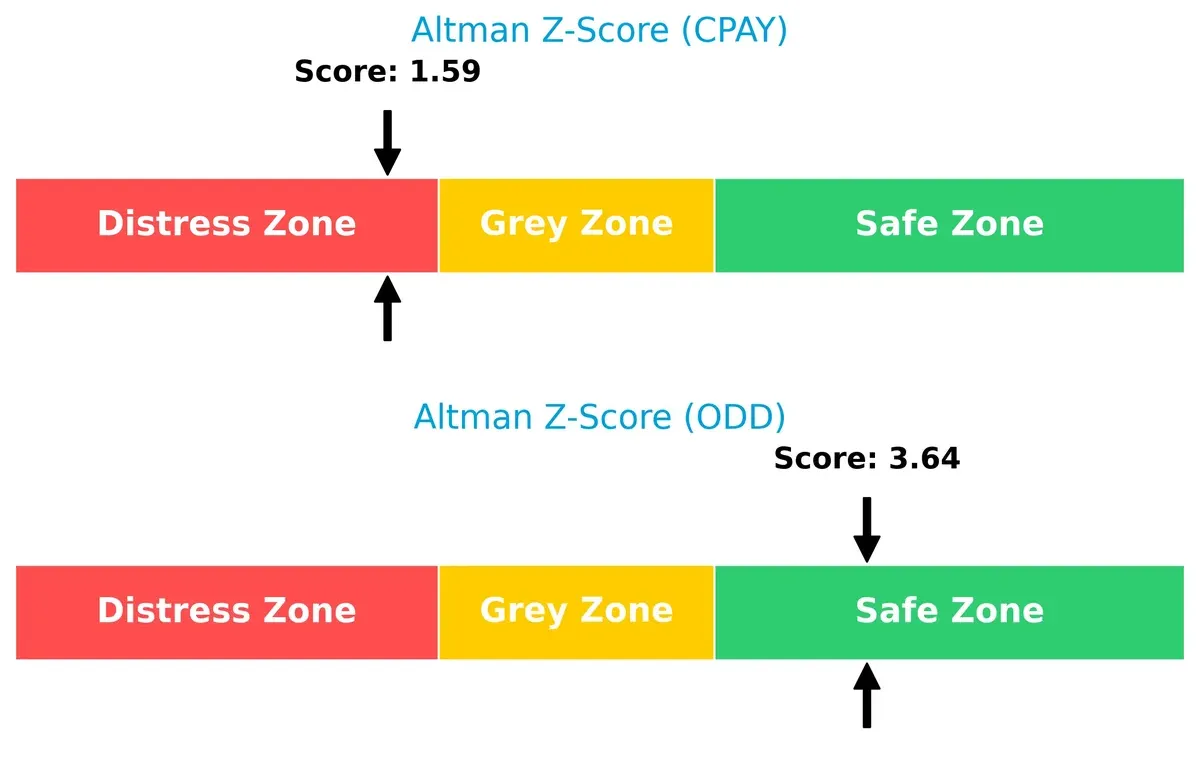

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap highlights a critical divergence in financial resilience between these firms:

Oddity Tech sits safely above 3.6, signaling strong solvency and low bankruptcy risk. Corpay’s 1.59 places it in the distress zone, raising red flags about its long-term survival under current market stress.

Financial Health: Quality of Operations

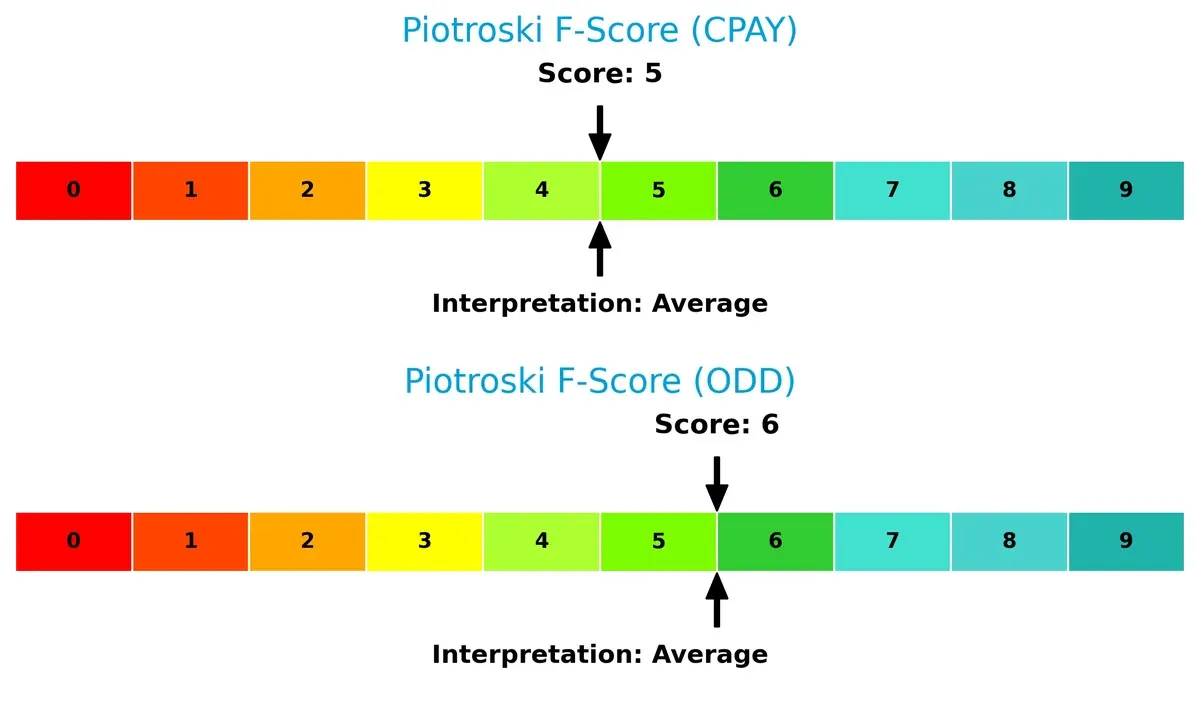

Piotroski F-Scores reveal nuanced operational quality differences:

Oddity Tech scores a 6, slightly outperforming Corpay’s 5, suggesting marginally stronger financial health. Both firms sit in the average range, but Corpay’s lower score hints at some internal weaknesses investors should monitor closely.

How are the two companies positioned?

This section dissects the operational DNA of CPAY and ODD by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which model offers a more resilient, sustainable advantage today.

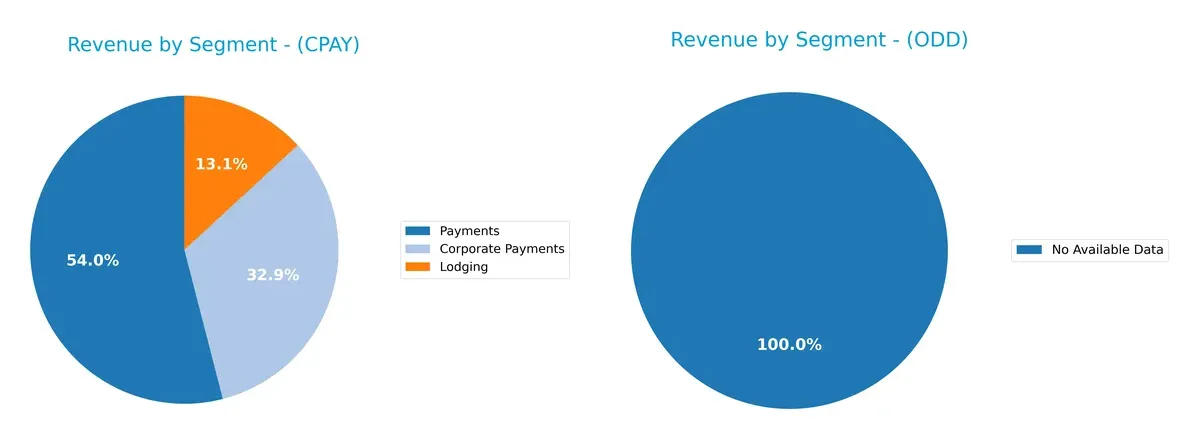

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Corpay, Inc. and Oddity Tech Ltd. diversify their income streams and where their primary sector bets lie:

Corpay, Inc. anchors its revenue in Payments with $2B, complemented by Corporate Payments at $1.2B and Lodging at $489M. This mix shows moderate diversification across financial services, reducing concentration risk. Oddity Tech Ltd. lacks available data, preventing meaningful comparison. Corpay’s focus on multiple payment-related segments suggests a strategic pivot toward ecosystem lock-in, leveraging transaction volume and corporate expense management.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Corpay, Inc. and Oddity Tech Ltd.:

Corpay Strengths

- Diversified revenue streams across payments and lodging

- Strong net margin at 23.62%

- Favorable ROE at 27.55%

- Global presence in US, UK, and Brazil

- Favorable fixed asset turnover at 9.59

Oddity Strengths

- High ROIC of 28.56% well above WACC

- Strong net margin at 15.69%

- Excellent interest coverage at 1521

- Low debt-to-assets ratio at 5.17%

- Favorable asset and fixed asset turnover ratios

Corpay Weaknesses

- Low current ratio below 1 signals liquidity risk

- High debt-to-equity at 2.58

- Unfavorable PB ratio at 5.43

- Asset turnover below industry standards at 0.17

- No dividend yield

Oddity Weaknesses

- High WACC at 18.62% pressures returns

- Elevated PB ratio at 8.54

- Zero dividend yield

- Limited geographic diversification, concentrated in North America

Corpay’s diversified revenue and global footprint contrast with Oddity’s superior capital efficiency and low leverage. However, Corpay’s liquidity and asset turnover raise concerns. Oddity’s high capital costs and geographic concentration may constrain growth. Both firms show no dividend payout, emphasizing reinvestment strategies.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competition erosion:

Corpay, Inc.: Efficient Capital Allocator with Cost Advantage

Corpay’s moat stems from cost advantage via streamlined payment infrastructure, delivering a 2.5% ROIC premium over WACC despite a declining trend. Its 43% EBIT margin reflects margin stability, but slowing ROIC warns of rising competition. Expansion into global payment markets in 2026 could deepen its moat if execution remains disciplined.

Oddity Tech Ltd.: Rapid Growth Fueled by Intangible Assets

Oddity’s competitive edge lies in brand strength and digital innovation, driving a 9.9% ROIC premium over WACC with an expanding trend. Oddity’s margin growth and 2657% EPS surge reveal a scaling moat, contrasting Corpay’s slower momentum. Continued product innovation and market disruption in beauty tech highlight its upside potential.

Cost Efficiency vs. Innovation Leadership

Oddity Tech commands a wider and deepening moat, shown by superior ROIC growth and rapid profitability expansion. Corpay maintains a solid but narrowing moat reliant on operational scale. Oddity is better positioned to defend and extend market share in a dynamic sector.

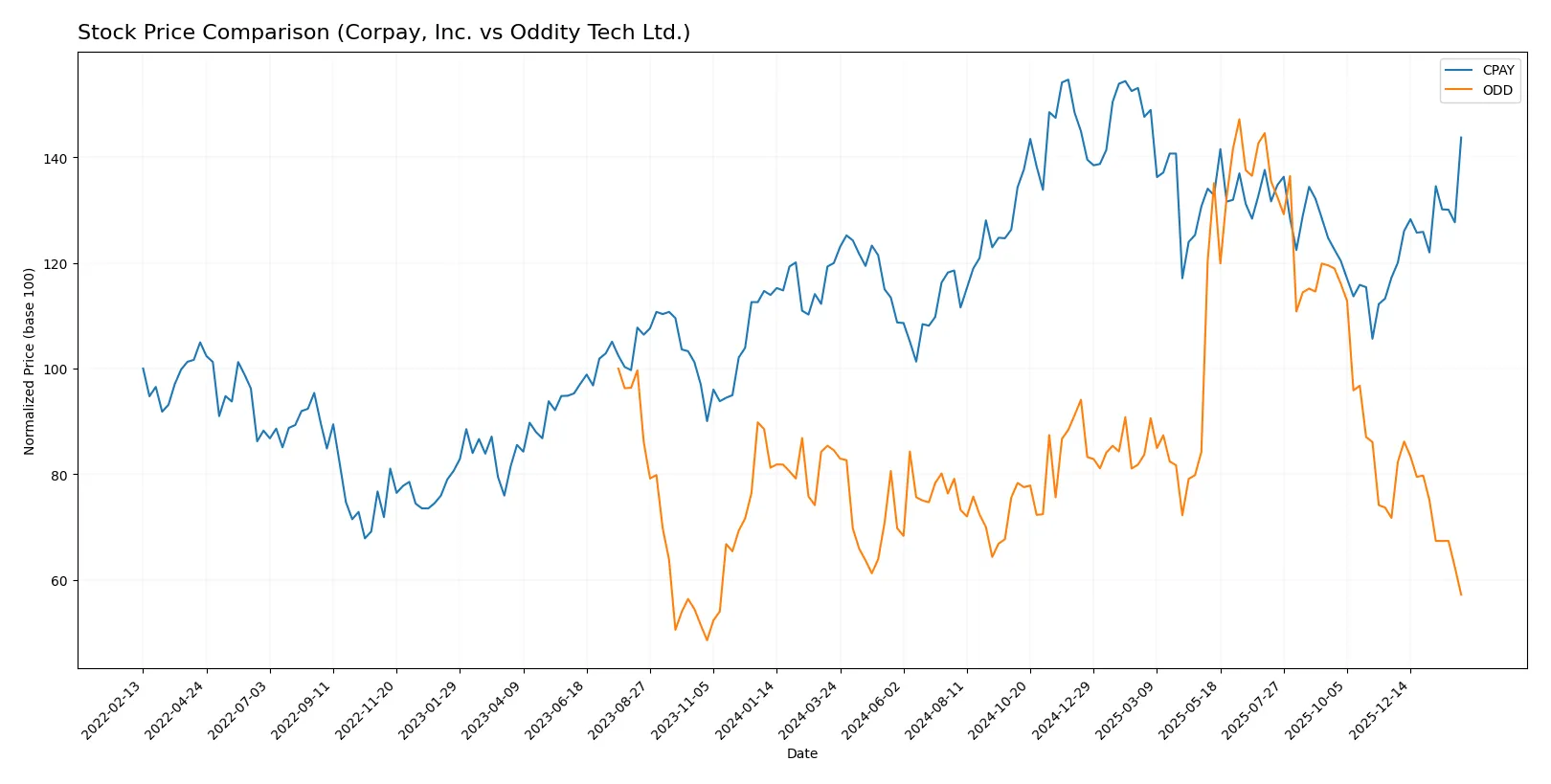

Which stock offers better returns?

Over the past year, Corpay, Inc. showed significant price appreciation with accelerating momentum, while Oddity Tech Ltd. faced steep declines and decelerating losses, reflecting contrasting market dynamics.

Trend Comparison

Corpay, Inc.’s stock rose 19.8% over the past 12 months, marking a bullish trend with accelerating gains and a high volatility of 31.25%. The recent three-month trend remains strong with a 22.63% increase.

Oddity Tech Ltd.’s stock declined 32.32% over the same period, signaling a bearish trend with decelerating losses and lower volatility at 11.98%. The recent quarter continued the downward trend with a 20.24% drop.

Corpay, Inc. outperformed Oddity Tech Ltd. substantially, delivering positive returns versus significant losses for Oddity Tech, thus showing superior market performance over the past year.

Target Prices

Analysts present a clear target consensus for both Corpay, Inc. and Oddity Tech Ltd., reflecting cautious optimism.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Corpay, Inc. | 300 | 390 | 359.33 |

| Oddity Tech Ltd. | 40 | 80 | 63.6 |

Corpay’s consensus target of 359.33 slightly exceeds its current price of 354.19, signaling moderate upside potential. Oddity Tech’s consensus target of 63.6 more than doubles its current price of 30.07, indicating strong growth expectations despite higher volatility risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Corpay, Inc. and Oddity Tech Ltd.:

Corpay, Inc. Grades

This table lists recent analyst grades and actions for Corpay, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Neutral | 2026-02-06 |

| JP Morgan | Maintain | Overweight | 2026-02-05 |

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Morgan Stanley | Maintain | Overweight | 2026-02-05 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-26 |

| Oppenheimer | Maintain | Outperform | 2026-01-12 |

| Oppenheimer | Upgrade | Outperform | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-11-06 |

| RBC Capital | Maintain | Sector Perform | 2025-11-06 |

| JP Morgan | Maintain | Overweight | 2025-11-06 |

Oddity Tech Ltd. Grades

This table shows recent analyst grades and actions for Oddity Tech Ltd.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-08 |

| JP Morgan | Maintain | Overweight | 2025-12-12 |

| Barclays | Maintain | Equal Weight | 2025-11-21 |

| JP Morgan | Maintain | Overweight | 2025-11-21 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-21 |

| Needham | Maintain | Buy | 2025-11-20 |

| Keybanc | Maintain | Overweight | 2025-10-08 |

| JMP Securities | Maintain | Market Outperform | 2025-09-23 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

| JMP Securities | Maintain | Market Outperform | 2025-08-05 |

Which company has the best grades?

Corpay, Inc. has several Overweight and Outperform grades, indicating moderate to strong confidence. Oddity Tech Ltd. also holds multiple Overweight and Market Outperform grades, with a Buy rating from Needham. Both companies maintain solid institutional support, but Oddity Tech shows a slightly wider range of bullish ratings, potentially signaling stronger investor enthusiasm.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Corpay, Inc.

- Operates in a mature payments sector with established competitors and moderate innovation pressure.

Oddity Tech Ltd.

- Faces intense disruption risk in offline beauty markets and fast-evolving digital consumer trends.

2. Capital Structure & Debt

Corpay, Inc.

- High debt-to-equity ratio (2.58) signals leveraged balance sheet and financial risk.

Oddity Tech Ltd.

- Very low leverage (0.08 DE), indicating strong financial stability and low default risk.

3. Stock Volatility

Corpay, Inc.

- Beta of 0.81 implies lower volatility than the market, offering relative stability.

Oddity Tech Ltd.

- Beta of 3.19 shows high stock price volatility and heightened investor risk.

4. Regulatory & Legal

Corpay, Inc.

- Subject to global payment regulations and compliance challenges across multiple jurisdictions.

Oddity Tech Ltd.

- Faces consumer protection scrutiny and regulatory shifts in diverse international beauty markets.

5. Supply Chain & Operations

Corpay, Inc.

- Complex global operations with potential exposure to logistics disruptions and cost inflation.

Oddity Tech Ltd.

- Smaller scale and digital-first model reduce traditional supply chain risks but increase tech dependency.

6. ESG & Climate Transition

Corpay, Inc.

- Exposure to climate transition risks in transportation-related services and sustainability pressures.

Oddity Tech Ltd.

- Increasing ESG expectations in consumer sectors may impact brand reputation and regulatory costs.

7. Geopolitical Exposure

Corpay, Inc.

- Operates in multiple geographies including US, UK, Brazil, sensitive to trade policies and sanctions.

Oddity Tech Ltd.

- Based in Israel with global sales, faces geopolitical tensions and market access risks.

Which company shows a better risk-adjusted profile?

Corpay’s most impactful risk is its elevated leverage, signaling potential financial distress, confirmed by its Altman Z-score in the distress zone. Oddity’s key risk lies in its extreme stock volatility, which may deter risk-averse investors. Overall, Oddity Tech exhibits a better risk-adjusted profile, supported by a safe-zone Altman Z-score and low debt, despite its price swings. This contrast highlights Oddity’s robust balance sheet against Corpay’s leverage vulnerability in 2026.

Final Verdict: Which stock to choose?

Corpay, Inc. stands out as a cash-generating powerhouse with strong operational efficiency and a solid return on equity. Its key point of vigilance is the strained liquidity position, which could challenge short-term flexibility. It suits investors targeting aggressive growth with tolerance for balance sheet risks.

Oddity Tech Ltd. boasts a robust strategic moat driven by high return on invested capital and conservative leverage. Its superior liquidity and financial stability offer a safer profile compared to Corpay. This makes it attractive for investors favoring growth at a reasonable price with a focus on capital preservation.

If you prioritize dynamic growth and can navigate tighter liquidity, Corpay offers compelling upside through operational strength and earnings growth. However, if you seek better stability with a sustainable competitive advantage and cleaner balance sheet, Oddity Tech outshines as the prudent choice for risk-conscious growth investors.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Corpay, Inc. and Oddity Tech Ltd. to enhance your investment decisions: