Home > Comparison > Technology > CPAY vs GDDY

The strategic rivalry between Corpay, Inc. and GoDaddy Inc. defines the current trajectory of the technology sector’s software infrastructure industry. Corpay operates as a capital-intensive payments platform focusing on vehicle and corporate expense management. In contrast, GoDaddy emphasizes scalable cloud-based services, including domain registration and website hosting. This analysis will assess which operational model delivers superior risk-adjusted returns for a diversified portfolio amidst evolving digital infrastructure demands.

Table of contents

Companies Overview

Corpay and GoDaddy stand as pivotal players in the evolving software infrastructure landscape.

Corpay, Inc.: Global Payments Innovator

Corpay dominates the business payments sector, generating revenue through vehicle-related expense management, corporate payments, and lodging solutions. Its strategic focus in 2026 targets expanding cross-border payment capabilities while enhancing virtual card products. Corpay leverages a broad portfolio including fuel, tolls, and fleet maintenance payments, serving global businesses with scalable infrastructure.

GoDaddy Inc.: Digital Identity Enabler

GoDaddy leads in cloud-based technology services, primarily through domain registration and website hosting products. Its latest strategy prioritizes integrated marketing tools and e-commerce capabilities to empower small businesses online. GoDaddy’s platform includes website builders, security solutions, and payment facilitation, creating a comprehensive ecosystem for digital presence and commerce.

Strategic Collision: Similarities & Divergences

Both operate in software infrastructure but diverge sharply in focus—Corpay targets corporate payments with a specialized financial services model, while GoDaddy embraces an open platform for digital identity and commerce. Their competitive battleground lies in enabling business operations, yet Corpay emphasizes transaction efficiency, and GoDaddy prioritizes digital customer acquisition. These distinct models shape contrasting investment profiles: Corpay’s niche financial infrastructure versus GoDaddy’s broad cloud services platform.

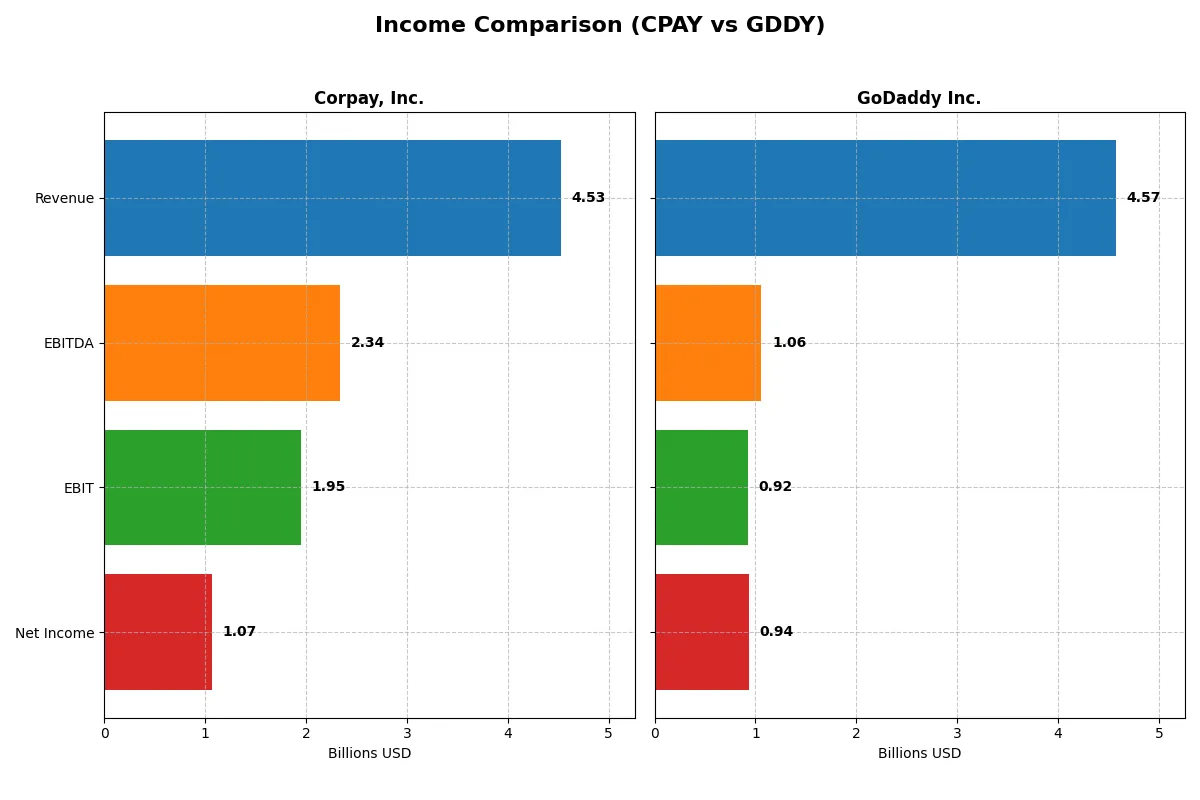

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Corpay, Inc. (CPAY) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Revenue | 4.53B | 4.57B |

| Cost of Revenue | 1.36B | 1.65B |

| Operating Expenses | 1.21B | 2.03B |

| Gross Profit | 3.17B | 2.92B |

| EBITDA | 2.34B | 1.06B |

| EBIT | 1.95B | 924M |

| Interest Expense | 404M | 158M |

| Net Income | 1.07B | 937M |

| EPS | 15.25 | 6.63 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs the more efficient and profitable business engine in recent years.

Corpay, Inc. Analysis

Corpay’s revenue rose steadily from 2.83B in 2021 to 4.53B in 2025. Net income grew from 839M to 1.07B over the same period. Gross margins remain strong near 70%, while net margins hover around a healthy 23.6%. The 2025 results show solid momentum with a 13.9% revenue increase and a 10.4% EBIT growth, reflecting operational efficiency.

GoDaddy Inc. Analysis

GoDaddy’s revenue climbed from 3.32B in 2020 to 4.57B in 2024. Net income surged impressively from a loss of 495M in 2020 to 937M in 2024. Gross margin stands at a favorable 63.9%, with net margins around 20.5%. Despite a recent 7.5% revenue increase, net income and EPS declined sharply in the latest year, signaling short-term margin pressure.

Margin Strength vs. Growth Resilience

Corpay delivers superior margin health and consistent income growth, with expanding EBIT and net margins underpinning operational strength. GoDaddy shows remarkable net income recovery and growth over five years but faces margin volatility recently. For investors prioritizing margin stability and efficiency, Corpay’s profile appears more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Corpay, Inc. (CPAY) | GoDaddy Inc. (GDDY) |

|---|---|---|

| ROE | 27.5% | 135.4% |

| ROIC | 8.8% | 16.0% |

| P/E | 19.7 | 29.8 |

| P/B | 5.4 | 40.3 |

| Current Ratio | 0.98 | 0.72 |

| Quick Ratio | 0.98 | 0.72 |

| D/E | 2.58 | 5.63 |

| Debt-to-Assets | 37.9% | 47.3% |

| Interest Coverage | 4.8 | 5.6 |

| Asset Turnover | 0.17 | 0.56 |

| Fixed Asset Turnover | 9.6 | 22.2 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, unveiling hidden risks and operational strengths that guide investment decisions with clarity.

Corpay, Inc.

Corpay delivers strong profitability with a 27.55% ROE and a solid 23.62% net margin, signaling operational excellence. Its P/E ratio of 19.73 suggests a fairly valued stock, though a high P/B at 5.43 indicates some valuation stretch. The company does not pay dividends, focusing instead on reinvestment for growth, maintaining a cautious balance sheet despite unfavorable leverage and liquidity metrics.

GoDaddy Inc.

GoDaddy boasts an exceptional 135.37% ROE and a respectable 20.49% net margin, reflecting high efficiency. However, its P/E of 29.76 and very elevated P/B ratio of 40.28 mark the stock as expensive. The firm also pays no dividends, channeling capital into research and development. Its high debt-to-equity ratio and weak liquidity ratios present notable financial risks.

Premium Valuation vs. Operational Safety

GoDaddy leads in profitability but trades at a premium with elevated financial risk. Corpay offers a more balanced valuation and stable profitability but shows leverage and liquidity concerns. Risk-tolerant investors might prefer GoDaddy’s growth profile, while conservative ones may lean toward Corpay’s operational steadiness.

Which one offers the Superior Shareholder Reward?

Corpay, Inc. (CPAY) eschews dividends but delivers value through robust free cash flow (FCF) and prudent reinvestment, reflected in a 0% payout but strong FCF per share of $18.5 in 2025. Its moderate buyback activity complements this, supporting shareholder value sustainably. GoDaddy Inc. (GDDY) also pays no dividends but emphasizes aggressive share buybacks, underpinned by improving free cash flow ($8.9 per share in 2024) and a focus on deleveraging. However, its high financial leverage and volatile margins raise sustainability concerns. I find CPAY’s balanced reinvestment and moderate leverage offer a more attractive, risk-managed total return profile for 2026 investors.

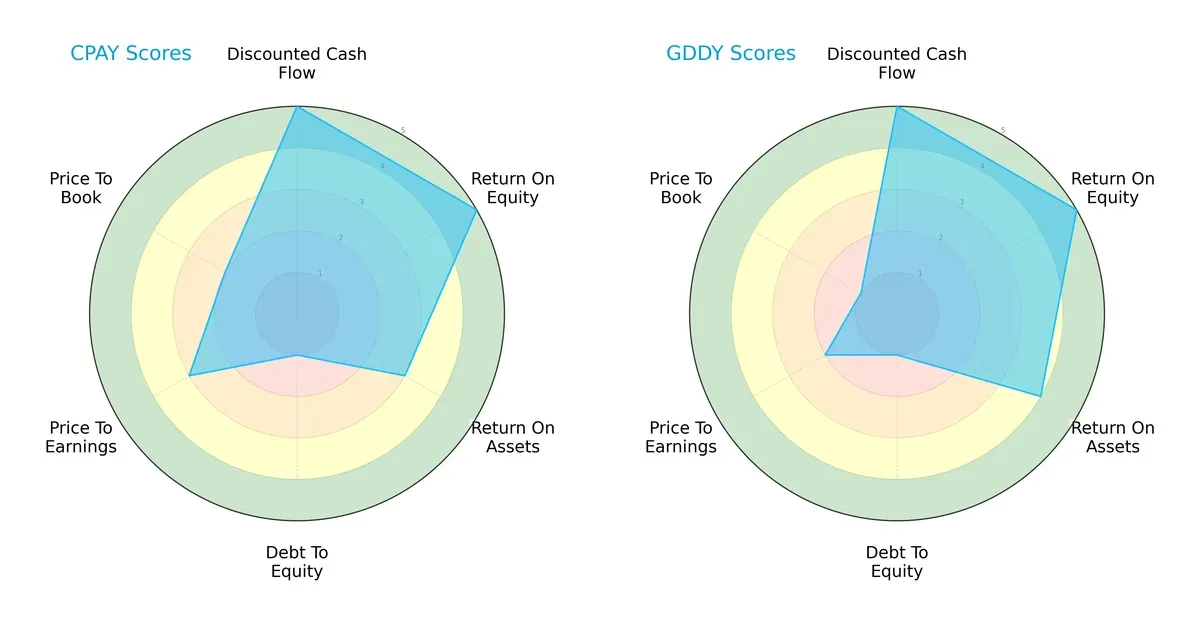

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and strategic trade-offs of Corpay, Inc. and GoDaddy Inc., highlighting their financial strengths and vulnerabilities:

Both firms share high DCF and ROE scores, signaling strong cash flow and efficient equity use. GoDaddy edges Corpay on ROA, demonstrating superior asset efficiency. Both suffer from very unfavorable debt-to-equity scores, exposing leverage risks. Corpay holds a slight advantage in valuation metrics (PE/PB), indicating a more balanced valuation profile. Overall, GoDaddy leans on operational efficiency, while Corpay offers a steadier valuation approach.

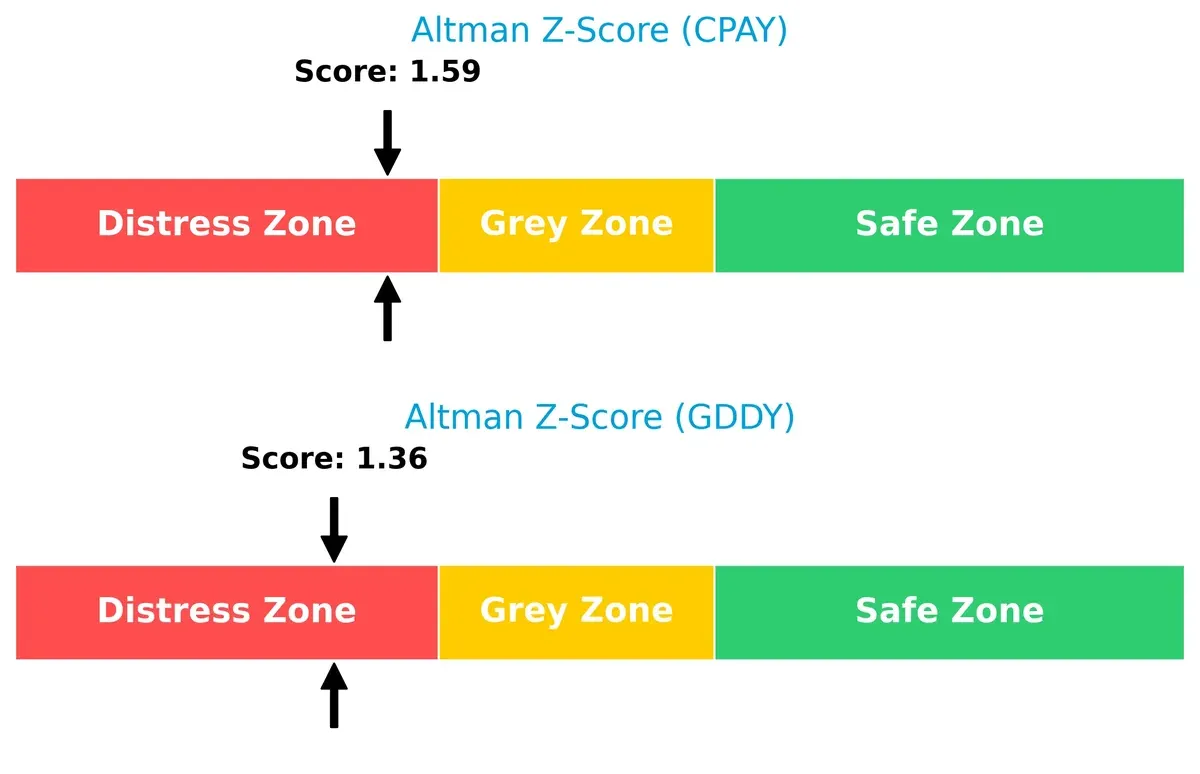

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both companies in the distress zone, indicating elevated bankruptcy risk in this cycle:

Corpay’s Z-score of 1.59 slightly outperforms GoDaddy’s 1.36, but both signal financial distress. This calls for caution, as neither firm currently demonstrates the solvency needed to weather prolonged market stress confidently.

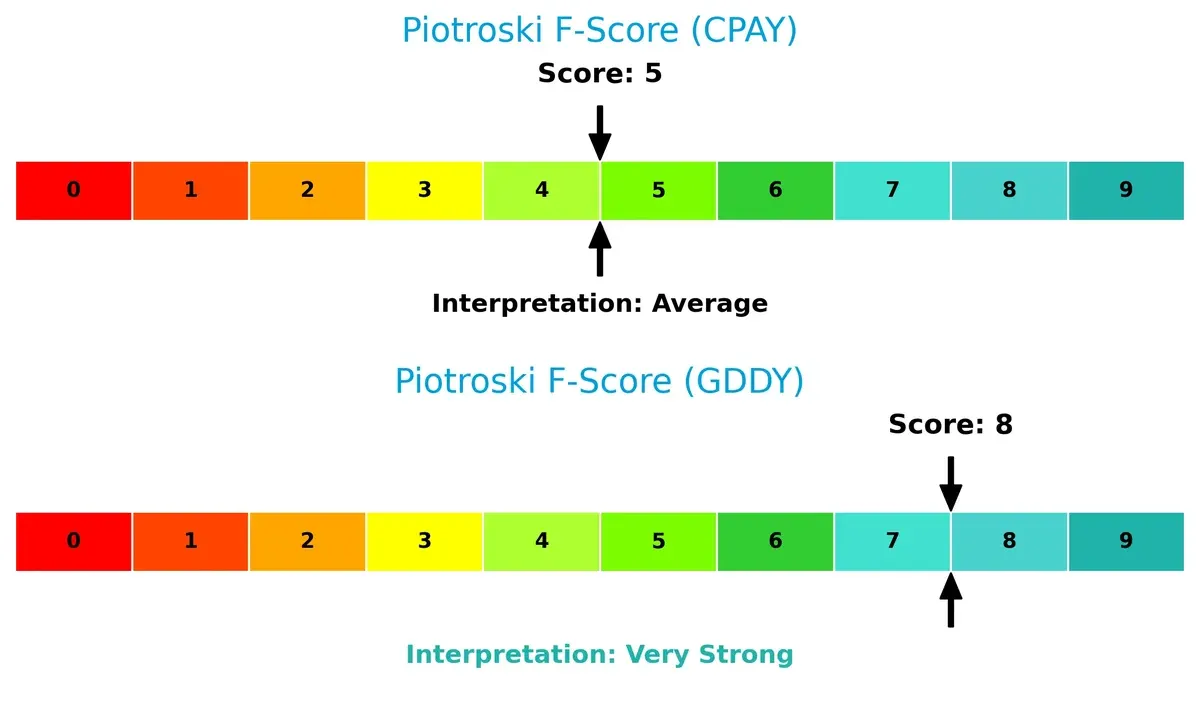

Financial Health: Quality of Operations

GoDaddy’s Piotroski F-Score of 8 versus Corpay’s 5 marks a clear difference in operational quality and financial strength:

GoDaddy shows very strong internal fundamentals, suggesting robust profitability, liquidity, and efficiency. Corpay’s average score raises red flags about potential internal weaknesses. Investors should weigh these operational disparities carefully when allocating capital.

How are the two companies positioned?

This section dissects the operational DNA of Corpay and GoDaddy by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

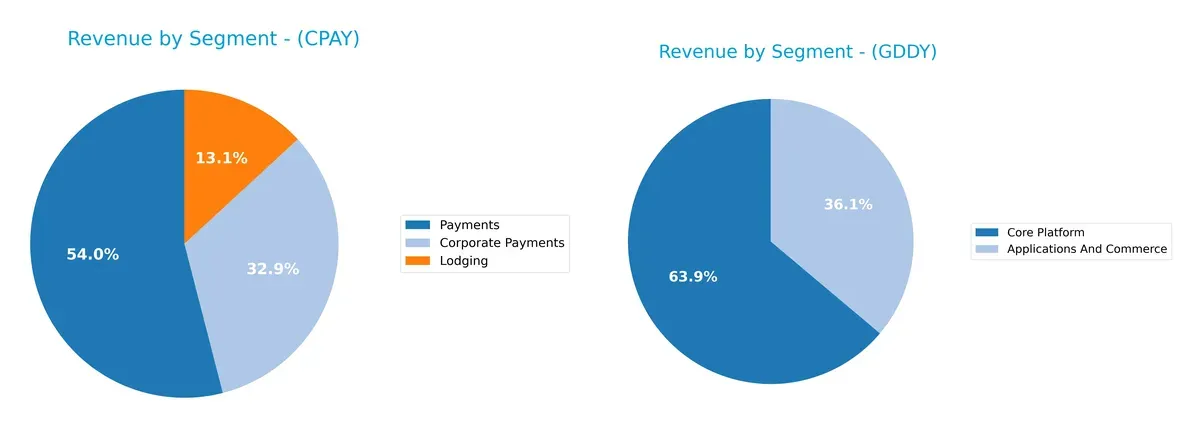

This visual comparison dissects how Corpay, Inc. and GoDaddy Inc. diversify their income streams and where their primary sector bets lie:

Corpay’s revenue pivots around Payments at $2B, anchored by Corporate Payments ($1.2B) and Lodging ($489M), showing moderate diversification. GoDaddy leans heavily on its Core Platform, pulling in $2.92B, with Applications and Commerce adding $1.65B, indicating a more balanced mix. Corpay’s concentration in payments signals dependency risks, while GoDaddy’s platform dominance suggests strong ecosystem lock-in and steady infrastructure control.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Corpay and GoDaddy:

Corpay Strengths

- Diversified revenue across Corporate Payments, Lodging, and Payments

- Favorable net margin at 23.62%

- ROE strong at 27.55%

- WACC at a low 6.26% supports capital efficiency

- Favorable fixed asset turnover at 9.59

GoDaddy Strengths

- Higher ROE at 135.37% indicates strong profitability

- Favorable ROIC at 16.02% above WACC of 7.27%

- Strong net margin at 20.49%

- Favorable interest coverage at 5.84

- Leading fixed asset turnover at 22.22

- Large global presence with significant US and Non-US revenue

Corpay Weaknesses

- Unfavorable current ratio at 0.98 signals liquidity risk

- High debt to equity ratio at 2.58

- Unfavorable price-to-book at 5.43

- Low asset turnover at 0.17 limits operational efficiency

- No dividend yield

- Moderate debt to assets at 37.86%

GoDaddy Weaknesses

- Very low current and quick ratios at 0.72 raise liquidity concerns

- High debt to equity at 5.63 indicates leverage risk

- Unfavorable P/E at 29.76 and very high P/B at 40.28 suggest overvaluation

- No dividend yield

- Moderate asset turnover at 0.56

Corpay shows solid profitability with diversified revenue but faces liquidity and leverage challenges. GoDaddy delivers exceptional profitability and global scale but carries higher leverage and liquidity risks alongside valuation concerns. These factors shape each firm’s financial and operational strategy moving forward.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting long-term profits from relentless competition erosion. Let’s examine two distinct moats in action:

Corpay, Inc.: Specialized Cost Advantage

Corpay’s moat stems from its cost-efficient payment solutions across diverse geographies. It translates into a strong 43% EBIT margin but faces a declining ROIC trend. New markets could deepen this cost edge if operational efficiency improves.

GoDaddy Inc.: Expanding Network Effects

GoDaddy leverages network effects in digital identity and hosting services, fueling a rising ROIC and 20% EBIT margin. Its expanding global footprint and product integrations deepen its moat, outpacing Corpay’s growth in profitability.

Cost Efficiency vs. Network Effects: The Moat Showdown

GoDaddy’s growing ROIC and network effects create a wider, more sustainable moat than Corpay’s narrowing cost advantage. GoDaddy is better positioned to defend and expand its market share in 2026.

Which stock offers better returns?

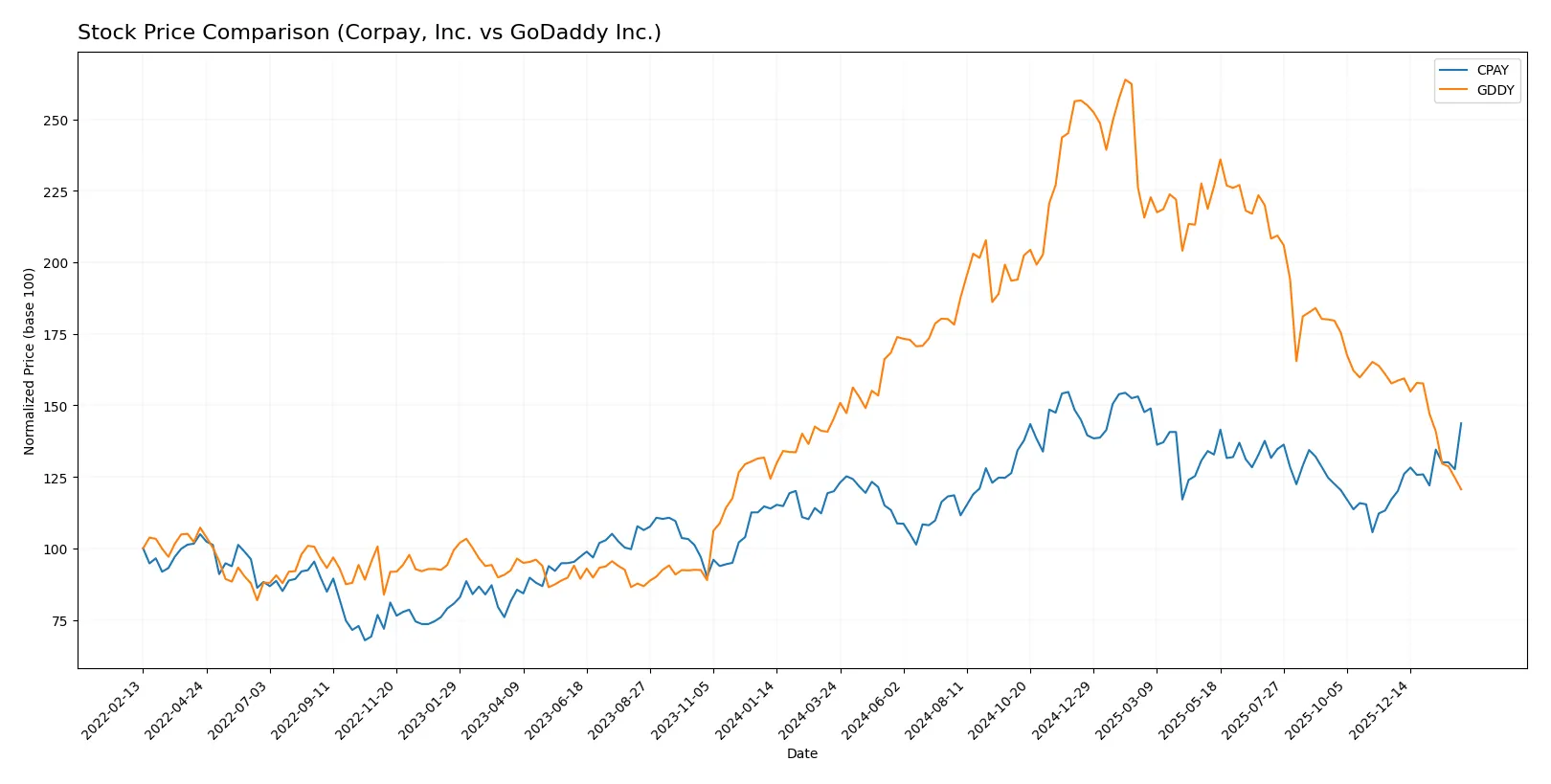

Over the past 12 months, Corpay, Inc. showed strong price appreciation with accelerating momentum, while GoDaddy Inc. faced a declining trend marked by deceleration and notable drawdowns.

Trend Comparison

Corpay, Inc. posted a bullish trend with a 19.8% price increase over the last year. The trend accelerated, reaching a high of 381.18 and a low of 249.66, with volatility at 31.25.

GoDaddy Inc. exhibited a bearish trend, declining 17.04% over the same period. The negative trend decelerated, hitting a low of 97.22 and a high of 212.65, with volatility at 28.07.

Corpay’s bullish performance contrasts with GoDaddy’s bearish slide. Corpay delivered the highest market returns over the 12-month span.

Target Prices

Analysts present a clear consensus on target prices for Corpay, Inc. and GoDaddy Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Corpay, Inc. | 300 | 390 | 359.33 |

| GoDaddy Inc. | 70 | 173 | 138.5 |

The target consensus for Corpay sits slightly above its current price of 354.19, indicating moderate upside potential. GoDaddy’s consensus target of 138.5 suggests significant room for appreciation from the current 97.22 price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Corpay, Inc. Grades

The following table summarizes recent institutional grades for Corpay, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Neutral | 2026-02-06 |

| JP Morgan | Maintain | Overweight | 2026-02-05 |

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Morgan Stanley | Maintain | Overweight | 2026-02-05 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-26 |

| Oppenheimer | Maintain | Outperform | 2026-01-12 |

| Oppenheimer | Upgrade | Outperform | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-11-06 |

| RBC Capital | Maintain | Sector Perform | 2025-11-06 |

| JP Morgan | Maintain | Overweight | 2025-11-06 |

GoDaddy Inc. Grades

Below is a summary of recent grades issued for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

Which company has the best grades?

Corpay, Inc. holds stronger recent grades with multiple Overweight and Outperform ratings. GoDaddy shows a mix of Buy, Hold, and Neutral. Corpay’s higher grades suggest more institutional confidence, potentially influencing investor sentiment positively.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Corpay, Inc.

- Operates in competitive payments and corporate solutions markets with global exposure. Competition intensifies with fintech entrants.

GoDaddy Inc.

- Faces fierce competition in cloud technology, domain registration, and hosting, with pressure from large cloud providers.

2. Capital Structure & Debt

Corpay, Inc.

- High debt-to-equity ratio (2.58) signals financial leverage risk; interest coverage moderate at 4.83x.

GoDaddy Inc.

- Even higher debt-to-equity (5.63) raises solvency concerns; interest coverage better at 5.84x but leverage remains a red flag.

3. Stock Volatility

Corpay, Inc.

- Beta of 0.81 indicates lower volatility and more stability relative to the market.

GoDaddy Inc.

- Beta near 0.93 suggests moderately higher price swings, increasing risk for risk-averse investors.

4. Regulatory & Legal

Corpay, Inc.

- Payment processing subject to evolving financial regulations and cross-border compliance risks.

GoDaddy Inc.

- Cloud and hosting services face data privacy and cybersecurity regulatory challenges globally.

5. Supply Chain & Operations

Corpay, Inc.

- Relies on robust payment networks and travel logistics; disruptions could impact service delivery.

GoDaddy Inc.

- Depends on data centers and internet infrastructure; operational risks include outages and cyberattacks.

6. ESG & Climate Transition

Corpay, Inc.

- Increasing scrutiny on sustainability in corporate travel and fleet management.

GoDaddy Inc.

- Pressure to reduce carbon footprint of data centers and improve energy efficiency in tech operations.

7. Geopolitical Exposure

Corpay, Inc.

- Exposure to US, UK, Brazil markets with currency and regulatory risks amid geopolitical tensions.

GoDaddy Inc.

- International digital presence subjects company to global trade policies and political risks affecting internet governance.

Which company shows a better risk-adjusted profile?

Corpay’s biggest risk is its high financial leverage combined with a low current ratio, increasing short-term liquidity risks. GoDaddy’s primary concern is even higher debt levels paired with significant valuation multiples, adding solvency and market pricing risks. Despite Corpay’s operational challenges, its lower beta and more moderate valuation provide a slightly better risk-adjusted profile. Notably, both firms fall in the Altman Z-Score distress zone, but GoDaddy’s stronger Piotroski score signals better financial health resilience.

Final Verdict: Which stock to choose?

Corpay, Inc. (CPAY) stands out with its superpower of operational efficiency, driving solid returns on equity and consistent value creation above its cost of capital. However, its high leverage and tight liquidity ratios warrant vigilance. CPAY suits an aggressive growth portfolio willing to tolerate balance sheet risks for strong cash flow performance.

GoDaddy Inc. (GDDY) leverages a strategic moat rooted in scalable recurring revenues and an expanding competitive advantage, reflected in its rapidly growing ROIC. Relative to CPAY, it offers better profitability growth and a more robust operating asset base, though it carries elevated debt and valuation premiums. GDDY fits well within a GARP (Growth at a Reasonable Price) portfolio seeking durable growth with some margin of safety.

If you prioritize operational efficiency and cash flow-driven growth, Corpay outshines with focused capital allocation despite its leverage risks. However, if you seek a company with a widening moat and superior growth stability, GoDaddy offers better sustainability and competitive positioning, albeit at a premium and with its own financial risks. Both names present analytical scenarios aligned with distinct investor risk appetites and strategic goals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Corpay, Inc. and GoDaddy Inc. to enhance your investment decisions: