In the fast-evolving technology sector, CoreWeave, Inc. and Zscaler, Inc. stand out as innovative leaders in software infrastructure. CoreWeave specializes in cloud platforms supporting AI workloads, while Zscaler focuses on cloud security solutions. Both target large enterprise markets with overlapping technological needs, making their comparison compelling. This article will guide you through their strengths to determine which company presents a more attractive investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between CoreWeave and Zscaler by providing an overview of these two companies and their main differences.

CoreWeave Overview

CoreWeave, Inc. operates a cloud platform focused on scaling, support, and acceleration for GenAI workloads. The company builds infrastructure supporting compute tasks for enterprises, offering GPU and CPU compute, storage, networking, managed services, and virtual and bare metal servers. Founded in 2017 and based in New Jersey, CoreWeave targets specialized cloud infrastructure needs with innovative lifecycle controllers and AI-related services.

Zscaler Overview

Zscaler, Inc. is a global cloud security provider delivering solutions for secure access to SaaS applications, private data centers, and public clouds. Its products include Internet access, private access, digital experience monitoring, and workload segmentation to ensure compliance and reduce security risks. Founded in 2007 and headquartered in California, Zscaler serves diverse industries with a focus on cloud security and digital experience management.

Key similarities and differences

Both CoreWeave and Zscaler operate in the technology sector within software infrastructure, providing cloud-related services. CoreWeave emphasizes cloud compute infrastructure for AI and rendering, while Zscaler specializes in cloud security and access management. CoreWeave is a newer, smaller company with a higher beta, indicating more volatility, whereas Zscaler has a larger workforce and market cap with a more stable beta, reflecting its established presence in cloud security.

Income Statement Comparison

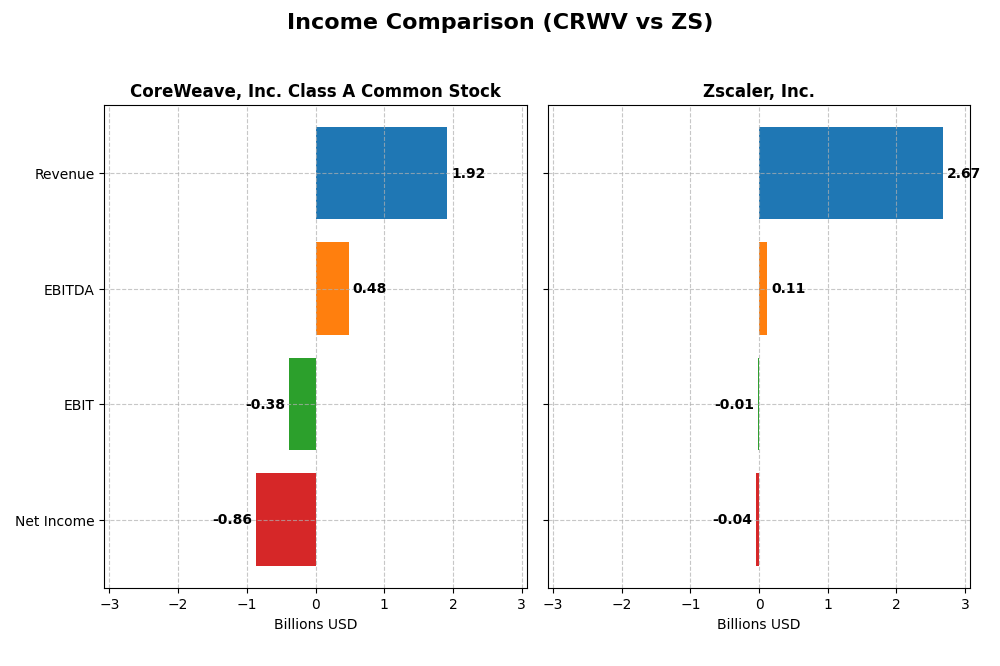

The following table presents a side-by-side comparison of the most recent full fiscal year income statement metrics for CoreWeave, Inc. Class A Common Stock and Zscaler, Inc.

| Metric | CoreWeave, Inc. Class A Common Stock | Zscaler, Inc. |

|---|---|---|

| Market Cap | 50.4B | 34.1B |

| Revenue | 1.92B | 2.67B |

| EBITDA | 480M | 112M |

| EBIT | -383M | -8.8M |

| Net Income | -937.8M | -41.5M |

| EPS | -2.33 | -0.27 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

CoreWeave, Inc. Class A Common Stock

CoreWeave’s revenue surged from $15.8M in 2022 to $1.92B in 2024, showing rapid growth. Despite a favorable gross margin near 74%, the company posted a negative net income of -$863M in 2024, reflecting high interest expenses and operating losses. The latest year saw improved EBIT but persistent net losses, indicating ongoing profitability challenges amid expansion.

Zscaler, Inc.

Zscaler’s revenue increased steadily from $673M in 2021 to $2.67B in 2025, accompanied by a strong gross margin of 77%. While EBIT margins remain slightly negative, net losses narrowed to -$41M in 2025 from -$202M in 2023, showing improving profitability. The company’s consistent growth and improved margins signal operational progress with reduced losses over time.

Which one has the stronger fundamentals?

Zscaler demonstrates stronger fundamentals with steady revenue growth, higher gross margins, and narrowing net losses. CoreWeave’s explosive revenue growth contrasts with significant net losses and unfavorable interest expenses, impacting margins. While both have favorable revenue trends, Zscaler’s more balanced income statement and margin improvements suggest comparatively more stable financial health.

Financial Ratios Comparison

The table below presents a side-by-side comparison of the most recent key financial ratios for CoreWeave, Inc. Class A Common Stock (CRWV) and Zscaler, Inc. (ZS), based on their latest reported fiscal years.

| Ratios | CoreWeave, Inc. (CRWV) FY 2024 | Zscaler, Inc. (ZS) FY 2025 |

|---|---|---|

| ROE (%) | 2.09 | -2.31 |

| ROIC (%) | 2.08 | -3.18 |

| P/E | -18.7 | -1063.0 |

| P/B | -39.1 | 24.51 |

| Current Ratio | 0.39 | 2.01 |

| Quick Ratio | 0.39 | 2.01 |

| D/E | -25.68 | 1.00 |

| Debt-to-Assets | 59.6% | 28.0% |

| Interest Coverage | 0.90 | -13.49 |

| Asset Turnover | 0.11 | 0.42 |

| Fixed Asset Turnover | 0.13 | 4.22 |

| Payout ratio | -6.7% | 0% |

| Dividend yield (%) | 0.36 | 0 |

Interpretation of the Ratios

CoreWeave, Inc. Class A Common Stock

CoreWeave exhibits several unfavorable ratios, including a weak current ratio at 0.39, high debt-to-assets at 59.56%, and poor interest coverage at -1.06, signaling liquidity and solvency concerns. However, it shows a strong return on equity at 208.77%. The company does not pay dividends, likely reflecting reinvestment in growth and infrastructure development.

Zscaler, Inc.

Zscaler presents a mixed picture with favorable liquidity ratios such as a current ratio of 2.01 and low debt-to-assets at 27.98%, but several profitability metrics like negative ROE (-2.31%) and net margin (-1.55%) are unfavorable. The company does not pay dividends, consistent with a focus on R&D and expansion in cloud security solutions.

Which one has the best ratios?

Zscaler holds a slightly more favorable ratio profile than CoreWeave, mainly due to stronger liquidity and lower leverage. CoreWeave’s high leverage and weak liquidity weigh heavily against it, despite its impressive ROE. Overall, Zscaler’s ratios are slightly unfavorable, while CoreWeave’s are clearly unfavorable.

Strategic Positioning

This section compares the strategic positioning of CoreWeave, Inc. Class A Common Stock (CRWV) and Zscaler, Inc. (ZS) including Market position, Key segments, and disruption:

CoreWeave, Inc. Class A Common Stock

- Focuses on cloud infrastructure with high beta, facing strong competitive pressure in software infrastructure.

- Provides GPU/CPU compute, storage, networking, VFX, AI model training, and mission control services.

- Infrastructure-centric services with potential exposure to evolving cloud and AI technologies.

Zscaler, Inc.

- Operates in cloud security, moderate beta, competes globally with established market presence.

- Offers cloud security solutions for Internet access, private access, digital experience, and workload segmentation.

- Cloud security platform exposed to ongoing technological advances in cybersecurity and cloud computing.

CoreWeave vs Zscaler Positioning

CoreWeave’s approach is concentrated on cloud infrastructure and AI compute workloads, while Zscaler pursues a diversified cloud security portfolio across industries. CoreWeave faces higher volatility; Zscaler benefits from broader market segments and a growing profitability trend.

Which has the best competitive advantage?

Both companies are currently shedding value as ROIC is below WACC. Zscaler shows improving profitability with a growing ROIC trend, while CoreWeave’s profitability remains stable but unfavorable, indicating Zscaler may have a slight edge in competitive advantage.

Stock Comparison

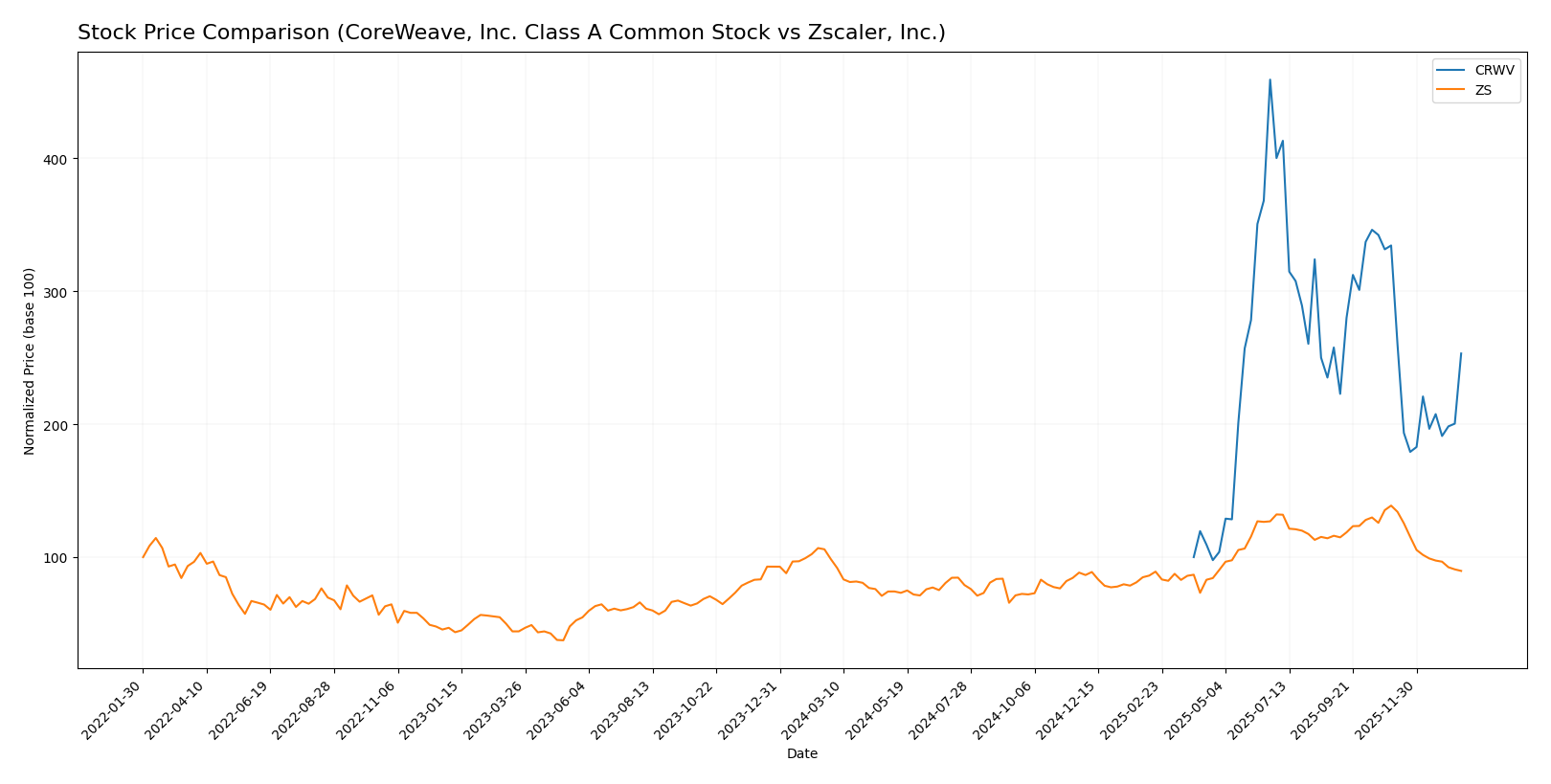

The stock price movements of CoreWeave, Inc. Class A Common Stock (CRWV) and Zscaler, Inc. (ZS) over the past 12 months reveal contrasting trading dynamics, with CRWV showing a significant upward trend while ZS experiences a decline.

Trend Analysis

CoreWeave (CRWV) exhibited a strong bullish trend over the past year, with a price increase of 153.08%. The trend shows deceleration and a recent negative correction of -24.29% from November 2025 to January 2026. Volatility is moderate, with a standard deviation of 35.67.

Zscaler (ZS) faced a bearish trend over the same period, declining by 9.03%. This downward trend also decelerated, with a sharper recent drop of -35.38%. Volatility remains high, with a standard deviation of 47.11.

Comparing both stocks, CoreWeave delivered the highest market performance over the last 12 months, significantly outperforming Zscaler’s declining trend.

Target Prices

Here is the consensus target price outlook from reliable analysts for these two technology infrastructure companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CoreWeave, Inc. Class A Common Stock | 175 | 68 | 115.79 |

| Zscaler, Inc. | 360 | 260 | 311.41 |

Analysts expect CoreWeave’s stock to appreciate from its current price of $101.23 toward a consensus target of $115.79, indicating moderate upside potential. Zscaler’s consensus target of $311.41 is significantly above its current price of $213.98, reflecting stronger bullish sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for CoreWeave, Inc. Class A Common Stock (CRWV) and Zscaler, Inc. (ZS):

Rating Comparison

CRWV Rating

- Rating: D+, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: Very Unfavorable, score of 1.

- ROE Score: Very Unfavorable, with a score of 1.

- ROA Score: Very Unfavorable, score of 1.

- Debt To Equity Score: Very Unfavorable, score of 1.

- Overall Score: Very Unfavorable, score of 1.

ZS Rating

- Rating: C-, also Very Favorable according to analysts.

- Discounted Cash Flow Score: Favorable, score of 4.

- ROE Score: Very Unfavorable, score of 1.

- ROA Score: Very Unfavorable, score of 1.

- Debt To Equity Score: Very Unfavorable, score of 1.

- Overall Score: Very Unfavorable, score of 1.

Which one is the best rated?

ZS holds a higher rating grade (C-) compared to CRWV’s D+, mainly due to a favorable discounted cash flow score of 4 versus CRWV’s 1. Both share very unfavorable scores in ROE, ROA, debt to equity, and overall metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

CRWV Scores

- Altman Z-Score: 0.80, in the distress zone, indicating high bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

ZS Scores

- Altman Z-Score: 4.89, in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

Which company has the best scores?

ZS has a significantly higher Altman Z-Score, placing it in the safe zone, unlike CRWV which is in distress. Both companies share the same very weak Piotroski Score of 3. Overall, ZS shows stronger financial stability based on these scores.

Grades Comparison

The following is a comparison of recent grades assigned to CoreWeave, Inc. Class A Common Stock and Zscaler, Inc.:

CoreWeave, Inc. Class A Common Stock Grades

This table presents recent grades from verifiable grading companies for CoreWeave, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| DA Davidson | Upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Barclays | Maintain | Equal Weight | 2025-11-12 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-11 |

Overall, CoreWeave’s grades show a balanced mix of Buy, Overweight, Neutral, and Equal Weight ratings with mostly maintained actions and one upgrade.

Zscaler, Inc. Grades

This table presents recent grades from verifiable grading companies for Zscaler, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Mizuho | Upgrade | Outperform | 2025-12-16 |

| Bernstein | Downgrade | Market Perform | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-12-01 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Baird | Maintain | Outperform | 2025-11-26 |

| BTIG | Maintain | Buy | 2025-11-26 |

Zscaler’s ratings predominantly include Buy, Overweight, and Outperform grades, with mostly maintained actions and one upgrade and one downgrade.

Which company has the best grades?

Zscaler, Inc. has received more consistently strong ratings such as Outperform and Buy compared to CoreWeave’s mixture of Buy, Overweight, and Neutral grades. This pattern suggests Zscaler is viewed more favorably by analysts, which may influence investor confidence and portfolio decisions.

Strengths and Weaknesses

Below is a comparative overview of CoreWeave, Inc. Class A Common Stock (CRWV) and Zscaler, Inc. (ZS) based on their key strengths and weaknesses as of the most recent fiscal data.

| Criterion | CoreWeave, Inc. (CRWV) | Zscaler, Inc. (ZS) |

|---|---|---|

| Diversification | Limited product segmentation; focus on specific markets | Concentrated segment with $2.67B revenue, indicating focused service offering |

| Profitability | Negative net margin (-45.08%), low ROIC (2.08%), high WACC (84.93%) | Slightly negative net margin (-1.55%), negative ROIC (-3.18%), moderate WACC (8.4%) |

| Innovation | High ROE (208.77%) suggests efficient management but value destruction persists | Growing ROIC trend signals improving innovation impact despite current losses |

| Global presence | Moderate; financial leverage high with debt to assets at 59.56% | Strong liquidity with current ratio 2.01 and moderate debt (27.98% debt to assets) |

| Market Share | Low asset turnover (0.11) indicates underutilization of assets | Better asset turnover (0.42) and fixed asset turnover (4.22) hint at more effective operations |

Key takeaways: CoreWeave faces significant profitability and efficiency challenges despite strong management returns, indicating risk in value creation. Zscaler shows improving profitability trends and stronger liquidity, though still shedding value, suggesting cautious optimism for investors.

Risk Analysis

Below is a comparative risk table for CoreWeave, Inc. Class A Common Stock (CRWV) and Zscaler, Inc. (ZS) based on the most recent fiscal data available.

| Metric | CoreWeave, Inc. (CRWV) | Zscaler, Inc. (ZS) |

|---|---|---|

| Market Risk | Very high beta (21.65) indicating extreme volatility | Moderate beta (1.02), reflecting average market sensitivity |

| Debt level | High debt-to-assets ratio (59.56%), poor interest coverage (-1.06) | Moderate debt-to-assets (27.98%), also negative interest coverage (-0.92) |

| Regulatory Risk | Moderate, technology sector exposure with potential data compliance issues | Moderate, operates in cloud security with evolving regulatory landscape |

| Operational Risk | Low asset turnover (0.11) and weak liquidity ratios (current ratio 0.39) | Better liquidity (current ratio 2.01), higher asset turnover (0.42) |

| Environmental Risk | Limited exposure, mostly data center operations | Limited exposure, primarily software-based services |

| Geopolitical Risk | US based, subject to domestic tech policy changes | US based, exposed to global cloud security demands and risks |

The most significant risks for CoreWeave lie in its extremely high market volatility and financial distress signals, including weak liquidity and heavy leverage, highlighting potential solvency concerns. Zscaler, while facing regulatory and operational challenges, maintains better liquidity and lower leverage, reducing its default risk. Investors should weigh CoreWeave’s aggressive growth potential against its financial vulnerabilities and consider Zscaler’s more stable but still challenging environment.

Which Stock to Choose?

CoreWeave, Inc. Class A Common Stock (CRWV) shows a favorable income evolution with strong revenue growth of 736.64% in one year but suffers from negative net margin (-45.08%) and low current ratios (0.39). Financial ratios are mostly unfavorable, with 71.43% negative, and the company is shedding value as ROIC is well below WACC. Its rating is very unfavorable (D+), with distress zone Altman Z-Score and very weak Piotroski score.

Zscaler, Inc. (ZS) presents a favorable income statement with consistent revenue growth of 23.31% in the last year and improved net margin, though still negative (-1.55%). Its financial ratios are slightly unfavorable, with 50% negative but a strong current ratio (2.01). The company is also shedding value but shows a growing ROIC trend. Ratings are very unfavorable (C-) overall, but it has a safe zone Altman Z-Score despite a very weak Piotroski score.

Investors focused on growth might find CoreWeave’s rapid revenue expansion appealing despite its financial challenges and value destruction. Conversely, those prioritizing stability could see Zscaler’s improving profitability and healthier liquidity as more favorable, given its slightly better financial ratios and safer bankruptcy risk profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CoreWeave, Inc. Class A Common Stock and Zscaler, Inc. to enhance your investment decisions: