In the fast-evolving software infrastructure sector, CoreWeave, Inc. (CRWV) and Wix.com Ltd. (WIX) stand out as innovative players shaping the future of cloud and web services. CoreWeave focuses on high-performance cloud computing for AI workloads, while Wix empowers millions with user-friendly web development tools. This article will compare their strategies, market positions, and growth potential to help you decide which company deserves a place in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between CoreWeave and Wix.com by providing an overview of these two companies and their main differences.

CoreWeave Overview

CoreWeave, Inc. operates a cloud platform specializing in scaling, support, and acceleration for generative AI workloads. Positioned in the software infrastructure industry, CoreWeave offers GPU and CPU compute, storage, networking, and managed services tailored for enterprises. Founded in 2017 and based in Livingston, NJ, it supports AI model training, rendering, and mission control through a sophisticated infrastructure platform.

Wix.com Overview

Wix.com Ltd. develops and markets a cloud-based platform enabling users worldwide to create websites and web applications with ease. Operating in software infrastructure, Wix offers tools like drag-and-drop editors, AI-powered logo makers, and payment solutions. Founded in 2006 and headquartered in Tel Aviv, Israel, Wix serves over 222M registered users and 6M premium subscribers, focusing on empowering small businesses and creators.

Key similarities and differences

Both CoreWeave and Wix.com operate in the technology sector focusing on cloud-based software infrastructure. CoreWeave targets enterprise-scale AI compute and infrastructure services, while Wix.com caters primarily to individuals and small businesses with website creation and management tools. Their market caps differ significantly, with CoreWeave at approximately $50B and Wix around $4.5B, reflecting different scales and user bases within cloud service markets.

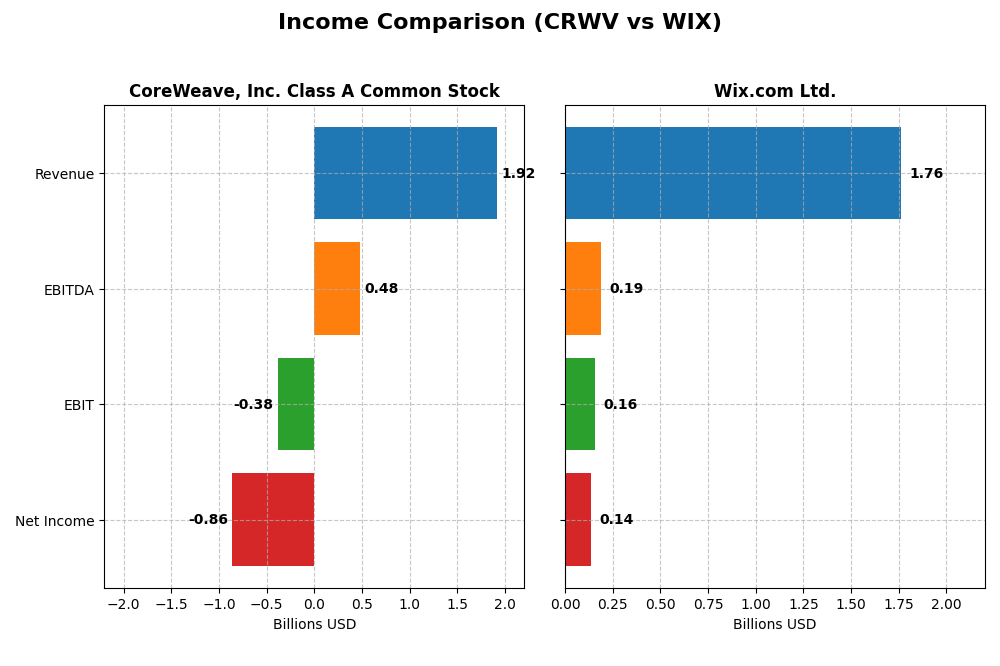

Income Statement Comparison

This table compares the latest fiscal year income statement metrics for CoreWeave, Inc. Class A Common Stock (CRWV) and Wix.com Ltd. (WIX), showing key financial figures to highlight their performance.

| Metric | CoreWeave, Inc. Class A Common Stock (CRWV) | Wix.com Ltd. (WIX) |

|---|---|---|

| Market Cap | 50.4B | 4.46B |

| Revenue | 1.92B | 1.76B |

| EBITDA | 480M | 186M |

| EBIT | -383M | 155M |

| Net Income | -937.8M | 138.3M |

| EPS | -2.33 | 2.49 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CoreWeave, Inc. Class A Common Stock

CoreWeave’s revenue surged dramatically from $15.8M in 2022 to $1.92B in 2024, reflecting rapid expansion. Despite this, net income remained negative, worsening to -$937.8M in 2024. Gross margins stayed robust around 74%, but EBIT and net margins were deeply negative, indicating high costs and interest expenses. The latest year showed strong revenue growth but continued losses.

Wix.com Ltd.

Wix’s revenue steadily increased from $985M in 2020 to $1.76B in 2024, with net income turning positive at $138.3M in 2024 after prior losses. Gross margin remained solid near 68%, while EBIT margin improved to 8.8%. The company demonstrated consistent margin expansion and profitability gains, with the most recent year showing significant growth in net income and EPS.

Which one has the stronger fundamentals?

Wix exhibits stronger fundamentals with sustained revenue growth, positive net income, and improving margins, supported by favorable evaluations in nearly all income statement metrics. CoreWeave, despite impressive revenue expansion and gross margin, struggles with negative profitability and high interest costs, presenting more risk in its financial health.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CoreWeave, Inc. Class A Common Stock (CRWV) and Wix.com Ltd. (WIX) for the fiscal year 2024, highlighting their latest available metrics.

| Ratios | CoreWeave, Inc. (CRWV) | Wix.com Ltd. (WIX) |

|---|---|---|

| ROE | 2.09% | -1.76% |

| ROIC | 2.08% | 9.13% |

| P/E | -18.73 | 86.21 |

| P/B | -39.11 | -151.35 |

| Current Ratio | 0.39 | 0.84 |

| Quick Ratio | 0.39 | 0.84 |

| D/E | -25.68 | -12.31 |

| Debt-to-Assets | 59.56% | 50.70% |

| Interest Coverage | 0.90 | 25.92 |

| Asset Turnover | 0.11 | 0.92 |

| Fixed Asset Turnover | 0.13 | 3.33 |

| Payout Ratio | -6.69% | 0% |

| Dividend Yield | 0.36% | 0% |

Interpretation of the Ratios

CoreWeave, Inc. Class A Common Stock

CoreWeave shows mostly unfavorable ratios, including a weak current ratio of 0.39 and high debt-to-assets at 59.56%, which raise liquidity and solvency concerns. Positive aspects include a strong ROE of 208.77% and favorable PE and PB ratios, although negative net margin and interest coverage are risks. The company does not pay dividends, reflecting likely reinvestment in growth and infrastructure.

Wix.com Ltd.

Wix presents mixed ratios with a slightly unfavorable global view. Its current ratio at 0.84 is below ideal, but interest coverage is strong at 40.14, indicating good debt service capacity. ROE is negative at -175.57%, signaling potential profitability issues. Wix does not pay dividends, likely prioritizing innovation, R&D, and business expansion over shareholder distributions.

Which one has the best ratios?

Between the two, Wix’s ratios show a more balanced profile with fewer unfavorable metrics and strong interest coverage, despite negative ROE and no dividends. CoreWeave’s ratios reveal more liquidity and profitability weaknesses, making Wix slightly more stable in comparison based on the available financial ratios.

Strategic Positioning

This section compares the strategic positioning of CoreWeave (CRWV) and Wix.com (WIX) focusing on Market position, Key segments, and exposure to disruption:

CoreWeave, Inc. Class A Common Stock

- Strong market cap of 50B; high beta indicates significant competitive pressure and volatility.

- Focused on cloud infrastructure for GenAI with GPU, CPU compute, storage, networking, and managed services.

- Positioned in software infrastructure with advanced AI and VFX workloads; no explicit disruption exposure mentioned.

Wix.com Ltd.

- Smaller market cap near 4.5B; moderate beta suggests steadier competitive environment.

- Diversified cloud platform enabling website creation with business solutions and creative subscriptions.

- Offers AI-driven tools like logo maker and automated services, adapting to evolving web and e-commerce demands.

CoreWeave vs Wix.com Positioning

CoreWeave pursues a concentrated strategy centered on GenAI cloud infrastructure, benefiting from niche specialization but facing high volatility. Wix.com adopts a diversified approach with multiple business and creative solutions, potentially reducing risk but with lower market cap scale.

Which has the best competitive advantage?

Both companies are currently shedding value relative to their cost of capital. Wix shows improving profitability trends, indicating some strengthening competitive advantage, while CoreWeave’s stable but unfavorable ROIC suggests weaker moat sustainability.

Stock Comparison

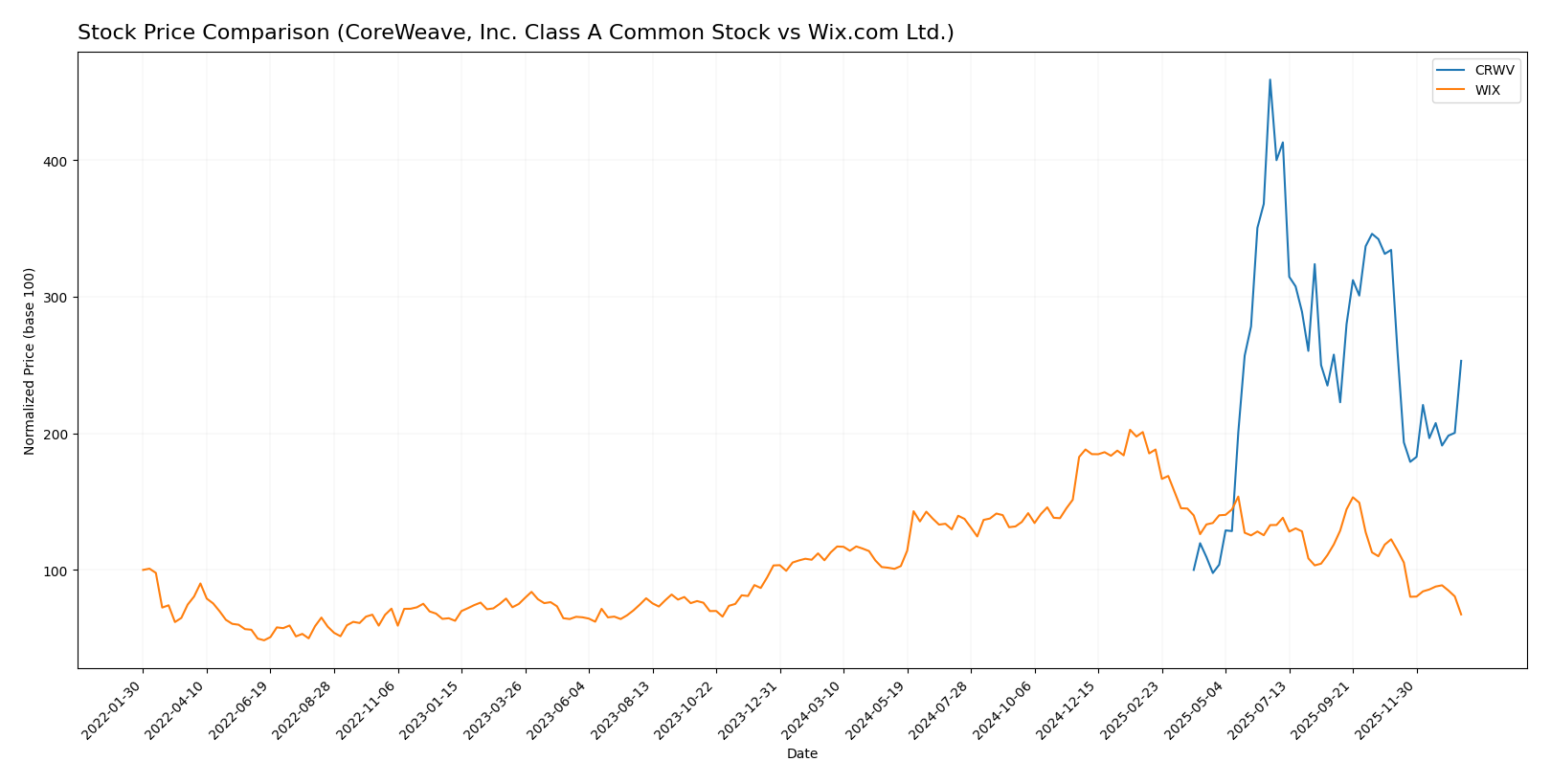

The stock price movements of CoreWeave, Inc. Class A Common Stock (CRWV) and Wix.com Ltd. (WIX) over the past 12 months reveal contrasting dynamics, with CRWV showing strong gains despite recent pullbacks, while WIX experiences a sustained decline.

Trend Analysis

CoreWeave’s stock price increased by 153.08% over the past year, indicating a bullish trend with decelerating momentum. The highest price reached 183.58, the lowest 39.09, and volatility measured by standard deviation was 35.67.

Wix.com Ltd. exhibited a bearish trend with a 40.28% price decline in the same period. Its price peaked at 240.89 and bottomed at 80.16, with decelerating downward momentum and a standard deviation of 34.39.

Comparing both stocks, CoreWeave delivered the highest market performance with a significant positive price change, while Wix.com showed a marked negative trend over the analyzed year.

Target Prices

The current analyst consensus provides a clear outlook on target prices for CoreWeave, Inc. and Wix.com Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CoreWeave, Inc. Class A Common Stock | 175 | 68 | 115.79 |

| Wix.com Ltd. | 210 | 70 | 160.27 |

Analysts expect CoreWeave’s stock to appreciate moderately from its current price of 101.23 USD, while Wix.com shows a higher upside potential compared to its present price of 80.16 USD. These targets suggest cautious optimism with room for growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CoreWeave, Inc. Class A Common Stock (CRWV) and Wix.com Ltd. (WIX):

Rating Comparison

CRWV Rating

- Rating: D+, considered very favorable by analysts.

- Discounted Cash Flow Score: Very unfavorable at 1.

- ROE Score: Very unfavorable at 1.

- ROA Score: Very unfavorable at 1.

- Debt To Equity Score: Very unfavorable at 1.

- Overall Score: Very unfavorable at 1.

WIX Rating

- Rating: C, also considered very favorable.

- Discounted Cash Flow Score: Moderate at 3.

- ROE Score: Very unfavorable at 1.

- ROA Score: Favorable at 4.

- Debt To Equity Score: Very unfavorable at 1.

- Overall Score: Moderate at 2.

Which one is the best rated?

Based strictly on the provided data, WIX holds a higher overall score and outperforms CRWV in discounted cash flow and return on assets, making it the better-rated stock. CRWV scores uniformly low across all financial metrics.

Scores Comparison

Here is a comparison of the financial health scores for CoreWeave and Wix.com:

CRWV Scores

- Altman Z-Score: 0.80, in distress zone, high bankruptcy risk.

- Piotroski Score: 3, very weak financial strength.

WIX Scores

- Altman Z-Score: 1.83, in grey zone, moderate bankruptcy risk.

- Piotroski Score: 6, average financial strength.

Which company has the best scores?

Wix.com shows stronger financial health with a higher Altman Z-Score in the grey zone and an average Piotroski Score. CoreWeave is in the distress zone with very weak Piotroski results, indicating greater financial risk.

Grades Comparison

Here is a comparison of the most recent reliable grades for CoreWeave, Inc. Class A Common Stock and Wix.com Ltd.:

CoreWeave, Inc. Class A Common Stock Grades

The following table summarizes recent analyst grades for CoreWeave from reputable firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| DA Davidson | Upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Barclays | Maintain | Equal Weight | 2025-11-12 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-11 |

CoreWeave’s grades predominantly range from Neutral to Buy and Overweight, reflecting a stable to moderately positive analyst sentiment.

Wix.com Ltd. Grades

Below are recent grades issued by verified analysts for Wix.com Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| Wells Fargo | Maintain | Overweight | 2025-12-19 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-11-20 |

| Citizens | Maintain | Market Outperform | 2025-11-20 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-20 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-20 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-20 |

| Needham | Maintain | Buy | 2025-11-20 |

| B. Riley Securities | Maintain | Buy | 2025-11-20 |

Wix.com’s analyst ratings are predominantly Buy and Outperform, indicating a broadly favorable consensus.

Which company has the best grades?

Wix.com Ltd. has received generally higher and more consistently bullish grades compared to CoreWeave, with multiple Outperform and Overweight ratings. This suggests stronger analyst confidence, potentially influencing investor sentiment and positioning.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for CoreWeave, Inc. (CRWV) and Wix.com Ltd. (WIX) based on the most recent financial and operational data.

| Criterion | CoreWeave, Inc. Class A Common Stock (CRWV) | Wix.com Ltd. (WIX) |

|---|---|---|

| Diversification | Limited product/service diversification; focused on cloud GPU computing | Moderately diversified with Creative Subscription and Business Solutions segments, growing revenue across both |

| Profitability | Negative net margin (-45.08%), low ROIC (2.08%), high WACC (84.93%) indicating value destruction | Moderate net margin (7.86%), neutral ROIC (9.13%) with improving profitability trend |

| Innovation | Strong in niche GPU cloud computing but facing high capital costs | Continuous product innovation in website building and business solutions, supporting revenue growth |

| Global presence | Smaller scale with limited global reach | Established global presence with broad customer base |

| Market Share | Niche player in cloud GPU market, limited market share | Significant player in website creation platforms, growing market share |

Key takeaways: CoreWeave shows potential in a specialized field but struggles with profitability and value creation. Wix demonstrates stronger diversification and improving profitability, though some financial ratios suggest room for caution. Investors should weigh CoreWeave’s innovation against its financial risks, while Wix offers steadier growth with moderate risk.

Risk Analysis

Below is a comparative risk table for CoreWeave, Inc. (CRWV) and Wix.com Ltd. (WIX) based on the latest available data for 2024-2026.

| Metric | CoreWeave, Inc. (CRWV) | Wix.com Ltd. (WIX) |

|---|---|---|

| Market Risk | Very high beta (21.65), highly volatile | Moderate beta (1.42), less volatile |

| Debt level | High debt-to-assets (59.56%), weak interest coverage (-1.06) | Moderate debt-to-assets (50.7%), strong interest coverage (40.14) |

| Regulatory Risk | US tech sector regulations, moderate risk | Exposure to international regulations, medium risk |

| Operational Risk | Low current ratio (0.39), operational inefficiencies | Slightly better liquidity (0.84), diverse cloud services |

| Environmental Risk | Moderate, related to data center energy use | Moderate, standard for cloud-based software |

| Geopolitical Risk | US-based, stable environment | Higher due to Israel base and international markets |

In synthesis, CoreWeave’s most impactful risks are its extreme market volatility and financial distress signals, including poor liquidity and high leverage, raising bankruptcy concerns. Wix shows lower market risk but faces regulatory and geopolitical uncertainties internationally, alongside moderate financial risks. Investors should weigh CoreWeave’s high growth potential against its financial instability and Wix’s steadier but geopolitically sensitive profile.

Which Stock to Choose?

CoreWeave, Inc. Class A Common Stock (CRWV) shows strong revenue growth of nearly 12,000% over 2022-2024, but suffers from a negative net margin of -45.08% and unfavorable financial ratios including high debt and weak liquidity. Its overall rating is very unfavorable, reflecting value destruction and financial distress.

Wix.com Ltd. (WIX) demonstrates moderate revenue growth of 79% over 2020-2024, with a positive net margin of 7.86% and a more balanced financial profile. Although profitability ratios are mixed and debt remains a concern, the company has a favorable income statement evaluation and a moderate overall rating, with improving profitability trends.

Investors prioritizing high growth potential might consider CRWV’s rapid revenue expansion despite its financial risks, while those seeking relatively stable profitability and improving returns may find WIX’s profile more aligned with cautious growth or quality investing approaches. Both companies show signs of value destruction, but WIX’s growing profitability could appear more appealing for risk-averse investors.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CoreWeave, Inc. Class A Common Stock and Wix.com Ltd. to enhance your investment decisions: