In today’s fast-evolving tech landscape, CoreWeave, Inc. (CRWV) and Teradata Corporation (TDC) stand out as key players in the software infrastructure industry. Both companies provide essential cloud-based platforms that support enterprise data workloads, yet they differ in scale, innovation focus, and market approach. This comparison will help investors understand which company presents the most promising opportunity for their portfolio in 2026. Let’s dive into the details and identify the better investment choice.

Table of contents

Companies Overview

I will begin the comparison between CoreWeave and Teradata by providing an overview of these two companies and their main differences.

CoreWeave Overview

CoreWeave, Inc. operates a cloud platform focused on scaling, support, and acceleration for generative AI workloads. The company provides infrastructure services including GPU and CPU compute, storage, networking, and managed virtual and bare metal servers. Founded in 2017 and based in Livingston, NJ, CoreWeave targets enterprises needing specialized compute resources for AI model training, inference, and rendering.

Teradata Overview

Teradata Corporation delivers a connected multi-cloud data platform designed for enterprise analytics. Its flagship product, Teradata Vantage, enables organizations to unify diverse data sources and simplify analytics ecosystems. Founded in 1979 and headquartered in San Diego, CA, Teradata offers consulting, migration, and support services to clients across multiple industries including finance, healthcare, and telecommunications.

Key similarities and differences

Both companies operate in the software infrastructure sector, providing enterprise-level cloud computing solutions. CoreWeave specializes in GPU-accelerated workloads for AI and rendering, while Teradata focuses on data analytics and multi-cloud integration. CoreWeave is a younger, smaller company with a highly volatile stock, whereas Teradata is more established with a broader industry client base and a lower beta, indicating less stock price volatility.

Income Statement Comparison

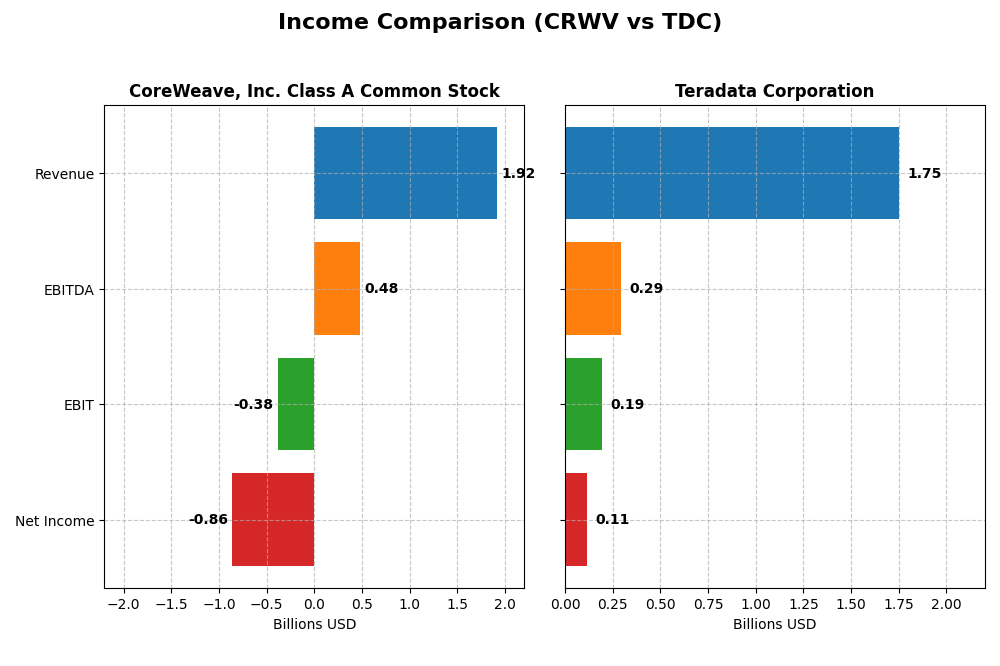

Below is the income statement comparison for CoreWeave, Inc. Class A Common Stock and Teradata Corporation for the fiscal year 2024.

| Metric | CoreWeave, Inc. (CRWV) | Teradata Corporation (TDC) |

|---|---|---|

| Market Cap | 50.4B | 2.8B |

| Revenue | 1.92B | 1.75B |

| EBITDA | 480M | 293M |

| EBIT | -383M | 193M |

| Net Income | -863M | 114M |

| EPS | -2.33 | 1.18 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CoreWeave, Inc. Class A Common Stock

CoreWeave experienced a dramatic revenue increase from $15.8M in 2022 to $1.92B in 2024, signaling rapid growth. However, net income remained negative, worsening from -$31M to -$863M, with net margin at -45.08% in 2024. The gross margin improved to 74.24%, but EBIT margin stayed negative at -20.02%, reflecting high operating costs and interest expenses.

Teradata Corporation

Teradata’s revenue slightly declined from $1.92B in 2021 to $1.75B in 2024, with net income decreasing from $147M to $114M. Despite this, margins remain positive, with a 2024 gross margin of 60.46% and EBIT margin of 11.03%. The net margin improved to 6.51% in 2024, supported by controlled interest expenses and a 31.29% EBIT growth over the past year.

Which one has the stronger fundamentals?

Teradata maintains positive profitability margins and steady net income despite slight revenue contraction, indicating resilient fundamentals. CoreWeave shows exceptional revenue growth but persistent net losses and negative margins, reflecting higher risk. Both companies have favorable overall income statement opinions, but Teradata’s stable profitability contrasts with CoreWeave’s volatile earnings and interest burden.

Financial Ratios Comparison

Below is a comparison of key financial ratios for CoreWeave, Inc. Class A Common Stock (CRWV) and Teradata Corporation (TDC) for the fiscal year 2024.

| Ratios | CoreWeave, Inc. (CRWV) | Teradata Corporation (TDC) |

|---|---|---|

| ROE | 2.09% | 85.7% |

| ROIC | 2.08% | 16.9% |

| P/E | -18.7 | 26.3 |

| P/B | -39.1 | 22.6 |

| Current Ratio | 0.39 | 0.81 |

| Quick Ratio | 0.39 | 0.79 |

| D/E | -25.7 | 4.33 |

| Debt-to-Assets | 59.6% | 33.8% |

| Interest Coverage | 0.90 | 7.21 |

| Asset Turnover | 0.11 | 1.03 |

| Fixed Asset Turnover | 0.13 | 9.07 |

| Payout ratio | -6.7% | 0% |

| Dividend yield | 0.36% | 0% |

Interpretation of the Ratios

CoreWeave, Inc. Class A Common Stock

CoreWeave’s ratios show a concerning picture with 71.43% unfavorable metrics, including a weak current ratio at 0.39 and negative interest coverage, indicating liquidity and solvency risks. Despite a strong ROE of 208.77%, low asset turnover and high debt-to-assets ratio at 59.56% are problematic. The company does not pay dividends, likely due to negative free cash flow and reinvestment in growth.

Teradata Corporation

Teradata presents a more balanced profile with 42.86% favorable and unfavorable ratios each, and a neutral overall rating. Its ROE at 85.71% and ROIC at 16.89% are strong, supported by solid asset turnover and interest coverage ratios. Current liquidity ratios remain below 1, posing mild concerns. Teradata does not pay dividends, probably prioritizing R&D and acquisitions to support its multi-cloud data platform.

Which one has the best ratios?

Teradata displays a more favorable and balanced set of financial ratios, with strengths in profitability and asset efficiency, despite some liquidity concerns. CoreWeave shows higher risks with more unfavorable ratios and liquidity challenges, although its exceptional ROE stands out. Overall, Teradata’s neutral rating indicates a comparatively healthier financial position.

Strategic Positioning

This section compares the strategic positioning of CoreWeave (CRWV) and Teradata (TDC) across market position, key segments, and exposure to technological disruption:

CoreWeave, Inc. Class A Common Stock (CRWV)

- Large market cap $50B with high beta 21.65, indicating volatile competitive pressures in cloud infrastructure.

- Focused on cloud platform infrastructure supporting GenAI, GPU/CPU compute, storage, networking, and managed services.

- Positioned in emerging GenAI infrastructure with potential disruption from evolving cloud and AI technologies.

Teradata Corporation (TDC)

- Smaller market cap $2.8B, low beta 0.57, implying stable competitive environment in enterprise analytics.

- Diversified multi-cloud data platform with analytics, consulting, and support services across multiple sectors.

- Exposed to cloud migration trends but benefits from integrated migration services and ecosystem simplification.

CoreWeave vs Teradata Positioning

CoreWeave targets a concentrated niche in AI compute infrastructure with high growth potential but volatile market dynamics. Teradata offers diversified analytics and consulting services, providing broader sector exposure and a more stable revenue base.

Which has the best competitive advantage?

Teradata shows a very favorable economic moat with growing ROIC above WACC, indicating durable competitive advantage. CoreWeave’s ROIC is significantly below WACC, signaling value destruction and an unfavorable moat position.

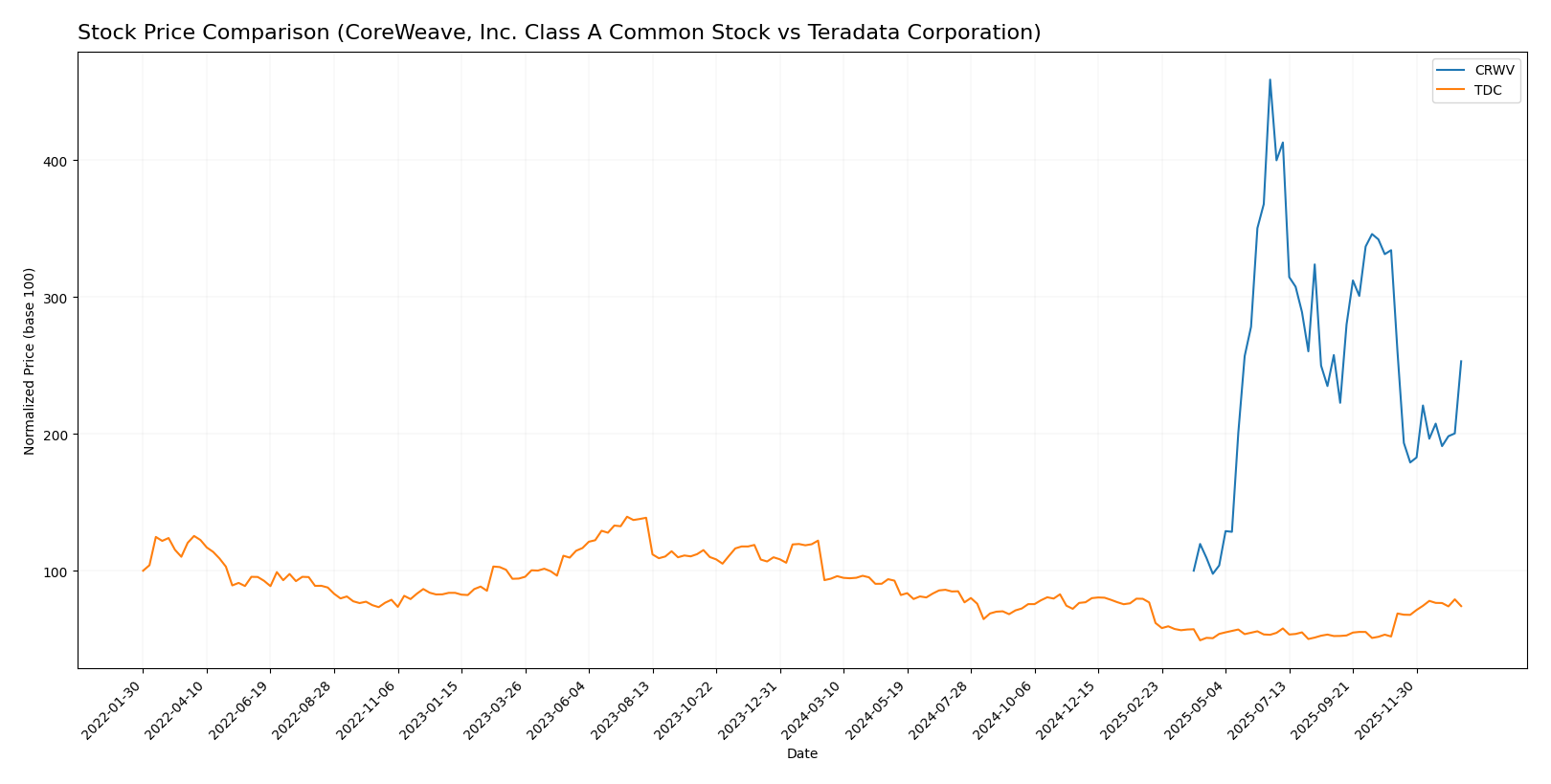

Stock Comparison

The stock price movements over the past 12 months reveal CoreWeave, Inc. (CRWV) exhibiting a strong bullish trend despite recent deceleration, while Teradata Corporation (TDC) shows an overall bearish trend with accelerating decline.

Trend Analysis

CoreWeave’s stock rose sharply by 153.08% over the past year, marking a bullish trend with high volatility (std deviation 35.67). The trend shows deceleration, peaking at 183.58 before recent declines.

Teradata’s stock fell 21.26% over the same period, confirming a bearish trend with low volatility (std deviation 5.63). The downward trend is accelerating, despite a recent short-term rebound of 42.78%.

Comparing both, CoreWeave delivered the highest market performance over the past year, outperforming Teradata by a significant margin despite recent short-term weakness.

Target Prices

The current target price consensus for CoreWeave, Inc. and Teradata Corporation reflects moderate upside potential according to analyst estimates.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CoreWeave, Inc. Class A Common Stock | 175 | 68 | 115.79 |

| Teradata Corporation | 35 | 27 | 31 |

Analysts expect CoreWeave’s stock to trade above its current price of 101.23 USD, signaling growth potential. Teradata’s consensus target of 31 USD is slightly above its current price of 29.77 USD, indicating modest upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CoreWeave, Inc. Class A Common Stock (CRWV) and Teradata Corporation (TDC):

Rating Comparison

CRWV Rating

- Rating: D+ with a very unfavorable overall score of 1.

- Discounted Cash Flow Score: 1, very unfavorable.

- ROE Score: 1, very unfavorable.

- ROA Score: 1, very unfavorable.

- Debt To Equity Score: 1, very unfavorable.

TDC Rating

- Rating: B+ with a moderate overall score of 3.

- Discounted Cash Flow Score: 4, favorable.

- ROE Score: 5, very favorable.

- ROA Score: 4, favorable.

- Debt To Equity Score: 1, very unfavorable.

Which one is the best rated?

Based strictly on the provided data, Teradata (TDC) is better rated than CoreWeave (CRWV) with higher scores in overall rating, discounted cash flow, ROE, and ROA. Both share a very unfavorable debt-to-equity score.

Scores Comparison

The scores comparison for CoreWeave (CRWV) and Teradata (TDC) highlights their financial risk and strength metrics:

CRWV Scores

- Altman Z-Score: 0.80, in distress zone, high bankruptcy risk

- Piotroski Score: 3, very weak financial strength

TDC Scores

- Altman Z-Score: 0.81, in distress zone, high bankruptcy risk

- Piotroski Score: 8, very strong financial strength

Which company has the best scores?

Teradata and CoreWeave both fall in the distress zone by Altman Z-Score, indicating high bankruptcy risk. However, Teradata’s Piotroski Score of 8 shows very strong financial strength compared to CoreWeave’s weak score of 3.

Grades Comparison

The following is a comparison of the recent grades assigned to CoreWeave, Inc. Class A Common Stock and Teradata Corporation by reputable financial institutions:

CoreWeave, Inc. Class A Common Stock Grades

This table summarizes recent grades from established grading companies for CoreWeave, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| DA Davidson | Upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Barclays | Maintain | Equal Weight | 2025-11-12 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-11 |

CoreWeave’s grades predominantly range from Neutral to Buy, showing a generally positive and stable analyst sentiment.

Teradata Corporation Grades

This table presents recent grades from recognized grading firms for Teradata Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Underweight | 2026-01-12 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Citizens | Upgrade | Market Outperform | 2025-11-10 |

| Barclays | Maintain | Underweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Guggenheim | Maintain | Buy | 2025-05-07 |

| Barclays | Maintain | Underweight | 2025-04-21 |

Teradata’s grades vary widely from Underweight to Buy, indicating a mixed analyst outlook with some cautious and some optimistic views.

Which company has the best grades?

CoreWeave has received consistently more favorable grades, predominantly Buy and Overweight ratings, compared to Teradata’s mixed ratings including several Underweight grades. This suggests CoreWeave may have stronger analyst confidence, potentially influencing investor perception of its growth prospects.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for CoreWeave, Inc. (CRWV) and Teradata Corporation (TDC) based on the latest financial and strategic data.

| Criterion | CoreWeave, Inc. (CRWV) | Teradata Corporation (TDC) |

|---|---|---|

| Diversification | Limited product segmentation; focused primarily on niche cloud computing services | Well-diversified with recurring revenue streams across software, services, and consulting |

| Profitability | Negative net margin (-45.08%), shedding value with ROIC below WACC | Moderate net margin (6.51%), creating value with ROIC significantly above WACC |

| Innovation | ROE is very high (208.77%), but challenges in profitability suggest innovation not yet translating to profits | Steady innovation reflected in growing ROIC and solid asset turnover ratios |

| Global presence | Smaller global footprint, less diversified geographically | Strong global presence with substantial international revenues (~$1.1B) |

| Market Share | Emerging player with small market share and low asset turnover | Established market share supported by recurring revenues over $2.8B |

Key takeaway: Teradata demonstrates a durable competitive advantage with consistent value creation and diversification, making it a more stable investment. CoreWeave shows high innovation potential but faces significant profitability and liquidity challenges, suggesting higher risk.

Risk Analysis

Below is a table summarizing key risk metrics for CoreWeave, Inc. (CRWV) and Teradata Corporation (TDC) based on their latest 2024 financial data and market conditions:

| Metric | CoreWeave, Inc. (CRWV) | Teradata Corporation (TDC) |

|---|---|---|

| Market Risk | Very high beta 21.65 indicates extreme volatility | Low beta 0.57 signals low volatility |

| Debt level | High debt-to-assets 59.56%, negative debt/equity ratio | Moderate debt-to-assets 33.8%, debt/equity 4.33 (unfavorable) |

| Regulatory Risk | Moderate – technology sector, US-based with no immediate known issues | Moderate – operates globally, subject to data privacy regulations |

| Operational Risk | Low asset turnover (0.11) and negative interest coverage (-1.06) suggest operational inefficiency | Efficient asset turnover (1.03) and solid interest coverage (6.66) |

| Environmental Risk | Low to moderate; data center energy use but no significant disclosures | Low; primarily software services with limited environmental impact |

| Geopolitical Risk | US-focused but exposed to global cloud demand fluctuations | Global exposure, including volatile regions, increasing geopolitical sensitivity |

In synthesis, CoreWeave faces the most impactful risks from its very high market volatility and financial distress signals, including poor liquidity and high leverage. Teradata shows more operational stability but carries moderate debt risks and geopolitical exposure. Investors should be cautious with CoreWeave’s financial health despite its growth potential, while Teradata presents a more balanced risk profile with better financial footing.

Which Stock to Choose?

CoreWeave, Inc. Class A (CRWV) shows strong revenue growth with a favorable income statement overall, yet it struggles with negative net margins, high debt levels, and an unfavorable global financial ratio evaluation. Its rating is very unfavorable despite a high ROE.

Teradata Corporation (TDC) presents a stable income statement with positive net margin and EBIT margin, moderate revenue decline, and improving profitability. Financial ratios are neutral overall with some favorable indicators, and the company holds a very favorable rating with a strong Piotroski score.

Investors seeking growth might find CoreWeave’s rapid revenue expansion appealing, though its financial instability suggests caution. Conversely, those prioritizing durable profitability and a solid competitive moat may view Teradata as more favorable given its value creation and improving financial health.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CoreWeave, Inc. Class A Common Stock and Teradata Corporation to enhance your investment decisions: