In the dynamic realm of software infrastructure, CoreWeave, Inc. (CRWV) and Rubrik, Inc. (RBRK) emerge as compelling contenders. Both companies innovate in cloud-based solutions—CoreWeave focuses on scalable GPU and AI compute infrastructure, while Rubrik excels in comprehensive data security and recovery. Their overlapping markets and distinct strategies offer investors a unique comparison. Join me as we analyze which stock holds greater promise for your portfolio in 2026.

Table of contents

Companies Overview

I will begin the comparison between CoreWeave and Rubrik by providing an overview of these two companies and their main differences.

CoreWeave Overview

CoreWeave, Inc. operates a cloud platform specializing in scaling, support, and acceleration for GenAI workloads. The company provides infrastructure services such as GPU and CPU compute, storage, networking, and managed services, including virtual and bare metal servers. CoreWeave also offers solutions for VFX rendering, AI model training, and mission control, positioning itself as a key player in high-performance cloud infrastructure.

Rubrik Overview

Rubrik, Inc. delivers data security solutions targeting both individuals and enterprises globally. Its offerings encompass enterprise, cloud, and SaaS data protection, along with data threat analytics and cyber recovery services. Serving diverse sectors like finance, healthcare, education, and technology, Rubrik focuses on securing unstructured data and enhancing data security posture through comprehensive protection solutions.

Key similarities and differences

Both CoreWeave and Rubrik operate within the software infrastructure sector, providing cloud-based services to enterprise clients. CoreWeave emphasizes scalable compute infrastructure tailored for AI and rendering workloads, whereas Rubrik concentrates on data security and protection across multiple industries. While CoreWeave’s business model is driven by compute resource provisioning, Rubrik’s model centers on safeguarding data integrity and recovery capabilities.

Income Statement Comparison

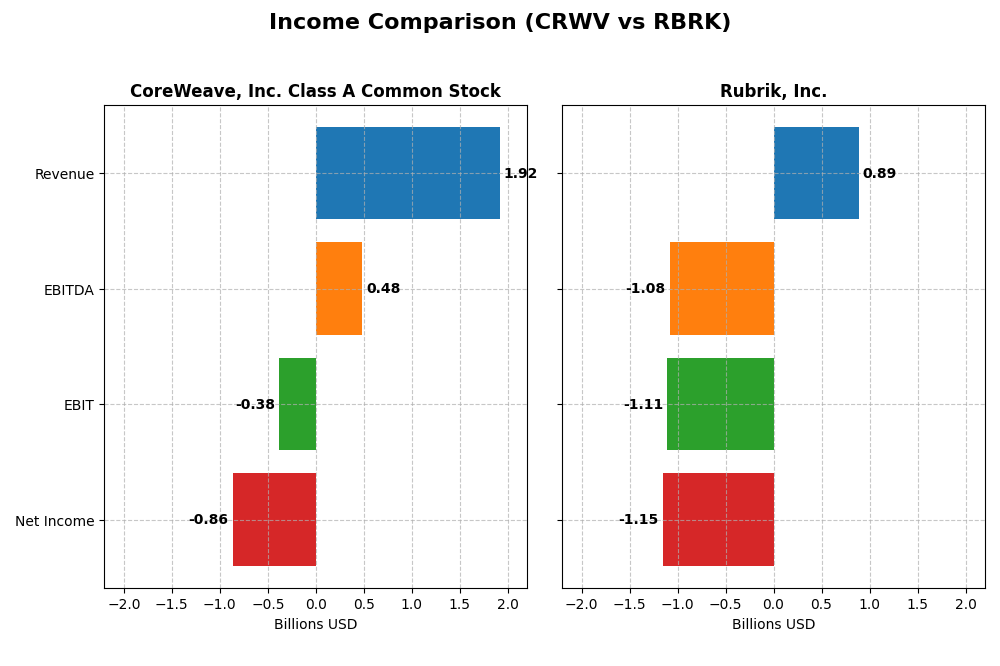

The table below presents a side-by-side comparison of the latest income statement metrics for CoreWeave, Inc. Class A Common Stock (CRWV) and Rubrik, Inc. (RBRK) for the fiscal year 2024 and 2025 respectively.

| Metric | CoreWeave, Inc. (CRWV) 2024 | Rubrik, Inc. (RBRK) 2025 |

|---|---|---|

| Market Cap | 50.4B | 13.4B |

| Revenue | 1.92B | 887M |

| EBITDA | 480M | -1.08B |

| EBIT | -383M | -1.11B |

| Net Income | -863M | -1.15B |

| EPS | -2.33 | -7.48 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

CoreWeave, Inc. Class A Common Stock

CoreWeave’s revenue surged dramatically from $15.8M in 2022 to $1.92B in 2024, signaling rapid expansion. Despite strong gross margins around 74%, operating and net margins remained negative, reflecting high costs and interest expenses. In 2024, revenue growth slowed compared to the previous year but margins improved, showing signs of operational scaling.

Rubrik, Inc.

Rubrik experienced steady revenue growth from $388M in 2021 to $887M in 2025, with gross margins above 70%. However, its EBIT and net margins stayed deeply negative, worsening in 2025 due to rising operating expenses. The latest year showed a strong revenue increase but a significant decline in profitability and earnings per share, indicating margin pressure.

Which one has the stronger fundamentals?

CoreWeave demonstrates more favorable fundamentals with exceptional revenue and gross profit growth, combined with improving margins, despite ongoing net losses. Rubrik’s revenue growth is solid but overshadowed by deteriorating profitability and higher expenses. Overall, CoreWeave’s income statement reflects a more positive trajectory compared to Rubrik’s challenging margin profile.

Financial Ratios Comparison

This table presents the most recent available financial ratios for CoreWeave, Inc. Class A Common Stock (CRWV) and Rubrik, Inc. (RBRK), reflecting their fiscal year 2024 and 2025 data respectively.

| Ratios | CoreWeave, Inc. (CRWV) 2024 | Rubrik, Inc. (RBRK) 2025 |

|---|---|---|

| ROE | 2.09% | 2.09% |

| ROIC | 2.08% | -2.35% |

| P/E | -18.73 | -9.79 |

| P/B | -39.11 | -20.42 |

| Current Ratio | 0.39 | 1.13 |

| Quick Ratio | 0.39 | 1.13 |

| D/E (Debt to Equity) | -25.68 | -0.63 |

| Debt-to-Assets | 59.56% | 24.65% |

| Interest Coverage | 0.90 | -27.49 |

| Asset Turnover | 0.11 | 0.62 |

| Fixed Asset Turnover | 0.13 | 16.67 |

| Payout Ratio | -6.69% | 0% |

| Dividend Yield | 0.36% | 0% |

Interpretation of the Ratios

CoreWeave, Inc. Class A Common Stock

CoreWeave’s ratios show strengths in return on equity (208.77%) and favorable price metrics, but weaknesses in net margin (-45.08%), return on invested capital (2.08%), and liquidity ratios (current ratio 0.39). The company does not pay dividends, reflecting a high-growth or reinvestment phase, prioritizing expansion over shareholder payouts.

Rubrik, Inc.

Rubrik presents a mixed ratio profile with favorable return on equity (208.55%) and weighted average cost of capital (5.34%), but suffers from a very negative net margin (-130.26%) and interest coverage. Its current and quick ratios are healthier than CoreWeave’s. Rubrik does not pay dividends, likely due to continued investments and negative net income.

Which one has the best ratios?

Rubrik exhibits a more favorable overall ratio profile with 57.14% favorable metrics compared to CoreWeave’s 28.57%, particularly in liquidity and asset turnover. CoreWeave faces greater challenges in profitability and liquidity. However, both companies have significant risks, especially in profitability and cash flow generation.

Strategic Positioning

This section compares the strategic positioning of CoreWeave and Rubrik, including market position, key segments, and exposure to technological disruption:

CoreWeave

- Large market cap of 50B with high beta, facing intense competitive pressure in cloud infrastructure

- Focuses on GPU/CPU compute, storage, networking, and AI workloads as core business drivers

- Operates in cloud infrastructure supporting GenAI workloads, potentially sensitive to rapid tech shifts

Rubrik

- Smaller market cap of 13B, low beta, competing in data security with diverse industry clients

- Key revenue from subscriptions in data protection, SaaS, and cyber recovery across sectors

- Provides data security and cyber recovery solutions, with steady exposure to cybersecurity changes

CoreWeave vs Rubrik Positioning

CoreWeave’s strategy centers on diversified cloud infrastructure and AI compute services, while Rubrik concentrates on data security and protection subscriptions. CoreWeave’s large market cap contrasts with Rubrik’s broad sector coverage but smaller scale, showing different risk and growth profiles.

Which has the best competitive advantage?

Both companies are currently shedding value, but CoreWeave shows stable profitability while Rubrik faces declining returns. Based on MOAT evaluation, CoreWeave has a less unfavorable competitive position than Rubrik.

Stock Comparison

The stock price movements of CoreWeave, Inc. Class A Common Stock (CRWV) and Rubrik, Inc. (RBRK) over the past 12 months reveal significant bullish trends with decelerating momentum and recent short-term declines in both securities.

Trend Analysis

CoreWeave’s stock rose 153.08% over the past year, marking a strong bullish trend despite deceleration and high volatility (std. dev. 35.67). The price ranged from a low of 39.09 to a high of 183.58, with recent weakness showing a -24.29% drop.

Rubrik’s stock appreciated 76.58% in the same period, also reflecting a bullish but decelerating trend with lower volatility (std. dev. 21.4). The price fluctuated between 28.65 and 97.91, followed by a recent -10.85% decline.

Comparing both, CoreWeave outperformed Rubrik in market performance over the past year, delivering the highest total price appreciation despite recent downward pressure on both stocks.

Target Prices

Analysts provide a clear consensus on the target prices for CoreWeave, Inc. and Rubrik, Inc., reflecting their growth outlook.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CoreWeave, Inc. Class A Common Stock | 175 | 68 | 115.79 |

| Rubrik, Inc. | 113 | 105 | 109.33 |

The target consensus for CoreWeave suggests upside potential from its current price of 101.23 USD, while Rubrik’s consensus indicates a significant upward revision from its current price of 67.10 USD. Overall, analysts expect positive growth trajectories for both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CoreWeave, Inc. Class A Common Stock (CRWV) and Rubrik, Inc. (RBRK):

Rating Comparison

CRWV Rating

- Rating: D+ indicating a very favorable status despite low scores.

- Discounted Cash Flow Score: 1, rated very unfavorable, suggesting concerns on valuation.

- ROE Score: 1, very unfavorable, indicating low profit efficiency from equity.

- ROA Score: 1, very unfavorable, showing limited asset utilization effectiveness.

- Debt To Equity Score: 1, very unfavorable, implying higher financial risk due to debt levels.

- Overall Score: 1, very unfavorable, reflecting poor overall financial health and performance.

RBRK Rating

- Rating: C with a very favorable status, showing stronger overall investor perception.

- Discounted Cash Flow Score: 1, also very unfavorable, reflecting similar valuation concerns.

- ROE Score: 5, very favorable, showing high efficiency in generating profit from shareholders’ equity.

- ROA Score: 1, very unfavorable, indicating weak effectiveness in asset use.

- Debt To Equity Score: 1, very unfavorable, also indicating financial risk related to leverage.

- Overall Score: 2, moderate, suggesting better but still cautious overall assessment.

Which one is the best rated?

Based strictly on the provided data, RBRK holds a better rating overall with a C rating and higher scores, notably in return on equity, whereas CRWV’s ratings and scores are uniformly very unfavorable.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

CRWV Scores

- Altman Z-Score: 0.80, in distress zone indicating high bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

RBRK Scores

- Altman Z-Score: 1.41, also in distress zone with high bankruptcy risk.

- Piotroski Score: 4, considered average financial strength.

Which company has the best scores?

RBRK shows a higher Altman Z-Score and Piotroski Score than CRWV, indicating relatively better financial health within the distress zone and average financial strength compared to CRWV’s very weak rating.

Grades Comparison

The following tables summarize the latest reliable grades assigned to CoreWeave, Inc. Class A Common Stock and Rubrik, Inc.:

CoreWeave, Inc. Class A Common Stock Grades

This table presents the recent grades and rating actions from verified financial institutions for CoreWeave:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| DA Davidson | Upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Barclays | Maintain | Equal Weight | 2025-11-12 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-11 |

CoreWeave’s grades show a balance between Buy and Neutral/Equal Weight ratings, with stability in recent assessments and one upgrade noted.

Rubrik, Inc. Grades

This table shows the latest verified grades and rating actions for Rubrik:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

Rubrik’s grades predominantly indicate strong positive sentiment, with multiple Outperform ratings and one recent upgrade.

Which company has the best grades?

Rubrik has generally received higher grades, with more Outperform and Overweight ratings compared to CoreWeave’s mix of Buy and Neutral grades. This may indicate stronger analyst confidence in Rubrik’s near-term prospects, potentially influencing investor sentiment accordingly.

Strengths and Weaknesses

Below is a comparative overview of CoreWeave, Inc. (CRWV) and Rubrik, Inc. (RBRK) based on key investment criteria reflecting their recent financial and operational profiles.

| Criterion | CoreWeave, Inc. (CRWV) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Diversification | Limited product segmentation; focused on niche | Broad revenue base with strong subscription focus (828.7M USD in 2025) and diversified services |

| Profitability | Negative net margin (-45.1%), ROIC 2.08% (unfavorable), value destroying | Negative net margin (-130.3%), declining ROIC (-234.85%), value destroying with worsening profitability |

| Innovation | Moderate with high ROE (208.77%) but lacks clear growth in ROIC | High fixed asset turnover (16.67) indicating efficient asset use; innovation status mixed due to negative profitability |

| Global presence | Limited data; appears less diversified globally | Likely stronger global reach given revenue scale and subscription model |

| Market Share | Smaller scale, less diversified revenue streams | Larger market share suggested by substantial subscription revenue and favorable financial ratios |

Key takeaways: Both companies currently struggle with profitability and value creation, with Rubrik facing a sharper decline in ROIC and profitability despite stronger revenue diversification. CoreWeave shows some operational strengths but limited scale and unfavorable liquidity indicators. Investors should weigh the ongoing value destruction and consider risk management carefully before investing.

Risk Analysis

Below is a comparative table highlighting key risks for CoreWeave, Inc. Class A Common Stock (CRWV) and Rubrik, Inc. (RBRK) based on the most recent data from 2025-2026:

| Metric | CoreWeave, Inc. (CRWV) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Market Risk | Very high beta (21.65), indicating extreme volatility and sensitivity to market swings | Low beta (0.28), reflecting low market volatility risk |

| Debt level | High debt to assets (59.6%), poor interest coverage (-1.06), indicating financial leverage concerns | Moderate debt to assets (24.7%), but poor interest coverage (-26.8) signals risk in debt servicing |

| Regulatory Risk | Moderate, as a cloud infrastructure company exposed to evolving data privacy laws | Moderate, operating in data security sector with compliance demands |

| Operational Risk | Infrastructure scaling challenges with rapid growth; unfavorable liquidity ratios (current ratio 0.39) | Larger scale with better liquidity (current ratio 1.13) but complexity in cybersecurity solutions |

| Environmental Risk | Low direct impact but dependent on energy-intensive data centers | Low direct impact, though data centers contribute indirectly |

| Geopolitical Risk | US-based with global clients, moderate exposure to geopolitical tensions affecting cloud services | US-based, with diversified sectors served, moderate geopolitical exposure |

In synthesis, CoreWeave faces the most impactful risks from its extremely high market volatility and financial leverage, combined with weak liquidity, which heightens default risk (Altman Z-score in distress zone). Rubrik shows better market stability and balance sheet strength but struggles with profitability and interest coverage, posing operational and financial risks. Investors should weigh CoreWeave’s growth potential against its financial fragility and consider Rubrik’s steadier profile with caution on debt servicing.

Which Stock to Choose?

CoreWeave, Inc. Class A Common Stock (CRWV) shows strong revenue growth of 12,000% over 2022-2024, with favorable gross margin and net margin improvements. However, profitability remains negative, debt is high, liquidity ratios are weak, and the overall financial ratios evaluation is unfavorable.

Rubrik, Inc. (RBRK) presents moderate revenue growth of 129% over 2021-2025 with a favorable gross margin but significant losses reflected in negative margins and declining profitability. Its debt and liquidity ratios are better than CRWV, and the financial ratios evaluation is globally favorable despite a very unfavorable MOAT status.

Investors focused on growth may find CoreWeave’s rapid income expansion and improving margins appealing despite its weaker financial ratios and debt concerns, whereas those prioritizing financial stability might view Rubrik’s more balanced ratios and moderate growth as more suitable. Both companies exhibit signs of value destruction, implying careful risk assessment is warranted.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CoreWeave, Inc. Class A Common Stock and Rubrik, Inc. to enhance your investment decisions: