In the fast-evolving technology sector, Palo Alto Networks, Inc. (PANW) and CoreWeave, Inc. Class A Common Stock (CRWV) stand out as key players in software infrastructure. While Palo Alto Networks leads in cybersecurity solutions with a broad enterprise footprint, CoreWeave specializes in cloud platforms supporting AI and compute workloads. This comparison explores their innovation strategies and market positions to help you decide which company offers the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Palo Alto Networks and CoreWeave by providing an overview of these two companies and their main differences.

Palo Alto Networks Overview

Palo Alto Networks, Inc. is a leading cybersecurity company providing comprehensive solutions globally. Its offerings include firewall appliances, security management software, and cloud security services, targeting medium to large enterprises, service providers, and government entities. Founded in 2005 and headquartered in Santa Clara, California, it operates across various industries including financial services, healthcare, and telecommunications, with a market cap of $128B.

CoreWeave Overview

CoreWeave, Inc. operates a cloud platform focused on scaling and accelerating generative AI workloads. The company delivers GPU and CPU compute, storage, networking, and managed services, supporting AI model training, inference, and VFX rendering. Incorporated in 2017 and based in Livingston, New Jersey, CoreWeave has a market cap of $50B and is a relatively smaller player with 881 employees compared to its peer.

Key similarities and differences

Both Palo Alto Networks and CoreWeave operate within the technology sector and the software infrastructure industry, offering solutions to support enterprise computing needs. Palo Alto Networks centers on cybersecurity products and services, while CoreWeave specializes in cloud infrastructure tailored for AI workloads. The companies differ significantly in scale, market capitalization, and employee count, reflecting distinct market positions and operational focuses.

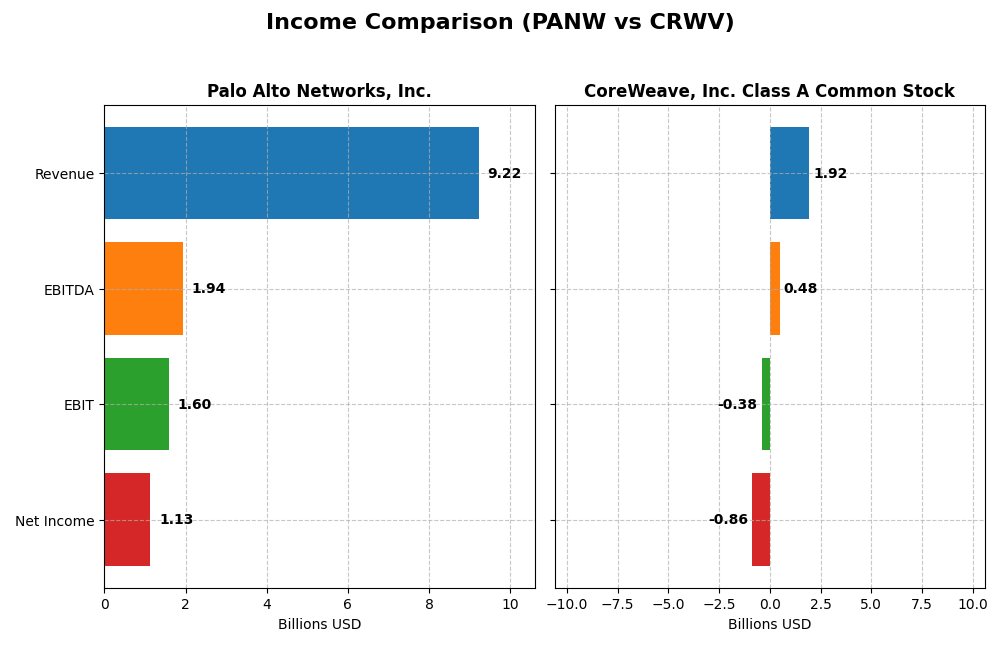

Income Statement Comparison

Below is a comparison of key income statement metrics for Palo Alto Networks, Inc. and CoreWeave, Inc. Class A Common Stock based on their most recent fiscal year data.

| Metric | Palo Alto Networks, Inc. | CoreWeave, Inc. Class A Common Stock |

|---|---|---|

| Market Cap | 128.4B | 50.4B |

| Revenue | 9.22B | 1.92B |

| EBITDA | 1.94B | 480M |

| EBIT | 1.60B | -383M |

| Net Income | 1.13B | -863M |

| EPS | 1.71 | -2.33 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Palo Alto Networks, Inc.

From 2021 to 2025, Palo Alto Networks exhibited strong revenue growth, rising from $4.3B to $9.2B, with net income turning positive and reaching $1.13B in 2025. Margins, including gross and EBIT, remained favorable, reflecting efficient cost management. However, the latest year saw a slowdown in net margin and EPS growth despite a 14.9% revenue increase, indicating margin pressure.

CoreWeave, Inc. Class A Common Stock

CoreWeave’s revenue surged dramatically from $15.8M in 2022 to $1.9B in 2024, driven by rapid expansion. Despite this, the company reported net losses, with net income at -$863M in 2024. Gross margin stayed high, but EBIT and net margins were negative, and interest expenses were substantial, reflecting ongoing investment and operational challenges in the latest fiscal year.

Which one has the stronger fundamentals?

Palo Alto Networks displays more stable and favorable fundamentals, with consistent revenue and net income growth and healthy margins. CoreWeave’s rapid revenue expansion contrasts with persistent net losses and unfavorable EBIT and net margins. While both show favorable global income opinions, Palo Alto’s stronger profitability and margin stability suggest a more robust income statement foundation.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Palo Alto Networks, Inc. (PANW) and CoreWeave, Inc. Class A Common Stock (CRWV) based on their most recent fiscal year data.

| Ratios | Palo Alto Networks, Inc. (2025) | CoreWeave, Inc. Class A (2024) |

|---|---|---|

| ROE | 14.5% | 208.8% |

| ROIC | 5.7% | 2.1% |

| P/E | 101.4 | -18.7 |

| P/B | 14.7 | -39.1 |

| Current Ratio | 0.89 | 0.39 |

| Quick Ratio | 0.89 | 0.39 |

| D/E (Debt-to-Equity) | 0.04 | -25.7 |

| Debt-to-Assets | 1.4% | 59.6% |

| Interest Coverage | 414.3 | 0.90 |

| Asset Turnover | 0.39 | 0.11 |

| Fixed Asset Turnover | 12.6 | 0.13 |

| Payout Ratio | 0 | -6.7% |

| Dividend Yield | 0% | 0.36% |

Interpretation of the Ratios

Palo Alto Networks, Inc.

Palo Alto Networks shows a mix of strengths and weaknesses in its financial ratios. It has favorable metrics such as net margin at 12.3%, low debt-to-equity at 0.04, and strong interest coverage. However, the company faces challenges with a high price-to-earnings ratio of 101.43 and a low current ratio of 0.89, indicating liquidity concerns. The company does not pay dividends, reflecting a focus on growth and reinvestment rather than shareholder payouts.

CoreWeave, Inc. Class A Common Stock

CoreWeave’s ratios reveal significant weaknesses, including a deeply negative net margin of -45.08%, a high weighted average cost of capital (WACC) at 84.93%, and a poor current ratio of 0.39, pointing to liquidity risks. Despite a favorable return on equity of 208.77%, the overall financial health is strained. CoreWeave does not pay dividends, likely due to ongoing reinvestment and growth priorities in its early stage.

Which one has the best ratios?

Palo Alto Networks holds a slightly favorable ratio profile with more balanced financial stability and profitability metrics, while CoreWeave’s ratios indicate a highly unfavorable situation with liquidity and profitability challenges. Therefore, Palo Alto Networks currently demonstrates stronger financial ratio performance compared to CoreWeave.

Strategic Positioning

This section compares the strategic positioning of Palo Alto Networks, Inc. (PANW) and CoreWeave, Inc. (CRWV) including market position, key segments, and disruption:

Palo Alto Networks, Inc.

- Large market cap ($128B) with moderate competitive pressure in cybersecurity infrastructure.

- Focused on cybersecurity solutions: firewall, subscriptions, support services, and consulting.

- Exposure to technological disruption in cloud security and cybersecurity automation.

CoreWeave, Inc. Class A Common Stock

- Mid-size market cap ($50B) with high volatility and competitive pressure in cloud infrastructure.

- Provides cloud platform for GenAI workloads including GPU/CPU compute and AI model services.

- Exposure to disruption in AI infrastructure and cloud compute scalability.

PANW vs CRWV Positioning

PANW’s strategy is concentrated on cybersecurity with diversified subscription and support revenue streams, benefiting from scale. CRWV focuses on emerging AI cloud infrastructure, a narrower but rapidly evolving segment with higher risk and growth potential.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC. PANW shows improving profitability trends (slightly unfavorable moat), while CRWV has stable but unfavorable profitability, indicating PANW holds a marginally stronger competitive advantage.

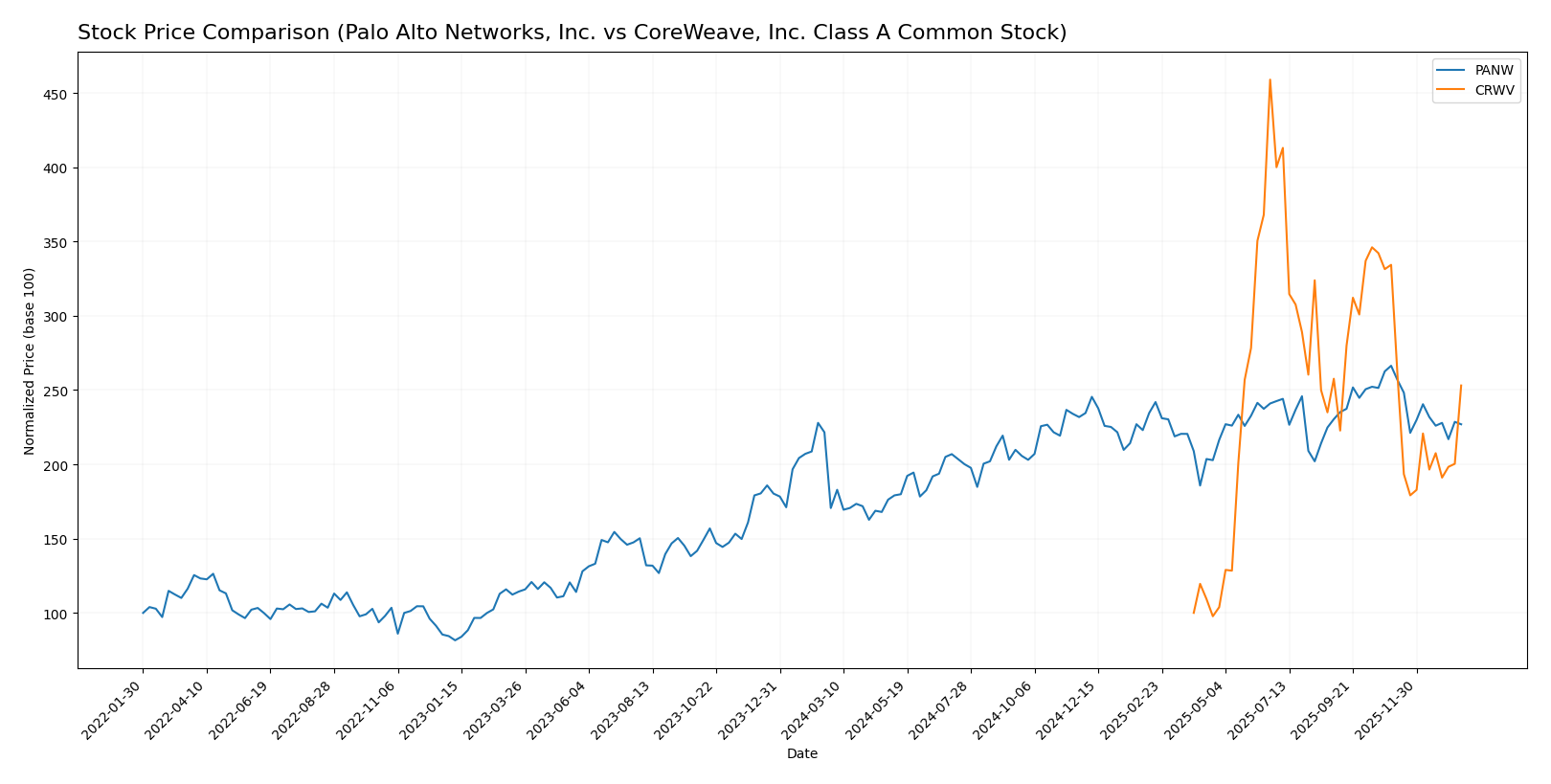

Stock Comparison

The stock price chart over the past 12 months reveals distinct bullish trends for both Palo Alto Networks, Inc. and CoreWeave, Inc. Class A Common Stock, with notable price increases followed by recent deceleration phases.

Trend Analysis

Palo Alto Networks, Inc. recorded a 33.05% price increase over the past year, indicating a bullish trend with decelerating momentum. The stock ranged from a low of 134.51 to a high of 220.24, with recent weeks showing a -14.79% decline.

CoreWeave, Inc. Class A Common Stock experienced a stronger bullish trend, rising 153.08% over the last 12 months but also showing deceleration. Its price varied between 39.09 and 183.58, with a recent drop of -24.29%.

Comparing both, CoreWeave delivered the highest market performance over the analyzed period, outperforming Palo Alto Networks despite greater recent volatility and stronger recent declines.

Target Prices

Analysts present a constructive consensus for Palo Alto Networks, Inc. and CoreWeave, Inc. based on current target price estimates.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Palo Alto Networks, Inc. | 265 | 157 | 231.07 |

| CoreWeave, Inc. Class A | 175 | 68 | 115.79 |

The consensus target for Palo Alto Networks exceeds its current price of $187.66, indicating moderate upside potential. CoreWeave’s consensus target is also above its current price of $101.23, suggesting expectations of growth despite its higher volatility.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Palo Alto Networks, Inc. and CoreWeave, Inc. Class A Common Stock:

Rating Comparison

Palo Alto Networks, Inc. Rating

- Rating: B, categorized as Very Favorable.

- Discounted Cash Flow Score: 4, indicating Favorable.

- ROE Score: 4, classified as Favorable.

- ROA Score: 3, rated Moderate.

- Debt To Equity Score: 4, marked Favorable.

- Overall Score: 3, assessed as Moderate.

CoreWeave, Inc. Class A Common Stock Rating

- Rating: D+, categorized as Very Favorable.

- Discounted Cash Flow Score: 1, indicating Very Unfavorable.

- ROE Score: 1, classified as Very Unfavorable.

- ROA Score: 1, rated Very Unfavorable.

- Debt To Equity Score: 1, marked Very Unfavorable.

- Overall Score: 1, assessed as Very Unfavorable.

Which one is the best rated?

Based strictly on the provided data, Palo Alto Networks holds a significantly better rating and higher financial scores compared to CoreWeave, which shows very unfavorable scores across key metrics and a lower overall rating.

Scores Comparison

Here is a comparison of the financial health scores for Palo Alto Networks and CoreWeave, Inc.:

Palo Alto Networks Scores

- Altman Z-Score: 5.95, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

CoreWeave Scores

- Altman Z-Score: 0.80, indicating a distress zone with high bankruptcy risk.

- Piotroski Score: 3, reflecting very weak financial strength.

Which company has the best scores?

Based on the provided data, Palo Alto Networks has significantly better scores, with a safe zone Altman Z-Score and an average Piotroski Score, compared to CoreWeave’s distress zone and very weak Piotroski Score.

Grades Comparison

The following presents a detailed comparison of recent grades assigned to Palo Alto Networks, Inc. and CoreWeave, Inc. Class A Common Stock:

Palo Alto Networks, Inc. Grades

This table summarizes recent grades and rating actions from established grading companies for Palo Alto Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Guggenheim | Upgrade | Neutral | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-18 |

| Goldman Sachs | Maintain | Buy | 2025-11-21 |

| HSBC | Downgrade | Reduce | 2025-11-21 |

| Needham | Maintain | Buy | 2025-11-20 |

| WestPark Capital | Maintain | Hold | 2025-11-20 |

| Bernstein | Maintain | Outperform | 2025-11-20 |

| DA Davidson | Maintain | Buy | 2025-11-20 |

The overall grading trend for Palo Alto Networks shows mostly stable to positive ratings, with a majority favoring buy or overweight recommendations, despite a single recent downgrade to reduce.

CoreWeave, Inc. Class A Common Stock Grades

This table provides recent grading details from recognized grading firms for CoreWeave, Inc. Class A Common Stock:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| DA Davidson | Upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Barclays | Maintain | Equal Weight | 2025-11-12 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-11 |

CoreWeave’s grades show consistent maintenance of buy and overweight ratings, with upgrades reflecting a generally positive outlook from multiple firms.

Which company has the best grades?

Both Palo Alto Networks and CoreWeave hold a consensus “Buy” rating, but Palo Alto Networks has a larger number of buy and outperform grades from major firms. This may indicate stronger analyst conviction, potentially impacting investor confidence and portfolio decisions more positively than CoreWeave’s balanced rating distribution.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Palo Alto Networks, Inc. (PANW) and CoreWeave, Inc. Class A Common Stock (CRWV) based on recent financial and operational data.

| Criterion | Palo Alto Networks, Inc. (PANW) | CoreWeave, Inc. Class A Common Stock (CRWV) |

|---|---|---|

| Diversification | Strong product and subscription revenue streams with $1.8B in products and $4.97B in subscriptions (2025) | Limited diversification, primarily focused on niche cloud infrastructure |

| Profitability | Positive net margin of 12.3%, neutral ROIC at 5.67% | Negative net margin (-45.08%), low ROIC at 2.08% |

| Innovation | Consistent revenue growth and growing ROIC trend (224.5%) | Profitability stagnant with no ROIC growth |

| Global presence | Established global footprint with a broad customer base | Smaller scale, limited global penetration |

| Market Share | Significant market share in cybersecurity | Emerging market player with limited market share |

Key takeaways: Palo Alto Networks exhibits strong diversification and improving profitability despite slight value destruction, while CoreWeave struggles with profitability and scale, reflecting higher investment risks. Investors should weigh PANW’s stability against CRWV’s growth challenges.

Risk Analysis

Below is a comparative table highlighting key risks for Palo Alto Networks, Inc. (PANW) and CoreWeave, Inc. Class A Common Stock (CRWV) based on the most recent data available.

| Metric | Palo Alto Networks, Inc. (PANW) | CoreWeave, Inc. Class A (CRWV) |

|---|---|---|

| Market Risk | Moderate (Beta 0.75) | Extremely High (Beta 21.65) |

| Debt Level | Very Low (Debt-to-Equity 0.04) | High (Debt-to-Assets 59.56%) |

| Regulatory Risk | Moderate (Cybersecurity industry regulations) | Moderate (Cloud infrastructure sector) |

| Operational Risk | Moderate (Complex product ecosystem) | High (Young company, scaling challenges) |

| Environmental Risk | Low (Software sector) | Low (Software sector) |

| Geopolitical Risk | Moderate (Global customer base) | Moderate (Global cloud services exposure) |

The most impactful and likely risks are CoreWeave’s extreme market volatility and high debt load, signaling financial instability and operational challenges. Palo Alto Networks shows strong financial health but faces typical industry regulatory and operational risks.

Which Stock to Choose?

Palo Alto Networks, Inc. (PANW) shows a favorable income evolution with 14.87% revenue growth in the last year and a strong gross margin of 73.41%. Its financial ratios are slightly favorable overall, with low debt and solid profitability, though valuation multiples appear high. The company’s rating is very favorable, supported by a B grade and strong stability scores.

CoreWeave, Inc. Class A Common Stock (CRWV) exhibits very high revenue growth of 736.64% last year but suffers from negative net margins and weak profitability. Financial ratios are mostly unfavorable, with high debt levels and liquidity concerns. Its rating is very unfavorable overall, reflected in a D+ grade and distress-zone bankruptcy risk metrics.

Investors focused on growth might see potential in CRWV due to its explosive revenue expansion despite challenges in profitability and financial health. Conversely, those prioritizing financial stability and consistent profitability could find PANW’s slightly favorable ratios and strong rating more aligned with a risk-averse or quality investing profile. The choice might depend on the investor’s tolerance for risk and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Palo Alto Networks, Inc. and CoreWeave, Inc. Class A Common Stock to enhance your investment decisions: